Global Cellulose Insulation Market By Type (Thermal, Electric, Acoustic), By Material Type (Wood Cellulose Insulation, Cotton Cellulose Insulation, Recycled Paper Cellulose Insulation), By Installation Type (Blown-In Insulation, Spray-On Insulation, Batt Insulation), By Functionality (Thermal Resistance, Sound Absorption, Fire Resistance, Moisture Control), By Application (Residential, Commercial/Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 160422

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

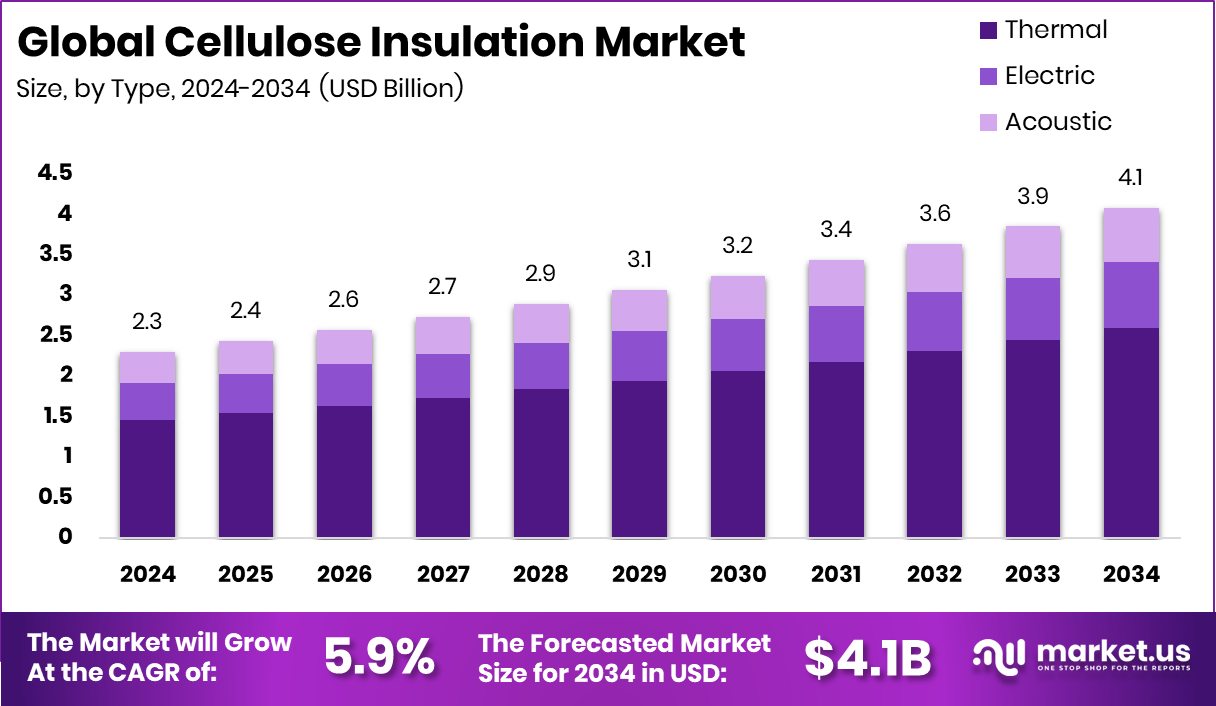

The Global Cellulose Insulation Market is expected to be worth around USD 4.1 billion by 2034, up from USD 2.3 billion in 2024, and is projected to grow at a CAGR of 5.9% from 2025 to 2034. Rising energy-efficient construction practices in North America 42.80% share, continue to strengthen this market growth.

Cellulose insulation is a loose-fill or dense-packed material primarily composed of recycled paper, wood fiber, and other cellulosic materials. It is treated with fire retardants to make it safe for use in building cavities, walls, roofs, and attics. When installed correctly, it forms a thick blanket over gaps and cavities, reducing convective air movement and slowing the transfer of heat. Its high recycled content and relatively low embodied energy make it a greener alternative compared to many traditional insulation types.

