Global High-temperature and Low-sag Conductor Market Size, Share, And Enhanced Productivity By Type (ACCC, ACSS, ACCR, ACSR, AAC, ACAR), By Application (Power Transmission, Power Distribution, Bare Overhead Transmission Conductor, Support Conductors, Retrofit), By End-User (Utilities, Industrial, Commercial, Renewable Power Generators, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171351

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

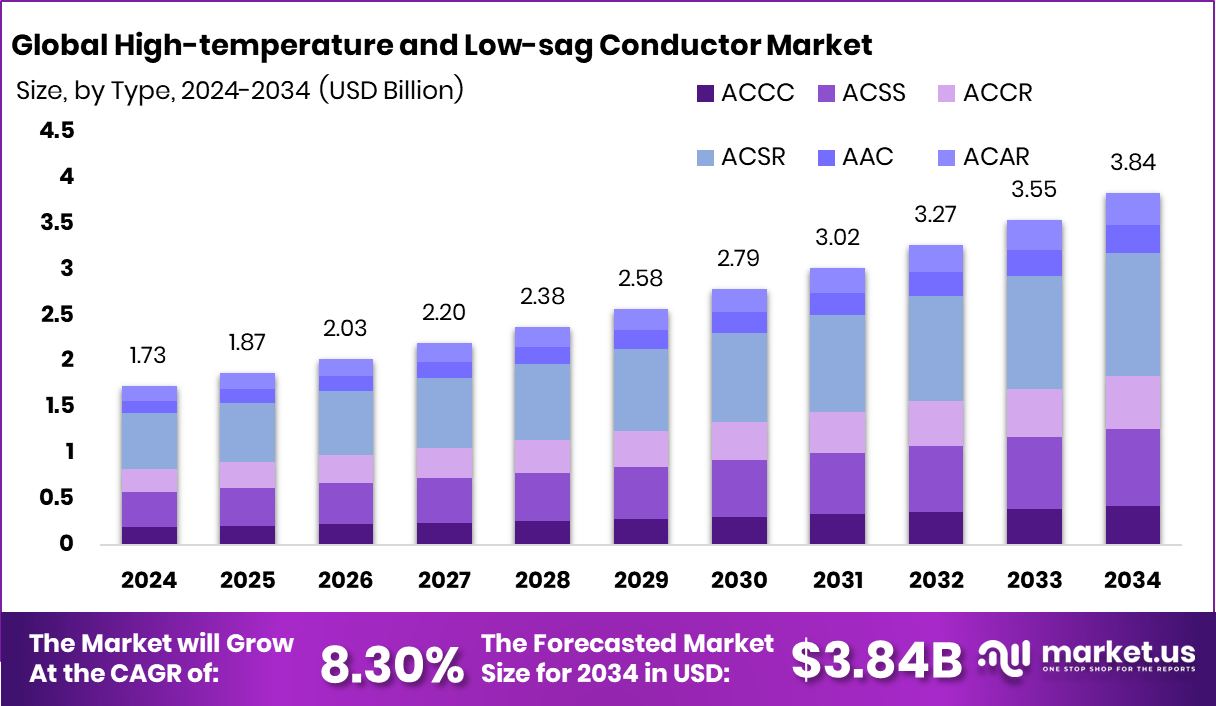

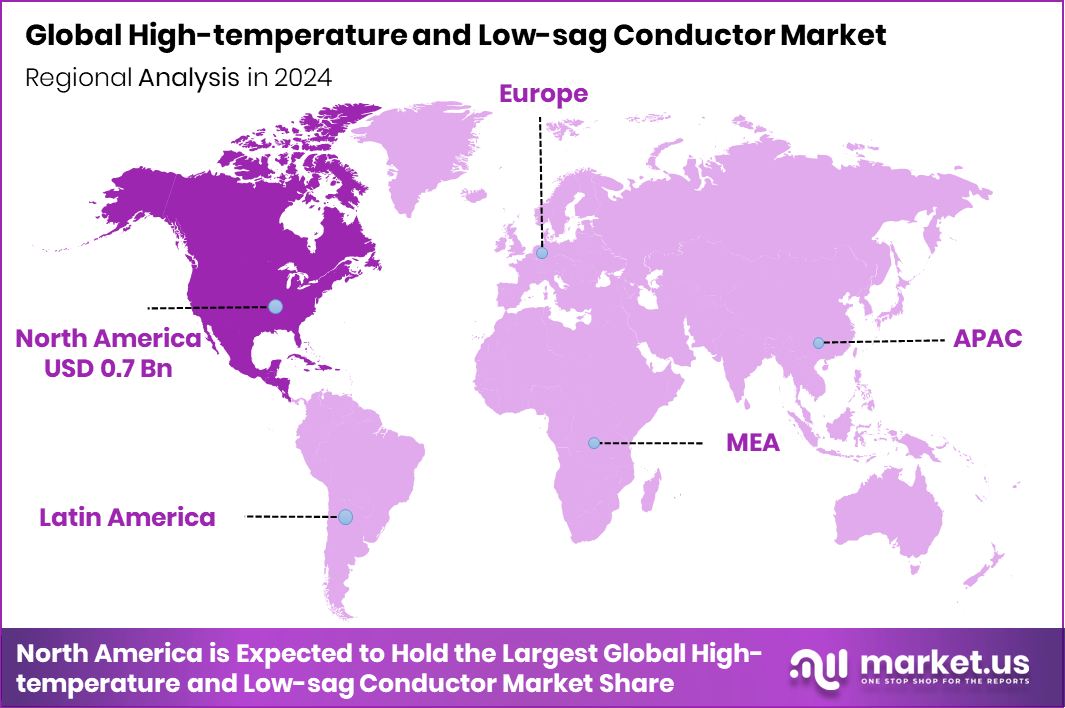

The Global High-temperature and Low-sag Conductor Market is expected to be worth around USD 3.84 billion by 2034, up from USD 1.73 billion in 2024, and is projected to grow at a CAGR of 8.30% from 2025 to 2034. North America accounted for 45.30% of the High-temperature Low-sag Conductor Market, totaling USD 0.7 Bn.

High-temperature and Low-sag (HTLS) Conductor is a specialized overhead power transmission conductor designed to carry higher electrical loads while maintaining minimal sag, even at elevated operating temperatures. Unlike conventional conductors, HTLS solutions improve line capacity without requiring taller towers or wider rights-of-way. This makes them especially suitable for upgrading existing transmission corridors where space, safety, and reliability are critical.

The High-temperature and Low-sag Conductor Market represents the supply and deployment of these advanced conductors across power transmission networks. The market is closely linked to grid modernization, renewable energy integration, and the need to move large volumes of electricity efficiently over long distances. Utilities and grid operators increasingly view HTLS conductors as practical tools to strengthen networks without major structural changes.

