Global Expanded Clay Market Size, Share, And Enhanced Productivity By Form (Granules, Custom Shapes, Powder), By Type (Standard Expanded Clay, Lightweight Expanded Clay Aggregate, Cubic Expanded Clay Aggregate, Granulated Expanded Clay), By Production Process (Rotary Kiln Expansion, Fluidized Bed Expansion, Plasma Activation), By Application (Construction, Wastewater Treatment, Horticulture, Environmental Remediation), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 177650

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

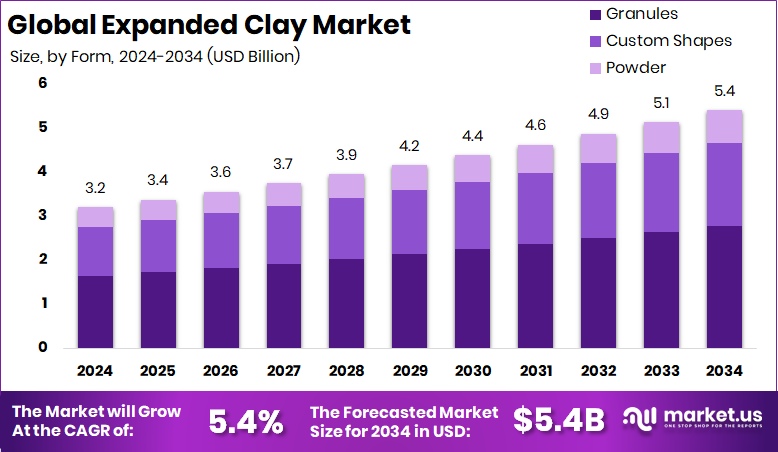

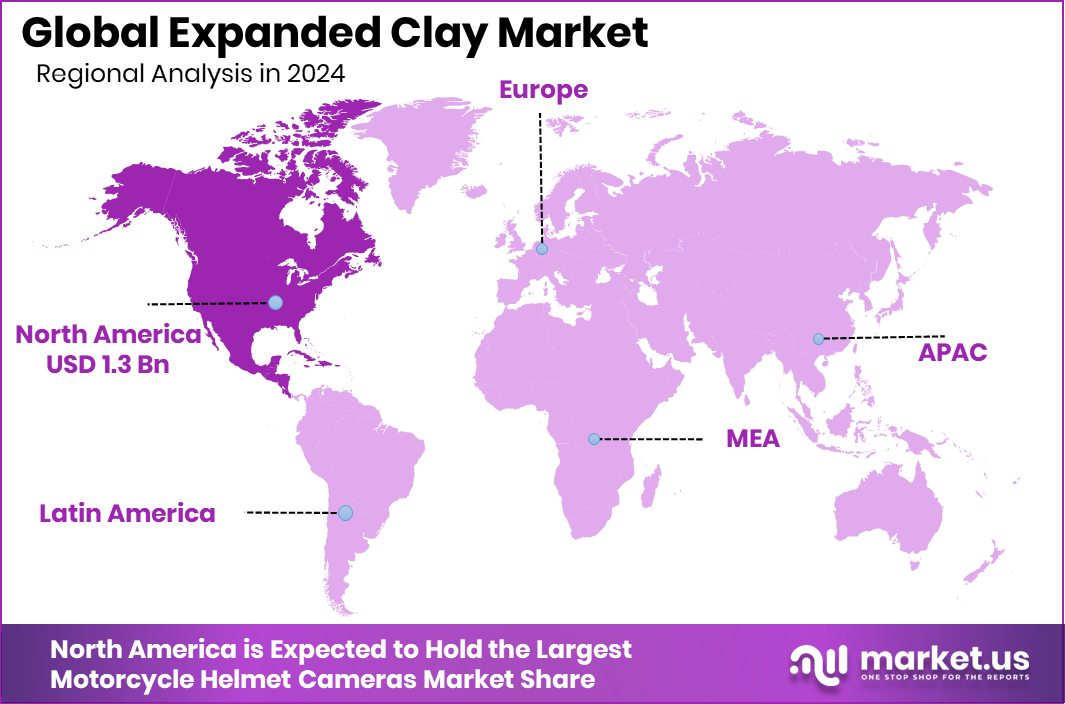

The Global Expanded Clay Market is expected to be worth around USD 5.4 billion by 2034, up from USD 3.2 billion in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034. North America accounted for 46.8%, reaching USD 1.3 Bn.

