Global Direct Current Arc Fault Circuit Interrupter Market Size, Share Analysis Report By Product Type (Plug-on AFCI Breakers, Load Center AFCI Breakers, Stand-alone AFCIs, Combination AFCIs), By Voltage Rating (120V AFCI, 240V AFCI), By Installation Type (Panel Mounted, In-Line, Embedded), By Current Rating (15 Amperes, 30 Amperes, 60 Amperes), By Application (Residential, Commercial, Industrial) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170618

- Number of Pages: 382

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

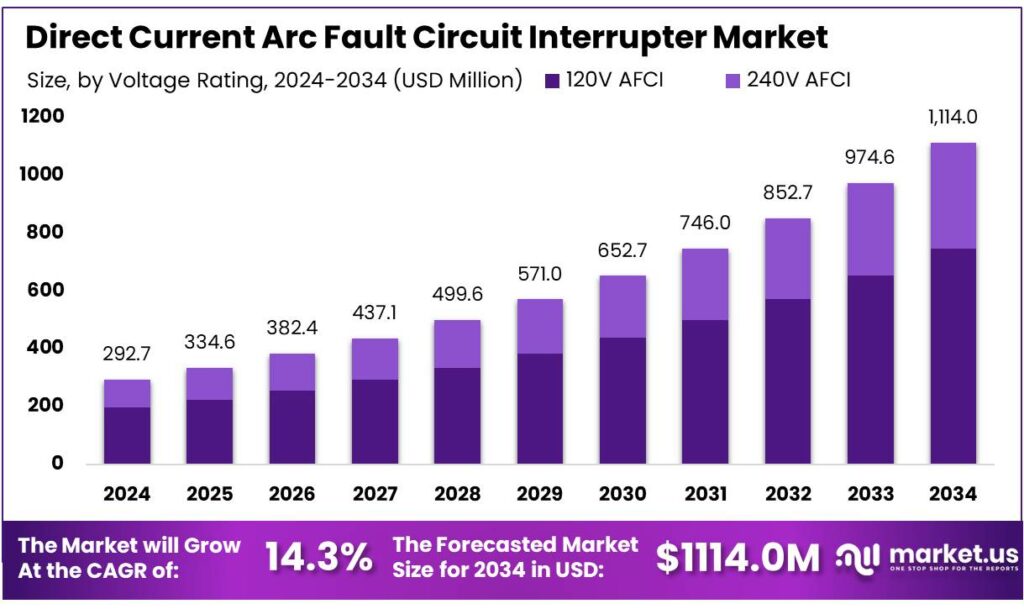

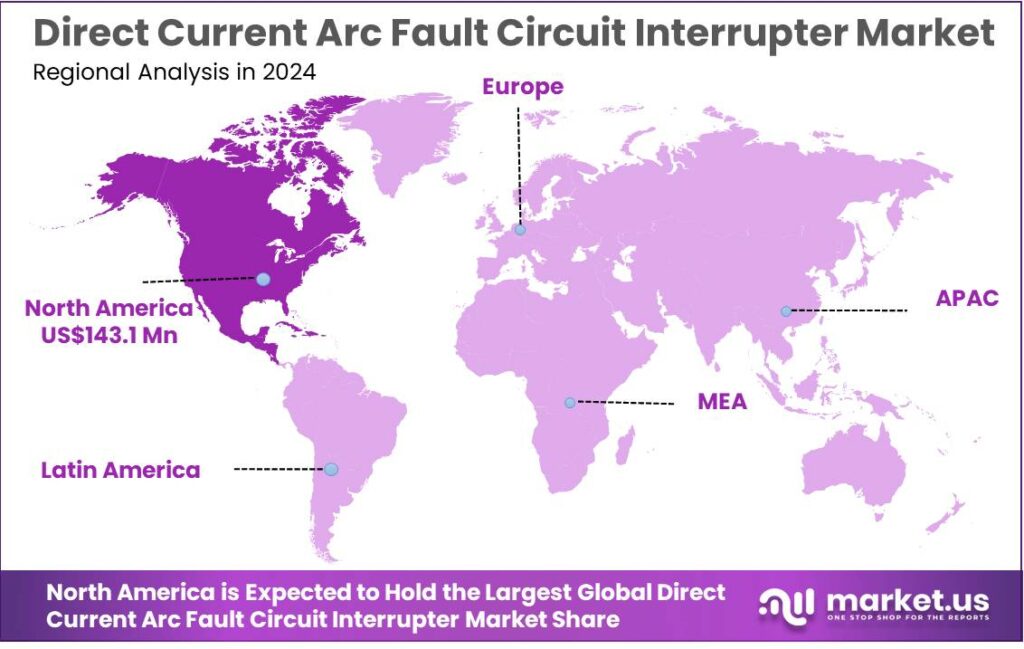

The Global Direct Current Arc Fault Circuit Interrupter Market size is expected to be worth around USD 1114.0 Million by 2034, from USD 292.7 Million in 2024, growing at a CAGR of 14.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 48.9% share, holding USD 143.1 Million revenue.

Direct Current Arc Fault Circuit Interrupters (DC AFCIs) are safety devices designed to detect and stop hazardous DC arcing—a type of electrical fault that can overheat conductors and trigger fires, especially in high-voltage DC environments like solar PV strings, battery energy storage, and DC distribution equipment. The technology has moved from “nice-to-have” to “code-and-standards driven,” with product designs increasingly integrated into inverters, converters, charge controllers, and combiner equipment rather than installed as purely standalone protection.

From an industrial scenario standpoint, the strongest pull comes from solar PV scale-up and the safety expectations that follow it. Global PV reached over 2.2 TW of cumulative capacity by end-2024, with over 600 GW newly commissioned that year—meaning millions of additional connectors, junctions, and rooftop penetrations where DC arc risks must be managed at design and commissioning stages. The investment side reinforces this: the IEA notes solar PV capacity-addition investment surpassed USD 480 billion in 2023, supporting faster deployment of electronics, protection hardware, and compliant BOS architectures.

