Global High-End Copper Foil Market Size, Share, And Enhanced Productivity By Type (Electrode Foll, Circuit Board Foll, Winding Foil, Heat Sink Foll), By Thickness (Below 18 Micron, 18-35 Micron, 35-50 Micron, Above 50 Micran), By Application (Consumer Electronics, Automotive, Aerospace, Telecommunications, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174250

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

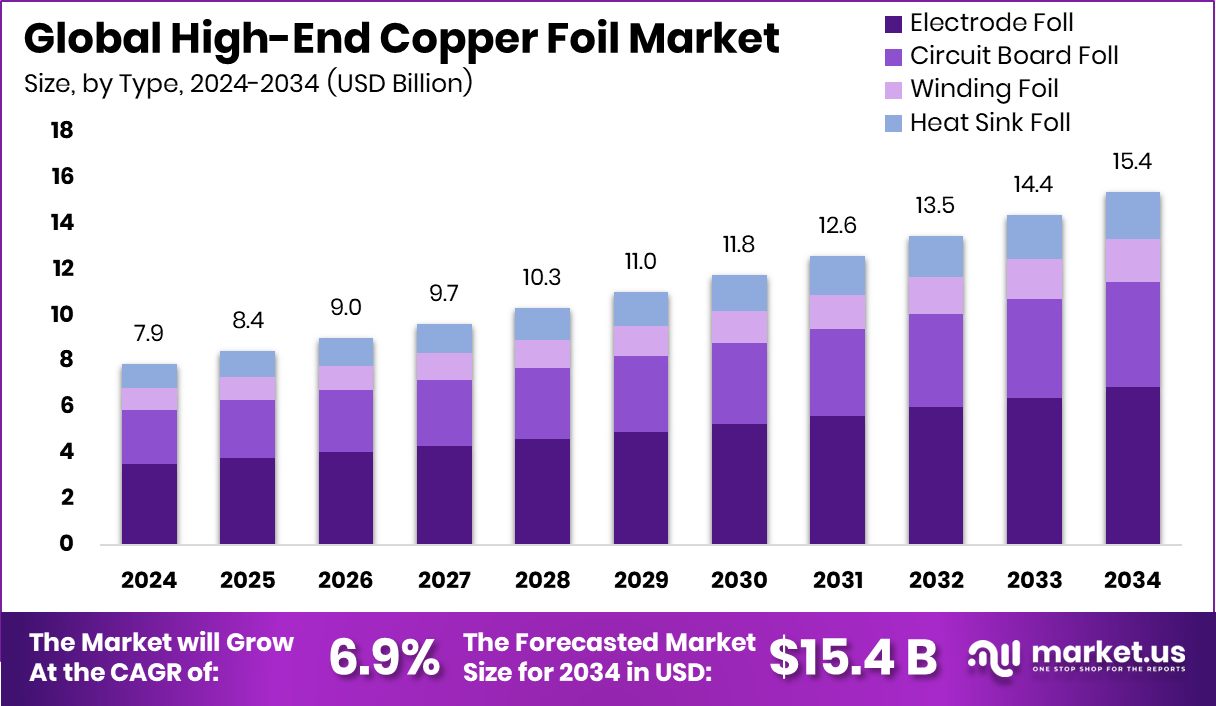

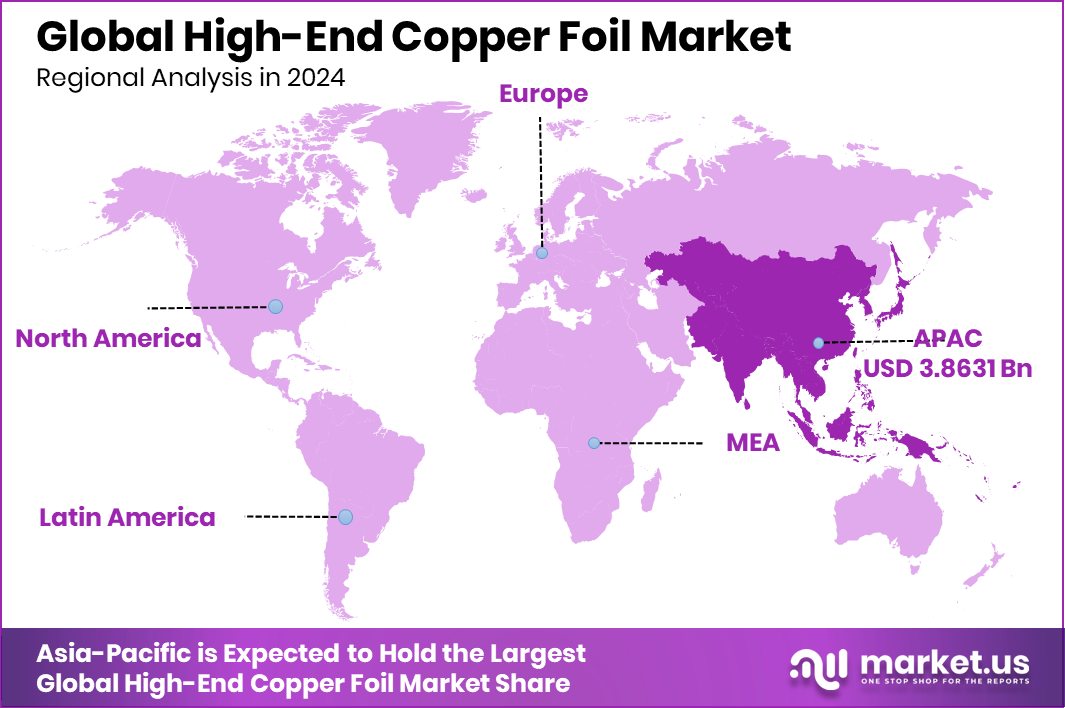

The Global High-End Copper Foil Market is expected to be worth around USD 15.4 billion by 2034, up from USD 7.9 billion in 2024, and is projected to grow at a CAGR of 6.9% from 2025 to 2034. Asia Pacific led regional demand at 49%, generating USD 3.8631 Bn revenue regionally.

High-end copper foil is a refined, ultra-thin copper material engineered for excellent conductivity, strength, and surface uniformity. It is mainly used in advanced electronics, batteries, and high-frequency circuits where precision, reliability, and stable electrical performance are critical for modern compact devices.

The high-end copper foil market covers the production and supply of premium copper foils for electronics, energy storage, and industrial applications. It reflects rising investment in advanced manufacturing, as seen with Volta receiving $140 million for a Quebec battery copper foil plant, alongside a $194 million boost from a South Korean export bank for the same regional EV materials project.

Market growth is supported by large-scale copper and materials investments. Ivanhoe received $500 million from Qatar to support copper buildout, while Capstone secured $360 million for its Chile copper project, strengthening long-term raw material availability.

Demand continues rising as manufacturers expand regional capacity. A copper foil maker raising $700 million to build a European plant highlights a strong appetite for localised supply. In India, Vidya Wires plans ₹320 crore in fresh funds to support capacity expansion and growth.

Future opportunities are tied to large integrated investments. Hindalco plans to invest ₹45,000 crore across aluminium and copper businesses, supporting advanced copper processing. Such commitments create scope for technology upgrades, supply security, and wider adoption of high-end copper foil globally.

Key Takeaways

- The Global High-End Copper Foil Market is expected to be worth around USD 15.4 billion by 2034, up from USD 7.9 billion in 2024, and is projected to grow at a CAGR of 6.9% from 2025 to 2034.

- Electrode foil leads the High-End Copper Foil Market with 44.6% share, driven by lithium-ion battery demand.

