Global Green Cement Market Size, Share Analysis Report By Type (Fly Ash, Slag, Recycled Aggregate, Others), By Application (Residential, Non-Residential, Infrastructure) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173407

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

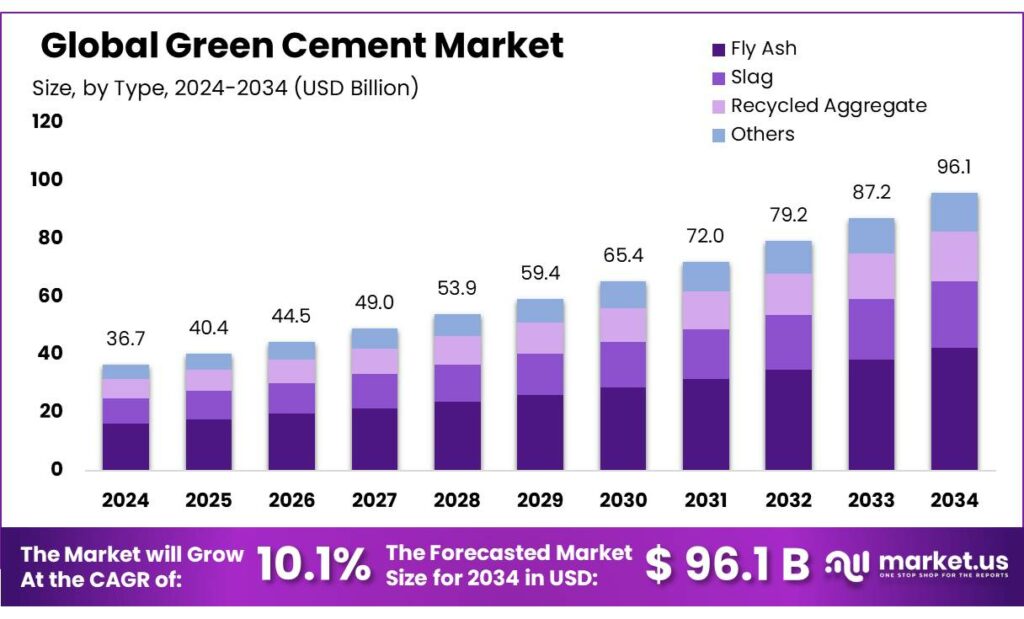

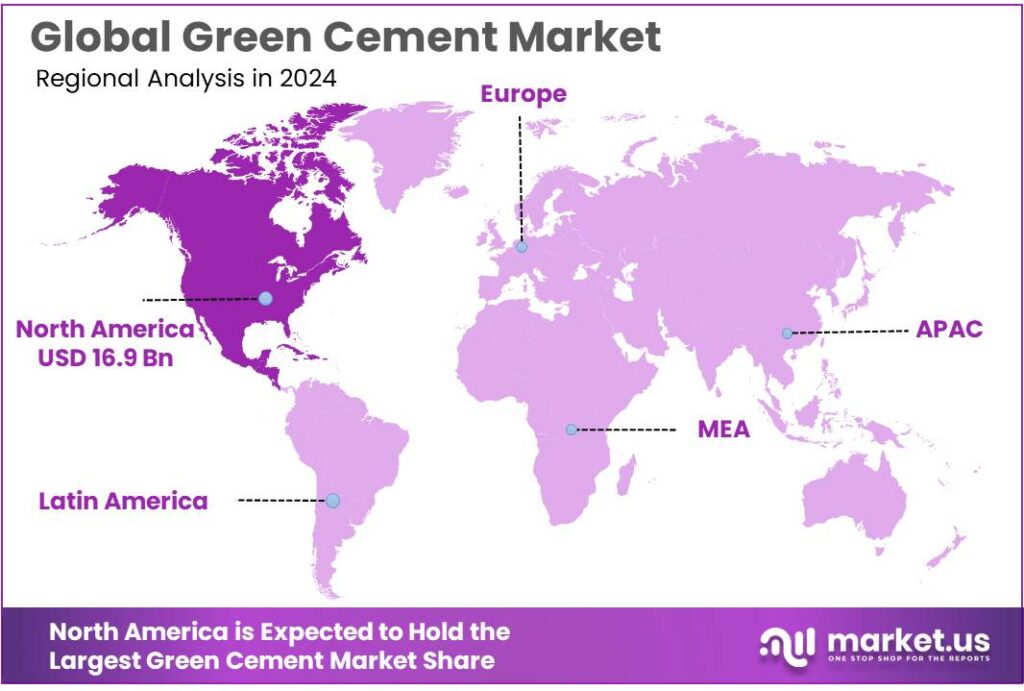

Global Green Cement Market size is expected to be worth around USD 96.1 Billion by 2034, from USD 36.7 Billion in 2024, growing at a CAGR of 10.1% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 46.1% share, holding USD 16.9 Billion in revenue.

Green cement is an umbrella term for lower-carbon binders and concrete mixes that reduce emissions versus ordinary Portland cement (OPC) by cutting clinker content, using alternative raw materials and fuels, and/or adding carbon-capture or carbon-mineralisation steps. Its relevance is tied to the scale of cement demand: global cement production was estimated at ~4.1 billion tonnes in 2022, meaning even small percentage shifts in clinker factor or energy intensity translate into very large absolute CO₂ savings.

The industrial scenario is shaped by an unusually “hard-to-abate” emissions profile. A large share of cement’s CO₂ comes from limestone calcination and high-temperature kiln heat, making efficiency alone insufficient. Sector assessments commonly place cement at ~7–8% of global CO₂ emissions, underscoring why procurement rules and carbon policies increasingly target the material itself rather than only construction operations.

In the United States, decarbonisation economics are also being reshaped by carbon-management incentives; for example, the Section 45Q tax credit can reach $85 per metric ton of CO₂ for qualifying sequestration under prevailing wage and apprenticeship conditions, which can materially improve CCUS project bankability for cement plants.

The Global Cement and Concrete Association’s roadmap highlights that actions between now and 2030 could avoid almost 5 billion tonnes of CO₂ compared with a business-as-usual trajectory, helping standardise near-term levers such as SCM use, efficiency, and early CCUS deployment.

