Global CIGS Thin-Film Solar Cells Market Size, Share, And Business Benefit By Product Type (Flexible, Rigid), By Film Thickness (1-2 Micro Meters, 2-3 Micro Meters, 3-4 Micro Meters), By Deposition Technique (Chemical Vapour Deposition, Electrospray Deposition, Coevaporation, Film production), By End-use (Energy and Power, Automobiles, Electronics and Electrical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 165520

- Number of Pages: 343

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

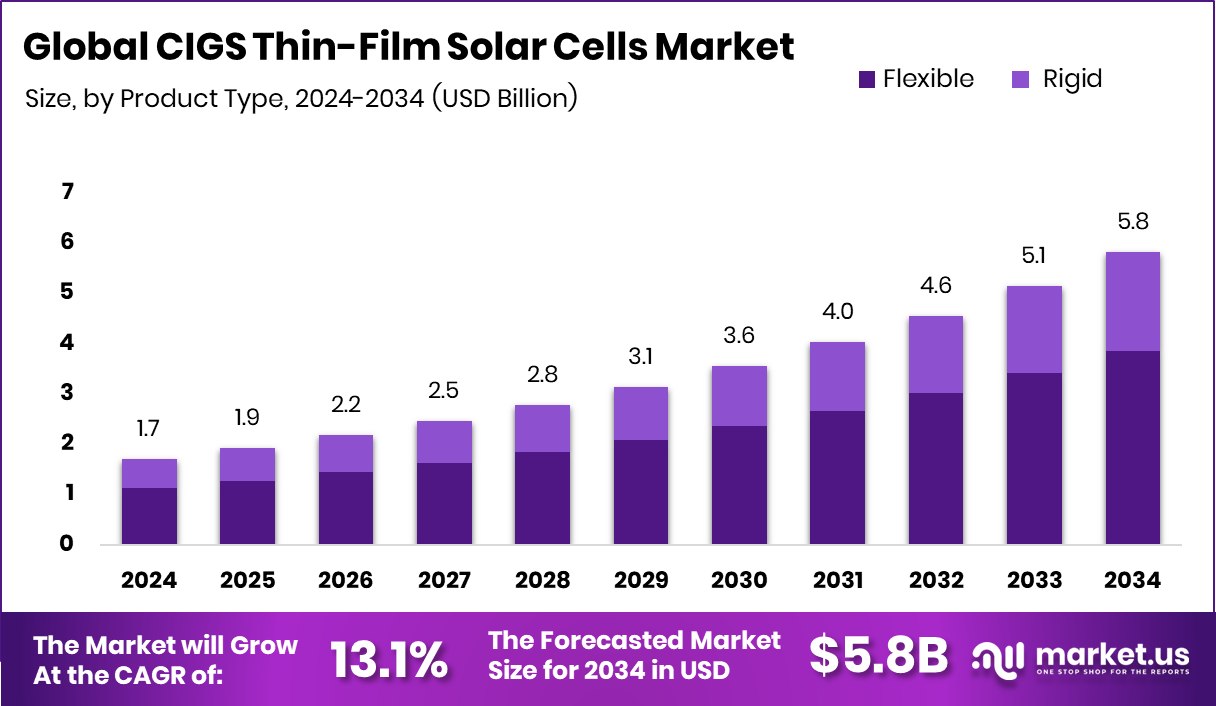

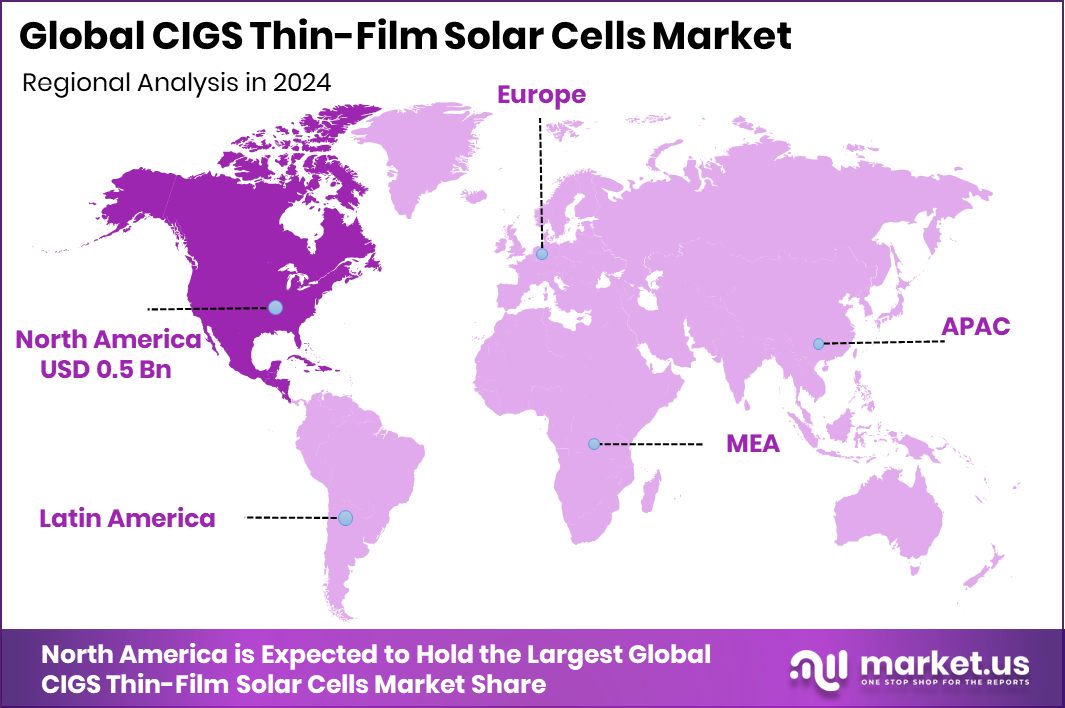

The Global CIGS Thin-Film Solar Cells Market is expected to be worth around USD 5.8 billion by 2034, up from USD 1.7 billion in 2024, and is projected to grow at a CAGR of 13.1% from 2025 to 2034. Advancing solar technologies strengthen North America at 32.90% and USD 0.5 Bn.

CIGS thin-film solar cells are lightweight photovoltaic devices made from copper, indium, gallium, and selenium. They convert sunlight into electricity using a very thin active layer, which makes them flexible, durable, and suitable for rooftops, portable panels, curved structures, and building-integrated systems. They also offer better performance in low-light and high-temperature conditions compared to many conventional modules.

The CIGS thin-film solar cell market includes the production, deployment, and integration of these modules across residential, commercial, industrial, and utility-scale projects. The market benefits from rising clean-energy commitments, investments in lightweight solar materials, and interest in flexible solar solutions for modern infrastructure and mobility applications.

