Global Food Processing Machinery Market Size, Share Analysis Report By Type (Depositor, Extruding Machines, Mixers, Refrigeration, Slicers And Dicers, Others), By Machinery Type (Processing Machinery, Packaging Machinery, Utilities and Ancillary Systems, By Mode of Operation (Semiautomatic, Fully Automatic), By Application (Bakery And Confectionery, Meat, Poultry And Seafood, Dairy, Beverages, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174158

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

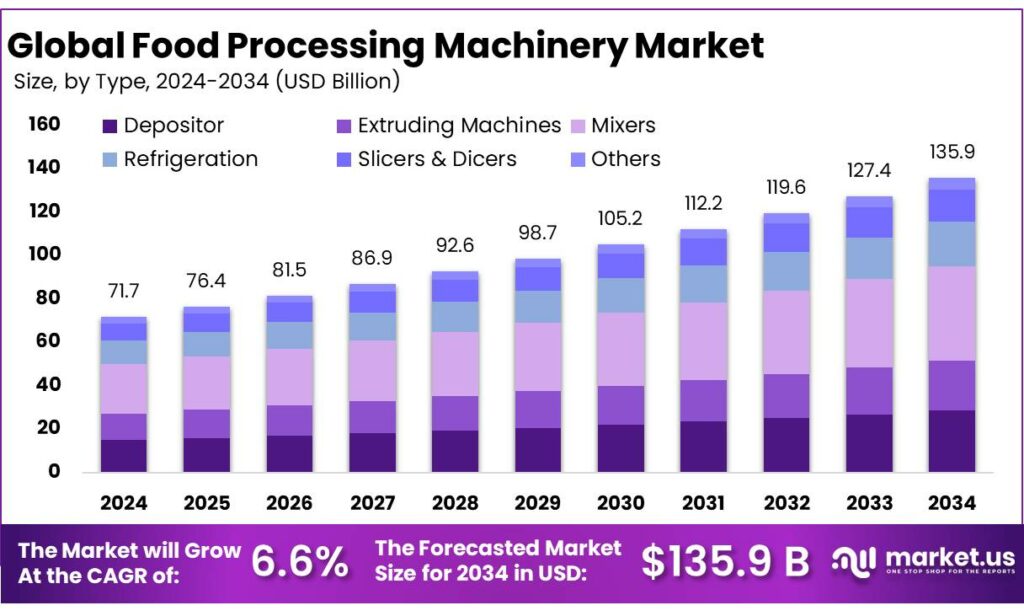

Global Food Processing Machinery Market size is expected to be worth around USD 135.9 Billion by 2034, from USD 71.7 Billion in 2024, growing at a CAGR of 8.2% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 44.2% share, holding USD 3.4 Million in revenue.

Food processing machinery covers the equipment used to transform raw farm and animal inputs into safe, consistent, packaged foods at scale—mixing, grinding, thermal processing, separation, filling, and cleaning-in-place systems. Its role is expanding as food companies try to deliver uniform quality while meeting tighter hygiene, traceability, and labeling expectations. A major structural pressure point is inefficiency: globally, about 13.2% of food is lost between harvest and retail stages, and another 19% is wasted at retail, food service, and household levels. That waste equated to roughly 1.05 billion tonnes in 2022 across retail, food service, and households, highlighting why better processing, packaging, and cold-chain interfaces matter.

Industrially, demand is anchored in the sheer size and modernization needs of food manufacturing. In the United States alone, “Food Manufacturing” (NAICS 311) recorded value of shipments of $904.1 billion in 2021, indicating the scale of plants that continuously invest in new lines, retrofits, and efficiency upgrades. In Europe, the food and drink industry reports 4.6 million employees, about €1.1 trillion in turnover, and €230 billion in value added, reinforcing the breadth of processing capacity and the ongoing need for high-performance equipment.

