Global Diatomite Market Size, Share Analysis Report By Type (Calcined, Flux-Calcined, Natural), By Application (Filter Aids, Cementitious Materials, Fillers, Absorbents, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160800

- Number of Pages: 356

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

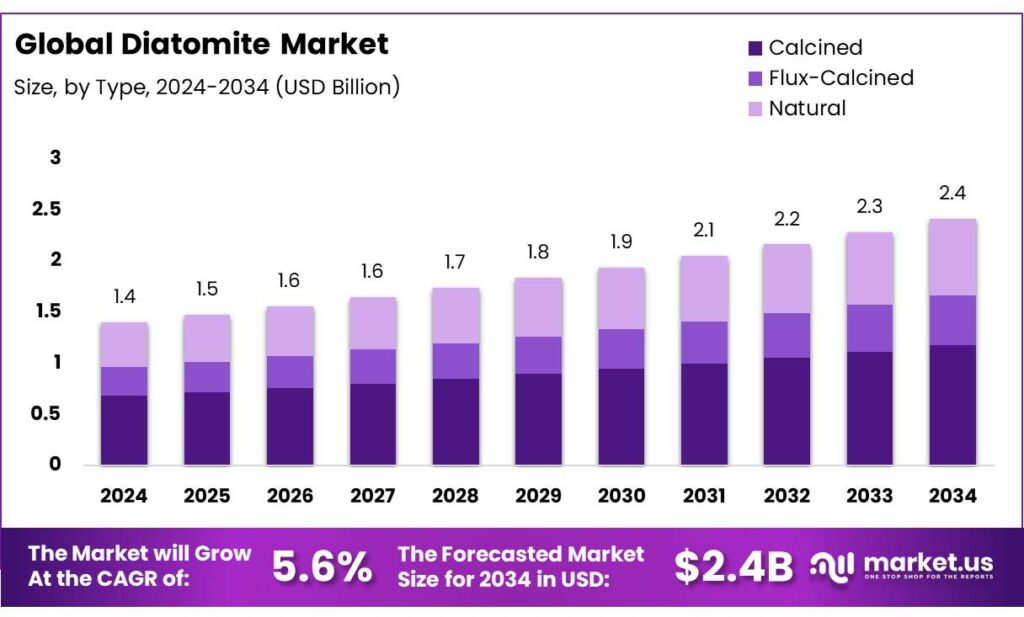

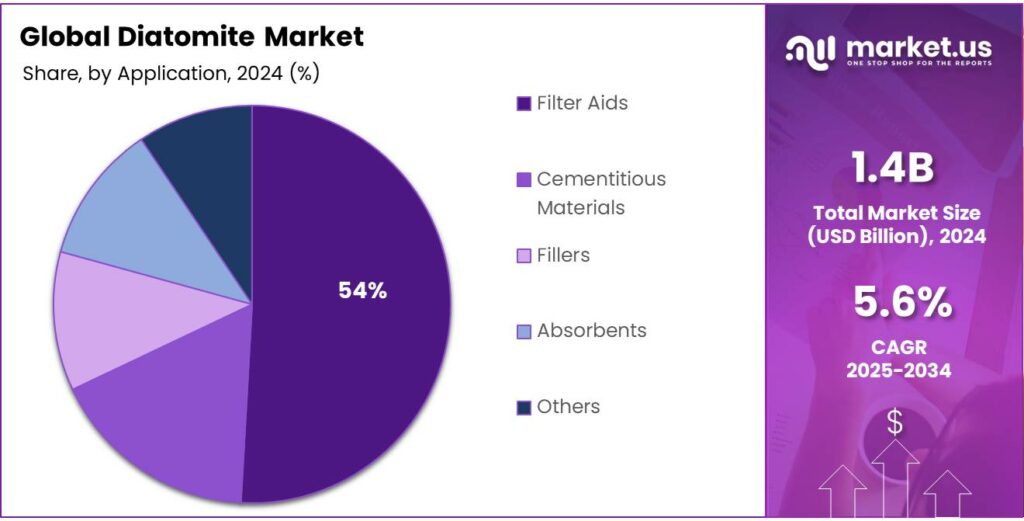

The Global Diatomite Market size is expected to be worth around USD 2.4 Billion by 2034, from USD 1.4 Billion in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034.