- Regulation and standards are a clear demand engine because they turn “best practice” into “must have.” In the U.S., NEC 690.11 requires DC arc-fault protection for PV systems operating at 80 V or greater. In parallel, certification pathways such as UL 1699B define performance expectations for PV DC arc-fault circuit protection devices, shaping product design, testing, and procurement specifications across EPCs and inverter/combiner ecosystems.

- Policy incentives also expand the installed base that needs protection. The IEA highlights that, in the U.S., PV additions increased 70% in 2023 to a record 32 GW, supported by Inflation Reduction Act tax credits—growth that indirectly lifts demand for compliant, inspection-ready AFCI-equipped hardware.

Risk economics also support adoption: electrical distribution and lighting equipment contributed to an estimated annual average of 32,620 U.S. home fires in 2015–2019, keeping insurers, AHJs, and safety bodies focused on prevention technologies and better code compliance—momentum that increasingly extends to rooftop PV DC circuits.

Government initiatives that accelerate solar deployment also indirectly expand the AFCI “attach rate,” because faster permitting and more installations increase the addressable installed base. For example, the U.S. DOE’s SolarAPP+ Prize was a $1 million program to speed adoption of automated permitting, lowering friction for residential solar rollout. At the platform level, SolarAPP+ reports 335+ jurisdictions served, 110K+ permits issued, and 105K+ staff hours saved—evidence of a permitting ecosystem that is scaling.

Key Takeaways

- Direct Current Arc Fault Circuit Interrupter Market size is expected to be worth around USD 1114.0 Million by 2034, from USD 292.7 Million in 2024, growing at a CAGR of 14.3%.

- Plug-on AFCI Breakers held a dominant market position, capturing more than a 37.8% share.

- 120V AFCI held a dominant market position, capturing more than a 67.2% share.

- Panel Mounted held a dominant market position, capturing more than a 59.3% share.

- 15 Amperes held a dominant market position, capturing more than a 49.1% share.