Regulation and public policy also directly shape machinery upgrades. In the U.S., FDA’s FSMA framework is built around preventiofety plan with hazard analysis and risk-based preventive controls—requirements that frequently drive hyn, and the Preventive Controls for Human Food rule requires covered facilities to maintain a food sagienic redesign, automated monitoring, and validation-ready equipment. In India, policy support is explicit: the Union Cabinet approved a total outlay of ₹6,520 crore for PMKSY for 2021–22 to 2025–26, including an additional ₹1,920 crore. The same package includes ₹1,000 crore earmarked for 50 multi-product food irradiation units and 100 NABL-accredited food testing labs—investments that expand processing infrastructure and increase demand for compliant, industrial-grade machinery and QA systems.

Safety and regulatory expectations are a major machinery upgrade catalyst. The World Health Organization links unsafe food to around 600 million foodborne disease cases and 420,000 deaths each year, reinforcing why processors invest in hygienic design, traceability-ready lines, validated kill steps, and contamination controls. In the U.S., FDA’s Food Safety Modernization Act formalized the shift from reaction to prevention, pushing plants toward preventive controls, verification, and modernized process monitoring—needs that often translate into new equipment, sensors, and automation retrofits.

Commercial drivers also include tighter margins and input swings. For example, FAO reporting shows the overall Food Price Index averaged 124.3 points in December 2025, and full-year 2025 food prices were 4.3% higher than 2024, reminding processors that energy, ingredients, and logistics variability can quickly compress profitability—making efficiency, waste reduction, and uptime more valuable.

Key Takeaways

- Food Processing Machinery Market size is expected to be worth around USD 135.9 Billion by 2034, from USD 71.7 Billion in 2024, growing at a CAGR of 8.2%.

- Mixers held a dominant market position, capturing more than a 32.7% share of the global food processing machinery market.

- Processing Machinery held a dominant market position, capturing more than a 59.1% share in the global food processing machinery market.

- Fully Automatic held a dominant market position, capturing more than a 67.3% share in the food processing machinery market.

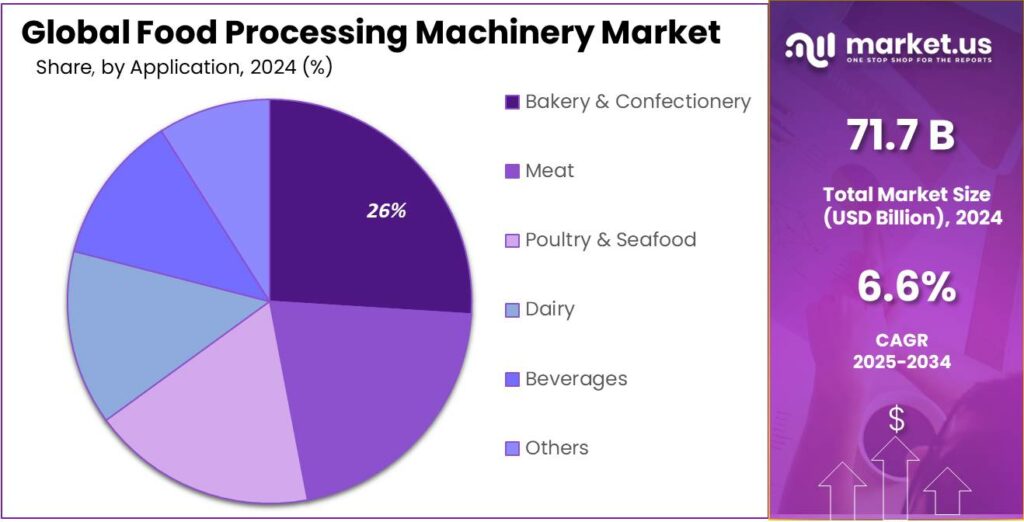

- Bakery & Confectionery held a dominant market position, capturing more than a 26.8% share of the food processing machinery market.