CIGS demand grows as countries push for cleaner power and lighter, more adaptable solar technologies. Large investments across India strengthen this momentum, especially with Tata Power committing ₹25,000 crore to renewable projects by FY27 and REC funding ₹7,500 crore for a 1.04GW hybrid project. These capital flows expand solar-ready infrastructure, creating wider space for CIGS adoption.

Demand rises as industries and utilities look for solar modules that maintain high efficiency even under heat or partial shading. Funding activity across the broader energy ecosystem—such as Hero Future Energies securing ₹1,000 crore from SBI and Core Energy Systems raising ₹200 crore—indirectly boosts requirements for innovative materials like CIGS that support hybrid and distributed energy setups.

Opportunities emerge in hybrid systems, storage-linked solar, and decentralized power solutions. Projects such as Oriana Power securing ₹212 crore for a battery-energy-storage project in Karnataka highlight how storage-integrated solar is becoming mainstream. This shift favors CIGS, as its lightweight design fits buildings, mobility platforms, microgrids, and next-generation renewable installations.

Key Takeaways

- The Global CIGS Thin-Film Solar Cells Market is expected to be worth around USD 5.8 billion by 2034, up from USD 1.7 billion in 2024, and is projected to grow at a CAGR of 13.1% from 2025 to 2034.

- In the CIGS thin-film solar cells market, flexible products dominate strongly with a 66.2% share today.

- Film thickness of 2-3 micrometers leads the CIGS Thin-Film Solar Cells Market with 48.8% overall.

- Chemical vapor deposition holds 31.40% inside the CIGS Thin-Film Solar Cells Market, enabling scalable production.

