Global Electric Insulator Market By Dielectric Material (Ceramic/Porcelain, Glass, and Composite/Polymer), By Voltage Rating (Low Voltage, Medium Voltage, High Voltage, and Others), By Installation (Outdoor and Indoor), By Application (Transmission Lines, Substations and Switchgear, Transformers and Bushings, and Others), By End-Use (Utilities, Commercial And Industrial, and Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175244

- Number of Pages: 319

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

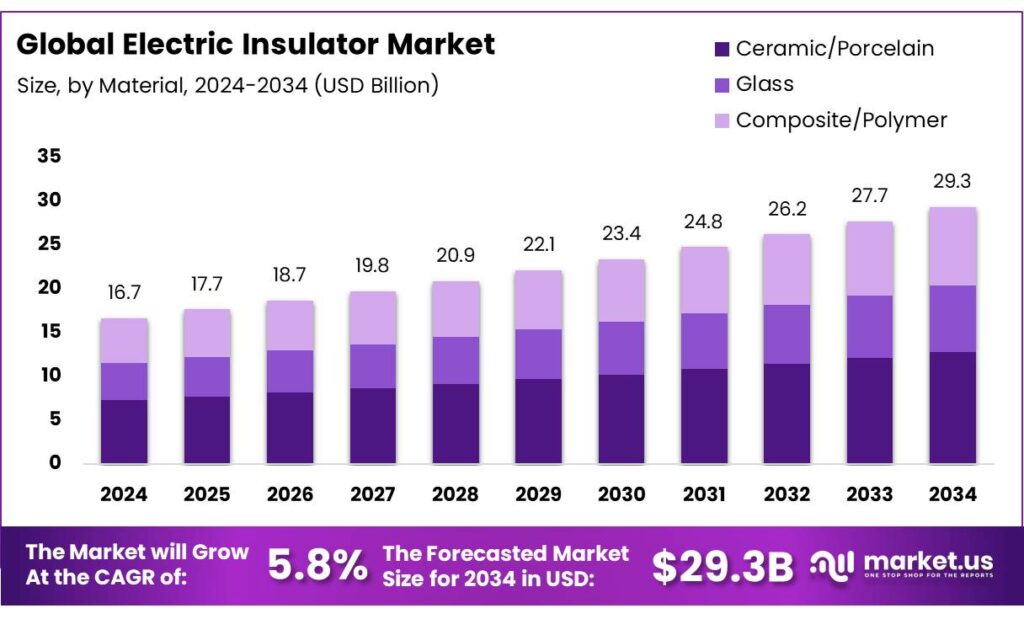

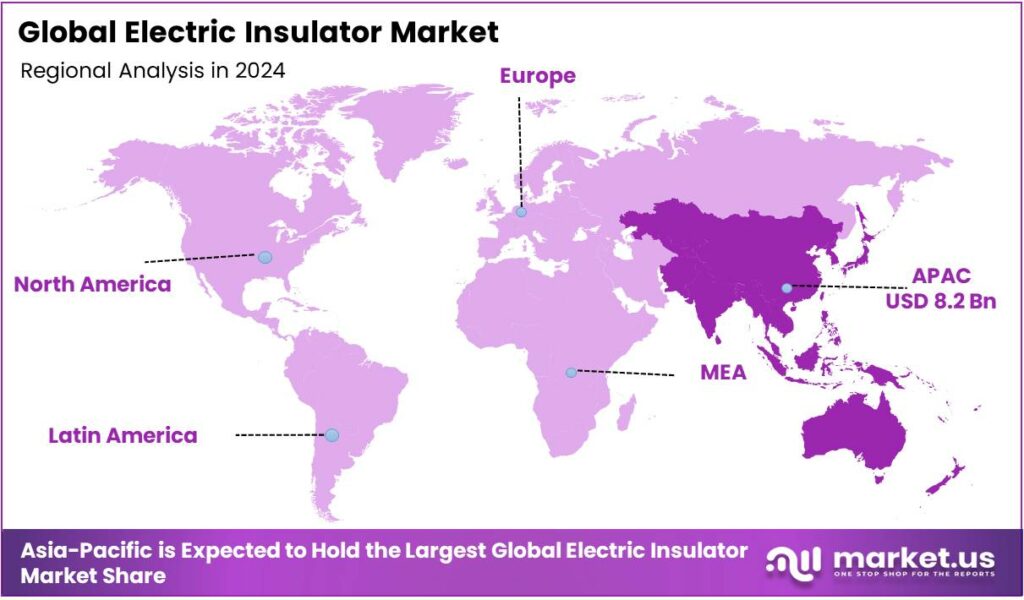

Global Electric Insulator Market size is expected to be worth around USD 29.3 Billion by 2034, from USD 16.7 Billion in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 48.9% share, holding USD 8.2 Billion in revenue.

