Global Carbon Aerogel Market Size, Share, Growth Analysis By Product Form (Blanket, Particle, Panel, and Monolith), By Type (Resorcinol-Formaldehyde Based, Polyacrylonitrile Based, and Others), By Application (Energy And Power, Oil And Gas, Automotive, Aerospace And Marine, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 167474

- Number of Pages: 382

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

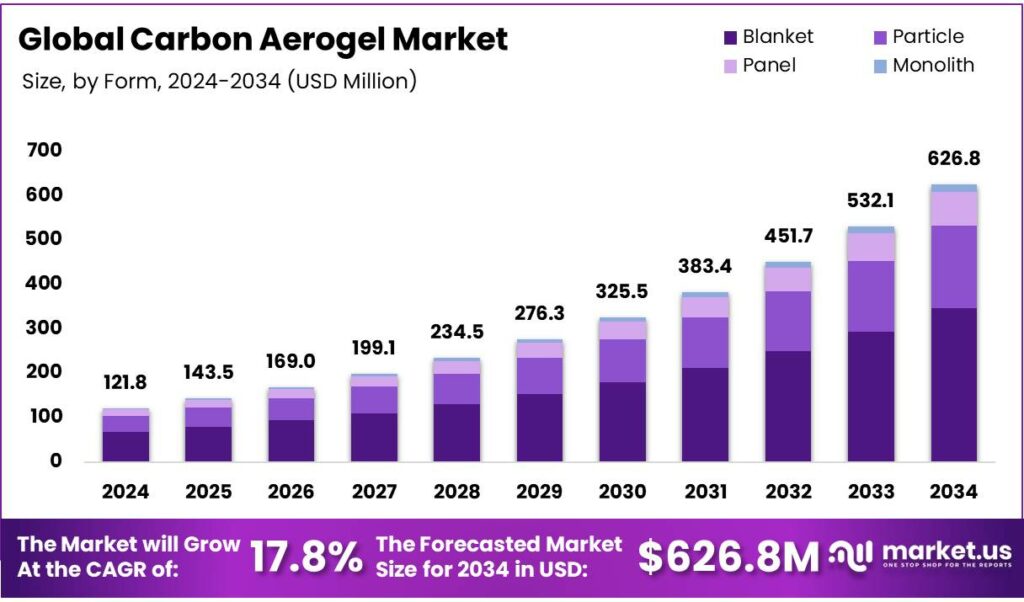

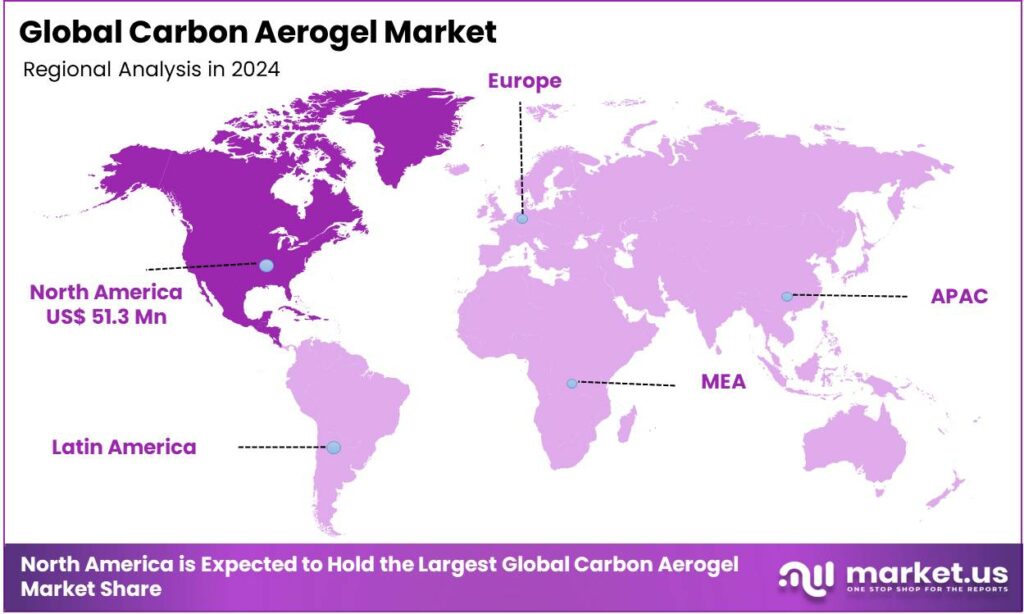

The Global Carbon Aerogel (CAG) Market size is expected to be worth around USD 626.8 Million by 2034, from USD 121.8 Million in 2024, growing at a CAGR of 17.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 42.1% share, holding USD 51.3 Million revenue.

Aerogel is an ultra-lightweight solid material derived from a gel, where the liquid component is replaced with gas, making it up to 99.8% air. Similarly, the carbon aerogel (CAG) is an ultralight, porous carbon-based material made from a 3D network of nanoparticles. It is produced by pyrolyzing (heating in an oxygen-poor environment) an organic aerogel, which removes non-carbon molecules and creates a highly conductive and porous structure.

