Global Cutting Equipment Market Size, Share, Growth Analysis By Technology (Laser, Plasma, Waterjet, Carbon-arc), By End User (Metal Fabrication, Automotive, Construction, Aerospace and Defense, Shipbuilding, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 178240

- Number of Pages: 240

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

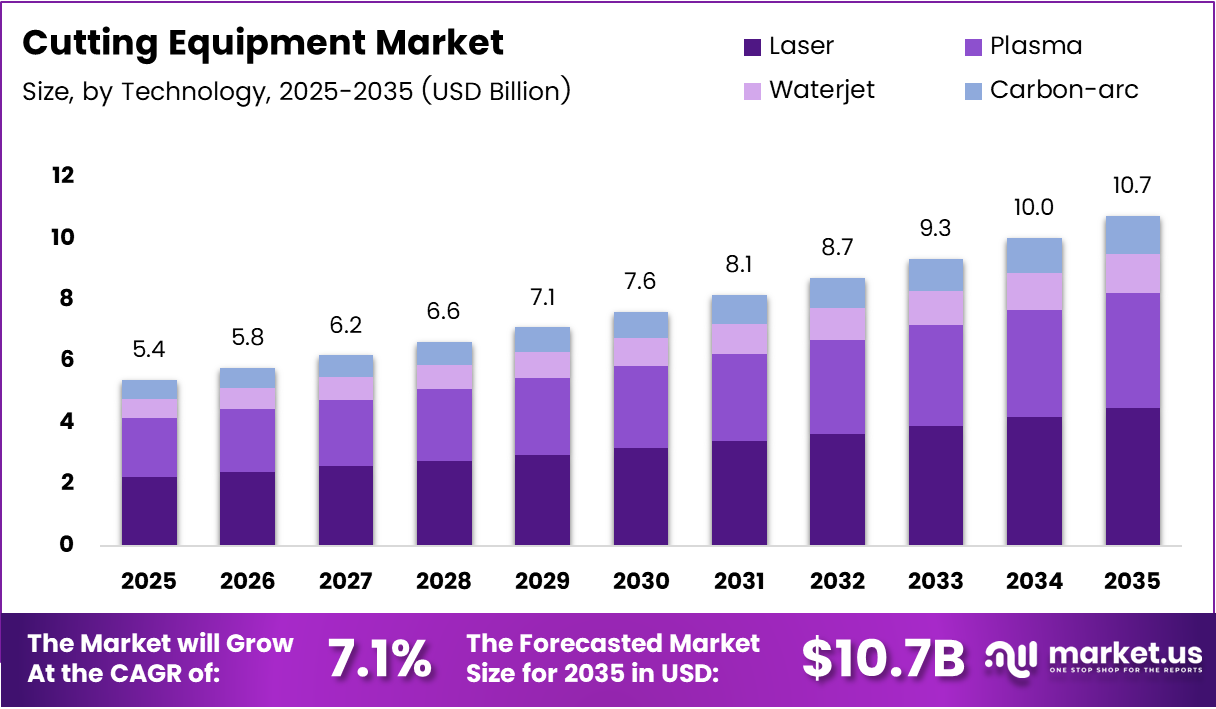

Global Cutting Equipment Market size is expected to be worth around USD 10.7 Billion by 2035 from USD 5.4 Billion in 2025, growing at a CAGR of 7.1% during the forecast period 2026 to 2035.

The cutting equipment market covers industrial machines and systems used to cut, shape, and process materials such as metals, composites, and alloys. These tools include laser cutters, plasma systems, waterjet machines, and carbon-arc equipment. Manufacturers across multiple industries rely on these solutions to meet precision and efficiency requirements.

Industrial sectors such as automotive, aerospace, metal fabrication, and construction drive consistent demand for advanced material processing systems. Modern production environments require high-speed and high-accuracy cutting solutions to support growing output volumes. Consequently, manufacturers continue upgrading their equipment to stay competitive in global supply chains.

Government investment in infrastructure development and defense manufacturing creates significant opportunities for the cutting equipment sector. Regulatory frameworks promoting domestic manufacturing and energy-efficient production further support market adoption. Moreover, policy-driven industrial expansion in emerging economies accelerates equipment procurement across multiple end-user segments.

