Global Fertilizer Spreader Market Size, Share, And Business Benefits By Product Type (Centrifugal Broadcast Spreaders, Rotary Broadcast Spreaders, Pendulum Broadcast Spreaders, Drop Spreaders), By Fertilizer Form (Granular, Powdered, Liquid), By Capacity (Small (Less than 500 lbs), Medium (500 lbs to 1,500 lbs), Large (Greater than 1,500 lbs)), By Technology (Mechanical, Hydraulic, Electric), By Application (Agricultural, Commercial, Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 157609

- Number of Pages: 282

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

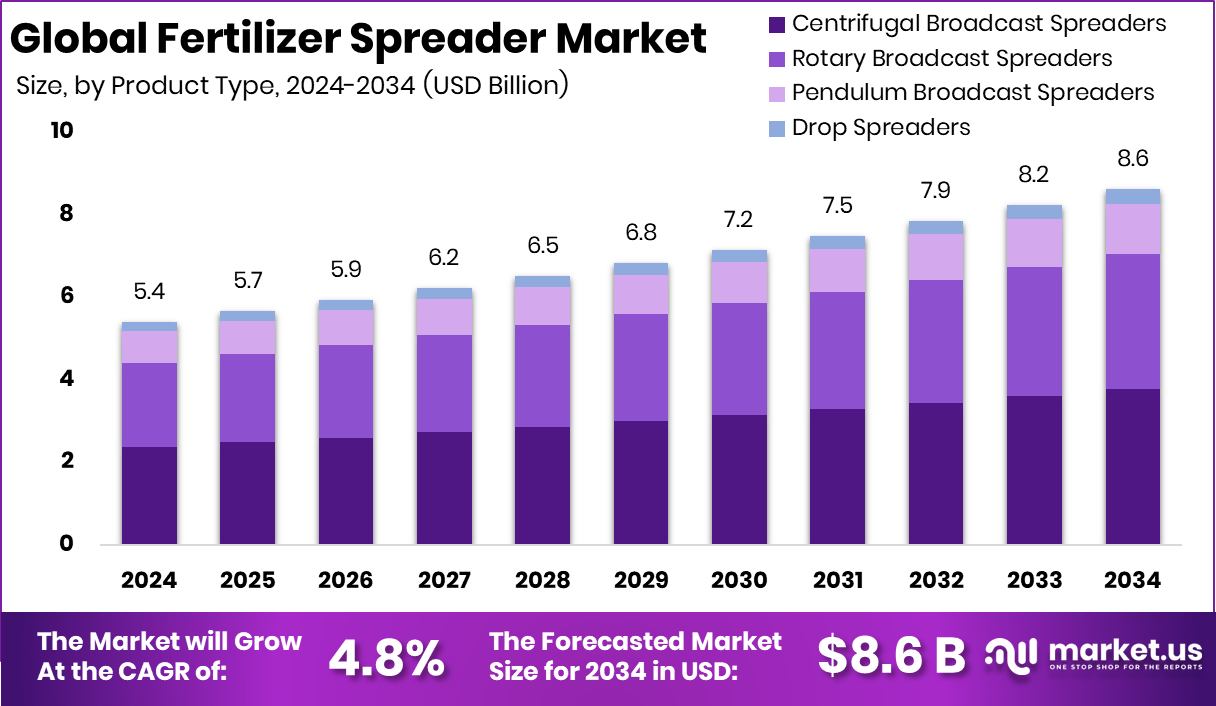

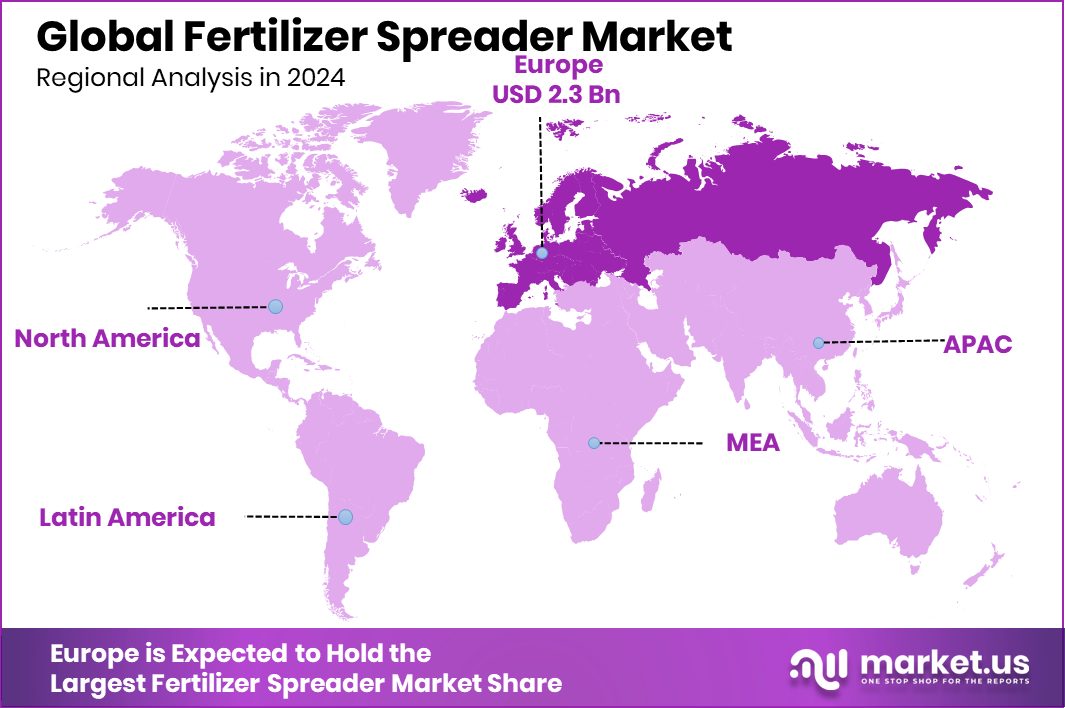

The Global Fertilizer Spreader Market is expected to be worth around USD 8.6 billion by 2034, up from USD 5.4 billion in 2024, and is projected to grow at a CAGR of 4.8% from 2025 to 2034. Europe’s Fertilizer Spreader Market, valued at USD 2.3 Bn, highlights rising mechanization and efficiency.

A fertilizer spreader is a farming tool or machine designed to evenly distribute fertilizers across fields, gardens, or lawns. Ensuring uniform coverage helps crops absorb nutrients more efficiently, reduces waste, and saves time compared to manual application. Fertilizer spreaders come in different types, such as handheld, broadcast, drop, and tractor-mounted models, each suitable for different scales of farming and landscaping needs.

The fertilizer spreader market refers to the industry that produces and sells these machines for both small-scale and large-scale agricultural use. The market is shaped by factors like increasing global food demand, modern farming practices, and the rising need for higher crop productivity. As farmers adopt more mechanized methods, the demand for efficient fertilizer application tools has been steadily growing.

One of the key growth factors is the rising need to improve crop yields while minimizing fertilizer wastage. With the global population expanding, farmers are under pressure to produce more food on limited land, making precision tools like fertilizer spreaders essential. According to an industry report, NitroVolt raised €3.5M in seed funding to advance green ammonia production.

The demand is further driven by changing agricultural practices. As more regions shift toward sustainable and mechanized farming, the adoption of fertilizer spreaders increases. Small farmers and large agribusinesses alike are recognizing the efficiency gains from using these machines. According to an industry report, NUTRO provides $300,000 through Soil Growth Grants.

Key Takeaways

- The Global Fertilizer Spreader Market is expected to be worth around USD 8.6 billion by 2034, up from USD 5.4 billion in 2024, and is projected to grow at a CAGR of 4.8% from 2025 to 2034.

- The fertilizer spreader market shows strong demand, with centrifugal broadcast spreaders holding a 43.8% share.

- Granular fertilizers dominate the fertilizer spreader market, capturing 59.5% due to ease of application.

- Medium-capacity spreaders, ranging from 500 to 1,500 lbs, lead the fertilizer spreader market with 47.4%.

- Mechanical technology remains dominant in the fertilizer spreader market, accounting for 48.2% of the market share globally.

