Global Child-Resistant Packaging Market Size, Share, Growth Analysis By Product Type (Caps & Closures, Blister & Clamshell Packs, Bags & Pouches, Cartons & Boxes, Jars, Bottles & Containers, and Tubes & Sachets), By Packaging Material (Plastic, Paper & Paperboard, Metal, and Glass), By End-Use (Pharmaceuticals, Food & Beverages, Home Care, Cosmetics & Personal Care, Chemicals, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 168297

- Number of Pages: 369

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

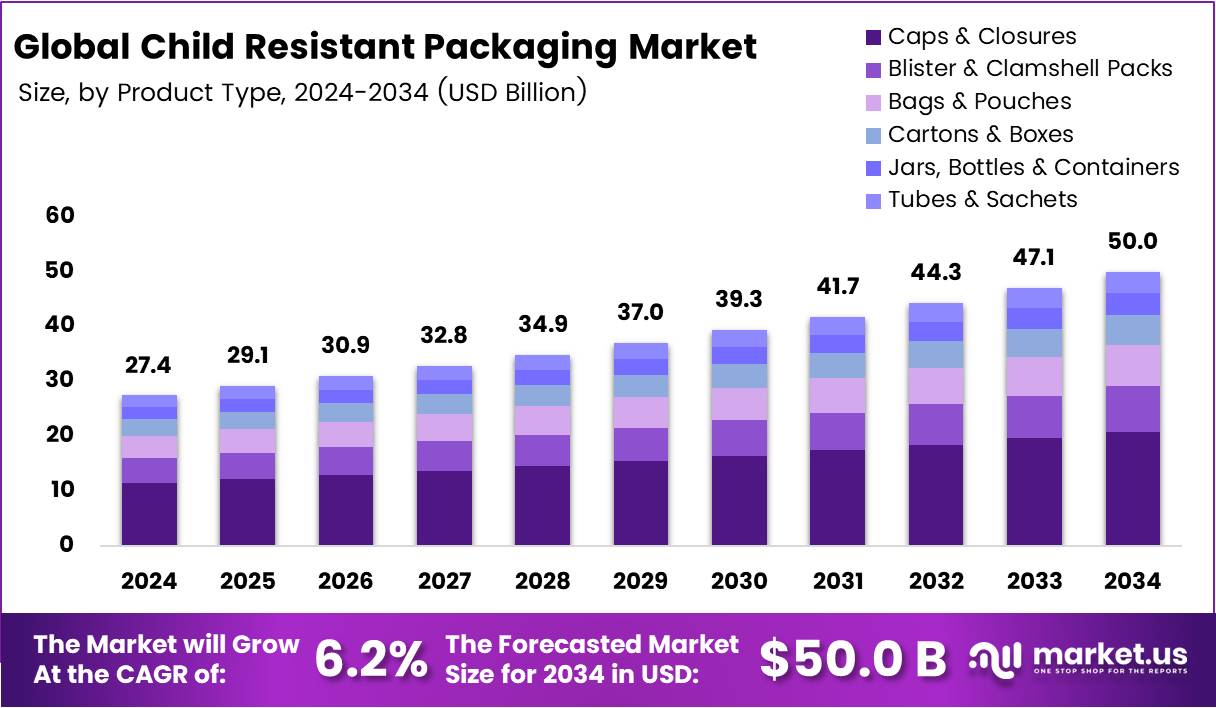

The Global Child-Resistant Packaging Market size is expected to be worth around USD 50.0 Billion by 2034, from USD 27.4 Billion in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034.

Child-resistant packaging (CRP) is a type of packaging designed to be difficult for children under five to open or obtain a toxic amount of the substance inside, while remaining easy for adults to use conveniently. The market is driven by increasing safety awareness, regulatory requirements, and a rising emphasis on sustainability.

Primarily used in the pharmaceutical sector to prevent accidental poisonings, child-resistant packaging is gaining traction in other industries such as cannabis, household chemicals, and cleaning products. In regions such as North America, strict regulations, such as the Poison Prevention Packaging Act, mandate child-resistant packaging for various products, fueling market demand.

Companies are focusing on the growing need for sustainable options by integrating eco-friendly materials into their designs, aligning with the circular economy. Similarly, the ongoing adoption of serialization and track-and-trace technologies enhances product security, while geopolitical tensions and raw material shortages continue to impact manufacturing and supply chain dynamics.

