Global Can Coatings Market Size, Share, Growth Analysis By Type (Epoxy, Polyester, Acrylic, and Others), By Technology (Water-based, Solvent-based, and Powder Coatings), By Substrate (Aluminum and Steel), By Can Type (Two Piece Can and Three Piece Can), By Application (Interior and Exterior), By End-Use (Beverages, Food, Personal Care, Household, Automotive And Industrial, Paints, Medical, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167452

- Number of Pages: 343

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

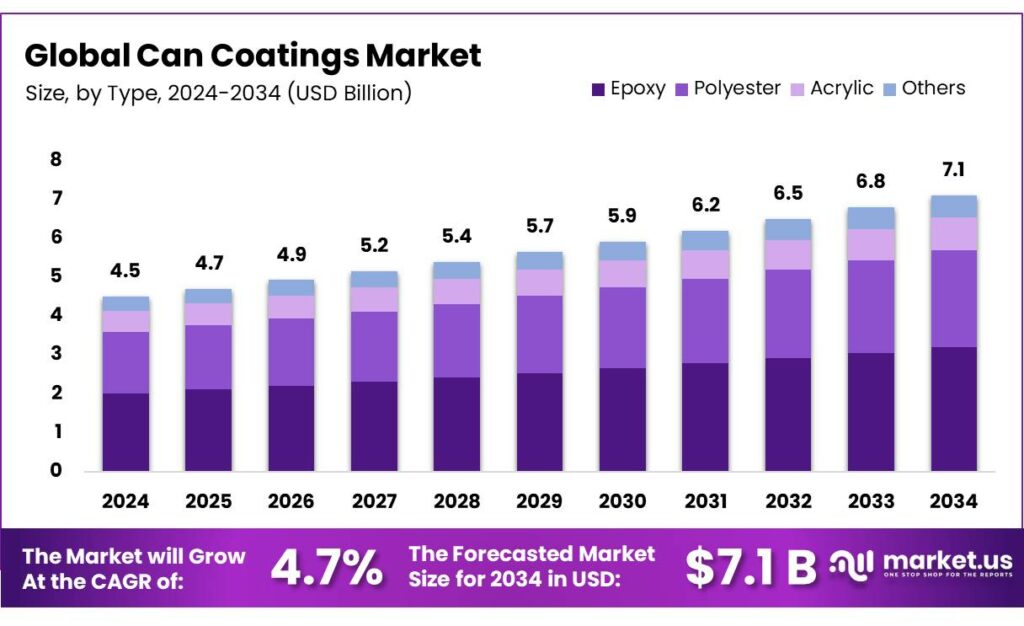

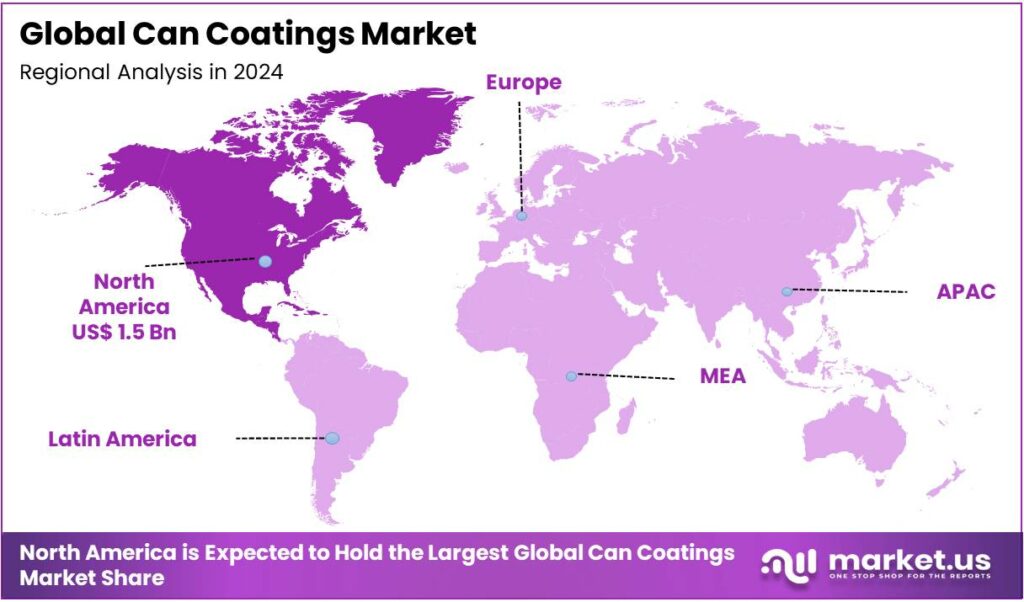

The Global Can Coatings Market size is expected to be worth around USD 7.1 Billion by 2034, from USD 4.5 Billion in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 36.7% share, holding USD 456.7 Million revenue.

Coatings are protective layers applied to the inside and outside of metal cans to prevent corrosion, preserve the product’s quality, and provide branding opportunities. Inside the can, they act as a barrier between the product and the metal, preventing chemical reactions and contamination, while outside coatings protect the can’s appearance and printed label. Common types include epoxy-based resins for interior protection and acrylic or polyester for exterior aesthetics.