Public funding is another catalyst. In the U.S., the World Resources Institute summarizes that the Department of Energy is investing $6.3 billion across 33 industrial demonstration projects, reinforcing a broader push to move low-carbon process technologies from lab to plant scale.

DOE has also announced plans for a Cement and Concrete Center of Excellence, with national laboratories eligible for up to $9 million via a competitive call to accelerate adoption of novel low-carbon cement and concrete technologies. In the U.S., the Inflation Reduction Act is cited as setting out USD 5.8 billion for industrial decarbonisation support linked to around 200 Mt CO₂ of reductions by 2030.

Key Takeaways

- Green Cement Market size is expected to be worth around USD 96.1 Billion by 2034, from USD 36.7 Billion in 2024, growing at a CAGR of 10.1%.

- Fly Ash held a dominant market position, capturing more than a 44.8% share.

- Residential held a dominant market position, capturing more than a 51.2% share.

- North America established itself as a dominant region in the global green cement market, accounting for approximately 46.1% of total market share and generating about USD 16.9 billion.

By Type Analysis

Fly Ash leads the Green Cement Market with a solid 44.8% share, supported by its wide availability and lower carbon footprint

In 2024, Fly Ash held a dominant market position, capturing more than a 44.8% share, mainly due to its proven performance in reducing clinker content and overall carbon emissions in cement production. Fly ash was widely adopted in green cement formulations because it improved durability, enhanced workability, and lowered heat of hydration, making it suitable for large infrastructure and residential projects. Its use also supported waste utilization from thermal power plants, which aligned well with circular economy goals.

During 2025, demand for fly ash–based green cement remained steady as governments and construction firms focused on sustainable building materials and long-life structures. The material’s cost advantage over traditional cement inputs, along with its consistent quality and regulatory acceptance, allowed fly ash to retain its leading position within the green cement market across both mature and emerging construction regions.

