Global Calcium Aluminosilicate Market Size, Share Analysis Report By Type (Natural, Synthetic), By Function (Adsorption, Ion Exchange, Anti-Caking, Stabilization, Catalysis, Others), By End-use (Agriculture, Food and Beverages, Water Treatment, Chemical Industry, Construction, Environmental Remediation, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161782

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

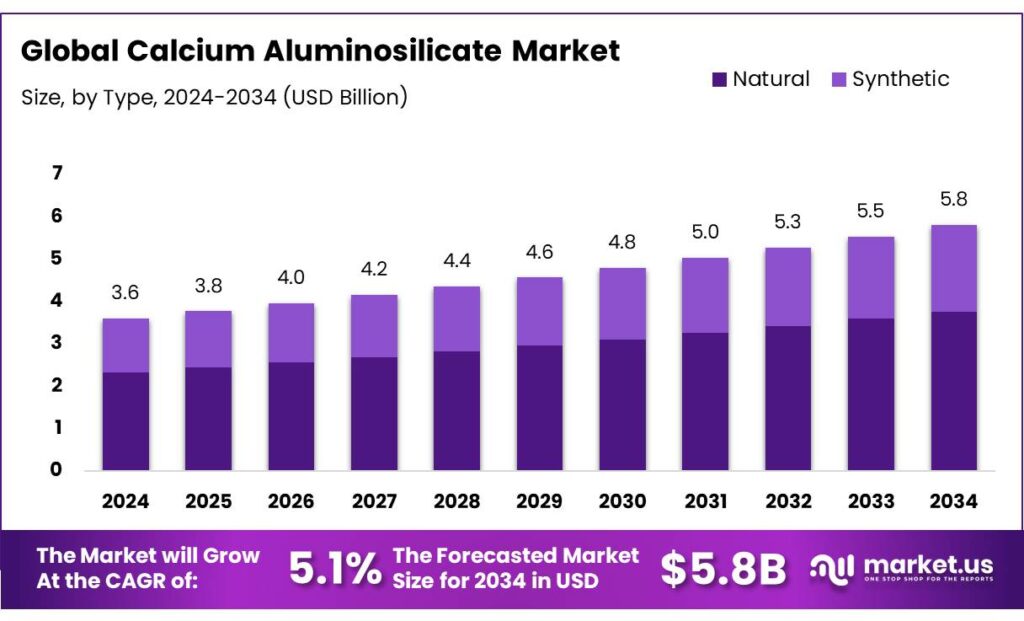

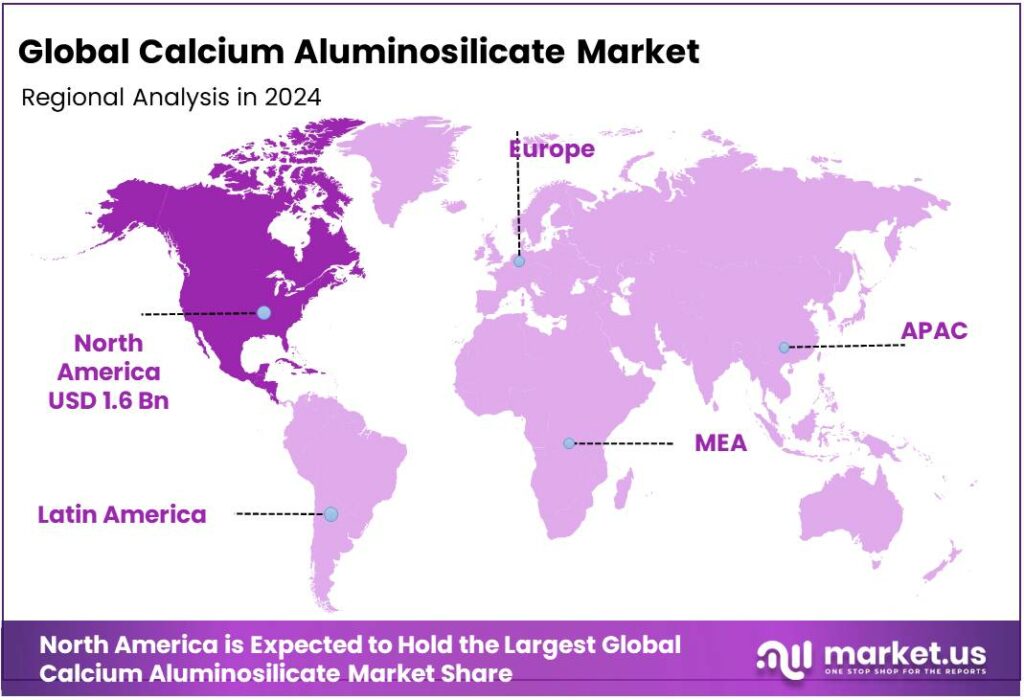

The Global Calcium Aluminosilicate Market size is expected to be worth around USD 5.8 Billion by 2034, from USD 3.6 Billion in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 45.8% share, holding USD 1.6 Billion in revenue.

The calcium aluminosilicate (CAS)—the anorthite-rich CaO–Al2O3–SiO2 family used across glass/ceramics, cements, metallurgical fluxes and as a legacy anti-caking agent (E556). In food uses, the European Union has progressively restricted several aluminium-containing additives; E556 was removed from the EU’s master list via Commission Regulation No. 380/2012 following EFSA’s work on aluminium exposure, which redirected formulators toward alternatives.

On the industrial side, demand for CAS-bearing materials tracks construction cycles (cements, tiles, sanitaryware, façade glass) and energy-transition build-outs (solar glass, high-temperature glass-ceramics). In the United States, portland (incl. blended) cement production was ~88 Mt in 2023, a useful barometer for CAS-related minerals used as fluxes and supplementary constituents. Globally, the cement sector remains carbon-intensive—36.8 Gt energy-related CO₂ in 2023 with ~7–8% attributed to cement—putting a premium on aluminosilicate routes that lower clinker or enable CCS-compatible chemistries.

