Global EDM Oils/Fluids Market Size, Share, And Enhanced Productivity By Product Type (Hydrocarbon Oils, Synthetic Oils, Vegetable Oils, Others), By Application (Die Sinking, Wire Cutting, Drilling, Others), By End-User (Automotive, Aerospace, Medical, Electronics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 168876

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

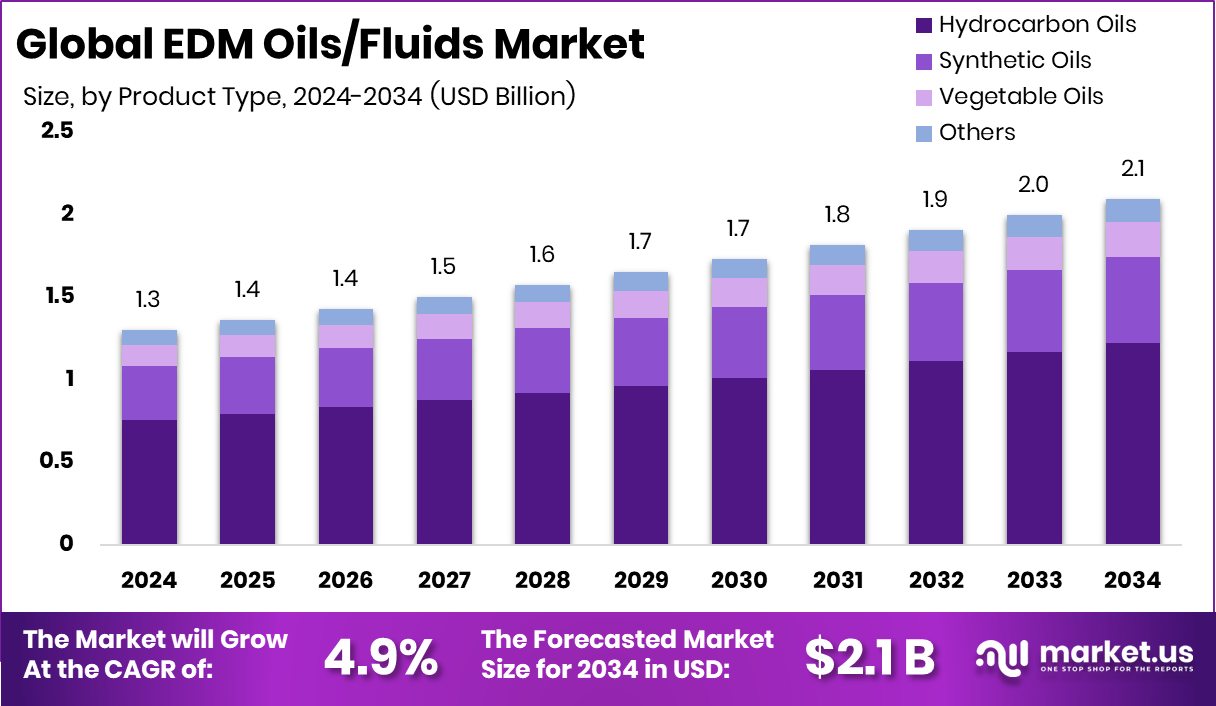

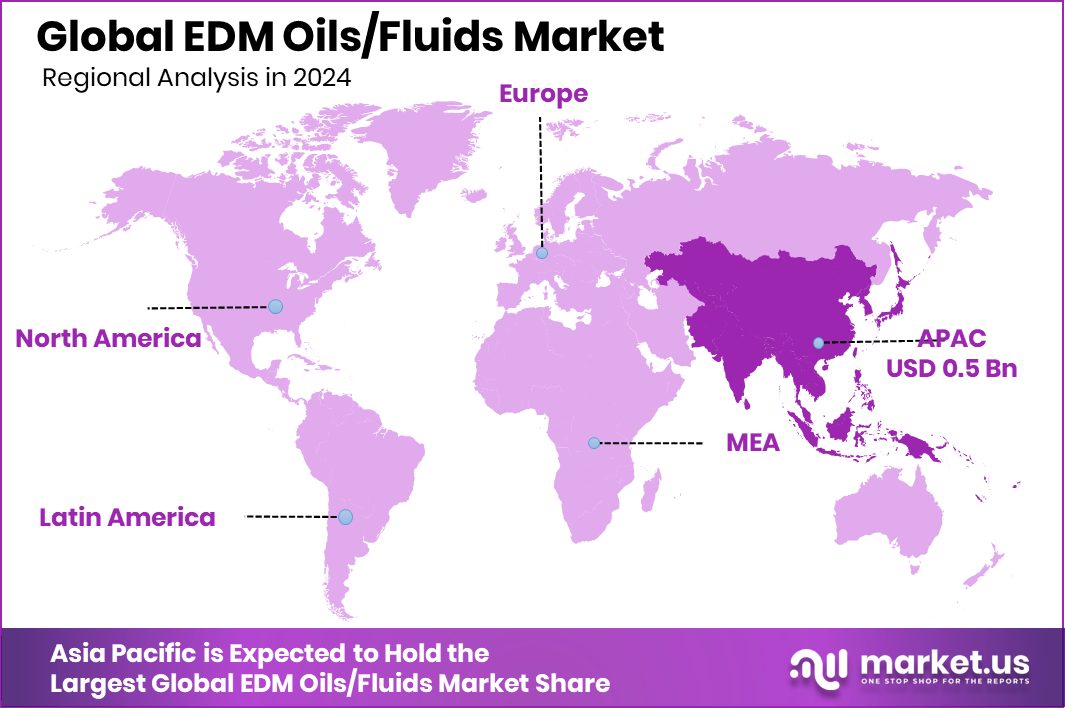

The Global EDM Oils/Fluids Market is expected to be worth around USD 2.1 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 4.9% from 2025 to 2034. Asia Pacific size for EDM Oils/Fluids stands at 41.7% worth USD 0.5 Bn.

EDM oils or fluids are specialized dielectric liquids used in electrical discharge machining to insulate the workpiece, carry away metal particles, and control heat. They need high flash points, low viscosity, and oxidation stability to keep precision parts accurate.

The EDM oils/fluids market covers the production and use of these dielectrics across job shops and factories. It is tied to automotive, aerospace, medical devices, and mold industries, where machining of hard alloys is essential.

Growth is supported by hydrocarbon investment, such as “Nigeria, others hold key to $40b oil reserves as foreign banks exit hydrocarbon market,” higher strategic petroleum reserves in Budget 2025, and BPH Energy Ltd raising $2.25 million for hydrocarbon projects.

Demand strengthens as Turkey secures rights to 90% of oil and gas output in Somalia, and long-term supply visibility improves, pushing manufacturers to expand EDM capacity and choose higher-performance fluids.

Opportunities emerge from alternative and synthetic feedstocks, with GrainCorp’s VC arm backing a synthetic palm oil startup’s $1.2 million pre-seed round, and from resilience cases like First Brands winning access to the last $600 million of emergency funds.

Key Takeaways

- The Global EDM Oils/Fluids Market is expected to be worth around USD 2.1 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 4.9% from 2025 to 2034.

- In the EDM Oils/Fluids Market, hydrocarbon oils dominate with 58.3%, due to stability, cooling efficiency, and availability.

