Global Freight Forwarding Market Size, Share, Growth Analysis By Service Type (Transportation & Warehousing, Value Added Services, Packaging, Others), By Mode of Transport (Ocean/Sea Freight, Air Freight, Road Freight, Rail Freight), By Application (Oil & Gas, Retail & E-commerce, Healthcare, Food & Beverages, Industrial & Manufacturing, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 175890

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

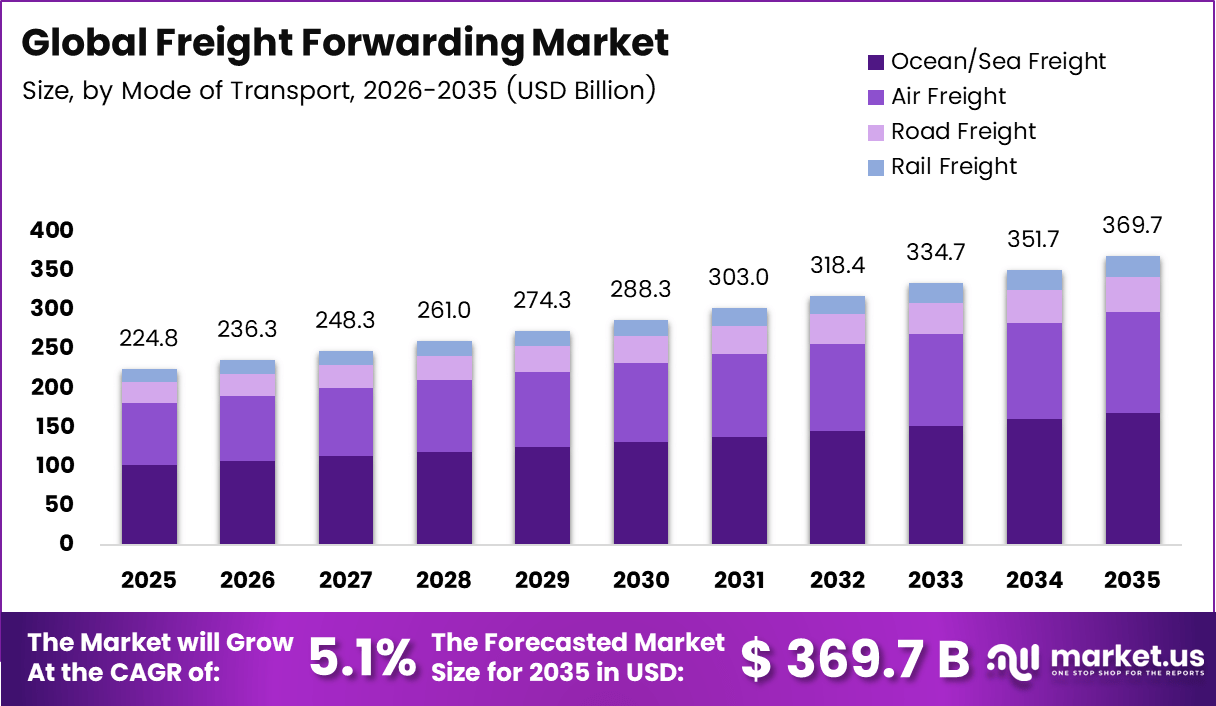

Global Freight Forwarding Market size is expected to be worth around USD 369.7 Billion by 2035 from USD 224.8 Billion in 2025, growing at a CAGR of 5.1% during the forecast period 2026 to 2035.

Freight forwarding represents a crucial logistics service that coordinates the movement of goods across international borders. These intermediaries manage complex supply chains by arranging transportation, documentation, customs clearance, and warehousing on behalf of shippers. Consequently, they enable businesses to focus on core operations while experts handle intricate logistics challenges.

The market encompasses multiple transportation modes including ocean, air, road, and rail freight services. Moreover, freight forwarders provide value-added services such as packaging, cargo insurance, and tracking solutions. This comprehensive approach streamlines global trade by consolidating shipments and optimizing routes for cost efficiency.

Market growth stems from expanding international trade and rising e-commerce activities worldwide. Additionally, manufacturers increasingly adopt just-in-time inventory models requiring reliable logistics partners. Therefore, demand for integrated freight forwarding solutions continues accelerating across diverse industry verticals including retail, healthcare, and manufacturing.