- The IEA classifies cement “not on track,” calling for accelerated clinker substitution, alternative binders and CCUS to cut sector emissions ~20% by 2030. A concrete illustration is Heidelberg Materials’ Brevik (Norway) project, which is capturing about 400,000 t CO₂/yr under the Longship program—an example of public-funded decarbonization creating pull for compatible materials and admixture systems.

A powerful growth engine for CAS-relevant glass/ceramics is the expansion of solar PV and renewables, which lifts demand for flat/solar glass, kiln refractories and abrasion-resistant CAS glass-ceramics used in module, furnace and handling ecosystems. The IEA reports >USD 480 bn invested in solar PV capacity in 2023, more than all other generation technologies combined, signaling durable downstream materials demand.

- Meanwhile, global ceramic tile output remained large—<16 billion m² in 2023 despite a cyclical dip—sustaining substantial need for CAS-containing kiln furniture, setters, and thermal linings. These process-equipment uses often rely on calcium-aluminate/cas-rich refractories for strength beyond 1,000 °C in metallurgical and petrochemical settings.

Key Takeaways

- Calcium Aluminosilicate Market size is expected to be worth around USD 5.8 Billion by 2034, from USD 3.6 Billion in 2024, growing at a CAGR of 5.1%.

- Natural Calcium Aluminosilicate held a dominant market position, capturing more than a 65.3% share of the overall market.

- Adsorption held a dominant market position in the Calcium Aluminosilicate market, capturing more than a 31.4% share.

