Global Heavy Duty Motor Oil Market Size, Share, And Business Benefit By Types (Synthetic Oil, Synthetic Blends, Conventional Oil, High-mileage Oil), By Application (Trucks, Buses and Vans, Tractors, Cars and Light-Duty Vehicles, Power Generation, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 164587

- Number of Pages: 273

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

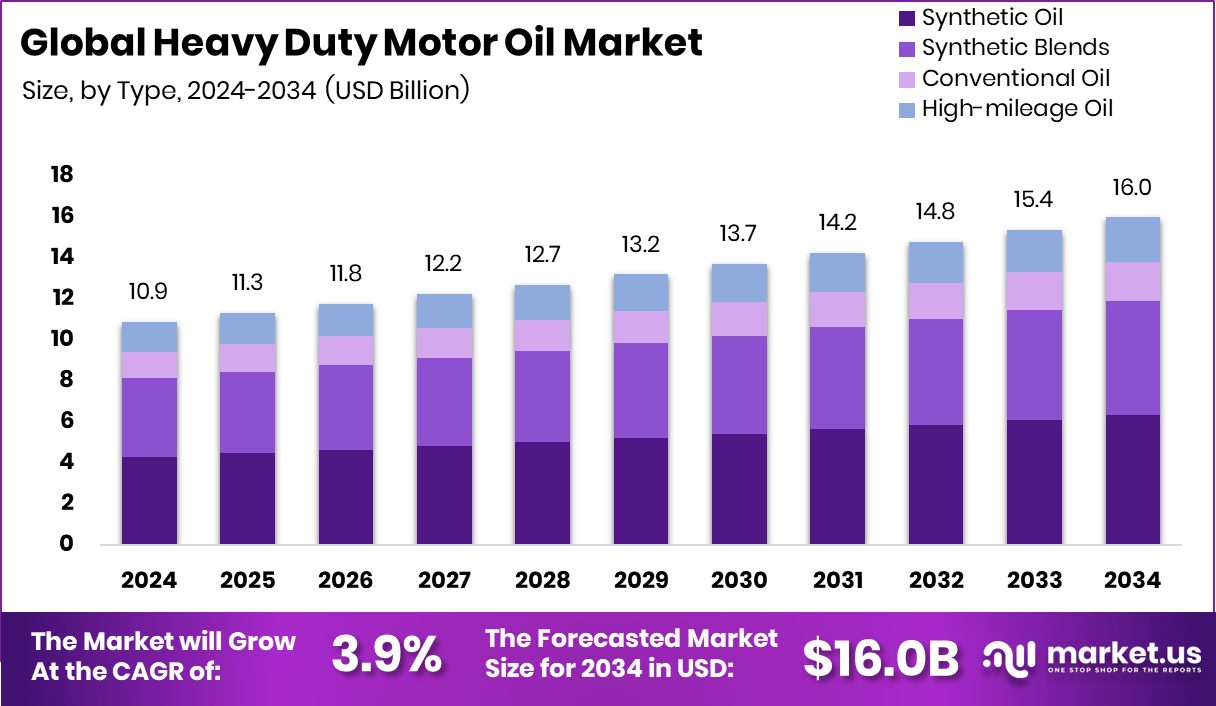

The Global Heavy Duty Motor Oil Market is expected to be worth around USD 16.0 billion by 2034, up from USD 10.9 billion in 2024, and is projected to grow at a CAGR of 3.9% from 2025 to 2034. Growing transportation, logistics, and manufacturing activities in the Asia-Pacific 48.30% boosted heavy-duty oil consumption.

Heavy duty motor oil is a specialised lubricant formulated for vehicles and equipment that operate under tougher conditions than everyday cars. These include commercial trucks, buses, agricultural machinery, mining vehicles, and large off-road equipment. The formulation must withstand higher loads, elevated temperatures, greater continuous operation, and more severe engine stresses. It protects engines by reducing friction, preventing wear, resisting oxidation, and maintaining viscosity under challenging service cycles.