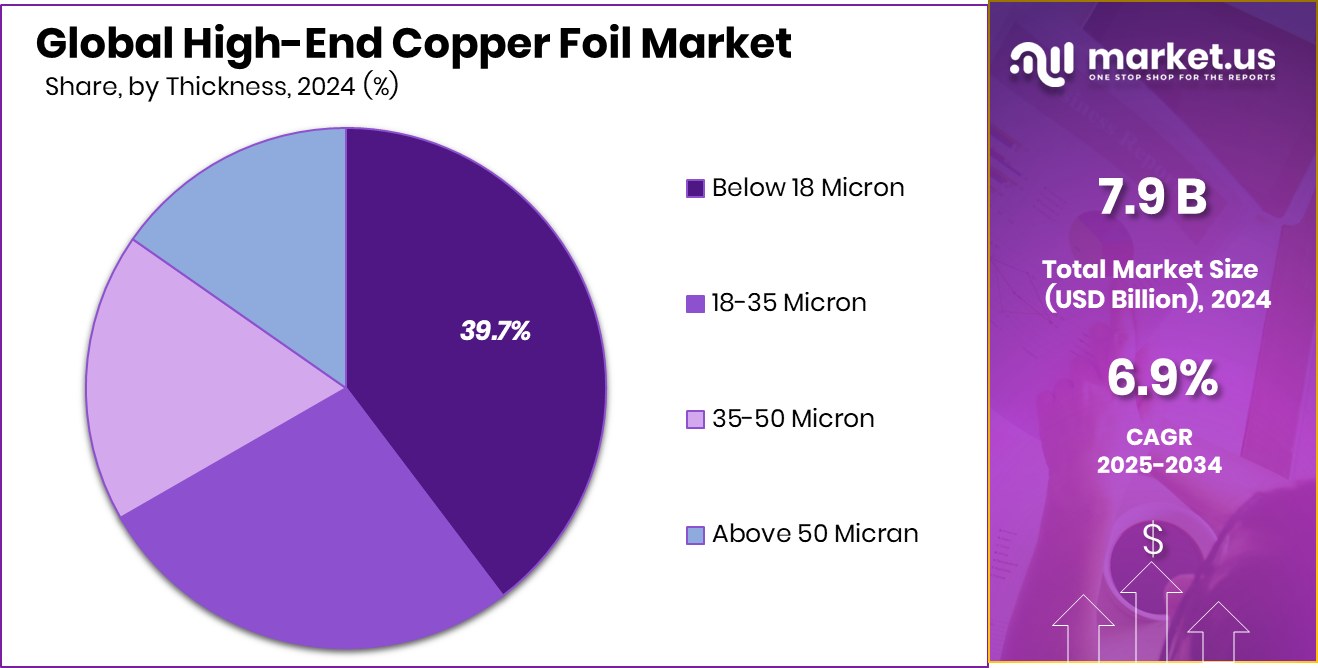

- Below 18 micron copper foil holds 39.7% share, preferred for lightweight, high-energy-density electronic applications.

- Consumer electronics account for 37.6% share, supported by smartphones, wearables, and advanced portable device manufacturing.

- Asia Pacific accounted for 49% of the high-end copper foil market, USD 3.8631 Bn.

By Type Analysis

High-End Copper Foil Market shows electrode foil leading type with 44.6% share.

In 2024, the High-End Copper Foil Market by type was led by Electrode Foil, accounting for 44.6% of total demand. This dominance reflects the rising need for highly uniform, high-purity copper foil used in advanced electronic and energy applications. Electrodeposited copper foil is preferred because it offers better thickness control, smoother surfaces, and strong adhesion to substrates. These features are critical for lithium-ion batteries, compact circuit designs, and high-frequency signal transmission.

Manufacturers are investing in process upgrades to improve tensile strength and conductivity while reducing defect rates. As consumer devices become thinner and more powerful, electrode foil continues to gain traction due to its ability to support miniaturisation without compromising electrical performance or long-term reliability.

By Thickness Analysis

High-End Copper Foil Market sees below 18 micron thickness dominating 39.7% segment.

In 2024, the High-End Copper Foil Market by thickness showed a strong preference for below 18 micron products, which captured 39.7% of overall usage. Ultra-thin copper foil is increasingly required to support lightweight, flexible, and space-efficient electronic components. Thinner foils allow higher circuit density and better heat dissipation, which are essential for modern batteries, smartphones, and wearable electronics.

Producers are refining rolling and electrodeposition techniques to achieve consistent thickness while maintaining mechanical strength. Demand for below-18-micron foil is also supported by the shift toward compact battery designs in portable devices. This thickness category balances performance and material efficiency, helping manufacturers reduce copper consumption while still meeting strict electrical and durability standards.

By Application Analysis

High-End Copper Foil Market driven by consumer electronics application holding 37.6% share.

