Global Car Security Systems Market Size, Share, Growth Analysis By Vehicle (Passenger Vehicles, Commercial Vehicles, Electric & Hybrid Vehicles), By Product (Immobilizer, Remote Keyless Entry, Central Locking System, Car Alarm, Others), By Technology (Basic Security, Intermediate Security, Advanced Security, Integrated Security Ecosystems, Others), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172536

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

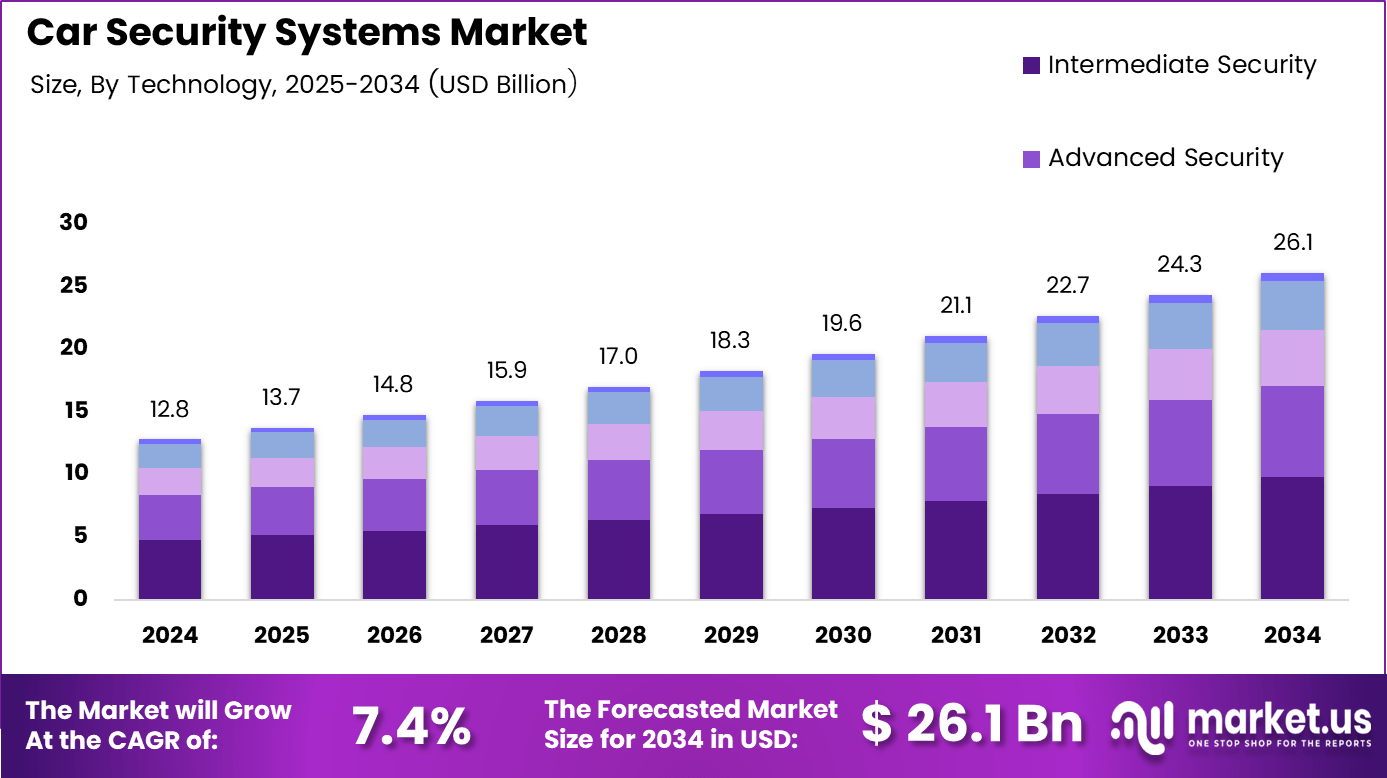

The Global Car Security Systems Market size is expected to be worth around USD 26.1 billion by 2034, from USD 12.8 billion in 2024, growing at a CAGR of 7.4% during the forecast period from 2025 to 2034.