Government initiatives supporting trade liberalization further boost market expansion opportunities. Furthermore, investments in port infrastructure and transportation networks enhance freight forwarding capabilities. However, the industry faces challenges from fluctuating fuel prices and complex regulatory requirements across different jurisdictions.

Digital transformation initiatives are reshaping traditional freight forwarding operations significantly. Companies now leverage artificial intelligence for route optimization and blockchain for transparent documentation. Additionally, real-time cargo tracking systems provide enhanced visibility throughout the supply chain, improving customer satisfaction and operational efficiency.

Emerging markets in Asia, Africa, and Latin America present substantial growth opportunities. According to KG Logistics, Each year over 1.8 million toones of cargo were shipped from here, with the potential to accommodate 15 wide-bodied cargo aircrafts simultaneously. Occupying a 21 square – kilometre site with four runways, this is the number one international air freight gateway in the US with close to 100 carriers operating out of the airport.

The freight forwarding industry is dominated by European and Asian giants, with Kuehne + Nagel leading in ocean freight 4.3M TEUs and air cargo 1.9M metric tons. DHL Supply Chain tops revenue charts at $33.5B, while Chinese provider Sinotrans handles the second-highest ocean volume at 4.8M TEUs. The top 21 providers collectively manage billions in logistics revenue, with European companies holding nine positions, Asian firms claiming eight spots, and U.S. providers securing three placements in this competitive global market.

Strategic acquisitions continue reshaping the competitive landscape within freight forwarding services. Moreover, sustainability concerns drive adoption of low-emission transportation practices and green logistics solutions. Consequently, market players invest in eco-friendly technologies to meet evolving environmental regulations and customer expectations for responsible supply chain management.

Key Takeaways

- Global Freight Forwarding Market projected to reach USD 369.7 Billion by 2035 from USD 224.8 Billion in 2025

