Global Floor Grinding Machine Market Size, Share, Growth Analysis By Type (Walk-behind Floor Grinders, Ride-on Floor Grinders), By Operation Mode (Automatic Floor Grinders, Manual Floor Grinders, Semi-Automatic Floor Grinders), By End Use (Commercial, Industrial, Residential, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 178823

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

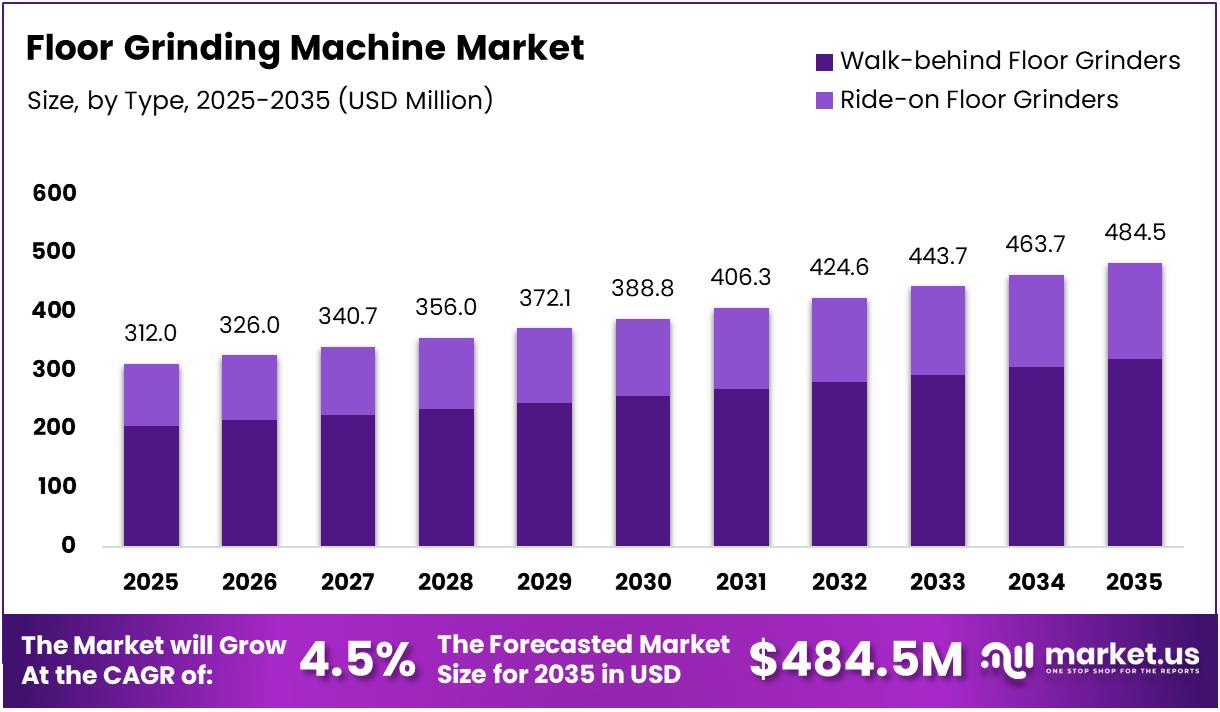

The Global Floor Grinding Machine Market size is expected to be worth around USD 484.5 Million by 2035 from USD 312.0 Million in 2025, growing at a CAGR of 4.5% during the forecast period 2026 to 2035.

Floor grinding machines are specialized industrial tools used to grind, level, and polish concrete, stone, and other hard floor surfaces. They are widely deployed in commercial buildings, warehouses, manufacturing facilities, and residential renovation projects. Moreover, these machines prepare surfaces for coatings, sealers, and decorative finishes, making them essential equipment in modern construction and flooring operations.

The market is driven by growing global construction activity and rising preference for polished concrete flooring in commercial and public spaces. Additionally, automated and high-efficiency grinding machines are replacing traditional manual methods. This technological shift improves productivity and reduces labor costs, encouraging broader adoption across diverse end-use sectors and project scales.

