Global Energy Storage for Microgrids Market Size, Share, Growth Analysis By Type (Battery Energy Storage Systems, Flywheel Energy Storage, Pumped Hydro Storage, Others), By Microgrid Type (Grid-connected Microgrids, Remote Microgrids, Hybrid Microgrids), By Application (Enhanced Grid Stability, Backup Power and Islanding, Peak Shaving and Demand Response, Improved Renewable Energy Integration, Others), By End-use (Residential, Commercial, Industrial, Military) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167205

- Number of Pages: 290

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

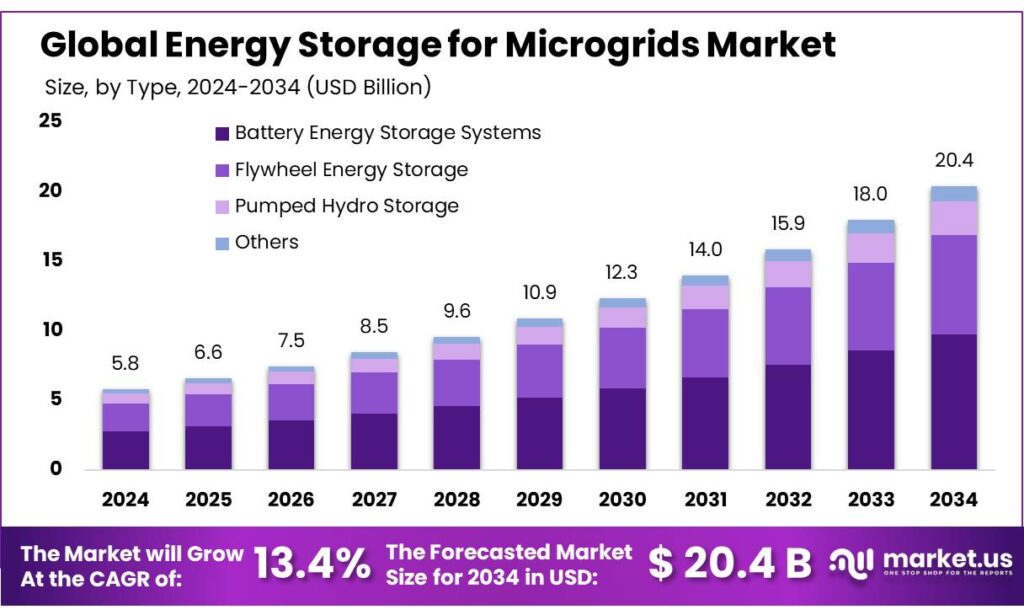

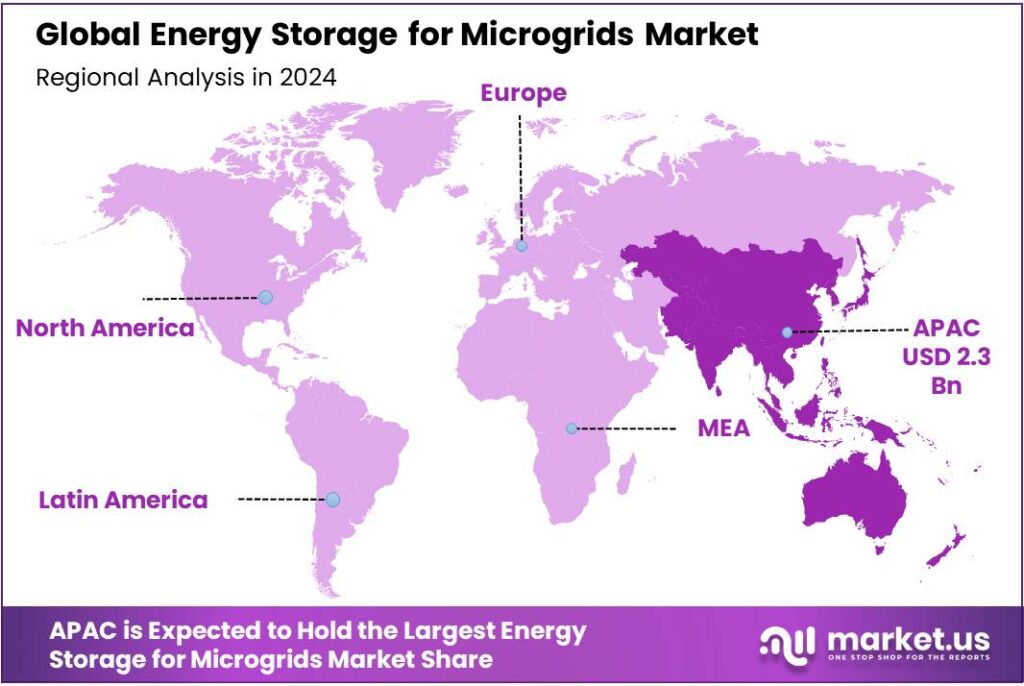

The Global Energy Storage for Microgrids Market size is expected to be worth around USD 20.4 Billion by 2034, from USD 5.8 Billion in 2024, growing at a CAGR of 13.4% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific (APAC) held a dominan market position, capturing more than a 41.20% share, holding USD 2.3 Billion revenue.

Energy storage for microgrids has been positioned as a core enabling technology for distributed, resilient and decarbonized power systems. The sector has been expanding in response to rising variable renewable generation and resilience requirements; global grid-scale battery storage capacity is projected to expand markedly under ambitious decarbonization pathways — for example, grid-scale battery capacity is estimated to reach nearly 970 GW by 2030 in the IEA Net-Zero Scenario.

Investment activity and asset-scale deployments are already visible in regional markets: Europe’s cumulative battery fleet reached 61.1 GWh with 21.9 GWh of new BESS installations in 2024, illustrating rapid deployment momentum at continent scale.

