Global Feminine Wipes Market Size, Share, Growth Analysis By Material Fabric (Cotton, Synthetic, Biodegradable), By Nature (Conventional, Natural/Organic), By Application (General Wipes, Sanitary Wipes), By Distribution Channel (Supermarkets/Hypermarkets, Pharmacy and Drug Stores, Online Retail Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171693

- Number of Pages: 295

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

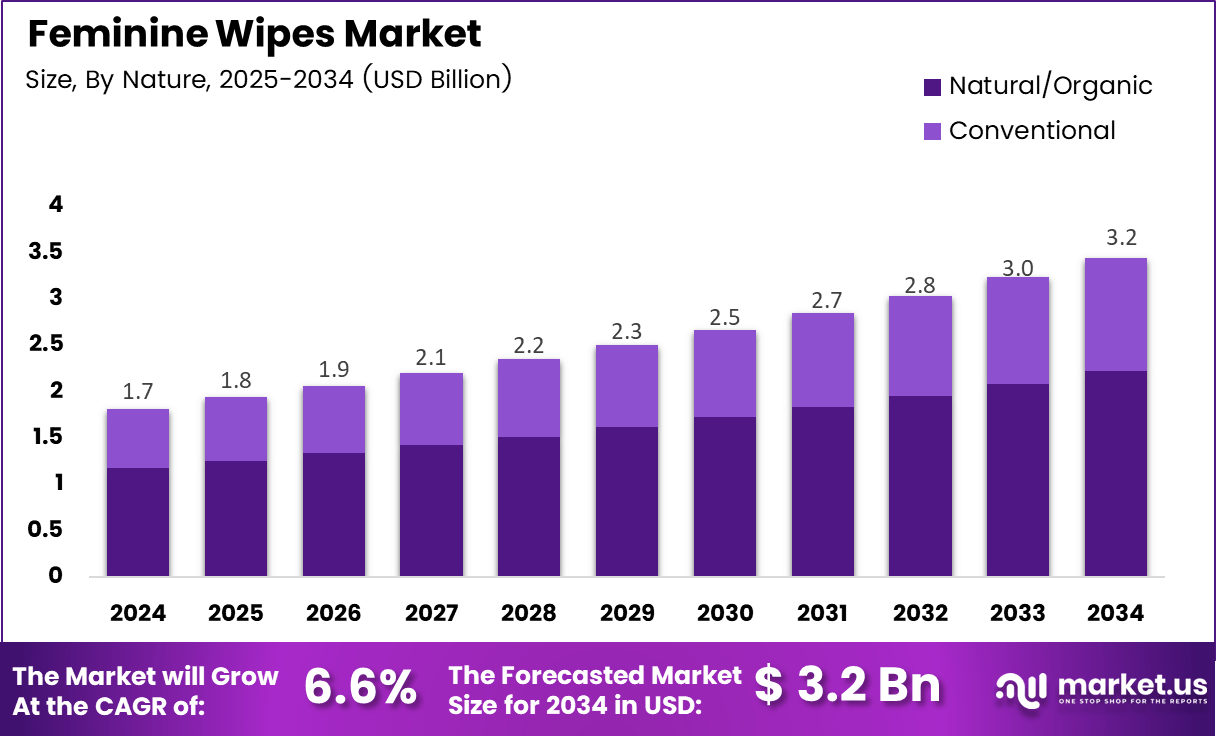

The Global Feminine Wipes Market size is expected to be worth around USD 3.2 billion by 2034, from USD 1.7 billion in 2024, growing at a CAGR of 6.6% during the forecast period from 2025 to 2034.

The Feminine Wipes Market refers to disposable, pre moistened wipes designed for external intimate hygiene and daily cleanliness. These products support odor control system, skin comfort, and hygiene convenience. Increasing health awareness, urban lifestyles, and demand for easy to use feminine hygiene solutions continue to strengthen market relevance across personal care segments.

Feminine wipes show consistent growth as women increasingly prioritize preventive hygiene and comfort. Moreover, rising workforce participation and frequent travel support regular usage. Consequently, demand accelerates for gentle, skin safe, and portable feminine care products within organized retail and digital commerce channels.