Growth factors for the market are driven by rising investments in clean energy and grid reinforcement. Large funding initiatives such as SSE’s £33 bn grid upgrade plan, PLN’s EUR 6.5 million grant for renewable transmission, and Avaada Group’s Rs 8,500 crore renewable funding highlight the scale of infrastructure expansion that supports advanced conductor adoption.

Demand is growing as renewable power generation expands and requires stronger transmission links. Major capital flows, including Nuveen’s $1.3 billion Energy & Power Infrastructure Credit Fund, Egypt’s $184.1 million solar and storage financing, and India’s $89 million renewable scaling investment, are increasing pressure on grids to handle higher loads reliably.

Opportunities are emerging as innovation funding accelerates grid-ready technologies. Supportive capital, such as Factor2 Energy’s $9.1 million raise, the US$500 million DRE Nigeria Fund, a new $60 million solar innovation round, and £3.2 million backing for UK renewable projects, creates strong long-term potential for HTLS conductor deployment.

Key Takeaways

- The Global High-temperature and Low-sag Conductor Market is expected to be worth around USD 3.84 billion by 2034, up from USD 1.73 billion in 2024, and is projected to grow at a CAGR of 8.30% from 2025 to 2034.

- Within the High-temperature and Low-sag Conductor Market, ACSR leads the type share at 34.8% globally today.

