Global Cyclopentanone Market Size, Share Analysis Report By Grade (High-Purity Cyclopentanone, Industrial-Grade Cyclopentanone), By Application (Pharmaceuticals, Agriculture, Flavors And Fragrances, Polymers And Resins, Others), By Sales Channel (Direct Sales, Indirect Sales) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 163804

- Number of Pages: 398

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

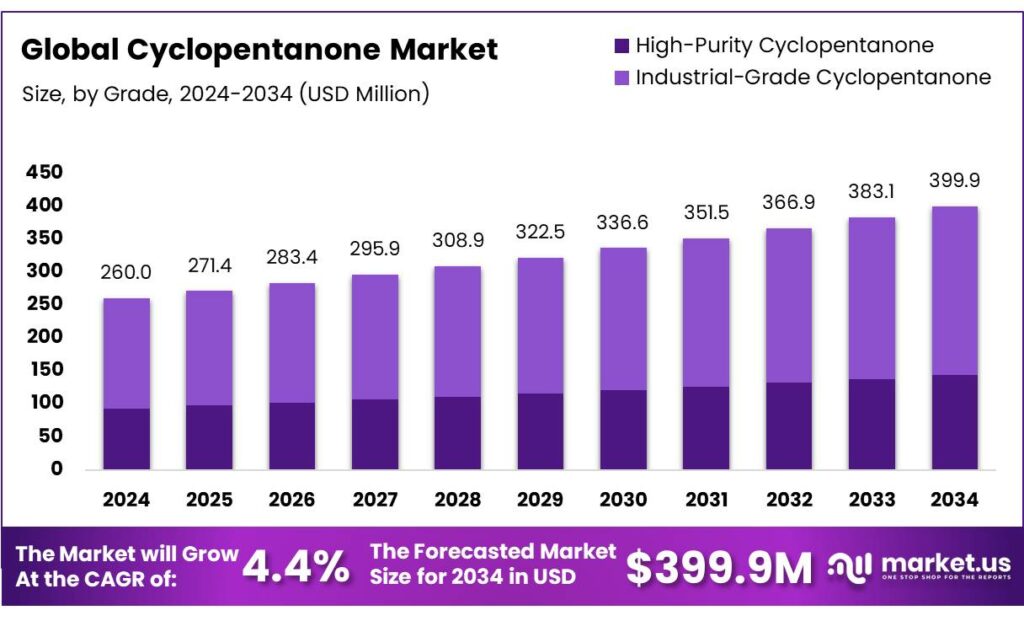

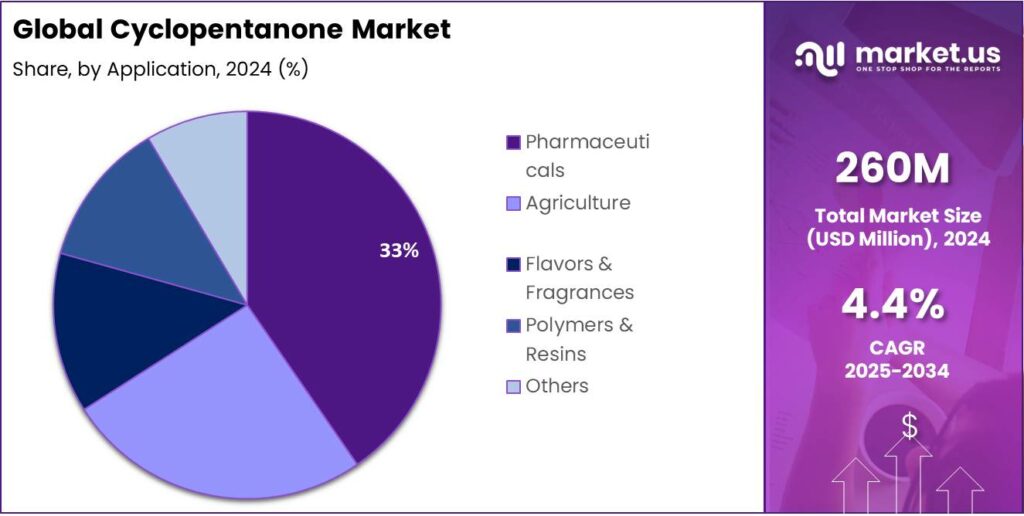

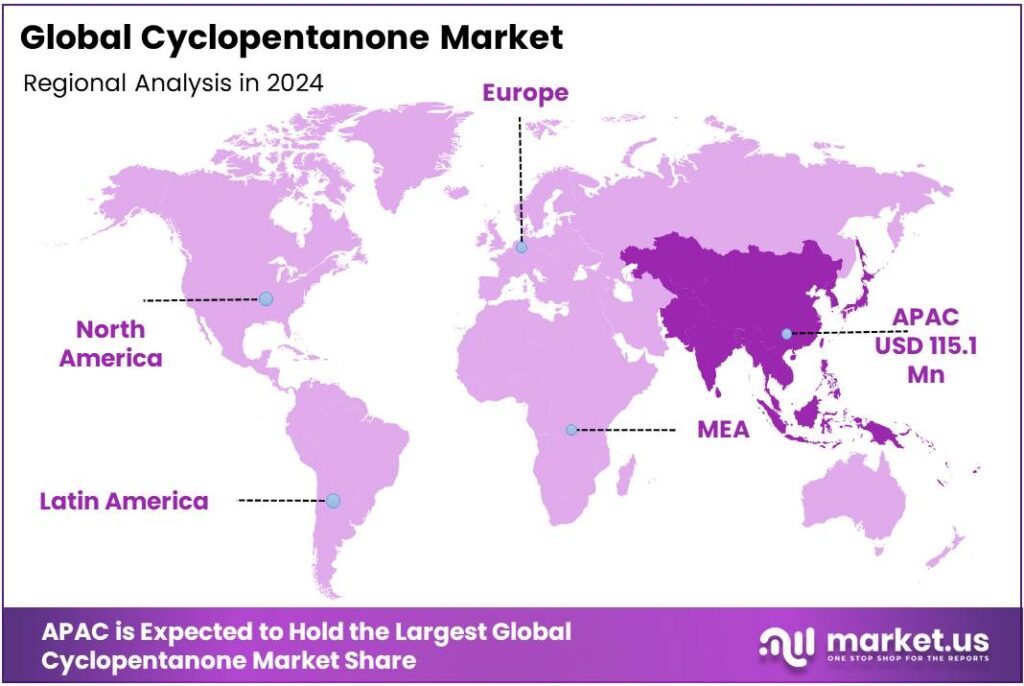

The Global Cyclopentanone Market size is expected to be worth around USD 399.9 Million by 2034, from USD 260.0 Million in 2024, growing at a CAGR of 4.4% during the forecast period from 2025 to 2034. In 2024 Asia-Pacific (APAC) held a dominant market position, capturing more than a 44.3% share, holding USD 115.1 Million in revenue.

Cyclopentanone is a niche C5 ketone used as a high-purity solvent and an intermediate in pharmaceuticals, flavors & fragrances, crop-protection actives, and specialty polymers. Its demand is closely tied to the broader petrochemical and fine-chemicals value chain. Strategically, producers site capacity near cracker and refinery hubs to access naphtha/LPG-derived C5 streams or develop catalytic routes from bio-platforms.

The backdrop is supportive: petrochemicals are set to account for over one-third of global oil-demand growth by 2030 and nearly half by 2050, underscoring durable feedstock availability and integration economics for solvents and ketones like cyclopentanone.

- The industrial context is robust yet cost-sensitive. In 2023, world chemical sales totaled €5,195 billion, with EU-27 sales at €655 billion; the European industry also reports ~1.2 million workers and €10.2 billion in R&I investments, reflecting a deep customer base for pharmaceutical, agrochemical, and fragrance intermediates where cyclopentanone participates.

Energy remains a defining input: in the United States, the industrial sector consumed 35% of total end-use energy in 2022, and within manufacturing the chemicals subsector is a leading energy user, highlighting exposure of ketone producers to power and fuel prices. Globally, petrochemicals are also poised to consume an additional 56 billion m³ of natural gas by 2030, a signal of sustained feedstock-energy coupling for organic solvents manufacturing.

Current drivers include downstream demand in regulated applications and integration with refinery/petchem systems. The IEA estimates that, of ~10 million b/d oil-demand growth to 2030, the chemical sector accounts for more than one-third, reinforcing long-run availability of naphtha/LPG streams that underpin C5 ketone production. On the cost side, DOE/EIA analyses show the chemicals industry’s substantial energy share and feedstock intensity, so energy-efficiency and electrification projects directly improve ketone margins.

