Global Glyoxylic Acid Market Size, Share, And Business Benefits By Type (Glyoxylic Acid 50, Glyoxylic Acid 40), By Derivative (Vanillin, Allantoin, p-Hydroxyphenylglycine, 2-Hydroxyquinoxaline, Others), By Application (Pharmaceuticals, Agrochemicals, Aromas, Personal Care and Cosmetics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 161657

- Number of Pages: 362

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

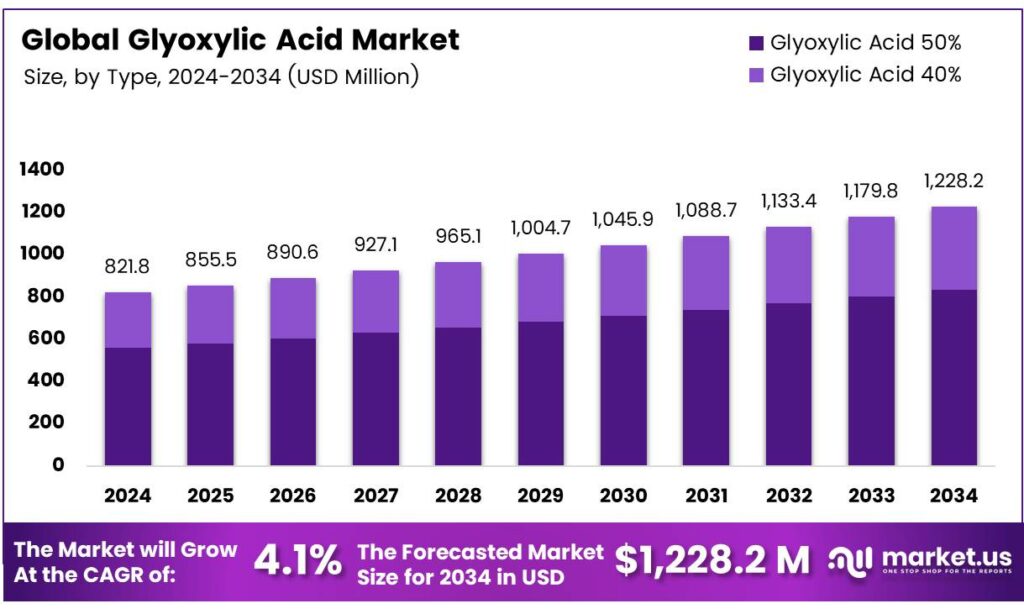

The Global Glyoxylic Acid Market size is expected to be worth around USD 1228.2 Million by 2034, from USD 821.8 Million in 2024, growing at a CAGR of 4.1% during the forecast period from 2025 to 2034.

Glyoxylic acid, a highly reactive compound formed during the metabolism of glycine, hydroxyproline, and glycolate, can accumulate in the cytosol and convert to oxalate, a potentially harmful substance. It is typically supplied in 50% w/v aqueous solutions but used in cosmetic products at concentrations up to 12%. Glycolic acid can be directly quantified using ion-exchange chromatography with conductivity detection.

The process involves diluting urine with sodium tetraborate, injecting it, and eluting glycolic acid after 20 minutes with an isocratic tetraborate mobile phase. Although no internal standard is used, the method offers high precision (CV ≤ 3%) and a detection limit of 4.5 μmol/L (29 μg/dL). It avoids interference from organic acids like glyoxylic, oxalic, and lactic acids.

This technique has been adapted to measure glycolic acid in plasma ultrafiltrate and urine from healthy individuals and in cases of ethylene glycol poisoning. While simple, accurate, and precise, the method’s 60-minute run time per sample (including elution, cleaning, and column re-equilibration) makes it impractical for emergency ethylene glycol testing, which requires a 2–4 hour turnaround.

Glycine absorption and its byproducts (ammonia, glycolic acid, glyoxylic acid, glutamic acid) correlate with clinical symptoms like confusion. Glycine absorption triggers significant vasopressin release. In animal studies, glycine 1.5% irrigant is linked to poor survival rates and severe cases of TUR syndrome, particularly when accompanied by significant neurological symptoms.

Key Takeaways

- The Global Glyoxylic Acid Market is expected to grow from USD 821.8 million in 2024 to USD 1228.2 million by 2034 at a CAGR of 4.1%.