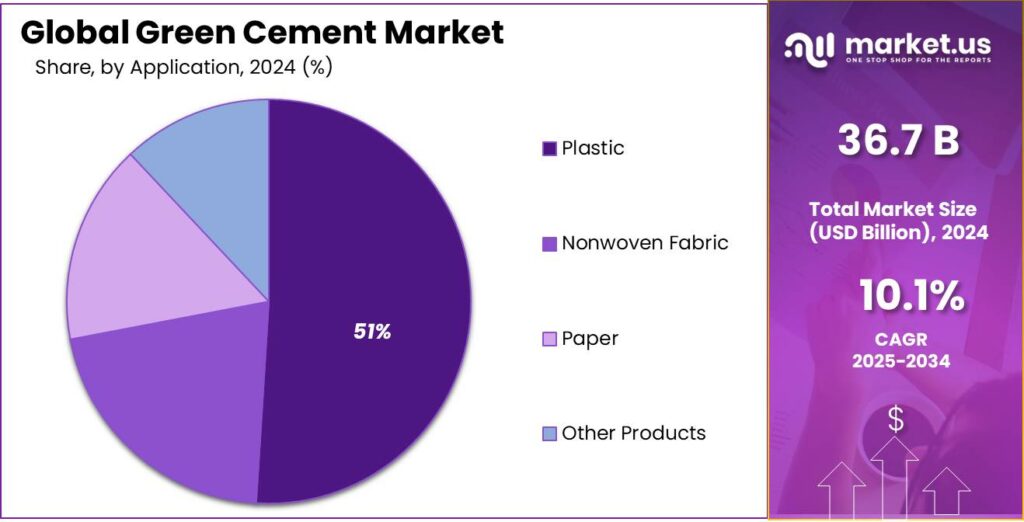

By Application Analysis

Residential construction leads the Green Cement Market with a strong 51.2% share, driven by sustainable housing demand

In 2024, Residential held a dominant market position, capturing more than a 51.2% share, supported by rising demand for eco-friendly housing and energy-efficient building materials. Green cement was increasingly used in individual homes, apartments, and housing projects as builders aimed to reduce carbon emissions and comply with evolving building standards. Its benefits, such as improved durability and lower environmental impact, made it suitable for long-term residential structures.

In 2025, the segment continued to grow as government housing programs and urban development projects emphasized sustainable construction practices. Growing awareness among homeowners about environmental responsibility and lifecycle cost savings further supported the steady use of green cement in residential applications, allowing this segment to maintain its leading position within the overall market.

Key Market Segments

By Type

- Fly Ash

- Slag

- Recycled Aggregate

- Others

By Application

- Residential

- Non-Residential

- Infrastructure

Emerging Trends

Calcined Clay (LC3) Is Moving From Pilot To Big Projects

A major latest trend in green cement is the commercial push toward calcined-clay blends—especially Limestone Calcined Clay Cement (LC3)—because they offer meaningful CO₂ cuts without depending heavily on increasingly constrained “waste” SCMs like fly ash. This trend is gaining speed for a simple reason: the cement sector is under pressure to reduce emissions, yet its average emissions intensity has stayed just under 0.6 t CO₂ per tonne of cement since 2018.

LC3 is attracting attention because the chemistry is practical and the carbon benefit is clear. The LC3 Consortium explains that LC3 can save up to 40% of CO₂ compared with ordinary Portland cement, mainly because it lowers the clinker factor while maintaining performance in many applications. This is now being echoed beyond research circles: a recent peer-reviewed review (2025) describes LC3 formulations and notes LC3 can reduce CO₂ emissions by around 30–40% versus OPC by cutting clinker use and lowering energy needs for clay processing.

This shift is also being reinforced by policy environments that reward measurable embedded-carbon reductions. In Europe, the Carbon Border Adjustment Mechanism (CBAM) began its transitional phase on 1 October 2023, with the first reporting period ending 31 January 2024—pushing importers to report embedded emissions and, in practice, encouraging more product-level carbon accounting.