- Market expected to grow at a CAGR of 5.1% during the forecast period 2026-2035

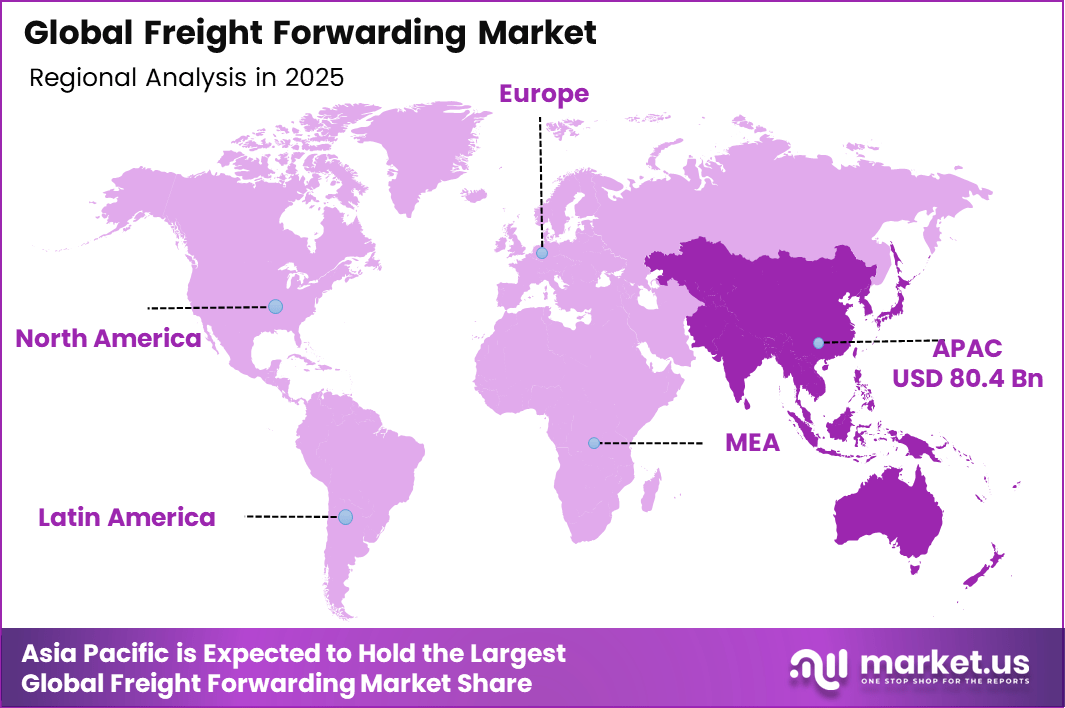

- Asia Pacific dominates with 35.8% market share, valued at USD 80.4 Billion

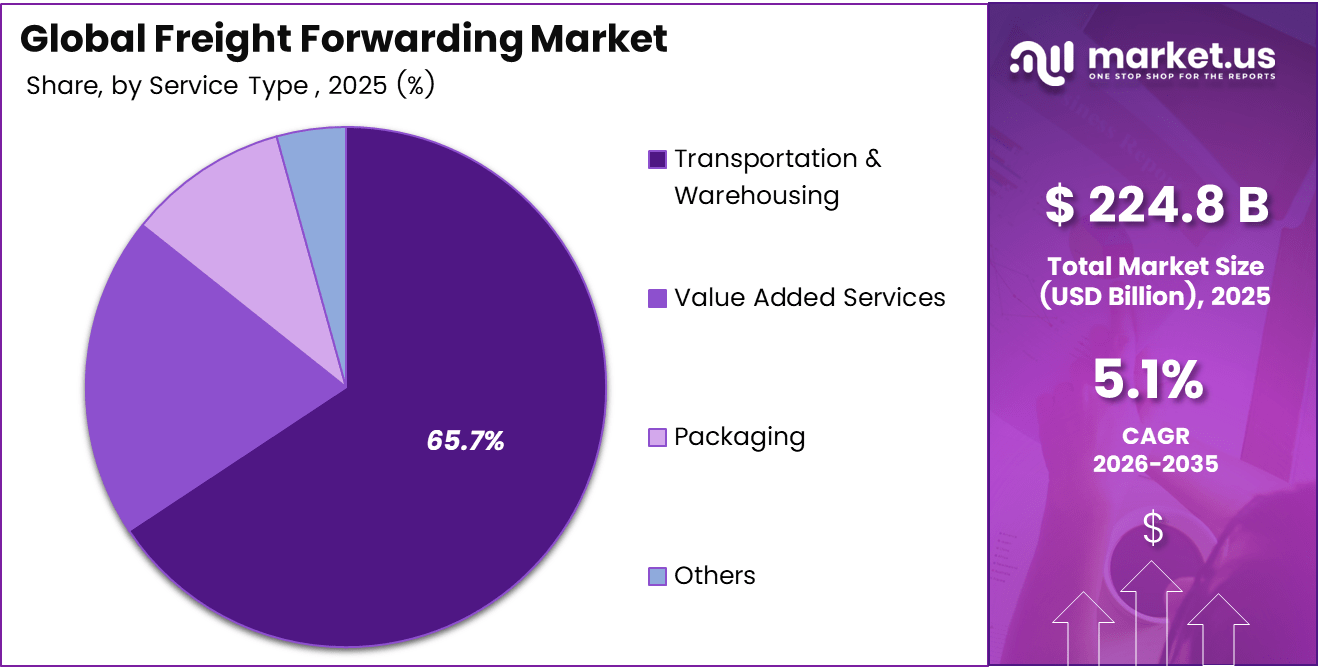

- Transportation & Warehousing segment leads with 65.7% share in Service Type category

- Ocean/Sea Freight accounts for 45.6% of Mode of Transport segment

- Oil & Gas application holds 30.1% market share among end-use industries

Service Type Analysis

Transportation & Warehousing dominates with 65.7% due to core logistics requirements and integrated supply chain management needs.

In 2025, Transportation & Warehousing held a dominant market position in the By Service Type segment of Freight Forwarding Market, with a 65.7% share. This segment encompasses essential activities including cargo movement, storage facilities, and distribution center operations. Moreover, businesses require comprehensive logistics solutions that combine transportation efficiency with strategic warehousing capabilities for inventory management.

Value Added Services represent an increasingly important segment within freight forwarding operations. These offerings include customs brokerage, cargo insurance, quality inspections, and supply chain consulting. Consequently, companies differentiate themselves by providing specialized services that enhance customer value beyond basic transportation and storage functions.