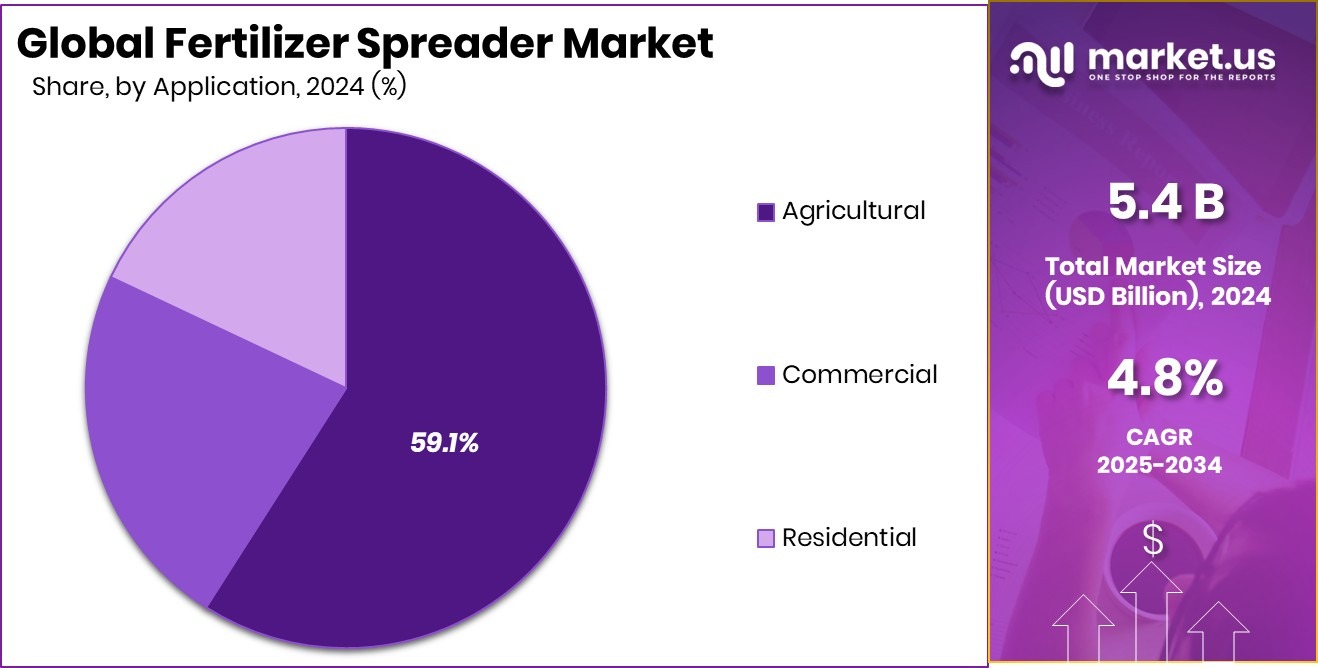

- Agricultural applications drive the fertilizer spreader market, securing a leading 59.1% market contribution.

- The 42.8% market share in Europe reflects strong adoption of advanced fertilizer spreader technologies.

By Product Type Analysis

The fertilizer spreader market is dominated by centrifugal broadcast spreaders, capturing 43.8%.

In 2024, Centrifugal Broadcast Spreaders held a dominant market position in the By Product Type segment of the Fertilizer Spreader Market, with a 43.8% share. This leadership reflects the widespread adoption of centrifugal models due to their ability to cover large areas quickly and with a uniform distribution of fertilizers. Farmers increasingly prefer these spreaders because they save significant time compared to manual application and ensure consistent nutrient delivery, which is crucial for improving crop yield and soil health.

The dominance of centrifugal broadcast spreaders is also linked to their versatility. They can be used effectively in both small farms and large agricultural fields, making them suitable across diverse farming practices. Their relatively simple design, ease of operation, and cost-effectiveness further enhance their appeal among users who want efficient solutions without complex handling requirements.

Additionally, rising awareness about reducing fertilizer wastage has pushed demand for tools that deliver even application, and centrifugal spreaders are well-positioned to meet this expectation. With agriculture increasingly shifting toward mechanization, this segment’s strong market share underlines its role as a trusted choice for farmers aiming for higher productivity.