The Car Security Systems Market represents solutions designed to prevent vehicle theft, unauthorized access, and tampering using mechanical and electronic safeguards. It includes steering locks, alarms, immobilizers, biometric access, and connected monitoring technologies. As vehicle ownership rises globally, security systems increasingly function as essential vehicle protection infrastructure rather than optional accessories.

From an analyst viewpoint, Car Security Systems focus on safeguarding physical assets while enhancing driver confidence and ownership value. These systems combine deterrence, detection, and response mechanisms to make vehicles difficult to steal or misuse. Consequently, adoption remains closely linked with urbanization trends, vehicle density growth, and rising awareness of automotive crime risks.

Market growth continues steadily as governments emphasize vehicle safety standards and theft prevention initiatives. Regulatory authorities increasingly recommend or mandate basic anti-theft mechanisms in new vehicles. Meanwhile, public investment in smart city infrastructure indirectly supports connected car security adoption by enabling data networks, surveillance integration, and real-time vehicle tracking environments.

Opportunities expand as consumers seek layered security solutions that combine mechanical strength with electronic intelligence. Aftermarket demand remains strong due to older vehicle fleets lacking factory-installed protection. Additionally, integration with connected car platforms and smartphone-based controls supports transactional demand, particularly among urban commuters and fleet operators prioritizing asset protection.

Technology evolution significantly shapes this market through embedded controllers, biometric sensors, and low-power electronics. Modern systems increasingly rely on compact microcontrollers for authentication and alarm processing. According to survey, fingerprint sensors can store up to 127 identities, enabling personalized and restricted vehicle access without reliance on traditional keys.

Mechanical security remains relevant alongside digital solutions. According to study, steering wheel locks constructed entirely from metal physically prevent vehicle operation by restricting steering movement. Adjustable designs typically extend between 58.0 and 85.0 centimeters, making forced vehicle control impractical during unauthorized entry attempts.

Cost accessibility further supports adoption across income segments. According to retail and installation guides, mechanical steering locks and basic electronic systems typically cost between $250 and $500 depending on configuration. Low-power buzzers operating at 4–8 volts and drawing up to 30 mA, as noted in electronics reference sources, support energy-efficient alarm functionality.

Overall, the Car Security Systems Market benefits from converging mechanical reliability, electronic intelligence, and regulatory backing. As vehicle theft prevention gains policy attention and consumer urgency, demand remains resilient. Keywords such as vehicle anti-theft systems, automotive security solutions, steering locks, biometric car access, and connected vehicle protection continue shaping market visibility.

Key Takeaways

- The global Car Security Systems Market is projected to grow from USD 12.8 billion in 2024 to USD 26.1 billion by 2034, registering a CAGR of 7.4%.

- Passenger Vehicles represent the largest vehicle segment, accounting for a dominant share of 59.3% of the total market in 2024.