Packaging services constitute another vital component of freight forwarding solutions. Proper packaging ensures cargo protection during transit while meeting international shipping standards and regulatory requirements.

Additionally, specialized packaging for fragile, hazardous, or temperature-sensitive goods requires expertise that freight forwarders develop to serve diverse industry needs effectively.

Mode of Transport Analysis

Ocean/Sea Freight dominates with 45.6% due to cost-effectiveness for bulk cargo and extensive global port connectivity.

In 2025, Ocean/Sea Freight held a dominant market position in the By Mode of Transport segment of Freight Forwarding Market, with a 45.6% share. Maritime shipping offers the most economical solution for transporting large volumes across international routes. Furthermore, containerization has standardized ocean freight operations, enabling efficient intermodal transfers and reducing handling costs significantly.

Air Freight provides the fastest transportation option for time-sensitive and high-value shipments. This mode serves industries requiring rapid delivery such as pharmaceuticals, electronics, and perishable goods. However, higher costs limit air freight to specific cargo types where speed justifies premium pricing over alternative transportation methods.

Road Freight remains essential for domestic distribution and last-mile delivery services. Trucks offer flexibility in reaching locations without rail or port access. Additionally, road transport facilitates seamless door-to-door service when combined with other modes, making it indispensable for comprehensive freight forwarding solutions.

Rail Freight transport presents an environmentally sustainable alternative for long-distance inland transportation. Trains efficiently move bulk commodities and containers across continental routes. Moreover, rail networks connect manufacturing hubs with seaports, supporting multimodal logistics strategies that optimize cost and transit time.

Application Analysis

Oil & Gas dominates with 30.1% due to complex logistics requirements and specialized handling needs for energy sector cargo.

In 2025, Oil & Gas held a dominant market position in the By Application segment of Freight Forwarding Market, with a 30.1% share. Energy sector logistics involve transporting heavy equipment, drilling machinery, and petroleum products globally. Consequently, freight forwarders develop specialized capabilities for handling oversized cargo and managing hazardous materials regulations across international borders.

Retail & E-commerce represents a rapidly growing application segment driven by online shopping expansion. Cross-border e-commerce requires efficient international shipping solutions with customs clearance expertise. Additionally, consumers expect fast delivery times, pushing freight forwarders to optimize routes and implement advanced tracking systems for enhanced customer experience.

Healthcare applications demand stringent quality controls and temperature-controlled transportation capabilities. Pharmaceutical products and medical equipment require specialized handling to maintain efficacy and compliance with regulatory standards. Therefore, freight forwarders invest in cold chain infrastructure and validation processes to serve this critical industry segment effectively.

Food & Beverages sector requires specialized logistics for perishable goods transportation. Maintaining product freshness throughout the supply chain necessitates refrigerated containers and rapid transit times. Moreover, food safety regulations across different markets require freight forwarders to possess comprehensive knowledge of international compliance requirements.

Key Market Segments

By Service Type

- Transportation & Warehousing

- Value Added Services

- Packaging

- Others

By Mode of Transport

- Ocean/Sea Freight

- Air Freight

- Road Freight

- Rail Freight

By Application

- Oil & Gas

- Retail & E-commerce

- Healthcare

- Food & Beverages

- Industrial & Manufacturing

- Others

Drivers

Expansion of Cross-Border E-Commerce Requiring Integrated International Logistics Solutions Drives Market Growth

Online retail expansion creates unprecedented demand for reliable international shipping services. E-commerce platforms require freight forwarders capable of managing customs documentation, last-mile delivery, and returns processing across multiple countries. Moreover, consumers expect transparent tracking and fast delivery times, pushing logistics providers to enhance operational capabilities continuously.

Global manufacturing outsourcing intensifies demand for sophisticated multimodal freight services. Companies relocating production to cost-effective regions need efficient supply chains connecting factories with global markets. Additionally, just-in-time inventory models minimize warehousing costs but require precise coordination between manufacturers, freight forwarders, and retailers.

International trade agreements facilitate higher cargo movement volumes by reducing tariff barriers. These agreements create new trade corridors and expand market access for businesses. Consequently, freight forwarding services become essential for companies seeking to capitalize on favorable trade conditions and reach international customers efficiently.

