Global Dimethyl Sulphate Market Size, Share, And Business Benefit By Purity (Reagent Grade, Technical Grade), By Application (Chemical Intermediates (Alkylation Reactions, Methylation Reactions, Agrochemical Intermediates, Pharmaceutical Intermediates, Others), Dyes and Pigments, Film Coatings, Pesticides, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 165395

- Number of Pages: 253

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

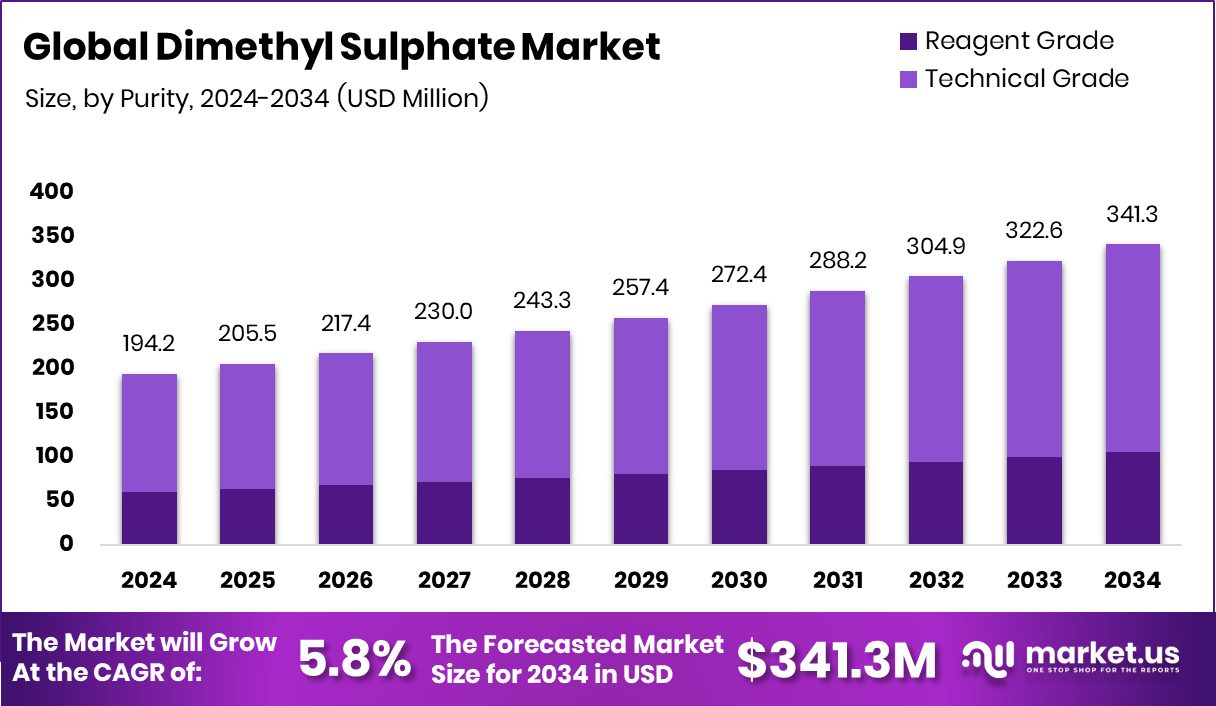

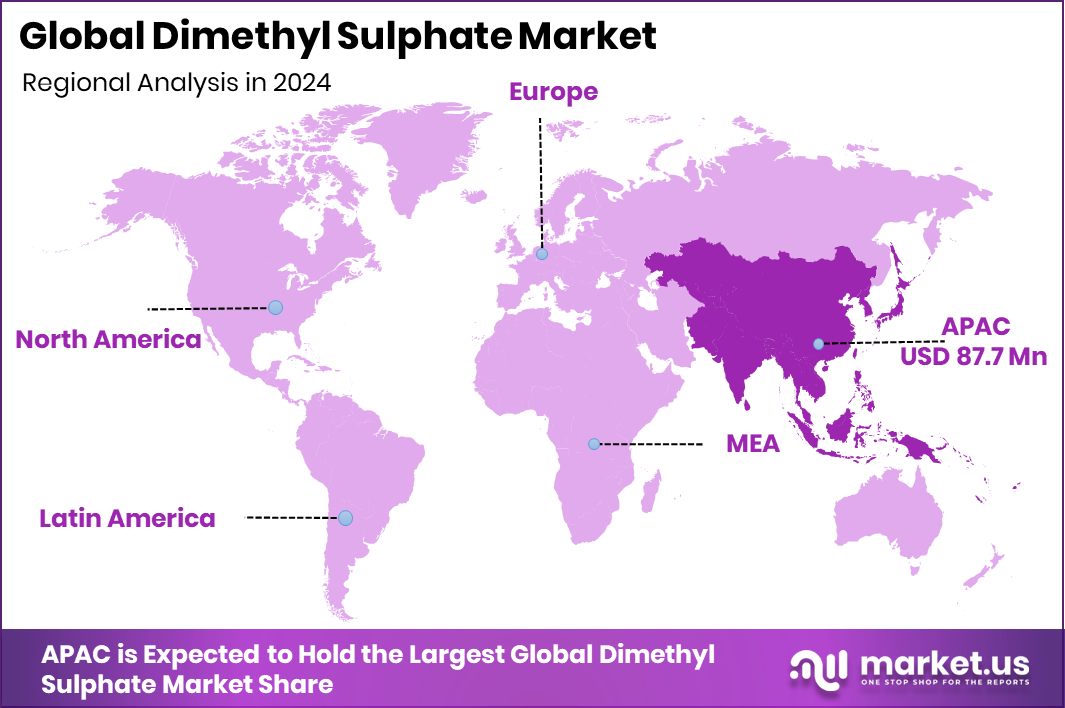

The Global Dimethyl Sulphate Market is expected to be worth around USD 341.3 million by 2034, up from USD 194.2 million in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034. Asia-Pacific’s industrial growth and chemical demand strongly supported its USD 87.7 Mn market value.

Dimethyl sulfate is a powerful chemical compound used mainly as a methylating agent in the production of dyes, pharmaceuticals, and agricultural chemicals. It is a colorless, oily liquid known for its strong reactivity. The compound plays a critical role in organic synthesis processes, especially in creating intermediates for surfactants and crop protection agents.

The global demand for high-performance agrochemicals and specialty chemicals drives the growth of dimethyl sulfate. The push toward efficient synthesis and improved yields in chemical industries encourages its use in methylation reactions. The sector gains additional momentum from recent agricultural and biopesticide funding, such as the US$37 million FARM program by CABI, India Pesticides’ ₹800 Cr IPO approval, BiocSol’s €5.2 M seed round, and SOLASTA Bio’s $14 M fund to scale peptide-based biopesticides.

Demand for dimethyl sulfate is increasing due to its importance in creating advanced pesticide intermediates and industrial additives. With agriculture and chemical manufacturing expanding globally, industries seek reliable methylating agents for cost-effective and precise synthesis. Recent developments in microbial and bio-based pesticide technologies further raise the requirement for methylation processes in formulation.

The market holds strong opportunities in developing safer handling techniques and greener methylation processes. Innovations in waste reduction and controlled reactivity can make Dimethyl Sulphate more sustainable. Additionally, ongoing global funding to reduce pesticide use and improve agricultural efficiency encourages producers to develop high-purity and low-emission variants, widening the scope for growth in this sector.

Key Takeaways

- The Global Dimethyl Sulphate Market is expected to be worth around USD 341.3 million by 2034, up from USD 194.2 million in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034.

- Technical grade dimethyl sulfate holds 69.3% market share and is widely used for industrial and synthesis purposes.