The heavy-duty motor oil market encompasses the manufacturing, supply, and distribution of these high-performance lubricants. This market covers different base types (mineral, semi-synthetic, and full synthetic), various viscosity grades, and a range of applications (on-road heavy commercial vehicles, off-road equipment, and power-generation engines). The demand is global, driven by fleet operations, infrastructure, agricultural industries, and regions with growing heavy-duty vehicle penetration.

One major growth driver is the expansion of heavy-duty commercial fleets and off-road equipment in emerging economies. As infrastructure development and logistics operations ramp up, more heavy trucks, buses, and construction and agricultural vehicles enter service—and all require suitable lubricants for reliable performance. Moreover, modern engines demand better protection and efficiency. Stricter emission regulations force manufacturers to adopt engine oils that support after-treatment systems, extended oil drain intervals, and tougher duty cycles, which boosts demand for the advanced grades of heavy-duty motor oil.

Demand is also fuelled by preventive-maintenance practices and fleet uptime priorities. Operators are increasingly focused on reducing downtime, maintenance costs, and unexpected failures, which means opting for premium lubricant solutions rather than standard ones. As vehicle usage intensifies—long hauls, heavy loads, extended idling—the lubricant must perform under more stress.

An exciting opportunity lies in sustainable and next-generation lubricant formulations. With rising environmental and regulatory pressure, there is room to develop biodegradable base oils, recycled-oil solutions, and advanced additive packages that extend service life, improve fuel efficiency, and reduce waste. Also, digital monitoring and condition-based maintenance create opportunities for lubricants packaged with predictive analytics services.

For example, recent corporate news includes a company’s profit rising to Rs 2.33 billion on strong engine-oil demand, another firm securing Rs 84 crore Series A funding, and investments such as Germany granting €350 m to a producer of green hydrogen-derived synthetic aviation fuel alongside a synthetic palm oil startup raising US $1.2 million pre-seed. These show that capital is flowing into related ecosystems, suggesting that lubricant firms aligned with sustainability and high-performance may find strong backing.

Key Takeaways

- The Global Heavy Duty Motor Oil Market is expected to be worth around USD 16.0 billion by 2034, up from USD 10.9 billion in 2024, and is projected to grow at a CAGR of 3.9% from 2025 to 2034.

- In 2024, Synthetic Oil dominated the Heavy Duty Motor Oil Market, capturing 39.5% of the global share.