- Glyoxylic Acid 50% held a 67.9% market share in 2024, driven by its efficiency in pharmaceuticals, cosmetics, and agrochemicals.

- Vanillin dominated the derivative segment in 2024 with a 34.2% share, fueled by demand in the food, beverage, and fragrance industries.

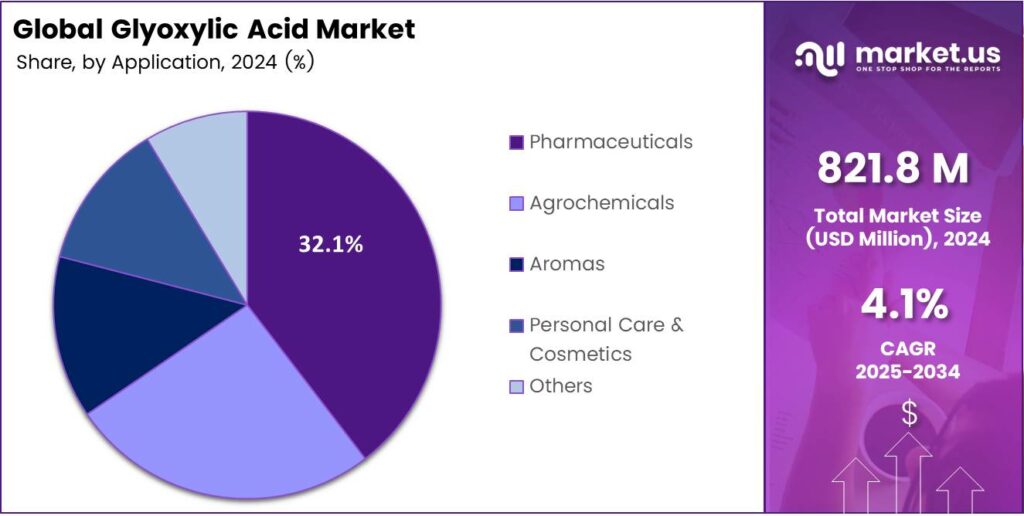

- Pharmaceuticals led the application segment in 2024 with a 32.1% share, propelled by amoxicillin and other intermediates.

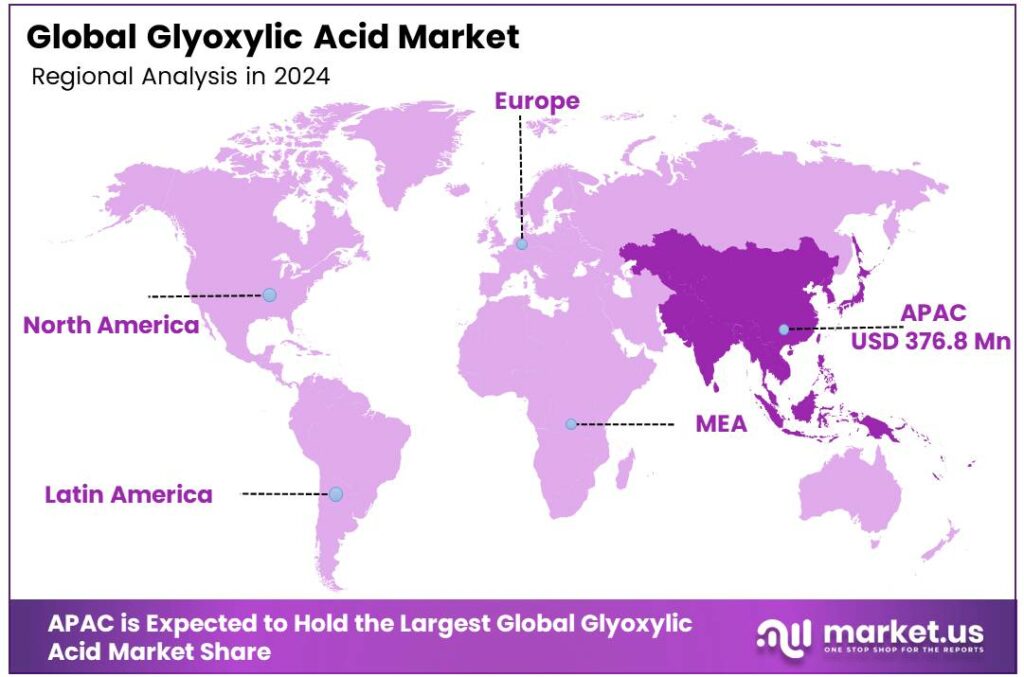

- Asia-Pacific accounted for 45.9% of global glyoxylic acid consumption in 2024, valued at USD 376.8 million, led by China, India, South Korea, and Japan.