Diatomite, also known as diatomaceous earth, is a naturally occurring, soft, siliceous sedimentary rock comprised primarily of fossilized remains of diatoms (photosynthetic algae). It is characterized by high porosity, low density, chemical inertness, and good thermal insulation. The material finds use across filtration, absorbents, fillers, lightweight aggregates, pest control, and even specialized pharma/biomedical segments.- According to the U.S. Geological Survey, in 2023 U.S. production was about 830,000 metric tons with a processed value of roughly US$340 million. In 2024, U.S. production was estimated to increase to 880,000 tons, with an f.o.b. value of about US$520 million, and about 65 % of output was consumed in filtration applications. Supply-side structure is characterized by a small number of producers with integrated mining and processing facilities, and by regional hubs in North America, Europe, China and Latin America.

Several key drivers underpin growth in the diatomite industry. First, the rising demand in water and wastewater treatment sectors is pushing filter-media demand, especially under increasingly strict environmental regulations. Second, the agriculture and allied sector is adopting diatomite for organic pest management, soil conditioning, and feed additives, leveraging its non-chemical, eco-friendly profile. Third, growth in beverage, pharmaceutical, and chemical processing industries is fueling demand for high-grade filtration aids.

On the policy/government side, while diatomite is not often singled out as a strategic mineral, its upstream resource lies within mining policy frameworks. In India, for instance, the government launched a National Critical Mineral Mission (NCMM) in 2025, under which the Geological Survey of India (GSI) is to undertake 1,200 exploration projects between 2024–25 and 2030–31. Though diatomite was not explicitly named among the 30 critical minerals, the broader push toward mineral self-reliance and streamlined exploration could benefit associated mineral sectors. The Indian government also created a joint venture, Khanij Bidesh India Limited (KABIL), to explore and secure strategic minerals overseas.Key Takeaways

- Diatomite Market size is expected to be worth around USD 2.4 Billion by 2034, from USD 1.4 Billion in 2024, growing at a CAGR of 5.6%.

- Calcined diatomite held a dominant market position, capturing more than a 48.9% share of the global diatomite market.

- Filter Aids held a dominant market position, capturing more than a 54.5% share of the global diatomite market.

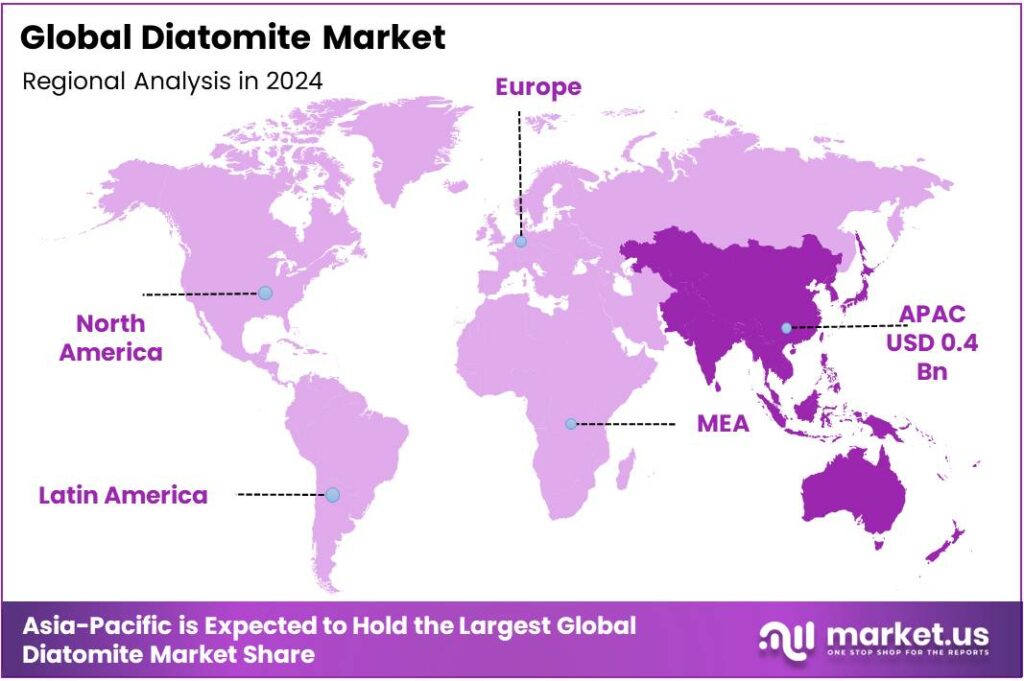

- Asia-Pacific (APAC) region held a dominant position in the global diatomite market, capturing more than a 34.8% share, which was valued at approximately USD 0.4 billion.