Expanded clay is a lightweight aggregate produced by heating natural clay at high temperatures, causing it to expand and form porous, durable pellets. The material is valued for its strength-to-weight ratio, thermal insulation properties, and resistance to fire and moisture. It is commonly available in forms such as granules, custom shapes, and powder, and includes types like standard expanded clay, lightweight expanded clay aggregate, cubic forms, and granulated variants. Production processes such as rotary kiln expansion, fluidized bed expansion, and plasma activation determine its final structure and performance characteristics.

The expanded clay market refers to the global production and consumption of this material across applications, including construction, wastewater treatment, horticulture, and environmental remediation. Demand is closely linked to infrastructure development, green building practices, and sustainable landscaping solutions. In construction, expanded clay is widely used in lightweight concrete, insulation layers, and geotechnical fills.

Growth is supported by increasing investment and innovation across industries associated with the term “Clay.” Sequoia led a $1.5B tender offer for sales automation startup Clay, while Clay secured USD $40 million at a USD $1.25 billion valuation. Clay also raised $100 million in Series C funding at a $3.1 billion valuation, allocating funds to product development.

Opportunities remain strong as industries scale production and innovation, similar to MiAlgae securing $18.5m to expand microalgae production, reflecting broader investment confidence in sustainable material ecosystems.

Key Takeaways

- The Global Expanded Clay Market is expected to be worth around USD 5.4 billion by 2034, up from USD 3.2 billion in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034.

- Granules dominated the Expanded Clay Market with 51.3% share across global demand.

- Lightweight Expanded Clay Aggregate held 48.5% in the Expanded Clay Market by type.

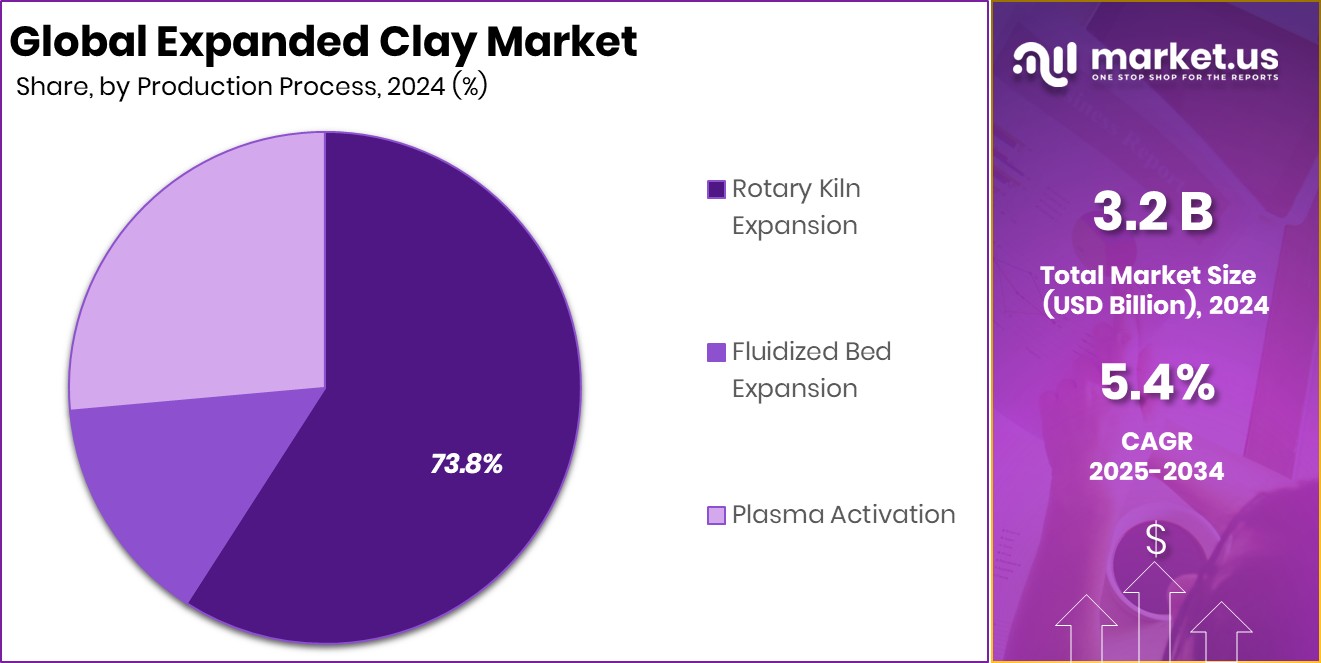

- Rotary Kiln Expansion accounted for 73.8% of the Expanded Clay Market production processes globally.

- Construction applications captured 59.2% share in the Expanded Clay Market worldwide.

- The North American market is valued at USD 1.3 Bn.