Industry 4.0 integration transforms how manufacturers operate cutting and material processing systems. Smart factories increasingly deploy CNC-based automated cutting platforms that reduce human error and improve output quality. Additionally, in July 2025, AMETEK completed the acquisition of FARO Technologies in a deal valued at approximately $920 million, reinforcing strategic consolidation trends in precision measurement and cutting technology.

According to the International Federation of Robotics, global manufacturing robot density reached 162 robots per 10,000 employees in 2023, more than double the figure from seven years prior. This rapid automation expansion reflects strong industrial demand for precision equipment, including cutting systems integrated with robotic workflows.

According to Notifix, European Union manufacturing automation reached approximately 219 robots per 10,000 employees, indicating strong investment in industrial precision technologies. This level of automation directly supports demand for advanced cutting solutions that integrate with modern robotic and digital manufacturing environments.

Key Takeaways

- The global cutting equipment market is valued at USD 5.4 Billion in 2025.

- The market is projected to reach USD 10.7 Billion by 2035, growing at a CAGR of 7.1%.

- By Technology, the Laser segment dominates with a 44.7% market share in 2025.

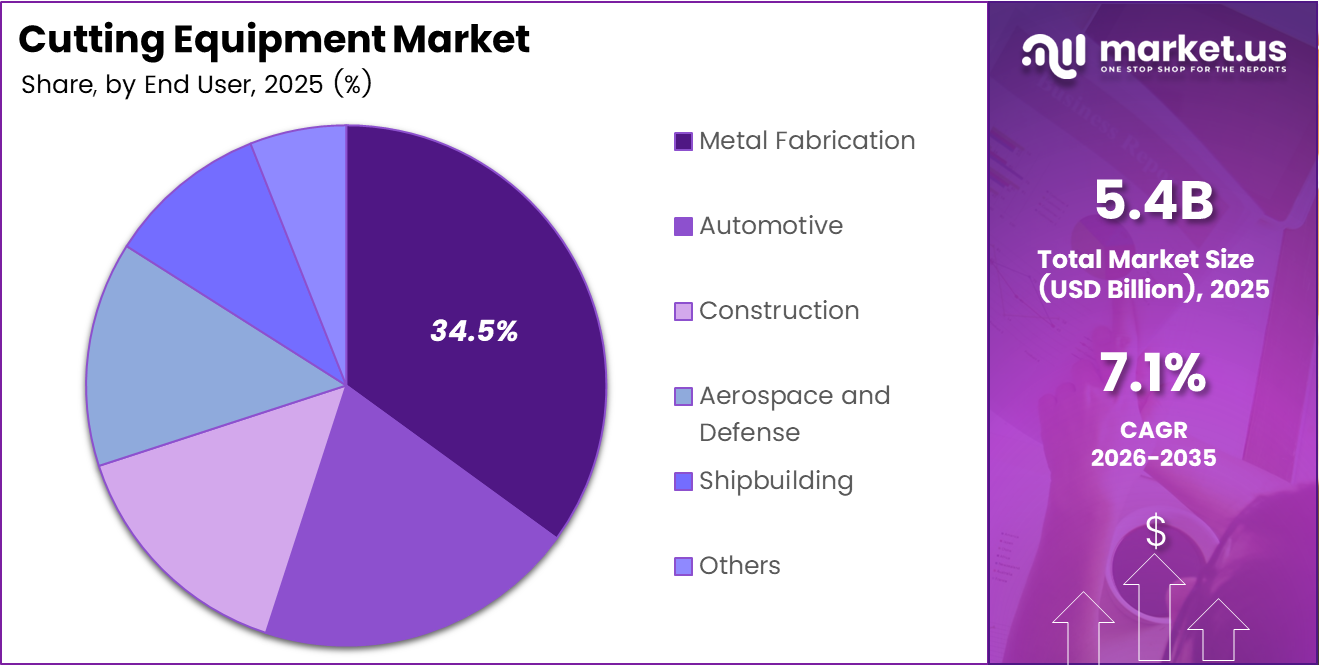

- By End User, the Metal Fabrication segment holds the largest share at 34.5% in 2025.