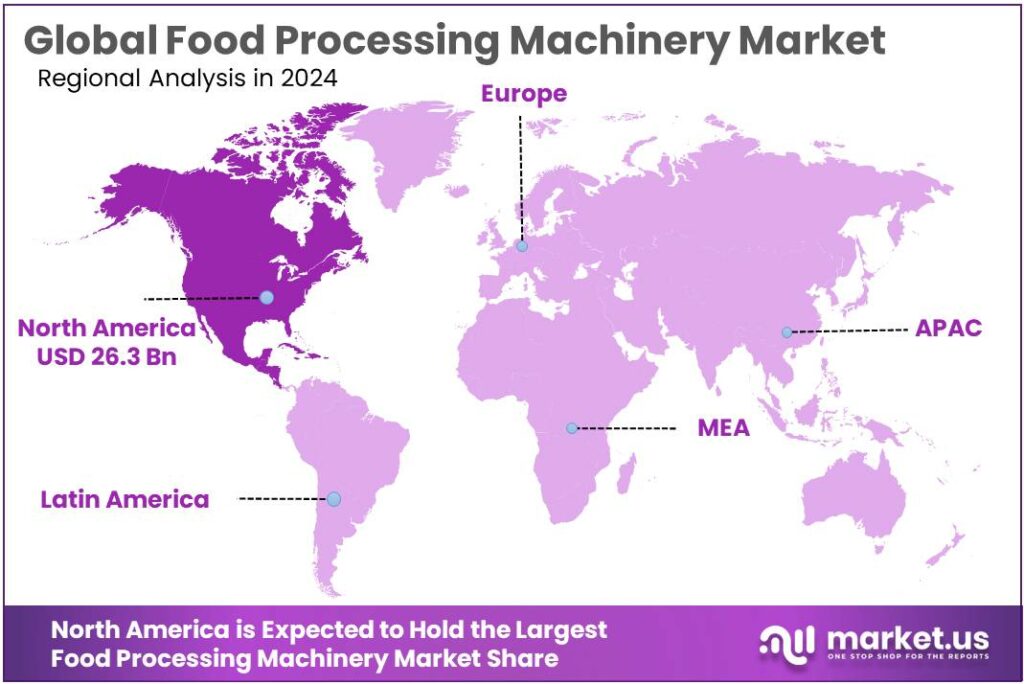

- North America dominated the food processing machinery market with a 36.7% share, valued at 26.3 Bn.

By Type Analysis

Mixers dominate with a 32.7% share driven by everyday processing needs

In 2024, Mixers held a dominant market position, capturing more than a 32.7% share of the global food processing machinery market. This leadership comes from their essential role across nearly every food category, including bakery, dairy, beverages, sauces, and ready-to-eat meals. Mixers are used daily for blending, kneading, emulsifying, and uniform ingredient distribution, making them one of the most frequently operated machines in processing plants. Food producers prefer mixers because they improve batch consistency, reduce manual handling, and support hygiene standards. Their ability to handle both small and large volumes makes them suitable for artisanal producers as well as industrial-scale manufacturers, strengthening steady demand throughout 2024.

By Machinery Type Analysis

Processing machinery leads with a 59.1% share due to its central role in food production

In 2024, Processing Machinery held a dominant market position, capturing more than a 59.1% share in the global food processing machinery market. This strong position comes from its direct involvement in core food transformation activities such as cleaning, cutting, grinding, mixing, heating, and cooking. Almost every processed food category depends on processing machinery to convert raw agricultural inputs into safe, edible, and uniform products. Food manufacturers rely on these machines to maintain consistent quality, meet hygiene standards, and manage large production volumes. Because processing machinery operates at the heart of production lines, it naturally accounts for the largest share of capital spending in food processing plants during 2024.

By Mode of Operation Analysis

Fully automatic systems dominate with a 67.3% share due to speed and consistency

In 2024, Fully Automatic held a dominant market position, capturing more than a 67.3% share in the food processing machinery market by mode of operation. This dominance reflects the growing need for high-speed, reliable, and consistent food production. Fully automatic machines reduce manual intervention, which helps food manufacturers maintain uniform quality and strict hygiene standards. These systems are widely used in large processing plants where continuous operation and precise control are essential. By minimizing human error and lowering labor dependency, fully automatic machinery supports higher output levels, making it the preferred choice for manufacturers focused on scale and efficiency during 2024.