The major drivers of these coatings are the food and beverage industries. However, as food and beverages closely impact human health, the market is under tight scrutiny. Complying with these regulatory frameworks might sometimes be challenging for manufacturers. As regulations around can coatings grow stringent, there is a demand for sustainable and BPA-free can coatings.

- According to the Can Manufacturers Institute (CMI) of the United States, the can industry accounts for the annual domestic production of approximately 135 billion food, beverages, aerosol, and general line cans.

Key Takeaways

- The global can coatings market was valued at USD 4.5 billion in 2024.

- The global can coatings market is projected to grow at a CAGR of 4.7% and is estimated to reach USD 7.1 billion by 2034.

- Based on the types of can coatings, epoxy can coatings dominated the market, with around 44.9% of the total global market.

- Based on the technology used, the can coatings market is dominated by the solvent-based coating, comprising around 45.7% of the market.

- On the basis of substrate, aluminum cans held a major share of the can coatings market, around 70.5%.

- In 2024, around 63.2% of the can coatings were utilized for two-piece cans.

- Based on the applications of the can coatings, interior applications led the market with a substantial market share of around 69.1%.

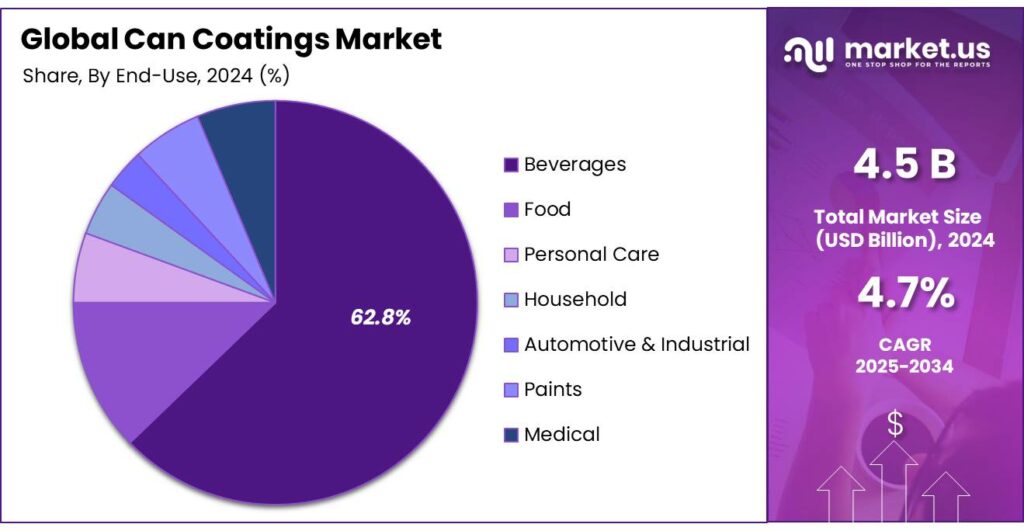

- The beverage industry emerged as a major segment in the market among the end-uses of can coatings, with 62.8% of the market share.