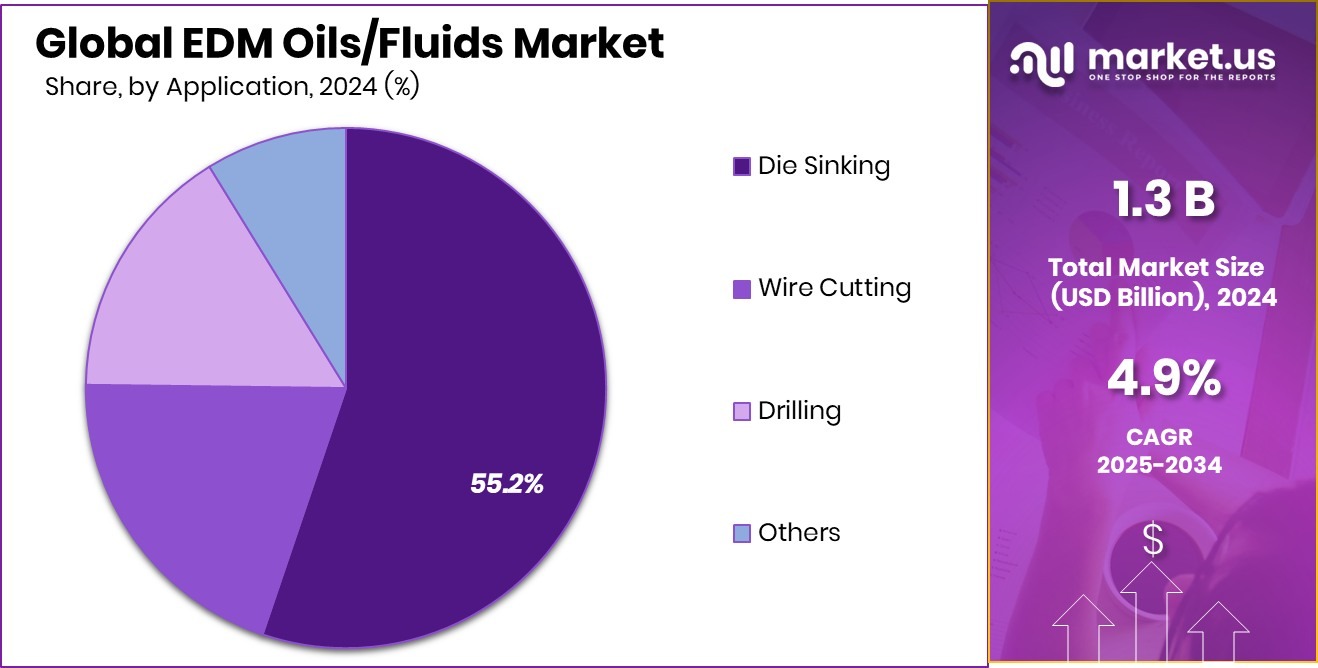

- Die sinking leads the EDM Oils/Fluids Market at 55.2%, driven by precision mold manufacturing and tooling demand.

- Automotive accounts for 44.7% of the EDM Oils/Fluids Market, supported by precision component machining needs.

- In the Asia Pacific, EDM Oils/Fluids demand reflects a 41.7% share reaching USD 0.5 Bn.

By Product Type Analysis

In the EDM Oils/Fluids Market, hydrocarbon oils lead with 58.3% due to stability.

In 2024, Hydrocarbon Oils held a dominant market position in By Product Type segment of the EDM Oils/Fluids Market, with a 58.3% share. This strong position reflects their long-standing acceptance as reliable dielectric fluids in electrical discharge machining operations. Hydrocarbon oils are widely preferred because they deliver consistent insulation, stable spark control, and effective heat dissipation during the machining of hard metals.

Their balanced viscosity supports smooth flushing of eroded particles, which helps maintain dimensional accuracy and surface finish. In addition, these oils align well with existing EDM machine designs, reducing the need for equipment modification or process changes.

For many manufacturers, hydrocarbon oils offer predictable performance across varied operating conditions, making them suitable for both high-volume production and precision toolmaking. As machining complexity increases, their proven operational stability continues to reinforce their leading role within this segment.

By Application Analysis

Die sinking dominates the EDM Oils/Fluids Market with a 55.2% share, driven by precision machining.

In 2024, Die Sinking held a dominant market position in By Application segment of the EDM Oils/Fluids Market, with a 44.7% share. This dominance is closely linked to the wide use of die-sinking processes for producing complex cavities, sharp corners, and intricate geometries that are difficult to achieve through conventional machining.

EDM oils and fluids play a critical role in die sinking by ensuring stable spark generation and efficient removal of eroded material from tight machining zones. The process relies heavily on consistent dielectric performance to maintain accuracy and surface quality, especially in precision tooling and mold manufacturing.

As industries increasingly demand detailed and high-tolerance components, die sinking continues to drive steady consumption of EDM oils within this application segment.

