Global Food Grade Acetic Acid Market Size, Share Report By Fermentation Type (Aerobic Fermentation, Anaerobic Fermentation, Others), By Product Type (Synthetic Acetic Acid, Bio-based Acetic Acid), By Purity (Upto 99%, Above 99%), By Application (Commercial, Household, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154368

- Number of Pages: 359

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

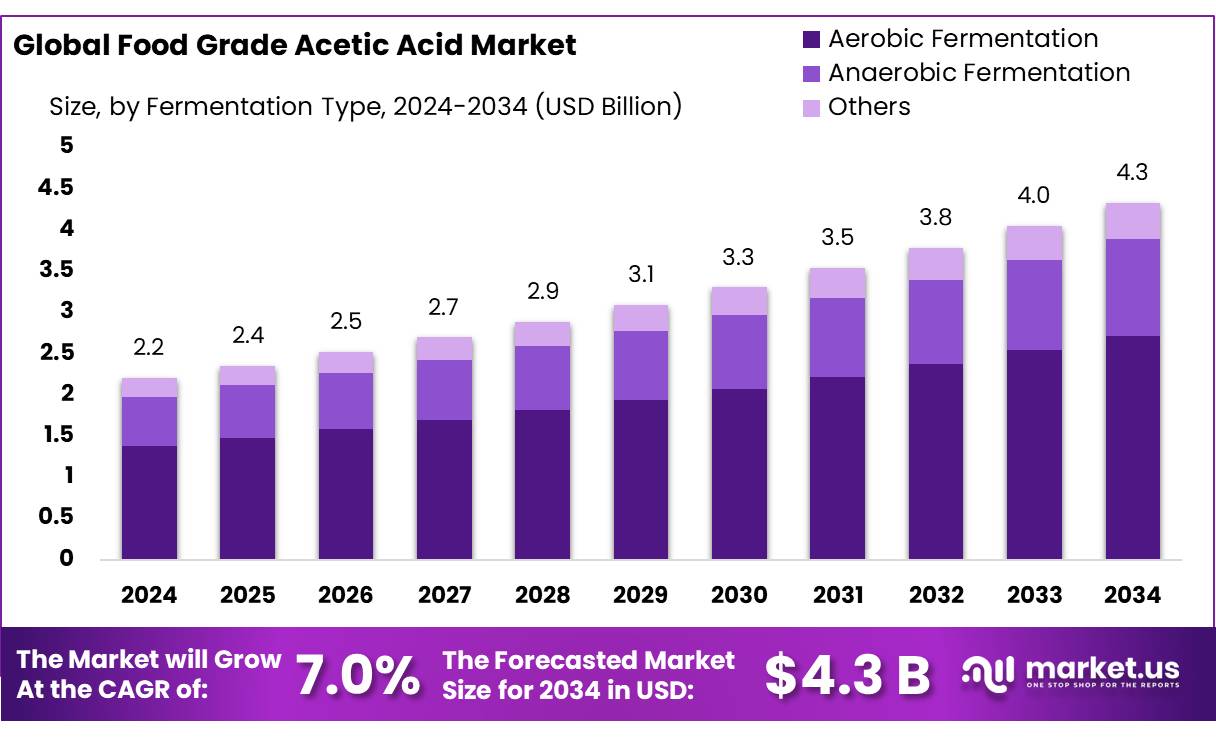

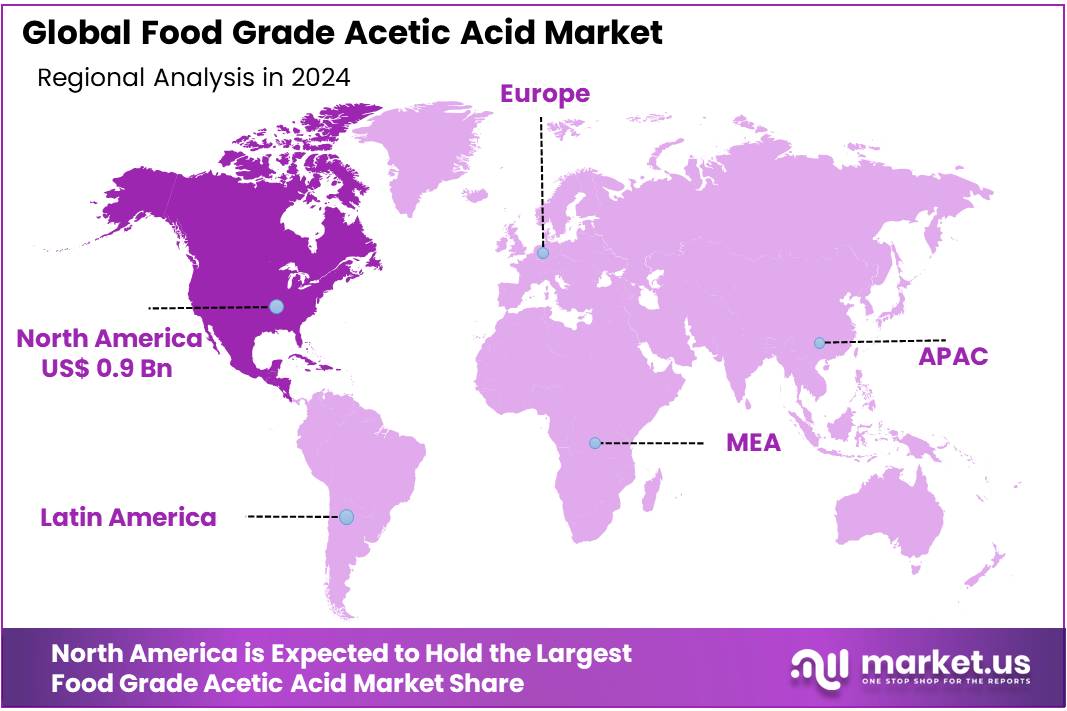

The Global Food Grade Acetic Acid Market size is expected to be worth around USD 4.3 Billion by 2034, from USD 2.2 Billion in 2024, growing at a CAGR of 7.0% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 44.90% share, holding USD 0.9 Billion in revenue.

Food-grade acetic acid, primarily utilized in the food and beverage industry as a preservative, acidity regulator, and flavor enhancer, is witnessing significant growth in India. This growth is driven by increasing demand for processed foods, rising health consciousness among consumers, and supportive government initiatives.

A notable development in India’s food-grade acetic acid production is the commissioning of a green ethanol-based plant by Jubilant Ingrevia in April 2022. Located in Gajraula, Uttar Pradesh, this facility has a production capacity of 25,000 tons per annum and utilizes bio-based feedstock, aligning with global sustainability trends.