- In 2024, North America was the most dominant region in the can coatings market, accounting for around 34.3% of the total global consumption.

Type Analysis

Epoxy Can Coatings Dominated the Market in 2024.

The can coatings market is segmented based on the types into epoxy, polyester, acrylic, and others. The epoxy coatings dominated the market, comprising around 44.9% of the market share. These coatings are the most widely used due to their superior performance characteristics, particularly in terms of durability and chemical resistance. They provide excellent protection against corrosion, moisture, and various chemicals, making them ideal for preserving the contents of cans, particularly in food and beverage packaging.

In addition, the robust adhesion properties of epoxy coatings ensure a long-lasting finish, preventing the can from degrading over time. Compared to polyester or acrylic coatings, epoxy coatings offer higher resistance to high temperatures and are more cost-effective, which contributes to their dominance.

Technology Analysis

In 2024, Solvent-Based Can Coatings Were a Prominent Segment in the Market.

The can coatings market is segmented on the basis of technology used into water-based, solvent-based, and powder coatings. The solvent-based coatings led the market, constituting about 45.7% of the market share. These coatings dominate the market as they offer exceptional adhesion, smooth finish, and high resistance to corrosion and chemicals compared to water-based or powder coatings. Their ability to cure effectively under a wide range of environmental conditions makes them especially suitable for high-speed production lines in the food and beverage industry.

In addition, solvent-based coatings provide superior protection for both steel and aluminum cans, ensuring product integrity even during long storage periods. For instance, in beverage cans containing acidic or carbonated drinks, solvent-based coatings prevent metal leaching and maintain flavor stability. Similarly, their fast-drying properties and consistent film quality make them preferred for large-scale, high-efficiency manufacturing operations.

Substrate Analysis

Aluminium Cans Were at the Forefront in the Can Coatings Market.

Based on the substrate, the can coatings market is segmented into aluminium and steel. Can coatings are most widely utilized for aluminum cans, as aluminum is more chemically reactive than steel, making protective coatings essential to prevent corrosion and maintain product quality. Aluminum cans are extensively used in the beverage industry, covering over 70% of global can packaging, due to their lightweight nature, recyclability, and ability to preserve taste.

However, without coatings, the metal can react with acidic or carbonated beverages, leading to contamination or flavor changes. Coatings create an effective barrier between the aluminum and the contents, ensuring safety and shelf stability. In contrast, steel cans, often used for non-acidic foods or industrial products, are naturally more resistant and often require less intensive coating protection.

Can Type Analysis

Piece Cans Held a Major Share of the Can Coatings Market.

Based on the types of cans, the market is divided into two-piece cans and three-piece cans. Around 63.2% of the total global market is comprised of the two-piece cans, as their seamless structure, consisting of a body and an integrated base, requires superior interior protection to prevent corrosion and maintain product integrity. Unlike three-piece cans, which have welded side seams that can be coated separately, two-piece cans have continuous surfaces formed through drawing and ironing processes, making uniform coating essential.

These cans are extensively used in the beverage industry for carbonated drinks, which exert internal pressure and demand high coating performance to avoid metal interaction and flavor alteration. Additionally, two-piece cans are thinner and lighter, increasing the importance of coatings to ensure durability, chemical resistance, and extended shelf life of the contents.

Application Analysis

The Can Coatings Were Mostly Utilized for Interior Coating Applications.

Based on the applications of can coatings, the market is divided into interior and exterior applications. The interior coating applications dominated the market, with a substantial market share of 69.1%. Can coatings are widely utilized for interior applications as the inside of the can comes in direct contact with the product, making protection from chemical reactions, corrosion, and contamination essential. Beverages and foods, particularly those that are acidic or carbonated, can react with metals such as aluminum or steel, potentially affecting flavor, color, and safety.