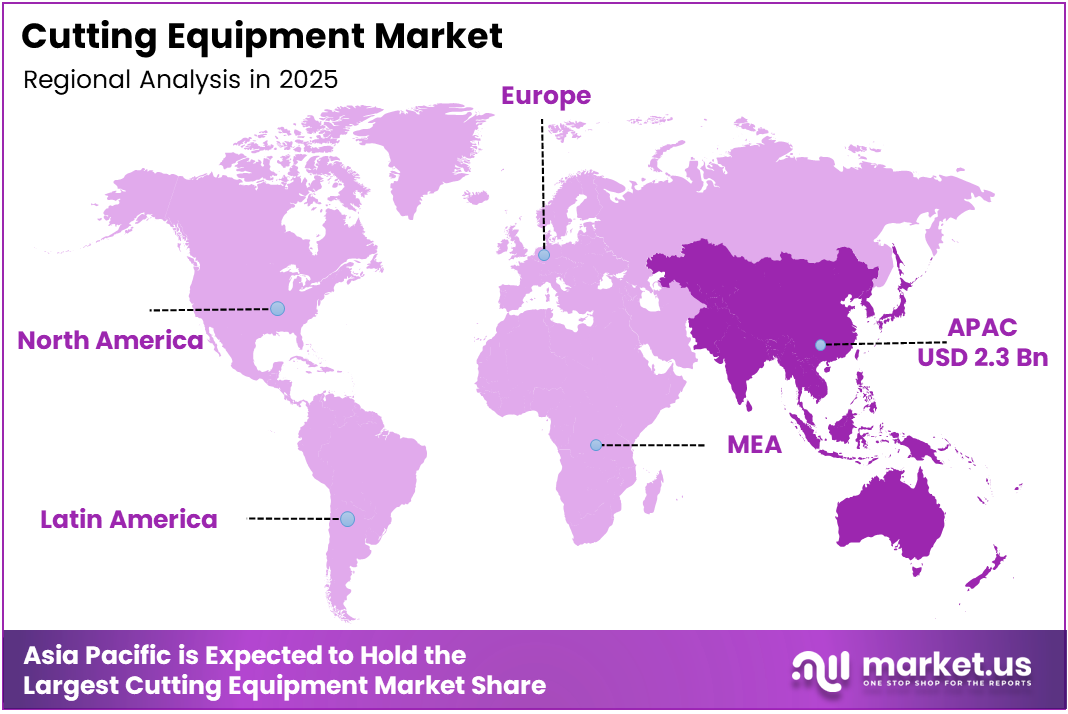

- Asia Pacific leads regional demand with a 42.60% share, valued at USD 2.3 Billion.

- North America and Europe represent strong secondary markets driven by industrial automation and infrastructure investment.

Technology Analysis

Laser dominates with 44.7% due to high-speed processing and precision capabilities across metal fabrication and industrial applications.

In 2025, Laser cutting held a dominant market position in the By Technology segment of the Cutting Equipment Market, with a 44.7% share. Laser systems deliver superior accuracy, high cutting speeds, and minimal material waste. Moreover, growing adoption across automotive and aerospace manufacturing continues to reinforce laser technology as the preferred industrial cutting solution.

Plasma cutting systems maintain strong demand in heavy metal processing and structural fabrication applications. These systems offer cost-effective performance for thick metal cutting operations where laser precision is not critical. Consequently, industries such as shipbuilding, construction, and heavy engineering actively deploy plasma cutting across high-volume production environments.

Waterjet cutting technology supports applications requiring no heat-affected zones, particularly in aerospace and composite material processing. This method handles a wide range of materials including titanium, stone, glass, and ceramics. Additionally, waterjet systems appeal to manufacturers seeking versatile, eco-friendly cutting solutions without thermal distortion risks.

Carbon-arc cutting serves specialized industrial applications including weld preparation, gouging, and metal removal tasks. This technology delivers reliable performance in maintenance, repair, and heavy fabrication environments. However, its niche use cases limit broader market penetration compared to laser and plasma cutting alternatives.