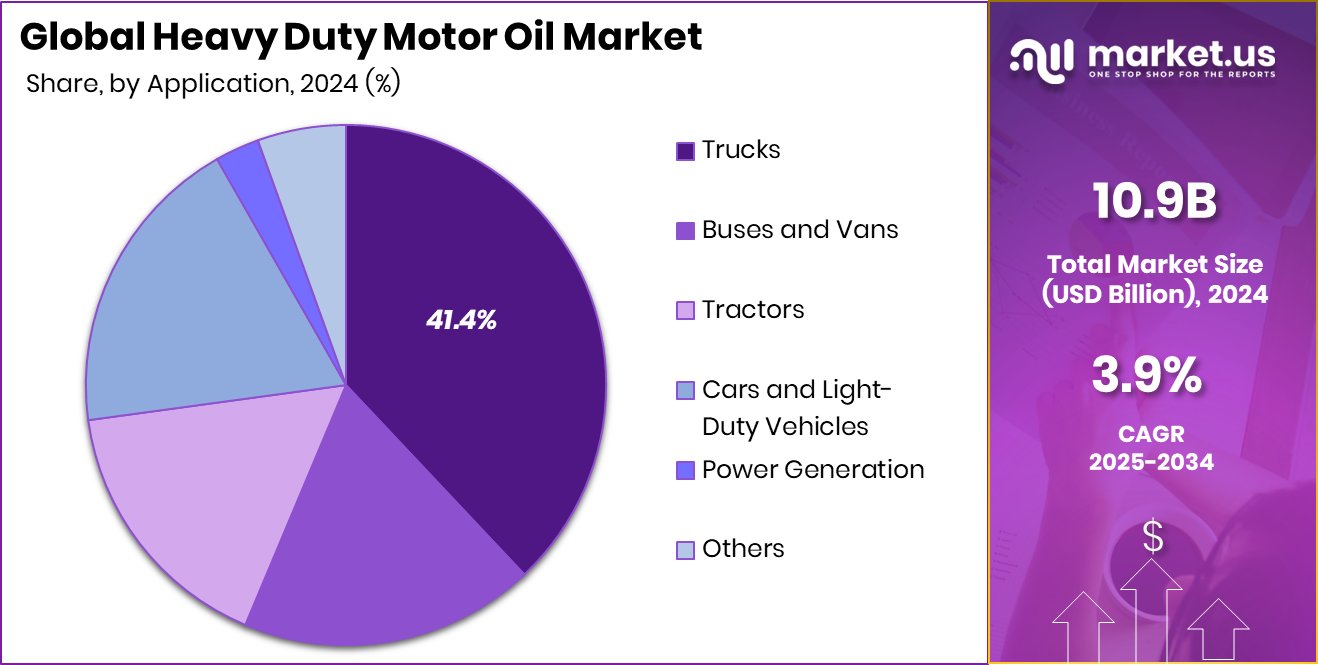

- Trucks accounted for the largest segment in the Heavy Duty Motor Oil Market, holding 41.4% share

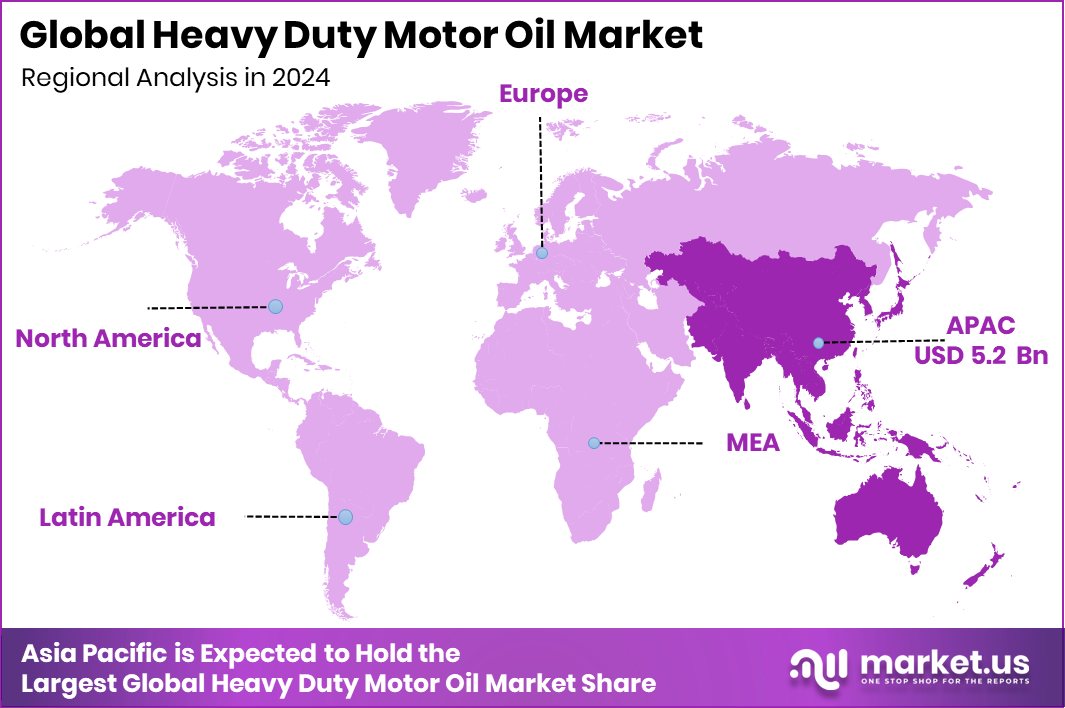

- The Asia-Pacific market value reached around USD 5.2 billion, reflecting strong industrial expansion.

By Types Analysis

In 2024, synthetic oil dominated the Heavy Duty Motor Oil Market, capturing 39.5% share..