The cellulose insulation market refers to the commercial system of producing, distributing, installing, and maintaining cellulose-based insulation materials across residential, commercial, and industrial sectors. It encompasses manufacturing plants (for shredding and treating raw materials), logistics (transport and storage), installation services, and ongoing maintenance or retrofit upgrades. Growth in this market is tied to broader construction trends, energy-efficiency regulations, funding programs, and consumer demand for sustainable building materials.

Growth factors include stricter energy-efficiency codes and regulations, which push new buildings and renovations toward better insulation standards. Rising awareness of carbon footprints and sustainability also drives the uptake of eco-friendly products. Public funding and stimulus programs (such as infrastructure or housing upgrades) that subsidize insulation upgrades further catalyze market expansion. Additionally, growing construction activity, especially in colder climates or energy-constrained regions, supports increased demand for insulation products, including cellulose.

Demand for cellulose insulation is driven by homeowners and building owners seeking to reduce heating and cooling costs, and by retrofit projects in older buildings that often lack adequate insulation. The availability of government grants and subsidized programs—such as the £1 billion insulation scheme in the UK that will cover over 300,000 homes and could save each family ~£400 annually—lowers the up-front cost barrier and spurs uptake.

In social housing, programs like the Social Housing Decarbonisation Fund, targeting 8,800 homes with free efficiency upgrades and average savings of £400, further push demand. In the U.S., investments such as a $12.8 million small-cities grant to modernize housing also support demand in municipal and public housing sectors.

Opportunities for the cellulose insulation market lie in expanding into under-insulated regions, retrofitting existing housing stock, and leveraging green building certifications or incentives. The fact that millions of homes still lack adequate insulation offers a large addressable market. Programs funded by governments or international climate initiatives create opportunities for installers, manufacturers, and supply chains.

Key Takeaways

- The Global Cellulose Insulation Market is expected to be worth around USD 4.1 billion by 2034, up from USD 2.3 billion in 2024, and is projected to grow at a CAGR of 5.9% from 2025 to 2034.

- In 2024, thermal cellulose insulation dominated the market, holding a strong 63.6% share.

- Recycled paper cellulose insulation accounted for 46.7% market share due to its eco-friendly composition.

- Blown-in cellulose insulation led with a 56.9% share owing to its easy application process.

- Thermal resistance functionality dominated with a 59.8% share, highlighting its role in reducing energy consumption.