At the same time, the innovation ecosystem around low-carbon cement is getting louder and more crowded. Reuters has reported that more than 60 startups are working on low-carbon concrete approaches, while the sector overall is widely described as contributing 7–8% of global CO₂ emissions—keeping investors, governments, and builders focused on scalable alternatives. This broader momentum helps LC3 because it normalizes the idea that “cement can change,” and it encourages updated standards, faster approvals, and more demonstrations.

Drivers

Carbon Rules and Public Buying Are Pushing Green Cement

One major driving factor for green cement is the rapid shift from “nice-to-have” sustainability claims to measurable, regulated carbon performance in construction materials. Cement is under the spotlight because the sector’s emissions are large and hard to avoid. Trusted sources note that global cement manufacturing released about 1.6 billion metric tonnes of CO₂ in 2022, which is roughly 8% of the world’s total CO₂ emissions.

Policy pressure is now moving into day-to-day trade and contracting decisions. In the European Union, the Carbon Border Adjustment Mechanism (CBAM) entered its transitional phase on 1 October 2023, and the first reporting period ended 31 January 2024. During this stage, importers must report embedded emissions for covered goods, including cement, which effectively forces more suppliers to calculate and disclose product-level carbon data.

- In the United States, federal support is also shaping demand signals by helping heavy industry invest in lower-emissions production. A widely cited policy summary explains that the Inflation Reduction Act created a new $5.8 billion Advanced Industrial Facilities Deployment Program under the DOE Office of Clean Energy Demonstrations, aimed at cutting emissions from energy-intensive industrial facilities.

Industry commitments add another layer of pull. The Global Cement and Concrete Association (GCCA) frames the scale of near-term action by stating that roadmap actions to 2030 could prevent almost 5 billion tonnes of CO₂ compared with a business-as-usual path. That number is not just a climate statistic—it is a market signal.

Restraints

Limited Supply of SCMs Slows Green Cement Scaling

A major restraining factor for green cement is the limited and increasingly uncertain supply of the most widely used clinker substitutes, often called supplementary cementitious materials (SCMs). In simple terms, many “greener” cement blends depend on materials like fly ash (from coal power) and granulated blast furnace slag. These materials can lower the clinker content in cement, which is important because cement’s emissions intensity has stayed just under 0.6 t CO₂ per tonne of cement since 2018, meaning the sector needs faster structural changes to cut carbon.

- The supply challenge is not theoretical—credible scenario work shows sharp declines ahead in regions that are cleaning up coal power and conventional steel production. A published EU-focused scenario analysis projects fly ash supply falling from 8.5 Mt in 2025 to 1.9–2.7 Mt in 2035, and then to 0–1.1 Mt by 2045. In the same analysis, blast furnace slag supply is projected to drop from 18–19 Mt in 2025 to 6.9–11.4 Mt in 2035, and to 0–3.2 Mt by 2045.

In the United States, trusted government sources also underline how closely fly ash availability is tied to coal operations and to policy constraints around coal ash handling. EPA describes coal combustion residuals as one of the largest industrial waste streams and notes that nearly 130 million tons of coal ash were generated in 2014. On the reuse side, EPA’s radiation/CCR information indicates that about 65% of total fly ash generated was reused, primarily in concrete and blended cement, and that fly ash can typically substitute for cement at 10–40% depending on application and mix design.

Government and public-interest institutions encourage beneficial use, but that does not remove the operational friction that producers experience. The National Academies notes that at least 35.2 million tons of coal ash were beneficially reused in 2021 (citing EPA-related material), reflecting a large circular-use market that still requires careful control and oversight.

Opportunity

Government “Buy Clean” Spending Can Create Mass Demand

One major growth opportunity for green cement is the fast-expanding role of government procurement in creating stable, high-volume demand for low-carbon construction materials. Cement and concrete are in a special position because they are used in almost every public asset—roads, bridges, airports, schools, hospitals, water systems, and government buildings. This is important because the International Energy Agency (IEA) says cement sector emissions must fall by an average of 3% per year through 2030 to align with a net-zero pathway.

In the United States, a clear demand signal is already visible through federal “low-embodied carbon” purchasing. The General Services Administration (GSA) has tied procurement to Inflation Reduction Act support, including $2.15 billion specifically aimed at low-embodied-carbon construction materials such as concrete. GSA also announced it had identified over 150 federal building projects that will prioritize these materials.