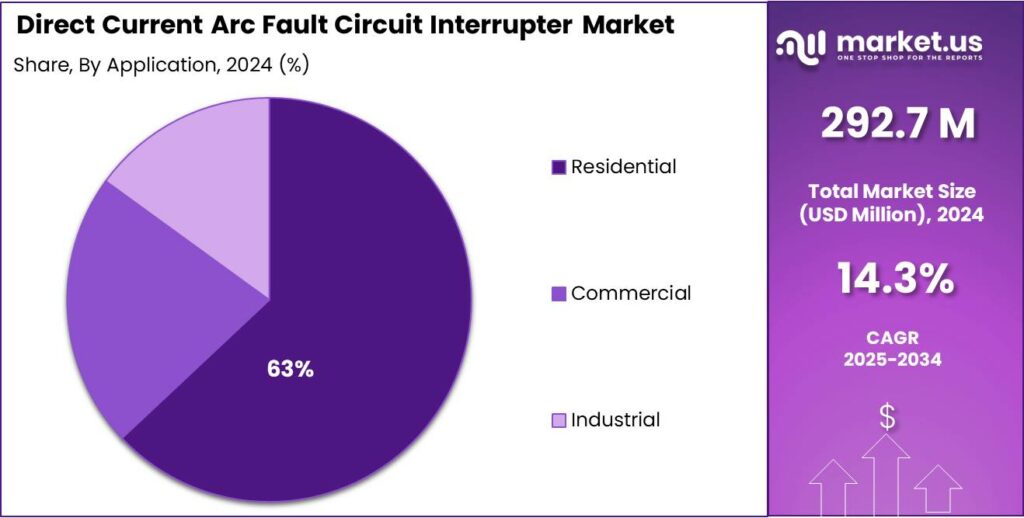

- Residential held a dominant market position, capturing more than a 63.5% share.

- North America held a commanding position in the direct current arc fault circuit interrupter market, capturing 48.9% of regional share and representing approximately US$143.1 million.

By Product Type Analysis

Plug-on AFCI breakers lead with a 37.8% share, supported by faster installation and reduced wiring effort

In 2024, Plug-on AFCI Breakers held a dominant market position, capturing more than a 37.8% share. This leadership was mainly driven by their easy plug-on design, which reduced installation time and minimized wiring errors compared to traditional pigtail breakers. Electricians preferred plug-on AFCI breakers for residential and light commercial projects where speed, safety, and consistency were important. During 2024, stricter electrical safety codes and rising awareness of arc-fault protection increased demand for these breakers. In 2025, adoption continued steadily as new construction and panel upgrades favored plug-on solutions that improved safety compliance while lowering overall labor costs, supporting the segment’s strong position in the market.

By Voltage Rating Analysis

120V AFCI dominates with a 67.2% share, driven by widespread use in standard electrical systems

In 2024, 120V AFCI held a dominant market position, capturing more than a 67.2% share. This dominance was supported by its extensive use in residential and small commercial electrical circuits where 120V systems are standard. The segment benefited from strong enforcement of electrical safety codes that require arc-fault protection in living spaces, bedrooms, and common areas. During 2024, growth was reinforced by new housing construction and panel replacement projects focused on improving fire safety. In 2025, demand remained stable as ongoing renovation activity and safety upgrades continued to favor 120V AFCI solutions, sustaining the segment’s leading role in the direct current arc fault circuit interrupter market.

By Installation Type Analysis

Panel-mounted AFCIs lead with a 59.3% share, favored for centralized protection and easier maintenance

In 2024, Panel Mounted held a dominant market position, capturing more than a 59.3% share. This leadership was driven by their use in centralized electrical panels, where arc-fault protection could be managed and monitored from a single location. Panel-mounted AFCIs were widely adopted in residential and commercial buildings due to their compatibility with standard distribution boards and ease of inspection during maintenance. During 2024, growth was supported by new construction activity and electrical panel upgrades focused on improving fire safety. In 2025, steady demand continued as safety regulations and retrofit projects encouraged the use of panel-mounted solutions, reinforcing their strong position in the direct current arc fault circuit interrupter market.