Governments in emerging economies are investing significantly in infrastructure and commercial real estate, directly fueling demand for floor preparation equipment. Furthermore, environmental regulations promoting dust-free and low-emission grinding technologies are pushing manufacturers to innovate continuously. Consequently, compliance-driven product development is creating new revenue streams in regulated markets across Asia, Europe, and North America.

The integration of IoT and smart sensors is further transforming the floor grinding equipment market. Manufacturers are developing compact, portable solutions targeting small-scale contractors and residential projects. Therefore, innovation in machine design and connectivity is expected to sustain healthy market growth and expand the addressable customer base throughout the forecast period.

According to Legend Robot, automated floor grinding robots achieve a coverage rate exceeding 95%, with operational efficiency ranging from 800 to 1,000 square meters per day for rough grinding and up to 3,000 to 4,000 square meters per day for polishing. These figures clearly demonstrate the substantial productivity advantages that automation brings to floor surface preparation.

According to data on angle grinder technology, proper dust collection attachments can reduce airborne dust by approximately 80 to 90 percent. Additionally, modern floor grinding machines with energy-efficient motors achieve power savings of up to 40% compared to older models. These advancements support both operator safety and cost-efficiency across commercial and industrial flooring applications.

Key Takeaways

- The Global Floor Grinding Machine Market is valued at USD 312.0 Million in 2025 and is projected to reach USD 484.5 Million by 2035.

- The market is growing at a CAGR of 4.5% during the forecast period 2026 to 2035.

- By Type, Walk-behind Floor Grinders dominate with a 65.7% market share in 2025.

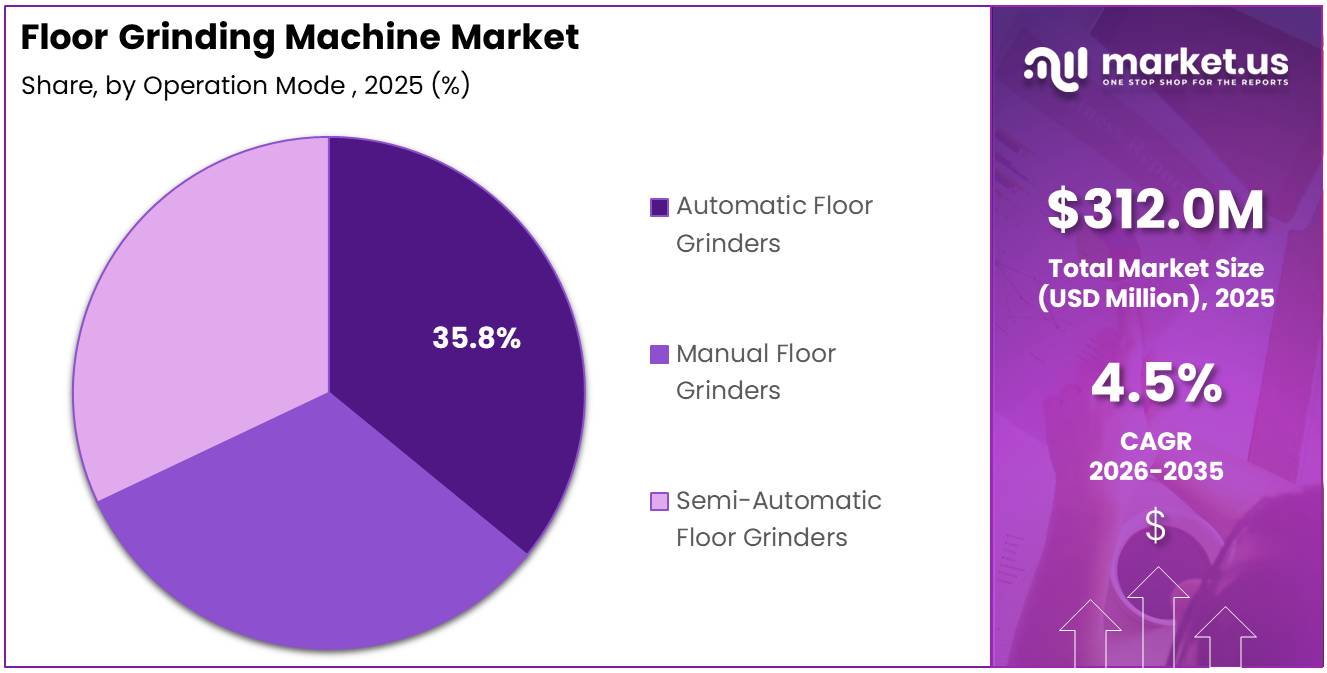

- By Operation Mode, Automatic Floor Grinders lead with a 35.8% market share in 2025.