In 2024, Synthetic Oil held a dominant market position in the By Types segment of the Heavy Duty Motor Oil Market, capturing a 39.5% share. This dominance is attributed to its superior engine protection, enhanced viscosity stability, and better oxidation resistance under extreme conditions. Synthetic oils are preferred for heavy-duty commercial vehicles, offering extended oil drain intervals and improved fuel efficiency.

Their ability to perform effectively in both high-temperature and low-temperature environments supports engine longevity and operational reliability. The rising use of advanced engines and the growing focus on emission compliance have further strengthened synthetic oil adoption, making it the preferred choice among fleet operators and industrial users in 2024.

By Application Analysis

Trucks led the Heavy Duty Motor Oil Market with a 41.4% share in 2024.

In 2024, Trucks held a dominant market position in the By Application segment of the Heavy Duty Motor Oil Market, capturing a 41.4% share. The segment’s strength is driven by the extensive use of heavy-duty motor oils in long-haul and commercial trucking fleets that require consistent engine performance under high-load operations. These vehicles demand lubricants that provide superior wear protection, thermal stability, and extended service intervals.

The growth of logistics, e-commerce, and freight transportation has further supported the rising consumption of motor oils in the truck segment. Continuous engine advancements and stricter emission standards have reinforced the use of high-performance oils, making trucks the leading application area in 2024.

Key Market Segments

By Types

- Synthetic Oil

- Synthetic Blends

- Conventional Oil

- High-mileage Oil

By Application

- Trucks

- Buses and Vans

- Tractors

- Cars and Light-Duty Vehicles

- Power Generation

- Others

Driving Factors

Expanding Infrastructure and Energy Transition Fuel Market Growth

One of the strongest driving factors for the Heavy Duty Motor Oil Market is the expansion of global infrastructure and modernization of industrial energy systems. As governments worldwide invest in energy transitions and transport upgrades, demand for high-performance lubricants rises. The U.S. Department of Energy’s decision to direct $100 million toward modernizing declining coal plants highlights a shift toward cleaner, more efficient industrial operations.

Similarly, India’s government approving Rs 5,400 crore in viability gap funding to develop 30 GWh of battery storage shows long-term investment in reliable energy and logistics networks. Such large-scale funding initiatives drive the need for durable motor oils capable of sustaining extended operation hours and supporting efficient fleet movement, reinforcing market momentum.

Restraining Factors

Rising Shift Toward Clean and Alternative Energy Sources

A key restraining factor for the Heavy Duty Motor Oil Market is the growing global transition toward cleaner and renewable energy alternatives. As more industries and governments invest in decarbonization, demand for traditional petroleum-based lubricants faces gradual pressure. The rise of electric vehicles, hybrid fleets, and advanced battery systems reduces reliance on conventional diesel engines that use heavy-duty motor oils. This transition is supported by large-scale funding and innovation in cleaner technologies.

For instance, Core Energy Systems, a company focused on nuclear power solutions, recently raised ₹200 crore in funding to expand sustainable and low-emission energy capabilities. Such investments highlight the accelerating shift toward green power, indirectly limiting the long-term growth prospects of traditional motor oil markets.

Growth Opportunity

Rising Investments in Clean and Efficient Engine Technologies

A major growth opportunity in the Heavy Duty Motor Oil Market lies in developing cleaner, more efficient, and sustainable engine oil formulations. As industries and fleets aim to reduce carbon emissions, there is growing demand for low-viscosity, bio-based, and long-drain lubricants that enhance fuel economy and cut maintenance costs. The global energy sector is also witnessing a surge in sustainable investment activity.

For instance, there are 862 clean energy projects currently seeking funding, highlighting the scale of opportunity for supporting technologies like efficient lubricants that complement clean power transitions. Manufacturers focusing on eco-friendly motor oil innovations can align with these sustainability goals, capture new customers, and strengthen their role in the evolving energy and transportation landscape.