By Type Analysis

Glyoxylic Acid 50% dominates with 67.9% due to its high industrial-grade purity and broad applications.

In 2024, Glyoxylic Acid 50% held a dominant market position in the By Type Analysis segment of the Glyoxylic Acid Market, with a 67.9% share. Its superior concentration level ensures high efficiency in producing intermediates for pharmaceuticals, cosmetics, and agrochemicals. The segment benefits from increased use in vanillin and allantoin manufacturing, where high-grade purity improves yield and reaction stability.

The Glyoxylic Acid 40% segment also shows consistent growth as it caters to industries requiring milder formulations. It is increasingly used in cosmetic formulations and fragrance intermediates where lower concentration minimizes irritation risks while maintaining functionality. This type remains favored in applications demanding controlled reactivity, including certain personal care and coating solutions. Emerging economies adopting lower-cost production routes are expected to boost the 40% segment in the coming years.

By Derivative Analysis

Vanillin dominates with 34.2% due to its extensive use in flavoring and fragrance production.

In 2024, Vanillin held a dominant market position in the By Derivative segment of the Glyoxylic Acid Market, with a 34.2% share. Rising global demand for natural and synthetic vanillin in the food, beverage, and fragrance industries drives consumption. The product’s ability to replace petrochemical-based ingredients aligns with sustainability trends.

Supported by technological innovations and favorable food regulations, vanillin derived from glyoxylic acid continues to gain traction worldwide. The Allantoin segment benefits from growing use in dermatological and cosmetic formulations. Allantoin enhances skin protection and regeneration, making it vital in lotions, creams, and shampoos. The rising global preference for soothing ingredients and skin-repair agents sustains its steady growth.

The p-Hydroxyphenylglycine segment supports pharmaceutical and antibiotic manufacturing. It plays an essential role in producing semi-synthetic penicillins, expanding its use in the healthcare sector. The ongoing global need for antibiotics ensures continuous industrial utilization. The 2-Hydroxyquinoxaline segment finds application in specialty chemicals and research formulations. Though smaller in volume, its contribution remains critical for innovation in chemical synthesis and niche drug intermediates.

By Application Analysis

Pharmaceuticals dominate with 32.1% due to their vital role in active ingredient synthesis.

In 2024, Pharmaceuticals held a dominant market position in the By Application segment of the Glyoxylic Acid Market, with a 32.1% share. Its extensive use in synthesizing amoxicillin and other pharmaceutical intermediates drives global demand. Increasing healthcare expenditure, generic drug production, and R&D expansion strengthen the segment’s outlook.

The Agrochemicals segment leverages glyoxylic acid for herbicide and pesticide intermediates. The growing need for efficient crop protection solutions and sustainable farming practices fosters adoption. Government initiatives for green agrochemicals further amplify demand. The Aromas segment witnesses robust growth due to the rising consumption of fragrances and flavor enhancers.

Glyoxylic acid acts as a precursor in aroma compound synthesis, aligning with trends in natural and bio-based scent development. The Personal Care and Cosmetics segment benefits from increasing awareness of skin health and personal hygiene. Glyoxylic acid derivatives enhance formulations in hair treatments and skincare, making this sector a promising contributor to long-term market expansion.

Key Market Segments

By Type

- Glyoxylic Acid 50%

- Glyoxylic Acid 40%

By Derivative

- Vanillin

- Allantoin

- p-Hydroxyphenylglycine

- 2-Hydroxyquinoxaline

- Others

By Application

- Pharmaceuticals

- Agrochemicals

- Aromas

- Personal Care and Cosmetics

- Others

Driver

Growing demand for flavor, fragrance, and pharmaceutical intermediates

One of the strongest drivers for glyoxylic acid is its role as a precursor and intermediate in high-value chemicals — especially in vanillin (a key flavor) and aroma compounds — and in pharmaceutical syntheses. As consumer markets push for more natural flavoring and fragrance ingredients, demand for vanilla and its derivatives has steadily grown.

