Global Chromatography Reagents Market Size, Share and Report Analysis By Type (Buffers, lon Pair Reagents, Solvents, Others), By Physical State of Mobile Phase (Gas Chromatography Reagents, Liquid Chromatography Reagents, Super-Critical Fluid Chromatography Reagents), By Technology (Ion Exchange, Affinity Exchange, Size Exclusion, Hydrophobic Interaction, Mixed-Mode, Others), By Application (Pharmaceutical, Food and Beverages, Water and Environmental Analysis, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 178125

- Number of Pages: 328

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

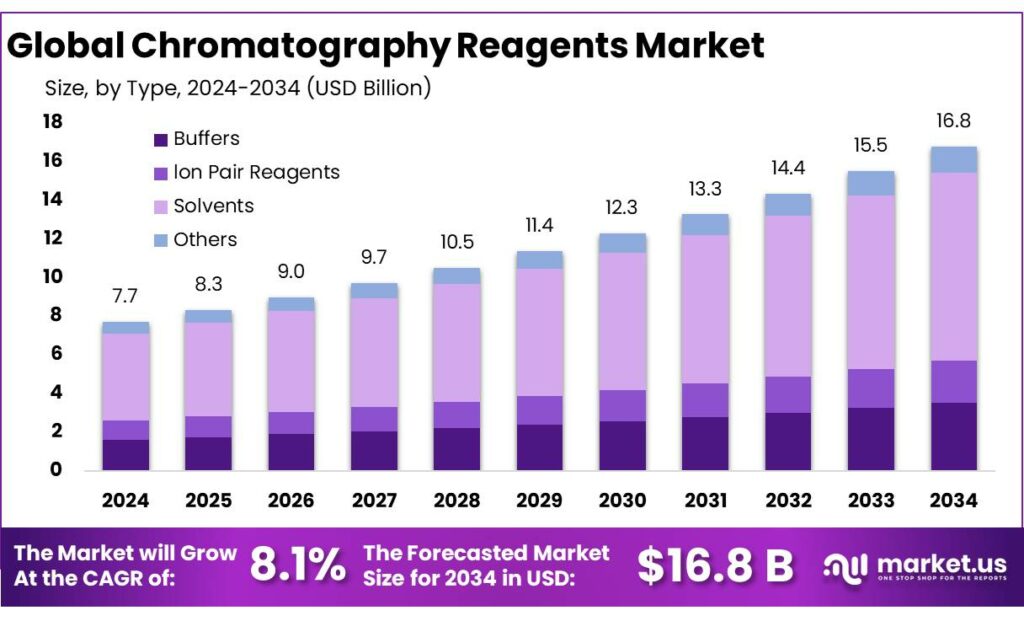

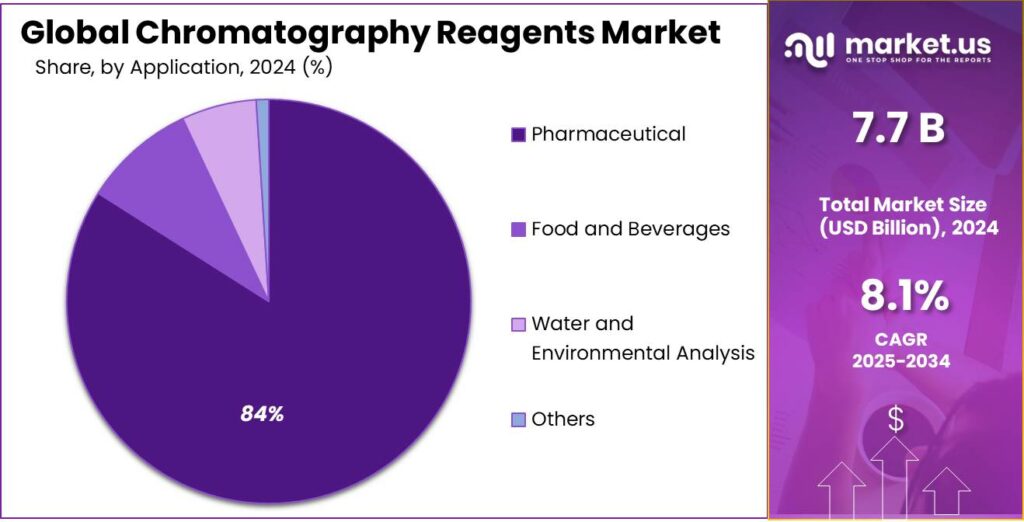

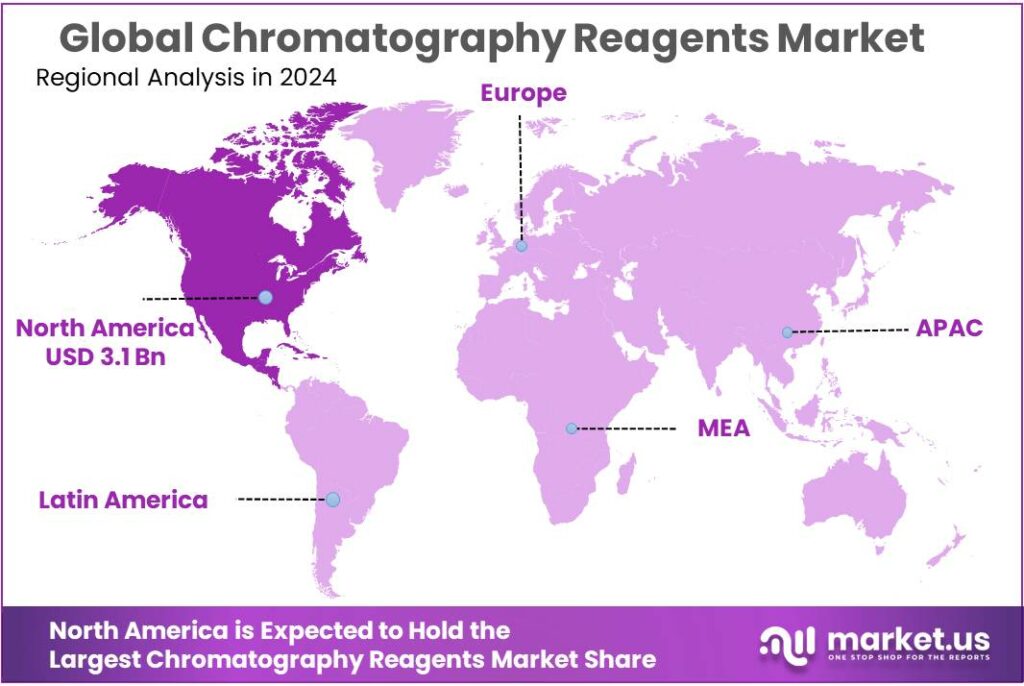

The Global Chromatography Reagents Market is expected to be worth around USD 16.8 Billion by 2034, up from USD 7.7 Billion in 2024, and is projected to grow at a CAGR of 8.1% from 2025 to 2034. The North America segment maintained 41.4%, supporting a Chromatography Reagents value of USD 3.1 Bn.

Chromatography reagents—covering high-purity solvents, buffers, ion-pairing agents, derivatization chemicals, reference standards, and chromatography media—are the consumable backbone of modern separation science. They enable laboratories to isolate, identify, and quantify trace compounds with reproducible retention times and low background noise, which is essential for regulated testing where results must be defensible. Demand is structurally tied to the expansion of instrumented analytical capacity and to the growing complexity of samples in food, pharmaceuticals, environmental monitoring, and clinical diagnostics.

The chromatography reagents landscape is closely tied to food safety, pharmaceuticals/biologics, environmental monitoring, and chemicals. Food and beverage testing remains a strong pull because chromatography is central to multi-residue pesticide screening, mycotoxins, processing contaminants, and authenticity/adulteration checks. The scale of the food-risk burden reinforces this need: WHO estimates unsafe food causes 600 million foodborne disease cases and 420,000 deaths each year. In parallel, global food movement continues to expand and diversify supply chains; FAO projected the global food import bill at about USD 1.98 trillion in 2023, which increases the complexity of surveillance across borders and raises the value of harmonized, defensible analytical results.