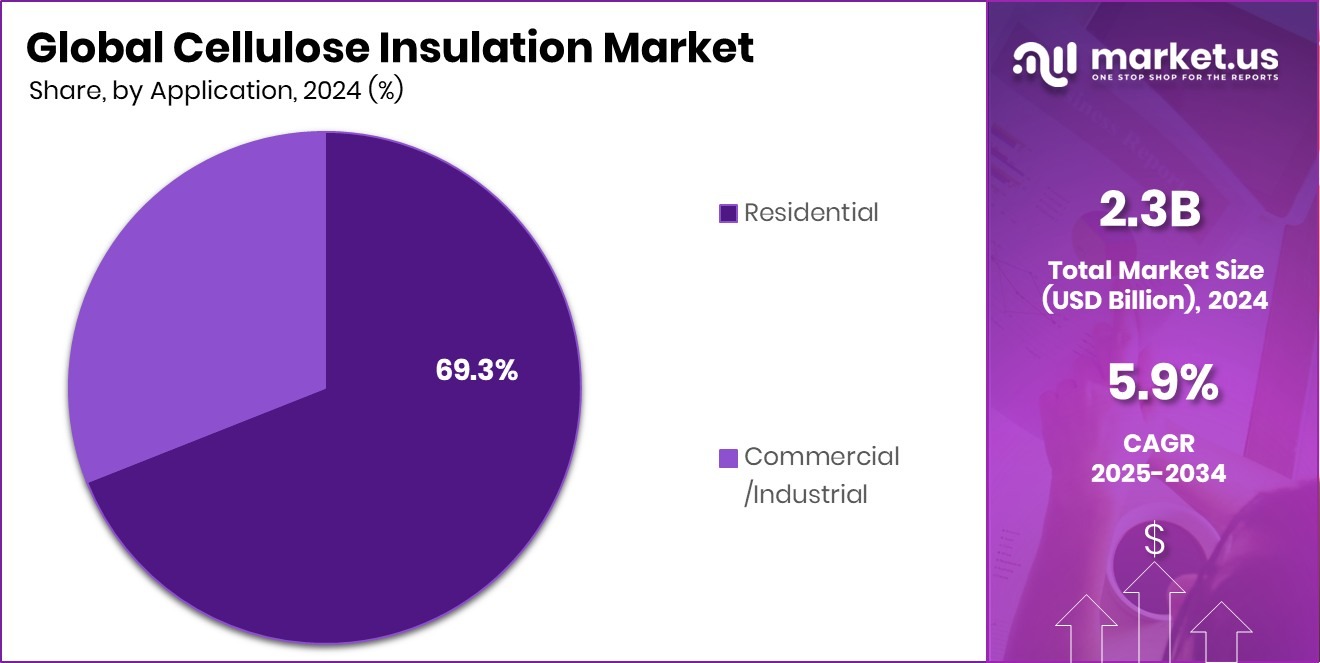

- Residential application captured 69.3% share, driven by retrofits and new home insulation initiatives worldwide.

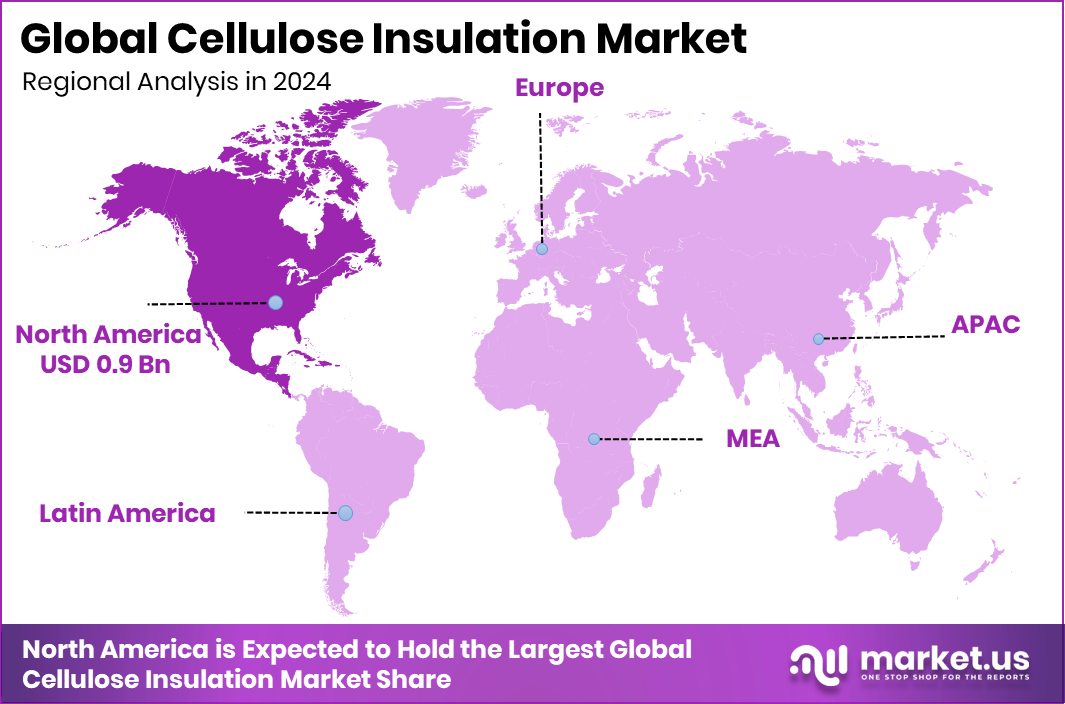

- North America recorded a strong market valuation of around USD 0.9 billion.