Carbon aerogels are valued for their high surface area, low density, and electrical conductivity, making them useful for applications in energy storage, catalysis, and environmental cleanup. The energy storage is a major driver of these aerogels. However, due to their porosity, they are in high demand for components in the automotive, aerospace, and marine industries. In addition, due to their high absorption capacities, they are used for cleaning up oil spills and absorbing toxic chemicals from wastewater. However, as these aerogels have a very complex production process, the companies face difficulties when scaling up production.

Key Takeaways

- The global carbon aerogel market was valued at USD 121.8 million in 2024.

- The global carbon aerogel market is projected to grow at a CAGR of 17.8% and is estimated to reach USD 626.8 million by 2034.

- Based on the forms of the product, the carbon aerogel in blanket form dominated the market, with around 55.3% of the total global market.

- On the basis of the type of product, the carbon aerogel based on resorcinol-formaldehyde held a major share of the market, around 46.5%.

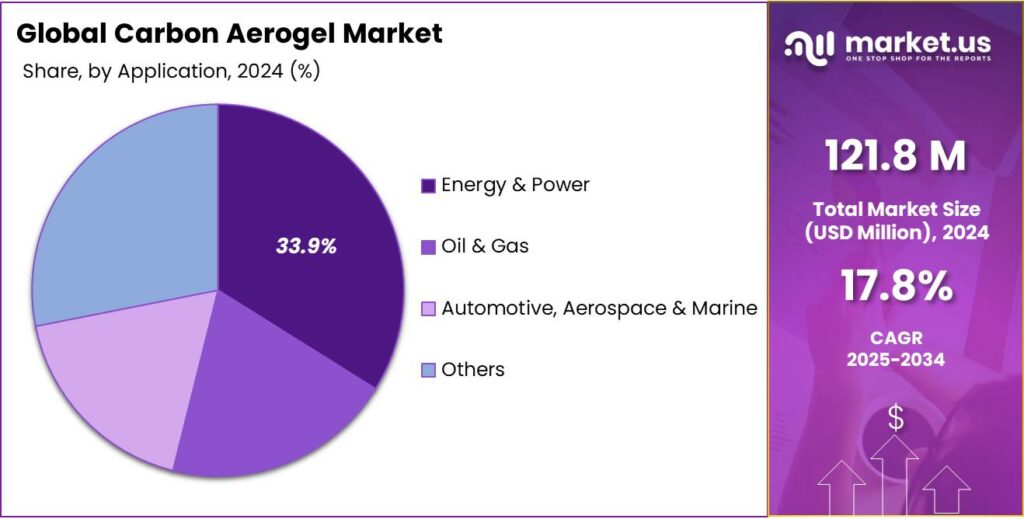

- Among the applications of carbon aerogel, the energy and power industry emerged as a major segment in the market, with 33.9% of the market share.