End User Analysis

Metal Fabrication dominates with 34.5% due to high-volume demand for precision cutting across structural and industrial component production.

In 2025, Metal Fabrication held a dominant market position in the By End User segment of the Cutting Equipment Market, with a 34.5% share. This sector relies on cutting equipment for structural components, sheet metal processing, and custom part manufacturing. Therefore, continuous growth in industrial output and custom fabrication requirements sustains strong demand for advanced cutting machinery.

The Automotive industry represents a significant end-user segment demanding high-precision cutting solutions for body panels, engine parts, and structural assemblies. Increasing vehicle production volumes and the shift to electric vehicle platforms drive new equipment investments. Moreover, automotive manufacturers require cutting systems that support tight tolerances and high-speed production cycles.

The Construction sector consumes cutting equipment for steel beam processing, pipe cutting, and site fabrication activities. Large-scale infrastructure development programs across emerging and developed markets fuel consistent equipment procurement. Additionally, rising demand for prefabricated structural components expands construction-related cutting equipment usage.

The Aerospace and Defense segment demands cutting equipment capable of processing advanced alloys and composite materials to strict dimensional standards. Defense procurement programs and commercial aircraft production expansion support steady equipment investments. However, certification requirements and material complexity create barriers that favor established technology providers.

The Shipbuilding segment uses heavy-duty plasma and oxy-fuel cutting systems for large-scale hull fabrication and plate processing. Naval expansion programs and commercial shipping demand drive procurement across major shipbuilding nations. Consequently, shipyards increasingly invest in automated cutting platforms to improve throughput and reduce labor dependency.

The Others category includes rail, energy, electronics, and general engineering industries that collectively represent diversified demand for cutting solutions. These sectors adopt both standard and specialized cutting systems based on specific material and precision requirements. Additionally, growing industrial activity in renewable energy and railway infrastructure projects contributes to broader market expansion.

Key Market Segments

By Technology

- Laser

- Plasma

- Waterjet

- Carbon-arc

By End User

- Metal Fabrication

- Automotive

- Construction

- Aerospace and Defense

- Shipbuilding

- Others

Drivers

Rapid Expansion of Manufacturing Activities Increases Demand for High-Precision Cutting Equipment

Automotive, aerospace, and metal fabrication manufacturers rapidly expand production capacities, creating consistent demand for advanced cutting systems. These industries require laser, plasma, and waterjet solutions capable of processing complex materials at high speed. Moreover, in July 2024, Sandvik completed acquisition of approximately 72.4% stake in Suzhou Ahno Precision Cutting Tool Technology, reflecting strong strategic investment in precision cutting capabilities.

According to the International Federation of Robotics, South Korea leads global automation with approximately 1,012 robots per 10,000 manufacturing employees. This level of automation intensity signals the strong interdependence between robotic manufacturing systems and precision cutting equipment. Consequently, nations pursuing high-density automation strategies become priority markets for cutting equipment manufacturers.

Rising adoption of CNC-based automated cutting systems significantly reduces human error and improves production efficiency across industrial operations. Growing infrastructure and construction projects further drive consumption of steel processing and cutting machinery. Additionally, increasing demand for customized industrial components requiring advanced cutting solutions sustains strong market momentum across multiple end-user segments.

Restraints

High Initial Capital Investment and Skilled Workforce Shortage Limit Cutting Equipment Market Adoption

Advanced industrial cutting equipment carries significant upfront costs that create adoption barriers, particularly for small and medium enterprises. Laser and waterjet systems require substantial capital investment alongside ongoing maintenance expenditures. Therefore, many manufacturers delay equipment upgrades or defer adoption due to limited access to financing and long payback periods.

A shortage of skilled technicians capable of operating and maintaining sophisticated cutting technologies constrains market growth across several regions. Modern CNC and laser systems require specialized training and programming knowledge. Moreover, workforce gaps in developing markets reduce the operational effectiveness of newly installed equipment, limiting realized productivity gains.