An electric insulator is a component made from non-conductive materials, such as porcelain, glass, or plastic, that blocks the flow of electric current, preventing short circuits and shocks by isolating conductors from each other or from the ground, crucial for safety and functionality in power lines, appliances, and electronics. The market is primarily driven by the expansion and modernization of electrical infrastructure, as utilities globally seek to enhance grid reliability, safety, and resilience against environmental stresses.

- According to the US Energy Administration, in 2023, global electricity capacity reached around 9,090 million kW. Similarly, there is a significant expansion in renewable energy capacity from 3,040 million kW in 2021 to 3,834 million kW in 2023.

Ceramic/porcelain insulators remain dominant due to their high dielectric strength, mechanical robustness, and long-term environmental durability, while polymer and composite materials are gaining traction for lightweight, high-performance applications. Medium-voltage insulators are widely used as they serve the extensive distribution networks that link substations to urban, industrial, and rural consumers, whereas most insulators are deployed on overhead transmission lines to provide critical electrical isolation and mechanical support.

- According to a report by the International Energy Agency (IEA), there are nearly 7 million kilometers (km) of transmission lines and 72 million kms of distribution lines worldwide.

Furthermore, the utility sector accounts for the largest consumption of insulators due to the scale and exposure of transmission and distribution infrastructure. Moreover, manufacturers are employing strategic activities such as technological innovation, capacity expansion, and strategic partnerships to strengthen competitiveness, while geopolitical tensions and supply chain constraints for ceramics, glass, and polymers influence procurement and deployment strategies worldwide.

- A decade back, investments in fossil fuel supply were 30% higher than those for electricity generation, grids, and storage. However, investment in the electricity sector reached USD 1.5 trillion in 2025, some 50% higher than the total amount being spent on bringing oil, natural gas, and coal to market.

Key Takeaways

- The global electric insulator market was valued at USD 16.7 billion in 2024.

- The global electric insulator market is projected to grow at a CAGR of 5.8% and is estimated to reach USD 29.3 billion by 2034.

- On the basis of materials of electric insulator, ceramic/porcelain dominated the market, constituting 43.8% of the total market share.

- Based on the voltage rating, medium voltage electric insulator dominated the market, with a substantial market share of around 40.9%.

- Based on the applications of electric insulators, transmission lines led the market, comprising 43.6% of the total market.

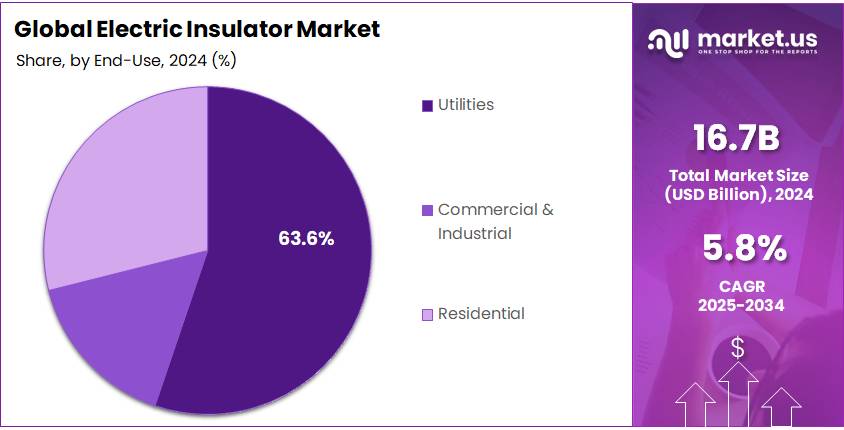

- Among the end-uses, the utilities sector held a major share in the electric insulator market, 63.6% of the market share.

- In 2024, the Asia Pacific was the most dominant region in the electric insulator market, accounting for 48.9% of the total global consumption.

Dielectric Material Analysis

Ceramic/Porcelain is a Prominent Segment in the Electric Insulator Market.

The electric insulator market is segmented based on materials into ceramic/porcelain, glass, and composite/polymer. The ceramic/porcelain led the electric insulator market, comprising 43.8% of the market share. Ceramic and porcelain insulators remain more widely used than glass or polymer alternatives in many electric transmission and distribution applications, principally due to their proven dielectric performance, mechanical robustness, and environmental resilience.