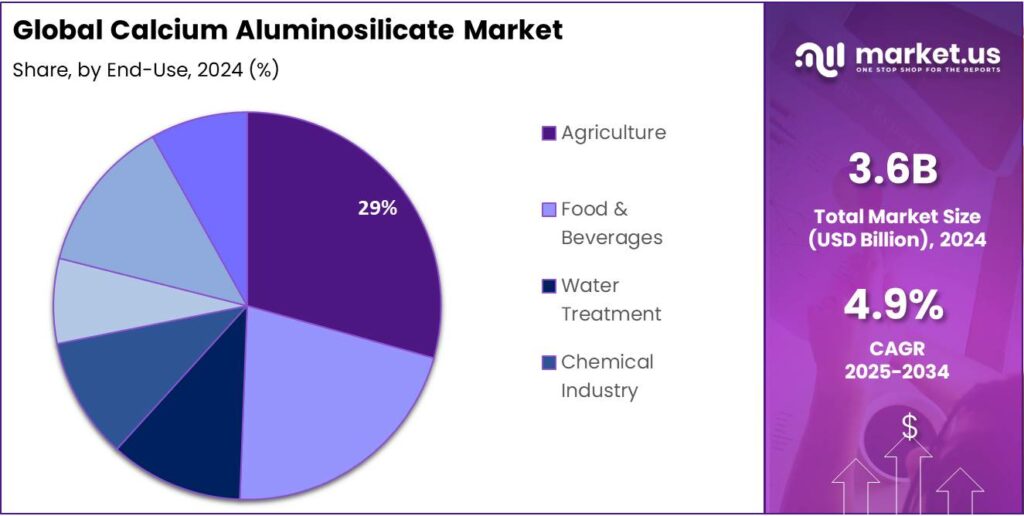

- Agriculture held a dominant market position in the Calcium Aluminosilicate market, capturing more than a 29.2% share.

- North America emerged as the leading region in the Calcium Aluminosilicate market, capturing a significant 45.8% share and accounting for an estimated USD 1.6 billion.

By Type Analysis

Natural Calcium Aluminosilicate dominates with 65.3% share in 2024 due to widespread industrial adoption

In 2024, Natural Calcium Aluminosilicate held a dominant market position, capturing more than a 65.3% share of the overall market. The preference for natural sources is primarily driven by their consistent chemical composition, thermal stability, and eco-friendly profile, making them suitable for high-demand applications in ceramics, refractories, and construction materials. Over the year, manufacturers increasingly relied on natural CAS for applications requiring minimal processing and lower energy consumption, aligning with sustainable production trends.

The segment’s growth is further supported by the expansion of the construction and industrial sectors in emerging economies, where demand for cost-effective and reliable mineral materials is rising. Looking ahead to 2025, the natural type is expected to maintain its leading position as industries continue to prioritize materials that combine performance with environmental compliance, sustaining steady adoption across traditional and emerging applications.

By Function Analysis

Adsorption function leads with 31.4% share in 2024 due to its versatile industrial applications

In 2024, Adsorption held a dominant market position in the Calcium Aluminosilicate market, capturing more than a 31.4% share. The segment’s leadership is driven by the material’s excellent capacity to trap moisture, gases, and impurities, making it highly valuable in water treatment, air purification, and chemical processing industries. Industries increasingly adopted CAS for adsorption applications because it provides reliable performance with low maintenance and long operational life.

Over the year, growth was particularly noted in environmental and industrial processes where high-efficiency adsorption is required. Looking ahead to 2025, the adsorption function is expected to retain a strong presence as demand for clean and efficient industrial processes continues to rise, supporting broader adoption of CAS across chemical, environmental, and industrial sectors.

By End-use Analysis

Agriculture end-use leads with 29.2% share in 2024 due to its soil enhancement benefits

In 2024, Agriculture held a dominant market position in the Calcium Aluminosilicate market, capturing more than a 29.2% share. The segment’s growth is driven by the material’s ability to improve soil structure, enhance nutrient retention, and regulate pH levels, making it a valuable input for sustainable farming practices. Farmers and agricultural suppliers increasingly preferred CAS for crop yield improvement and long-term soil health, particularly in regions facing soil degradation and nutrient depletion.

Over the year, adoption was notably strong in both conventional and organic farming systems, reflecting a trend towards eco-friendly and high-performance soil amendments. Looking ahead to 2025, the agricultural segment is expected to maintain its leading position as demand rises for natural, efficient, and environmentally responsible solutions to support global food security and sustainable crop production.

Key Market Segments

By Type

- Natural

- Synthetic

By Function

- Adsorption

- Ion Exchange

- Anti-Caking

- Stabilization

- Catalysis

- Others

By End-use

- Agriculture

- Food & Beverages

- Water Treatment

- Chemical Industry

- Construction

- Environmental Remediation

- Others

Emerging Trends

Spec-tight, low-aluminium CAS for fortified foods and humid supply chains

First, the operating scale is unmistakable. The World Food Programme reports it reached ~107 million people in 2023 and distributed ~3.1 million metric tonnes of food—much of it flours, blends, salts and premixes that have to dose cleanly in tough climates. Clumping at any step risks under- or over-fortification. That is pushing buyers to prefer anti-caking aids like CAS that are well-characterized, come with identity/purity documentation, and stay performant after weeks in warehouses.