- This opportunity becomes even more tangible when the budget is broken down. In one GSA announcement, the agency outlined planned spending that included $767 million for concrete, alongside $384 million for asphalt, $464 million for glass, and $388 million for steel—all aimed at cleaner construction projects.

The second part of the opportunity is that procurement demand can accelerate the rollout of new green cement chemistries, not only blended Portland cement. For example, limestone-calcined clay cement (LC3) is promoted as able to save up to 40% CO₂ compared with ordinary Portland cement, mainly by reducing clinker content.

Regional Insights

North America dominates the Green Cement Market with 46.10% share and revenue reaching USD 16.9 Bn by 2025 due to strong sustainability commitments and regulatory support

In 2024–2025, North America established itself as a dominant region in the global green cement market, accounting for approximately 46.1% of total market share and generating about USD 16.9 billion in 2025. This regional leadership was supported by robust demand for low-carbon building materials, driven by stringent environmental regulations and proactive government policies that encouraged the use of sustainable construction inputs.

Regulatory frameworks aimed at reducing greenhouse gas emissions were influential in guiding procurement practices and specifying low-emission materials for major infrastructure developments. Construction activity across residential, commercial, and institutional segments in North America continued to integrate green cement solutions as part of broader sustainability goals, supporting consistent revenue growth year on year.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

JSW Cement is a major Indian producer of blended and green cementitious products, including GGBS and PSC, which reduce carbon emissions in construction. In 2024, the company reported a ₹6,028 crore revenue with 12.15 MT produced cement and GGBS, and green products formed ~79.7 % of its portfolio by 2025. Expanding grinding capacity to 20.6 MMTPA strengthened its low-carbon offerings.

Holcim Ltd., a global building materials leader, integrated green cement into its portfolio through brands like ECOPact and ECOPlanet. In 2024, Holcim posted CHF 26,407 million net sales, with advanced sustainable solutions contributing 36 % of overall net sales. Its ongoing investments in recycled materials and circular construction aim to expand low-carbon cement usage across Europe and North America.

UltraTech Cement Limited remains a leading cement manufacturer with a strong emphasis on low-carbon and green products. In 2025, the company achieved a >200 MT capacity, exceeding goals ahead of schedule, while reporting strong quarterly performance with ₹1,232 crore PAT and ~21 % sales growth, reflecting its growing footprint in sustainable construction materials.

Top Key Players Outlook

- JSW Cement

- Green Cement Inc.

- Holcim Ltd.

- ACC Limited

- UltraTech Cement Limited

- CEMEX S.A.B. de C.V.

- CRH pic

- CarbonCure Technologies Inc.

- Heidelberg Cement

Recent Industry Developments

In 2024, Holcim reported CHF 26,407 million in net sales, with advanced sustainable products such as ECOPact and ECOPlanet contributing about 36 % of total net sales, where ECOPact accounted for 29 % of ready-mix concrete and ECOPlanet represented 26 % of cement net sales, supported by recycling 10.2 million tons of construction and demolition materials, about 20 % more than the prior year.

In 2025, UltraTech expanded its green energy capacity to approximately 1,372 MW, including renewable and waste heat recovery systems, meeting roughly 27.8 % of its total power needs through clean energy sources and further lowering operational emissions.

Report Scope

Report Features Description Market Value (2024) USD 36.7 Bn Forecast Revenue (2034) USD 96.1 Bn CAGR (2025-2034) 10.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Fly Ash, Slag, Recycled Aggregate, Others), By Application (Residential, Non-Residential, Infrastructure) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape JSW Cement, Green Cement Inc., Holcim Ltd., ACC Limited, UltraTech Cement Limited, CEMEX S.A.B. de C.V., CRH pic, CarbonCure Technologies Inc., Heidelberg Cement Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- JSW Cement

- Green Cement Inc.

- Holcim Ltd.

- ACC Limited

- UltraTech Cement Limited

- CEMEX S.A.B. de C.V.

- CRH pic

- CarbonCure Technologies Inc.

- Heidelberg Cement