Latest Trends

Growing Financial Support for Energy and Lubricant Innovation

One of the latest trends shaping the Heavy Duty Motor Oil Market is the increasing flow of capital into sustainable energy and lubricant-related infrastructure. Governments and financial institutions are now prioritizing clean energy projects and advanced lubricant technologies that align with carbon-reduction goals.

A notable example is the recent US$500 million DRE Nigeria Fund launched by NSIA, SEforALL, ISA, and Africa50, aimed at driving decentralized renewable energy growth across Africa. This type of large-scale funding not only accelerates cleaner energy adoption but also opens pathways for hybrid lubricants and advanced oil formulations designed for new-generation engines.

Regional Analysis

In 2024, the Asia-Pacific dominated the Heavy Duty Motor Oil Market with a 48.30% share.

In 2024, Asia-Pacific emerged as the dominant region in the Heavy Duty Motor Oil Market, holding a 48.30% share valued at USD 5.2 billion. The region’s leadership is supported by its vast commercial vehicle base, rapid industrialization, and expanding logistics sector across China, India, and Southeast Asia. Strong growth in infrastructure development, construction equipment usage, and long-haul freight transportation continues to drive higher lubricant demand.

In North America, steady fleet modernization and preventive maintenance trends sustain market performance, supported by technological advancements in oil formulations. Europe shows consistent growth driven by stringent emission regulations and increased use of synthetic motor oils to enhance fuel efficiency. Meanwhile, the Middle East & Africa market benefits from active construction projects and expanding mining operations requiring durable lubrication solutions.

Latin America maintains gradual progress with improving industrial activities and recovery in transportation sectors. Collectively, these regions contribute to the global demand pattern, but Asia-Pacific remains the clear leader due to its fast-growing heavy-duty vehicle population, strong manufacturing ecosystem, and rising adoption of premium synthetic lubricants to meet evolving environmental and operational standards.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF continued to strengthen its position through its advanced additive technologies and chemical innovations that improve oil stability, oxidation resistance, and engine cleanliness. The company’s strong focus on high-performance lubricants aligned with the industry’s shift toward low-emission and fuel-efficient formulations.

Chevron Oronite, a major player in lubricant additive manufacturing, emphasized expanding its product portfolio to meet growing demand for heavy-duty diesel engine oils capable of handling extended drain intervals and stricter emission regulations. Its expertise in formulating base stocks and performance-enhancing chemicals contributed to better wear protection and thermal efficiency.

Lubrizol, known for its specialized additive packages, concentrated on research-driven advancements to enhance viscosity control, reduce friction, and improve long-term engine reliability. The company’s technological focus supports OEM and fleet maintenance requirements for durability under severe conditions.

Together, these companies are driving innovation in the heavy-duty motor oil segment by introducing cleaner, more efficient, and sustainable formulations that align with evolving emission norms, highlighting their critical role in shaping the next generation of performance-driven lubricant technologies in 2024.

Top Key Players in the Market

- BASF

- Chevron Oronite

- Lubrizol

- Lanxess

- Evonik

- Croda

- Huntsman

- Multisol

- Total

Recent Developments

- In March 2025, BASF announced an investment to increase capacity for aminic antioxidants at its Puebla, Mexico, manufacturing site. The move is meant to address growing global demand for long-life lubricants, highlighting BASF’s focus on lubricant additive components.

- In December 2024, Lubrizol announced the launch of CV9660, a new heavy-duty lubricant technology designed to reduce emissions while enhancing engine performance and extending longevity.

Report Scope

Report Features Description Market Value (2024) USD 10.9 Billion Forecast Revenue (2034) USD 16.0 Billion CAGR (2025-2034) 3.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Types (Synthetic Oil, Synthetic Blends, Conventional Oil, High-mileage Oil), By Application (Trucks, Buses and Vans, Tractors, Cars and Light-Duty Vehicles, Power Generation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF, Chevron Oronite, Lubrizol, Lanxess, Evonik, Croda, Huntsman, Multisol, Total Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Heavy Duty Motor Oil MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Heavy Duty Motor Oil MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF

- Chevron Oronite

- Lubrizol

- Lanxess

- Evonik

- Croda

- Huntsman

- Multisol

- Total