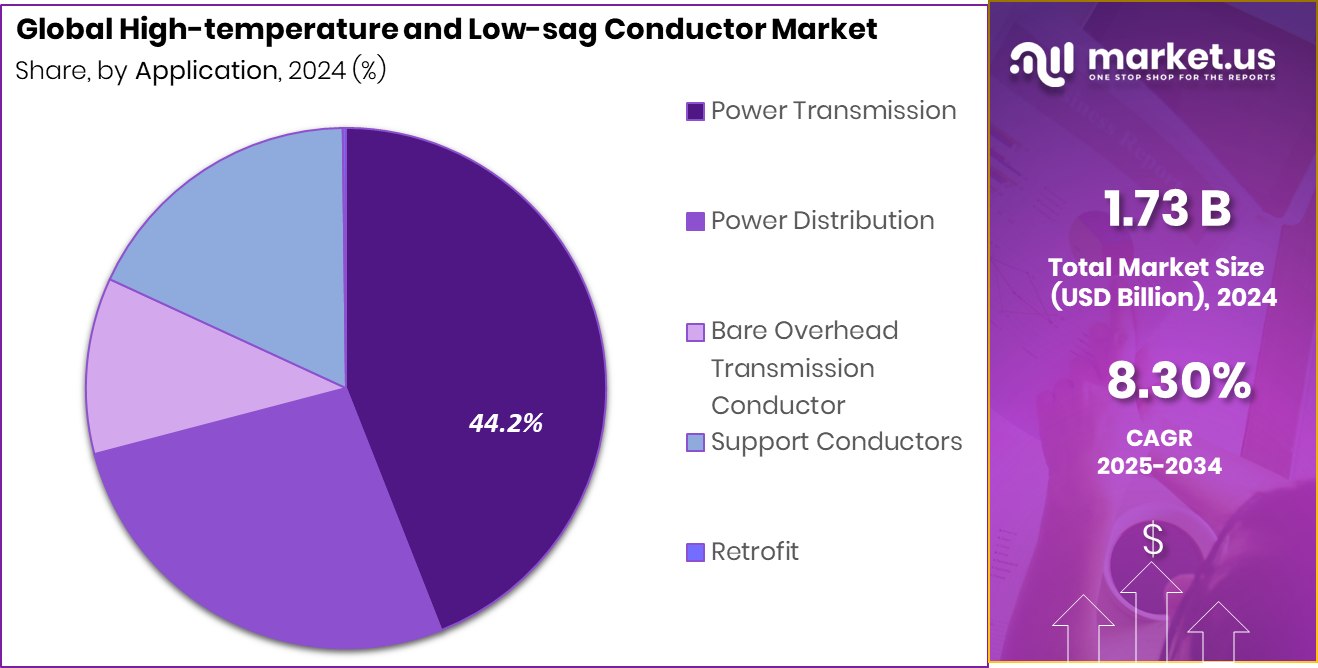

- High-temperature and Low-sag Conductor Market sees power transmission dominate applications with 44.2% share worldwide currently.

- In the High-temperature and Low-sag Conductor Market, utilities remain the leading end-users holding 51.4% share overall.

- High-temperature Low-sag Conductor Market in North America reached USD 0.7 Bn, capturing 45.30% share.

By Type Analysis

In the High-temperature and Low-sag Conductor Market, ACSR dominates the segment with 34.8% share.

In 2024, ACSR held a dominant market position in the By Type segment of the High-temperature and Low-sag Conductor Market, with a 34.8% share. This leadership reflects the segment’s strong acceptance in grid networks where proven mechanical strength and stable performance are essential. ACSR continues to be widely deployed in projects that demand dependable load-bearing capacity while maintaining conductor integrity under varying operating conditions.

The segment’s dominance is also supported by its long-standing presence across transmission corridors, where utilities and operators prioritize reliability and predictable lifecycle behavior. With a 34.8% share, ACSR remains a preferred choice for maintaining network continuity and supporting steady power flow, reinforcing its role as a cornerstone conductor type within the high-temperature and low-sag conductor landscape.

By Application Analysis

Within the High-temperature and Low-sag Conductor Market, power transmission leads applications, holding 44.2%.

In 2024, Power Transmission held a dominant market position in the By Application segment of the High-temperature and Low-sag Conductor Market, with a 44.2% share. This strong position highlights the critical role of advanced conductors in supporting long-distance electricity transfer while meeting rising demand and operational efficiency expectations.

The 44.2% share underscores how power transmission applications rely on these conductors to enhance line capacity without major infrastructure changes. Their adoption supports stable grid operations, improved thermal performance, and efficient utilization of existing corridors. As transmission systems remain central to energy delivery, the Power Transmission segment continues to anchor market demand through its scale, technical requirements, and consistent deployment across high-voltage networks.