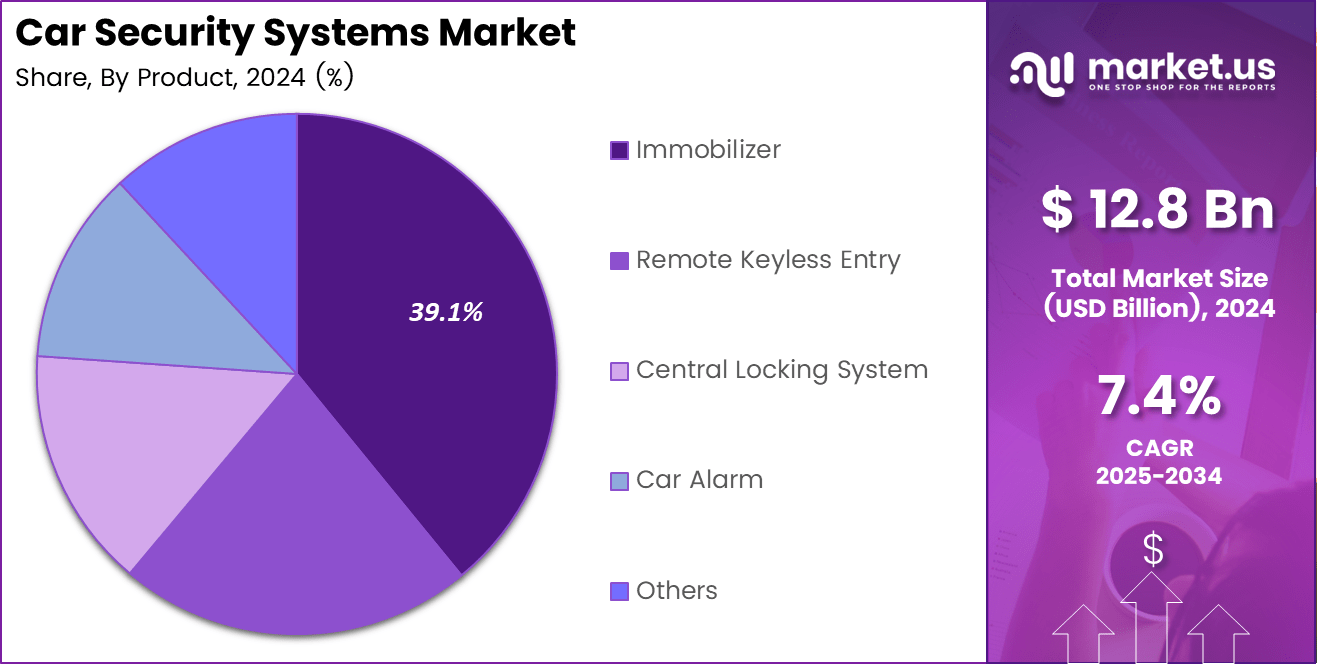

- Immobilizers lead the product landscape with a market share of 39.1%, reflecting strong demand for engine-level theft prevention solutions.

- Intermediate Security technologies dominate the technology segment with a share of 37.4%, balancing affordability and functional protection.

- OEM sales channels account for the highest contribution at 67.2%, driven by factory-level integration of security systems.