Policy and capex cycles provide multiple growth avenues. India’s Production-Linked Incentive programs—designed to deepen manufacturing value-addition and exports—carry an aggregate outlay of ₹1.97 lakh crore across 14 sectors, while investments of ₹1.32 lakh crore had materialized by June 2024; such schemes catalyze local sourcing of solvents/intermediates for pharma and agrochemicals, favoring cyclopentanone capacity and import substitution

Key Takeaways

- Cyclopentanone Market size is expected to be worth around USD 399.9 Million by 2034, from USD 260.0 Million in 2024, growing at a CAGR of 4.4%.

- Industrial-Grade Cyclopentanone held a dominant market position, capturing more than a 64.9% share of the global market.

- Pharmaceuticals held a dominant market position, capturing more than a 33.2% share of the global cyclopentanone market.

- Direct Sales held a dominant market position, capturing more than a 67.3% share of the global cyclopentanone market.

- Asia-Pacific (APAC) region held a dominant position in the global cyclopentanone market, accounting for 44.30% of total revenue, valued at approximately USD 115.1 million.

By Grade Analysis

Industrial-Grade Cyclopentanone dominates with 64.9% share owing to its large-scale industrial demand

In 2024, Industrial-Grade Cyclopentanone held a dominant market position, capturing more than a 64.9% share of the global market. This strong share reflects the compound’s extensive utilization across large-scale manufacturing processes, including agrochemicals, pharmaceuticals, and specialty solvent production. Industrial-grade material remains the preferred choice for bulk users due to its cost-effectiveness and suitability for intermediate synthesis in fine chemicals and coatings. The consistent performance of industrial-grade cyclopentanone in oxidation and hydrogenation processes has ensured steady consumption by chemical manufacturers.

In 2025, the demand for industrial-grade cyclopentanone is expected to witness a moderate rise, driven by expanding pharmaceutical intermediate manufacturing and growing solvent applications in Asia-Pacific and Europe. The segment’s resilience is further supported by increasing investments in specialty chemical production and industrial infrastructure. Industrial users continue to rely on this grade for large-batch processing, owing to its balance between purity, performance, and economic viability. As a result, industrial-grade cyclopentanone is projected to maintain its leading market position through the forecast period, underpinning the overall stability and growth of the global cyclopentanone market.

By Application Analysis

Pharmaceuticals dominate with 33.2% share driven by rising demand for chemical intermediates

In 2024, Pharmaceuticals held a dominant market position, capturing more than a 33.2% share of the global cyclopentanone market. This dominance is mainly attributed to the compound’s critical role as an intermediate in the synthesis of active pharmaceutical ingredients and fine chemicals. Cyclopentanone’s strong solvency and reactivity make it suitable for producing a variety of drug intermediates, including hormones, antibiotics, and specialty compounds. The rising global focus on drug innovation, coupled with expansion in generics and contract manufacturing, has supported the consistent demand for pharmaceutical-grade cyclopentanone.

By 2025, the pharmaceutical application segment is expected to show stable growth, supported by increasing R&D expenditure and ongoing investments in advanced synthesis technologies. The compound’s use in developing complex molecular structures continues to drive procurement from pharmaceutical producers in Asia-Pacific and Europe. Growing healthcare needs and stronger manufacturing capabilities in emerging markets further enhance the segment’s outlook. As a result, cyclopentanone’s role in pharmaceutical synthesis remains one of the key contributors to its overall market expansion, ensuring sustained demand across global production networks.

By Sales Channel Analysis

Direct Sales dominate with 67.3% share due to strong supplier–manufacturer partnerships

In 2024, Direct Sales held a dominant market position, capturing more than a 67.3% share of the global cyclopentanone market. This dominance reflects the preference of chemical manufacturers and industrial end-users to procure cyclopentanone directly from producers, ensuring better pricing, quality assurance, and consistent supply. Direct transactions enable suppliers to build long-term relationships with major buyers in pharmaceuticals, agrochemicals, and specialty solvents, minimizing dependence on third-party distributors. The direct sales model also supports customized logistics and technical assistance, which are critical for handling high-purity and industrial-grade variants.