By Type Analysis

In 2024, thermal cellulose insulation held a 63.6% share.

In 2024, Thermal held a dominant market position in the By Type segment of the Cellulose Insulation Market, with a 63.6% share. This segment’s leadership reflects its critical role in improving building energy efficiency and reducing heat loss across residential and commercial structures. Thermal cellulose insulation is favored for its ability to provide consistent temperature regulation, lower energy consumption, and enhance indoor comfort.

Its composition—primarily recycled cellulose materials—supports sustainable construction practices while offering effective thermal resistance. Growing adoption in retrofit programs and energy-saving initiatives has further boosted its demand. Government-backed insulation schemes and decarbonization funds have also encouraged homeowners to invest in thermal solutions for long-term cost and energy savings.

By Material Type Analysis

Recycled paper cellulose insulation dominated with a 46.7% market share.

In 2024, Recycled Paper Cellulose Insulation held a dominant market position in the By Material Type segment of the Cellulose Insulation Market, with a 46.7% share. This strong share highlights the growing preference for eco-friendly and cost-effective insulation solutions derived from post-consumer waste paper. Recycled paper cellulose insulation is valued for its high thermal efficiency, sound absorption, and sustainability benefits, making it a preferred choice for green building projects.

Its production process, which utilizes minimal energy and repurposes waste materials, aligns with global sustainability goals. Increasing government emphasis on energy-efficient housing and the availability of incentives for using recycled materials have further driven demand for recycled paper-based cellulose insulation across residential and commercial applications.

By Installation Type Analysis

Blown-in insulation accounted for a 56.9% share in 2024 installations.

In 2024, Blown-In Insulation held a dominant market position in the By Installation Type segment of the Cellulose Insulation Market, with a 56.9% share. This method’s popularity stems from its efficiency in filling irregular spaces and wall cavities, ensuring uniform coverage and superior thermal performance. Blown-in cellulose insulation is widely preferred in both new constructions and retrofit projects due to its quick installation process and minimal structural disruption.

It provides excellent air sealing, reducing heat loss and enhancing energy savings in homes and commercial buildings. The growing focus on energy efficiency, coupled with cost-effective installation and compatibility with existing building frameworks, continues to strengthen the dominance of blown-in insulation across key construction applications.

By Functionality Analysis

Thermal resistance functionality captured 59.8% of the cellulose insulation market.

In 2024, Thermal Resistance held a dominant market position in the By Functionality segment of the Cellulose Insulation Market, with a 59.8% share. This dominance highlights its essential role in maintaining indoor temperature stability and reducing energy consumption in buildings. Thermal resistance insulation helps minimize heat transfer, ensuring greater comfort and lower utility costs throughout the year.

Its effectiveness in meeting energy-efficiency standards and sustainability goals has made it the preferred choice for residential and commercial structures. The growing focus on environmentally friendly construction materials and government-driven initiatives promoting energy conservation have further supported the demand for cellulose insulation with strong thermal resistance performance, reinforcing its leading position within the market.

By Application Analysis

Residential applications led the cellulose insulation market with a 69.3% share.

In 2024, Residential held a dominant market position in the By Application segment of the Cellulose Insulation Market, with a 69.3% share. This strong presence reflects the growing demand for energy-efficient and sustainable insulation solutions in homes. Residential buildings increasingly adopt cellulose insulation to reduce heating and cooling costs, improve comfort, and support eco-friendly construction goals.

The segment benefits from widespread government-backed housing initiatives and funding programs that promote insulation upgrades to cut energy bills. Homeowners’ rising awareness of environmental impact and cost savings has further accelerated the adoption of cellulose insulation in new builds and retrofits, solidifying the residential sector’s leadership within the overall market.