According to the International Organization of the Flavor Industry (IOFI), global vanilla and vanillin derivatives consumption is rising at 2–4% per year in food and fragrance applications (IOFI annual reports). In many synthetic routes, glyoxylic acid is used in the pathway to convert enzymes or oxidize intermediates toward vanillin. Thus, as the food & beverage and perfume sectors expand, they pull demand for glyoxylic acid upward.

On the pharmaceutical side, many APIs (active pharmaceutical ingredients) rely on intermediates derived from glyoxylic acid or its salts. In countries like India, the government has actively encouraged domestic production of key starting materials (KSMs) and intermediates under its PLI (Production Linked Incentive) scheme. The PLI scheme for bulk drugs has a total outlay of ₹6,940 crore to incentivize the manufacturing of KSMs, intermediates, and APIs in India.

Restraint

Regulatory and safety concerns over exposure and substitution risks

A serious restraint for the glyoxylic acid market is its safety profile and regulatory uncertainty, especially when used in cosmetics or hair treatments. As glyoxylic acid is sometimes promoted as a safer alternative to formaldehyde in hair-straightening or smoothing products, regulatory scrutiny has increased. Some reports suggest that under heat, glyoxylic acid may degrade or release reactive species, raising concerns about kidney damage or irritation in users.

In the European Union, the ECHA (European Chemicals Agency) dossier for glyoxylic acid emphasizes that occupational exposure must be controlled, with strict protective measures for skin, eyes, and inhalation. In the European Union, the ECHA (European Chemicals Agency) dossier for glyoxylic acid emphasizes that occupational exposure must be controlled, with strict protective measures for skin, eyes, and inhalation.

Moreover, in some jurisdictions, formaldehyde is already classified as a human carcinogen, and any chemical alternative (like glyoxylic acid) is likely to draw similar scrutiny. For example, the California DTSC has flagged chemicals in hair straighteners (including glyoxylic acid) for potential kidney injury and formaldehyde release concerns.

Opportunity

Development of greener routes and bio-based production

A major opportunity for glyoxylic acid lies in developing sustainable and green production methods — for instance, through bio-based, electrochemical, or waste valorization routes — which can reduce carbon footprint, cost, and reliance on petrochemical feedstocks. In the chemical industry at large, pressure to decarbonize is growing, and many major chemical companies are investing in green pathways.

The adoption of such sustainable routes could make glyoxylic acid more attractive and cost-competitive. In academic literature, researchers have explored enzymatic oxidation of glycolic acid or direct electrochemical conversion of oxalate to glyoxylic acid with lower energy use and reduced by-products.

As regulatory policies (such as the European Green Deal and, US Inflation Reduction Act) push for lower-emission chemical processes, producers that can deliver “low-carbon glyoxylic acid” will gain a competitive advantage. Major chemical organizations, such as the International Council of Chemical Associations (ICCA), have set climate targets for their member companies, pushing for greener synthesis methods.

Trend

Rising substitution of formaldehyde in cosmetic and industrial resins

An emerging trend is the substitution of formaldehyde-based resins, crosslinkers, or straighteners with safer alternatives — and glyoxylic acid is increasingly being examined for this role. In wood-panel adhesives and resins for building, formaldehyde emissions regulations are becoming stricter. As a result, resin formulators are testing alternatives such as glyoxal, glyoxylic acid, or other carbonyl derivatives to reduce formaldehyde emissions.

In the hair-care sector, the trend toward formaldehyde-free or low-formaldehyde straightening treatments is gaining momentum due to consumer safety awareness and regulatory pressure. Some hair product companies advertise the use of glyoxylic acid as a safer alternative. Even though regulatory concerns remain (as discussed earlier), the marketing pressure is pushing adoption.

Regional Analysis

Asia-Pacific leads with a 45.9% share and a USD 376.8 Million market value.

The Asia-Pacific region leads the glyoxylic acid market, accounting for 45.9% of global consumption and a value of USD 376.8 million. This dominance arises from a few converging factors. First, many end-use industries such as flavor and fragrance, cosmetics, pharmaceuticals, and adhesives are concentrated in Asia — especially in China, India, South Korea, and Japan.