Key demand drivers also come from tighter regulatory expectations and enforcement frameworks that implicitly require robust analytical capability. In the United States, the FDA describes the Food Safety Modernization Act (FSMA) as shifting the system from response to prevention—an approach that elevates routine verification testing and supplier controls across the chain. In the EU, the Official Controls Regulation (EU) 2017/625 sets the framework for official controls across the agri-food chain, reinforcing standardized laboratory practices and confirmatory methods where chromatography is frequently the reference.

Government initiatives are also expanding laboratory capacity and contaminant transparency, reinforcing reagent pull-through. In India, the Ministry of Health & Family Welfare (PIB) states that FSSAI has notified 246 NABL-accredited laboratories for primary analysis and 24 Referral Food Laboratories for appellate samples, alongside mobile “Food Safety on Wheels” labs—an ecosystem that typically relies on chromatography consumables and standards for chemical and residue testing. In Europe, the Commission has communicated 50% reduction targets for the use and risk of chemical pesticides and for more hazardous pesticides, which elevates the need for sensitive residue monitoring to track progress and compliance.

Key Takeaways

- Chromatography Reagents Market is expected to be worth around USD 16.8 Billion by 2034, up from USD 7.7 Billion in 2024, and is projected to grow at a CAGR of 8.1%.

- Solvents held a dominant market position, capturing more than a 58.2% share.

- Liquid Chromatography Reagents held a dominant market position, capturing more than a 81.5% share.

- Affinity Exchange held a dominant market position, capturing more than a 37.9% share.

- Pharmaceutical held a dominant market position, capturing more than a 84.7% share.

- North America is the dominating region in the Chromatography Reagents Market, accounting for 41.4% share and around USD 3.1 Bn.

By Type Analysis

Solvents dominate with 58.2% driven by routine analytical consumption across industries

In 2024, Solvents held a dominant market position, capturing more than a 58.2% share. This strong position reflects their essential role in nearly every chromatographic workflow, from sample preparation to mobile phase formulation and column washing. Laboratories across food testing, pharmaceutical quality control, environmental monitoring, and academic research rely heavily on high-purity solvents such as methanol, acetonitrile, water, and buffer blends to ensure accurate separation and reproducible results. The consistent, repeat-use nature of solvents makes them a high-volume consumable, directly contributing to their leading share.

By Physical State of Mobile Phase Analysis

Liquid Chromatography Reagents lead strongly with 81.5% share driven by wide laboratory adoption

In 2024, Liquid Chromatography Reagents held a dominant market position, capturing more than a 81.5% share. This leadership reflects the broad use of liquid chromatography techniques across pharmaceutical testing, food safety analysis, environmental screening, and biotechnology research. Liquid-based mobile phases are widely preferred because they support the separation of complex, non-volatile, and heat-sensitive compounds that cannot be analyzed effectively using gas-based systems. As a result, laboratories depend heavily on high-purity solvents, buffers, and modifiers designed specifically for liquid chromatography systems.

By Technology Analysis

Affinity Exchange stands strong with 37.9% share backed by rising biologics demand

In 2024, Affinity Exchange held a dominant market position, capturing more than a 37.9% share. This position reflects its critical role in the purification and separation of complex biological molecules, especially in the pharmaceutical and biotechnology sectors. Affinity-based techniques are widely used to isolate proteins, antibodies, enzymes, and other biomolecules with high precision. Because these applications require specialized chromatography reagents such as affinity ligands and binding buffers, demand within this technology segment remained steady and commercially significant.

By Application Analysis

Pharmaceutical application leads firmly with 84.7% share driven by strict quality testing needs

In 2024, Pharmaceutical held a dominant market position, capturing more than a 84.7% share. This strong position reflects the central role chromatography reagents play in drug development, quality control, and regulatory compliance. Pharmaceutical companies depend heavily on chromatography techniques to test raw materials, monitor active pharmaceutical ingredients, and confirm the purity and stability of finished products. Since these processes require precise separation and accurate measurement, high-grade reagents are used routinely across production and research facilities.