- By End Use, the Commercial segment holds the largest share at 40.6% in 2025.

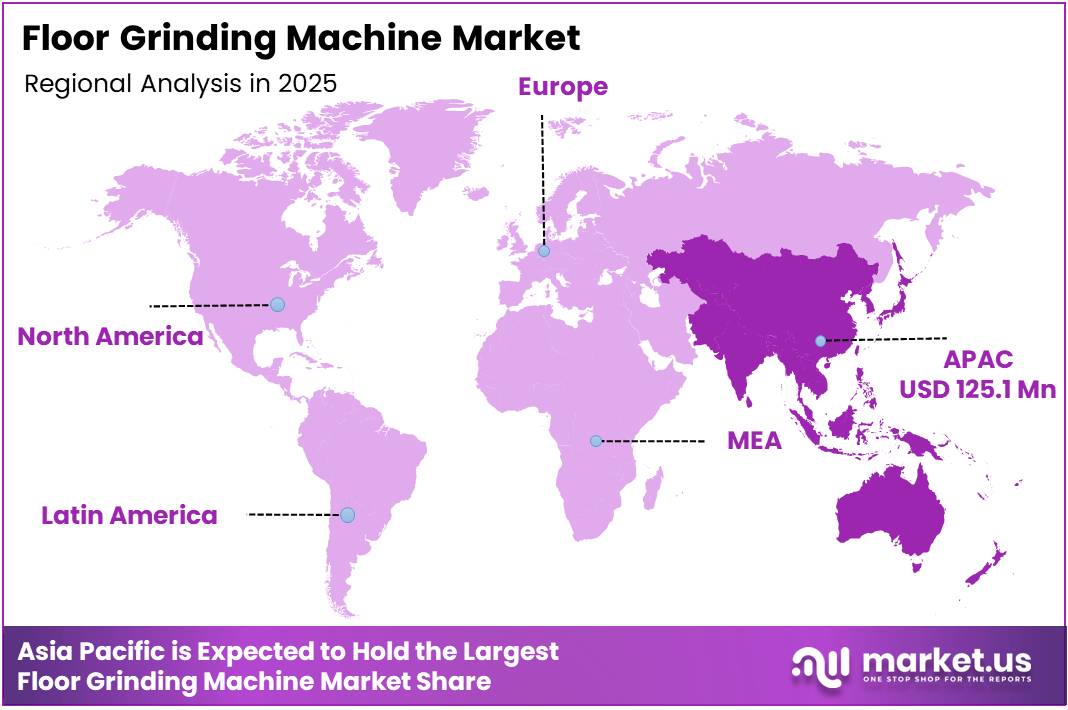

- Asia Pacific dominates the regional landscape with a 40.1% market share, valued at USD 125.1 Million in 2025.

By Type Analysis

Walk-behind Floor Grinders dominate with 65.7% due to their versatility, ease of use, and suitability across diverse project sizes.

In 2025, Walk-behind Floor Grinders held a dominant market position in the By Type segment of the Floor Grinding Machine Market, with a 65.7% share. These machines are widely preferred for their maneuverability, cost-effectiveness, and broad applicability. Moreover, their compact design makes them suitable for both small commercial renovations and large industrial flooring projects with varied surface requirements.

Ride-on Floor Grinders are gaining significant traction in large-scale construction and renovation projects. These models deliver higher efficiency and considerably reduce operator fatigue over expansive floor areas. Consequently, sectors such as warehousing, logistics centers, and airports are increasingly investing in ride-on models to achieve faster project completion and consistently improved surface quality outcomes.

By Operation Mode Analysis

Automatic Floor Grinders dominate with 35.8% due to consistent performance, minimal operator dependency, and compatibility with smart technologies.