By Fertilizer Form Analysis

Granular fertilizers lead the fertilizer spreader market, holding a strong 59.5% share.

In 2024, Granular held a dominant market position in the By Fertilizer Form segment of the Fertilizer Spreader Market, with a 59.5% share. This dominance is driven by the widespread use of granular fertilizers in agriculture, as they are easier to handle, store, and apply compared to other forms.

Farmers often prefer granular fertilizers because they provide slow and controlled nutrient release, ensuring crops receive consistent nourishment over time. This characteristic makes them highly effective in supporting plant growth while reducing the risk of over-fertilization.

The high adoption of granular fertilizers also aligns with the operational efficiency of fertilizer spreaders. Most modern spreaders are designed to work optimally with granular inputs, allowing for precise and uniform distribution across large farming areas. This compatibility between fertilizer form and application equipment further strengthens the position of granular fertilizers in the market.

Moreover, the growing need for higher crop yields to meet food demand has encouraged farmers to rely on reliable and efficient fertilizer forms. The 59.5% share highlights not just the popularity of granular fertilizers but also their importance in driving agricultural productivity. Their ease of integration with mechanized spreading systems continues to reinforce their leading position in the market.

By Capacity Analysis

Medium capacity spreaders, between 500–1,500 lbs, control 47.4% of the market.

In 2024, Medium (500 lbs to 1,500 lbs) held a dominant market position in the By Capacity segment of the Fertilizer Spreader Market, with a 47.4% share. This leading position reflects the balance these spreaders provide between capacity, efficiency, and affordability, making them the most preferred choice among farmers and agricultural operators. Medium-capacity spreaders are particularly valued for their ability to cover large fields without frequent refilling, while still remaining easy to handle compared to larger models.

The popularity of this capacity range also comes from its suitability for diverse farming operations. Whether used in mid-sized farms or large-scale agriculture, medium-capacity spreaders strike the right balance between operational convenience and productivity. Their versatility allows them to support both row crops and broadacre farming, enhancing overall efficiency in fertilizer application.

Furthermore, the 47.4% share indicates growing adoption among farmers who seek cost-effective solutions that do not compromise on performance. These spreaders offer an ideal combination of mobility and coverage, reducing labor and time while ensuring precise fertilizer distribution. The strong demand for this segment underscores its importance in modernizing farming practices and maintaining consistent crop productivity in an increasingly competitive agricultural environment.

By Technology Analysis

Mechanical technology continues driving the fertilizer spreader market, accounting for 48.2% share.

In 2024, Mechanical held a dominant market position in the By Technology segment of the Fertilizer Spreader Market, with a 48.2% share. This dominance reflects the strong preference for mechanical spreaders due to their simplicity, reliability, and cost-effectiveness. Farmers value these machines for their straightforward design, which allows easy operation and maintenance without the need for advanced technical skills. This makes them accessible to a wide range of users, from smallholders to large-scale agricultural operations.

The 48.2% share also highlights the trust farmers place in mechanical systems for consistent fertilizer application. These spreaders are capable of delivering even distribution across fields, ensuring optimal nutrient absorption by crops. Their durability and adaptability across different terrains further strengthen their demand, especially in regions where affordability and practicality are top priorities.

Moreover, the growth of this segment is supported by the rising need for efficient yet affordable mechanization in agriculture. Many farmers prefer mechanical spreaders as they balance performance with low ownership costs, reducing the financial burden compared to more advanced systems. This clear market dominance underscores how mechanical technology remains a cornerstone of fertilizer application, contributing significantly to productivity and efficiency in farming practices.

By Application Analysis

Agricultural applications dominate the fertilizer spreader market, representing a 59.1% portion.

In 2024, Agricultural held a dominant market position in the By Application segment of the Fertilizer Spreader Market, with a 59.1% share. This dominance reflects the vital role fertilizer spreaders play in large-scale farming, where efficiency and precision are critical for sustaining crop yields. Agricultural use requires reliable equipment capable of covering extensive farmland, and spreaders designed for this purpose ensure uniform nutrient distribution that directly supports soil health and productivity.