- According to a study, it was projected that, in the U.S., child-resistant packaging reduced deaths among children from accidental poisoning by 45% between 1964 to 1992. Similarly, the use of child-resistant packaging was associated with a 34% reduction in the aspirin-related child mortality rate between 1973 to 1990 in the country.

- The U.S. Pact’s consumer packaged goods, retailer, and converter activators produced 33% of plastic packaging in scope in the U.S. by weight in 2023, placing 5.57M metric tons of plastic on the market.

Key Takeaways

- The global child-resistant packaging market was valued at US$27.4 billion in 2024.

- The global child-resistant packaging market is projected to grow at a CAGR of 6.2% and is estimated to reach US$50.0 billion by 2034.

- Based on the types of child-resistant packaging, caps and closures dominated the market, with 41.6% of the total global market.

- On the basis of packaging material of the child-resistant packaging, plastic held a major share of the market, around 38.7%.

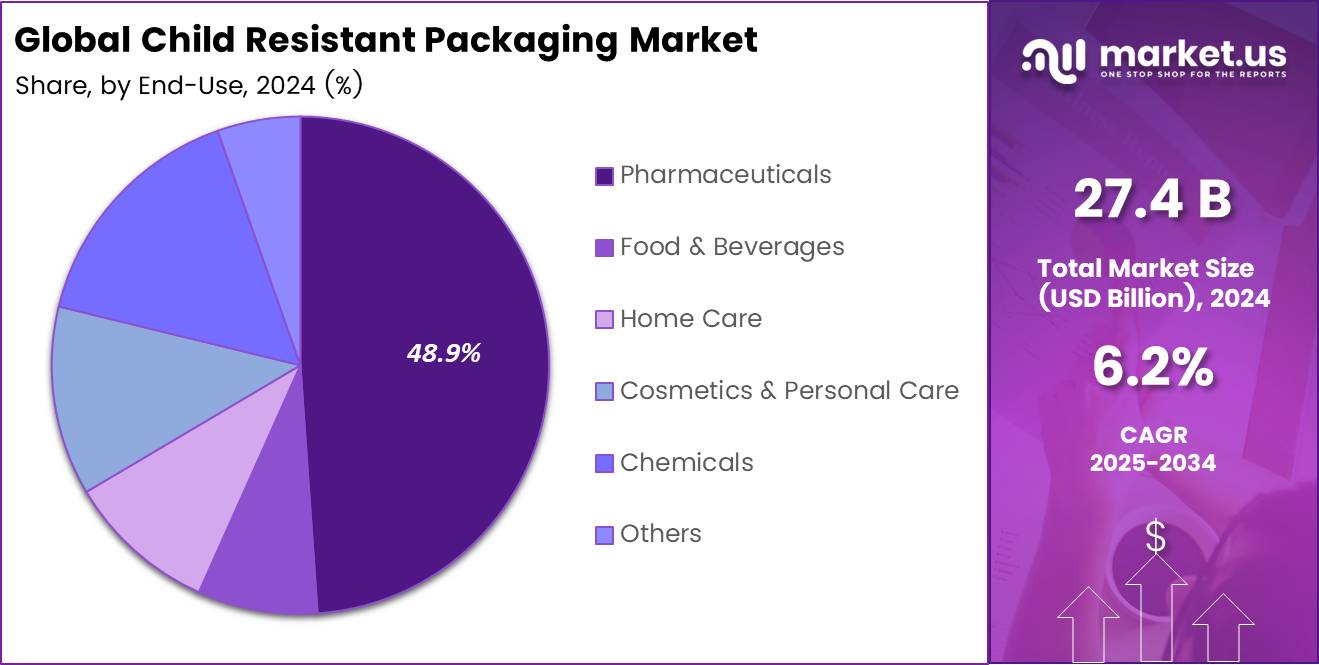

- Among the end-uses, the pharmaceutical industry emerged as a major segment in the child-resistant packaging market, with 48.9% of the market share.