Driving factors — Four principal drivers have been identified. First, capital cost reductions in batteries have materially improved microgrid economics: IRENA reported that fully installed battery storage costs fell to around USD 192/kWh in 2024, a roughly 93% decline versus 2010 levels, increasing the viability of storage-heavy microgrids.

Second, resilience and reliability requirements—exposed by extreme weather and grid outages—are incentivizing public and private investment; the U.S. Department of Energy and national programs have documented microgrid deployment models and cost ranges, guiding procurement and funding design. Third, regulatory reforms and market products have improved revenue stacking for microgrids. Fourth, circular-economy supply chains are lowering system costs and accelerating deployment.

Government initiatives and policy support: National and regional programs have been introduced to reduce barriers. India’s Ministry of Power published a National Framework for Promoting Energy Storage Systems and operational guidelines for viability gap funding, and a transmission-charge waiver combined with a approved support package of approximately ₹54 billionto back ~30 GWh of battery storage capacity through 2028.

Key Takeaways

- Energy Storage for Microgrids Market size is expected to be worth around USD 20.4 Billion by 2034, from USD 5.8 Billion in 2024, growing at a CAGR of 13.4%.

- Li-ion Battery held a dominant market position, capturing more than a 47.7% share.

- Smartwatches held a dominant market position, capturing more than a 58.9% share.

- Consumer Electronics held a dominant market position, capturing more than a 23.4% share.