By 2025, the share of direct sales is expected to remain strong, supported by expanding production facilities and increasing demand from large-scale industrial consumers. The growing integration of digital procurement channels by key chemical producers has further simplified bulk transactions, enhancing transparency and supply efficiency. Direct supply chains also allow better management of pricing volatility and regulatory compliance across regions. As industries continue to prioritize reliability and cost control, the direct sales channel is likely to retain its leading role in the global cyclopentanone distribution landscape.

Key Market Segments

By Grade

- High-Purity Cyclopentanone

- Industrial-Grade Cyclopentanone

By Application

- Pharmaceuticals

- Agriculture

- Flavors & Fragrances

- Polymers & Resins

- Others

By Sales Channel

- Direct Sales

- Indirect Sales

Emerging Trends

compliance-first flavours reshape specs and sourcing for cyclopentanone

Food brands are tightening flavour systems to satisfy two forces that now move together: stricter government approvals and consumers asking for simpler labels. This is changing how formulators specify aroma building blocks such as cyclopentanone (used to build creamy, fruity, minty notes). On the consumer side, the International Food Information Council (IFIC) reports confidence in the U.S. food supply fell to 62% in 2024 (down from 70% in 2022)—a signal that shoppers scrutinize ingredient lists more closely and reward “cleaner” claims.

Governments are reinforcing this direction with visible regulatory moves. The Codex GSFA remains the common global reference that lists additive provisions and maximum use levels across food categories, giving multinationals a single compass for specifications and compliance plans. Regulators are actively pruning that list: the Commission withdrew eight flavouring substances after manufacturers failed to provide sufficient safety data—foods containing them may not be placed on the EU market from 5 February 2025.

At the same time, scale and trade are expanding the number of products that depend on consistent flavour notes. The United States exported US$ 39.4 billion of processed food products in 2024, a reminder that flavour-reliant categories travel across borders and therefore must pass many regulators with identical sensory profiles. More broadly, U.S. agricultural exports totaled US$ 176.0 billion in 2024 (calendar year), underscoring the size of the outbound food system that needs stable, spec-compliant inputs.

Emerging markets are adding momentum on the manufacturing side: India’s food-processing market reached ₹30,49,800 crore (US$ 354.5 billion) in 2024 and is projected to hit ₹46,84,415 crore (US$ 535 billion) by FY26, expanding the number of plants, SKUs and flavour briefs that call for reliable building blocks. And demand fundamentals stay supportive: the OECD-FAO expects calorie intake to increase by 7% in middle-income countries by 2033, driven by more staples, livestock products and fats—precisely the categories where flavour systems keep products attractive at lower sugar/salt or with novel textures.

Drivers

Packaged-food flavour demand and standards are pulling cyclopentanone

Cyclopentanone benefits from a simple, powerful demand engine: the steady rise of processed and packaged foods—and the flavour systems that make them appealing—backed by clear, global food-additive standards. Flavour and aroma chemicals that build minty, fruity, and creamy notes are integral to modern retail foods; cyclopentanone is a recognised building block in several flavour compositions.

Three numbers show why this matters. First, calorie availability is still rising: the OECD-FAO projects a 7% increase in average daily calories in middle-income countries by 2033, reflecting higher consumption of staples, animal products and fats—categories that rely heavily on flavours to differentiate products on crowded shelves.

Second, the FAO reports that ultra-processed foods already account for 7% of globally traded calories and 12% of food imports in high-income countries evidence that flavour-reliant products are entrenched in cross-border food flows. Third, the packaged-food export engine is strong: the United States exported US$39.4 billion of processed food products in 2024, indicating resilient international demand for flavour-intensive categories from snacks to beverages.

Robust industrial scale in food and drink manufacturing ensures a wide, stable customer base for flavour ingredients. In Europe, the sector employs 4.6 million people and generates €1.1 trillion in turnover, underlining the depth of formulation work where flavour chemicals and solvents are specified, qualified and repeatedly purchased. Trade adds further pull: EU exports of agricultural, fisheries, and food & beverage products were €222 billion in 2022, sustaining cross-border brand portfolios that depend on consistent flavour profiles—and the intermediates that enable them.

The structure of food manufacturing also concentrates demand: in the U.S., meat processing represented 26.2% of food & beverage manufacturing sales in 2021, with beverages and “other foods” adding large shares—segments where flavour systems are central to product positioning.