Porcelain ceramics, produced by firing kaolin, feldspar, and quartz, deliver high dielectric strength, often exceeding 25 kV/mm, which supports reliable insulation under high‑voltage conditions, and their surface resists degradation and contamination, reducing flashover risk in polluted or coastal environments.

Unlike glass, which can suffer moisture condensation that increases surface leakage current, porcelain’s glazed surface minimizes such effects and maintains stable electrical properties across temperature extremes. Additionally, ceramic insulators exhibit superior thermal stability, corrosion resistance, and durability, with lifespans often extending 40 years or more under outdoor conditions, and resist chemical attack and UV exposure that can degrade polymer materials.

Voltage Rating Analysis

Medium Voltage Electric Insulators Dominated the Market.

On the basis of voltage rating of the electric insulator, the market is segmented into low voltage, medium voltage, high voltage, and others. The medium voltage electric insulators dominated the market, comprising 40.9% of the market share. Medium‑voltage electric insulators are utilized more broadly than their low‑ or high‑voltage counterparts as they align with the prevalent requirements of distribution networks, which constitute the largest segment of electrical infrastructure in most countries.

Medium‑voltage systems, typically 1 kV to 33 kV, serve as the backbone of urban and rural power distribution, linking substations to commercial, industrial, and residential users. The distribution lines outnumber high‑voltage transmission lines by a wide margin, resulting in proportionally greater demand for medium‑voltage insulators to support overhead lines, pole‑mounted transformers, and switchgear installations.

Additionally, medium‑voltage insulators offer an optimal balance of mechanical strength, ease of installation, and cost‑effective performance for frequent network configurations, whereas low‑voltage insulators are limited to shorter local circuits with lower stress requirements, and high‑voltage insulators are engineered for specialized transmission corridors with stringent clearance and dielectric demands.

Application Analysis

Electric Insulators Are Mostly Utilized for Transmission Lines.

Based on the applications of electric insulators, the market is divided into transmission lines, substations, switchgear, transformers, bushings, and others. Transmission lines dominated the market, with a notable market share of 43.6%. In electricity transmission systems, the vast majority of electric insulators are deployed on overhead transmission lines, as these lines consist of bare conductors that require continuous insulation and mechanical support across long distances.

In contrast, substation and switchgear insulation is often achieved through compact technologies such as gas‑insulated switchgear (GIS) or oil/gas‑filled bushings, where insulation is integrated within equipment enclosures rather than as standalone external units. Consequently, insulators are most visible and widely used along transmission lines, where they perform the critical dual functions of electrical isolation and conductor support in outdoor environments.

End-Use Analysis

The Utilities Sector Held a Major Share of the Electric Insulator Market.

Among the end-uses, 63.6% of the total global consumption of electric insulators is for the utilities sector. The utility sector utilizes most electric insulators, as power transmission and distribution infrastructure inherently requires large numbers of external insulating components to maintain system safety and reliability over extensive networks. Electric utilities operate many overhead lines and distribution feeders, supported by insulators that prevent current leakage to the ground or supporting structures, and reliably separate conductors along routes that serve end users.

In contrast, commercial, industrial, and residential sectors generally rely on internal or compact insulation integrated within wiring, switchgear, and equipment, rather than large standalone insulators, as their electrical systems operate at lower voltages and within protected environments. Consequently, the volume of dedicated insulator components deployed by utilities far exceeds that used in non‑utility sectors, reflecting the scale and outdoor exposure of grid infrastructure.

Key Market Segments

By Dielectric Material

- Ceramic/Porcelain

- Glass

- Composite/Polymer

By Voltage Rating

- Low Voltage

- Medium Voltage

- High Voltage

- Others

By Installation

- Outdoor

- Indoor

By Application

- Transmission Lines

- Substations and Switchgear

- Transformers and Bushings

- Others

By End-Use

- Utilities

- Commercial & Industrial

- Residential

Drivers

Expansion and Modernization of the Electrical Infrastructure Drive the Demand for Electric Insulators.

The expansion and modernization of electrical infrastructure is a critical driver for the deployment of advanced electric insulators, as utilities and governments seek to bolster grid reliability and safety amid rising electricity demand.

- According to the IEA, global electricity consumption in buildings increased by more than 600 TWh (5%) in 2024, accounting for nearly 60% of total growth in electricity consumption.