By Application Analysis

Bakery & confectionery leads with a 26.8% share driven by daily demand

In 2024, Bakery & Confectionery held a dominant market position, capturing more than a 26.8% share of the food processing machinery market by application. This strong share is linked to the everyday consumption of bread, biscuits, cakes, chocolates, and sugar-based snacks across both developed and emerging markets. Bakeries and confectionery producers depend heavily on machinery for mixing, kneading, shaping, baking, cooling, and packaging to maintain consistent taste and texture. High production frequency and short product cycles make equipment usage intense in this segment, encouraging regular investments in reliable and efficient machinery throughout 2024.

Key Market Segments

By Type

- Depositor

- Extruding Machines

- Mixers

- Refrigeration

- Slicers & Dicers

- Others

By Machinery Type

- Processing Machinery

- Primary Processing

- Thermal Processing

- Non-Thermal Processing

- Extrusion and Forming Systems

- Packaging Machinery

- Primary Packaging

- Secondary Packaging

- End-of-Line packaging

- Vacuum / MAP / Aseptic Systems

- Utilities and Ancillary Systems

By Mode of Operation

- Semiautomatic

- Fully Automatic

By Application

- Bakery & Confectionery

- Meat

- Poultry & Seafood

- Dairy

- Beverages

- Others

Emerging Trends

Robotics and Smart Automation Become the New Standard

A clear latest trend in food processing machinery is the fast move toward robotics, sensors, and data-driven automation on factory floors. Processors are not buying robots just to look modern—they are using automation to keep lines running steadily, reduce human contact with ready-to-eat foods, and improve consistency in cutting, portioning, packing, and palletizing. This trend sits on top of a much bigger industrial shift: the International Federation of Robotics (IFR) reported 4,281,585 robots operating in factories worldwide in 2023, up 10% year over year, showing how mainstream automation has become across industries.

Food plants are now following the same path, but with stricter hygiene expectations. The IFR highlighted that the food and beverage industry installed 25% more robots, reaching a peak of 3,402 units in 2021. That matters because food automation is not only about speed—it is also about clean handling, repeatable quality, and reduced contamination risk. Many of the newest installations focus on end-of-line packaging, where robots can work around the clock and help plants deal with shifting pack sizes and retailer requirements.

The trend is also becoming visible in national-level adoption patterns. Material shared with the UK’s Food and Drink Federation, citing IFR data, notes that the UK food and beverage industry increased installations of new robots by 76% to 348 units in 2022. This kind of jump is usually linked to practical pain points—difficulty hiring and retaining line workers, the need to hit delivery windows, and pressure to control rework and rejects. Robots do not solve every staffing problem, but they can stabilize repetitive tasks, which frees skilled workers to focus on supervision, maintenance, and quality checks.

Food safety expectations add more weight to this automation trend. In the United States alone, CDC estimates 48 million people get sick from foodborne illness each year, with 128,000 hospitalizations and 3,000 deaths. Those numbers keep food safety at the center of operational decisions, especially for ready-to-eat items where contamination risks are harder to “cook out.” Automation helps by reducing direct hand contact, tightening process controls, and enabling more consistent sanitation routines through modern hygienic equipment designs.

Drivers

Cutting Food Loss and Waste Pushes Machinery Upgrades

One major driver for food processing machinery is the hard push to reduce food loss and food waste across the supply chain. Globally, about 13.2% of food is lost between harvest and retail, before it ever reaches shops. That loss often happens because raw materials spoil, get damaged, or fail quality checks during storage, handling, and early-stage processing. Modern machinery helps processors tighten control—better sorting, controlled temperature steps, faster throughput, and cleaner handling—so more of what is produced becomes saleable product instead of shrink.

The pressure gets even stronger after food reaches consumers. The UNEP Food Waste Index shows 19% of food available to consumers is wasted, and in 2022 that added up to about 1.05 billion tonnes of food waste from retail, food service, and households. For processors, this is a commercial signal: buyers want longer shelf life, better portioning, and packaging that protects quality. That demand flows back into machinery—more precise filling, sealing, portion control, and packaging lines that reduce leaks, rejects, and spoilage. Even small improvements can matter when plants run millions of units a week.