The Indian government has implemented several initiatives to bolster domestic production of acetic acid. For instance, the “Make in India” campaign encourages local manufacturing, aiming to reduce reliance on imports. In line with this, INEOS Acetyls and Gujarat Narmada Valley Fertilizers & Chemicals Ltd (GNFC) have signed a Memorandum of Understanding to explore the construction of a 600,000-tonne-per-year acetic acid plant in Bharuch, Gujarat, with operations expected to commence by 2028. Currently, GNFC is the sole domestic producer of acetic acid in India, producing approximately 1.36 million tonnes annually.

Government initiatives play a pivotal role in fostering the growth of the food-grade acetic acid market. Policies promoting domestic manufacturing, such as the establishment of joint ventures like the one between INEOS and Gujarat Narmada Valley Fertilizers & Chemicals Ltd (GNFC) to develop a 600,000-tonne per year acetic acid plant in Gujarat, underscore the commitment to enhancing local production capabilities . These initiatives aim to reduce import dependency and bolster the domestic chemical industry’s competitiveness.

Key Takeaways

- Food Grade Acetic Acid Market size is expected to be worth around USD 4.3 Billion by 2034, from USD 2.2 Billion in 2024, growing at a CAGR of 7.0%.

- Aerobic Fermentation held a dominant market position, capturing more than a 62.8% share in the food-grade acetic acid market.

- Synthetic Acetic Acid held a dominant market position, capturing more than a 67.2% share in the food-grade acetic acid market.