Additionally, the research into high-voltage transmission design underscores the importance of proper insulation in maintaining operational stability, as suboptimal insulator quality and design can trigger tripping events during adverse weather, negatively impacting grid performance. Furthermore, the government investment programs, such as multi-billion-dollar grid resilience projects in the United States, emphasize upgrading transmission and distribution infrastructure to withstand extreme conditions and improve overall system safety.

- Global investment in electricity networks (including sub-stations, switchgear, metering, digital infrastructure, and electric vehicle fast-chargers) was around USD 270 billion in 2019, with distribution networks accounting for two-thirds of investment, and spending on digital grids for 15%.

Restraints

Balancing Performance with Cost and Material Choice Poses a Challenge to the Electric Insulator.

The selection of insulator materials presents a persistent challenge as manufacturers and utilities endeavor to balance performance attributes with cost constraints across diverse electrical infrastructure applications. For instance, conventional materials such as porcelain and glass offer high dielectric strength and mechanical robustness, with porcelain exhibiting dielectric strength in the order of approximately 4-10 kV/mm and long-term service records under compression loads. However, these materials are heavy, require careful handling, and may suffer from contamination-induced flashover in high-pollution environments, driving consideration of alternative materials.

Conversely, advanced polymer composite insulators, comprising silicone rubber housings and fibre-reinforced cores, deliver superior hydrophobic surface behavior and up to 65% higher flashover voltage under saline fog conditions compared to ceramic and glass in controlled studies. However, they are susceptible to UV-induced aging and environmental degradation that can shorten in-service life. The technical challenges are further compounded by raw material cost volatility, particularly in silicone and polymer feedstocks, which can pressure procurement budgets and complicate lifecycle cost planning for large-scale grid projects.

Opportunity

Material Innovation for High-Performance and Light-Weight Materials Creates Opportunities in the Market.

Material innovation in the electric insulator sector has generated significant opportunities by enabling the development of high‑performance, lightweight materials that address operational and infrastructure challenges. The feasibility of light‑weight polyurethane composite core fillers with densities as low as approximately 0.665 g·cm⁻³ that deliver strong insulation properties and mechanical performance for ultra‑high‑voltage insulators, reducing weight by 50%-75% compared to bulkier traditional alternatives.

Additionally, advanced composite insulators incorporating micro‑ and nano‑scale fillers have been observed to enhance dielectric strength, mechanical robustness, and environmental resistance while maintaining lower mass than conventional porcelain counterparts, facilitating easier handling and installation. These technological advancements create opportunities for utilities and manufacturers to deploy insulators that improve grid efficiency, reduce structural loading on towers, and meet stringent safety requirements across diverse climates.

- For instance, in November 2025, the Noida power authority in India announced to actively replace traditional porcelain and glass insulators with polymer-based alternatives across its network of over 108 substations and more than 9,000 km of power lines to reduce outages caused by environmental factors such as dust and moisture, thereby enhancing supply resilience for over 450,000 consumers.

Trends

Strategic Consolidation and Capacity Expansion among Manufacturers.

Strategic consolidation and capacity expansion among electric insulator manufacturers continue to shape industry dynamics as companies align operational capabilities with evolving grid requirements. For instance, Hubbell Incorporated, a long‑established manufacturer of electrical infrastructure components, pursues growth through acquisition and portfolio diversification to strengthen its product range and competitive positioning in utility‑oriented solutions. In December 2023, Hubbell Incorporated announced the complete acquisition of Systems Control, a leading manufacturer of substation control and relay panels.

Similarly, Hitachi Energy had publicly announced significant capacity investments, including the January 2025 expansion of its transformer components factory in Piteå, Sweden, where workforce levels are increasing by approximately 50%, with plans to grow from around 200 to 300 employees by 2030 to enhance production of composite insulators and related components.

These strategic moves reflect a broader industry trend toward scaling manufacturing capacity, consolidating technological expertise, and integrating production lines to meet rising utility demand and infrastructure modernization goals.

Geopolitical Impact Analysis

Compromised Electrical Grids in Various Countries Create Demand for Electric Insulators Amid Geopolitical Tensions.

The geopolitical tensions, most notably the Russia‑Ukraine conflict, have exerted pronounced effects on electricity transmission, grid integrity, and the supply of key insulator materials such as ceramics, glass, and polymers. Sustained missile strikes on Ukraine’s power infrastructure have damaged approximately half of the very high‑voltage substations and major generation assets, resulting in intermittent grid availability and extensive reconstruction requirements to restore and sustain transmission networks. Additionally, as China is the largest manufacturer of electric insulators, the import restrictions on Chinese goods in many countries have surged the prices.