By Current Rating Analysis

15-ampere AFCIs lead with a 49.1% share, supported by standard circuit use and safety compliance

In 2024, 15 Amperes held a dominant market position, capturing more than a 49.1% share. This dominance was mainly driven by the widespread use of 15-amp circuits in residential electrical systems, where lighting and general outlet loads are commonly connected. The segment benefited from building codes that require arc-fault protection on standard branch circuits to reduce fire risk. During 2024, demand increased with new housing projects and routine electrical upgrades. In 2025, adoption remained steady as homeowners and contractors continued to prefer 15-amp AFCIs for cost-effective protection in everyday electrical applications, maintaining the segment’s strong market presence.

By Application Analysis

Residential applications lead with a 63.5% share, driven by safety codes and housing growth

In 2024, Residential held a dominant market position, capturing more than a 63.5% share. This leadership was supported by strict electrical safety requirements aimed at reducing fire risks in homes, where arc faults are a common cause of electrical accidents. Residential buildings widely adopted direct current AFCIs in bedrooms, living areas, and distributed circuits to meet compliance standards. During 2024, new housing construction and renovation activity increased installation volumes. In 2025, steady demand continued as homeowners and builders prioritized safety upgrades and code-compliant electrical systems, reinforcing the residential segment’s strong role in the direct current arc fault circuit interrupter market.

Key Market Segments

By Product Type

- Plug-on AFCI Breakers

- Load Center AFCI Breakers

- Stand-alone AFCIs

- Combination AFCIs

By Voltage Rating

- 120V AFCI

- 240V AFCI

By Installation Type

- Panel Mounted

- In-Line, Embedded

By Current Rating

- 15 Amperes

- 30 Amperes

- 60 Amperes

By Application

- Residential

- Commercial

- Industrial

Emerging Trends

Smarter Inverter-Built Arc Detection Is Rising

A clear latest trend in Direct Current Arc Fault Circuit Interrupters (DC AFCIs) is that arc-fault protection is becoming software-driven and inverter-integrated, not a separate “extra box.” Instead of adding standalone interrupters, many solar and DC power designs are embedding arc detection inside inverters, converters, and charge controllers, then validating performance against PV DC arc-fault requirements such as UL 1699B. This makes installation cleaner, helps with code compliance, and gives OEMs room to improve performance through firmware updates over time.

This shift is happening because the DC footprint is expanding fast. In 2023, the world connected 447 GW of new solar capacity, lifting total installed solar to around 1.6 TW. More PV means more connectors, terminations, and long DC cable runs—exactly where series arcs can start if something loosens or degrades. With that scale, buyers want protection that is built-in, tested, and easy for inspectors to accept.

The U.S. had 42,708 food and beverage manufacturing establishments in 2022, so even small adoption of rooftop PV and storage creates a large installed base where reliable arc-fault protection matters. Programs like the U.S. DOE Better Plants also encourage energy upgrades, with participating manufacturers pledging 25% energy-intensity improvement over 10 years, which often leads to on-site generation and electrical modernization where DC AFCI features can be specified upfront.

Drivers

Safety Codes Push DC Arc-Fault Protection Into New Builds

One major driver for Direct Current Arc Fault Circuit Interrupters (DC AFCIs) is simple: more DC power is being installed in places where fire risk is taken seriously, and electrical codes increasingly expect arc-fault mitigation. When a DC arc starts, it can keep burning because DC current doesn’t naturally cross zero like AC. That persistence is exactly why project owners, insurers, and inspectors pay attention to DC arc-fault protection—especially on or in buildings.

- In 2023, global solar installations reached 447 GW of new capacity, taking total installed solar capacity to about 1.6 TW. That is a huge base of rooftop, commercial, and utility DC circuits that must be installed, maintained, and protected. As the installed base grows, the industry naturally tightens its approach to preventing rare but high-impact failures—fire events don’t need to be common to drive purchasing decisions.