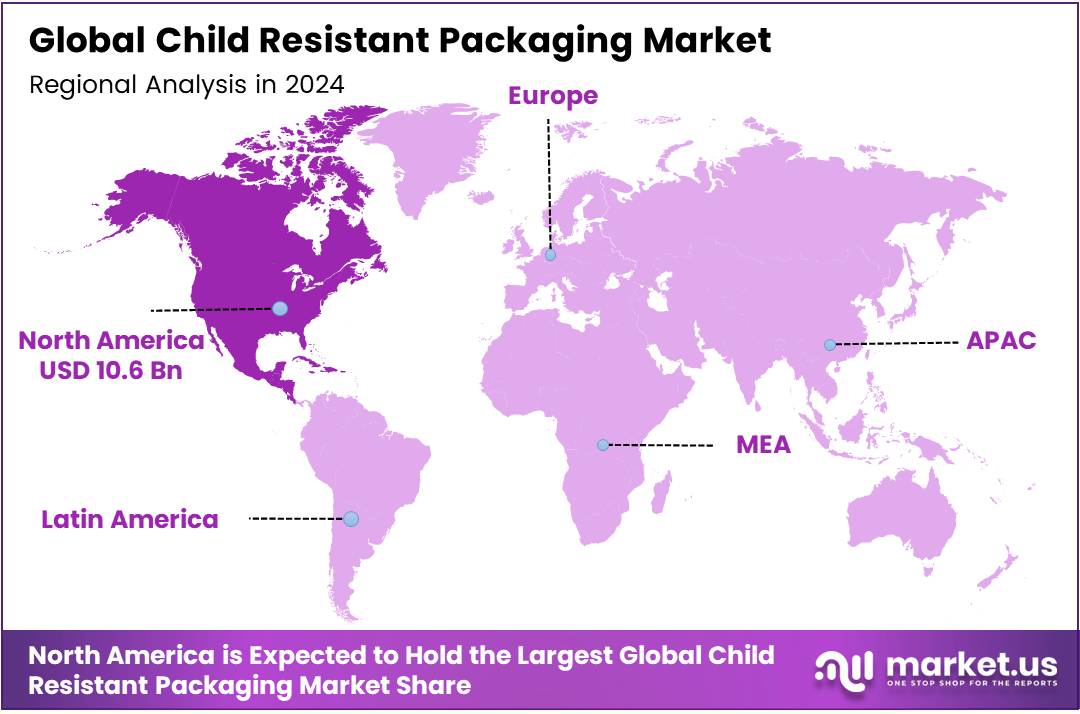

- In 2024, North America was the most dominant region in the child-resistant packaging market, accounting for 38.6% of the total global consumption.

Product Type Analysis

Caps and Closures Dominated the Child-Resistant Packaging Market in 2024.

The child-resistant packaging market is segmented based on the product types into caps and closures, blister and clamshell packs, bags and pouches, cartons and boxes, jars, bottles & containers, and tubes & sachets. The caps and closures dominated the child-resistant packaging market, comprising 41.6% of the market share. They are more widely used in child-resistant packaging compared to other formats due to their practicality, cost-effectiveness, and ease of integration into existing packaging lines.

The push-and-turn or squeeze-to-release mechanisms commonly found in caps and closures are highly effective in preventing children from accessing contents while remaining relatively simple for adults to open. This ease of use for seniors, coupled with low manufacturing costs, makes caps and closures an attractive option for a variety of industries, particularly pharmaceuticals and over-the-counter medications.

For instance, child-resistant caps are standard on prescription bottles, where safety and convenience are critical. Moreover, caps can be easily adapted to a wide range of container sizes and are compatible with various materials such as glass and plastic, offering flexibility in packaging design.

Packaging Material Analysis

Plastics are a Prominent Segment in the Child-Resistant Packaging Market.

The child-resistant packaging market is segmented on the basis of packaging material into plastic, paper & paperboard, metal, and glass. The plastic products led the child-resistant packaging market, constituting 38.7% of the market share.

Most child-resistant packaging is manufactured from plastic rather than paper, paperboard, metal, or glass due to plastic’s versatility, durability, and cost-effectiveness. Plastics can be molded into intricate shapes and designed with advanced mechanisms, making them ideal for child-resistant applications. Additionally, plastic packaging is lightweight, reducing transportation costs compared to heavier materials such as glass or metal.

