Global Hair Gel Market Size, Share, Growth Analysis Type (Water-Based, Alcohol-Based, Gel Creams, Aloe Vera Based), Application (Styling, Hold, Shine, Moisturizing), End Use (Men, Women, Unisex), Distribution Channel (Online Retailers, Supermarkets/Hypermarkets, Beauty Stores, Pharmacies, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 177074

- Number of Pages: 314

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

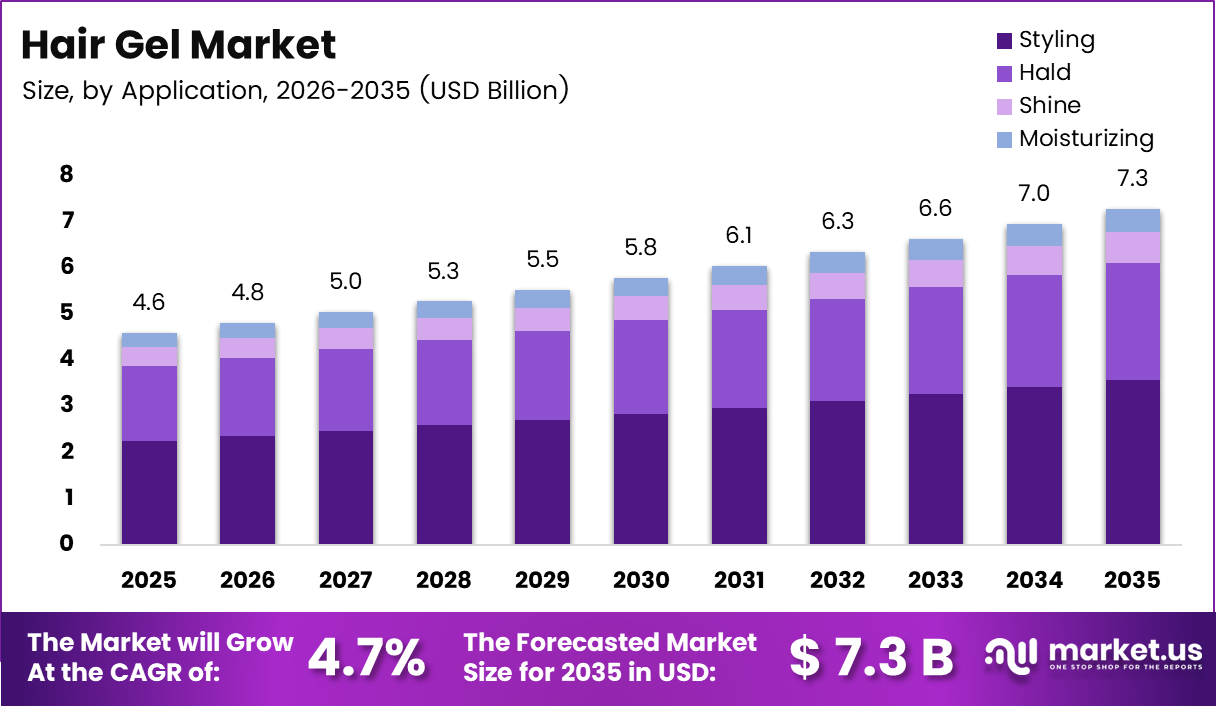

Global Hair Gel Market size is expected to be worth around USD 7.3 Billion by 2035 from USD 4.6 Billion in 2025, growing at a CAGR of 4.7% during the forecast period 2026 to 2035.

Hair gel represents a specialized cosmetic styling product designed to maintain hairstyles through polymer-based formulations. These products offer varying hold strengths and finishes for diverse consumer preferences. Moreover, they cater to multiple hair types and styling requirements across demographic segments.

The market encompasses water-based, alcohol-based, gel creams, and aloe vera Extract Formulation. Consequently, manufacturers develop products addressing specific consumer needs including hold strength, shine enhancement, and moisturizing properties. Additionally, innovations focus on reducing hair damage while maintaining styling effectiveness.

