Global Epoxy Powder Coatings Market Size, Share, And Enhanced Productivity By Chemistry (Fusion-Bonded Epoxy (FBE), Pure Epoxy, Epoxy-Polyester Hybrid), By End-user (Building and Construction, Automotive and Transportation, Electrical and Electronics, Appliances and Furniture, Energy, Marine, Aerospace, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 177800

- Number of Pages: 323

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

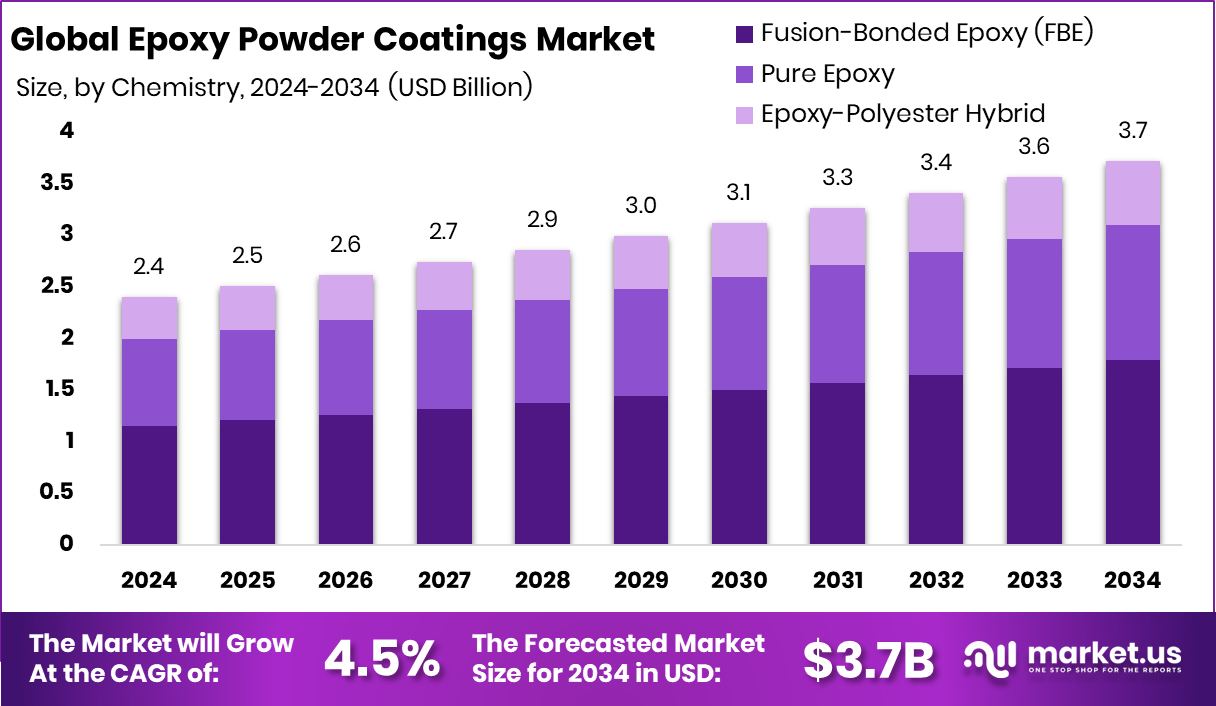

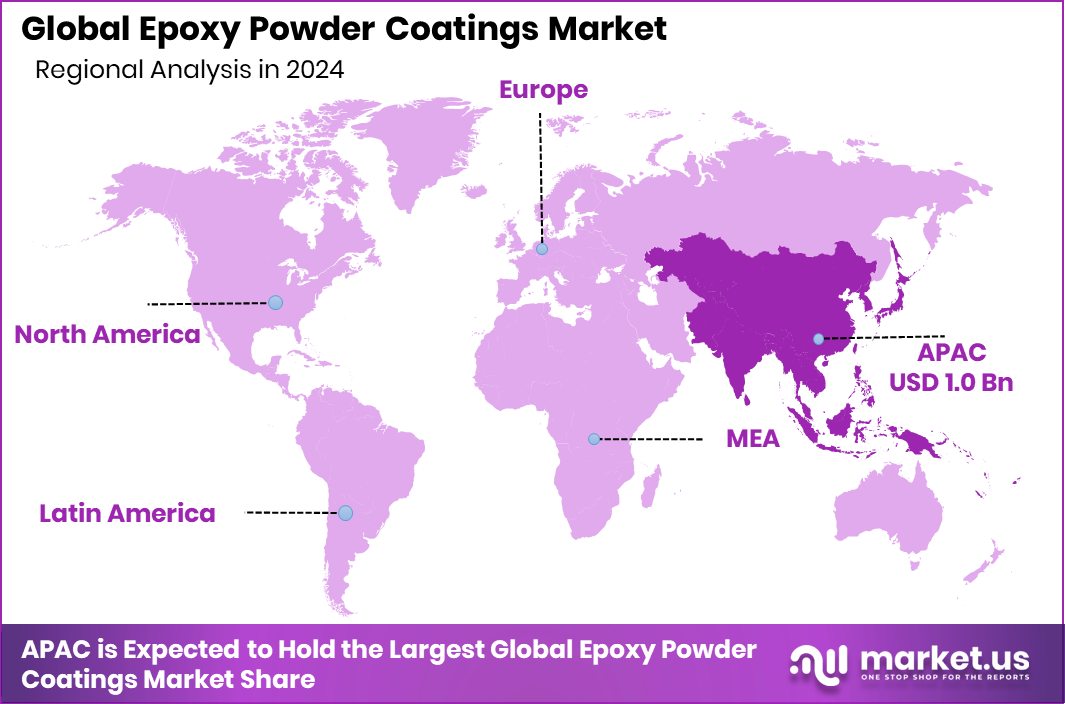

The Global Epoxy Powder Coatings Market is expected to be worth around USD 3.7 billion by 2034, up from USD 2.4 billion in 2024, and is projected to grow at a CAGR of 4.5% from 2025 to 2034. Asia Pacific accounted for 45.2%, totaling USD 1.0 Bn.

Epoxy powder coatings are dry finishing materials made from epoxy resins that are applied electrostatically and cured under heat to form a hard, protective surface. They are widely used because they offer strong adhesion, corrosion resistance, and long service life. Different chemistries, such as Fusion-Bonded Epoxy (FBE), pure epoxy, and epoxy-polyester hybrids, are selected depending on performance needs. These coatings are commonly applied across building and construction, automotive and transportation, electrical and electronics, appliances and furniture, energy, marine, aerospace, and other industrial sectors where surface durability is critical.

The epoxy powder coatings market refers to the global production, distribution, and application of these coatings across industrial and infrastructure projects. Demand is closely tied to construction activity, transportation, manufacturing, and energy investments. For example, the Trump order to paint the border wall black, potentially increasing costs by $500 million or more, highlights how large-scale infrastructure decisions can directly influence coating consumption.

Growth is supported by innovation in materials and sustainability. Interface Polymers and Flexipol winning an £850K grant for “Recycle Ready” barrier films reflects development in advanced polymer technologies. In aerospace, German satellite maker Reflex Aerospace is closing a €50M funding round, and Xovian Aerospace is raising $2.5 Mn, indicating expanding high-performance coating requirements.

Opportunities are also linked to energy transition projects. The final EU funding decision for a €350m German eSAF plant signals industrial expansion, where protective epoxy coatings will remain essential for long-term asset protection.

Key Takeaways

- The Global Epoxy Powder Coatings Market is expected to be worth around USD 3.7 billion by 2034, up from USD 2.4 billion in 2024, and is projected to grow at a CAGR of 4.5% from 2025 to 2034.

- Fusion-Bonded Epoxy held 48.1% in Epoxy Powder Coatings Market by chemistry.

