Global Critical Power and Cooling Market Size, Share, And Enhanced Productivity By Type (Uninterrupted Power Supply, Generators, Air Conditioning, Chilling Units, Others), By End-Use (Commercial, IT and Telecommunication, Transportation, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 176028

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

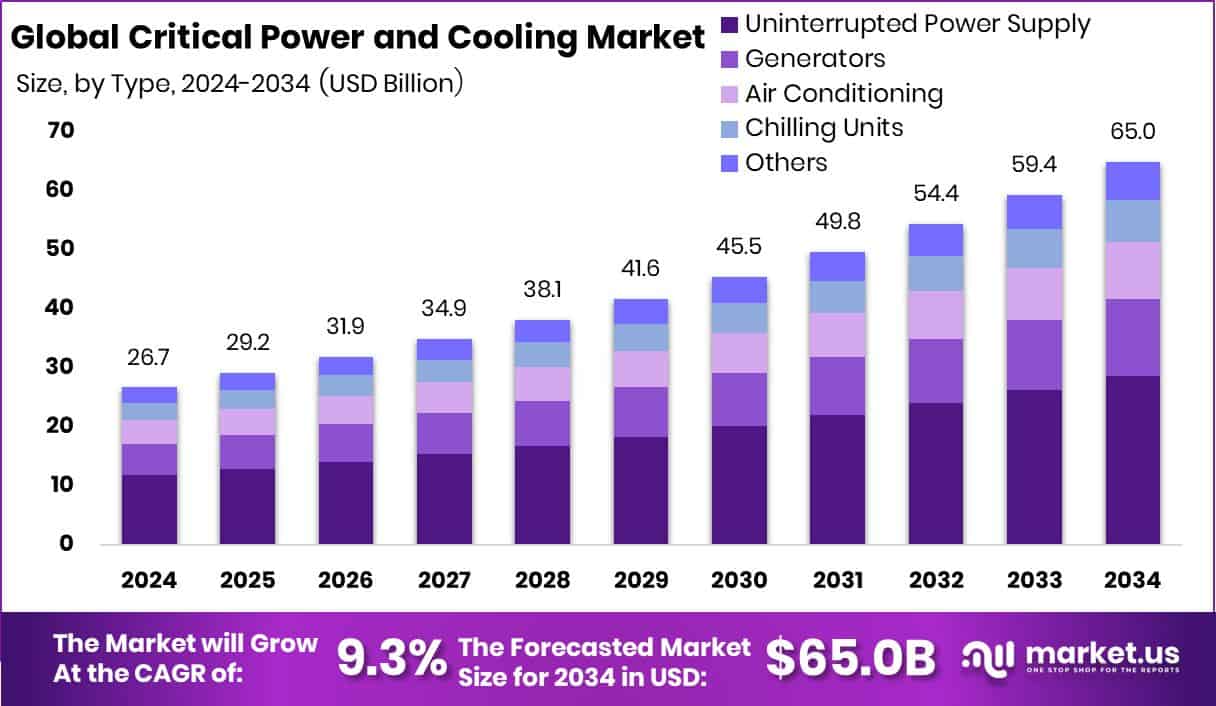

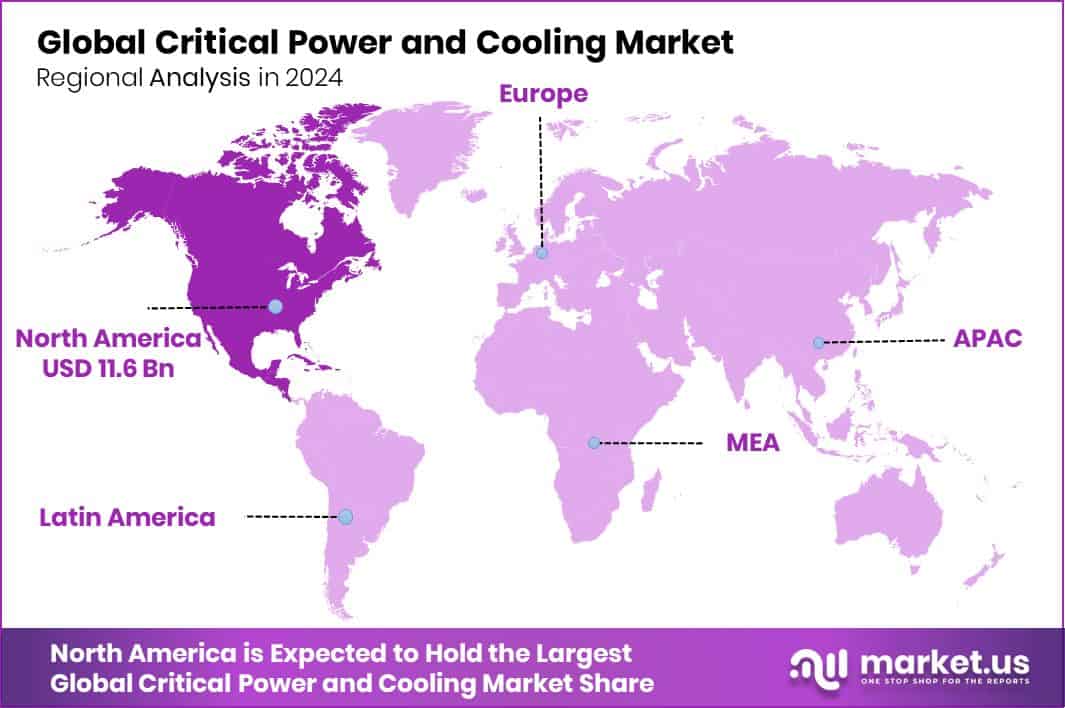

The Global Critical Power and Cooling Market is expected to be worth around USD 65.0 billion by 2034, up from USD 26.7 billion in 2024, and is projected to grow at a CAGR of 9.3% from 2025 to 2034. North America continued leading market demand with its notable 43.6% share and USD 11.6 Bn scale.

The Critical Power and Cooling segment refers to the systems that keep essential facilities running without interruption. It includes power backup units such as UPS systems, generators, and precision cooling technologies like air conditioning and chilling units. These solutions protect equipment, maintain stable temperatures, and ensure continuous operations in environments where downtime can cause major losses. The Critical Power and Cooling Market represents the global demand for these systems across commercial buildings, IT and telecommunication hubs, transportation networks, and other mission-critical settings. As digital operations expand, organizations increasingly invest in resilient power and cooling infrastructures to maintain reliability.

Growth in this market is strongly supported by rising data center expansion and increasing cloud dependency. Governments are also encouraging efficient cooling innovations, such as the DOE announcing $40 million for advanced cooling technologies and another $46 million for heat pump projects, which accelerates adoption. Demand continues to rise as industries aim to reduce energy consumption while maintaining stable operations. There is also an opportunity in high-performance computing, highlighted by the DOE’s $42 million funding for improved cooling systems, pushing new technologies into mainstream use.

Opportunities further expand as research institutions and innovators secure funding to develop sustainable cooling. Projects such as a £2.8 million initiative for energy-efficient cooling and investments like Iceotope’s £30 million and $10 million rounds show strong global interest. These developments point to continuous advancement in the Critical Power and Cooling Market as facilities seek solutions that balance performance, reliability, and environmental efficiency.

Key Takeaways

- The Global Critical Power and Cooling Market is expected to be worth around USD 65.0 billion by 2034, up from USD 26.7 billion in 2024, and is projected to grow at a CAGR of 9.3% from 2025 to 2034.

- In the Critical Power and Cooling Market, Uninterrupted Power Supply leads with a strong 44.1% share.