By Type Analysis

Calcined Diatomite Leads the Market with 48.9% Share Owing to Its Enhanced Filtration and Thermal Stability

In 2024, Calcined diatomite held a dominant market position, capturing more than a 48.9% share of the global diatomite market. The strong performance of this segment can be attributed to its superior filtration efficiency, high brightness, and excellent thermal stability, which make it suitable for a wide range of industrial applications. Calcined diatomite is widely used in filtration processes for beverages, chemicals, and pharmaceuticals, as well as in catalyst support, insulation materials, and paint formulations. The calcination process removes organic impurities and enhances the product’s porosity, improving its performance in demanding industrial environments.

During 2024, the demand for calcined grades was primarily supported by growth in the beverage and water treatment industries, where effective and consistent filtration is critical. With global filtration applications continuing to expand, particularly in food and chemical manufacturing, the consumption of calcined diatomite increased steadily. In 2025, the segment is expected to maintain its leading position as industries shift toward high-performance filter aids and thermally stable fillers. Additionally, the expansion of construction and coating industries across Asia-Pacific and North America is expected to further boost the usage of calcined diatomite in thermal insulation and as a lightweight filler material.

By Application Analysis

Filter Aids Segment Dominates with 54.5% Share Driven by Strong Demand in Industrial Filtration Applications

In 2024, Filter Aids held a dominant market position, capturing more than a 54.5% share of the global diatomite market. This leadership was largely due to the extensive use of diatomite as a filtration medium across industries such as beverages, pharmaceuticals, food processing, and chemicals. The natural porosity and high surface area of diatomite make it highly effective in removing fine particles and impurities, ensuring clarity and quality in final products. In particular, breweries, wineries, and water treatment facilities accounted for a significant portion of this demand, as diatomite filter aids are valued for their consistent performance and chemical inertness.

Throughout 2024, the market witnessed steady consumption growth supported by rising industrial output and stricter quality standards for liquid filtration. The use of diatomite-based filter aids in wastewater treatment and edible oil refining also contributed to its dominant share. In 2025, the segment is expected to retain its leading position, driven by the ongoing expansion of the food and beverage processing sector and increased focus on sustainable and efficient filtration technologies. Moreover, industries are gradually replacing synthetic filtration materials with natural and environmentally friendly alternatives like diatomite, further strengthening this segment’s market position.

Key Market Segments

By Type

- Calcined

- Flux-Calcined

- Natural

By Application

- Filter Aids

- Cementitious Materials

- Fillers

- Absorbents

- Others

Emerging Trends

Rise of Wastewater Reuse and Circular Water Economy in Food & Beverage

One of the clearest, most meaningful trends seen lately is the strong shift toward wastewater reuse and circular water systems, especially in food and beverage operations. It’s not just about treating water; it’s about treating it well enough to reuse it, closing loops, and reducing waste. For the diatomite industry, this matters because diatomite is often used as a filter or absorbent in water treatment stages—so more reuse means more demand for reliable, safe filtration materials.

Food & beverage plants generate a lot of wastewater—from washing produce, rinsing equipment, cooling, cleaning, etc. Instead of just sending that water out, many companies now prefer to reclaim it. According to the Food and Agriculture Organization (FAO), better water and wastewater practices can boost a plant’s resource efficiency by up to 30%. In practice, that means less fresh water needed, lower discharge, and higher internal reuse.

In India, this trend is being pushed by policy too. Under India’s “bulk consumer” regulations, water users that consume more than 5,000 liters daily are being mandated to reuse 50% of their wastewater by 2031. Also, the recent Liquid Waste Management Rules (2024) set staged targets: new societies, industries, etc. must begin reuse. These legal nudges are making reuse not just a choice, but often a requirement.