Key Market Segments

By Type

- Buffers

- lon Pair Reagents

- Solvents

- Others

By Physical State of Mobile Phase

- Gas Chromatography Reagents

- Liquid Chromatography Reagents

- Super-Critical Fluid Chromatography Reagents

By Technology

- Ion Exchange

- Affinity Exchange

- Size Exclusion

- Hydrophobic Interaction

- Mixed-Mode

- Others

By Application

- Pharmaceutical

- Food and Beverages

- Water and Environmental Analysis

- Others

Emerging Trends

LC-MS ready mobile phases and multi-residue methods are becoming the default in food testing

A clear latest trend in chromatography reagents is the move toward LC-MS-compatible, ready-to-use mobile phases and reagent kits that support fast, high-confidence multi-residue testing in food. Food labs are under pressure to check more compounds, in more sample types, with fewer re-runs. That is pushing routine work away from “mix it yourself every morning” chemistry and toward pre-qualified solvents, additives, and calibration mixes that reduce variability and keep instruments stable. In practical terms, laboratories want reagents that are consistent from bottle to bottle, low in background impurities, and easy to document for audits.

This trend is closely tied to what regulators are asking laboratories to do. In Europe, EFSA explains that official labs test food for more than 740 pesticides and generate around 26 million individual test results each year, based on monitoring activity; it also reports 133,000 food samples collected in 2023 across the EU, Iceland, and Norway. At this scale, small differences in solvent quality, buffer preparation, or contamination control can quickly become expensive. A lab running thousands of samples cannot afford frequent troubleshooting, blocked lines, noisy baselines, or drifting retention times.

- Food safety risk adds to the urgency. WHO estimates 600 million people fall ill from unsafe food each year and 420,000 die annually, and it notes US$110 billion in productivity losses and medical expenses in low- and middle-income countries due to unsafe food. Governments respond to burdens of this size by tightening surveillance expectations and pushing prevention frameworks. In the U.S., FDA’s FSMA approach emphasizes prevention, and FDA cites federal estimates of 48 million foodborne illness cases per year, with 128,000 hospitalizations and 3,000 deaths.

The same pattern shows up in trade. FAO notes that food and agricultural trade nearly quintupled from USD 400 billion in 2000 to USD 1.9 trillion in 2022. With more food moving across borders, there is more pressure to prove compliance quickly, especially for residues and authenticity checks. That pushes labs toward high-throughput LC methods where reagent consistency matters.

Drivers

Food-safety testing expansion is the biggest demand engine for chromatography reagents

One major driving factor for chromatography reagents is the steady expansion of food-safety and contaminant testing, pushed by public health risk, tighter regulatory expectations, and larger cross-border food trade. Chromatography sits at the center of this work because it can separate and measure very small amounts of pesticides, veterinary drug residues, processing contaminants, adulterants, and additives. When official monitoring programs increase the number of samples, the demand rises directly for chromatography-grade solvents, buffers, mobile-phase modifiers, and certified reference standards.

- The World Health Organization estimates that 600 million people fall ill from unsafe food each year and 420,000 die annually. WHO also estimates an economic burden of US$110 billion per year in productivity losses and medical expenses from unsafe food in low- and middle-income countries—another reason governments keep strengthening surveillance systems.

Regulatory monitoring programs show how high the testing volume has become, especially for pesticide residues where chromatography is the workhorse. In Europe, EFSA’s public infographic on residue monitoring reports that official laboratories test food samples for more than 740 pesticides and generate around 26 million individual test results each year; it also notes that 133,000 samples were collected in 2023 across monitoring programs. High sample counts like these are not one-off events; they represent recurring annual programs, meaning reagent demand is continuous rather than cyclical.