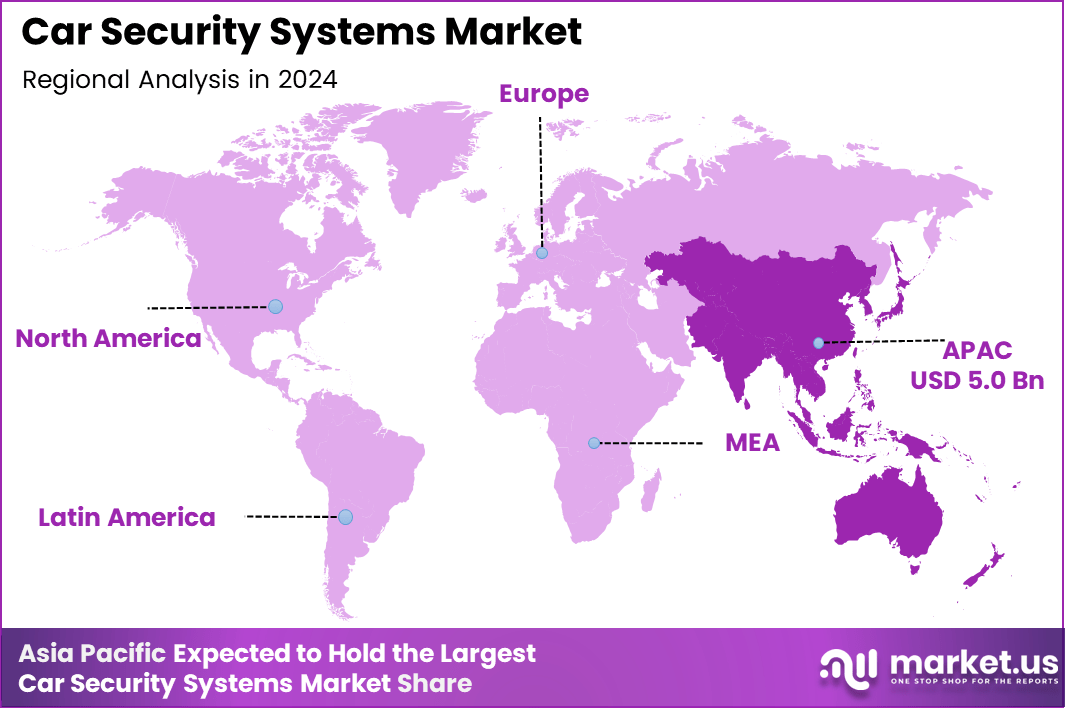

- Asia Pacific emerges as the leading region with a market share of 39.6%, valued at USD 5.0 billion in 2024.

By Vehicle Analysis

Passenger Vehicles dominates with 59.3% due to higher ownership rates and stronger consumer focus on personal vehicle protection.

In 2024, Passenger Vehicles held a dominant market position in the By Vehicle Analysis segment of Car Security Systems Market, with a 59.3% share. This dominance reflects rising urban car ownership, increasing theft incidents, and higher willingness among private owners to invest in security features that protect personal mobility assets.

Commercial Vehicles represent a steady adoption segment, driven by the need to protect logistics fleets, delivery vans, and company-owned cars. Fleet operators increasingly emphasize theft prevention and asset monitoring to reduce downtime, insurance costs, and operational losses, supporting consistent demand for robust and scalable security system installations.

Electric & Hybrid Vehicles are gaining attention as these models incorporate higher-value electronic components and advanced software systems. Owners of such vehicles prioritize enhanced protection due to higher replacement costs and increasing connectivity, which raises exposure to both physical theft and electronic intrusion risks.

By Product Analysis

Immobilizer dominates with 39.1% due to its effectiveness in preventing unauthorized engine ignition.

In 2024, Immobilizer held a dominant market position in the By Product Analysis segment of Car Security Systems Market, with a 39.1% share. Immobilizers directly block engine startup without proper authentication, making them a preferred baseline security feature across both entry-level and mid-range vehicles.

Remote Keyless Entry systems support user convenience while integrating security through encrypted access. Their adoption continues as consumers value seamless vehicle access combined with basic theft deterrence, especially in urban environments where daily vehicle usage frequency remains high.

Central Locking Systems contribute to synchronized door security and ease of operation. These systems are commonly paired with alarms and keyless entry, creating layered protection that enhances user confidence and simplifies vehicle access management across multiple entry points.

Car Alarm and Other products serve as visible deterrents and alert mechanisms. Audible warnings and motion detection discourage break-ins, while additional products such as steering locks and tracking modules complement electronic systems to provide comprehensive vehicle protection coverage.

By Technology Analysis

Intermediate Security dominates with 37.4% due to its balance between cost, functionality, and reliability.

In 2024, Intermediate Security held a dominant market position in the By Technology Analysis segment of Car Security Systems Market, with a 37.4% share. This category combines alarms, immobilizers, and basic sensors, offering effective protection without the higher costs of advanced integrated platforms.

Basic Security systems continue to serve price-sensitive buyers by offering fundamental protection features. These solutions remain relevant in entry-level vehicles and emerging markets where affordability and compliance with minimum safety expectations drive purchasing decisions.

Advanced Security technologies address rising concerns around sophisticated theft methods. Features such as biometric access, encrypted communication, and smart authentication enhance protection for premium vehicles and technology-aware consumers seeking higher assurance levels.

Integrated Security Ecosystems and Other technologies represent evolving solutions that connect multiple security layers. These systems increasingly align with connected vehicle platforms, enabling centralized control, monitoring, and future scalability as automotive electronics architectures advance.

By Sales Channel Analysis

OEM dominates with 67.2% due to factory-level integration and regulatory alignment.

In 2024, OEM held a dominant market position in the By Sales Channel Analysis segment of Car Security Systems Market, with a 67.2% share. Vehicle manufacturers increasingly integrate security systems during production, ensuring compatibility, reliability, and compliance with safety regulations across global markets.