Growth opportunities expand through natural and sustainable product innovation. Manufacturers increasingly focus on plant based materials, clean formulations, and transparent labeling. Additionally, government supported women health education initiatives indirectly encourage feminine hygiene adoption, especially in developing regions where awareness programs improve acceptance and long term usage patterns.

Regulatory oversight also shapes market momentum. Authorities emphasize ingredient safety, microbiome protection, and accurate cosmetic claims. Therefore, companies invest in compliance with cosmetic safety norms and ethical certifications. This regulatory environment strengthens consumer trust while enabling premiumization aligned with clean beauty and responsible personal care trends.

Product innovation remains a key differentiator. According to manufacturer disclosures, Plush Feminine ultra soft intimate wipes use 100% bamboo fiber, supporting biodegradability and skin compatibility. Moreover, positioning as a natural way to maintain intimate hygiene appeals to consumers seeking gentle alternatives to conventional cleansing products.

Skin comfort benefits further reinforce adoption. As stated on product information, aloe vera extracts help soothe, moisturize, and replenish sensitive skin. Additionally, maintaining a pH balance level of 3.5 with lactic acid supports freshness and external skin harmony, aligning with recommended intimate hygiene practices.

Ingredient transparency strengthens consumer confidence. According to manufacturer and certification sources, these wipes remain paraben and alcohol free while holding PETA certified cruelty free and vegan status. Packaging details indicate packs include 20 wipes, with shelf life of 3 years for makeup removal wipes and 1 year for feminine hygiene wipes.

Key Takeaways

- The global Feminine Wipes Market is projected to reach USD 3.2 billion by 2034, rising from USD 235.2 million in 2024 at a CAGR of 6.6%.

- By material fabric, synthetic wipes represent the leading segment with a dominant share of 44.8%.

- By nature, conventional feminine wipes account for the largest segment, holding 69.1% of the total market.