Codes and listing requirements translate that safety concern into real procurement. The NEC’s PV arc-fault provision (commonly referenced as 690.11) calls for PV systems with DC circuits operating at 80 V DC or greater between conductors to have listed PV arc-fault circuit protection. In practice, this pushes manufacturers to embed detection and interruption functions into inverters, combiner boxes, and other PV equipment so installers can meet inspection expectations without complex add-ons.

This driver is amplified in food and beverage facilities, where uptime matters, maintenance teams are stretched, and safety culture is strong. The U.S. had 42,708 food and beverage manufacturing establishments in 2022, showing how widely distributed these industrial sites are across the country. Many of these plants are modernizing power systems for efficiency, electrification, and onsite generation. Energy intensity also helps explain why electrical upgrades keep happening: U.S. manufacturing energy data shows that a group of major sectors—including food—accounted for 74% of manufacturing energy expenditures in 2022.

Restraints

Nuisance Trips And Troubleshooting Slow Adoption

A major restraint for Direct Current Arc Fault Circuit Interrupters (DC AFCIs) is the fear of nuisance trips—when the device shuts down a system even though there isn’t a real, dangerous arc. That matters because many DC AFCI solutions rely on detecting “arc-like” electrical noise patterns. In real installations, DC systems can be noisy for perfectly normal reasons. Researchers have repeatedly noted that detection must be robust without creating nuisance trips from other sources of noise—and that’s harder than it sounds in the field.

It can mean lost generation, service calls, truck rolls, and long fault-finding sessions where technicians must prove whether the trip was “real” or “false.” This is especially painful in commercial and industrial rooftops where access is controlled, production schedules are tight, and maintenance teams have limited spare time. The result is a practical hesitation: some owners prefer simpler protection schemes unless code enforcement, insurance requirements, or procurement specs clearly demand DC AFCI functionality.

This restraint shows up sharply in food and beverage operations, where downtime is expensive and safety is non-negotiable. The U.S. has 42,708 food and beverage manufacturing establishments (2022), meaning there are tens of thousands of sites where electrical reliability decisions are made cautiously and with operational risk in mind.

Energy cost pressure also keeps reliability conversations active: the U.S. EIA reported that major manufacturing sectors—including food—were part of the group accounting for 74% of manufacturing energy expenditures in 2022. When energy and uptime are both critical, operators tend to avoid anything that might create avoidable stoppages or hard-to-diagnose alarms.

Opportunity

Rooftop Solar And Storage Create A Big Upgrade Cycle

A major growth opportunity for Direct Current Arc Fault Circuit Interrupters (DC AFCIs) is the fast-growing mix of rooftop solar + on-site battery storage in commercial and industrial facilities. These sites are adding more high-voltage DC wiring, connectors, and power electronics—exactly the places where a persistent DC arc can become a fire risk. As safety expectations rise, DC AFCIs become an “easy-to-justify” add-on or built-in feature, especially when equipment is being replaced anyway.

- Solar Power Europe reports that the world added 447 GW of new solar in 2023, bringing total solar capacity to about 1.6 TW. At the broader energy level, IRENA’s 2024 statistics show renewable capacity grew by 473 GW in 2023, with solar additions alone around 346 GW. Every new rooftop system and every retrofit increases the number of DC circuits that must be installed cleanly, monitored well, and protected in a way that inspectors and insurers accept.

Food and beverage manufacturing is a strong “use case” for this opportunity because it combines big roofs, constant power demand, and low tolerance for disruptions. The USDA reports 42,708 food and beverage manufacturing establishments in the United States in 2022. Even a small share of these sites adopting rooftop PV, DC-coupled storage, or DC microgrids creates a large addressable base for DC AFCI-enabled equipment—especially where fire risk and business continuity are board-level concerns.

Government and public programs also help push upgrades forward. The U.S. DOE Better Plants program asks participating manufacturers to pledge a 25% energy-intensity reduction over 10 years, and provides technical support to help reach that goal. When plants chase efficiency and decarbonization, they often modernize electrical distribution and add onsite generation—creating natural decision points to specify safer DC protection architectures, including DC AFCIs.