Maintenance costs for high-precision cutting systems add to total cost of ownership beyond the initial purchase price. Consumable components such as laser optics, plasma electrodes, and waterjet nozzles require regular replacement. Consequently, manufacturers with limited operational budgets find it difficult to sustain advanced cutting equipment over full product lifecycles without dedicated support infrastructure.

Growth Factors

Smart Manufacturing Integration and Emerging Economy Expansion Accelerate Cutting Equipment Market Growth

Increasing penetration of smart manufacturing and Industry 4.0 integration transforms cutting equipment operations across industrial facilities. Manufacturers deploy connected systems capable of real-time monitoring, predictive diagnostics, and remote process control. Additionally, in May 2024, the Piolas 400 laser processing machine launched commercially for industrial users including acrylic goods manufacturing, demonstrating active product innovation in the market.

According to Notifix, North America manufacturing robot density reached approximately 197 robots per 10,000 employees, reflecting deep automation integration across manufacturing facilities. This automation intensity creates sustained demand for compatible precision cutting systems that integrate seamlessly with robotic workflows. Therefore, North American manufacturers continue investing in cutting equipment upgrades aligned with smart factory architectures.

Rising demand for portable and compact cutting machines supports adoption among small and medium manufacturing enterprises seeking affordable entry-level solutions. Expansion of shipbuilding, railways, and heavy engineering sectors in emerging economies creates new procurement opportunities. Moreover, growing adoption of eco-friendly and energy-efficient cutting technologies aligns with corporate sustainability mandates and tightening environmental regulations.

Emerging Trends

Fiber Laser Technology, AI Integration, and Digital Connectivity Reshape the Cutting Equipment Market

Fiber laser cutting technology rapidly gains market share due to its superior speed, energy efficiency, and accuracy in metal processing applications. Manufacturers increasingly replace older CO2 laser and plasma systems with fiber laser platforms to improve throughput and reduce operating costs. According to BusinessWire, China reached approximately 470 robots per 10,000 manufacturing employees, indicating massive industrial scaling that drives fiber laser adoption.

Integration of AI-based predictive maintenance features reduces unplanned downtime and extends equipment lifecycle across industrial cutting operations. Modern cutting systems embed sensors and machine learning algorithms that identify wear patterns before failures occur. Moreover, rising popularity of multi-process cutting machines supporting laser, plasma, and oxy-fuel in single units simplifies production floor management and reduces capital expenditure.

Growing shift toward digital monitoring, remote operation, and cloud-connected industrial cutting platforms enables manufacturers to optimize performance across distributed facilities. Digital twins and IoT-enabled dashboards provide real-time operational visibility and remote diagnostics. Consequently, equipment manufacturers increasingly offer software-as-a-service platforms alongside hardware, creating new recurring revenue streams and deeper customer relationships.

Regional Analysis

Asia Pacific Dominates the Cutting Equipment Market with a Market Share of 42.60%, Valued at USD 2.3 Billion

Asia Pacific commands the largest share of the cutting equipment market, holding 42.60% of global revenue valued at approximately USD 2.3 Billion in 2025. China, Japan, South Korea, and India drive demand through massive industrial manufacturing, shipbuilding, and infrastructure development activities. Moreover, rapid automation expansion and government-backed manufacturing programs continue to accelerate cutting equipment adoption across the region.

North America Cutting Equipment Market Trends

North America maintains a strong position in the global cutting equipment market, supported by advanced automotive manufacturing, aerospace production, and defense industrial activities. The United States leads regional demand through continuous modernization of fabrication facilities and growing adoption of CNC and laser cutting systems. Additionally, reshoring initiatives and infrastructure investment programs generate consistent equipment procurement across key industrial sectors.

Europe Cutting Equipment Market Trends

Europe sustains significant cutting equipment demand across Germany, France, Italy, and the UK, driven by precision engineering, automotive manufacturing, and defense production. European manufacturers prioritize energy-efficient and environmentally compliant cutting solutions aligned with the region’s stringent sustainability regulations. Furthermore, heavy investment in renewable energy infrastructure and rail network expansion creates new demand for advanced cutting and processing machinery.