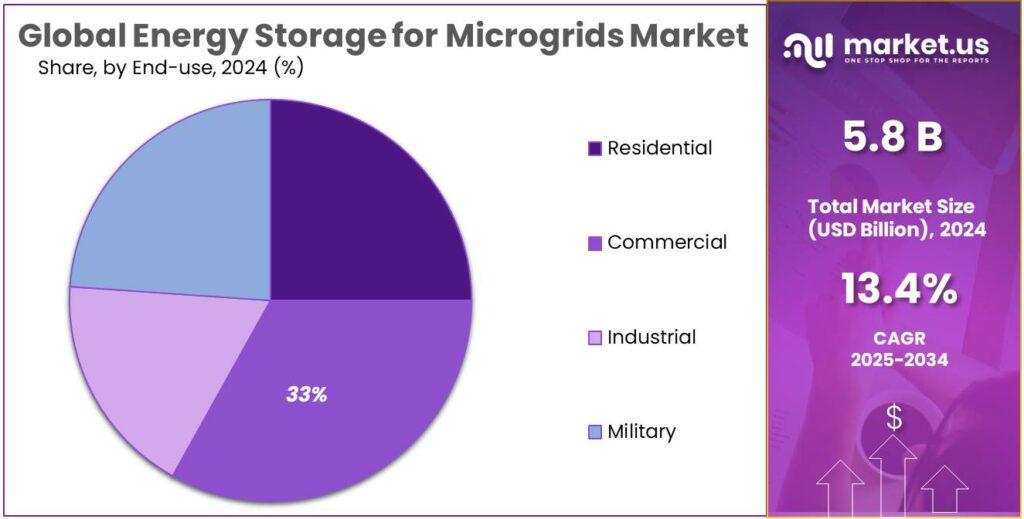

- Commercial held a dominant market position, capturing more than a 33.1% share.

- Asia-Pacific (APAC) stands out as the dominant region, accounting for around 41.20% of global demand, valued at roughly USD 2.3 billion.

By Type Analysis

Li-ion Battery leads the segment with a strong 47.7% share in 2024

In 2024, Li-ion Battery held a dominant market position, capturing more than a 47.7% share in the Energy Storage for Microgrids Market under Battery Energy Storage Systems. Their high energy density, compact design, and longer cycle life compared to other battery types made them the preferred choice for both commercial and community-scale microgrid projects. Many governments and utilities continued supporting lithium-ion installations because they help integrate intermittent renewable power—especially solar and wind—more efficiently.

Moving into 2025, the adoption of lithium-ion batteries in microgrids is expected to grow further as manufacturing costs gradually ease and supply chains stabilize. More projects are shifting from diesel-backup systems toward cleaner lithium-based storage, especially where power reliability remains a challenge.

By Microgrid Type Analysis

Grid-connected Microgrids take the lead with a strong 58.9% share in 2024

In 2024, Smartwatches held a dominant market position, capturing more than a 58.9% share—representing the rising preference for grid-connected microgrids in modern energy systems. This dominance reflects how these systems allow communities, campuses, industries, and utilities to balance local renewable power generation with the main electricity grid. Their biggest strength in 2024 was flexibility: when grid power was stable, they could draw from it, and when outages occurred, they instantly shifted to stored energy and local sources like solar, wind, or biomass.

By 2025, the momentum continues as policies and infrastructure investments support expansion. More regions are integrating advanced digital controls, remote monitoring, and smart metering to help these microgrids operate more efficiently. The adoption trend is especially visible in places facing rising electricity demand, unstable transmission lines, or ambitious renewable energy goals. As industries, hospitals, universities, and residential clusters invest more in energy reliability, grid-connected microgrids are expected to remain the preferred model into 2025.

By Application Analysis

Enhanced Grid Stability leads the segment with a solid 23.4% share in 2024

In 2024, Consumer Electronics held a dominant market position, capturing more than a 23.4% share, reflecting the growing focus on enhanced grid stability within the Energy Storage for Microgrids Market. This segment gained priority as more regions adopted intermittent renewable energy sources like wind and solar, which naturally create fluctuations in voltage and frequency. Energy storage systems supporting enhanced grid stability helped maintain smooth and reliable power delivery, especially during peak demand or unexpected outages. In 2024, many utilities and industrial facilities prioritized this application because it reduced dependence on emergency diesel backup and improved overall operational reliability.

Moving into 2025, interest in stability-focused energy storage solutions is expected to expand as aging grid infrastructure and rising electrification increase system stress. More projects are being planned where storage acts as a controllable buffer—absorbing excess power during high generation hours and releasing it when demand surpasses supply. This capability not only keeps grids balanced but also supports smoother renewable energy integration.

By End-use Analysis

Commercial users lead the market with a notable 33.1% share in 2024

In 2024, Commercial held a dominant market position, capturing more than a 33.1% share in the Energy Storage for Microgrids Market. This strong position was driven by rising energy costs, increasing grid instability, and a growing need for uninterrupted power in sectors like retail, hospitality, data centers, and corporate facilities. Many commercial buildings began pairing renewable energy systems with microgrid storage to reduce demand charges and ensure business continuity during power interruptions. In 2024, the commercial sector also accelerated adoption because energy storage helped reduce operating expenses and supported sustainability targets.