Market expansion stems from rising grooming consciousness among male consumers globally. Urban and semi-urban populations increasingly adopt professional styling products for daily grooming routines. Therefore, demand for long-lasting and strong-hold solutions continues accelerating across key demographics.

Youth populations influenced by fashion trends and pop culture significantly drive consumption patterns. However, growing awareness about chemical ingredients and scalp sensitivity presents challenges. Consequently, manufacturers pivot toward organic and herbal formulations to address consumer concerns.

Distribution channels have diversified considerably through supermarkets, specialty beauty stores, and online platforms. This widespread availability enhances product accessibility across consumer segments. Additionally, e-commerce platforms enable personalized product discovery and convenient purchasing experiences.

According to Henkel, natural styling products containing aloe vera maintain hair’s natural moisture balance with 15% more moisture retention. Furthermore, formulation innovations focus on pH optimization between 7.3 and 7.5 for enhanced scalp compatibility. These developments reflect industry commitment to balancing styling performance with hair health.

The competitive landscape features established personal care conglomerates and specialized grooming brands. Strategic acquisitions and product portfolio expansions characterize recent market activities. Moreover, sustainability initiatives and eco-friendly packaging gain prominence as consumers prioritize environmental considerations in purchasing decisions.

Key Takeaways

- Global Hair Gel Market projected to reach USD 7.3 Billion by 2035, growing at 4.7% CAGR from 2025 to 2035

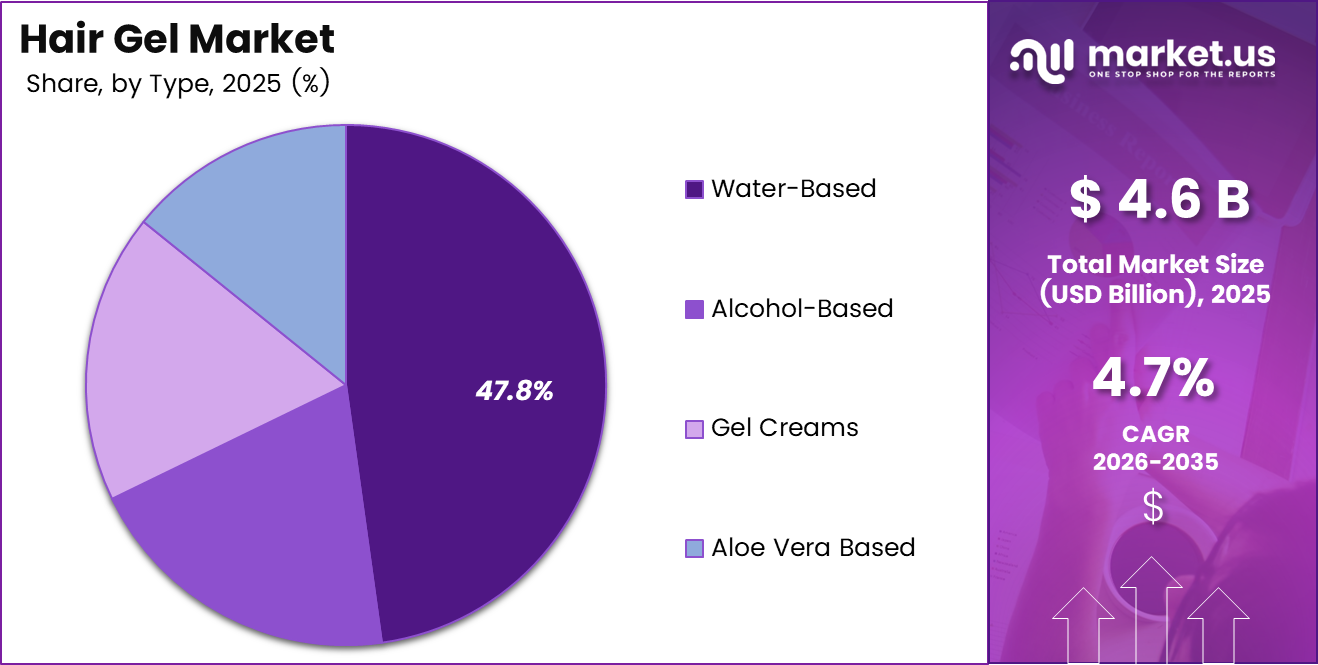

- Water-Based segment dominates Type category with 47.8% market share in 2025

- Styling application leads with 49.1% share, driven by professional and daily grooming needs