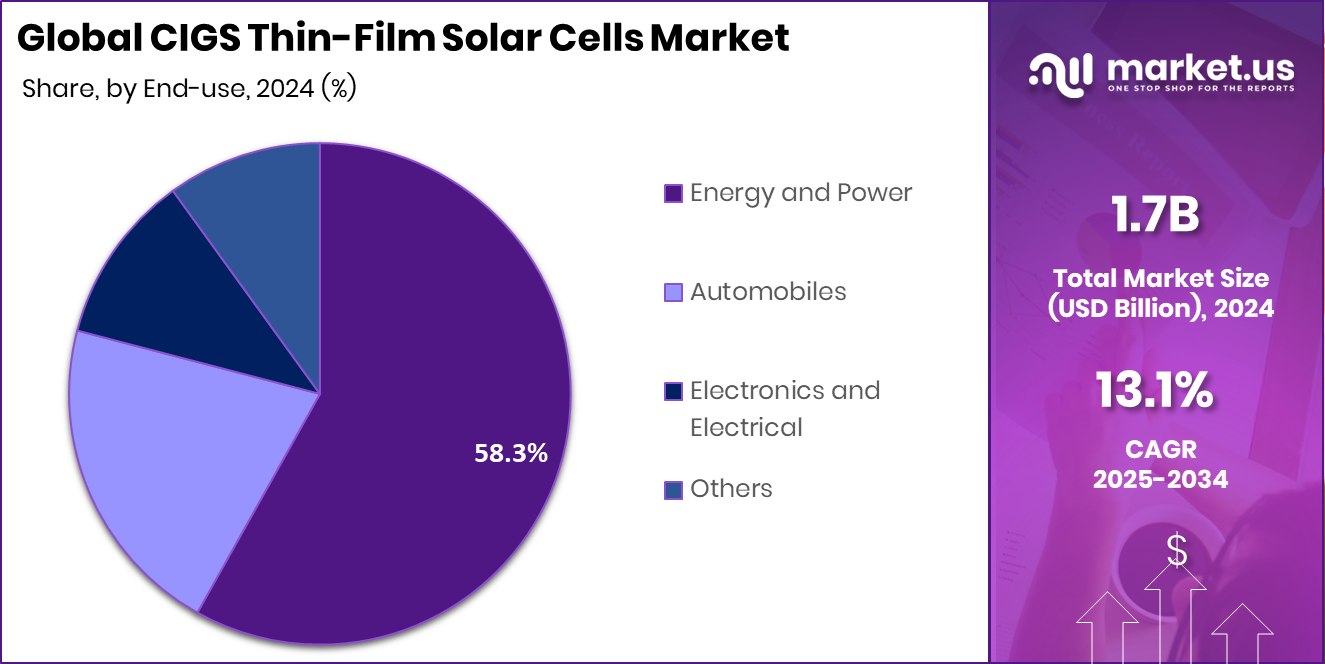

- Energy and power applications dominate the CIGS thin-film solar cells market, with 58.3% driving expansion.

- Strong renewable adoption supports North America’s 32.90% share worth USD 0.5 Bn.

By Product Type Analysis

CIGS Thin-Film Solar Cells Market shows the flexible segment leading with 66.2%.

In 2024, Flexible held a dominant market position in the By Product Type segment of the CIGS Thin-Film Solar Cells Market, capturing a 66.2% share. This leadership reflects the strong preference for lightweight and adaptable solar formats that fit rooftops, portable systems, curved surfaces, and building-integrated structures. The wide acceptance of flexible designs comes from their easy installation, reduced structural load, and suitability for projects where rigid panels cannot be used effectively.

Their ability to sustain performance under heat, partial shading, and low-light conditions further strengthens their appeal. With these advantages, the flexible category continues to anchor the product landscape and defines the direction of CIGS adoption across diverse application needs.

By Film Thickness Analysis

CIGS Thin-Film Solar Cells Market sees 2-3 micrometers thickness capturing 48.8%.

In 2024, 2–3 Micro Meters held a dominant market position in the By Film Thickness segment of the CIGS Thin-Film Solar Cells Market, securing a 48.8% share. This thickness range is favored because it strikes the right balance between material efficiency and strong light-absorption capability, allowing manufacturers to achieve stable performance without increasing production complexity.