OEM-installed systems benefit from seamless integration with vehicle electronics and centralized control units. Buyers often prefer factory-fitted solutions as they offer standardized performance, warranty coverage, and higher trust compared to post-purchase installations.

Aftermarket channels continue to play a vital role for older vehicles and customization needs. Consumers upgrade or replace security systems to address evolving threats, extend vehicle lifespan protection, and add features not originally included at the time of purchase.

Overall, the coexistence of OEM and aftermarket channels ensures broad market coverage. While OEM installations dominate volume, aftermarket solutions sustain long-term demand by addressing replacement cycles, technology upgrades, and diverse consumer security preferences.

Key Market Segments

By Vehicle

- Passenger Vehicles

- Commercial Vehicles

- Electric & Hybrid Vehicles

By Product

- Immobilizer

- Remote Keyless Entry

- Central Locking System

- Car Alarm

- Others

By Technology

- Basic Security

- Intermediate Security

- Advanced Security

- Integrated Security Ecosystems

- Others

By Sales Channel

- OEM

- Aftermarket

Drivers

Rising Vehicle Theft Rates Across Urban Areas Drives Market Growth

Rising vehicle theft incidents in urban and semi urban regions continue to push demand for reliable car security systems. As cities expand and vehicle density increases, theft risks become more frequent and organized. Consequently, vehicle owners increasingly prefer integrated security solutions that combine alarms, immobilizers, and access control features.

Mandatory vehicle safety and security regulations also support market expansion. Governments and transport authorities emphasize minimum anti theft requirements to reduce crime and insurance losses. These policies encourage manufacturers to integrate security features at the production stage, improving standardization and broad adoption across passenger and commercial vehicles.

Growing consumer awareness regarding personal vehicle safety further strengthens demand. Vehicle owners view cars as long term assets and seek protection against financial loss and inconvenience. This mindset encourages spending on security technologies, especially in regions with high replacement costs and limited public transport alternatives.

Additionally, the increasing installation of electronic control Panel unit enables advanced in vehicle security features. Modern vehicle architectures support sensors, controllers, and communication modules, allowing security systems to function more accurately. As electronic content per vehicle rises, security solutions become easier to integrate and more effective.

Restraints

High Installation Costs Limit Adoption Across Price Sensitive Segments

High initial installation and replacement costs remain a key restraint for the car security systems market. Advanced systems often require specialized hardware and skilled installation, increasing total ownership costs. Price sensitive buyers may delay adoption, especially when security features are not perceived as immediately necessary.

Limited penetration of security technologies in low cost and entry level vehicles further restricts market reach. Manufacturers in this segment prioritize affordability, leaving security upgrades as optional rather than standard. As a result, a large portion of the global vehicle fleet continues to operate with minimal protection.

Another challenge arises from the complexity of integrating modern security systems with older vehicle platforms. Legacy electrical architectures often lack compatibility with newer sensors and control units. This increases installation difficulty, time, and cost for both installers and vehicle owners.

Together, these factors slow adoption in developing markets and among older vehicles. While awareness is improving, economic and technical barriers continue to influence purchasing decisions and delay upgrades in certain consumer groups.

Growth Factors

Expansion of Electric and Connected Vehicles Creates New Opportunities

The expansion of electric and connected vehicle production worldwide presents strong growth opportunities for car security systems. These vehicles rely heavily on software and electronics, increasing the need for advanced protection against theft and unauthorized access. Security becomes a core component rather than an optional add on.

Increasing adoption of aftermarket security upgrades also supports opportunity growth. Aging vehicle fleets require enhanced protection as theft techniques evolve. Owners invest in upgrades to extend vehicle life and protect resale value, sustaining long term aftermarket demand.

Rapid motorization growth in emerging economies further expands the addressable market. Rising disposable incomes allow first time buyers to invest in vehicle protection. As awareness improves, security systems gain acceptance alongside other comfort and safety features.

Integration of artificial intelligence based monitoring and predictive threat detection opens new value segments. AI enables pattern recognition and early alerts, improving response effectiveness and supporting premium security offerings.