- Upto 99% held a dominant market position, capturing more than a 74.6% share in the food-grade acetic acid market.

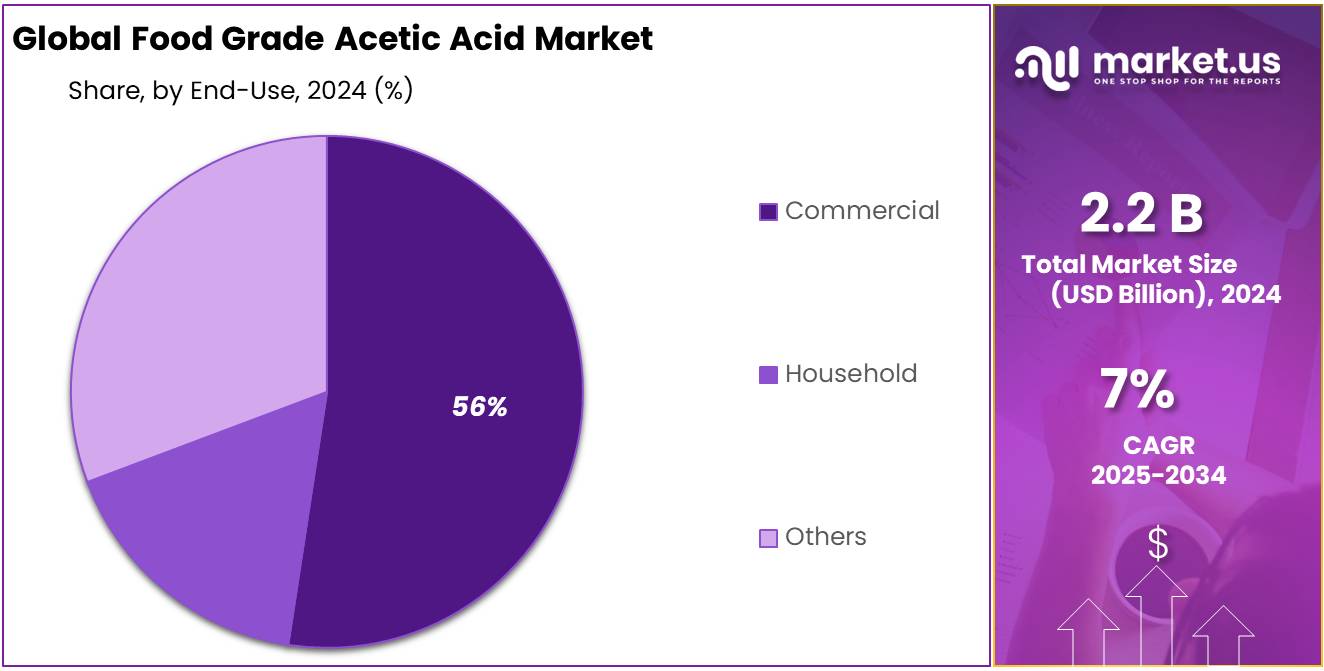

- Commercial held a dominant market position, capturing more than a 56.3% share in the food-grade acetic acid market.

- North America held a dominant position in the global food grade acetic acid market, accounting for 44.90% of the total market share, with a market value of approximately USD 0.9 billion.

By Fermentation Type Analysis

Aerobic Fermentation dominates with 62.8% share in 2024 due to its efficiency and widespread use in food-grade acetic acid production.

In 2024, Aerobic Fermentation held a dominant market position, capturing more than a 62.8% share in the food-grade acetic acid market by fermentation type. This strong lead can be linked to the method’s high conversion efficiency and its ability to produce acetic acid in a cleaner, more sustainable way using oxygen. Aerobic fermentation is widely used in the food industry for vinegar production, where bacteria such as Acetobacter oxidize ethanol into acetic acid in the presence of oxygen. The demand for naturally fermented food-grade acids is rising in both developed and developing markets, especially due to growing consumer awareness about clean-label and bio-based ingredients.