Interior coatings act as a barrier, ensuring product purity and extending shelf life. For instance, epoxy-based coatings are commonly used inside beverage cans to prevent metal leaching and preserve taste stability. In contrast, exterior coatings are primarily applied for decorative and branding purposes, facing less chemical stress and requiring less frequent or complex protection compared to the interior surfaces.

End-Use Analysis

The Beverage Sector Emerged as a Leading Segment in the Can Coatings Market.

On the basis of end-uses of can coatings, the market is segmented into beverages, food, personal care, household, automotive & industrial, paints, medical, and others. Approximately 62.8% of the revenue in the can coatings market is generated by the beverages sector, due to the massive global consumption of canned drinks such as soft drinks, beer, and energy beverages, which together account for a majority of metal can usage. Beverages are highly sensitive to contamination and flavor changes, requiring advanced coatings to prevent metal interaction, corrosion, and carbon dioxide loss.

For instance, acidic drinks such as colas or fruit juices can react with uncoated metal, altering taste and safety. Coatings provide a vital barrier that ensures product integrity and extends shelf life. In contrast, sectors such as food, personal care, or industrial products have lower packaging turnover or use alternative materials such as glass, plastic, or laminated containers.

Key Market Segments

By Type

- Epoxy

- Polyester

- Acrylic

- Others

By Technology

- Water-based

- Solvent-based

- Powder Coatings

By Substrate

- Aluminum

- Steel

By Can Type

- Two Piece Can

- Three Piece Can

By Application

- Interior

- Exterior

By End-Use

- Food

- Fruits & Vegetables

- Dairy & Dairy Products

- Meat, Poultry & Seafood

- Ready Meals

- Others

- Beverages

- Non-alcoholic Beverages

- Carbonated Drinks

- RTD Tea & Coffee

- Functional Beverages

- Juices

- Others

- Alcoholic Beverages

- Beer

- Wine

- Distilled Spirit

- Personal Care

- Deodorants

- Hair Mousse

- Hair Spray

- Shaving Mousse/Foam

- Suncare

- Others

- Household

- Insecticides

- Plant Protection

- Air Fresheners

- Furniture & Wax Polishes

- Disinfectants

- Surface Care

- Others

- Automotive & Industrial

- Greases

- Lubricants

- Spray Oils

- Cleaners

- Paints

- Industrial

- Consumer

- Medical

- Inhaler

- Topical Application

- Others

- Non-alcoholic Beverages

Drivers

Increased Demand for Packaged Foods and Beverages Drives the Can Coatings Market.

The growing demand for packaged foods and beverages is a key factor driving the can coatings market. According to the Bureau of Labor Statistics, in 2024, 87% of full-time employed individuals worked on an average weekday in the United States. As urbanization and busy lifestyles increase, consumers are turning to convenient, ready-to-eat meals and canned drinks for their daily needs. For instance, global canned beverage consumption has surged, with soft drink and energy drink production reaching billions of units annually. In addition, the popularity of canned craft beers and sparkling waters has encouraged manufacturers to enhance packaging durability and aesthetics.

Can coatings, particularly epoxy and polyester types, play a crucial role in preventing corrosion, maintaining flavor integrity, and ensuring product safety. In addition, they help extend the shelf life of foods such as soups, fruits, and vegetables, which are frequently stored for long periods. According to the Bureau of Labor Statistics (BLS), in 2024, Americans spent an average of just under an hour per day, specifically 53 minutes, on food preparation and cleanup. This willingness to spend less time on food preparation demands high-quality canned vegetables, fruits, and soups, boosting the can coatings market.

Restraints

Regulatory Pressure Remains a Significant Challenge in the Can Coatings Market.

Regulatory pressure continues to pose a significant challenge in the can coatings market as governments and health agencies impose stricter standards on food safety, chemical use, and environmental impact. One of the most notable regulations involves restrictions on bisphenol A (BPA), a chemical commonly used in epoxy coatings. Several regions, including the European Union, Canada, and parts of the United States, have banned or limited BPA in food-contact materials, prompting manufacturers to reformulate coatings to meet compliance requirements. For instance, the European Commission adopted a ban on the use of BPA in all food contact materials, including coatings on metal cans and reusable plastic bottles.