There is also a clear climate and compliance angle behind this driver. Food loss and waste account for around 8–10% of annual global greenhouse gas emissions. That figure is regularly used by major global institutions to show why waste reduction is not just a “nice-to-have.” It is becoming part of how food companies explain sustainability progress to regulators, retailers, and investors. When waste becomes visible as emissions, investment in efficient processing lines becomes easier to justify internally, especially for energy-heavy steps like drying, freezing, pasteurization, sterilization, and refrigeration-linked processing.

Government initiatives are reinforcing this trend by backing processing capacity and modernization. In the United States, USDA announced final awards of more than $35 million in grants to 15 independent meat processors in 12 states through the Meat and Poultry Processing Expansion Program. Programs like this don’t just add capacity—they typically require plants to meet modern hygiene and operational standards, which often means buying newer equipment, automation, and validated cleaning systems.

Restraints

High Upfront Cost and Slow Credit Approval Limits Adoption

A major restraint for food processing machinery is the high upfront cost of modern, hygienic, automated equipment—especially for small and mid-sized processors. Many plants run on thin margins and prefer to keep older machines running longer, even if yields are lower and downtime is higher. India’s Ministry of Food Processing Industries (MoFPI) has highlighted that high capital costs for modern machinery can deter SMEs from adopting advanced equipment, which slows technology upgrades across the sector.

This cost barrier becomes more serious because machinery buying is rarely “cash-only.” Many processors depend on bank loans or government-linked credit support. When documentation or approvals move slowly, projects get delayed and orders are postponed. A recent example from Karnataka shows how paperwork can directly block funding. Under the PM Formalisation of Micro Food Processing Enterprises (PMFME) scheme, rural food startups reportedly faced banks refusing to process loans without a Consent for Establishment (CFE) certificate from the state pollution control board.

- The same report notes that over the last 5 years, nearly 8,000 PMFME units were established, attracting about ₹1,000 crore in investments, and the current delays risk derailing a target of 5,000 units by FY 2025–26. It also warns that delays could affect the creation of 40,000–50,000 rural jobs and the full use of ₹206 crore earmarked for the scheme’s final year.

This is why public programs matter, but they do not remove the restraint entirely. For instance, in the United States, USDA announced final awards of more than $35 million in grants to 15 independent meat processors in 12 states to support processing expansion. That kind of support can unlock equipment purchases, but it also underlines the point: many processors need external help to justify and fund large upgrades. Where grants are limited, and loan approvals depend on multiple clearances, the adoption curve stays uneven.

Opportunity

Government-Led Processing Infrastructure Expansion Creates Demand

A major growth opportunity for food processing machinery is the steady build-out of modern processing infrastructure backed by government programs, especially where the goal is to reduce post-harvest losses and improve food safety. When public policy shifts from “farm production” to “value addition,” it creates a direct pull for equipment such as washing and grading lines, pulping and extraction systems, thermal processing units, aseptic filling, packaging machines, and hygienic handling systems.

India is a clear example of how policy translates into machinery demand. The Union Cabinet approved a total outlay of ₹6,520 crore for the Pradhan Mantri Kisan Sampada Yojana (PMKSY) for the 2021–22 to 2025–26 cycle, including an additional ₹1,920 crore to strengthen value addition and supporting infrastructure. Within this push, the government explicitly earmarked ₹1,000 crore for setting up 50 Multi-Product Food Irradiation Units under the Integrated Cold Chain and Value Addition Infrastructure component, and also linked this expansion with capacity building for testing labs.

The second leg of opportunity is the formalization and scaling of micro and small food enterprises, where even a modest jump in capacity leads to new purchases of semi-automatic and automatic equipment. The PM Formalisation of Micro Food Processing Enterprises (PMFME) scheme is designed to directly assist 2,00,000 micro food processing units with credit-linked subsidies, alongside common infrastructure support. It is also planned as a multi-year program running from 2020–21 to 2025–26 with a total outlay of ₹10,000 crore, which signals sustained support rather than a one-off initiative.

There is a practical proof point for how many units can emerge when support mechanisms work. In Karnataka, reporting around PMFME implementation noted that nearly 8,000 units were established over the last 5 years, attracting around ₹1,000 crore in investments, with a state target of adding 5,000 more units by FY 2025–26. The same coverage also cites an average investment range of ₹10–15 lakh per unit, which aligns closely with the entry price band where small processors typically buy first-stage machinery.