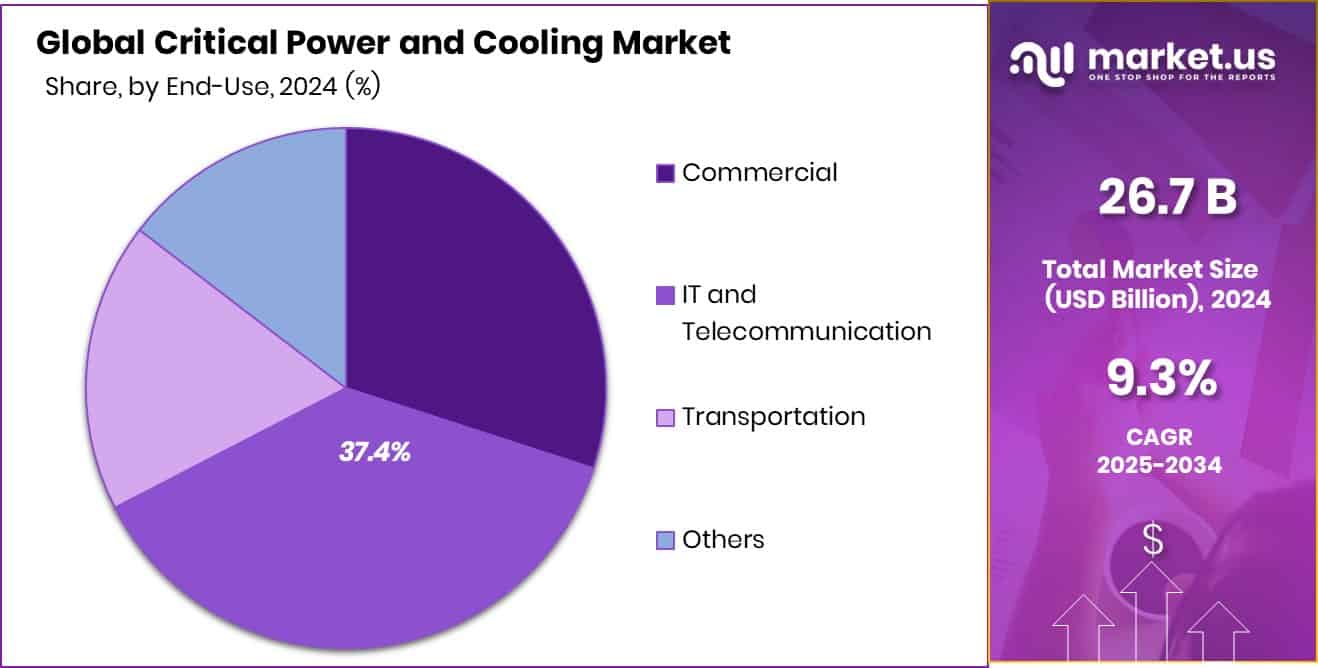

- IT and Telecommunication dominates the Critical Power and Cooling Market end-use segment with a notable 37.4% share.

- The North America reached a valuation of USD 11.6 Bn in 2024 overall.

By Type Analysis

Uninterrupted power supply leads the Critical Power and Cooling Market with 44.1% dominance.

In 2024, the Critical Power and Cooling Market saw strong momentum, with Uninterrupted Power Supply (UPS) systems holding a dominant 44.1% share in the By Type segment. This leadership comes from the growing need for stable and continuous electricity across data centers, hospitals, industrial plants, and financial institutions. As digital operations expanded, UPS systems became essential for preventing downtime, protecting equipment, and ensuring business continuity.

Companies increasingly adopted advanced lithium-ion UPS technologies for better efficiency, longer life, and reduced maintenance. Moreover, rising investments in hyperscale data centers and cloud infrastructure boosted demand for high-capacity UPS units. Government initiatives promoting resilient power systems further supported the segment’s growth across global markets.

By End-Use Analysis

IT and telecommunication segment drives the Critical Power and Cooling Market with 37.4% share.

In 2024, the Critical Power and Cooling Market observed impressive growth in the By End-Use segment, with IT and Telecommunication securing a leading 37.4% share. This dominance is driven by the rapid expansion of digital ecosystems, cloud computing, and 5G rollout. Data centers, telecom towers, and network facilities require constant, uninterrupted power and precise cooling to maintain optimal performance and prevent equipment failure.

As global data consumption surged, operators prioritized robust power backup systems and energy-efficient cooling solutions to minimize outages and improve sustainability. The rising shift toward edge computing and AI-driven workloads also intensified the need for reliable critical power infrastructure. These trends positioned IT and telecom as the fastest-growing end-use category.

Key Market Segments

By Type

- Uninterrupted Power Supply

- Generators

- Air Conditioning

- Chilling Units

- Others

By End-Use

- Commercial

- IT and Telecommunication

- Transportation

- Others

Driving Factors

Rising demand for uninterrupted power reliability

The Critical Power and Cooling Market is strongly influenced by the rising demand for uninterrupted power reliability across digital and industrial ecosystems. As operations become more automated and data-dependent, businesses require stable power backup systems and efficient cooling to avoid outages and equipment failures. This need is reinforced by the growing pressure of global temperatures, prompting the development of next-generation cooling solutions.

A notable example is Transaera securing $10.5 million to build highly energy-efficient air-conditioning systems designed for extreme heat conditions. Such innovations highlight how rising climate challenges and operational risks are driving organizations to adopt more advanced, reliable, and energy-smart power and cooling infrastructures to protect mission-critical environments.

Restraining Factors

High installation costs limit adoption

A major restraint in the Critical Power and Cooling Market is the high installation cost, which can slow adoption among small and mid-sized facilities. Setting up advanced UPS systems, generators, and precision cooling units often requires substantial upfront capital, along with ongoing spending for maintenance and skilled labor. In addition, policy-linked incentives that prioritize alternative technologies can shift buyer focus.

For instance, the Boiler Upgrade Scheme introduced a £2,500 grant in November 2025 for air-to-air heat pumps, making them more accessible compared to traditional cooling systems. Such financial support for competing technologies can temporarily reduce investment momentum in conventional critical cooling setups, widening the cost barrier for many users.

Growth Opportunity

Expansion of energy-efficient cooling technologies

There is vast opportunity in expanding energy-efficient cooling technologies as industries shift toward greener and more cost-effective operations. Many facilities are upgrading outdated systems in favor of solutions that reduce energy consumption while maximizing thermal performance. Government-backed initiatives also support this transition, fostering a favorable environment for innovation.