By Product Type Analysis

Synthetic Acetic Acid dominates with 67.2% share in 2024 due to its large-scale availability and consistent quality.

In 2024, Synthetic Acetic Acid held a dominant market position, capturing more than a 67.2% share in the food-grade acetic acid market by product type. This dominance is mainly due to its large-scale production capabilities, cost-effectiveness, and consistent purity levels that meet food industry standards. Synthetic acetic acid, typically produced through methanol carbonylation, is widely used in food applications such as flavoring agents, preservatives, and acidity regulators in processed foods, pickles, and sauces. Manufacturers prefer synthetic variants because they offer stable supply chains and uniform chemical composition, which is essential for mass food processing.

By Purity Analysis

Upto 99% purity dominates with 74.6% share in 2024 due to its wide use in food processing and preservation.

In 2024, Upto 99% held a dominant market position, capturing more than a 74.6% share in the food-grade acetic acid market by purity. This high share is mainly attributed to its suitability for a wide range of food applications, including flavoring agents, pickling solutions, preservatives, and acidity regulators. Acetic acid with up to 99% purity is commonly used because it offers the right balance between effectiveness and safety, meeting regulatory standards while being cost-efficient for mass food production.

By Application Analysis

Commercial application dominates with 56.3% share in 2024 due to its strong demand in food processing and bulk ingredient supply.

In 2024, Commercial held a dominant market position, capturing more than a 56.3% share in the food-grade acetic acid market by application. This leading position is largely driven by the increasing use of acetic acid in large-scale food processing units, commercial kitchens, and bulk food manufacturing facilities. Commercial food producers rely on food-grade acetic acid for its role in pickling, flavoring, and preserving processed foods, sauces, and condiments, where maintaining consistency and shelf life is critical.

Key Market Segments

By Fermentation Type

- Aerobic Fermentation

- Anaerobic Fermentation

- Others

By Product Type

- Synthetic Acetic Acid

- Bio-based Acetic Acid

By Purity

- Upto 99%

- Above 99%

By Application

- Commercial

- Household

- Others

Emerging Trends

Surge in Demand for Natural and Clean-Label Food Ingredients

A prominent trend shaping the food-grade acetic acid market is the escalating consumer preference for natural and clean-label ingredients. Consumers are increasingly scrutinizing food labels, seeking products that are free from artificial additives, preservatives, and chemicals. This shift towards natural and transparent food products has led to a surge in demand for ingredients like food-grade acetic acid, which is derived from natural sources such as vinegar and is perceived as a safer alternative to synthetic preservatives.

Food-grade acetic acid serves multiple functions in food processing, including acting as a preservative, flavor enhancer, and acidity regulator. Its natural origin and effectiveness in extending shelf life without compromising food quality make it a preferred choice for manufacturers aiming to meet the rising consumer demand for clean-label products. Moreover, food-grade acetic acid is commonly used in the production of vinegar, a staple in many households and a key ingredient in various cuisines worldwide.

Government initiatives and regulations also play a significant role in promoting the use of natural ingredients in food products. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) have established guidelines for the safe use of food-grade acetic acid in food products, ensuring its quality and safety for consumption. These regulations not only safeguard public health but also encourage food manufacturers to adopt natural preservatives like acetic acid in their products.

Drivers

Growing Demand for Clean Label and Natural Food Products

One of the major driving factors behind the increasing demand for food-grade acetic acid is the rising consumer preference for clean label and natural food products. Consumers today are more health-conscious than ever, and they are increasingly seeking foods that are free from artificial additives, preservatives, and chemicals. This has led to a significant demand for natural ingredients like food-grade acetic acid, which is commonly used as a preservative, flavoring agent, and acidulant in a wide range of food products.

Acetic acid, especially in its food-grade form, is derived from natural sources such as vinegar and is considered a safer alternative to synthetic preservatives. With the rise in consumer awareness about the potential health risks posed by synthetic chemicals in food, the demand for natural and organic food ingredients has surged in recent years. This shift in consumer behavior has, in turn, spurred food manufacturers to adopt natural preservatives like acetic acid in order to meet the growing demand for cleaner, healthier food options.