In 2024, the High-End Copper Foil Market by application was dominated by Consumer Electronics, holding a 37.6% share. This leadership is driven by sustained demand for smartphones, laptops, tablets, and smart home devices. High-end copper foil is essential in these products for printed circuit boards and battery components, where stable conductivity and fine patterning are critical.

The trend toward faster processors, higher storage capacity, and longer battery life directly increases copper foil usage per device. Electronics brands are also focusing on slimmer designs, which require thinner and more reliable foil materials. As consumer electronics continue to evolve toward high performance in compact formats, copper foil remains a core enabling material.

Key Market Segments

By Type

- Electrode Foll

- Circuit Board Foll

- Winding Foil

- Heat Sink Foll

By Thickness

- Below 18 Micron

- 18-35 Micron

- 35-50 Micron

- Above 50 Micran

By Application

- Consumer Electronics

- Automotive

- Aerospace

- Telecommunications

- Others

Driving Factors

Advanced Electronics Pushes Copper Foil Demand Globally

The High-End Copper Foil Market is strongly driven by rising demand for advanced electronics and energy systems that rely on stable electrical conductivity and heat management. As global funding priorities shift, manufacturing-focused sectors are absorbing more responsibility for materials efficiency.

For example, the US Supreme Court’s allowing former President Trump to withhold $4 billion in food aid funding has indirectly highlighted how capital is being redirected toward domestic industrial strength and infrastructure-linked manufacturing. This shift supports materials like high-end copper foil that are essential for electronics, power systems, and data infrastructure.

Manufacturers increasingly require copper foil with tight thickness control and high purity to support compact, high-performance designs. As electronic devices, grids, and digital infrastructure expand, the need for reliable copper-based materials continues to grow steadily across regions.

Restraining Factors

High Capital And Energy Costs Limit Expansion

One key restraining factor for the High-End Copper Foil Market is the high cost of production, especially energy consumption and thermal control during manufacturing. Advanced copper foil production requires precise temperature regulation, clean environments, and energy-intensive processes, which increase operational costs. This challenge is visible even in adjacent thermal technology sectors, where Chennai-based Tan90 Thermal Solutions raised ₹20 crore in Series A funding to scale its thermal management solutions.

Such funding highlights how companies must invest heavily just to manage heat efficiently. For copper foil producers, similar cost pressures can delay capacity expansion or limit price flexibility. Smaller manufacturers often struggle to scale without strong financial backing, making cost control and energy efficiency ongoing constraints for market growth.

Growth Opportunity

Data Centre Cooling Drives Material Innovation Demand

A major growth opportunity for the High-End Copper Foil Market is emerging from data centres and high-performance computing infrastructure. These systems demand efficient electrical flow and advanced heat dissipation, where copper-based materials play a vital role. Innovation in cooling directly supports copper foil usage, as shown by a Swiss startup raising $1.85 million to commercialise metal foam cooling for data centres.

Such technologies increase the need for compatible, high-quality copper components that can handle thermal stress. As data centres grow in size and density, copper foil demand rises not only for circuitry but also for thermal and structural applications. This creates long-term opportunities for suppliers focused on performance-driven, next-generation copper foil solutions.

Latest Trends

Thermal Management Integration Shapes Copper Foil Designs

One of the latest trends in the High-End Copper Foil Market is the closer integration of copper foil with advanced thermal management systems. Modern electronics no longer treat conductivity and cooling separately; materials are expected to support both functions. This trend is reinforced by public support for cooling innovation, including $1 million in federal funding for Advanced Cooling Technologies and over $4 million in California grants for a thermal storage startup. These investments signal a growing emphasis on heat-efficient infrastructure. As cooling systems evolve, copper foil designs are adapting with improved surface treatments and structural performance. This alignment between cooling innovation and copper materials is shaping new product development across high-end applications.

Regional Analysis

Asia Pacific dominated the High-End Copper Foil Market with 49% share, USD 3.8631 Bn.

The High-End Copper Foil Market shows clear regional differentiation based on manufacturing intensity, electronics demand, and supply-chain maturity. Asia Pacific stands as the dominating region, accounting for 49% of the global market and generating USD 3.8631 Bn in value, supported by its strong presence in consumer electronics manufacturing, battery production, and printed circuit board fabrication. Countries across this region benefit from large-scale production capacity and integrated downstream electronics ecosystems, making Asia Pacific the central hub for high-end copper foil demand and supply.