- Men segment holds 56.3% share in End Use category, reflecting male grooming trends

- Online Retailers command 34.2% of Distribution Channel segment through e-commerce expansion

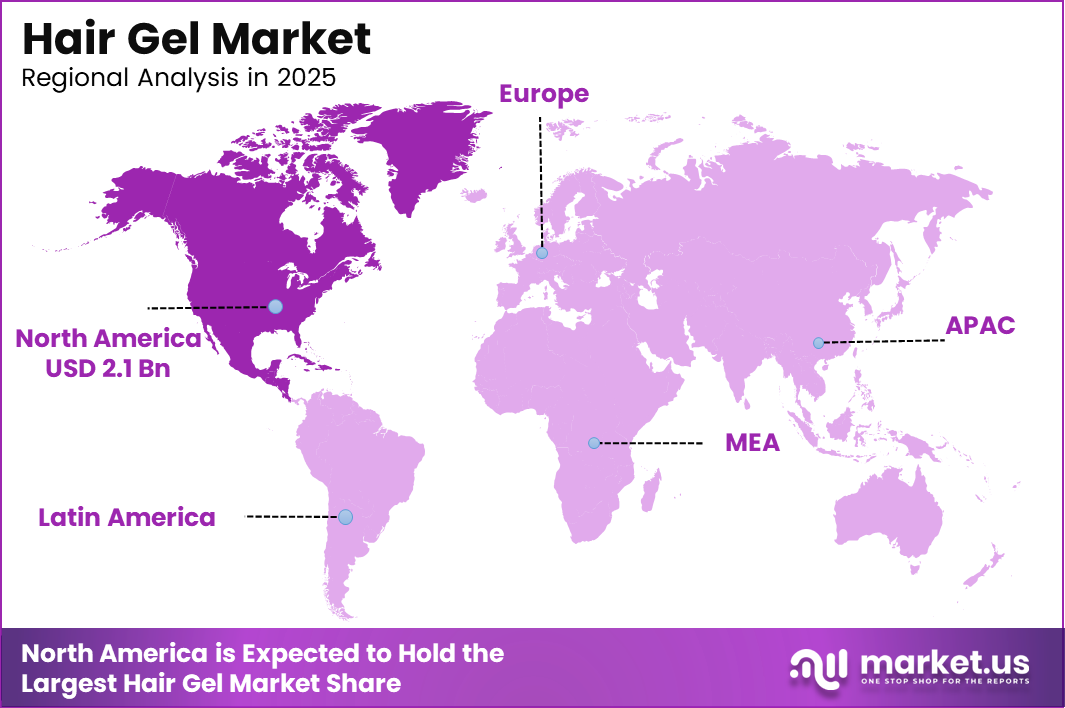

- North America dominates regional market with 45.7% share, valued at USD 2.1 Billion

- Rising demand for organic and alcohol-free formulations reshapes product development strategies

- Premium salon-grade products and celebrity endorsements accelerate market growth opportunities

Type Analysis

Water-Based dominates with 47.8% due to consumer preference for non-damaging and easy-to-wash formulations.

In 2025, Water-Based held a dominant market position in the Type segment of Hair Gel Market, with a 47.8% share. These formulations offer superior washability and reduced chemical exposure compared to alternatives. Moreover, water-based gels minimize scalp irritation while providing adequate styling hold for everyday use.