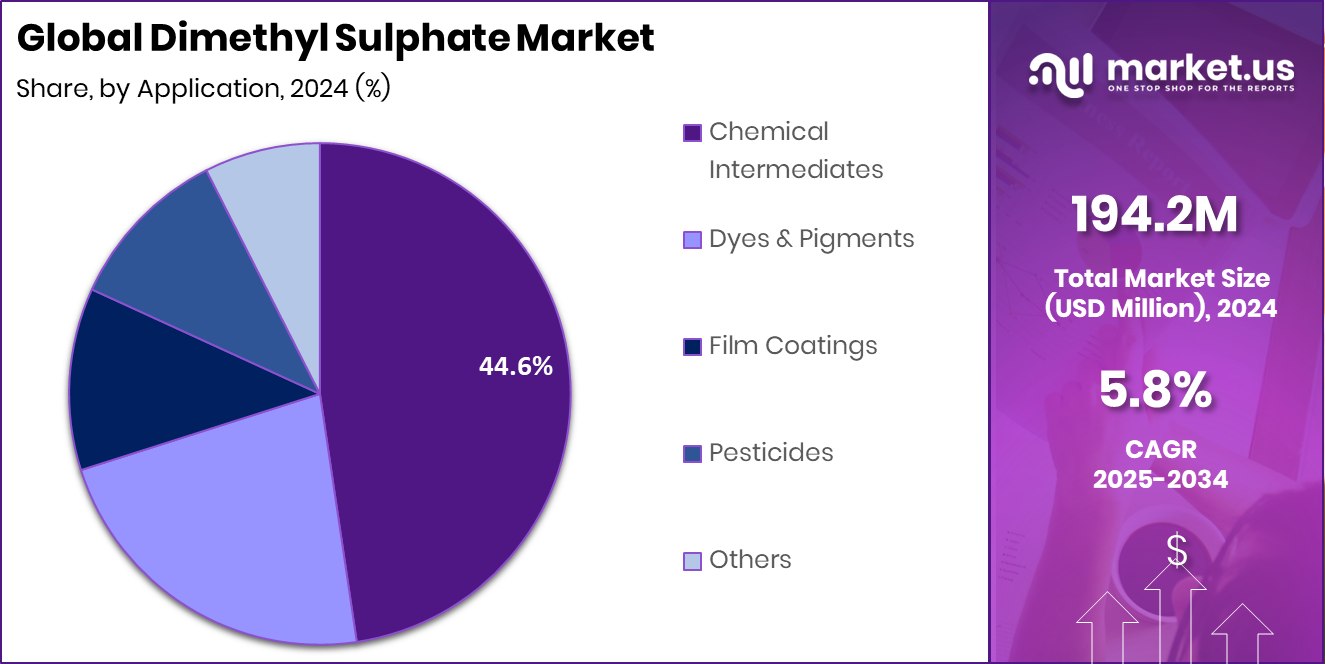

- Chemical intermediates dominate 44.6% share, making dimethyl sulfate crucial in creating advanced organic compounds.

- The Asia-Pacific recorded a total valuation of USD 87.7 million that year.

By Purity Analysis

The dimethyl sulfate market sees dominance from the technical grade with a 69.3% share.

In 2024, Technical Grade held a dominant market position in the By Purity segment of the Dimethyl Sulphate Market, accounting for a 69.3% share. This dominance reflects its extensive use in industrial synthesis processes, particularly in agrochemicals, dyes, and pharmaceutical intermediates. The technical grade variant offers high efficiency in methylation reactions, making it suitable for large-scale manufacturing where consistency and performance are essential.

Its wide acceptance across production facilities is driven by cost-effectiveness and compatibility with existing chemical synthesis systems. The growing demand for high-purity reagents in industrial and agricultural applications further supports its leadership in the market, positioning Technical Grade as the preferred choice among manufacturers in 2024.

By Application Analysis

The dimethyl sulfate market thrives through the chemical intermediates segment, holding a 44.6% share.

In 2024, Chemical Intermediates held a dominant market position in the By Application segment of the Dimethyl Sulphate Market, capturing a 44.6% share. This strong position is attributed to its vital role in producing a wide range of downstream chemicals, including agrochemical and pharmaceutical intermediates. Chemical intermediates serve as essential building blocks in methylation reactions, enabling the synthesis of active compounds and specialty materials.

The extensive use of dimethyl sulfate in creating intermediates for dyes, surfactants, and industrial additives reinforces its prominence. Increasing industrial demand for efficient and high-performance reagents further supports the segment’s dominance, making chemical intermediates a critical driver of the dimethyl sulphate market’s overall growth in 2024.

Key Market Segments

By Purity

- Reagent Grade

- Technical Grade

By Application

- Chemical Intermediates

- Alkylation Reactions

- Methylation Reactions

- Agrochemical Intermediates

- Pharmaceutical Intermediates

- Others

- Dyes and Pigments

- Film Coatings

- Pesticides

- Others

Driving Factors

Rising Agrochemical Production Strengthens Dimethyl Sulphate Demand

A key driving factor for the Dimethyl Sulphate market is the steady rise in global agrochemical production. Dimethyl Sulphate plays a vital role as a methylating agent in manufacturing pesticide intermediates and crop-protection chemicals. With agriculture expanding and farmers seeking efficient solutions to increase yield, the demand for advanced agrochemicals continues to grow. This trend is supported by strong government and institutional efforts toward safer and more sustainable farming practices.

For example, the UM Bio Station recently received a $6.6 million EPA grant to fight pesticide pollution, which highlights rising environmental attention. Such initiatives promote cleaner production technologies, indirectly supporting the use of dimethyl sulfoxide in optimized and controlled synthesis processes across agrochemical manufacturing.

Restraining Factors

Health and Environmental Risks Limit Market Expansion

One major restraining factor for the Dimethyl sulfoxide market is its high toxicity and strict handling requirements. The compound is known for being hazardous to human health and the environment, which limits its widespread use.

Many industries are now adopting safer or bio-based alternatives to reduce chemical exposure and contamination risks. Regulatory authorities continue to tighten safety standards and environmental laws, increasing compliance costs for producers and users of Dimethyl Sulphate.

At the same time, new investments are being directed toward safer pesticide innovations. For example, the Gates Foundation led a $45 million funding round for the pesticide venture Enko, emphasizing the shift toward less toxic and more sustainable chemical solutions in the agricultural sector.

Growth Opportunity

Advancements in Safe Chemical Handling Create Opportunities

A major growth opportunity for the dimethyl sulfate market lies in the development of safer handling and exposure control technologies. As awareness grows about the health effects of chemical exposure, industries are investing in better protective systems and cleaner production methods. This shift encourages innovation in containment, automated dosing, and low-emission processes for hazardous reagents like Dimethyl Sulphate.