In 2025, Automatic Floor Grinders held a dominant market position in the By Operation Mode segment of the Floor Grinding Machine Market, with a 35.8% share. These machines deliver consistent results with minimal operator intervention. Additionally, their compatibility with IoT systems and smart sensors makes them ideal for large-scale, precision-driven flooring operations in commercial and industrial environments.

Manual Floor Grinders remain a practical and widely used choice for smaller contractors and budget-sensitive projects. They offer greater operator control and are simpler to maintain with fewer components. However, reliance on skilled labor limits their scalability in high-volume applications, making them most common in residential and small commercial renovation work across developing markets.

Semi-Automatic Floor Grinders represent a growing middle-ground solution combining operator guidance with automated processing efficiency. They appeal to mid-sized contractors seeking productivity improvements without the high capital cost of fully automatic models. Therefore, this segment is gaining steady adoption across commercial and light industrial flooring projects, particularly in cost-conscious markets seeking performance upgrades.

By End Use Analysis

Commercial dominates with 40.6% due to strong demand for polished flooring in retail, hospitality, and office environments.

In 2025, Commercial held a dominant market position in the By End Use segment of the Floor Grinding Machine Market, with a 40.6% share. Retail spaces, offices, hospitality venues, and public facilities drive this strong demand. Moreover, the growing preference for polished concrete aesthetics in commercial interiors continues to sustain this segment’s leadership position across global markets.

Industrial applications represent a significant share of floor grinding demand, particularly in manufacturing plants, warehouses, and distribution centers. These environments require durable, level floors capable of handling heavy machinery and high foot traffic volumes. Consequently, industrial operators invest in high-capacity grinding solutions to maintain safety standards and meet operational floor performance requirements.

The Residential segment is growing steadily as homeowners increasingly choose polished concrete and stone flooring for modern interiors. Rising disposable incomes and renovation trends contribute to this expansion. Additionally, compact and user-friendly grinding machines are making residential floor preparation more accessible, even for small-scale home improvement and remodeling contractors.

The Others category includes specialty applications such as parking structures, sports facilities, and public infrastructure projects. These end uses require customized grinding solutions to meet specific surface preparation standards. Furthermore, municipal and government-funded projects continue to generate steady demand within this diverse and expanding sub-segment across multiple global regions.

Key Market Segments

By Type

- Walk-behind Floor Grinders

- Ride-on Floor Grinders

By Operation Mode

- Automatic Floor Grinders

- Manual Floor Grinders

- Semi-Automatic Floor Grinders

By End Use

- Commercial

- Industrial

- Residential

- Others

Drivers

Rising Construction Activity and Automation Demand Drive Floor Grinding Machine Market Growth

Rising demand for polished and smooth flooring in commercial and residential construction is a primary growth driver. As urbanization accelerates globally, new buildings increasingly require professional surface preparation services. Moreover, the hospitality, retail, and office sectors are adopting decorative concrete floors, directly increasing the need for efficient and reliable floor grinding equipment.

The increasing adoption of automated and high-efficiency grinding machines is transforming standard flooring operations. Contractors now prefer automated systems that reduce labor dependency and deliver more consistent results. Consequently, businesses investing in technology upgrades are choosing advanced floor grinders that offer faster turnaround times, lower operational costs, and superior surface finishing quality.

Growing preference for eco-friendly and dust-free grinding technologies is also driving significant market demand. Environmental regulations and worker safety standards are pushing manufacturers to develop machines with effective dust collection and low-emission systems. Therefore, sustainability-focused buyers are prioritizing greener grinding solutions, expanding the addressable market across regulated industries and compliance-driven geographies worldwide.

Restraints

Skilled Labor Shortages and Regulatory Challenges Restrain Floor Grinding Machine Market Growth

A limited skilled workforce for operating sophisticated floor grinding equipment remains a significant market challenge. Modern grinding machines, particularly automatic and semi-automatic models, require trained operators to achieve optimal surface results. Consequently, many small and mid-sized contractors struggle to deploy advanced equipment effectively, limiting overall market penetration in cost-sensitive and developing regions.