Another interesting statistic: studies suggest that if 80 % of urban wastewater could be treated by 2030, the volume of reclaimed water available would increase by 400 % over current levels. That kind of growth in reclaimed supply will push demand for filtering, pretreatment, polishing — spaces where diatomite is well placed.

Drivers

Surge in Food & Beverage Industry’s Demand for Efficient Water Treatment and Recycling

In food and beverage manufacturing, water is used in many ways: washing, blanching, cooling, cleaning equipment, ingredient dissolution, packaging. Because of that, factories produce large volumes of wastewater laden with organic matter, residual oils, suspended particles, microbes. To meet regulatory limits (and to protect consumers), the waste streams must be cleaned, filtered, and often recycled. Traditional biological treatment cannot remove all fine particulates or colloids; that’s where filtration media like diatomite become indispensable. Diatomite is effective in fine particulate removal, high porosity, and safe for food-grade or low-contamination uses.

From a governance and policy viewpoint, governments are tightening wastewater rules, pushing industrial players to treat and reuse more water. In India, for example, the liquid waste management rules of 2024 propose that food and beverage facilities must reuse at least 20 % of their wastewater by 2027–28, with the target rising further in subsequent years. This kind of enforced reuse mandate compels the food industry to pick robust filtration systems, boosting demand for filtration media like diatomite.

Another piece of data: the food, beverage, and agricultural sector together account for 75–80 % of global water use. That means any efficiency gain or reuse in that sector has outsized impact. When a food plant employs better filtration, it reduces fresh water draw, cuts disposal costs, and can reuse treated water for non-critical operations — making diatomite a preferred choice as a filter medium due to its cost, performance, and adaptability.

From a human perspective, the food & beverage industry is under pressure: consumers care about “clean, safe, sustainable food,” and regulators enforce stricter effluent norms. Factories can’t afford shutdowns over violations, so they invest in technologies that are dependable and proven. Diatomite fits into that role as a reliable filtration medium that has decades of track record.

Restraints

Health, Safety & Regulatory Burdens of Silica Exposure

One critical brake on the growth of the diatomite (diatomaceous earth) industry is the health and regulatory risk associated with silica dust exposure. This may sound technical, but at its heart it’s about people’s lungs, safety, and stricter rules — and that can slow down production, raise costs, and limit where and how diatomite can be used.

Diatomite is largely made of amorphous silica, which is less hazardous than crystalline silica. Yet, processing, calcining, or handling can convert part of it into crystalline forms (e.g. cristobalite), which are known to cause serious respiratory diseases. In some diatomaceous earth after calcination, the crystalline content may range from 1 % up to 75% depending on temperature and process.

In 2024, the U.S. Department of Labor’s Mine Safety and Health Administration (MSHA) introduced a final rule lowering allowable limits of respirable crystalline silica to 50 µg/m³, prompting mining operators to adopt stronger engineering controls and monitoring.

These regulations force companies in mining, milling, and handling of diatomite to invest in dust control systems, ventilation, personal protective equipment (PPE), monitoring systems, health surveillance, and compliance programs. For smaller producers, such cost burdens can be heavy, squeezing margins or deterring operations in marginal deposits. The cost to retrofit existing plants with dust control and ventilation systems is nontrivial and may delay expansion plans.

From a human perspective, workers in mining and processing plants worry about long-term exposure. Diseases such as silicosis, lung cancer, chronic bronchitis, and kidney disease are well documented in occupational health studies of silica exposure. These risks heighten scrutiny by regulators, unions, and public health bodies, especially in jurisdictions with stronger health enforcement. Companies may face sanctions, fines, or litigation if exposure limits are breached.

Opportunity

Expansion through Water Reuse & Circular Economy in Food & Beverage Sector

This trend creates direct demand for filtration aids — precoat filters, polishing media, adsorbents — in which diatomite is commonly used. Because diatomite is relatively low cost, chemically inert, and has good porosity, it fits well in many filtration circuits, especially in first stages or polishing.

These policy mandates essentially force many food and beverage units to upgrade or install wastewater recovery and filtration systems — opening a market for filtration media and consumables like diatomite. The fact that only 28% of India’s urban wastewater is currently treated (and less reused) underscores how large the unserved opportunity is.