Alcohol-Based gels deliver stronger hold and faster drying times preferred by professional stylists. However, concerns about hair dryness and damage limit widespread adoption among health-conscious consumers. Consequently, manufacturers reformulate products with moisturizing agents to balance performance with hair care benefits.

Gel Creams combine styling hold with conditioning properties for versatile applications. These hybrid formulations cater to consumers seeking multi-functional products that simplify grooming routines. Additionally, gel creams address specific needs like frizz control and texture enhancement across hair types.

Aloe Vera Based gels capitalize on natural ingredient trends and organic product demand. According to Henkel, aloe vera maintains natural moisture balance with 15% enhanced retention. Therefore, these formulations attract environmentally conscious consumers prioritizing scalp health and sustainable beauty solutions.

Application Analysis

Styling dominates with 49.1% as consumers prioritize hold strength and hairstyle maintenance capabilities.

In 2025, Styling’ held a dominant market position in the Application segment of Hair Gel Market, with a 49.1% share. Professional hairstylists and individual consumers rely on styling gels for creating structured looks. Moreover, fashion trends and workplace grooming standards continuously drive demand for reliable hold products.

Hold application focuses on maintaining hairstyles throughout extended periods under various environmental conditions. Consumers seek products offering strong fixation without flaking or residue buildup. Consequently, polymer technology advancements enable longer-lasting hold while maintaining natural hair movement and texture.

Shine enhancement appeals to consumers desiring glossy finish and healthy hair appearance. These formulations incorporate light-reflecting ingredients that add luminosity without greasiness. Additionally, shine gels complement styling applications by providing finishing touches to completed hairstyles.

Moisturizing gels address dual needs of styling and hair care simultaneously. These products prevent dryness associated with traditional alcohol-based formulations while maintaining adequate hold. Therefore, moisturizing applications attract consumers with chemically treated or naturally dry hair seeking protective styling solutions.

End Use Analysis

Men dominates with 56.3% driven by expanding male grooming consciousness and professional styling adoption.

In 2025, Men held a dominant market position in the End Use segment of Hair Gel Market, with a 56.3% share. Rising grooming standards among urban male populations fuel consistent demand for styling products. Moreover, professional environments and social media influence encourage regular hair gel usage across age demographics.

Women segment encompasses diverse styling needs from casual to professional applications. Female consumers increasingly adopt gel products for managing specific hair types and achieving varied looks. Consequently, manufacturers develop targeted formulations addressing concerns like frizz control and curl definition.

Unisex products appeal to gender-neutral marketing trends and shared household consumption patterns. These formulations focus on versatile performance across different hair types and styling preferences. Additionally, unisex positioning enables broader market reach while simplifying product selection for consumers seeking multipurpose solutions.

Distribution Channel Analysis

Online Retailers dominates with 34.2% due to e-commerce convenience and personalized product discovery capabilities.

In 2025, Online Retailers held a dominant market position in the Distribution Channel segment of Hair Gel Market, with a 34.2% share. Digital platforms offer extensive product variety and competitive pricing compared to physical retail locations. Moreover, subscription services and direct-to-consumer models enhance customer retention and purchasing convenience.

Supermarkets/Hypermarkets provide mainstream accessibility for mass-market hair gel brands across consumer segments. These channels enable impulse purchases and brand discovery through prominent shelf placement and promotional activities. Consequently, established brands maintain significant presence in these high-traffic retail environments.

Beauty Stores cater to premium and specialty product segments with expert consultation services. Dedicated beauty retailers offer curated selections and personalized recommendations that enhance customer experience. Additionally, these channels support professional-grade products requiring detailed product knowledge and demonstration.

Pharmacies and Others serve niche distribution needs including travel-size products and therapeutic formulations. Pharmacy channels appeal to consumers seeking dermatologically tested options for sensitive scalps. Therefore, these alternative channels complement primary distribution networks while addressing specific consumer requirements.

Drivers

Rising Male Grooming Consciousness Drives Market Expansion Across Demographics

Male grooming consciousness has intensified significantly across urban and semi-urban demographics globally. Professional environments and social expectations encourage regular styling product usage among men. Consequently, hair gel consumption patterns reflect broader cultural shifts toward personal appearance and self-care priorities.