- Government initiatives also make this driver stronger because they formalize testing frequency and compliance expectations. In the United States, FDA’s Food Safety Modernization Act (FSMA) reflects a prevention-led approach and is supported by CDC burden figures cited on FDA pages: 48 million Americans get sick from foodborne diseases each year, 128,000 are hospitalized, and 3,000 die annually.

Restraints

High compliance costs and testing complexity limit wider adoption of chromatography reagents

One major restraining factor for the chromatography reagents market is the high cost and operational complexity of regulatory compliance testing, especially in food and agricultural monitoring. While food safety programs continue to expand, the financial and technical burden of maintaining accredited laboratories, trained analysts, validated methods, and high-purity reagents can slow down adoption, particularly in developing regions and small-scale industries.

According to the World Health Organization, 600 million people fall ill each year due to unsafe food and 420,000 die annually. These figures have pushed governments to strengthen surveillance systems. However, building and maintaining the laboratory infrastructure required to address such a burden is expensive. Regular calibration, method validation, and quality documentation add further costs. WHO also estimates that unsafe food leads to US$110 billion in productivity losses and medical expenses each year in low- and middle-income countries, highlighting the broader economic strain that can limit laboratory investments.

In Europe, monitoring programs are extensive. The European Food Safety Authority reports that 133,000 food samples were collected in 2023, covering testing for more than 740 pesticides, resulting in approximately 26 million individual test results annually. In the United States, the FDA’s Food Safety Modernization Act (FSMA) has shifted focus toward preventive controls and stronger supplier verification. The FDA notes that 48 million Americans get sick from foodborne diseases each year, with 128,000 hospitalizations and 3,000 deaths annually.

Opportunity

Scaling Food Contaminant And Authenticity Testing To Match Global Trade Volumes

A major growth opportunity for chromatography reagents is the continued expansion of food contaminant and authenticity testing, as governments and food companies try to keep pace with larger trade flows and tighter safety expectations. Chromatography remains the everyday tool for checking pesticide residues, veterinary drugs, additives, processing by-products, and fraud markers because it can separate complex mixtures and confirm trace levels with high confidence. As a result, when official monitoring programs add more samples or widen the list of compounds, demand rises for chromatography-grade solvents, mobile-phase additives, buffers, and certified reference standards.

- FAO reports that food and agricultural trade rose from USD 400 billion in 2000 to USD 1.9 trillion in 2022. More trade means more ingredients moving across borders, more supplier networks, and more chances for residue non-compliance or adulteration. For testing labs, that translates into a steady pipeline of samples that need reliable, repeatable analysis—exactly the kind of work where reagents are consumed every day, not occasionally.

The second reason is the sheer scale of regulatory residue monitoring, especially in Europe where the public data shows how large these programs have become. EFSA’s monitoring infographics note that 133,000 food samples were collected in 2023, that monitoring covers more than 740 pesticides, and that around 26 million individual test results are reported each year. Each sample often requires multiple runs, calibration checks, and confirmation steps. That workload creates room for suppliers to grow through ready-to-use mobile phases, LC-MS compatible solvent systems, pre-measured buffer kits, and multi-analyte reference mixes that help labs move faster while staying consistent.

- Public-health pressure keeps the direction of travel the same. WHO estimates 600 million people fall ill from unsafe food each year and 420,000 die annually, and it also notes US$110 billion in productivity losses and medical expenses linked to unsafe food in low- and middle-income countries. These figures support ongoing government action, not a one-time push. In the U.S., FDA’s FSMA framework is built on prevention and stronger verification, and FDA’s background page cites CDC burden figures of 48 million illnesses, 128,000 hospitalizations, and 3,000 deaths each year from foodborne diseases.

Regional Insights

North America leads with 41.4% share and about $3.1 Bn, supported by strong pharma output and strict food testing rules

North America is the dominating region in the Chromatography Reagents Market, accounting for 41.4% share and around $3.1 Bn. This leadership is strongly linked to the region’s heavy use of chromatography in regulated industries—especially pharmaceuticals, biologics, and large-scale food safety testing—where results must meet tight quality and audit standards. In the U.S., chromatography demand is reinforced by an active regulatory testing network. FDA’s Office of Regulatory Science notes it operates 15 laboratories across the United States that support public health work, including human and animal food testing and medical product-related analysis.