Regional Insights

North America leads with 36.70% share, supported by a mature processing base valued at 26.3

In 2024, North America dominated the food processing machinery market with a 36.7% share, valued at 26.3 Bn, backed by a deep and highly industrialized food supply chain that continuously invests in high-throughput, hygienic equipment. The region’s processors operate at scale across meat, dairy, bakery, beverages, and prepared foods, which keeps demand steady for core systems like mixing, thermal processing, conveying, and packaging.

Regulation and compliance needs add another layer of momentum. The U.S. Food Safety Modernization Act (FSMA) shifted food safety toward prevention, pushing manufacturers to improve process control, sanitation design, and documentation—factors that commonly trigger equipment upgrades and line modernization through 2024–2025.

In 2025, North America’s demand is further supported by ongoing production activity in both the U.S. and Canada. Canada’s manufacturing sector reported total revenue of $935.6 billion in 2023, reflecting a large processing and industrial base that continues to renew plant equipment. On the output side, Canada’s monthly survey showed food product sales rising to $12.9 billion in December 2024, highlighting strong throughput that typically favors automation and capacity additions into 2025.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

GEA Group AG is a major provider of processing, separation, and packaging-related systems for dairy, beverages, and prepared foods. In fiscal 2024, GEA generated revenues of about EUR 5.4 billion and operated with 18,000+ employees across 150+ countries, reflecting its large installed base and service reach. This scale helps GEA win multi-site modernization projects and recurring aftermarket work in food and beverage plants.

JBT (now operating as JBT Marel) is a key technology supplier across food processing and automation. In 2024, JBT reported total revenue of $1,716.0 million, supported by a strong mix of systems plus recurring aftermarket activity. On workforce scale, JBT reported 5,045 employees (JBT portion) in 2024, reflecting a sizable global service-and-install base for processing equipment.

Krones AG is a leading player in beverage and liquid-food lines, spanning processing, filling, and packaging. In 2024, Krones delivered consolidated sales of €5,293.6 million (first time above €5 billion) and employed around 20,000 people worldwide. This scale supports large turnkey projects, fast commissioning, and lifecycle services—key buying factors for high-throughput producers.

Top Key Players Outlook

- Buhler AG

- GEA Group AG

- Tetra Laval (Tetra Pak)

- John Bean Technologies (JBT)

- Krones AG

- Marel hf.

- Alfa Laval AB

- B SPX FLOW Inc.

- Tomra Systems ASA

- Satake Corp.

Recent Industry Developments

In 2024, Bühler delivered CHF 3.0 billion in turnover with CHF 2.8 billion order intake and a CHF 1.9 billion order book, showing a solid base of ongoing projects and service demand.

In 2024, GEA reported EUR 5.4 billion in revenue and employed around 18,000 people across 150+ countries, reflecting its broad global footprint in dairy, beverage, meat, and other food lines.

Report Scope

Report Features Description Market Value (2024) USD 71.7 Bn Forecast Revenue (2034) USD 135.9 Bn CAGR (2025-2034) 6.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Depositor, Extruding Machines, Mixers, Refrigeration, Slicers And Dicers, Others), By Machinery Type (Processing Machinery, Packaging Machinery, Utilities and Ancillary Systems, By Mode of Operation (Semiautomatic, Fully Automatic), By Application (Bakery And Confectionery, Meat, Poultry And Seafood, Dairy, Beverages, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Buhler AG, GEA Group AG, Tetra Laval (Tetra Pak), John Bean Technologies (JBT), Krones AG, Marel hf., Alfa Laval AB, B SPX FLOW Inc., Tomra Systems ASA, Satake Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Food Processing Machinery MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Food Processing Machinery MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Buhler AG

- GEA Group AG

- Tetra Laval (Tetra Pak)

- John Bean Technologies (JBT)

- Krones AG

- Marel hf.

- Alfa Laval AB

- B SPX FLOW Inc.

- Tomra Systems ASA

- Satake Corp.