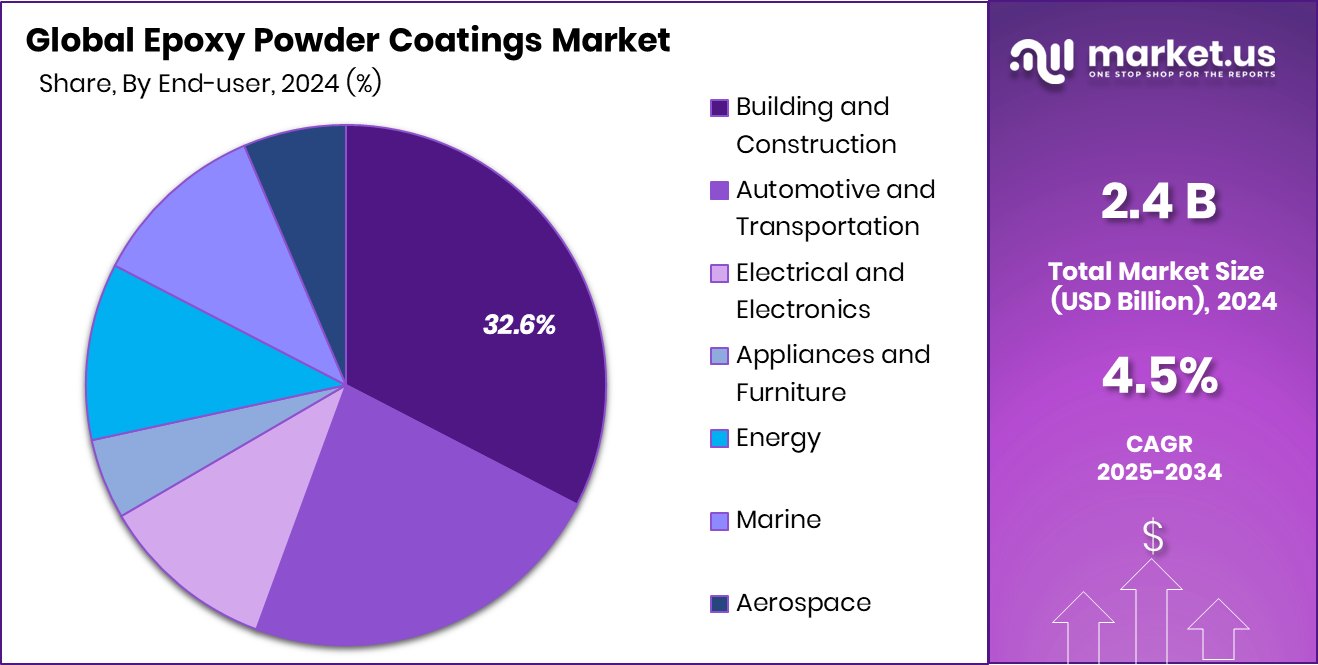

- Building and Construction accounted for 32.6% of Epoxy Powder Coatings Market.

- Asia Pacific market reached USD 1.0 Bn in 2024.

By Chemistry Analysis

Fusion-Bonded Epoxy dominated the Epoxy Powder Coatings Market with 48.1% share.

In 2024, Fusion-Bonded Epoxy (FBE) accounted for 48.1% of the Epoxy Powder Coatings Market by chemistry, making it the leading segment. FBE coatings are widely used for corrosion protection on pipelines, reinforcing steel bars, valves, and fittings due to their strong adhesion, chemical resistance, and long-term durability. Their ability to provide uniform coating thickness and high-performance protection in harsh environments supports strong demand across infrastructure and industrial projects.

Oil and gas transportation networks, water pipelines, and industrial facilities continue to rely heavily on FBE coatings for extended asset life and reduced maintenance costs. The segment’s dominance reflects its proven reliability, technical performance, and suitability for large-scale protective coating applications globally.

By End-user Analysis

Building and Construction held 32.6% Epoxy Powder Coatings Market share.

In 2024, the Building and Construction sector held 32.6% of the Epoxy Powder Coatings Market by end user, positioning it as a key demand driver. Epoxy powder coatings are extensively used in structural steel, architectural components, rebar, flooring systems, and metal fixtures due to their superior mechanical strength and corrosion resistance. Rapid urban development, infrastructure upgrades, and commercial construction activities are supporting sustained coating consumption.

Builders prefer powder coatings for their durability, environmental compliance, and cost efficiency compared to traditional liquid coatings. Growth in residential complexes, industrial facilities, and public infrastructure projects continues to reinforce demand from the construction sector, solidifying its significant share within the overall epoxy powder coatings market.

Key Market Segments

By Chemistry

- Fusion-Bonded Epoxy (FBE)

- Pure Epoxy

- Epoxy-Polyester Hybrid

By End-user

- Building and Construction

- Automotive and Transportation

- Electrical and Electronics

- Appliances and Furniture

- Energy

- Marine

- Aerospace

- Others

Driving Factors

Rising global infrastructure development projects

The Epoxy Powder Coatings Market continues to benefit from rising global infrastructure development projects across construction, transportation, and energy sectors. Large public works, industrial plants, pipelines, and power facilities require durable surface protection to prevent corrosion and extend asset life. Epoxy powder coatings are widely preferred because they provide strong adhesion, chemical resistance, and long-term performance in demanding environments.

Investment momentum in energy infrastructure further strengthens this demand. For instance, Nuclear Power Group Alva Energy launching with $33 million in funding reflects renewed activity in advanced power projects. Such developments directly support the need for high-performance protective coatings used in structural steel, equipment housings, and energy installations, reinforcing consistent consumption across infrastructure-driven markets.

Restraining Factors

Fluctuating epoxy resin raw material

Volatility in epoxy resin raw material pricing remains a key restraint for the Epoxy Powder Coatings Market. Since epoxy resins are derived from petrochemical feedstocks, supply chain disruptions and cost fluctuations can impact manufacturing margins and pricing stability. Sudden shifts in availability influence procurement planning for coating producers and end users. At the same time, strong capital flows into alternative energy technologies may redirect investment priorities within the broader materials sector.

Next-gen nuclear funding appearing livelier following Inertia’s $450M raise illustrates how capital concentration in emerging energy platforms can reshape supplier focus and long-term sourcing strategies. These financial dynamics contribute to uncertainty in raw material markets, placing pressure on coating manufacturers managing cost competitiveness.