Restraints

Volatility in Fuel Prices Impacting Freight Cost Structures and Profit Margins Limits Market Growth

Fluctuating fuel prices create significant uncertainty in freight forwarding cost management. Transportation represents the largest expense component, making operations vulnerable to oil price volatility. Moreover, freight forwarders struggle to pass increased costs to customers immediately due to contractual pricing agreements and competitive pressures within the industry.

Complex customs regulations across different jurisdictions create substantial operational challenges. Each country maintains unique documentation requirements, import restrictions, and compliance procedures. Consequently, freight forwarders must invest heavily in expertise and systems to navigate regulatory complexities, increasing operational costs and potential delays.

Documentation errors or incomplete paperwork can result in shipment delays and financial penalties. Furthermore, frequent regulatory changes require continuous training and process updates. Therefore, smaller freight forwarding companies may lack resources to maintain comprehensive compliance programs across all international markets they serve.

Growth Factors

Increasing Demand for End-to-End Digital Freight Forwarding Platforms Accelerates Market Expansion

Digital transformation initiatives revolutionize traditional freight forwarding operations through automation and data analytics. Cloud-based platforms enable real-time shipment tracking, automated documentation, and predictive analytics for route optimization. Additionally, digital solutions improve customer experience by providing transparency and reducing manual paperwork throughout the shipping process.

Emerging trade corridors in Asia, Africa, and Latin America present substantial expansion opportunities. Infrastructure development in these regions improves port facilities, road networks, and rail connectivity. Consequently, freight forwarders can establish new routes and service offerings to capitalize on growing trade volumes in developing markets.

Small and mid-sized enterprises increasingly outsource supply chain management to specialized logistics providers. These companies lack internal expertise and resources for managing complex international shipping operations. Therefore, freight forwarders offering comprehensive solutions gain market share by serving this expanding customer segment effectively.

Emerging Trends

Accelerated Adoption of AI and Data Analytics for Route Optimization and Pricing Reshapes Market Landscape

Artificial intelligence applications transform freight forwarding through predictive analytics and intelligent automation. Machine learning algorithms optimize routing decisions based on historical data, weather patterns, and traffic conditions. Moreover, AI-powered pricing models enable dynamic rate adjustments that maximize profitability while maintaining competitive market positioning.

Blockchain technology enhances shipment documentation security and transparency across global supply chains. Distributed ledger systems create immutable records of transactions, reducing fraud risks and improving trust among stakeholders. Additionally, smart contracts automate payment processes upon delivery confirmation, streamlining financial settlements between multiple parties.

Sustainability concerns drive adoption of low-emission transportation practices throughout the freight forwarding industry. Companies invest in fuel-efficient vehicles, alternative energy sources, and carbon offset programs. Furthermore, customers increasingly prioritize environmental responsibility when selecting logistics partners, making green initiatives essential for maintaining competitive advantage in the market.

Regional Analysis

Asia Pacific Dominates the Freight Forwarding Market with a Market Share of 35.8%, Valued at USD 80.4 Billion

Asia Pacific leads the global freight forwarding market with a 35.8% share, valued at USD 80.4 Billion, driven by robust manufacturing activities and expanding e-commerce sectors. The region benefits from major shipping routes connecting Asian production centers with global consumer markets. Moreover, infrastructure investments in ports and logistics facilities strengthen the region’s position as a critical trade hub.

North America Freight Forwarding Market Trends

North America maintains significant market presence through advanced logistics infrastructure and high e-commerce penetration rates. The region’s freight forwarding sector benefits from strong cross-border trade between United States, Canada, and Mexico. Additionally, technological innovation and automation drive operational efficiency improvements across North American logistics networks, supporting continued market growth.

Europe Freight Forwarding Market Trends

Europe demonstrates strong freight forwarding demand supported by intra-regional trade and manufacturing activities. The European Union’s integrated market facilitates seamless cross-border cargo movement within member states. Furthermore, sustainability regulations push European freight forwarders toward environmentally friendly practices, positioning the region as a leader in green logistics innovation.

Middle East & Africa Freight Forwarding Market Trends

Middle East & Africa emerges as a growing freight forwarding market driven by infrastructure development and trade diversification initiatives. Strategic geographic positioning enables the region to serve as a logistics bridge between Asia, Europe, and Africa. Moreover, investments in port facilities and free trade zones enhance the region’s competitiveness as a global transshipment hub.