Research funding also supports this direction—for instance, an $11 million NIH grant was awarded to study the link between chemical exposure and dementia risk. Such initiatives promote safer industrial environments and strengthen demand for controlled-use chemicals. Manufacturers focusing on improved safety standards and eco-friendly synthesis processes can capture significant long-term growth opportunities.

Latest Trends

Government Tax Incentives Shape Market Dynamics

A major trend in the Dimethyl Sulphate market is the influence of government tax incentives on agrochemical production. Policy decisions, especially in major agricultural economies, directly affect chemical demand and pricing structures.

For instance, Brazil’s tax exemptions on pesticides, amounting to about US$2.2 billion per year, have significantly lowered production costs for agricultural inputs. This encourages higher chemical consumption for crop protection, indirectly supporting upstream reagents like Dimethyl Sulphate used in pesticide synthesis.

Such fiscal benefits allow manufacturers to expand capacity and invest in efficiency improvements. As a result, the market is witnessing steady adoption in developing regions, where supportive policies and subsidies drive both affordability and industrial growth, shaping long-term trends in chemical manufacturing and trade.

Regional Analysis

In 2024, the Dimethyl Sulphate Market in Asia-Pacific held a 45.2% share.

In 2024, the Dimethyl Sulphate Market showed strong regional diversity, with Asia-Pacific emerging as the dominant region, holding a 45.2% share valued at USD 87.7 million. The region’s dominance is supported by expanding chemical manufacturing industries in countries such as China, India, and Japan, where demand for agrochemicals, dyes, and pharmaceutical intermediates continues to grow rapidly.

North America maintained a steady presence due to consistent utilization in specialty chemical production and industrial processing. Europe followed closely, emphasizing sustainable synthesis and safer handling techniques under strict environmental regulations. The Middle East & Africa region witnessed gradual growth, mainly driven by industrialization and emerging agricultural applications.

Latin America demonstrated potential expansion opportunities due to agricultural diversification and the increasing adoption of methylating agents in crop protection formulations. Together, these regional performances highlight Asia-Pacific’s leading influence and its key role in driving global Dimethyl Sulphate consumption, supported by robust industrial infrastructure and strong downstream chemical demand.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Evonik Industries AG maintained its focus on optimizing methylation chemistry for specialty intermediates and expanding safe-handling processes in chemical synthesis. The company’s expertise in precision chemicals supported a consistent supply for agrochemical and pharmaceutical manufacturers.

LANXESS AG strengthened its market presence by improving product safety and advancing environmental compliance across its chemical portfolio, ensuring stable output for industrial users.

BASF SE continued to prioritize innovation in efficient synthesis methods and emission control systems, aligning with global sustainability goals. Collectively, these companies demonstrate strong technical leadership and operational discipline in maintaining the reliability and environmental responsibility of Dimethyl Sulphate production.

Their focus on greener process technologies and high-purity formulations reflects a long-term strategy to balance productivity with safety and sustainability, which remains essential for the market’s evolution in 2024.

Top Key Players in the Market

- Evonik Industries AG

- LANXESS AG

- BASF SE

- Aarti Industries Limited

- Angene International Limited

- Anhui Jin’ao Chemical Co., Ltd.

- Others

Recent Developments

- In March 2025, BASF reported that in 2024 the company generated approximately €11 billion in sales from products launched over the past five years, with around 45 % of its 1,159 new patent applications focused on sustainability. This underscores BASF’s push into innovative, greener chemistries.

- In February 2024, LANXESS completed an expansion of its Rhenodiv® production plant at its Jhagadia site in India. The new production line is part of the Rhein Chemie business unit and is designed to boost capacity for rubber goods and tyre industry applications in the Indian sub-continent and wider Asian markets. The new facility uses modern equipment and is water-based and solvent-free, aligning with cleaner production practices.

Report Scope

Report Features Description Market Value (2024) USD 194.2 Million Forecast Revenue (2034) USD 341.3 Million CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (Reagent Grade, Technical Grade), By Application (Chemical Intermediates (Alkylation Reactions, Methylation Reactions, Agrochemical Intermediates, Pharmaceutical Intermediates, Others), Dyes and Pigments, Film Coatings, Pesticides, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Evonik Industries AG, LANXESS AG, BASF SE, Aarti Industries Limited, Angene International Limited, Anhui Jin’ao Chemical Co., Ltd., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Dimethyl Sulphate MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Dimethyl Sulphate MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Evonik Industries AG

- LANXESS AG

- BASF SE

- Aarti Industries Limited

- Angene International Limited

- Anhui Jin'ao Chemical Co., Ltd.

- Others