North America represents a technologically advanced market, driven by innovation-focused electronics and energy storage applications, with steady demand for high-performance copper foil grades. Europe follows with consistent uptake, supported by advanced automotive electronics, industrial applications, and strict quality requirements.

Middle East & Africa remains an emerging region, with demand linked to gradual industrial expansion and electronics assembly activities. Latin America shows developing potential, supported by growing electronics consumption and regional manufacturing initiatives. Overall, Asia Pacific clearly leads the market landscape, while other regions contribute through stable, application-specific demand patterns aligned with their industrial structures.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Chang Chun Petrochemical Co., Ltd. plays a strategic role in the global high-end copper foil market through its strong materials science background and integrated chemical manufacturing capabilities. The company’s expertise in advanced materials supports consistent quality and process control, which are critical for high-end copper foil used in electronics and energy-related applications. Its long-standing industrial presence allows it to align copper foil development with downstream material requirements, strengthening its position as a reliable supplier in performance-sensitive segments.

Civen Metal Material (Shanghai) Co., Ltd. is viewed as a focused specialist with deep know-how in precision copper foil manufacturing. The company is recognised for its attention to thickness uniformity, surface treatment, and mechanical performance, which are essential for high-density electronic applications. Its operations are closely aligned with regional electronics manufacturing ecosystems, enabling responsiveness to customer specifications and evolving technical demands in high-end applications.

Doosan Corporation brings diversification strength and engineering discipline to the high-end copper foil market. With a broad industrial portfolio, Doosan leverages process optimisation, quality systems, and scale-driven efficiencies. This positions the company well to support advanced electronics and energy storage applications that require a stable supply, technical consistency, and long-term reliability, reinforcing its competitive standing in 2024.

Top Key Players in the Market

- Chang Chun Petrochemical Co. Ltd

- Civen Metal Material(Shanghai) Co., Ltd

- Doosan Corporation

- Fukuda Metal Foil & Powder Co. Ltd

- JX Nippon Mining & Metals Corporation

- Mitsui Mining & Smelting Co. Ltd

- Solus Advanced Materials

- Sumitomo Metal Mining Co. Ltd

- SH Copper Products Co. Ltd

- The Furukawa Electric C,o. Ltd

Recent Developments

- In September 2025, Fukuda Metal Foil & Powder updated its product information to introduce or revise details related to its copper and related metal materials, reflecting enhancements or expansions in its product portfolio. This update indicates the company is actively refining its offerings in high-performance metal foils and powders.

- In May 2024, JX Nippon Mining & Metals announced plans to expand its copper foil production facility in Japan to meet growing global demand—especially from manufacturers of electric vehicle batteries and advanced electronics. This move shows the company is boosting capacity to support key high-performance materials like copper foil.

Report Scope

Report Features Description Market Value (2024) USD 7.9 Billion Forecast Revenue (2034) USD 15.4 Billion CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Electrode Foll, Circuit Board Foll, Winding Foil, Heat Sink Foll), By Thickness (Below 18 Micron, 18-35 Micron, 35-50 Micron, Above Micronran), By Application (Consumer Electronics, Automotive, Aerospace, Telecommunications, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Chang Chun Petrochemical Co. Ltd, Civen Metal Material(Shanghai) Co. Ltd, Doosan Corporation, Fukuda Metal Foil & Powder Co. Ltd, JX Nippon Mining & Metals Corporation, Mitsui Mining & Smelting Co. Ltd, Solus Advanced Materials, Sumitomo Metal Mining Co. Ltd, SH Copper Products Co. Ltd, The Furukawa Electric Co. Ltd Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  High-End Copper Foil MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

High-End Copper Foil MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Chang Chun Petrochemical Co. Ltd

- Civen Metal Material(Shanghai) Co., Ltd

- Doosan Corporation

- Fukuda Metal Foil & Powder Co. Ltd

- JX Nippon Mining & Metals Corporation

- Mitsui Mining & Smelting Co. Ltd

- Solus Advanced Materials

- Sumitomo Metal Mining Co. Ltd

- SH Copper Products Co. Ltd

- The Furukawa Electric C,o. Ltd