Demand for long-lasting and strong-hold styling solutions continues accelerating among active consumers. Professional and recreational activities require hairstyles maintaining integrity throughout extended periods. Therefore, manufacturers focus on polymer innovations delivering superior hold without compromising hair health or natural movement.

Youth populations influenced by fashion trends and pop culture significantly impact consumption patterns. Social media and entertainment and celebrity endorsements shape styling preferences across demographic segments. Additionally, widespread product availability through supermarkets, salons, and online channels enhances accessibility and purchase convenience across consumer markets.

Restraints

Consumer Concerns Over Hair Damage Limit Market Penetration

Growing consumer awareness regarding hair damage and scalp sensitivity presents significant market challenges. Chemical ingredients in traditional formulations cause dryness, breakage, and irritation among regular users. Consequently, health-conscious consumers increasingly scrutinize product compositions before purchasing styling products.

Alcohol-based formulations particularly face criticism for stripping natural oils and causing long-term hair damage. Dermatological concerns about scalp health further discourage prolonged usage among sensitive consumers. Therefore, manufacturers invest heavily in reformulation efforts addressing these legitimate health considerations.

Availability of alternative styling products including creams, waxes, and serums intensifies competitive pressures. These substitutes offer comparable styling benefits with perceived gentler formulations and natural ingredient profiles. Additionally, product diversification enables consumers to avoid traditional gels while achieving desired styling outcomes through alternative solutions.

Growth Factors

Innovation and Premiumization Accelerate Market Development

Development of herbal, organic, and chemical-free hair gel formulations represents significant growth opportunity. Natural ingredient preferences align with broader clean beauty movements across cosmetic categories. Consequently, brands incorporating botanical extracts and sustainable formulations capture environmentally conscious consumer segments effectively.

Premiumization through salon-grade and professional styling products expands addressable market opportunities. Consumers increasingly invest in higher-quality formulations delivering superior performance and specialized benefits. Therefore, premium positioning enables brands to differentiate offerings while commanding favorable pricing in competitive markets.

Expansion into emerging markets with rising disposable incomes unlocks substantial growth potential. Economic development in Asia Pacific and Latin America creates expanding middle-class consumer bases. Additionally, customizable hair gels targeting specific hair types and textures enable personalized solutions addressing diverse consumer needs across global markets.

Emerging Trends

Sustainability and Multi-Functionality Reshape Product Development

Increasing popularity of alcohol-free and non-sticky gel variants transforms formulation priorities across manufacturers. Consumers demand products delivering strong hold without traditional drawbacks like residue or hair damage. Consequently, research focuses on alternative polymer systems providing desired performance while maintaining hair health.

Adoption of sustainable packaging and eco-friendly ingredients reflects environmental consciousness among consumers. Biodegradable containers and refillable formats reduce plastic waste while appealing to sustainability-focused demographics. Therefore, brands incorporating circular economy principles strengthen market positioning and brand loyalty.

Celebrity and influencer-driven product endorsements significantly impact purchasing decisions across demographic segments. Social media marketing and authentic testimonials create powerful brand awareness and consumer trust. Additionally, innovation in multi-functional gels offering simultaneous styling and hair care benefits simplifies grooming routines while addressing holistic consumer needs.

Regional Analysis

North America Dominates the Hair Gel Market with a Market Share of 45.7%, Valued at USD 2.1 Billion

North America leads global market share at 45.7% with valuation reaching USD 2.1 Billion. Established grooming culture and high disposable incomes drive consistent product consumption across demographics. Moreover, extensive distribution networks and premium brand presence reinforce regional market dominance through accessible product availability.

Europe Hair Gel Market Trends

Europe demonstrates strong demand for organic and natural formulations aligned with regional sustainability preferences. Regulatory frameworks emphasizing cosmetic safety standards influence product development and market positioning. Consequently, European consumers exhibit sophisticated preferences for premium and dermatologically tested styling solutions.