Similarly, high-quality plastics are resistant to breakage, which is important for packaging that needs to withstand handling without compromising safety or integrity. For instance, plastic bottles with child-resistant caps are commonly used for pharmaceuticals and cleaning products. While glass or metal may offer a premium feel or more robust protection in specific instances, plastic’s ability to be easily mass-produced, customized for various container sizes, and integrated with tamper-evident features makes it the preferred choice for most child-resistant packaging.

End-Use Analysis

The Pharmaceuticals Industry Emerged as a Leading Segment in the Child-Resistant Packaging Market.

On the basis of end-uses, the child-resistant packaging market is segmented into pharmaceuticals, food & beverages, home care, cosmetics and personal care, chemicals, and others. Approximately 48.9% of the child-resistant packaging market revenue is generated by the pharmaceuticals industry. Child-resistant packaging is most commonly used in the pharmaceutical industry due to strict regulatory requirements aimed at preventing accidental poisoning or ingestion by children.

Medications, especially over-the-counter drugs and prescription pills, are often small and colorful, making them particularly attractive to young children, making child-resistant packaging critical for children safety. While child-resistant packaging is used in other sectors such as home care and chemicals, such as cleaning products or pesticides, the demand in pharmaceuticals is more acute due to the high risk of harm from improper ingestion.

In contrast, industries such as food & beverages or cosmetics generally face lower risks, and child-resistant packaging is not typically required, unless the product is potentially harmful, such as alcohol-based products.

Key Market Segments

By Product Type:

- Caps & Closures

- Blister & Clamshell Packs

- Bags & Pouches

- Cartons & Boxes

- Jars, Bottles & Containers

- Tubes & Sachets

By Packaging Material:

- Plastic

- Paper & Paperboard

- Metal

- Glass

By End-Use:

- Pharmaceuticals

- Food & Beverages

- Home Care

- Cosmetics & Personal Care

- Chemicals

- Others

Drivers

Increased Safety Awareness Drives the Child-Resistant Packaging Market.

Increased safety awareness and evolving regulatory frameworks are significantly driving the growth of the child-resistant packaging market. As concerns over the safety of hazardous substances, particularly pharmaceuticals and chemicals, have grown, the demand for packaging solutions that prevent access by children has surged.

Various countries have passed laws regarding child-resistant packaging, including the United States and member states of the European Union, Canada, and Australia. For instance, in the U.S., the Consumer Product Safety Commission’s (CPSC) Poison Prevention Packaging Act (PPPA) requires certain hazardous household substances, over-the-counter (OTC) medications, and most prescription drugs to be in special packaging to prevent accidental ingestion by children under five years of age.

Similarly, the EU’s CLP Regulation mandates child-resistant packaging (CRP) for certain hazardous chemicals sold to the public to prevent accidental poisoning. This is triggered by specific health hazard classifications, such as acute toxicity, and requires packaging to meet certain criteria and pass tests defined by standards such as EN ISO 8317 and EN 862.

For instance, cannabis products, which often target a broader consumer base, have adopted child-resistant packaging as part of their regulatory compliance to prevent underage access. These increasing regulations and societal awareness around safety are pushing manufacturers to design more effective, convenient, and reliable packaging solutions, enhancing the overall demand for child-resistant options across various sectors.

Restraints

High Cost Associated with Designing, Testing, and Certifying Compliant Packaging Systems Might Hamper the Growth of the Child-Resistant Packaging Market.

The high cost associated with designing, testing, and certifying compliant child-resistant packaging is one of the most significant factors restraining market growth, particularly for small and mid-sized manufacturers. Developing packaging that meets strict regulatory standards—such as CPSC 16 CFR 1700 in the U.S. or ISO 8317 internationally—requires extensive R&D, multiple prototype iterations, and the use of specialized materials and engineering designs that ensure both child resistance and adult accessibility. Certification itself is an expensive and time-consuming process.

Packaging must pass rigorous real-world performance tests, including child-panel testing where at least 85% of children must fail to open the package within the first five minutes, and adult-panel testing where older adults must be able to open and properly reclose it. These protocols demand third-party validation, detailed documentation, and quality-assurance procedures, all of which add substantial financial and operational burden.

The challenge intensifies as companies must frequently update packaging to align with evolving safety regulations and market expectations, resulting in ongoing compliance costs. Moreover, the rising demand for sustainable and recyclable child-resistant packaging requires additional investment in material innovation and environmental certification.