- In 2024, North America was the most dominant region in the carbon aerogel market, accounting for around 42.1% of the total global consumption.

Form Analysis

Carbon Aerogel in Blanket Form Dominated the Market in 2024.

The carbon aerogel market is segmented based on product forms into blanket, particle, panel, and monolith. The carbon aerogel in blanket form dominated the market, comprising around 55.3% of the market share. They are more widely utilized than particles, monoliths, and panels as they combine flexibility, ease of handling, and high-performance thermal insulation in a practical form.

With ultralow thermal conductivity often below 0.015 W/m·K and densities as low as 0.1 g/cm³, blankets can conform to irregular surfaces, pipelines, and equipment enclosures where rigid panels would be difficult to install. Unlike particles, blankets reduce dust generation and material loss, improving safety and reusability. Reinforced with fibers, aerogel blankets maintain mechanical strength while preserving porosity and insulation efficiency, making them ideal for aerospace, energy storage, and industrial insulation applications, where adaptability and coverage are critical.

Type Analysis

Resorcinol-Formaldehyde-Based Carbon Aerogel Held a Major Share of the Market.

Based on the type of carbon aerogel, the market is segmented into resorcinol-formaldehyde-based, polyacrylonitrile-based, and others. The resorcinol-formaldehyde-based carbon aerogel sheets dominated the market, comprising around 46.5% of the market share. They are widely used as they offer a superior combination of high surface area, tunable porosity, and excellent electrical conductivity compared to polyacrylonitrile (PAN) or other carbon aerogels.

RF aerogels can achieve surface areas exceeding 2000 m²/g and pore volumes up to 3 cm³/g, making them ideal for applications in supercapacitors, catalyst supports, and adsorption systems. Their sol–gel synthesis allows precise control over density, pore size, and mechanical strength, which is harder to achieve with PAN-based aerogels. Additionally, RF aerogels exhibit excellent thermal and chemical stability, withstanding temperatures above 1000°C in inert atmospheres, making them suitable for high-performance insulation and energy storage applications. This versatility makes RF aerogels the preferred choice in both industrial and research applications.

Application Analysis

The Energy and Power Industry Emerged as a Leading Segment in the Carbon Aerogel Market.

On the basis of applications of carbon aerogel, the market is segmented into energy & power, oil & gas, automotive, aerospace & marine, and others. Approximately 33.9% of the revenue in the carbon aerogel market is generated by the energy and power industry. The industry utilizes most carbon aerogel as its unique combination of high surface area, electrical conductivity, and thermal stability directly addresses the sector’s critical needs. Carbon aerogels, with surface areas up to 2500 m²/g and excellent porosity, are ideal for supercapacitors, battery electrodes, and energy storage systems, enabling faster charge-discharge cycles and higher energy density.

While other industries, such as automotive, aerospace, and oil & gas, benefit from aerogels for insulation or lightweight components, their application scale is smaller compared to large-scale energy storage deployments. Additionally, the rapid global shift toward renewable energy and electric vehicles has amplified demand for high-performance electrodes and thermal management solutions, positioning the energy and power sector as the primary driver of carbon aerogel utilization.

Key Market Segments

By Product Form

- Blanket

- Particle

- Panel

- Monolith

By Type- Resorcinol-Formaldehyde Based

- Polyacrylonitrile Based

- Others

By Application

- Energy & Power

- Oil & Gas

- Automotive, Aerospace & Marine

- Others

Drivers

The Demand for High-Performance Energy Storage Drives the Carbon Aerogel Market.

The growing demand for high-performance energy storage solutions is a major factor driving the carbon aerogel market. Carbon aerogels are highly porous, lightweight materials with exceptional electrical conductivity and a large surface area, up to 2500 m² per gram, making them ideal for use in supercapacitors and advanced batteries.