Emerging Trends

Shift Toward Smartphone Based Access Transforms Market Trends

A major trend shaping the car security systems market is the shift toward smartphone based vehicle access and control. Mobile applications allow users to lock, unlock, and monitor vehicles remotely, improving convenience and perceived control over vehicle security.

Growing adoption of biometric authentication for vehicle entry and ignition is another important trend. Fingerprint and facial recognition technologies reduce dependence on physical keys, lowering theft risk while enhancing personalization and user experience.

Increasing deployment of cloud connected real time vehicle monitoring platforms supports proactive security management. These platforms enable alerts, tracking, and diagnostics, helping owners respond quickly to potential threats and improving recovery outcomes.

Finally, convergence of car security systems with advanced driver assistance technologies is gaining momentum. Shared sensors and processors allow tighter integration, supporting unified vehicle safety and security architectures aligned with modern automotive design trends.

Regional Analysis

Asia Pacific Dominates the Car Security Systems Market with a Market Share of 39.6%, Valued at USD 5.0 billion

Asia Pacific leads the Car Security Systems Market, supported by rapid vehicle ownership growth, urbanization, and rising theft concerns across major economies. In 2024, the region accounted for a dominant 39.6% share, with market value reaching USD 5.0 billion, driven by strong demand for factory-installed and aftermarket security solutions. Expanding middle-class populations and regulatory emphasis on vehicle safety further reinforce adoption across passenger and commercial vehicles.

North America Car Security Systems Market Trends

North America represents a mature yet innovation-driven market for car security systems. High vehicle ownership rates and strong consumer awareness around asset protection support steady demand. Advanced electronic security features, connected vehicle adoption, and insurance-linked security requirements continue to shape purchasing behavior across both new vehicles and aftermarket installations.

Europe Car Security Systems Market Trends

Europe shows consistent demand due to stringent vehicle safety regulations and a well-established automotive manufacturing base. Security systems are widely integrated at the OEM level, while aftermarket upgrades remain relevant for older vehicles. Increasing focus on connected mobility and data security further influences system design and adoption patterns.

Middle East and Africa Car Security Systems Market Trends

The Middle East and Africa market is gradually expanding, supported by rising vehicle imports and growing awareness of theft prevention. Demand is concentrated in urban centers where vehicle density and replacement costs are higher. Aftermarket solutions play a significant role due to diverse vehicle age profiles across the region.

Latin America Car Security Systems Market Trends

Latin America demonstrates moderate growth, driven by improving economic conditions and increasing personal vehicle ownership. Theft concerns in metropolitan areas encourage adoption of alarms, immobilizers, and tracking solutions. Price sensitivity remains a key factor, shaping demand toward cost-effective and scalable security offerings.

U.S. Car Security Systems Market Trends

The U.S. market benefits from strong consumer focus on vehicle protection and advanced electronic integration. OEM-installed systems dominate new vehicle sales, while aftermarket demand remains stable for upgrades and replacements. Growing interest in connected and app-based security features continues to influence system innovation.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Car Security Systems Company Insights

ALPHA Corporation operates at the practical end of vehicle security, where reliability, low failure rates, and consistent OEM fitment matter more than headline features. In 2024, its positioning aligns with steady demand for immobilizers and access control hardware that supports high production volumes, long program lifecycles, and cost sensitive vehicle platforms. The company’s advantage comes from building proven components that integrate smoothly into existing electrical architectures and reduce warranty exposure for automakers.

Continental remains a system level player that connects security functions with broader vehicle electronics, especially central locking, keyless entry, telematics, and domain control integration. In 2024, the market favors suppliers that can bundle security with connectivity and safety electronics, because OEMs prefer fewer integration partners and simpler validation pathways. Continental’s scale and platform approach support multi region vehicle programs, while its cybersecurity readiness increasingly influences adoption in connected car roadmaps.

Mitsubishi Electric benefits from its depth in automotive electronics, where security features depend on robust ECUs, sensors, and control logic rather than standalone alarms. In 2024, growth links strongly to tighter theft prevention requirements, higher penetration of electronic immobilization, and security by design in body control modules. The company’s strengths in quality and electronics manufacturing discipline support consistent performance under harsh operating conditions.