A strong example comes from Colorado securing $200 million in federal funding to accelerate the adoption of heat pumps and other clean-energy projects. This funding push highlights a broader market opportunity to introduce sustainable cooling systems that align with global decarbonization goals. As efficiency standards rise, suppliers of advanced cooling and power technologies stand to benefit from increasing demand across multiple sectors.

Latest Trends

Rapid shift toward liquid-cooling solutions

One of the most prominent trends in the Critical Power and Cooling Market is the rapid shift toward liquid-cooling solutions, especially as data centers experience higher computing loads driven by AI, cloud services, and high-performance hardware. Liquid cooling enables better heat management and supports denser rack configurations, making it an ideal alternative to traditional air-cooling systems. This shift is further accelerated by growing infrastructure investments.

For example, a $975 million bond proposal for DPS includes funding for expanded air-conditioning, highlighting the rising need for modern cooling enhancements across public and commercial facilities. Together, these developments show that liquid-cooling adoption and advanced cooling infrastructure upgrades are defining the next wave of market evolution.

Regional Analysis

North America held a strong 43.6% share of the Critical Power and Cooling Market.

North America dominated the Critical Power and Cooling Market with a 43.6% share, reaching USD 11.6 Bn, supported by large data center clusters, strong IT infrastructure, and high dependence on uninterrupted digital operations. The region’s enterprises continued investing in advanced backup systems due to rising cloud workloads and the expansion of hyperscale facilities.

Europe followed with steady demand driven by increasing automation, energy-efficient power systems, and resilient infrastructure upgrades across major economies. Asia Pacific showed rapid adoption supported by ongoing industrialization and a growing technology ecosystem, particularly in emerging digital hubs.

The Middle East & Africa experienced gradual market development as businesses strengthened power reliability to reduce operational risks. Latin America also witnessed rising deployments of critical power equipment, aided by digital transformation initiatives and increasing data center activities.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ABB continued strengthening its presence through a broad portfolio of power protection, electrical distribution, and precision cooling solutions. The company’s long-standing expertise in energy efficiency and grid resilience positioned it as a preferred partner for large-scale data centers and industrial facilities aiming to reduce downtime and improve operational stability. Its integrated systems helped businesses optimize power continuity while enhancing sustainability performance.

Asetek A/S remained influential in the cooling segment, driven by its specialization in liquid-cooling technologies. The company gained recognition for developing high-performance, energy-saving thermal solutions widely used in data center environments. By focusing on reducing heat loads and improving cooling efficiency, Asetek supported operators looking to manage increasing computing densities and lower operating costs. Its innovation-oriented approach strengthened its role in the evolving thermal management ecosystem.

Cyber Power Systems contributed significantly through its comprehensive UPS systems, surge protection devices, and power management technologies. The company’s solutions aligned with growing demand for secure, uninterrupted power across IT networks, telecom infrastructure, and commercial setups. Its emphasis on reliability and scalable protection kept it relevant as businesses expanded digital operations globally.

Top Key Players in the Market

- ABB

- Asetek A/S

- Cyber Power Systems

- Daikin Industries Ltd.

- Delta Electronic, Inc.

- Eaton Corporation

- General Electric

- Johnson Controls, Inc.

- Rittal GmbH & Co. Kg

- Schneider Electric

- Siemens

- Socomec

Recent Developments

- In April 2025, Daikin launched the Pro-C Computer Room Air Handler (CRAH) range to expand its portfolio of data center cooling products. The Pro-C units offer flexible cooling capacities tailored for different data center layouts and integrate optimized heat exchangers and advanced controls for improved reliability and efficiency.

- In May 2024, Eaton acquired a 49% stake in NordicEPOD AS, a company that designs and builds standardized power modules for data centers. This deal strengthens Eaton’s position in critical power infrastructure for data centers in Europe.

Report Scope

Report Features Description Market Value (2024) USD 26.7 Billion Forecast Revenue (2034) USD 65.0 Billion CAGR (2025-2034) 9.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Uninterrupted Power Supply, Generators, Air Conditioning, Chilling Units, Others), By End-Use (Commercial, IT and Telecommunication, Transportation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB, Asetek A/S, Cyber Power Systems, Daikin Industries Ltd., Delta Electronic, Inc., Eaton Corporation, General Electric, Johnson Controls, Inc., Rittal GmbH & Co. Kg, Schneider Electric, Siemens, Socomec Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Critical Power and Cooling MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Critical Power and Cooling MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB

- Asetek A/S

- Cyber Power Systems

- Daikin Industries Ltd.

- Delta Electronic, Inc.

- Eaton Corporation

- General Electric

- Johnson Controls, Inc.

- Rittal GmbH & Co. Kg

- Schneider Electric

- Siemens

- Socomec