Regional Insights

North America leads with 48.9% share and US$143.1 Mn market value in 2024, driven by strict safety codes and large retrofit demand

In 2024, North America held a commanding position in the direct current arc fault circuit interrupter market, capturing 48.9% of regional share and representing approximately US$143.1 million in value. This dominance was supported by stringent electrical safety standards and code evolution—notably National Electrical Code (NEC) expansions that increased requirements for arc-fault protection across residential and certain commercial occupancies—prompting broad adoption of AFCI solutions during new construction and panel upgrade cycles.

Strong residential market activity, high rates of home electrification projects, and accelerated installation of distributed DC systems created a dual demand stream: new panels in housing starts and retrofit installations in older stock. In 2024, manufacturers and electrical contractors prioritized panel-mounted and plug-on AFCI devices that offered simplified installation and compliance with inspection regimes, supporting higher average selling prices and faster unit turnover in North American channels.

Additional drivers included growing awareness of arc-fault fire risk, increased replacement of legacy breakers during service upgrades, and expanding deployment in institutional facilities where safety codes were strictly enforced. Supply-side responses included investments in product certification, improved detection algorithms, and targeted training for installers to reduce false trips and improve field reliability.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

General Electric maintains a presence in circuit protection through its grid and power distribution technologies. In 2024, GE generated revenues exceeding USD 68 billion, supporting electrical safety products for residential and commercial use. GE’s AFCI solutions benefit from strong brand recognition and established distribution networks.

Fonrich is an emerging player focused on DC protection devices, including arc fault circuit interrupters. In 2024, the company expanded its presence in Asia and Europe, supplying AFCI solutions for solar and DC power systems. Its products typically support voltage ratings above 100 V DC, targeting renewable applications.

Emerson Electric contributes to electrical safety through control and protection technologies, including AFCI-related components. In 2024, Emerson recorded revenues near USD 17 billion, with operations across 150+ countries. Its strength lies in integrating protection solutions within broader electrical and automation systems.

Top Key Players Outlook

- ABB

- Eaton

- Emerson Electric

- Fonrich

- General Electric

- Grote

- Honeywell

- Legrand

- Mersen

- Rockwell Automation

Recent Industry Developments

In 2024, Honeywell also actively aligns its offerings with updated safety standards such as the 2024 NFPA 70E, which guides electrical safety in the workplace; this alignment helps users better manage arc flash and arc fault risks by incorporating new definitions, safety practices, and equipment guidance into everyday work practices.

In 2024, Fonrich reported that its operations included 1 million units shipped, with installation capacity exceeding 60 GW of PV systems globally, and it successfully secured several million dollars in Series A funding to support growth and innovation efforts.

In 2024, Emerson Electric Co., a long-established U.S. industrial technology company founded in 1890 and reporting US $2.475 billion in revenue for fiscal 2025, is known more for broad industrial automation and electrical safety solutions rather than selling standalone Direct Current Arc Fault Circuit Interrupters (DC AFCIs) specifically, but it is recognised as a key player in the global DC AFCI landscape alongside major electrical protection vendors.

Report Scope

Report Features Description Market Value (2024) USD 292.7 Mn Forecast Revenue (2034) USD 1114.0 Mn CAGR (2025-2034) 14.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Plug-on AFCI Breakers, Load Center AFCI Breakers, Stand-alone AFCIs, Combination AFCIs), By Voltage Rating (120V AFCI, 240V AFCI), By Installation Type (Panel Mounted, In-Line, Embedded), By Current Rating (15 Amperes, 30 Amperes, 60 Amperes), By Application (Residential, Commercial, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB, Eaton, Emerson Electric, Fonrich, General Electric, Grote, Honeywell, Legrand, Mersen, Rockwell Automation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Direct Current Arc Fault Circuit Interrupter MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Direct Current Arc Fault Circuit Interrupter MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB

- Eaton

- Emerson Electric

- Fonrich

- General Electric

- Grote

- Honeywell

- Legrand

- Mersen

- Rockwell Automation