Latin America Freight Forwarding Market Trends

Latin America shows promising growth potential fueled by agricultural exports and expanding manufacturing sectors. The region’s freight forwarding market benefits from trade agreements promoting international commerce. Additionally, e-commerce growth creates new opportunities for logistics providers offering specialized cross-border shipping services to meet rising consumer demand.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

A.P. Moller – Maersk maintains its position as a global leader in integrated logistics and freight forwarding services. The Danish conglomerate leverages extensive ocean freight capabilities combined with comprehensive supply chain solutions. Moreover, Maersk invests heavily in digital transformation initiatives to enhance customer experience and operational efficiency across its worldwide network.

DHL Group delivers comprehensive freight forwarding services through its global logistics network spanning over 220 countries and territories. The company excels in providing time-definite international shipping solutions across air, ocean, and road transportation modes. Additionally, DHL’s expertise in customs clearance and regulatory compliance enables seamless cross-border shipments for diverse industry verticals.

Kuehne+Nagel operates as one of the world’s leading logistics providers with strong capabilities in sea freight and air freight forwarding. The Swiss company focuses on industry-specific solutions for sectors including healthcare, automotive, and high-tech manufacturing. Furthermore, Kuehne+Nagel’s advanced technology platforms provide customers with real-time visibility and control over their global supply chains.

DSV A/S ranks among the largest transport and logistics companies globally following strategic acquisitions expanding its market presence. The Danish company offers integrated freight forwarding solutions combining road, air, and sea transportation services. Moreover, DSV’s scalable infrastructure and standardized processes enable efficient handling of complex international shipments across multiple industry sectors.

Key Players

- A.P. Moller – Maersk

- C.H. Robinson

- CIMC Wetrans Logistics

- DACHSER

- DHL Group

- DSV A/S

- Expeditors International of Washington, Inc.

- FedEx

- GEODIS

- Hellmann Worldwide Logistics

- Kerry Logistics Network, Ltd.

- Kintetsu World Express

- Kuehne+Nagel

- Lineage, Inc.

- LX Pantos

- Other Key Players

Recent Developments

- January 2026 – Werner Enterprises acquired privately owned First Fleet for approximately USD 245 million in cash, establishing Werner as the fifth-largest Dedicated carrier in the United States and meaningfully increasing revenues from its higher-margin Dedicated division while delivering immediate accretion to earnings per share.

- April 2025 – Noatum Logistics, an AD Ports Group company and leading global logistics management services provider, announced the acquisition of 152 long-haul transport trucks from Mercedes Benz to enhance its freight forwarding operations across the Middle East region.

- February 2025 – SG Holdings, a leading Japanese logistics company, announced its acquisition of Morrison Express, a global freight forwarding and logistics service provider renowned for expertise in semiconductor and high-tech logistics, significantly expanding the SG Holdings Group’s Asian market presence.

Report Scope

Report Features Description Market Value (2025) USD 224.8 Billion Forecast Revenue (2035) USD 369.7 Billion CAGR (2026-2035) 5.1% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Transportation & Warehousing, Value Added Services, Packaging, Others), By Mode of Transport (Ocean/Sea Freight, Air Freight, Road Freight, Rail Freight), By Application (Oil & Gas, Retail & E-commerce, Healthcare, Food & Beverages, Industrial & Manufacturing, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape A.P. Moller – Maersk, C.H. Robinson, CIMC Wetrans Logistics, DACHSER, DHL Group, DSV A/S, Expeditors International of Washington, Inc., FedEx, GEODIS, Hellmann Worldwide Logistics, Kerry Logistics Network, Ltd., Kintetsu World Express, Kuehne+Nagel, Lineage, Inc., LX Pantos, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Global Freight Forwarding MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Global Freight Forwarding MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- A.P. Moller - Maersk

- C.H. Robinson

- CIMC Wetrans Logistics

- DACHSER

- DHL Group

- DSV A/S

- Expeditors International of Washington, Inc.

- FedEx

- GEODIS

- Hellmann Worldwide Logistics

- Kerry Logistics Network, Ltd.

- Kintetsu World Express

- Kuehne+Nagel

- Lineage, Inc.

- LX Pantos

- Other Key Players