Similarly, the FDA has banned the use of BPA in materials for baby bottles, sippy cups, and infant formula packaging. Developing alternatives that match the durability and adhesion of epoxy coatings while remaining cost-effective has proven complex. Additionally, producers face growing scrutiny related to volatile organic compound (VOC) emissions, waste disposal, and recyclability. For instance, coating producers must adapt to various sustainability directives promoting circular economy principles, such as reducing hazardous substances and improving material recovery, increasing both research costs and production complexities in the industry.

Opportunity

Sustainable and BPA-Free Coatings Create Opportunities in the Market.

The shift toward sustainable and BPA-free coatings is opening new opportunities in the can coatings market as consumers and regulators increasingly prioritize health and environmental safety. Traditional epoxy coatings, which often contained bisphenol A (BPA), have faced growing scrutiny due to potential health concerns, prompting manufacturers to develop alternatives such as polyester, acrylic, and oleoresin-based coatings. Several beverage producers have transitioned to BPA-free linings in aluminum cans to meet stricter food safety standards and consumer expectations.

For instance, in August 2022, PPG announced the launch of its next-generation acrylic internal spray coating for aluminium beverage cans, which does not use bisphenol-A (BPA) or bisphenol starting substances and reportedly offers enhanced application properties. In addition, sustainability goals are driving companies to adopt eco-friendly materials that reduce carbon emissions and enhance recyclability. Innovations such as water-based and plant-derived coatings are gaining traction, aligning with circular economy initiatives and helping brands strengthen their green credentials while ensuring product protection and shelf stability.

Trends

Shift Towards Retail Ready Packaging.

The shift toward retail-ready packaging (RRP) is an emerging trend influencing the can coatings market, driven by the need for efficiency, visibility, and sustainability in modern retail environments. Retail-ready packaging allows products to move quickly from transport to shelf, reducing handling time and labor costs for retailers.

In supermarkets and convenience stores, canned beverages and foods are increasingly displayed in multipacks or shelf-ready trays, designed for easy stacking and appealing presentation. For instance, the use of lightweight aluminum cans with printed coatings has increased in beverage packaging over the past decade, reflecting both branding and logistical advantages.

Can coatings play a vital role in maintaining the appearance and integrity of such packaging, ensuring resistance to abrasion, corrosion, and handling damage. Additionally, the rise of e-commerce and bulk retailing is reinforcing the demand for durable, coated metal packaging that protects products through extended transport and storage cycles.

Geopolitical Impact Analysis

Geopolitical Tensions Are Impacting the Can Coatings market by Disrupting the Essential Supply Chains in the Market.

The geopolitical tensions have significantly impacted the can coatings market, with supply chain disruptions being one of the most notable effects. Trade restrictions, especially in regions such as Eastern Europe and Asia, have led to delays in the sourcing of raw materials, such as resins and solvents, which are critical in the production of can coatings. For instance, the ongoing conflict between Russia and Ukraine has severely impacted the availability of key chemicals, forcing manufacturers to either find alternative suppliers or absorb rising costs.

Additionally, tariffs and sanctions imposed on certain countries have raised prices for coatings and packaging materials, which, in turn, increase production costs for can manufacturers. For instance, the United States has significantly increased tariffs on imported steel and aluminum under Section 232 in early 2025, raising them to 50% from the previous 25% and 10%, respectively. These tariffs on steel and aluminum, used in cans, have significantly impacted the can coatings market.

In addition, these geopolitical tensions have resulted in labor shortages and logistical issues, further straining the manufacturing process. Furthermore, as countries turn inward to secure their domestic markets, international collaboration in the production and distribution of coatings has become more complicated. The market has also seen a rise in innovation, as companies focus on developing more resilient and sustainable coatings to better withstand global uncertainties.