By Form Analysis

Expanded Clay Market granules segment held 51.3% of the market share.

In 2024, granules accounted for 51.3% of the Expanded Clay Market by form, reflecting a strong preference for uniform particle size and easy handling in construction and horticulture applications. Granular expanded clay is widely used due to its lightweight structure, high porosity, and consistent performance in drainage and insulation systems.

Contractors favor granules because they offer better flow characteristics during placement and reduce overall structural load. Their durability and resistance to moisture further strengthen their adoption in infrastructure and landscaping projects. The 51.3% share highlights the growing demand for practical, easy-to-transport forms that improve on-site efficiency while maintaining structural reliability across diverse end-use applications.

By Type Analysis

Expanded Clay Market: lightweight expanded clay aggregate captured 48.5% share.

In 2024, Lightweight Expanded Clay Aggregate represented 48.5% of the Expanded Clay Market by type, underscoring its broad utility in modern construction practices. This material is valued for its excellent thermal insulation, fire resistance, and low density, making it suitable for lightweight concrete, green roofs, and geotechnical fills.

Builders increasingly rely on lightweight aggregates to reduce dead load in high-rise structures while maintaining strength and stability. The 48.5% market share reflects steady integration of this material into sustainable building solutions, where energy efficiency and structural optimization remain key priorities. Its adaptability across residential, commercial, and infrastructure projects continues to support consistent demand.

By Production Process Analysis

Expanded Clay Market rotary kiln expansion dominated with 73.8% share.

In 2024, Rotary Kiln Expansion dominated the Expanded Clay Market by production process, accounting for 73.8% of total output. This method remains the preferred manufacturing technique due to its ability to produce uniform, high-strength aggregates with controlled porosity. Rotary kiln technology ensures consistent heating and expansion of clay pellets, resulting in reliable physical properties and enhanced product performance.

Producers favor this process because it supports large-scale production while maintaining the quality standards required for construction-grade materials. The significant 73.8% share highlights the industry’s reliance on established, efficient production systems that balance operational scalability with consistent aggregate quality across various applications.

By Application Analysis

Expanded Clay Market construction application accounted for 59.2% share.

In 2024, construction emerged as the leading application segment in the Expanded Clay Market, capturing 59.2% of total demand. Expanded clay is widely used in lightweight concrete, structural fills, insulation layers, and green building systems. The material’s strength-to-weight ratio, thermal efficiency, and long-term durability make it a preferred choice in residential and commercial construction projects.

With infrastructure development and urban expansion continuing across multiple regions, construction activities remain a primary consumption driver. The 59.2% share clearly demonstrates the sector’s dominant role in shaping production volumes and guiding investment decisions within the expanded clay industry.

Key Market Segments

By Form

- Granules

- Custom Shapes

- Powder

By Type

- Standard Expanded Clay

- Lightweight Expanded Clay Aggregate

- Cubic Expanded Clay Aggregate

- Granulated Expanded Clay

By Production Process

- Rotary Kiln Expansion

- Fluidized Bed Expansion

- Plasma Activation

By Application

- Construction

- Wastewater Treatment

- Horticulture

- Environmental Remediation

Driving Factors

Rising infrastructure investment globally increases expanded clay demand

Rising infrastructure investment globally continues to increase demand for expanded clay, particularly in construction and water management projects. Expanded clay is widely used in lightweight concrete, drainage layers, and filtration systems, making it closely linked to public infrastructure upgrades. Kent County securing $6.2M in funding for a new wastewater treatment plant highlights ongoing municipal investment in water systems.

Such projects require reliable filtration media and structural fill materials, where expanded clay plays a functional role due to its porosity and durability. As governments prioritize resilient infrastructure and modernized utilities, the need for lightweight, long-lasting aggregates strengthens, directly supporting production volumes and long-term consumption patterns within the expanded clay industry.

Restraining Factors

High energy costs in clay expansion production

High energy costs in clay expansion production remain a significant restraint for manufacturers. The rotary kiln process requires sustained high temperatures, making operational expenses sensitive to fuel and electricity price fluctuations. While infrastructure funding remains active, such as Barrington receiving a $1.1 million grant for upgrades to an aging wastewater plant and $27M in federal funds allocated for Western Montana infrastructure projects, producers must still manage rising production costs.

Even when demand is supported by public spending, margin pressures can limit aggressive capacity expansion. Energy-intensive manufacturing combined with economic volatility may slow investment decisions and create cautious procurement behavior among construction and municipal project developers.