The 59.1% share highlights how essential these machines have become in meeting the rising global demand for food production. Farmers rely on agricultural spreaders to manage both time and resources efficiently, reducing manual labor while improving the effectiveness of fertilizer usage. Their ability to minimize wastage not only lowers input costs but also contributes to environmentally responsible farming practices.

Additionally, the agricultural segment benefits from ongoing mechanization trends, where medium to large farms increasingly invest in durable, high-capacity spreaders. These machines are adaptable across various crop types, making them indispensable for modern farming. The strong market position of the agricultural application underscores its central role in shaping the fertilizer spreader industry, as it continues to support higher productivity and sustainability in global agriculture.

Key Market Segments

By Product Type

- Centrifugal Broadcast Spreaders

- Rotary Broadcast Spreaders

- Pendulum Broadcast Spreaders

- Drop Spreaders

By Fertilizer Form

- Granular

- Powdered

- Liquid

By Capacity

- Small (Less than 500 lbs)

- Medium (500 lbs to 1,500 lbs)

- Large (Greater than 1,500 lbs)

By Technology

- Mechanical

- Hydraulic

- Electric

By Application

- Agricultural

- Commercial

- Residential

Driving Factors

Rising Food Demand Boosts Need for Fertilizer Spreaders

One of the biggest driving factors for the fertilizer spreader market is the fast-growing global demand for food. With the world population expected to keep rising, farmers are under constant pressure to produce more crops on the same or even less land. Fertilizer spreaders help them achieve this by making sure nutrients are spread evenly across the fields, leading to healthier soil and better yields.

This efficiency also reduces waste and saves costs, making it an attractive option for farmers. As more countries focus on improving food security, the role of fertilizer spreaders becomes even more important, positioning them as an essential tool in modern farming practices to meet the needs of growing populations.

Restraining Factors

High Equipment Costs Limit Wider Farmer Adoption

A key restraining factor for the fertilizer spreader market is the high cost of equipment, which makes it difficult for many small and medium-scale farmers to afford. While fertilizer spreaders improve efficiency and crop yields, the upfront investment and ongoing maintenance expenses can be a burden, especially in developing regions where farming incomes are limited.

Many farmers continue to rely on traditional manual methods because of this cost barrier. In addition, the lack of easy financing or subsidies in certain areas further slows adoption. As a result, even though fertilizer spreaders offer clear benefits, their growth potential is restrained by affordability issues, keeping advanced mechanization out of reach for a significant portion of the farming community.

Growth Opportunity

Smart Technology Creates Big Growth Opportunities Ahead

A major growth opportunity for the fertilizer spreader market lies in the adoption of smart technology and precision farming tools. Modern spreaders equipped with GPS, sensors, and automation can deliver fertilizers with pinpoint accuracy, reducing waste and improving crop health. These innovations also help farmers save time and lower costs while protecting the environment by avoiding the overuse of chemicals.

As governments and organizations worldwide promote sustainable agriculture, the demand for such advanced equipment is expected to grow rapidly. Farmers are becoming more open to investing in smart solutions that increase efficiency and profitability. This shift toward digital and automated farming creates a clear opportunity for fertilizer spreaders to expand their role in modern agriculture.

Latest Trends

Sustainable Farming Practices Drive Fertilizer Spreader Trends

One of the latest trends shaping the fertilizer spreader market is the growing focus on sustainable farming practices. Farmers today are under increasing pressure to reduce chemical use and adopt eco-friendly methods while still maintaining high yields. Fertilizer spreaders are being designed to apply nutrients more precisely, which helps minimize wastage and lowers the environmental impact on soil and water.

This trend is also supported by government initiatives and awareness programs that encourage the use of smart tools for sustainable agriculture. As more farmers seek equipment that balances productivity with responsibility toward the environment, fertilizer spreaders that enable efficient, targeted application are becoming a popular choice, highlighting sustainability as a clear market trend.

Regional Analysis

In 2024, Europe dominated the Fertilizer Spreader Market, holding a 42.8% share worth USD 2.3 Bn.

The Fertilizer Spreader Market shows strong regional variations, driven by differences in farming practices, technology adoption, and food production needs. Europe held a dominant market position in 2024, capturing 42.8% of the total share, valued at USD 2.3 billion.