Regional Analysis

North America Held the Largest Share of the Global Can Coatings Market.

In 2024, North America dominated the global can coatings market, holding about 34.3% of the total global consumption. The region held the largest share of the global can coatings market, supported by its strong food and beverage industry, advanced packaging technologies, and strict quality standards. The region’s high consumption of canned goods, ranging from soups and vegetables to soft drinks and craft beer, drives steady demand for protective and decorative coatings.

According to the Can Manufacturers Institute (CMI) of the United States, in 2024, the number of food cans exported reached approximately 23.7 billion cans. In addition, the manufacturers in the region have been early adopters of BPA-free and sustainable coating technologies to comply with food safety regulations and meet growing consumer demand for environmentally friendly packaging. Similarly, the rapid rise of ready-to-drink beverages and energy drinks has fueled innovation in can design and coatings that preserve flavor and extend shelf life. The region’s strong recycling infrastructure further supports the use of coated metal packaging, reinforcing its leadership in this market segment.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The major market players in the can coatings market are the Sherwin-Williams Company, PPG Industries, Akzo Nobel N.V., Kupsa Coatings, Kansai Paint, Artience, VPL Coatings GmbH, Tiger Coatings GmbH, Berger Paints India, Salchi Metalcoat, Altana AG, Münzing Corporation, Kangnam Jevisco, and Taralac. As there is a global demand for can coatings from various industries, particularly BPA-free coatings, the companies focus on market expansion and increasing their production facilities.

In addition, there is an emphasis on strategic acquisitions to eliminate the competition and expand the product profiles. For instance, in February 2025, Akzo Nobel N.V. confirmed that it had made an offer to acquire the Powder Coatings operations and International Research Center from its publicly listed subsidiary, Akzo Nobel India Limited.

The major players in the industry

- The Sherwin-Williams Company

- PPG Industries, Inc.

- Akzo Nobel N.V.

- Kupsa Coatings

- Kansai Paint Co., Ltd.

- artience Co., Ltd.

- VPL Coatings GmbH & Co KG

- TIGER Coatings GmbH & Co. KG

- Berger Paints India Limited

- Salchi Metalcoat S.r.l.

- Altana AG

- Münzing Corporation

- Kangnam Jevisco Co

- Taralac

- Other Key Players

Key Development

- In May 2024, Sherwin-Williams, an international paints and coatings manufacturer, announced that it had completed the expansion of its packaging coatings facility in Deeside, United Kingdom, and Tournus, France. The plants are dedicated to the production of the non-BPA epoxy coating valPure V70 for beverage cans.

- In July 2025, PPG announced the expansion of its easy-open end coatings for aluminum beverage cans to meet increased global market demand.

Report Scope

Report Features Description Market Value (2024) USD 4.5 Bn Forecast Revenue (2034) USD 7.1 Bn CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Epoxy, Polyester, Acrylic, and Others), By Technology (Water-based, Solvent-based, and Powder Coatings), By Substrate (Aluminum and Steel), By Can Type (Two Piece Can and Three Piece Can), By Application (Interior and Exterior), By End-Use (Beverages, Food, Personal Care, Household, Automotive & Industrial, Paints, Medical, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape The Sherwin-Williams Company, PPG Industries, Akzo Nobel N.V., Kupsa Coatings, Kansai Paint, Artience, VPL Coatings GmbH, Tiger Coatings GmbH, Berger Paints India, Salchi Metalcoat, Altana AG, Münzing Corporation, Kangnam Jevisco, Taralac, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- The Sherwin-Williams Company

- PPG Industries, Inc.

- Akzo Nobel N.V.

- Kupsa Coatings

- Kansai Paint Co., Ltd.

- artience Co., Ltd.

- VPL Coatings GmbH & Co KG

- TIGER Coatings GmbH & Co. KG

- Berger Paints India Limited

- Salchi Metalcoat S.r.l.

- Altana AG

- Münzing Corporation

- Kangnam Jevisco Co

- Taralac

- Other Key Players