Together, these expenses can limit participation from smaller companies, slow product launches, and deter innovation in highly regulated industries such as pharmaceuticals, cannabis, e-commerce, and household chemicals. Consequently, high development and compliance costs create market entry barriers and may slow the broader adoption and advancement of child-resistant packaging solutions.

Growth Factors

Shift Towards Circular Economy Creates Opportunities in the Child-Resistant Packaging Market.

The shift towards a circular economy is opening new opportunities for the child-resistant packaging market by encouraging the use of sustainable, reusable, and recyclable materials. The EU’s Packaging and Packaging Waste Directive (PPWD) implies that all packaging must meet specific sustainability and recyclability requirements throughout its life cycle, including reducing unnecessary packaging, increasing the use of recycled content, designing for recyclability and reuse, and placing the financial responsibility for waste management on producers through Extended Producer Responsibility (EPR) schemes.

As governments and businesses worldwide emphasize sustainability, companies are increasingly seeking packaging solutions that meet safety requirements and minimize environmental impact. For instance, in October 2025, Closure Systems International (CSI) announced the launch of the Omni mini XP 26mm closure, the company’s innovation in sustainable, high-performance packaging for PET non-returnable bottles.

Similarly, in August 2025, PakTech announced the launch of PakLock, a certified child-resistant cap engineered for hemp, CBD, and THC-infused beverages. The product is made from the same 100% recycled and fully recyclable HDPE. The push for a circular economy encourages the reuse of materials, thereby reducing waste and promoting a more sustainable lifecycle for products. This growing demand for eco-friendly child-resistant packaging solutions is expected to accelerate as consumer awareness about sustainability increases, creating a synergy between safety and environmental responsibility.

Emerging Trends

Rapid Adoption of Serialization and Track & Trace Packaging.

The adoption of serialization and track-and-trace technologies is becoming a key trend in the child-resistant packaging market, driven by the increasing need for security, authenticity, and regulatory compliance. Serialization involves assigning unique identification codes to each product, which can be scanned at various stages of the supply chain, ensuring that products are traceable from manufacturer to consumer. This technology is particularly prevalent in the pharmaceutical and cannabis industries, where counterfeit products and diversion are significant concerns.

For instance, pharmaceutical companies are integrating serialization with child-resistant packaging to prevent tampering while ensuring that each product can be traced back to its origin, supporting patient safety and regulatory requirements. The European Union’s Falsified Medicines Directive (FMD) requires manufacturers to place a unique, two-dimensional data matrix code on every pack of prescription medicine.

Similarly, in the United States, the Drug Supply Chain Security Act (DSCSA) requires a unique product identifier on prescription drug packages. In the cannabis sector, track-and-trace systems are implemented to ensure legal compliance and prevent illegal distribution. These systems enhance transparency, combat fraud, and improve inventory management, while adding a layer of safety by ensuring that only authorized and compliant products reach consumers, further boosting the demand for advanced child-resistant packaging solutions.

Geopolitical Impact Analysis

Geopolitical Tensions Cause Price Volatility in the Child-Resistant Packaging Market.

The geopolitical tensions have impacted the child-resistant packaging market in several ways, with disruptions in supply chains, rising raw material costs, and shifting trade policies being some of the most significant effects. The ongoing conflicts and trade disputes between major economies can lead to shortages of critical packaging materials such as plastics and metals, which are commonly used in child-resistant packaging solutions.

For instance, due to the Russia-Ukraine conflict, the price of petroleum has surged, increasing the prices of petrochemicals. Additionally, sanctions or import-export restrictions may hinder the flow of raw materials and finished packaging products across borders, delaying production timelines and impacting inventory availability.

For instance, the trade war between the United States and China, a major producer of plastic that is an important raw material for the packaging industry, has driven up the prices for plastics and some metals. These shortages often drive up prices of the packaging products, making it more challenging for manufacturers to maintain cost-effective production.

Similarly, regulatory changes, such as stricter packaging mandates or new safety standards, may be delayed or altered due to shifting governmental priorities in response to global tensions. In contrast, increased demand for secure packaging, particularly for pharmaceuticals and chemicals, is emerging as a result of heightened safety concerns.

Regional Analysis

North America Held the Largest Share of the Global Child Resistant Packaging Market.