Growth Opportunity

Expansion in the green building and insulation sectors

Expansion in the green building and insulation sectors presents strong opportunities for expanded clay producers. The material’s lightweight and insulating properties align well with sustainable construction practices and energy-efficient design standards. Federal initiatives also support wastewater infrastructure modernization, including $1.4 million in funding to support wastewater upgrades in Shamokin–Coal Township.

Such projects often require advanced filtration layers and structural backfill solutions, where expanded clay aggregates offer durability and environmental stability. As urban areas prioritize eco-conscious construction and improved water treatment systems, opportunities grow for expanded clay applications beyond traditional concrete use, particularly in environmental remediation and sustainable infrastructure development.

Latest Trends

Lightweight aggregates favored for thermal performance

Lightweight aggregates are increasingly favored for improved thermal performance in both residential and commercial construction. Expanded clay’s insulating capabilities make it suitable for energy-efficient building envelopes and roofing systems. Large-scale wastewater infrastructure upgrades further reinforce this trend, including the first phase of Winnipeg’s $3.2B North End sewage treatment plant upgrade nearing completion.

Projects of this scale require durable, stable materials for drainage and structural support, strengthening the relevance of expanded clay aggregates. The industry trend points toward combining structural performance with environmental efficiency, encouraging adoption in modern infrastructure designs focused on longevity, reduced weight loads, and improved thermal management.

Regional Analysis

North America held 46.8% of the Expanded Clay Market share.

The Expanded Clay Market demonstrates varied regional performance across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Among these regions, North America emerged as the dominating market, accounting for 46.8% of the total share, with a valuation of USD 1.3 Bn. This strong position reflects the region’s established construction sector and consistent adoption of lightweight aggregate materials in infrastructure and commercial development projects.

Europe and the Asia Pacific continue to represent important regional contributors, supported by steady construction and urban development activities. Meanwhile, the Middle East & Africa and Latin America maintain gradual participation in the overall market landscape, aligned with expanding infrastructure requirements.

However, North America clearly leads in both revenue contribution and market concentration, supported by its 46.8% share and USD 1.3 Bn market value. The regional distribution highlights North America’s dominant role in shaping global demand patterns within the expanded clay industry.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Expanded Clay Market remains shaped by established material producers such as LECA International, Saint-Gobain, and Arcosa Inc., each bringing distinct operational strengths to the industry. LECA International is widely recognized for its focus on lightweight expanded clay aggregates used in construction, geotechnical applications, and landscaping. The company’s emphasis on product consistency and sustainable building solutions supports its relevance in infrastructure and green building projects.

Saint-Gobain, known for its broader construction materials portfolio, integrates expanded clay solutions within its building systems approach. Its strong distribution network and technical expertise allow it to serve diverse construction requirements, particularly where lightweight and insulating aggregates are required. The company benefits from its integrated model, combining materials innovation with application-driven development.

Arcosa Inc. plays a strategic role through its construction products platform, supplying aggregates that support infrastructure, transportation, and structural projects. Its operational scale and regional production footprint enhance supply reliability. Collectively, these companies contribute to market stability through production efficiency, technical development, and alignment with long-term construction and infrastructure demand trends in 2024.

Top Key Players in the Market

- LECA International

- Saint-Gobain

- Arcosa Inc.

- Holcim Group

- Leca Asia

- Argex Group

- Laterlite S.p.A.

- Buildex

- ESCS

Recent Developments

- In July 2025, LECA International shared a new brochure on expanded clay aggregates through the European Expanded Clay Association (EXCA). The brochure highlights sustainable uses of expanded clay in construction, housing, infrastructure, and water management, reinforcing LECA’s role in promoting lightweight, durable aggregates.

- In February 2025, Saint-Gobain completed the acquisition of FOSROC, a global construction chemicals company. This deal expands Saint-Gobain’s range of construction materials and strengthens its footprint in regions such as India, the Middle East, and Asia-Pacific.

Report Scope

Report Features Description Market Value (2024) USD 3.2 Billion Forecast Revenue (2034) USD 5.4 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Granules, Custom Shapes, Powder), By Type (Standard Expanded Clay, Lightweight Expanded Clay Aggregate, Cubic Expanded Clay Aggregate, Granulated Expanded Clay), By Production Process (Rotary Kiln Expansion, Fluidized Bed Expansion, Plasma Activation), By Application (Construction, Wastewater Treatment, Horticulture, Environmental Remediation) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape LECA International, Saint-Gobain, Arcosa Inc., Holcim Group, Leca Asia, Argex Group, Laterlite S.p.A., Buildex, ESCS Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- LECA International

- Saint-Gobain

- Arcosa Inc.

- Holcim Group

- Leca Asia

- Argex Group

- Laterlite S.p.A.

- Buildex

- ESCS