Its consistency in delivering reliable power output across varied lighting conditions supports wider adoption across commercial and residential installations. The 2–3 micrometer layer also enables better flexibility and durability for modern lightweight solar formats. With these practical advantages, this segment maintains a strong lead and continues to define the preferred manufacturing standard within the CIGS thin-film ecosystem.

By Deposition Technique Analysis

CIGS Thin-Film Solar Cells Market reports chemical vapour deposition achieving 31.40%.

In 2024, Chemical Vapour Deposition held a dominant market position in the By Deposition Technique segment of the CIGS Thin-Film Solar Cells Market, accounting for a 31.40% share. This technique is valued for its ability to create uniform, high-quality thin films with strong adhesion and controlled composition, which are essential for stable CIGS performance.

Its precision in layer formation supports reliable efficiency levels and consistent manufacturing outcomes. The method also aligns well with scalable production environments, enabling steady output without compromising material integrity. With these strengths, Chemical Vapour Deposition continues to be the preferred approach within the segment, shaping production standards and reinforcing its leadership in CIGS thin-film cell fabrication.

By End-use Analysis

CIGS Thin-Film Solar Cells Market records energy power end-use dominating 58.3%.

In 2024, Energy and Power held a dominant market position in the By End-use segment of the CIGS Thin-Film Solar Cells Market, capturing a 58.3% share. This strong lead reflects the sector’s continuous push toward lightweight, efficient, and adaptable solar technologies that support grid-scale, distributed, and building-integrated applications.

CIGS modules fit well into modern energy systems because they perform reliably under varying temperatures and low-light conditions, making them suitable for diverse power environments. Their flexibility and ease of installation further strengthen their role in expanding renewable generation capacity. With these advantages, the Energy and Power segment remains the primary anchor for CIGS adoption and defines the segment’s overall direction in 2024.

Key Market Segments

By Product Type

- Flexible

- Rigid

By Film Thickness

- 1-2 Micro Meters

- 2-3 Micro Meters

- 3-4 Micro Meters

By Deposition Technique

- Chemical Vapour Deposition

- Electrospray Deposition

- Coevaporation

- Film production

By End-use

- Energy and Power

- Automobiles

- Electronics and Electrical

- Others

Driving Factors

Strong Renewable Push Accelerates CIGS Adoption

A major driving force for the CIGS Thin-Film Solar Cells Market is the rapid global shift toward cleaner and more adaptable solar technologies. CIGS panels are light, flexible, and perform well even in heat or low sunlight, making them suitable for modern rooftops, portable systems, and building-integrated designs. The market’s momentum grows stronger as renewable investments rise across large emerging economies.

Amp Energy India securing $250 million to expand its renewables portfolio shows how capital is steadily moving toward advanced solar technologies that support flexible deployment. The IEA also reports that India attracted $2.4 billion for clean power projects in 2024, signalling strong demand for innovative solar materials like CIGS that can scale across diverse power applications.

Restraining Factors

High Production Complexity Slows Market Expansion

One key restraining factor for the CIGS Thin-Film Solar Cells Market is the technical complexity involved in producing these cells. CIGS requires careful control of copper, indium, gallium, and selenium layers, and even small variations can affect performance. This makes manufacturing more demanding and costly compared to simpler solar technologies.

Many producers hesitate to scale up because the process needs advanced equipment, skilled teams, and strict quality checks. These challenges slow down wider adoption, especially among new or smaller manufacturers. Even though large investments continue to enter the clean-energy space—such as ReNew Power receiving $140 million in equity funding as it prepares to go public—the high manufacturing difficulty of CIGS remains a barrier that the market must address.

Growth Opportunity

Global Renewable Investments Unlock CIGS Potential

A major growth opportunity for the CIGS Thin-Film Solar Cells Market comes from the rising flow of international funding dedicated to clean energy and power-system upgrades. CIGS panels are light, flexible, and work well on rooftops, curved structures, and portable systems, which makes them ideal for new-age energy projects.

As countries expand solar adoption beyond traditional setups, CIGS finds a natural fit in modern buildings and remote installations. This opportunity becomes stronger as global organisations commit large sums to renewable expansion.

The EIB’s plan to mobilise €1 billion to strengthen electricity systems in Central America and Power Sustainable securing CA$1.8 billion for a renewable energy fund shows how supportive financial conditions are widening the space for advanced solar technologies like CIGS to grow.