Restraints

Clean-label scrutiny and tighter flavour approvals are narrowing room for cyclopentanone

Consumer skepticism about “chemical-sounding” ingredients and governments’ tighter approval lists for flavourings are putting real limits on synthetic aroma ketones such as cyclopentanone. In the United States, the International Food Information Council’s 2024 Food & Health Survey polled 3,000 adults; “No artificial ingredients/colors” rose to the top tier of in-store safety signals, reflecting how label language now shapes purchase intent.

That concern translates into specific risk perceptions: in IFIC’s reporting of top food-safety issues, 30% of respondents ranked “food additives and ingredients” among their top three worries—elevating the reputational headwinds for flavour chemicals. Momentum continued in 2025, when IFIC found overall confidence in the U.S. food supply at 55%, the lowest in its time series, underscoring persistent vigilance around ingredient lists.

Regulators are reinforcing this consumer pull with stricter market gates. The Codex General Standard for Food Additives (CXS 192) anchors maximum use levels globally and emphasizes alignment with Acceptable Daily Intakes (ADIs), meaning any flavouring—natural or synthetic—must sit within explicit safety bounds before broad uptake. In the European Union, Regulation (EC) No 1334/2008 requires that the food industry use only those flavouring substances on the Union List; anything not listed cannot be used in foods. This single, centralized list—first introduced EU-wide in 2012 and maintained by the European Commission—raises the bar for dossier quality, toxicology, and exposure modeling when companies seek approvals for specific molecules or uses.

Trade dynamics add another brake by increasing compliance complexity across destinations. While the United States shipped US$39.4 billion of processed food products in 2024, exporters face heterogeneous additive and labelling rules that often privilege “no artificial” claims—pushing reformulations toward naturals and shrinking the addressable space for synthetic ketones. Simultaneously, the U.S. agricultural trade balance has tilted: in 2023, imports exceeded exports by US$21 billion, and over 2014–2024 exports grew only 1% annually versus 6% for imports, a shift that tends to amplify retailer and regulator leverage over ingredient standards as foreign brands and private labels compete on “clean” credentials.

Opportunity

Rising Clean-Label and Natural Ingredient Demand Fuels Cyclopentanone Use

This trend creates a concrete opportunity for cyclopentanone-based intermediates. Even though cyclopentanone itself may not always be labelled to consumers, it serves as a valuable building block in synthesising aroma compounds that deliver buttery, creamy, fruity, or subtle botanical notes. As formulators pivot away from older synthetics, the ability to leverage cyclopentanone in advanced, lower-use-level flavour functions becomes a competitive advantage.

Geographically, Asia-Pacific is emerging as the fastest-growing region for natural flavours: in one estimate the natural flavours market in Asia-Pacific registered around US$ 2.7 billion in 2022. This regional strength matters because many flavour and fragrance houses are expanding or relocating capabilities closer to their growth centres, which means demand for flavour building blocks and solvent/intermediate chemistries will shift accordingly. Companies supplying cyclopentanone or derivatives can tap these regional dynamics—not just mature Western markets.

Government and policy initiatives further reinforce the opportunity. In India, for example, the food-processing sector has been given a strong push. The processed food market in India reached Rs 30,49,800 crore in 2024 and is expected to grow to around Rs 4,584,415 crore by end of FY26. This scale indicates massive formulation activity in foods, RTE/RTC, desserts, beverages and snacks—all of which place emphasis on flavour systems. As local manufacturing expands under schemes such as the Production Linked Incentive Scheme for Food Processing Industry demand for imported flavour-intermediates or locally-sourced chemicals will rise. Suppliers of cyclopentanone derivatives are well positioned to deliver to this ecosystem.

In practical terms, a manufacturer of cyclopentanone or a derivative might consider collaborating with flavour houses to qualify their product for low-use, high-purity applications, emphasize its support in clean-label blocks, and highlight compatibility with regional growth zones. They should track the natural flavour growth numbers and leverage supportive policy tailwinds to justify capacity expansions, regional supply hubs or tailored grades for high-purity flavour use.

In short: as clean-label, natural-flavour and emerging-market food manufacturing converge, cyclopentanone stands at an intersection of chemical supply, speciality ingredients and growth geography. Suppliers who anticipate this shift—investing in regulatory readiness, flavour-grade certification and regional logistics—may capture a meaningful slice of incremental volume, as the natural flavour segment grows from US$6.40 billion to ~US$10.5 billion by 2030 and food-processing hubs like India expand their scale rapidly.