By End-User Analysis

Automotive leads the EDM Oils/Fluids Market at 44.7% from tooling demand.

In 2024, Automotive held a dominant market position in the end-user segment of the EDM Oils/Fluids Market, with a 44.7% share. This leadership is supported by the automotive sector’s extensive use of EDM processes for manufacturing precision components such as gears, fuel system parts, tooling, and molds.

EDM oils and fluids are essential in these operations to ensure controlled sparking, dimensional accuracy, and consistent surface finish when machining hardened steels and complex alloys. Automotive production environments demand high repeatability and process stability, which increases reliance on high-performance dielectric fluids.

As vehicle designs continue to incorporate tighter tolerances and complex geometries, the automotive industry remains a key driver of sustained usage of EDM oils within this end-user segment.

Key Market Segments

By Product Type

- Hydrocarbon Oils

- Synthetic Oils

- Vegetable Oils

- Others

By Application

- Die Sinking

- Wire Cutting

- Drilling

- Others

By End-User

- Automotive

- Aerospace

- Medical

- Electronics

- Others

Driving Factors

Growing Precision Manufacturing Boosts EDM Fluid Demand

One of the strongest driving factors for the EDM oils/fluids market is the steady growth in precision manufacturing across industries that rely on accurate metal shaping. Electrical discharge machining is widely used where tight tolerances and complex designs are required, and this directly increases the need for stable, high-quality EDM fluids.

Investment trends linked to advanced materials and oil-based innovation further support this demand. For example, Evogene Ag-Seed Division was awarded a €1.2 million Horizon grant to develop improved oil-seed crops, highlighting continued interest in oil-based technologies.

In parallel, researchers receiving a $2.7 million NIH grant to develop the next generation of synthetic blood reflect broader advances in precision science and engineering. Together, these developments reinforce machining activity that depends on reliable EDM oils for consistent performance and surface quality.

Restraining Factors

Environmental Compliance Costs Limit EDM Fluid Usage

One major restraining factor in the EDM oils/fluids market is the rising pressure from environmental and safety regulations. EDM oils are petroleum-based and can generate fumes, waste residues, and disposal challenges during machining operations.

Many workshops face higher costs for ventilation systems, waste treatment, and regulatory compliance, which discourages frequent fluid replacement and affects overall consumption. Small and mid-sized manufacturers are especially sensitive to these added operational expenses. At the same time, growing interest in greener alternatives is shifting attention away from conventional formulations.

This shift is reflected in funding activity, such as the Estonian biotech developer ÄIO securing €1 million to develop greener alternatives for cosmetics products. Such investments signal broader industry moves toward sustainable solutions, indirectly limiting long-term dependence on traditional EDM oils.

Growth Opportunity

New Sustainable Formulations Create Strong Market Expansion

A major growth opportunity for the EDM oils/fluids market lies in the development of sustainable and innovative fluid formulations. Manufacturers are increasingly exploring safer, low-odor, and longer-life EDM oils that reduce waste and operating downtime. This shift encourages wider adoption of EDM processes, especially in facilities focused on cleaner production practices.

The emphasis on innovation and alternative formulations is also visible across other industries. For instance, edible coffee startup “Mokable” raised ¥150 million in seed funding through Suntory’s in-house venture program “FRONTIER DOJO,” showing how corporate-backed innovation can successfully commercialize new material concepts.

Similar innovation-driven approaches in EDM fluids can unlock new user groups, extend equipment life, and support long-term market growth without compromising machining performance.

Latest Trends

Synthetic Feedstocks Reshaping EDM Fluid Formulations

A key latest trend in the EDM oils/fluids market is the increasing shift toward synthetic and alternative feedstocks to ensure supply stability and performance consistency. Rising dependence on imported edible oils, with the edible oil import bill up 22% year on year, has highlighted vulnerability in traditional oil sourcing and pricing.

As a result, industries are paying closer attention to synthetics derived from controlled processes. This direction is reinforced by funding, such as an Alberta company receiving a $20-million provincial grant to use natural gas to create synthetic fuels.