According to a report by the Food and Agriculture Organization (FAO), the global organic food market is expected to grow significantly in the coming years, with a projected value of USD 327.6 billion by 2027. This growth is driven by the increasing adoption of organic farming practices and the rising consumer demand for food products that are free from harmful chemicals and artificial additives. As part of this trend, food-grade acetic acid is playing a pivotal role in enhancing the shelf life and flavor profile of organic and natural food products.

Additionally, government initiatives and regulations promoting food safety and the use of natural ingredients are contributing to the growth of the food-grade acetic acid market. The European Food Safety Authority (EFSA) and the U.S. Food and Drug Administration (FDA) have set guidelines and regulations for the safe use of food-grade acetic acid in food products, ensuring its quality and safety for consumption. These regulatory bodies also play a key role in building consumer trust in food-grade acetic acid as a safe and effective ingredient in food preservation.

Restraints

Volatility in Raw Material Prices

One major restraining factor for the food-grade acetic acid market is the volatility in the prices of its raw materials, primarily ethanol. Ethanol is the key raw material used in the production of acetic acid, and fluctuations in its cost can significantly impact the price stability of food-grade acetic acid. Since acetic acid is a commodity chemical, any change in the price of ethanol can have a direct effect on the cost of acetic acid production, which in turn may affect its affordability for food manufacturers.

The price of ethanol is influenced by various factors such as agricultural yields, government policies, and the global supply and demand balance. In many regions, ethanol is produced from crops like corn and sugarcane, which are highly susceptible to changes in weather conditions and global commodity prices. For example, poor crop yields due to unfavorable weather can lead to a reduction in ethanol supply, pushing up its price. When the cost of ethanol rises, food-grade acetic acid manufacturers may face increased production costs, which may lead to higher prices for the final product.

According to the U.S. Department of Agriculture (USDA), the price of ethanol in the U.S. has shown significant fluctuations over the years. In 2022, the average price of ethanol in the U.S. was around USD 2.5 per gallon, but it had spiked to as high as USD 3.5 per gallon during certain periods due to supply chain disruptions and the global energy crisis. These price hikes have a cascading effect on the production of food-grade acetic acid, as manufacturers struggle to keep their costs down while maintaining quality and consistency in the product.

Government policies also play a role in the fluctuation of ethanol prices. For instance, subsidies or taxes on ethanol production and the usage of biofuels can impact the overall pricing structure of ethanol. These shifts can create uncertainty for businesses that rely on acetic acid as a key ingredient in their products.

Opportunity

Rising Popularity of Plant-Based and Vegan Food Products

One significant growth opportunity for the food-grade acetic acid market is the increasing popularity of plant-based and vegan food products. As more consumers turn to plant-based diets for health, environmental, and ethical reasons, food manufacturers are seeking natural preservatives and ingredients that align with these trends. Food-grade acetic acid, which is derived from natural sources like vinegar, has found its place as an ideal ingredient in this growing segment.

The plant-based food market has seen rapid growth over the past few years. According to the Good Food Institute, the plant-based food industry in the U.S. was valued at $7 billion in 2020, and it is expected to continue expanding as more people adopt plant-based and vegan lifestyles. This growth presents an opportunity for food-grade acetic acid, as it is commonly used in the production of plant-based food products to enhance flavor, preserve freshness, and maintain product safety. With its natural, clean label appeal, acetic acid has become a favored ingredient in plant-based meat alternatives, dairy-free beverages, and vegan snacks.

Acetic acid’s role in food preservation is particularly important for plant-based products, as these often have a shorter shelf life compared to traditional animal-based foods. Acetic acid helps extend the shelf life of plant-based products without the use of synthetic preservatives, making it an attractive option for manufacturers who want to meet the demand for cleaner, healthier food options. As the plant-based food market continues to grow, the need for effective and natural preservatives like acetic acid will likely increase.