Key Market Segments

By Type

- Thermal

- Electric

- Acoustic

By Material Type

- Wood Cellulose Insulation

- Cotton Cellulose Insulation

- Recycled Paper Cellulose Insulation

By Installation Type

- Blown-In Insulation

- Spray-On Insulation

- Batt Insulation

By Functionality

- Thermal Resistance

- Sound Absorption

- Fire Resistance

- Moisture Control

By Application

- Residential

- Commercial/Industrial

Driving Factors

Rising Energy Efficiency Investments Boost Market Growth

One of the major driving factors of the Cellulose Insulation Market is the increasing investment in energy efficiency projects aimed at reducing heat loss and cutting energy bills. Governments and organizations are focusing on upgrading buildings with sustainable insulation materials like cellulose, which offer excellent thermal performance and eco-friendly benefits. Such initiatives are supported by major funding programs and industrial collaborations that encourage cleaner energy use.

For instance, IRFC inked a ₹10,560 crore funding deal with MAHAGENCO for the Koradi Thermal Expansion project, promoting energy-efficient infrastructure. Similarly, Chennai-based Tan90 Thermal Solutions raised ₹20 crore in Series A funding, highlighting growing investor confidence in advanced thermal and insulation technologies driving the market forward.

Restraining Factors

High Moisture Sensitivity Limits Wider Market Adoption

A key restraining factor for the Cellulose Insulation Market is its high sensitivity to moisture, which can reduce performance and longevity over time. When exposed to damp conditions, cellulose insulation may lose its thermal efficiency and become prone to mold or decay, requiring additional protective treatments and careful installation. This increases maintenance costs and limits its use in regions with high humidity or frequent rainfall.

Such challenges slow adoption despite the material’s eco-friendly benefits. However, ongoing innovations and funding for thermal technologies aim to overcome these issues. For example, Thermal energy storage system firm Exergy3 secured £1 million in funding, supporting research that could enhance insulation durability and energy storage performance in future applications.

Growth Opportunity

Expanding Green Construction Creates New Market Opportunities

A major growth opportunity for the Cellulose Insulation Market lies in the rapid expansion of green and energy-efficient construction projects. With global efforts to reduce carbon emissions, builders are increasingly using sustainable materials like cellulose insulation to meet environmental standards. Its recycled content, low embodied energy, and strong thermal performance make it an ideal choice for eco-friendly buildings and retrofits.

Growing investments in clean energy and advanced materials further support this shift. For instance, enaDyne raised €7 million in seed funding to develop non-thermal plasma catalysis technology for sustainable chemical production, while HYLENR secured $3 million pre-series A funding to commercialize zero-carbon thermal energy systems—both signaling strong investor interest in green innovations that align with cellulose insulation growth.

Latest Trends

Growing Focus on Sustainable Building and Climate Action

One of the latest trends in the Cellulose Insulation Market is the increasing focus on sustainable construction and climate-friendly building practices. Governments and industries are emphasizing insulation materials that reduce energy use and support green goals. Cellulose insulation, made from recycled paper and natural fibers, fits perfectly within this trend due to its low environmental impact and high efficiency. Public funding and corporate initiatives are driving large-scale adoption in housing and commercial projects.

For example, Governor Hochul announced a $1 billion Sustainable Future Program to support climate action and green jobs. Similarly, Tan90 Thermal Bags raised ₹20 crore to develop energy-efficient cooling solutions, reflecting growing investment interest in sustainable and climate-resilient technologies.

Regional Analysis

In 2024, North America dominated the Cellulose Insulation Market with a 42.80% share.

In 2024, North America dominated the Cellulose Insulation Market, accounting for 42.80% share and reaching a market value of USD 0.9 billion. The region’s dominance is supported by strong adoption of energy-efficient building standards, extensive retrofit programs, and government-backed insulation initiatives aimed at reducing household energy costs. Rising awareness of sustainable construction practices and the growing focus on reducing carbon emissions continue to drive the use of cellulose insulation across residential and commercial buildings.