The momentum continues as more businesses integrate automation, digital monitoring, and smart meters into their microgrid systems. The shift toward electric vehicle charging stations and rooftop solar installations is pushing commercial sites to rely more on flexible energy storage systems. With reliability becoming just as important as affordability, commercial microgrids are expected to support load balancing, demand response programs, and emergency backup more frequently in 2025.

Key Market Segments

By Type

- Battery Energy Storage Systems

- Flywheel Energy Storage

- Pumped Hydro Storage

- Others

By Microgrid Type

- Grid-connected Microgrids

- Remote Microgrids

- Hybrid Microgrids

By Application

- Enhanced Grid Stability

- Backup Power and Islanding

- Peak Shaving and Demand Response

- Improved Renewable Energy Integration

- Others

By End-use

- Residential

- Commercial

- Industrial

- Military

Emerging Trends

Cold-chain electrification makes microgrid storage a frontline food and climate trend

One of the most striking latest trends in energy storage for microgrids is how quickly it is being tied to food cold chains and sustainable cooling. Instead of seeing microgrids only as a way to power lights and basic loads, developers are now designing battery-backed systems around cold rooms, dairies, fish landing centers and pack-houses. The goal is simple: keep food cold, cut losses and stabilise local power at the same time.

Global food agencies keep reminding us of the scale of the problem. FAO estimates that roughly one-third of all food produced for human consumption is lost or wasted, about 1.3 billion tonnes every year. UNEP and FAO add that about 13–14% of food is lost between harvest and retail, while another 17–19% is wasted at retail and household level. That food carries embedded energy, water and labour, so every box of spoiled vegetables is also wasted electricity and fuel.

Cold chains sit at the centre of this issue. A joint UNEP–FAO report on sustainable food cold chains says that lack of effective refrigeration is responsible for the loss of about 12% of total food production, and that developing countries could save 144 million tonnes of food per year if they had cold-chain infrastructure comparable to richer nations. Those numbers have caught the attention of both energy planners and food ministries, because they show where targeted investment can unlock huge gains.

At the climate level, the opportunity is huge. A recent FAO-led factsheet notes that food loss and waste account for 8–10% of global greenhouse-gas emissions, while only about USD 0.1 billion per year is currently invested in tackling food loss and waste, compared with an estimated USD 48–50 billion needed. As financing starts to close that gap, many of those dollars are likely to land in projects that combine cold-chain upgrades with clean, battery-backed microgrids.

Drivers

Rising renewable demand and food cold chains push microgrid storage

A major driving factor for energy storage in microgrids is the rapid growth of renewables that need stable, local balancing. Global renewable electricity capacity additions reached about 507 GW in 2023, almost 50% higher than in 2022, as more than 130 countries supported clean power through policies and auctions. By the end of 2022, renewables already made up around 40% of global installed power capacity. As more solar and wind plants come online, grids need flexible storage close to the load, and microgrids are often the most practical way to do that.

Microgrids with batteries can smooth the ups and downs of local solar or wind, keeping frequency and voltage within safe limits even when the main grid is weak. This becomes essential in rural areas, islands, industrial estates, and city districts where renewables now dominate new capacity. IRENA notes that renewable power capacity rose by 473 GW in 2023 alone, with solar adding 346 GW and wind 116 GW.

At the same time, food and agriculture players are quietly becoming a strong voice for reliable, clean local power, which directly supports microgrid storage investments. A joint FAO/UNEP report shows that lack of effective refrigeration causes about 526 million tons of food to be lost each year, around 12% of global food production. FAO also estimates that over 13% of all food produced globally is lost before retail, equal to more than USD 400 billion annually. Many of these losses are due to poor or unreliable electricity for cold chains, storage, and processing – problems that microgrids with batteries can directly fix.