Moreover, government initiatives and policies aimed at promoting sustainable and healthy eating habits have further boosted the demand for plant-based foods. For example, the European Union has introduced various policies to reduce carbon emissions and promote plant-based diets as part of its Green Deal. These initiatives not only encourage consumers to choose plant-based foods but also drive food manufacturers to innovate and produce more plant-based products, creating further opportunities for food-grade acetic acid.

Regional Insights

North America leads the Food Grade Acetic Acid Market with 44.90% share, valued at USD 0.9 Billion in 2024

In 2024, North America held a dominant position in the global food grade acetic acid market, accounting for 44.90% of the total market share, with a market value of approximately USD 0.9 billion. This leadership can be attributed to the region’s well-established food processing industry, advanced food safety regulations, and high consumer demand for packaged and processed foods. The United States, in particular, plays a key role in driving market growth due to its significant consumption of vinegar-based products, sauces, condiments, and ready-to-eat meals, all of which utilize food-grade acetic acid as a core ingredient.

The regulatory environment in North America supports the widespread application of acetic acid in commercial food production. The U.S. Food and Drug Administration (FDA) classifies acetic acid as Generally Recognized as Safe (GRAS) when used in accordance with good manufacturing practices, enabling its use as an acidity regulator and preservative across a range of food categories. Furthermore, the demand for natural and clean-label food products is prompting manufacturers to favor food-grade additives with high purity levels and safety certification, further boosting regional adoption.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Daicel Corporation is a leading Japanese manufacturer of chemicals and materials, including food-grade acetic acid. The company produces acetic acid through its advanced fermentation process, which aligns with global demand for natural and clean-label ingredients. Daicel’s food-grade acetic acid is used in various food products, offering natural preservation and enhancing food safety. The company is committed to sustainability and innovation in its production processes, making it a key player in the global market.

DuPont is a multinational science and technology company that produces a wide range of specialty chemicals, including food-grade acetic acid. With its extensive R&D capabilities, DuPont provides high-quality acetic acid solutions to the food industry, focusing on food safety, preservation, and flavor enhancement. DuPont’s commitment to sustainability and clean-label trends positions it well within the food-grade acetic acid market, ensuring that it meets the evolving needs of both manufacturers and consumers.

Eastman is a global specialty chemicals company that manufactures a variety of products, including food-grade acetic acid. Known for its expertise in chemical manufacturing, Eastman offers acetic acid that is used in food preservation, beverages, and flavorings. The company’s commitment to sustainable and high-quality chemical production allows it to serve as a reliable supplier in the food-grade acetic acid market, meeting the growing demand for natural ingredients in food products.

Top Key Players Outlook

- Celanese Corporation

- Daicel Corporation

- DuPont

- Eastman

- INEOS Oxide LLC

- Jiangsu Sopo (Group) Co., Ltd

- LyondellBasell

- Mitsubishi Chemical

- Wacker Chemie

Recent Industry Developments

In 2024 Eastman Chemical Company, announced a price increase of $0.05 per pound (approximately ₹11.50 per kg) for its glacial acetic acid and dilute acetic acid grades in North and Latin America, effective April 1, 2024.

In 2024, Celanese completed the startup of a new acetic acid production facility in Clear Lake, Texas, with an annual capacity of 1.3 million tons.

Report Scope

Report Features Description Market Value (2024) USD 2.2 Bn Forecast Revenue (2034) USD 4.3 Bn CAGR (2025-2034) 7.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Fermentation Type (Aerobic Fermentation, Anaerobic Fermentation, Others), By Product Type (Synthetic Acetic Acid, Bio-based Acetic Acid), By Purity (Upto 99%, Above 99%), By Application (Commercial, Household, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Celanese Corporation, Daicel Corporation, DuPont, Eastman, INEOS Oxide LLC, Jiangsu Sopo (Group) Co., Ltd, LyondellBasell, Mitsubishi Chemical, Wacker Chemie Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Food Grade Acetic Acid MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Food Grade Acetic Acid MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Celanese Corporation

- Daicel Corporation

- DuPont

- Eastman

- INEOS Oxide LLC

- Jiangsu Sopo (Group) Co., Ltd

- LyondellBasell

- Mitsubishi Chemical

- Wacker Chemie