Regulatory and compliance challenges in certain regions create additional barriers for market participants. Import restrictions, safety certifications, and environmental compliance requirements vary significantly across countries. Moreover, navigating these complex frameworks increases operational costs for manufacturers and distributors, particularly when entering new geographic markets with strict equipment performance and emission standards.

Additionally, high initial investment costs for advanced floor grinding machines can deter smaller operators and independent service providers. Budget constraints limit adoption among small contractors who cannot afford premium automated models. However, as equipment financing options and rental models become more widely available, this barrier is gradually easing across cost-sensitive markets globally.

Growth Factors

IoT Integration and Urbanization in Emerging Markets Accelerate Floor Grinding Machine Market Growth

The integration of IoT and smart sensors in floor grinding machines is a transformative growth opportunity for the market. Connected machines monitor performance in real time, reduce unplanned downtime, and enable predictive maintenance scheduling. Moreover, data-driven insights help operators optimize grinding parameters, improving efficiency and reducing material waste across commercial and industrial flooring applications worldwide.

Development of compact and portable grinding solutions is creating new opportunities among small-scale project contractors. Residential renovation specialists and independent service providers increasingly require lightweight machines that are easy to transport between job sites. Consequently, manufacturers offering portable yet high-performance models are capturing growing demand among budget-conscious buyers and smaller flooring businesses globally.

Expansion into emerging markets experiencing rapid urbanization presents a significant long-term growth opportunity. Countries across Asia Pacific, Latin America, and Africa are undergoing construction booms driven by sustained infrastructure investment. Therefore, floor grinding machine manufacturers entering these regions with competitively priced products and strong local support networks stand to gain considerable market share.

Emerging Trends

Multi-Functional Machines and AI-Driven Maintenance Reshape the Floor Grinding Machine Market

A key emerging trend is the shift toward multi-functional machines that combine grinding, polishing, and surface preparation in a single unit. These all-in-one solutions reduce equipment investment and improve operational flexibility on job sites. Moreover, contractors benefit from faster project execution, as switching between tasks no longer requires multiple specialized machines or extended equipment setup time.

Increasing focus on operator safety and ergonomics is visibly reshaping floor grinding machine design priorities. Manufacturers are incorporating vibration-dampening handles, noise reduction features, and improved operator control interfaces. Consequently, worker comfort and safety compliance are becoming important competitive differentiators, particularly in markets with stringent occupational health regulations that demand higher equipment and operator safety standards.

The adoption of AI-driven predictive maintenance and performance optimization is gaining strong momentum across the market. AI algorithms analyze real-time machine data to detect component wear, prevent breakdowns, and schedule servicing proactively. Therefore, businesses using AI-enabled floor grinders achieve longer machine lifespans, reduced maintenance costs, and consistently higher surface finishing quality across large-scale flooring projects.

Regional Analysis

Asia Pacific Dominates the Floor Grinding Machine Market with a Market Share of 40.1%, Valued at USD 125.1 Million

Asia Pacific holds the leading position in the global Floor Grinding Machine Market, accounting for a 40.1% share, valued at approximately USD 125.1 Million in 2025. Rapid urbanization, large-scale infrastructure development, and booming construction activity across China, India, Japan, and Southeast Asia drive this dominance. Moreover, growing industrial and commercial flooring demand continues to strengthen the region’s market leadership throughout the forecast period.

North America Floor Grinding Machine Market Trends

North America represents a mature and technology-driven market for floor grinding equipment, led by robust demand in the United States. Commercial renovation projects, warehousing expansion, and strict surface safety compliance standards support consistent regional demand. Additionally, growing adoption of automated grinding solutions in construction and industrial sectors is sustaining steady market development across the region.

Europe Floor Grinding Machine Market Trends

Europe maintains a stable market position driven by active construction and renovation activity in Germany, the United Kingdom, and France. Environmental regulations promoting dust-free grinding technologies are notably influencing equipment purchasing decisions. Furthermore, the region’s strong emphasis on sustainability and worker safety is encouraging manufacturers to deliver compliant, energy-efficient, and ergonomically improved grinding solutions.