Another supporting piece: in certain Indian states, policies and infrastructure are aligning to support water circularity. For example, Maharashtra recently approved a policy to process and reuse sewage and wastewater across 424 urban local bodies, with a ₹500 crore budget, emphasizing reuse in industrial and urban settings. These state-level moves help build acceptance, regulatory confidence, and precedent for reuse approaches that industries can follow.

From the human side, manufacturers face public scrutiny, risks of non-compliance fines, and consumer pressure for sustainable operations. Many food brands now emphasize “sustainability” and “net zero water footprint” in their narratives. If a company can say, “We treat and reuse most of our water,” that can be a brand differentiator. Diatomite producers who tie themselves into that narrative — by offering food-grade, low-leach, certified filter media with warranties and safety assurances — can ride this wave.

Regional Insights

Asia-Pacific Leads the Global Diatomite Market with 34.8% Share Valued at USD 0.4 Billion

In 2024, the Asia-Pacific (APAC) region held a dominant position in the global diatomite market, capturing more than a 34.8% share, which was valued at approximately USD 0.4 billion. The region’s leadership can be attributed to the strong expansion of end-use industries such as food and beverage processing, water treatment, construction, and coatings.

Countries such as China, India, Japan, and Indonesia are key contributors to regional demand due to rapid industrialization and increasing environmental management activities. China, in particular, remains the largest producer and consumer of diatomite in the region, supported by abundant natural deposits and extensive use in filtration and absorbent applications.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Imerys is a global specialist in mineral-based functional materials, including diatomite, with a strong focus on filtration, absorbents, and functional fillers. In January 2025, Imerys completed its acquisition of Chemviron’s European diatomite and perlite business, which in 2024 had generated approximately €50 million in revenue and employed ~130 people. Imerys uses this acquisition to strengthen its product portfolio serving food, beverage, pharmaceutical, and filtration sectors, expanding its European footprint.

Dicalite is a vertically integrated industrial minerals company with a platform spanning diatomaceous earth, perlite, and vermiculite. It operates 5 mines and 12 processing/refining/packaging facilities across the U.S. and Europe. Founded in 1928, it supplies filter aids, fillers, and functional additives for food & beverage, water treatment, construction, horticulture, and other industrial markets. The company emphasizes purity, consistency, and proximity to customers due its geographically dispersed sites.

EP Minerals, owned by U.S. Silica, produces high-quality diatomite, perlite, and clay minerals. Its “Celatom” grade diatomite deposits are composed largely of freshwater diatoms, particularly Aulacoseira species, offering high performance as filter aids and functional additives. The company’s products serve many industries including food & beverage, biofuel, water treatment, paints, plastics, and insecticides. It maintains a global distribution network, shipping to nearly 100 countries, backed by substantial ore reserves and multiple manufacturing sites.

Top Key Players Outlook

- Imecarys

- EP Minerals

- Showa Chemical Industry Co., Ltd.

- Calgon Carbon Corporation

- Dicalite Management Group, LLC

- Diatomit CJSC

- JiLin Yuantong Mineral Co., Ltd.

- Reade International Corp.

- Seema Minerals & Metals

Recent Industry Developments

In 2024, Dicalite Management Group operated 5 mining complexes and 12 processing, refining, and packaging facilities, for a total of 17 facilities across North America and Europe.

In 2024, Calgon Carbon’s European division, Chemviron, was under negotiation to sell its diatomite and perlite business to Imerys. This Chemviron diatomite & perlite business had generated €50 million in revenue and employed around 130 people.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Bn Forecast Revenue (2034) USD 2.4 Bn CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Calcined, Flux-Calcined, Natural), By Application (Filter Aids, Cementitious Materials, Fillers, Absorbents, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Imecarys, EP Minerals, Showa Chemical Industry Co., Ltd., Calgon Carbon Corporation, Dicalite Management Group, LLC, Diatomit CJSC, JiLin Yuantong Mineral Co., Ltd., Reade International Corp., Seema Minerals & Metals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Imecarys

- EP Minerals

- Showa Chemical Industry Co., Ltd.

- Calgon Carbon Corporation

- Dicalite Management Group, LLC

- Diatomit CJSC

- JiLin Yuantong Mineral Co., Ltd.

- Reade International Corp.

- Seema Minerals & Metals