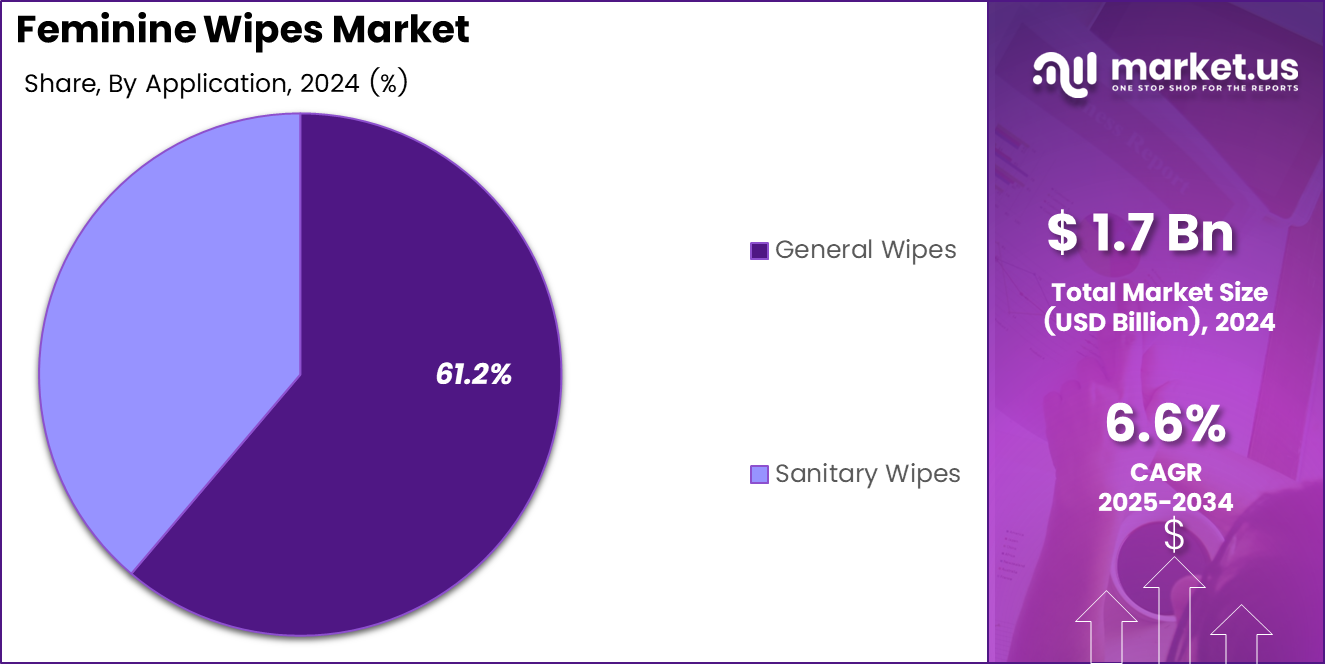

- By application, general wipes dominate the market with a share of 61.2%.

- By distribution channel, supermarkets and hypermarkets lead with a market share of 39.9%.

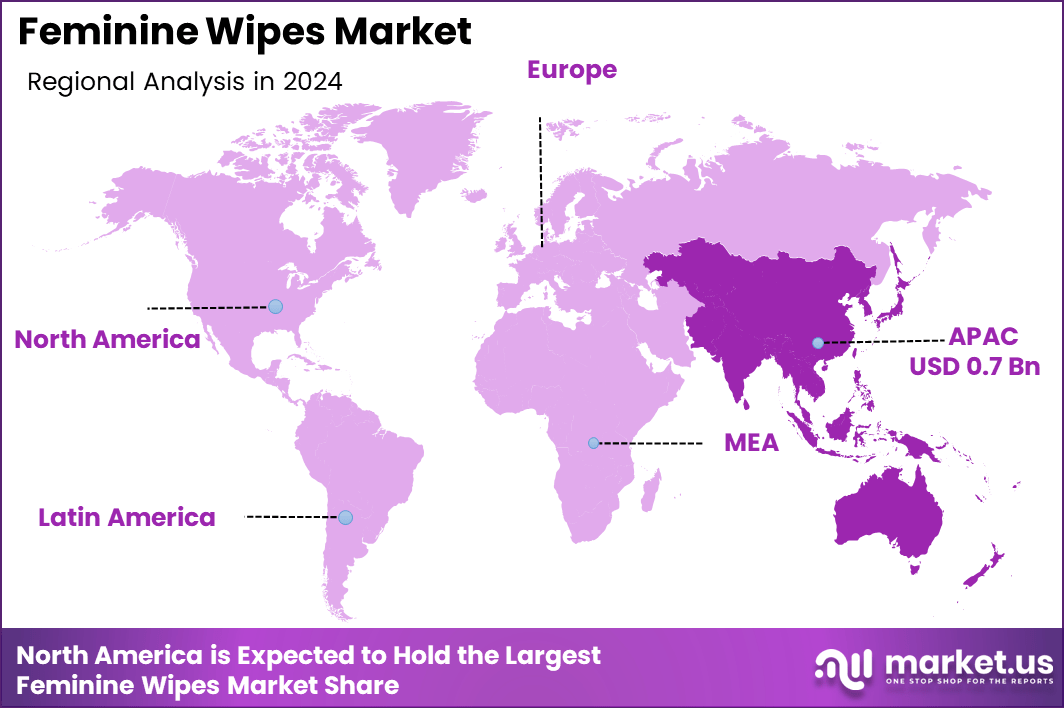

- Asia Pacific is the dominating region, accounting for 46.8% of the market and valued at USD 0.7 billion.

By Material Fabric Analysis

Synthetic dominates with 44.8% due to its consistent texture, durability, and cost efficiency.

In 2024, Synthetic held a dominant market position in the By Material Fabric Analysis segment of Feminine Wipes Market, with a 44.8% share. Manufacturers prefer synthetic fabrics for their uniform absorbency, longer shelf stability, and compatibility with mass production, supporting large scale retail distribution and competitive pricing strategies.

Cotton based feminine wipes address consumers seeking softness and familiarity in personal care materials. Transitioning preferences toward gentle textures encourage cotton usage, especially among sensitive skin users. However, higher costs and lower durability compared to synthetic alternatives limit broader adoption across price sensitive consumer segments.