- According to a study, the incorporation of CAG, at less than 30 wt%, increased the specific surface area of the CAG-CF fabric to above 230 m2 g−1 and the pore volume to about 0.35 cm3 g−1. The presence of the CAG improves the electrochemical performance of the composite electrodes and may enhance the mechanical response due to the high stiffness of the aerogel structure.

The CAG enables faster charge–discharge cycles and higher energy density compared to traditional carbon materials. For instance, carbon aerogel-based electrodes are being used in lithium-ion and sodium-ion batteries to improve power efficiency and lifespan, supporting applications in electric vehicles and renewable energy storage systems.

Their thermal stability and low density make them suitable for aerospace and defense applications, where weight reduction and energy efficiency are critical. Additionally, the global transition toward sustainable energy and the increasing production of electric vehicles continue to boost the need for efficient energy storage materials, further strengthening the adoption of carbon aerogels.

Restraints

Scaling up the Production Remains a Significant Challenge in the Carbon Aerogel Market.

Scaling up the production of carbon aerogels remains a major challenge due to the complexities involved in cost control, precursor material availability, and drying techniques. The synthesis process often requires expensive precursors such as resorcinol and formaldehyde, along with precise control of sol-gel reactions to achieve the desired pore structure and mechanical strength.

One of the most critical steps, supercritical or freeze-drying, is energy-intensive and time-consuming, accounting for up to 60-70% of total production costs. In addition, maintaining uniform porosity and structural integrity during large-scale fabrication is very difficult, as small inconsistencies can lead to defects that reduce performance.

Similarly, scaling laboratory-based methods to industrial levels without compromising the material’s surface area (typically around 600–2500 m²/g) poses engineering and economic challenges. Researchers are exploring alternative low-cost carbon sources, such as biomass and waste-derived materials, as well as more efficient drying and carbonization methods to make large-scale carbon aerogel production more viable.

Opportunity

The Role of Carbon Aerogel in Environmental Remediation Might Create Opportunities in the Market.

Carbon aerogels play a significant role in environmental remediation due to their exceptional adsorption capacity, high porosity, and tunable surface chemistry. With a surface area that can exceed 2000 m² per gram, these materials can efficiently capture and remove pollutants such as heavy metals, dyes, and organic contaminants from water and air. For instance, carbon aerogels modified with functional groups such as hydroxyl or carboxyl can selectively adsorb toxic ions such as lead (Pb²⁺) and cadmium (Cd²⁺) from wastewater. Their lightweight structure and reusability make them a sustainable alternative to traditional activated carbon filters.

Additionally, carbon aerogels show excellent performance in oil-water separation, with absorption capacities reaching up to 100 times their own weight, making them highly effective for cleaning up oil spills. The rising need for eco-friendly and efficient remediation technologies positions carbon aerogels as a promising material for addressing global pollution challenges.

Trends

Demand for Lightweight Components from Automotive, Aerospace & Marine Industries.

The increasing demand for lightweight components in the automotive, aerospace, and marine industries is driving the use of carbon aerogels as a key material for advanced structural applications. Carbon aerogels are among the lightest solid materials known, with densities as low as 0.003 g/cm³; however, they offer excellent mechanical strength, thermal insulation, and electrical conductivity.

In the automotive sector, they are being explored for use in lightweight battery casings, energy-absorbing panels, and heat management systems, helping to improve fuel efficiency and extend the range of electric vehicles. In aerospace applications, their exceptional thermal resistance and low density make them suitable for insulation in spacecraft and aircraft, where weight reduction is crucial.

Similarly, in the marine industry, carbon aerogels are used to create lightweight composite materials that enhance buoyancy and fuel efficiency. This ongoing trend toward material light-weighting continues to promote innovation and adoption of carbon aerogels across multiple transportation sectors. Global car production was approximately 92.5 million vehicles in 2024. Similarly, in June 2025, the global commercial fleet comprised 35,550 aircraft. Also, according to the United Nations Trade and Development Data Hub, in 2024, ships with a total gross tonnage of 71,690,983 were built in the world. As production of vehicles, aircraft, and ships increases, there will be a consistent demand for lightweight components.