Latin America Floor Grinding Machine Market Trends

Latin America is emerging as a growing market for floor grinding machines, supported by expanding construction activity in Brazil and Mexico. Infrastructure investments and ongoing urban development projects are generating new demand for surface preparation equipment. However, economic volatility and limited access to advanced machinery remain key challenges that moderate faster market growth across the region.

Middle East and Africa Floor Grinding Machine Market Trends

The Middle East and Africa region presents growing opportunities for floor grinding machine suppliers, particularly in GCC countries undergoing large-scale infrastructure and commercial development. Hospitality and real estate projects are key demand drivers. Additionally, increasing awareness of modern flooring standards in South Africa and other emerging economies is gradually expanding the regional market base.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Husqvarna Group is a globally recognized leader in floor grinding and surface preparation equipment. The company offers a comprehensive portfolio of grinding machines designed for commercial, industrial, and residential applications. Its strong global distribution network and ongoing investment in product innovation have positioned Husqvarna as a preferred choice among professional flooring contractors and large-scale construction companies worldwide.

Superabrasive Inc. specializes in high-performance diamond tooling and floor grinding systems designed for demanding professional environments. The company is known for engineering precision-built machines that deliver consistent surface finishes on concrete and stone floors. Moreover, its focus on continuous technological advancement and customer-specific solutions has helped it build a strong and loyal customer base across North America and international markets.

Klindex is an Italian manufacturer renowned for its innovative floor grinding and polishing machines used across commercial, industrial, and decorative flooring projects globally. The company combines deep engineering expertise with advanced product design to deliver reliable and versatile equipment. Additionally, Klindex’s broad international distribution presence and strong after-sales support make it a highly competitive player across European and emerging market segments.

Scanmaskin Sverige AB is a Swedish manufacturer recognized for producing durable, high-quality floor grinding machines built for demanding professional applications. The company serves contractors and flooring specialists with machines suited for concrete preparation and surface finishing projects. Furthermore, its acquisition by the Tyrolit Group in January 2025 is expected to significantly accelerate its global distribution reach and product development capabilities.

Key Players

- Husqvarna Group

- Superabrasive Inc.

- Klindex

- Scanmaskin Sverige AB

- SASE Company

- HTC Floor Systems

- Bartell Global (Diamatic)

- WerkMaster

- Xingyi Polishing

- High-Tech Grinding System

- Ronlon Machinery

- Schwamborn

- National Flooring Equipment

- CS Unitec

- Other Key Players

Recent Developments

- January 2025 – The Tyrolit Group announced the acquisition of the Scanmaskin Group, a Swedish manufacturer of professional floor grinding machines. This strategic move strengthens Tyrolit’s position in the surface preparation equipment market and is expected to expand Scanmaskin’s global distribution and product development capabilities significantly.

- March 2025 – National Flooring Equipment announced its acquisition of Syntec Diamond Tools, a supplier of diamond tooling solutions for the flooring industry. This acquisition broadens National Flooring Equipment’s product offering and allows it to deliver a more integrated solution combining grinding machines and diamond tooling to professional flooring contractors worldwide.

Report Scope

Report Features Description Market Value (2025) USD 312.0 Million Forecast Revenue (2035) USD 484.5 Million CAGR (2026-2035) 4.5% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Walk-behind Floor Grinders, Ride-on Floor Grinders), By Operation Mode (Automatic Floor Grinders, Manual Floor Grinders, Semi-Automatic Floor Grinders), By End Use (Commercial, Industrial, Residential, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Husqvarna Group, Superabrasive Inc., Klindex, Scanmaskin Sverige AB, SASE Company, HTC Floor Systems, Bartell Global (Diamatic), WerkMaster, Xingyi Polishing, High-Tech Grinding System, Ronlon Machinery, Schwamborn, National Flooring Equipment, CS Unitec, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Floor Grinding Machine MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Floor Grinding Machine MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Husqvarna Group

- Superabrasive Inc.

- Klindex

- Scanmaskin Sverige AB

- SASE Company

- HTC Floor Systems

- Bartell Global (Diamatic)

- WerkMaster

- Xingyi Polishing

- High-Tech Grinding System

- Ronlon Machinery

- Schwamborn

- National Flooring Equipment

- CS Unitec

- Other Key Players