Furthermore, the conflicts in the Middle East have created bottlenecks for inputs such as aluminum and petrochemical‑derived polymers, increasing procurement complexity for insulator manufacturers. Moreover, the January 2026 US military strike on Venezuela wrought significant damage to the nation’s electrical grid. These intertwined pressures underscore the impact of geopolitical instability on grid resilience and the raw material base critical to electric insulator deployment.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Electric Insulator Market.

In 2024, the Asia Pacific dominated the global electric insulator market, holding about 48.9% of the total global consumption. The region occupies a preeminent position in the global electric insulator landscape, driven by extensive power infrastructure development, rapid urbanization, and government‑led electricity access initiatives.

- According to the 2025 report on electricity by the IEA, Most of the increase in global electricity demand through 2027 is expected to come from emerging economies, which will account for around 85% of total growth. In 2024, more than half of the worldwide rise in electricity demand was driven by China alone, where consumption expanded by 7%, matching the pace of the previous year. China’s electricity demand is projected to grow by an average of 6% per year through 2027.

- Other emerging markets, including India and Southeast Asia, are also set to experience strong demand growth, supported by continued economic development and the rapid adoption of air conditioning. In India, electricity demand is forecast to increase at an average annual rate of 6.3% over the next three years, exceeding its average growth rate of 5% recorded between 2015 and 2024.

These Asian countries are at the forefront of the deployment and production of insulators for high‑voltage transmission and distribution systems. The leadership of the region reflects the scale of electricity infrastructure investments and regional manufacturing concentration of ceramic, glass, and polymer insulator technologies, positioning it as the dominant hub for insulator deployment globally.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Manufacturers of electric insulators are actively deploying a range of strategic initiatives to strengthen their competitive position, enhance operational performance, and broaden their market presence. Several firms are prioritizing technological innovation and product differentiation, which serve to meet evolving utility requirements for sustainability and reliability.

Additionally, manufacturers are expanding production footprints and geographic reach, including opening new facilities and diversifying manufacturing locations to reduce supply chain risks and improve delivery responsiveness. Furthermore, they emphasize strategic partnerships and alliances with utilities, transmission operators, and technology firms to further enhance competitive standing by aligning product development with specific grid modernization projects, enabling co‑creation of tailored solutions that augment system performance and long‑term engagement.

The Major Players in The Industry

- ABB Ltd

- Siemens AG

- General Electric Co.

- NGK Insulators Ltd

- Hubbell Inc.

- Toshiba Corp.

- Bharat Heavy Electricals Ltd

- Lapp Insulators GmbH

- Seves Group

- TE Connectivity

- MacLean Power Systems

- PPC Insulators

- Sediver SAS

- Aditya Birla Insulators

- Preformed Line Products

- Trench Group

- Other Key Players

Key Development

- In August 2025, Sediver announced an expansion of its West Memphis, Arkansas, plant, which manufactures power line parts, doubling the production capacity.

- In December 2025, Trench Group and Maschinenfabrik Reinhausen announced the signing of an agreement for Trench Group to acquire the composite insulator production assets of Reinhausen Power Composites (RPC).

Report Scope

Report Features Description Market Value (2024) US$16.7 Bn Forecast Revenue (2034) US$29.3 Bn CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Dielectric Material (Ceramic/Porcelain, Glass, and Composite/Polymer), By Voltage Rating (Low Voltage, Medium Voltage, High Voltage, and Others), By Installation (Outdoor and Indoor), By Application (Transmission Lines, Substations and Switchgear, Transformers and Bushings, and Others), By End-Use (Utilities, Commercial & Industrial, and Residential) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape ABB Ltd, Siemens AG, General Electric Co., NGK Insulators Ltd, Hubbell Inc., Toshiba Corp., Bharat Heavy Electricals Ltd, Lapp Insulators GmbH, Seves Group, TE Connectivity, MacLean Power Systems, PPC Insulators, Sediver SAS, Aditya Birla Insulators, Preformed Line Products, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- ABB Ltd

- Siemens AG

- General Electric Co.

- NGK Insulators Ltd

- Hubbell Inc.

- Toshiba Corp.

- Bharat Heavy Electricals Ltd

- Lapp Insulators GmbH

- Seves Group

- TE Connectivity

- MacLean Power Systems

- PPC Insulators

- Sediver SAS

- Aditya Birla Insulators

- Preformed Line Products

- Trench Group

- Other Key Players