Geopolitical Impact Analysis

Geopolitical Tensions Are Impacting the Carbon Aerogel market by Disrupting the Essential Supply Chains in the Market.

The geopolitical tensions have had a noticeable impact on the carbon aerogel market by disrupting supply chains, increasing production costs, and influencing trade dynamics for critical raw materials. Several precursor substances used in aerogel synthesis, such as resorcinol, formaldehyde, and carbon-based nanomaterials, depend on stable international trade and chemical supply networks. Political conflicts and trade restrictions between major economies have led to fluctuations in raw material availability and price volatility, slowing large-scale manufacturing. For instance, tensions affecting energy markets, such as the Russia-Ukraine conflict, have increased the cost of power-intensive production processes like supercritical drying and carbonization.

Moreover, restrictions on high-tech exports and collaborations between nations, such as the trade war between the US and China, have limited access to advanced manufacturing equipment and cross-border research, particularly in nanomaterial engineering. Regions with strong domestic production capabilities, such as North America and parts of Europe, have managed to maintain moderate stability by investing in local supply chains and recycling initiatives. In contrast, emerging economies dependent on imported precursors have faced delays and reduced production output. Despite these challenges, geopolitical pressures are also encouraging nations to develop self-reliant and sustainable production pathways, potentially reshaping the future dynamics of the carbon aerogel industry.

Regional Analysis

North America Held the Largest Share of the Global Carbon Aerogel Market.

In 2024, North America dominated the global carbon aerogel market, holding about 42.1% of the total global consumption. The region held the largest share of the global carbon aerogel market, driven by strong technological advancements, a well-established research ecosystem, and high demand from industries such as aerospace, defense, energy storage, and environmental engineering. The region’s focus on lightweight and high-performance materials has accelerated the adoption of carbon aerogels in applications such as supercapacitors, insulation panels, and catalyst supports.

The United States, in particular, has been at the forefront of developing carbon aerogel-based components for electric vehicles and aerospace systems. For instance, NASA has utilized aerogel materials for thermal shielding in space missions, highlighting their reliability in extreme environments. Additionally, the growing emphasis on sustainable technologies and renewable energy integration across the region has boosted research into carbon aerogels derived from bio-based precursors, reinforcing North America’s leadership in both innovation and industrial utilization of these advanced materials.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The major market players in the carbon aerogel market are Aerogel Technologies, American Elements, Wedge Group, and Aspen Aerogels. As there is a global demand for carbon aerogel from various industries, the companies focus on market expansion and increasing their production facilities. For instance, Aerogel Technologies is focused on scaling its ambient production method to create large sheets of its aerogel for new applications like thermal insulation and durable composites.

In addition, these participants partner with institutions for R&D and collaborate with different organizations and companies to cater to their specific needs. For instance, Aspen Aerogels collaborated with NASA to use carbon aerogel infiltration in the company’s CFOAM (carbon foam).

The following are some of the major players in the industry

- Aerogel Technologies, LLC

- American Elements

- Wedge Group LTD.

- Aspen Aerogels, Inc.

- Other Key Players

Key Development

- In October 2024, Aspen Aerogels announced that it would receive a loan of up to US$671 million from the US Department of Energy to help finance the construction of a silica and carbon aerogel blanket plant in Georgia.

Report Scope

Report Features Description Market Value (2024) US$121.8 Mn Forecast Revenue (2034) US$626.8 Mn CAGR (2025-2034) 17.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Form (Blanket, Particle, Panel, and Monolith), By Type (Resorcinol-Formaldehyde Based, Polyacrylonitrile Based, and Others), By Application (Energy & Power, Oil & Gas, Automotive, Aerospace & Marine, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Aerogel Technologies, American Elements, Wedge Group, Aspen Aerogels, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Aerogel Technologies, LLC

- American Elements

- Wedge Group LTD.

- Aspen Aerogels, Inc.

- Other Key Players