Advances like these encourage the development of EDM fluids with predictable quality, better thermal stability, and reduced supply risk. The trend supports long-term reliability for machinists while helping fluid producers manage cost volatility more effectively.

Regional Analysis

Asia Pacific leads the EDM Oils/Fluids market with 41.7% share at USD 0.5 Bn.

Asia Pacific stands as the dominating region in the EDM Oils/Fluids Market, holding a 41.7% share valued at USD 0.5 Bn. This leadership is supported by the region’s strong manufacturing base, particularly in automotive components, tooling, electronics, and industrial machinery. Countries across the Asia Pacific rely heavily on electrical discharge machining for high-precision production, which directly sustains consistent consumption of EDM oils and fluids. Large-scale industrial clusters and growing investments in advanced manufacturing continue to reinforce the region’s leading position.

North America represents a mature and technology-driven market where EDM oils are widely used in precision engineering, aerospace tooling, and medical equipment manufacturing. The region benefits from high automation levels and strict machining standards, supporting stable demand for reliable dielectric fluids.

Europe follows closely, supported by its strong mold-making and industrial equipment industries. Emphasis on accuracy, surface quality, and process efficiency keeps EDM fluids relevant across various production environments.

The Middle East & Africa market is gradually developing, driven by the expansion of industrial workshops and metal fabrication activities. Growing localized manufacturing supports steady adoption of EDM processes.

Latin America shows emerging potential as automotive assembly and industrial tooling activities expand, creating a consistent need for EDM oils in precision machining applications.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ExxonMobil plays an influential role in the EDM oils/fluids landscape through its deep expertise in base oils and advanced hydrocarbon processing. The company’s strength lies in its ability to deliver consistent oil quality, which is critical for EDM applications requiring stable dielectric performance and controlled machining environments. Its large refining and formulation capabilities allow it to support industrial users who value reliability, long service life, and predictable fluid behavior during precision operations.

Shell maintains a strong presence by leveraging long-standing knowledge in specialty fluids and industrial lubricants. Its approach focuses on process efficiency, thermal stability, and operational reliability, which aligns well with the functional needs of EDM machining. By emphasizing performance consistency and product adaptability, Shell supports manufacturers seeking reduced downtime, cleaner machining results, and smoother integration with existing EDM systems.

TotalEnergies brings a balanced perspective to the EDM oils/fluids market by combining traditional energy strengths with growing attention to efficiency and formulation improvements. Its capability to supply refined oils suited for demanding industrial processes helps address the needs of toolmaking, automotive components, and precision engineering sectors. Together, these three players shape market expectations around quality, performance consistency, and long-term supply stability in 2024.

Top Key Players in the Market

- ExxonMobil

- Shell

- TotalEnergies

- Chevron

- BP

- Idemitsu Kosan

- FUCHS Lubricants

- Petro-Canada Lubricants

- Castrol

- Quaker Houghton

Recent Developments

- In June 2025, Shell introduced Shell DLC Fluid S3, a direct liquid-cooling fluid designed for high-performance computing/data-center cooling — signalling Shell’s push into advanced, high-value specialty fluids beyond conventional lubricant portfolios.

- In April 2024, ExxonMobil announced that it is building a new lubricant-manufacturing plant in Maharashtra, India. Once completed (by end-2025), the plant will have a capacity of 159,000 kilolitres of finished lubricants per year — a significant expansion aimed at serving growing industrial lubricant demand in Asia.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 2.1 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Hydrocarbon Oils, Synthetic Oils, Vegetable Oils, Others), By Application (Die Sinking, Wire Cutting, Drilling, Others), By End-User (Automotive, Aerospace, Medical, Electronics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ExxonMobil, Shell, TotalEnergies, Chevron, BP, Idemitsu Kosan, FUCHS Lubricants, Petro-Canada Lubricants, Castrol, Quaker Houghton Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  EDM Oils/Fluids MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

EDM Oils/Fluids MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ExxonMobil

- Shell

- TotalEnergies

- Chevron

- BP

- Idemitsu Kosan

- FUCHS Lubricants

- Petro-Canada Lubricants

- Castrol

- Quaker Houghton