In 2024, North America dominated the global child-resistant packaging market, holding about 38.6% of the total global consumption. The region holds the largest share of the global child-resistant packaging market, driven by stringent safety regulations and high consumer awareness about product safety. In the United States, regulations such as the Poison Prevention Packaging Act (PPPA) have mandated child-resistant packaging for pharmaceuticals, household chemicals, and over-the-counter products.

This has led to widespread adoption of child-resistant packaging solutions across various sectors, particularly in the healthcare and cannabis industries. The legalization of cannabis in several U.S. states has further boosted demand for secure, tamper-evident, and child-resistant packaging, as these products are required by law to be protected from children’s access.

Additionally, rising awareness among consumers about product safety has fueled the growth of child-resistant packaging solutions. The combination of regulatory frameworks and heightened safety consciousness has made North America a dominant region for these packaging solutions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Child-Resistant Packaging Company Insights

Companies in the child-resistant packaging market employ several strategies to gain a competitive edge and increase sales. The manufacturers are focusing on innovation in design, developing packaging solutions that are child-resistant and senior-friendly, addressing the needs of older consumers with reduced dexterity.

Additionally, several companies are focusing on sustainability, incorporating eco-friendly materials and promoting recyclable or biodegradable packaging, which appeals to environmentally conscious consumers and aligns with growing regulatory pressure for sustainable practices.

Similarly, packaging manufacturers are increasingly offering customized solutions, tailoring their products to meet the unique needs of various industries, such as pharmaceuticals, cannabis, and household chemicals. Furthermore, players emphasize collaborating with regulatory bodies to stay ahead of safety standards and offering easy compliance with evolving regulations.

Top Key Players in the Market

- Amcor plc

- Aptar Group, Inc.

- Silgan Holdings Inc.

- Smurfit WestRock plc

- Gerresheimer AG

- Constantia Flexibles GmbH

- Closure Systems International Inc.

- Winpak Ltd.

- Bemis Manufacturing Company

- Bilcare Ltd.

- Origin Pharma Packaging

- Mold-Rite Plastics, LLC

- Berk Company, LLC

- ProAmpac LLC

- Dymapak LLC

- Sanner GmbH

- Other Key Players

Recent Developments

- In July 2025, Amcor, a global leader in developing and producing responsible packaging solutions, developed a polypropylene (PP) closure, Hector Child Resistant Closure (CRC), for household products, weighing just 7.25g, offering important material savings and CO2 reductions.

- In March 2024, Aptar announced its global capacity expansion plan in North America, at its Aptar Congers, New York. Aptar Pharma’s plans included a cleanroom extension at the Aptar Congers site for its Child-Resistant Senior-Friendly (CRSF) closure solutions to increase manufacturing capacity to supply customers locally.

Report Scope

Report Features Description Market Value (2024) USD 27.4 Billion Forecast Revenue (2034) USD 50.0 Billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Caps & Closures, Blister & Clamshell Packs, Bags & Pouches, Cartons & Boxes, Jars, Bottles & Containers, and Tubes & Sachets), By Packaging Material (Plastic, Paper & Paperboard, Metal, and Glass), By End-Use (Pharmaceuticals, Food & Beverages, Home Care, Cosmetics & Personal Care, Chemicals, and Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Amcor plc, AptarGroup, Silgan Holdings Inc., Smurfit WestRock plc, Gerresheimer AG, Constantia Flexibles GmbH, Closure Systems International Inc., Winpak Ltd., Bemis Manufacturing Company, Bilcare Ltd., Origin Pharma Packaging, Mold-Rite Plastics, LLC, O. Berk Company, LLC, ProAmpac LLC, Dymapak LLC, Sanner GmbH, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Child-Resistant Packaging MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Child-Resistant Packaging MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amcor plc

- Aptar Group, Inc.

- Silgan Holdings Inc.

- Smurfit WestRock plc

- Gerresheimer AG

- Constantia Flexibles GmbH

- Closure Systems International Inc.

- Winpak Ltd.

- Bemis Manufacturing Company

- Bilcare Ltd.

- Origin Pharma Packaging

- Mold-Rite Plastics, LLC

- Berk Company, LLC

- ProAmpac LLC

- Dymapak LLC

- Sanner GmbH

- Other Key Players