Middle East and Africa Cutting Equipment Market Trends

The Middle East and Africa region presents growing opportunities for cutting equipment suppliers as construction activity and industrial diversification programs accelerate. Gulf Cooperation Council nations invest heavily in infrastructure, shipbuilding, and manufacturing capacity as part of economic diversification strategies. Consequently, demand for plasma, laser, and oxy-fuel cutting systems expands across the region’s emerging industrial base.

Latin America Cutting Equipment Market Trends

Latin America shows moderate but consistent growth in cutting equipment adoption, driven primarily by Brazil and Mexico’s manufacturing and construction sectors. Expanding automotive production in Mexico and infrastructure investment programs across the region sustain steady demand for cutting and fabrication machinery. However, economic volatility and currency fluctuations in certain markets can moderate procurement cycles and capital equipment investment timelines.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Illinois Tool Works operates as a globally diversified industrial manufacturer with significant presence in welding and cutting equipment segments. The company leverages its broad product portfolio and deep distribution network to serve automotive, construction, and general manufacturing customers. Its engineering-driven approach and focus on productivity-enhancing tools reinforce its competitive standing in the industrial cutting equipment market.

AMADA WELD TECH delivers specialized laser and resistance welding systems alongside precision cutting solutions for electronics, medical, and automotive manufacturing applications. The company combines advanced photonics technology with deep process expertise to provide integrated production systems. Its focus on high-accuracy micro-cutting and welding applications positions it as a preferred supplier in technically demanding manufacturing environments.

The Lincoln Electric Company ranks among the most recognized brands in cutting and welding technologies, offering plasma cutting systems, automation solutions, and consumables across global industrial markets. The company actively invests in product innovation and expanded its portfolio through strategic acquisitions and technology partnerships. Its global manufacturing footprint and service network support consistent delivery and technical support across major industrial regions.

Koike Aronson, Inc. specializes in cutting and positioning equipment for metal fabrication, shipbuilding, and heavy industrial applications. The company designs and manufactures CNC cutting systems, pipe profilers, and positioners serving diverse end-user industries. Its engineering expertise in custom fabrication solutions and strong after-sales service capability differentiates it within competitive industrial cutting equipment segments.

Key Players

- Illinois Tool Works

- AMADA WELD TECH

- The Lincoln Electric Company

- Koike Aronson, Inc.

- GCE Group

- Ador Welding Ltd.

- OMAX Corporation

- OSG Corporation

- Hypertherm, Inc.

- Jet Edge, Inc.

- DAIHEN Corporation

Recent Developments

- October 2025 – Hymson Laser Technology Group completed the full acquisition of Germany-based Xteg, strengthening its European market presence and expanding its portfolio of high-performance laser cutting and processing systems for industrial manufacturing applications.

- June 2024 – GCC announced the launch of the new GCC LaserPro Spirit LS PRO laser engraver and cutting system, targeting industrial users seeking enhanced engraving precision, faster processing speeds, and improved reliability across a wide range of material types.

- June 2024 – GCC unveiled the GCC LaserPro Piolas 400 high-performance laser engraving and cutting machine, designed to deliver superior cutting accuracy and expanded material compatibility for demanding industrial production environments including sign-making and acrylic processing.

Report Scope

Report Features Description Market Value (2025) USD 5.4 Billion Forecast Revenue (2035) USD 10.7 Billion CAGR (2026-2035) 7.1% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Laser, Plasma, Waterjet, Carbon-arc), By End User (Metal Fabrication, Automotive, Construction, Aerospace and Defense, Shipbuilding, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Illinois Tool Works, AMADA WELD TECH, The Lincoln Electric Company, Koike Aronson Inc., GCE Group, Ador Welding Ltd., OMAX Corporation, OSG Corporation, Hypertherm Inc., Jet Edge Inc., DAIHEN Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Illinois Tool Works

- AMADA WELD TECH

- The Lincoln Electric Company

- Koike Aronson, Inc.

- GCE Group

- Ador Welding Ltd.

- OMAX Corporation

- OSG Corporation

- Hypertherm, Inc.

- Jet Edge, Inc.

- DAIHEN Corporation