Food safety enforcement also keeps routine testing volumes high. FDA cites federal estimates of about 48 million foodborne illness cases each year in the U.S., leading to 128,000 hospitalizations and 3,000 deaths—figures that continue to support prevention-focused oversight and ongoing monitoring programs. For reagent suppliers, this translates into consistent, repeat purchasing because chromatography is a core tool for residue, contaminant, and authenticity checks.

On the pharmaceutical side, North America benefits from ongoing investment and capacity expansion that increases analytical throughput. For example, AstraZeneca announced plans to invest $50 billion in the United States by 2030, reflecting the scale of manufacturing and R&D activity that typically requires extensive chromatography-based quality control and method validation. Overall, the region’s dominance is underpinned by deep regulatory infrastructure, high lab density, and continuous testing needs across food and pharma supply chains.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Waters is a core supplier to chromatography labs through LC/LC-MS systems and the consumables that keep those systems running (columns, chemistries, and service). In FY2024, Waters reported $2,958 million in sales and generated $762 million in operating cash flow (with $744 million free cash flow).

Honeywell supports chromatography reagent demand through high-purity chemicals and lab solvent lines used in analytical workflows across food, pharma, and industrial QA. In FY2024, Honeywell reported $38,498 million in sales and $4.9 billion in free cash flow. It also highlighted $14.6 billion capital deployed in 2024, including $8.9 billion toward acquisitions, reinforcing its ability to broaden specialty materials portfolios relevant to lab-grade chemical supply.

Restek is a chromatography-focused provider known for columns, standards, and related lab consumables used in GC/LC workflows. A corporate profile published by LCGC states Restek has 350 employees (employee-owners) and operates a 140,000-square-foot facility, with additional sites listed across multiple countries. Restek’s scale and manufacturing footprint support steady supply of chromatography standards and consumables that directly influence method accuracy and day-to-day lab throughput.

Top Key Players Outlook

- Waters Corporation

- Danaher Corporation

- GFS Chemicals Inc.

- Honeywell International Inc.

- Restek Corporation

- Tedia Company Inc.

- Concord Technology Co. Ltd.

- Spectrochem

- Agilent Technologies Inc.

- Regis Technologies Inc.

Recent Industry Developments

In 2024–2025, Xebec’s story was shaped more by restructuring activity than by lab-consumables expansion: Deloitte’s court page lists formal stay extension orders in March 2024, November 2024, and June 2025, showing the company remained in an ongoing restructuring process during this period.

Honeywell’s full-year 2024 sales were $38,498 million, and it generated $6.1 billion in operating cash flow with $4.9 billion in free cash flow, giving it the financial strength to keep investing in quality systems, supply reliability, and chemistry portfolios that labs depend on.

Report Scope

Report Features Description Market Value (2024) USD 7.7 Bn Forecast Revenue (2034) USD 16.8 Bn CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Buffers, lon Pair Reagents, Solvents, Others), By Physical State of Mobile Phase (Gas Chromatography Reagents, Liquid Chromatography Reagents, Super-Critical Fluid Chromatography Reagents), By Technology (Ion Exchange, Affinity Exchange, Size Exclusion, Hydrophobic Interaction, Mixed-Mode, Others), By Application (Pharmaceutical, Food and Beverages, Water and Environmental Analysis, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Waters Corporation, Danaher Corporation, GFS Chemicals Inc., Honeywell International Inc., Restek Corporation, Tedia Company Inc., Concord Technology Co. Ltd., Spectrochem, Agilent Technologies Inc., Regis Technologies Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Chromatography Reagents MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Chromatography Reagents MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Waters Corporation

- Danaher Corporation

- GFS Chemicals Inc.

- Honeywell International Inc.

- Restek Corporation

- Tedia Company Inc.

- Concord Technology Co. Ltd.

- Spectrochem

- Agilent Technologies Inc.

- Regis Technologies Inc.