In China and India, demand for vanillin, pharmaceuticals, and personal care products is scaling rapidly, which fuels upstream demand for glyoxylic acid as a precursor. Moreover, regional chemical infrastructure is robust — with integrated supply chains, proximity to raw materials, and access to export networks. That makes Asia-Pacific a logical hub.

Further, government policies in Asia often favor local chemical manufacturing through subsidies, tax incentives, and industrial policy. India’s PLI scheme for bulk drugs is intended to boost domestic manufacture of KSMs and intermediates — giving upstream chemicals like glyoxylic acid a structural advantage. As such, manufacturers in Asia can more competitively supply regional and global demand.

Although North America and Europe remain important, their share is lower because of higher regulatory costs, environmental compliance, and greater substitution pressure. Latin America, the Middle East & Africa have smaller chemical manufacturing bases and often rely on imports. Thus, Asia-Pacific’s combination of demand, policy support, infrastructure, and cost efficiency cements its lead region in glyoxylic acid.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Akema specializes in fine chemicals and holds a significant position in the glyoxylic acid market. The company leverages its strong regional presence and focus on high-purity derivatives, catering primarily to the pharmaceutical and cosmetic industries. Akema’s strategy is built on application-specific development and reliable supply chains, making it a preferred partner for clients requiring stringent quality standards and specialized formulations within the European and international markets.

Zhonglan Industry exerts considerable influence on the global glyoxylic acid market, particularly on pricing and volume. The company’s competitive advantage stems from its large-scale production capabilities and cost-effective manufacturing processes. This allows it to serve a broad industrial base, including agrochemicals and aroma chemicals. Zhonglan’s expansive output makes it a pivotal supplier, especially in the Asia-Pacific region, shaping market dynamics through its capacity and competitive export strategy.

STAN Chemical has established itself as a reliable and quality-focused manufacturer in the glyoxylic acid sector. The company competes by offering a consistent product portfolio that meets diverse industrial needs, from plastics to pharmaceutical intermediates. Its strategic focus on maintaining robust production standards and a responsive supply chain has secured its reputation as a dependable partner for both domestic and international clients, ensuring a stable position in a competitive global marketplace.

Top Key Players in the Market

- Akema S.r.l.

- Zhonglan Industry Co., Ltd.

- STAN Chemical Co., Ltd

- Xinjiang Guolin New Materials Co., Ltd

- Haihang Industry

- Hubei Hongyuan Pharmaceutical Technology Co., Ltd

- JIAXING ZHONGHUA CHEMICAL Co., Ltd

- WeylChem International GmbH

- Amzole India Pvt. Ltd

Recent Developments

- In 2024, Akema S.r.l., a key European producer of fine chemicals including glyoxylic acid for cosmetics and pharma, has focused on maintaining its market position through R&D investments. The company contributed to sector-wide efforts in sustainable formulations, aligning with EU regulations on chemical emissions.

- In 2024, STAN Chemical, a prominent Asian supplier of technical-grade glyoxylic acid for personal care and agrochemicals, emphasized partnerships 2024 to counter regional competition. STAN adapted to new EU environmental regulations by investing in waste reduction tech, which increased production costs but enhanced export viability to Europe.

Report Scope

Report Features Description Market Value (2024) USD 821.8 Million Forecast Revenue (2034) USD 1228.2 Million CAGR (2025-2034) 4.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Glyoxylic Acid, Glyoxylic Acid), By Derivative (Vanillin, Allantoin, p-Hydroxyphenylglycine, 2-Hydroxyquinoxaline, Others), By Application (Pharmaceuticals, Agrochemicals, Aromas, Personal Care and Cosmetics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Akema S.r.l., Zhonglan Industry Co., Ltd, STAN Chemical Co., Ltd, Xinjiang Guolin New Materials Co., Ltd, Haihang Industry, Hubei Hongyuan Pharmaceutical Technology Co., Ltd, JIAXING ZHONGHUA CHEMICAL Co., Ltd, WeylChem International GmbH, Amzole India Pvt. Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Akema S.r.l.

- Zhonglan Industry Co., Ltd.

- STAN Chemical Co., Ltd

- Xinjiang Guolin New Materials Co., Ltd

- Haihang Industry

- Hubei Hongyuan Pharmaceutical Technology Co., Ltd

- JIAXING ZHONGHUA CHEMICAL Co., Ltd

- WeylChem International GmbH

- Amzole India Pvt. Ltd