Growth Opportunity

Expansion in renewable energy infrastructure

The expansion of renewable energy infrastructure presents meaningful growth opportunities for the Epoxy Powder Coatings Market. Wind turbines, solar mounting systems, transmission components, and energy storage facilities all require protective coatings capable of withstanding harsh outdoor conditions. As renewable installations scale globally, demand for corrosion-resistant and weather-stable coatings is expected to rise steadily. Innovation in recycling and circular material technologies also supports long-term opportunities.

An MIT startup raising $6.5M in funding for new PET chemical recycling technology highlights the broader push toward sustainable material ecosystems. As renewable energy assets grow in number and sustainability targets tighten, epoxy powder coatings are positioned to play a central role in protecting long-life infrastructure.

Latest Trends

Development of sustainable powder formulations

A major trend shaping the Epoxy Powder Coatings Market is the development of more sustainable and environmentally responsible formulations. Manufacturers are focusing on lower emissions during production, improved recyclability of overspray powder, and enhanced material efficiency. The push for circular solutions is also influencing polymer innovation.

Interface Polymers and Flexipol winning an £850K grant to develop “Recycle Ready” barrier films reflects ongoing research into advanced polymer systems designed for easier recycling. This broader sustainability focus is encouraging coating producers to refine resin systems, improve energy efficiency during curing, and align products with evolving environmental standards, shaping product development strategies across the industry.

Regional Analysis

Asia Pacific led Epoxy Powder Coatings Market with 45.2% share.

The Epoxy Powder Coatings Market demonstrates varied regional dynamics across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, reflecting differences in industrial development and construction activity.

Asia Pacific emerged as the dominating region, accounting for 45.2% of the global market, valued at USD 1.0 Bn. The region’s leadership is supported by strong growth in construction, infrastructure expansion, and industrial manufacturing activities. Rapid urbanization and large-scale development projects continue to support coating demand across residential, commercial, and industrial segments.

North America maintains a steady market presence driven by refurbishment projects and protective coating requirements in industrial facilities. Europe shows consistent demand supported by established manufacturing and construction sectors.

Meanwhile, the Middle East & Africa and Latin America represent developing markets, where gradual infrastructure investments and industrial projects are contributing to moderate but stable growth within the overall Epoxy Powder Coatings Market landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

3M continues to build on its strength in advanced materials and surface technologies. Its deep focus on research-driven innovation and industrial solutions allows it to support demanding applications requiring durability, corrosion resistance, and long service life. The company’s global distribution capabilities and strong relationships across construction and industrial sectors enhance its strategic standing in epoxy-based coating systems.

Akzo Nobel N.V. remains a significant force in the coatings industry, supported by its well-established decorative and performance coatings portfolio. Its emphasis on sustainability, product efficiency, and regulatory compliance aligns well with the evolving needs of construction and infrastructure markets.

Arkema Group contributes through its specialty materials expertise and integrated chemical capabilities. Its focus on high-performance resins and advanced material solutions strengthens its position in epoxy powder coating formulations, supporting steady participation in 2024 market growth.

Top Key Players in the Market

- 3M

- Akzo Nobel N.V.

- Arkema Group

- Asian Paints PPG Pvt. Ltd.

- Axalta Coating Systems

- Berger Paints India Limited

- Diamond Vogel

- Hempel A/S

- IFS Coatings

- Jotun

Recent Developments

- In December 2025, 3M announced the expansion of its 3M Digital Materials Hub and debuted the Ask 3M innovation tool. This platform helps engineers simulate and select materials faster, including coatings and bonding solutions, accelerating material development cycles.

- In June 2025, AkzoNobel signed an agreement to sell its shareholding in AkzoNobel India Limited (ANIL), including its liquid paints and coatings business, to the JSW Group for approximately €1.4 billion. The company retained its India Powder Coatings operations and research center.

Report Scope

Report Features Description Market Value (2024) USD 2.4 Billion Forecast Revenue (2034) USD 3.7 Billion CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Chemistry (Fusion-Bonded Epoxy (FBE), Pure Epoxy, Epoxy-Polyester Hybrid), By End-user (Building and Construction, Automotive and Transportation, Electrical and Electronics, Appliances and Furniture, Energy, Marine, Aerospace, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape 3M, Akzo Nobel N.V., Arkema Group, Asian Paints PPG Pvt. Ltd., Axalta Coating Systems, Berger Paints India Limited, Diamond Vogel, Hempel A/S, IFS Coatings, Jotun Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Epoxy Powder Coatings MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Epoxy Powder Coatings MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M

- Akzo Nobel N.V.

- Arkema Group

- Asian Paints PPG Pvt. Ltd.

- Axalta Coating Systems

- Berger Paints India Limited

- Diamond Vogel

- Hempel A/S

- IFS Coatings

- Jotun