Europe follows with steady growth driven by stringent energy performance regulations and increasing renovation activities in older housing stock. The Asia Pacific region shows emerging potential, supported by expanding urban development and government initiatives promoting eco-friendly materials in countries such as Japan, China, and India.

Meanwhile, the Middle East & Africa and Latin America markets are gradually expanding, with construction modernization and energy conservation measures enhancing demand. However, North America remains the leading regional market, owing to strong regulatory frameworks, widespread awareness of thermal efficiency, and consistent funding support for sustainable housing upgrades. This regional leadership underscores North America’s position as a key growth hub for cellulose insulation solutions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Applegate Insulation continues to strengthen its presence in the global Cellulose Insulation Market through its focus on sustainability and advanced manufacturing processes. The company emphasizes high recycled content and precision-engineered cellulose products designed for superior thermal and acoustic performance. Its operations remain closely aligned with growing construction efficiency standards and green building initiatives. By maintaining consistent quality and supporting professional installation networks, Applegate reinforces its position as a reliable supplier in residential and commercial applications, ensuring long-term growth momentum.

Greenfiber has established itself as a key contributor to cellulose insulation innovation, leveraging its expertise in producing environmentally friendly and cost-effective materials. The company’s focus on energy-efficient performance and soundproofing qualities makes its products highly preferred among sustainable builders. Greenfiber’s emphasis on ease of installation and product durability allows it to capture growing demand from retrofit and new construction projects. The firm continues to benefit from increased awareness of recycled insulation materials as a practical alternative to traditional fiberglass options.

International Cellulose Corporation remains a specialized manufacturer focusing on high-quality cellulose-based thermal and acoustic insulation solutions. The company’s expertise in spray-applied coatings and sound-control systems supports its strong reputation in commercial and industrial projects. Its consistent focus on meeting architectural and environmental standards reinforces its market credibility. Through product customization and technical precision, International Cellulose Corporation continues to serve diverse customer needs while aligning with evolving global sustainability goals, securing its position as a trusted player in the cellulose insulation industry.

Top Key Players in the Market

- Applegate Insulation

- Greenfiber

- International Cellulose Corporation

- Nu-Wool Co., Inc.

- Advanced Fiber Technology

- Fiberlite Technologies, Inc.

- Hamilton Manufacturing Inc.

- Nature-Tech Solutions

- Eagle Cellulose Insulation

Recent Developments

- In July 2024, Greenfiber’s SANCTUARY Blow-In or Spray-Applied Insulation was selected for use in VISION House Las Vegas: Crossing the Rubicon, a sustainable home project by Beazer Homes and Green Builder Media.

- In February 2024, Saint-Gobain announced that it had acquired the business assets of International Cellulose Corporation, a major manufacturer of spray-on thermal and acoustical insulation products.

Report Scope

Report Features Description Market Value (2024) USD 2.3 Billion Forecast Revenue (2034) USD 4.1 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Thermal, Electric, Acoustic), By Material Type (Wood Cellulose Insulation, Cotton Cellulose Insulation, Recycled Paper Cellulose Insulation), By Installation Type (Blown-In Insulation, Spray-On Insulation, Batt Insulation), By Functionality (Thermal Resistance, Sound Absorption, Fire Resistance, Moisture Control), By Application (Residential, Commercial/Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Applegate Insulation, Greenfiber, International Cellulose Corporation, Nu-Wool Co., Inc., Advanced Fiber Technology, Fiberlite Technologies, Inc., Hamilton Manufacturing Inc., Nature-Tech Solutions, Eagle Cellulose Insulation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cellulose Insulation MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Cellulose Insulation MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Applegate Insulation

- Greenfiber

- International Cellulose Corporation

- Nu-Wool Co., Inc.

- Advanced Fiber Technology

- Fiberlite Technologies, Inc.

- Hamilton Manufacturing Inc.

- Nature-Tech Solutions

- Eagle Cellulose Insulation