Falling battery costs make this driver even stronger. IRENA reports that the installed cost of utility-scale battery energy storage systems has fallen by about 93% since 2010, down to roughly USD 192/kWh in 2024.

Governments are reacting: for example, India now offers viability-gap funding for grid-scale battery storage, with schemes supporting up to INR 18 lakh per MWh to accelerate projects that enhance reliability and nighttime supply. Such policies, combined with the pressure from food-system stakeholders to secure cold chains and cut losses, are pushing utilities, developers, and communities to adopt energy-storage-based microgrids much faster than a few years ago.

Restraints

Limited ability to pay keeps microgrid storage out of many food communities

A major restraining factor for energy storage in microgrids is simple affordability. The communities and food businesses that need reliable power most often have the weakest balance sheets. FAO and UNEP estimate that about 14% of all food produced is lost before it reaches the consumer, and another 17% is wasted later in the chain. Everyone agrees cold chains and local processing need better electricity, but paying for battery-based microgrids is another story.

The same FAO–UNEP work points out that lack of effective refrigeration alone causes the loss of 526 million tonnes of food, roughly 12% of global production, and that developing countries could save 144 million tonnes of food every year if they matched rich countries’ cold-chain infrastructure. Yet most small traders, dairy cooperatives or fishing groups cannot finance the solar-plus-storage systems that would power those cold rooms. They see the benefits clearly, but the upfront cheque is simply too big.

At farm level, the finance gap is even more visible. FAO notes that small farms under 2 hectares produce around 30–34% of the world’s food supply on only 24% of agricultural land. Another FAO factsheet highlights that smallholders provide up to 80% of the food supply in parts of Asia and sub-Saharan Africa. These farmers are central to global food security, but many rely on informal credit, have volatile incomes, and cannot easily borrow for long-lived assets like batteries and inverters.

On the energy side, the scale of investment needed is huge. A World Bank analysis shows that powering about 490 million people with mini-grids by 2030 will require more than 217,000 systems at a cumulative cost of USD 127 billion. At the current pace, only 44,800 mini-grids serving around 80 million people and USD 37 billion of investment are likely by 2030. Storage is a major part of those costs. For many rural or food-sector projects, the tariffs required to repay such investments would exceed what users can realistically pay.

Food and energy agencies are trying to respond. FAO and UNEP call for “targeted finance and policy support” to scale sustainable food cold chains, warning that more than 3 billion people cannot afford a healthy diet today. The World Bank’s “Mini Grids for Half a Billion People” handbook similarly stresses that concessional capital, results-based grants and risk-sharing instruments are needed to unlock private investment in storage-rich mini-grids.

Opportunity

Sustainable food cold chains create a huge new opening for microgrid storage

A powerful growth opportunity for energy storage in microgrids sits at the intersection of food systems and reliable cooling. Around the world, farmers, cooperatives and food companies are realising that without steady electricity, they lose both food and income. Microgrids with batteries can keep cold rooms, dairies and pack-houses running even when the main grid is weak or non-existent, turning an energy challenge into a long-term development opportunity.

Food agencies are very clear about the scale of the problem. FAO and the UN estimate that roughly 14% of food produced is lost between harvest and retail, and a further 17–19% is wasted at retail and household level.A joint FAO–UNEP report on cold chains highlights that poor or absent refrigeration alone leads to about 526 million tonnes of food being lost each year, equal to about 12% of global food production. For developers and investors, those numbers translate into a very concrete business case: wherever food spoils because power is unreliable, there is room for a microgrid with storage.

The climate angle makes the opportunity even stronger. The UN climate secretariat notes that food loss and waste are responsible for 8–10% of global greenhouse-gas emissions, almost five times aviation’s emissions, and cost roughly USD 1 trillion each year.If microgrid-based cold chains can cut a slice of those losses, they are not just selling kilowatt-hours; they are selling lower emissions, higher food security and better farmer income. That is exactly the kind of story climate funds, development banks and impact investors want to back.