Biodegradable fabrics represent an emerging sub segment driven by sustainability awareness. These materials align with eco conscious purchasing behavior and regulatory encouragement toward reduced plastic usage. Nevertheless, scalability challenges and higher production expenses currently restrict penetration, positioning biodegradable wipes as a premium niche within the market.

By Nature Analysis

Conventional dominates with 69.1% supported by widespread availability and affordability.

In 2024, Conventional held a dominant market position in the By Nature Analysis segment of Feminine Wipes Market, with a 69.1% share. These products benefit from established supply chains, broad consumer acceptance, and lower pricing, ensuring strong visibility across supermarkets, pharmacies, and high volume retail formats.

Natural and organic feminine wipes continue gaining attention as consumers transition toward cleaner personal care routines. This sub segment emphasizes plant based ingredients and reduced chemical exposure. However, higher price points and limited awareness in developing regions moderate adoption compared to conventional alternatives.

By Application Analysis

General Wipes dominates with 61.2% driven by everyday hygiene usage.

In 2024, General Wipes held a dominant market position in the By Application Analysis segment of Feminine Wipes Market, with a 61.2% share. Their versatility supports daily freshness, travel convenience, and routine personal care, making them a preferred choice across multiple age groups and lifestyles.

Sanitary wipes focus on menstruation related hygiene needs and targeted cleansing. Transitioning awareness around menstrual health supports gradual growth. However, limited usage frequency compared to general wipes results in lower overall consumption volumes within the application landscape.

By Distribution Channel Analysis

Supermarkets and Hypermarkets dominates with 39.9% due to high product visibility.

In 2024, Supermarkets and Hypermarkets held a dominant market position in the By Distribution Channel Analysis segment of Feminine Wipes Market, with a 39.9% share. These outlets provide convenience, bulk purchasing options, and strong brand exposure, reinforcing impulse driven and repeat purchases.

Pharmacy and drug stores emphasize trust and health oriented purchasing behavior. Consumers associate these channels with safety and expert recommendations, supporting steady demand for feminine hygiene products, particularly among health conscious buyers.

Online retail stores gain momentum through subscription models and discreet purchasing options. Meanwhile, other channels including specialty stores and convenience outlets support localized demand, contributing incremental volume across diverse consumer touchpoints.

Key Market Segments

By Material Fabric

- Cotton

- Synthetic

- Biodegradable

By Nature

- Conventional

- Natural/Organic

By Application

- General Wipes

- Sanitary Wipes

By Distribution Channel

- Supermarkets/Hypermarkets

- Pharmacy and Drug Stores

- Online Retail Stores

- Others

Drivers

Rising Awareness of Intimate Hygiene and Preventive Personal Care Drives Market Growth

Rising awareness of intimate hygiene has become a key driver for the feminine wipes market. Women increasingly understand the importance of daily intimate care to prevent irritation, infections, and discomfort. Health education campaigns, digital content, and product labeling have made hygiene routines more visible and acceptable, encouraging regular product usage.

Expanding female workforce participation further supports demand growth. Working women often seek convenient, on the go hygiene solutions that fit busy schedules. Feminine wipes offer portability, discretion, and ease of use, making them suitable for workplaces, travel, and daily commuting. This lifestyle shift steadily increases repeat purchases.

Growing penetration through organized retail and e commerce also accelerates market expansion. Supermarkets, pharmacies, and online platforms improve product visibility, availability, and price comparison. Online reviews and subscription offers further reduce hesitation among first time buyers.

The influence of healthcare professionals and gynecologists plays a strong role in market trust. Medical recommendations promote safe, routine intimate care, especially during menstruation, pregnancy, and post partum stages. As professional guidance becomes more accessible through clinics and digital consultations, consumer confidence in feminine wipes continues to rise.

Restraints

Increasing Concerns Over Chemical Ingredients Limit Market Adoption

Concerns about chemical ingredients present a major restraint for the feminine wipes market. Consumers increasingly worry about synthetic fragrances, preservatives, and alcohol based formulations. These ingredients are often linked to irritation, allergies, and potential disruption of the vaginal microbiome, reducing product acceptance among sensitive users.