Asia Pacific Hair Gel Market Trends

Asia Pacific represents fastest-growing regional market driven by expanding middle-class populations and urbanization. Rising grooming consciousness among male consumers particularly accelerates market development across key economies. Additionally, local brands compete effectively against international players through culturally relevant product positioning.

Latin America Hair Gel Market Trends

Latin America exhibits increasing adoption of styling products among younger demographics influenced by global fashion trends. Economic development and improving retail infrastructure enhance product accessibility across urban and emerging markets. Therefore, international brands expand regional presence through strategic partnerships and localized marketing approaches.

Middle East & Africa Hair Gel Market Trends

Middle East and Africa show growing demand concentrated in urban centers with developing grooming industries. Premium product segments gain traction among affluent consumer groups seeking international brand quality. Consequently, distribution expansion through modern retail channels supports gradual market development across diverse regional economies.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

L’Oréal S.A. maintains leadership position through extensive product portfolios spanning mass and premium segments. The company leverages research capabilities developing innovative formulations addressing diverse consumer needs globally. Moreover, strategic acquisitions like Color Wow expand professional haircare presence while strengthening competitive positioning across styling categories.

Unilever PLC commands significant market share through diverse brand portfolio including TRESemmé and other styling brands. The company’s acquisition of Dr. Squatch demonstrates commitment toward premium and high-growth personal care segments. Consequently, Unilever strengthens male grooming offerings while capitalizing on expanding consumer demand for specialized products.

Henkel AG & Co. KGaA focuses on professional and consumer styling solutions with emphasis on natural formulations. The company’s Natural Styling Hydrowave incorporates aloe vera maintaining moisture balance effectively. Additionally, Henkel’s innovation pipeline addresses consumer preferences for sustainable and performance-driven hair care solutions.

The Procter & Gamble Company leverages established brands and global distribution networks capturing mass-market consumer segments. The company invests in product innovation balancing affordability with quality across diverse geographic markets. Therefore, P&G maintains competitive relevance through consistent brand messaging and accessible product positioning strategies.

Key players

- L’Oréal S.A.

- Unilever PLC

- Henkel AG & Co. KGaA

- The Procter & Gamble Company

- Kao Corporation

- The Estée Lauder Companies Inc.

- Coty Inc.

- Mandom Corporation

- Revlon Inc.

- Shiseido Co., Ltd.

Recent Developments

- July 2025 – L’Oréal signed an agreement to acquire Color Wow, one of the world’s fastest growing and most innovative professional haircare brands. This strategic acquisition strengthens L’Oréal’s position in the premium professional styling segment while expanding its portfolio of high-performance hair care solutions globally.

- June 2025 – Unilever announced an agreement to acquire personal care brand Dr. Squatch from growth equity firm Summit Partners. This complementary acquisition marks another strategic step in expanding Unilever’s portfolio towards premium and high growth spaces, particularly strengthening its male grooming product offerings.

Report Scope

Report Features Description Market Value (2025) USD 4.6 Billion Forecast Revenue (2035) USD 7.3 Billion CAGR (2026-2035) 4.7% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Type (Water-Based, Alcohol-Based, Gel Creams, Aloe Vera Based), Application (Styling, Hold, Shine, Moisturizing), End Use (Men, Women, Unisex), Distribution Channel (Online Retailers, Supermarkets/Hypermarkets, Beauty Stores, Pharmacies, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape L’Oréal S.A., Unilever PLC, Henkel AG & Co. KGaA, The Procter & Gamble Company, Kao Corporation, The Estée Lauder Companies Inc., Coty Inc., Mandom Corporation, Revlon Inc., Shiseido Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- L'Oréal S.A.

- Unilever PLC

- Henkel AG & Co. KGaA

- The Procter & Gamble Company

- Kao Corporation

- The Estée Lauder Companies Inc.

- Coty Inc.

- Mandom Corporation

- Revlon Inc.

- Shiseido Co., Ltd.