By End-User Analysis

Acrossthe High-temperature and Low-sag Conductor Market, utilities remain primary end-users commanding 51.4%.

In 2024, Utilities held a dominant market position in the By End-User segment of the High-temperature and Low-sag Conductor Market, with a 51.4% share. This dominance reflects the central role utilities play in planning, upgrading, and operating transmission infrastructure to ensure a reliable power supply across regions.

With a 51.4% share, utilities remain the primary adopters of high-temperature and low-sag conductors, driven by their focus on grid stability, load management, and long-term asset performance. The segment’s strength highlights utilities’ continued investment in conductor solutions that support operational efficiency and system resilience, reinforcing their position as the leading end-user group shaping demand within this market.

Key Market Segments

By Type

- ACCC

- ACSS

- ACCR

- ACSR

- AAC

- ACAR

By Application

- Power Transmission

- Power Distribution

- Bare Overhead Transmission Conductor

- Support Conductors

- Retrofit

By End-User

- Utilities

- Industrial

- Commercial

- Renewable Power Generators

- Others

Driving Factors

Grid Retrofit Investments Drive HTLS Conductor Adoption

A key driving factor for the High-temperature and Low-sag Conductor Market is the rising focus on retrofitting existing infrastructure instead of building new assets. Power networks, like ships and buildings, increasingly adopt upgrade-first approaches to save costs, time, and land. This shift mirrors developments in other infrastructure sectors, where efficiency upgrades are prioritized over full replacements.

For example, the world’s first pay-as-you-save retrofit fund for ships raised USD 35 million, showing how performance upgrades are gaining financial backing. Similarly, VIVID and Barclays delivered the first loan under the £1.3 billion National Wealth Fund scheme to retrofit social housing, reinforcing confidence in retrofit-led models.

In power transmission, HTLS conductors fit this approach by allowing higher power flow on existing lines without major structural changes. As utilities face rising electricity demand and tighter permitting environments, retrofit-driven investments strongly support HTLS conductor adoption across transmission networks.

Restraining Factors

High Upfront Retrofit Costs Slow Adoption

One major restraining factor for the High-temperature and Low-sag Conductor Market is the high upfront cost of retrofitting existing infrastructure, even when long-term savings are clear. Upgrading transmission lines with advanced conductors requires skilled labor, specialized equipment, and careful planning to avoid service disruptions. This cost barrier is similar to challenges seen in other retrofit-driven sectors.

For instance, the Global Centre for Maritime Decarbonisation closed a pay-as-you-save vessel retrofit fund with commitments of up to USD 35 million, highlighting how large financial backing is still needed to make retrofits viable.

Likewise, the London Net Zero Neighbourhood Programme aims to deliver 20,000 home retrofits over five years, showing that large-scale upgrades demand sustained funding and coordination. In power transmission, limited access to such structured financing can delay HTLS conductor projects, slowing wider adoption.

Growth Opportunity

Large-Scale Transmission Expansion Creates Strong Opportunity

A major growth opportunity for the High-temperature and Low-sag Conductor Market comes from large-scale transmission expansion and grid strengthening projects. Governments and utilities are investing heavily to move more electricity across long distances while avoiding new corridors.

For example, the Queensland government confirmed AU$2.4 billion in funding for a major transmission project, highlighting strong demand for advanced conductors that increase capacity on existing lines. In India, Oriana Power secured ₹212 crore funding for a battery energy storage project in Karnataka, which increases the need for robust transmission links to balance and move stored power efficiently.

In the United States, the Department of Energy announced USD 13 billion in funding to expand the national grid, creating long-term opportunities for HTLS conductors that support higher loads, lower sag, and reliable power flow across upgraded networks.

Latest Trends

Government-Led Grid Strengthening Drives HTLS Adoption

A key latest trend in the High-temperature and Low-sag Conductor Market is the strong push from governments to strengthen power distribution and transmission networks. Policy-led funding programs are focusing on reducing losses, improving reliability, and upgrading aging grid assets.

In India, the Centre released ₹37,000 crore under the Revamped Distribution Sector Scheme (RDSS) to improve power distribution performance, which indirectly supports the use of advanced conductors during network upgrades. At the same time, India is considering a USD 12 billion plan to support state power distributors, aimed at restoring financial health and enabling infrastructure investments.