Stringent regulatory scrutiny also affects market growth. Intimate hygiene products face strict evaluation related to safety, ingredient disclosure, and product claims. Regulatory authorities closely monitor antibacterial, pH balancing, and therapeutic claims, which can delay product approvals and increase compliance costs for manufacturers.

Social stigma and limited open discussion around feminine hygiene remain challenges in conservative regions. Cultural discomfort restricts awareness, education, and retail promotion of intimate care products. Women in such markets may avoid purchasing wipes due to embarrassment or lack of reliable information.

Limited guidance in these regions also reduces trust in product safety and necessity. Without open communication from healthcare providers or public health initiatives, adoption remains slow. Together, ingredient safety concerns, regulatory pressure, and cultural barriers create measurable resistance to wider market penetration.

Growth Factors

Development of Gynecologist Approved Plant Based Formulations Creates New Growth Opportunities

The development of dermatologist tested and gynecologist approved plant based formulations offers strong growth opportunities. Consumers increasingly prefer natural ingredients that are gentle, safe, and suitable for daily use. Plant based wipes address concerns around chemicals while supporting long term intimate health.

Untapped demand in rural and semi urban areas presents another opportunity. Awareness led distribution through local healthcare workers, pharmacies, and educational programs can significantly expand market reach. As hygiene education improves, these populations show rising interest in affordable and reliable intimate care products.

Product customization for different life stages further enhances market potential. Feminine wipes designed for pregnancy, menopause, and post partum care address specific hormonal and sensitivity needs. Tailored formulations improve comfort and encourage consistent use across age groups.

Expansion of subscription based and direct to consumer platforms also supports growth. Online models offer privacy, convenience, and regular delivery, reducing purchase hesitation. These platforms allow brands to educate consumers directly, build loyalty, and gather feedback for faster innovation cycles.

Emerging Trends

Shift Toward Fragrance Free and pH Balanced Formulations Shapes Market Trends

A strong shift toward fragrance free and pH balanced feminine wipes is shaping current market trends. Consumers increasingly prioritize products that maintain natural pH levels and minimize irritation. Fragrance free options appeal to sensitive users and align with medical recommendations for daily intimate care.

Rising demand for biodegradable, plastic free, and compostable wipe materials reflects broader sustainability concerns. Environmentally conscious consumers prefer wipes that reduce waste and environmental impact. Brands adopting eco friendly materials improve brand perception and attract younger, sustainability focused buyers.

The integration of probiotic and prebiotic ingredients is another emerging trend. These ingredients support healthy vaginal flora and align with preventive wellness approaches. Products offering microbiome friendly benefits gain attention among informed consumers seeking functional hygiene solutions.

Together, these trends indicate a shift from basic cleansing toward wellness driven, sustainable, and science backed products. Innovation focused on safety, environmental responsibility, and long term health continues to redefine competitive positioning in the feminine wipes market.

Regional Analysis

Asia Pacific Dominates the Feminine Wipes Market with a Market Share of 46.8%, Valued at USD 0.7 Billion

Asia Pacific accounted for the largest share of the Feminine Wipes Market in 2024, supported by rising awareness of intimate hygiene and increasing adoption of daily personal care products. The region’s dominance is reinforced by a growing urban female population and higher product accessibility through supermarkets and online platforms. In value terms, Asia Pacific reached USD 0.7 Billion, reflecting strong volume consumption across emerging and developed economies. Rapid lifestyle changes and improving healthcare education further sustained its 46.8% market share.

North America Feminine Wipes Market Trends

North America demonstrated steady growth driven by high consumer awareness and established preventive hygiene practices. The region benefits from strong penetration of premium and dermatologically tested feminine wipes across retail and digital channels. Demand is further supported by working women seeking convenient on-the-go hygiene solutions. Consistent product usage and brand familiarity continue to support market stability.

Europe Feminine Wipes Market Trends

Europe showed stable expansion due to strong emphasis on personal wellness and routine intimate care. Regulatory focus on product safety and ingredient transparency positively influenced consumer trust. Increased preference for gentle and skin-friendly formulations supported adoption across multiple age groups. Organized retail presence played a key role in maintaining market penetration.