Qualcomm Technologies shapes the higher value portion of the market by enabling secure connectivity foundations that support digital keys, telematics based tracking, and OTA security updates. In 2024, as vehicles adopt connected architectures, the security stack increasingly shifts toward hardware backed security, encryption, and identity management at the compute and connectivity layer. Qualcomm’s role expands where OEMs prioritize integrated compute plus communications platforms to reduce attack surfaces and support feature upgrades over the vehicle lifecycle.

ALPHA Corporation operates at the practical end of vehicle security, where reliability, low failure rates, and consistent OEM fitment matter more than headline features. In 2024, its positioning aligns with steady demand for immobilizers and access control hardware that supports high production volumes, long program lifecycles, and cost sensitive vehicle platforms. The company’s advantage comes from building proven components that integrate smoothly into existing electrical architectures and reduce warranty exposure for automakers.

Continental remains a system level player that connects security functions with broader vehicle electronics, especially central locking, keyless entry, telematics, and domain control integration. In 2024, the market favors suppliers that can bundle security with connectivity and safety electronics, because OEMs prefer fewer integration partners and simpler validation pathways. Continental’s scale and platform approach support multi region vehicle programs, while its cybersecurity readiness increasingly influences adoption in connected car roadmaps.

Mitsubishi Electric benefits from its depth in automotive electronics, where security features depend on robust ECUs, sensors, and control logic rather than standalone alarms. In 2024, growth links strongly to tighter theft prevention requirements, higher penetration of electronic immobilization, and security by design in body control modules. The company’s strengths in quality and electronics manufacturing discipline support consistent performance under harsh operating conditions.

Qualcomm Technologies shapes the higher value portion of the market by enabling secure connectivity foundations that support digital keys, telematics based tracking, and OTA security updates. In 2024, as vehicles adopt connected architectures, the security stack increasingly shifts toward hardware backed security, encryption, and identity management at the compute and connectivity layer. Qualcomm’s role expands where OEMs prioritize integrated compute plus communications platforms to reduce attack surfaces and support feature upgrades over the vehicle lifecycle.

Top Key Players in the Market

- ALPHA Corporation

- Continental

- Mitsubishi Electric

- Qualcomm Technologies

- Stoneridge

- Tesla

- Thales Group

- Tokai Rika

- Valeo S.A.

- ZF Friedrichshafen

Recent Developments

- In Dec 2025, Samsung’s HARMAN agreed to acquire ZF’s advanced driver-assistance systems business, strengthening its position across core ADAS software, sensing, and system integration capabilities.This move secures HARMAN’s strategic foundation in centralized automotive electronics platforms, supporting scalable architectures for the fast-growing software-defined vehicle market.

- In Jun 2025, Qualcomm acquired Autotalks to accelerate global V2X deployments, integrating dedicated V2X communication technology into its automotive chipset portfolio.

The acquisition enhances road safety, automated driving performance, and traffic efficiency by enabling low-latency vehicle-to-vehicle and vehicle-to-infrastructure communication at scale.

Report Scope

Report Features Description Market Value (2024) USD 12.8 billion Forecast Revenue (2034) USD 26.1 billion CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle (Passenger Vehicles, Commercial Vehicles, Electric & Hybrid Vehicles), By Product (Immobilizer, Remote Keyless Entry, Central Locking System, Car Alarm, Others), By Technology (Basic Security, Intermediate Security, Advanced Security, Integrated Security Ecosystems, Others), By Sales Channel (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ALPHA Corporation, Continental, Mitsubishi Electric, Qualcomm Technologies, Stoneridge, Tesla, Thales Group, Tokai Rika, Valeo S.A., ZF Friedrichshafen Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Car Security Systems MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Car Security Systems MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ALPHA Corporation

- Continental

- Mitsubishi Electric

- Qualcomm Technologies

- Stoneridge

- Tesla

- Thales Group

- Tokai Rika

- Valeo S.A.

- ZF Friedrichshafen