Latest Trends

Growing Shift Toward Storage-Integrated Solar Systems

One of the latest trends in the CIGS Thin-Film Solar Cells Market is the growing move toward pairing lightweight solar technologies with long-duration energy storage systems. CIGS panels are flexible, easy to install, and work well in low light, making them suitable for buildings, portable units, and hybrid setups that need steady power.

As more energy projects combine solar with storage, CIGS becomes attractive for locations where dependable output is essential. This trend gains even more strength as storage investments rise globally. Highview securing £130 million for its long-duration energy storage solution shows how strongly the market is shifting toward solar-plus-storage models, creating new spaces where CIGS panels fit naturally and efficiently.

Regional Analysis

North America holds a 32.90% share valued at USD 0.5 Bn in 2024.

North America emerged as the dominant region, holding 32.90% of the CIGS Thin-Film Solar Cells Market valued at USD 0.5 billion. This leadership reflects the region’s strong focus on advanced solar technologies, rising clean-energy adoption, and continued integration of lightweight and flexible photovoltaic solutions. The market landscape in North America benefits from increasing preference for thin-film formats that perform well in varied climates and support modern rooftop, commercial, and decentralized power applications.

Europe shows steady adoption as energy systems continue shifting toward newer solar materials, while the Asia Pacific maintains interest driven by expanding renewable initiatives across emerging markets. The Middle East & Africa and Latin America are gradually exploring CIGS technologies for projects where flexible and low-weight modules provide operational advantages.

Across all regions, the momentum remains shaped by the performance benefits of CIGS, though North America’s 32.90% share highlights its position as the strongest contributor within the global landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Solar Frontier continues to stand out for its long-term commitment to CIGS technology and its emphasis on stability, manufacturing consistency, and large-scale deployment. The company’s experience in producing reliable thin-film modules positions it as an anchor player, especially in markets needing dependable output in varied climates.

MiaSolé remains an influential innovator due to its focus on flexible CIGS solutions. Its lightweight modules align well with building-integrated designs, portable systems, and applications where rigid panels are unsuitable. By pushing flexibility and efficiency improvements, MiaSolé strengthens the role of CIGS in modern solar infrastructure.

Nanosolar, known for exploring alternative deposition approaches and roll-to-roll concepts for CIGS, has contributed to shaping how thin-film manufacturing can become more scalable. Even though its commercial presence has fluctuated, its technological direction continues to influence discussions around cost, process efficiency, and next-generation fabrication.

Top Key Players in the Market

- Solar Frontie

- MiaSolé

- Nanosolar

- Avancis GmbH

- Solibro GmbH

- Hanergy Thin Film Power Group

- Siva Power

- Saint-Gobain Solar

- Sharp Corporation

Recent Developments

- In April 2024, Avancis announced that it is expanding its SKALA solar module portfolio ahead of Glasstec 2024 in Düsseldorf. The company introduced SKALA Matrix, a new BIPV module based on silicon wafer PV technology, while its established CIGS thin-film façade module line now appears under the name SKALA Prime. This move shows Avancis strengthening its role as a building-integrated solar specialist, combining its CIGS thin-film experience with new façade products and vacuum-coating know-how.

Report Scope

Report Features Description Market Value (2024) USD 1.7 Billion Forecast Revenue (2034) USD 5.8 Billion CAGR (2025-2034) 13.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Flexible, Rigid), By Film Thickness (1-2 Micro Meters, 2-3 Micro Meters, 3-4 Micro Meters), By Deposition Technique (Chemical Vapour Deposition, Electrospray Deposition, Coevaporation, Film production), By End-use (Energy and Power, Automobiles, Electronics and Electrical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Solar Frontie, MiaSolé, Nanosolar, Avancis GmbH, Solibro GmbH, Hanergy Thin Film Power Group, Siva Power, Saint-Gobain Solar, Sharp Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  CIGS Thin-Film Solar Cells MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

CIGS Thin-Film Solar Cells MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Solar Frontie

- MiaSolé

- Nanosolar

- Avancis GmbH

- Solibro GmbH

- Hanergy Thin Film Power Group

- Siva Power

- Saint-Gobain Solar

- Sharp Corporation