United States Feminine Wipes Market Trends

The U.S. market benefited from high disposable income levels and strong acceptance of preventive feminine hygiene products. Consumers increasingly favored wipes as part of daily self-care routines rather than occasional use. Wide availability through pharmacies and e-commerce platforms supported consistent demand. Educational initiatives around women’s health also contributed to market growth.

Middle East and Africa Feminine Wipes Market Trends

The Middle East and Africa region experienced gradual growth supported by urbanization and improving hygiene awareness. Market expansion remained selective, concentrated mainly in urban centers with access to organized retail. Cultural sensitivity still influenced adoption rates, but healthcare-led education initiatives supported slow but positive momentum.

Latin America Feminine Wipes Market Trends

Latin America recorded moderate growth due to increasing awareness of personal hygiene among younger consumers. Expanding retail networks and rising female workforce participation supported demand. Economic variability limited rapid expansion, yet affordability-focused product offerings helped maintain steady market uptake.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Feminine Wipes Company Insights

the global Feminine Wipes Market in 2024 reflects a mix of scale driven leadership and focused portfolio specialization among key players. Competitive positioning is shaped by brand trust, formulation safety, and wide distribution reach, especially across daily hygiene and sensitive care categories.

Procter & Gamble continues to hold a strong strategic position due to its deep expertise in personal care and hygiene. The company leverages large scale manufacturing, strong consumer trust, and consistent product innovation to address sensitive skin needs. Its focus on safety testing and everyday usability supports steady demand across mass markets.

Johnson Services, Inc. operates with a more service and supply focused approach, supporting hygiene product ecosystems through quality assurance and operational efficiency. Its role in the value chain strengthens reliability and compliance, which is increasingly important as intimate hygiene standards tighten globally.

Edgewell Personal Care benefits from its focused personal care portfolio and strong presence in female wellness categories. The company emphasizes dermatologically tested formulations and brand driven engagement, allowing it to capture consumers seeking trusted, everyday intimate care solutions with premium positioning.

KCWW maintains competitiveness through scale, private label strength, and broad hygiene product capabilities. Its ability to supply wipes across different fabric types and price points enables wide market penetration, particularly through organized retail and institutional channels.

Overall, these players collectively shape market direction by balancing trust, accessibility, and product safety. Their varied strategies highlight how scale leaders and focused care specialists coexist, supporting both mass adoption and evolving consumer expectations in the feminine wipes market.

Top Key Players in the Market

- Procter & Gamble

- Johnson Services, Inc.

- Edgewell Personal Care

- KCWW

- Unicharm Corporation

- Albaad

- Guy & O’Neill, Inc.

- Bodywise (UK) Limited

- Laclede, Inc.

Recent Developments

- In Nov 2025, Edgewell Personal Care Company (NYSE: EPC) entered into a definitive agreement to sell its feminine care business to Essity, a Sweden based global health and hygiene company, for $340 million.The divestment allows Edgewell to streamline its portfolio while strengthening Essity’s global position in feminine hygiene solutions.

- In Jan 2024, The Honey Pot Company, an Atlanta based and Black founded feminine care brand, was acquired by Compass Diversified (CODI) in an all cash transaction valued at $380 million.The acquisition supports The Honey Pot Company’s next growth phase by expanding distribution, innovation, and brand reach within the feminine wellness market.

Report Scope

Report Features Description Market Value (2024) USD 1.7 billion Forecast Revenue (2034) USD 3.2 billion CAGR (2025-2034) 6.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Fabric (Cotton, Synthetic, Biodegradable), By Nature (Conventional, Natural/Organic), By Application (General Wipes, Sanitary Wipes), By Distribution Channel (Supermarkets/Hypermarkets, Pharmacy and Drug Stores, Online Retail Stores, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Procter & Gamble, Johnson Services, Inc., Edgewell Personal Care, KCWW, Unicharm Corporation, Albaad, Guy & O’Neill, Inc., Bodywise (UK) Limited, Laclede, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Procter & Gamble

- Johnson Services, Inc.

- Edgewell Personal Care

- KCWW

- Unicharm Corporation

- Albaad

- Guy & O'Neill, Inc.

- Bodywise (UK) Limited

- Laclede, Inc.