These initiatives encourage utilities to modernize lines using solutions that carry more power without increasing sag. As government-backed grid reforms expand, HTLS conductors are increasingly viewed as practical tools for fast, efficient network upgrades.

Regional Analysis

North America led the high-temperature Low-sag conductor market, holding a 45.30% share worth USD 0.7 Bn.

North America emerged as the dominating region in the High-temperature and Low-sag Conductor Market, accounting for 45.30% of the global share and reaching a market value of USD 0.7 Bn. This strong regional position reflects the region’s mature transmission infrastructure and continuous focus on upgrading existing power lines to handle higher loads efficiently. Utilities across North America prioritize conductor solutions that improve thermal performance and reduce sag, supporting grid reliability and long-distance power flow.

Europe represents a steady regional presence, driven by the ongoing modernization of transmission networks and the need to enhance operational efficiency within established grid systems. Asia Pacific shows growing relevance as expanding electricity demand and grid expansion activities increase the need for advanced conductor technologies across densely populated and industrializing areas.

The Middle East & Africa region continues to adopt high-temperature and low-sag conductors to support grid stability across long transmission routes and challenging climatic conditions. Latin America contributes through gradual transmission development and reinforcement of existing networks, supporting regional power distribution needs.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Prysmian remains a strategically important player in the global High-temperature and Low-sag Conductor Market in 2024 due to its strong technical depth and long-standing expertise in energy transmission solutions. The company benefits from deep integration across power grid value chains, allowing it to align conductor design with evolving grid performance requirements. Prysmian’s focus on advanced conductor engineering supports utilities seeking higher capacity transmission without extensive right-of-way expansion, reinforcing its relevance in mature and regulated markets.

Sterlite Power is viewed as a growth-oriented participant with a strong execution mindset in transmission infrastructure and conductor deployment. The company’s positioning reflects its ability to combine manufacturing capabilities with a project-level understanding of grid constraints. In 2024, Sterlite Power continues to be recognized for addressing practical challenges such as line uprating, thermal efficiency, and deployment speed, which are critical for utilities operating under rising demand and tight timelines.

CTC Global Corporation holds a distinctive position through its specialization in advanced conductor technologies designed to enhance capacity while minimizing sag. Analysts see the company as a focused innovator, with its solutions tailored to retrofit existing lines efficiently. In 2024, CTC Global’s emphasis on performance-driven conductor design supports utilities aiming to modernize grids without major structural changes, strengthening its niche leadership in high-performance transmission conductors.

Top Key Players in the Market

- Prysmian

- Sterlite Power

- CTC Global Corporation

- SAPREM

- DeAngeli Prodotti s.r.l

- LS VINA Cable & System

- Premier Cables

- TS Conductor

Recent Developments

- In December 2024, Sterlite Power raised INR 725 crore from GEF Capital Partners and ENAM Holdings in December 2024 for its Global Products and Solutions (GPS) business. The funds are intended to expand production capabilities, accelerate new product development, and enhance manufacturing of conductors and cables.

- In April 2024, Prysmian (a global cable and energy-transmission solutions company) signed a definitive agreement to acquire Encore Wire for $290.00 per share in cash, expanding its North America exposure and broadening its offering for power generation and distribution customers.

Report Scope

Report Features Description Market Value (2024) USD 1.73 Billion Forecast Revenue (2034) USD 3.84 Billion CAGR (2025-2034) 8.30% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (ACCC, ACSS, ACCR, ACSR, AAC, ACAR), By Application (Power Transmission, Power Distribution, Bare Overhead Transmission Conductor, Support Conductors, Retrofit), By End-User (Utilities, Industrial, Commercial, Renewable Power Generators, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Prysmian, Sterlite Power, CTC Global Corporation, SAPREM, DeAngeli Prodotti s.r.l, LS VINA Cable & System, Premier Cables, TS Conductor Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  High-temperature and Low-sag Conductor MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

High-temperature and Low-sag Conductor MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Prysmian

- Sterlite Power

- CTC Global Corporation

- SAPREM

- DeAngeli Prodotti s.r.l

- LS VINA Cable & System

- Premier Cables

- TS Conductor