This leadership is largely attributed to the region’s advanced agricultural infrastructure, strong emphasis on mechanization, and widespread adoption of precision farming techniques. European farmers are increasingly focusing on sustainable practices, where fertilizer spreaders play a critical role in minimizing nutrient wastage and enhancing soil management.

Government support for environmentally friendly farming, along with strict regulations on fertilizer use, further accelerates the adoption of modern spreaders.

In North America, the market is supported by large-scale commercial farming operations and a strong push toward technology-driven agriculture. The Asia Pacific region is experiencing rapid growth, driven by rising food demand and the modernization of farming in developing economies.

Meanwhile, the Middle East & Africa and Latin America are witnessing gradual adoption, supported by improvements in agricultural productivity and mechanization efforts. Overall, while Europe leads the market with its significant share, emerging regions present strong future growth potential as mechanized farming continues to expand globally.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Deere & Company continues to hold a leading position through its emphasis on innovation and advanced machinery. Its focus on integrating precision farming technologies ensures that fertilizer spreaders are not only efficient but also aligned with sustainable agricultural practices. The company’s wide global presence further strengthens its influence in shaping demand patterns across both developed and emerging markets.

Kubota Corporation plays a pivotal role in the market with its reputation for compact yet highly efficient agricultural equipment. Its fertilizer spreaders are particularly suited for small to mid-sized farms, a key segment in Asia and other developing regions. Kubota’s strategy of combining user-friendly designs with reliable performance has helped it build strong trust among farmers seeking practical and cost-effective mechanization solutions.

Mahindra & Mahindra Ltd., a significant player in agricultural machinery from India, has been expanding its footprint globally. With deep connections to emerging markets, the company brings accessibility and affordability to mechanized farming tools, including fertilizer spreaders. Its ability to offer durable equipment tailored for diverse agricultural conditions positions it as a crucial contributor to the market.

Top Key Players in the Market

- Deere & Company

- Kubota Corporation

- Mahindra & Mahindra Ltd.

- Agco Corporation

- CNH Industrial N.V.

- Claas KGaA mbH

- Bucher Industries AG (KUHN Group)

- Adams Fertilizer Equipment

- Dalton AG Inc

- Teagle Machinery Ltd

- Bogballe A/S

Recent Developments

- In February 2025, Kubota unveiled an advanced fertilizer spreading solution combining its DSX-W GEOSPREAD disc spreader with TIM (Tractor Implement Management) technology. This smart system uses sensors and hydraulic controls to maintain the spreader’s optimal height, angle, and speed—helping farmers apply fertilizer precisely and comfortably while the tractor adjusts settings automatically.

- In 2024, Mahindra introduced a new 1020-lb Lift Spreader, designed to mount on CAT 1 tractors. It features a heavy-duty polyester (poly) hopper that resists rust and handles up to 18 bags of fertilizer, offering reliable performance in tough farming conditions.

Report Scope

Report Features Description Market Value (2024) USD 5.4 Billion Forecast Revenue (2034) USD 8.6 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Centrifugal Broadcast Spreaders, Rotary Broadcast Spreaders, Pendulum Broadcast Spreaders, Drop Spreaders), By Fertilizer Form (Granular, Powdered, Liquid), By Capacity (Small (Less than 500 lbs), Medium (500 lbs to 1,500 lbs), Large (Greater than 1,500 lbs)), By Technology (Mechanical, Hydraulic, Electric), By Application (Agricultural, Commercial, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Deere & Company, Kubota Corporation, Mahindra & Mahindra Ltd., Agco Corporation, CNH Industrial N.V., Claas KGaA mbH, Bucher Industries AG (KUHN Group), Adams Fertilizer Equipment, Dalton AG Inc, Teagle Machinery Ltd, Bogballe A/S Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fertilizer Spreader MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Fertilizer Spreader MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Deere & Company

- Kubota Corporation

- Mahindra & Mahindra Ltd.

- Agco Corporation

- CNH Industrial N.V.

- Claas KGaA mbH

- Bucher Industries AG (KUHN Group)

- Adams Fertilizer Equipment

- Dalton AG Inc

- Teagle Machinery Ltd

- Bogballe A/S