Access-to-energy numbers point in the same direction. The IEA reports that about 730 million people still lacked electricity in 2024, with progress slowing in recent years. In its SDG7 scenarios, more than half of new electricity access by 2030 is expected to come from decentralised solutions, with mini-grids providing about 30% of new connections and stand-alone systems 25%. A World Bank analysis adds that solar mini-grids could cost-effectively serve nearly half a billion people by 2030 if financing and policies line up.Every one of those new mini-grids is a potential platform for battery storage tied to food processing, milling, chilling or retail.

Regional Insights

APAC leads Energy Storage for Microgrids Adoption with a 41.20% share, worth USD 2.3 billion

In the Energy Storage for Microgrids Market, Asia-Pacific (APAC) stands out as the dominant region, accounting for around 41.20% of global demand, valued at roughly USD 2.3 billion. This leadership is underpinned by rapid growth in renewables, electrification needs, and government-backed decentralised energy programs across China, India, Japan, South Korea, and Southeast Asia.

According to IRENA, Asia added well over half of the world’s new renewable power capacity in recent years, with total regional renewable capacity surpassing 1,800 GW, driven mainly by solar PV and wind. This surge is pushing utilities and industrial users to deploy battery-based microgrids to manage intermittency, strengthen weak grids, and provide backup during peak demand or natural disasters.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

S&C Electric Company — S&C is presented as a specialist in integrated microgrid and energy-storage solutions, with extensive field experience in battery integration. The firm’s installations are reported to total approximately 189 MWh of energy-storage projects worldwide, demonstrating practical systems integration capability for community, utility-edge and commercial microgrids. This operational experience is leveraged in turnkey microgrid designs that combine controls, protection and service offerings to enable resilient islanding and grid-support functions.

Saft (TotalEnergies) — Saft is described as a provider of lithium-ion battery systems for stationary and renewable-coupled storage, delivering projects up to the hundreds of MW scale for grid and microgrid applications. As part of TotalEnergies’ wider strategy, the group targets 5–7 GW of battery storage capacity by 2030, indicating a strategic commitment to expand Saft’s stationary storage footprint and project pipeline for industrial and community microgrids. Saft’s product portfolio addresses multi-hour and grid-services use cases.

Siemens — Siemens’ energy and smart-infrastructure divisions supply power-electronics, battery inverters, controls and automated grid-management platforms used in microgrids; group revenues for fiscal 2024 were €75.9 billion, showing industrial scale and investment capacity for product development and global deliveries. Siemens’ Smart Infrastructure unit has been targeted for margin and growth improvements tied to electrification and building-level grid solutions, supporting commercial and utility microgrid deployments with digital control and asset management.

Top Key Players Outlook

- S&C Electric Company

- ABB

- Saft

- Siemens

- Eaton

- GE Vernova

- PowerSecure,

- Bloom Energy

- BoxPower Inc.

- Gridscape

Recent Industry Developments

In 2024, GE Vernova—recently spun off into an independent company—recorded approximately USD 35 billion in revenue, underscoring its wide reach in electrification and storage solutions.

In 2024, Siemens AG reported revenue of approximately €20.8 billion in its industrial business segment, with orders reaching €22.9 billion for the quarter, reflecting growing demand in electrification and grid-infrastructure solutions.

Report Scope

Report Features Description Market Value (2024) USD 5.8 Bn Forecast Revenue (2034) USD 20.4 Bn CAGR (2025-2034) 13.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Battery Energy Storage Systems, Flywheel Energy Storage, Pumped Hydro Storage, Others), By Microgrid Type (Grid-connected Microgrids, Remote Microgrids, Hybrid Microgrids), By Application (Enhanced Grid Stability, Backup Power and Islanding, Peak Shaving and Demand Response, Improved Renewable Energy Integration, Others), By End-use (Residential, Commercial, Industrial, Military) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape S&C Electric Company, ABB, Saft, Siemens, Eaton, GE Vernova, PowerSecure,, Bloom Energy, BoxPower Inc., Gridscape Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Energy Storage for Microgrids MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Energy Storage for Microgrids MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- S&C Electric Company

- ABB

- Saft

- Siemens

- Eaton

- GE Vernova

- PowerSecure,

- Bloom Energy

- BoxPower Inc.

- Gridscape