Regional Insights

Asia-Pacific leads the global cyclopentanone market with 44.30% share valued at USD 115.1 million

In 2024, the Asia-Pacific (APAC) region held a dominant position in the global cyclopentanone market, accounting for 44.30% of total revenue, valued at approximately USD 115.1 million. This dominance is primarily driven by the strong expansion of the chemical, pharmaceutical, and agrochemical sectors in countries such as China, India, Japan, and South Korea. The region’s rapid industrialization, along with increasing investment in fine chemical production, has significantly boosted demand for cyclopentanone as a key intermediate in specialty solvents, drug synthesis, and pesticide formulations. China continues to be the largest contributor to regional demand, supported by a well-established chemical manufacturing base and a steady rise in pharmaceutical R&D spending.

The demand growth is further reinforced by favorable government initiatives encouraging chemical industry modernization and sustainable production. For instance, China’s 14th Five-Year Plan emphasizes the expansion of green chemical processes and bio-based intermediates, directly supporting the transition toward cleaner solvent technologies where cyclopentanone is increasingly utilized. Similarly, India’s “Make in India” initiative has strengthened local chemical manufacturing capacity, contributing to higher regional consumption.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Caffaro Industrie S.p.A., headquartered in Italy, operates a fine chemicals division comprising 30 reactors, 25 distillation columns and more than 70 heat exchangers—an infrastructure designed for flexibility across product lines. Among its portfolio are ketones such as cyclopentanone, targeted at the pharmaceutical, agrochemical, fragrance and electronics sectors. The firm emphasises tailor-made production and dynamic mix adjustment according to market demand.

Junsei Chemical Co., Ltd., a Japanese fine chemical manufacturer established in 1948, is certified under ISO 9001 and ISO 14001 and conducts operations with GMP-compatible facilities. The company offers cyclopentanone (purity 99.0%+) under product listing, confirming its presence in the high-purity intermediate market. The firm leverages its long history and reagent-manufacturing expertise to serve research, pharmaceutical and analytical applications.

Zeon Corporation (Tokyo, Japan) maintains a robust presence in C5-chemistry and specialty solvents, including cyclopentanone. The company was awarded the Special Technology Prize by the Japan Chemical Industry Association for its innovative manufacturing method of cyclopentanone deriving from dicyclopentadiene (DCPD) feedstock with reduced CO₂ output. Zeon projects a sales growth rate of 19% for its cyclopentanone business through FY2030, reflecting strong commitment to the business line.

Top Key Players Outlook

- Caffaro Industrie SPA

- Zhejiang NHU Co., Ltd.

- JUNSEI CHEMICAL CO., LTD.

- Matrix Fine Chemicals GmbH

- Zeon Corporation

- SHANGHAI PEARLK CHEMICAL CO., LTD

- Solvay S.A.

- Freesia Chemicals

- Kanto Chemical Co., Inc.

Recent Industry Developments

In 2024, Caffaro Industrie reported group turnover of approximately €75 million for Caffaro alone, or about €150 million including related companies, signifying a robust business foundation for cyclopentanone production and distribution.

In 2024 JUNSEI CHEMICAL CO, maintained its operational strength via two major plants — its Ibaraki facility features reaction tanks of up to 10,000 L (2 units) and 20,000 L (1 unit), along with multiple pilot and analytical units for scale-up needs.

Report Scope

Report Features Description Market Value (2024) USD {{val1}} Forecast Revenue (2034) USD {{val2}} CAGR (2025-2034) {{cagr}}% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (High-Purity Cyclopentanone, Industrial-Grade Cyclopentanone), By Application (Pharmaceuticals, Agriculture, Flavors And Fragrances, Polymers And Resins, Others), By Sales Channel (Direct Sales, Indirect Sales) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Caffaro Industrie SPA, Zhejiang NHU Co., Ltd., JUNSEI CHEMICAL CO., LTD., Matrix Fine Chemicals GmbH, Zeon Corporation, SHANGHAI PEARLK CHEMICAL CO., LTD, Solvay S.A., Freesia Chemicals, Kanto Chemical Co., Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Caffaro Industrie SPA

- Zhejiang NHU Co., Ltd.

- JUNSEI CHEMICAL CO., LTD.

- Matrix Fine Chemicals GmbH

- Zeon Corporation

- SHANGHAI PEARLK CHEMICAL CO., LTD

- Solvay S.A.

- Freesia Chemicals

- Kanto Chemical Co., Inc.