Governments are locking in multi-year fortified-staple pipelines, which amplifies the need for humidity-resilient flow aids. In India, the Cabinet approved continuation of universal fortified rice to December 2028, with ₹17,082 crore in funding; officials also confirmed that by March 2024, 100% of rice supplied under central schemes was fortified. Multi-year mandates like this require consistent powder behavior at national scale—spurring interest in food-grade CAS with tighter particle-size control, validated heavy-metal limits, and robust flow at high relative humidity.

Second, compliance teams are standardizing around aluminium guidance. The WHO/FAO JECFA notes a PTWI of 2 mg/kg bw/week for total aluminium from all compounds, and maintains specifications for calcium aluminium silicate (INS 556). EFSA, meanwhile, set a Tolerable Weekly Intake (TWI) of 1 mg aluminium/kg bw/week for the EU—figures that underpin internal “aluminium budgets” for recipes. As a result, formulators are asking suppliers for low-Al, low-impurity CAS, clear certificates of analysis, and modelling that shows the additive keeps total aluminium exposure comfortably within limits.

Drivers

Safe, moisture-resilient flow in bigger food & feed supply chains

A major demand driver for calcium aluminosilicate (CAS) is the sheer scale—and moisture-management needs—of today’s food and feed supply chains. The UN Food and Agriculture Organization (FAO) estimates global cereal output at 2.848 billion tonnes in 2024, near a record, while forward guidance points to wheat at ~809.7 million tonnes in 2025. Every additional million tonnes of milled grain, powdered mixes, salts and seasonings must stay free-flowing from silo to shelf—precisely where anti-caking agents such as CAS are used to control clumping caused by humidity and electrostatic bridging.

Feed is an equally strong pull. The International Feed Industry Federation reports world compound feed production exceeds 1 billion tonnes annually, with an industry turnover above USD 400 billion. High-throughput feed mills and premix plants rely on anti-caking and flow aids to keep micronutrients, salts and fine powders homogeneous and dispensable at scale. IFIF also notes its members cover over 80% of global compound feed output, underscoring how widely such processing aids are embedded in feed safety and quality practices.

In Europe, risk managers and assessors have also evaluated aluminosilicates in food and feed contexts. The European Food Safety Authority (EFSA) has assessed aluminium-containing additives, including E556 (calcium aluminium silicate), in exposure and safety reviews; EFSA’s technical work helps manufacturers align usage with acceptable exposure ranges and labeling requirements.

- EFSA has also reviewed aluminosilicate of sodium, potassium and calcium as an anticaking agent in complete feed for pigs up to 30,000 mg/kg (i.e., 30 g/kg) in certain dossiers—evidence that anti-caking applications for aluminosilicates are well-studied in regulated, real-world feed scenarios. This scientific/regulatory scaffolding reduces adoption risk for CAS suppliers and users.

Restraints

Tightening scrutiny on aluminium intake and additive use

One clear brake on calcium aluminosilicate (CAS) growth—especially in food and feed—is the tightening focus on aluminium exposure across major jurisdictions. Europe’s food regulator (EFSA) set a Tolerable Weekly Intake (TWI) of 1 mg aluminium/kg body weight/week, concluding that a “significant part” of the population could exceed this level through ordinary diets. That headline figure, originally adopted in 2008 and reiterated in EFSA’s communication, continues to shape national risk-management and industry formulation choices.

Global expert committees add another layer of caution. The WHO/FAO JECFA established a Provisional Tolerable Weekly Intake (PTWI) of 2 mg/kg bw for total aluminium—explicitly covering aluminium from all compounds, including additives. While JECFA also assigned “ADI: not specified” to calcium aluminosilicate as an anti-caking agent (INS 556), the overarching PTWI keeps purchasers conservative, particularly for products targeted at children or high-consumption segments.

In the U.S., CAS-adjacent rules illustrate how strict ceilings can become de facto commercial barriers. Federal regulations recognise aluminium/calcium silicates as GRAS only at low inclusion levels—for example, not exceeding 2% in table salt and 5% in baking powder under good manufacturing practice. These numeric guardrails are workable for niche, technical roles, but they cap volume growth in mass-market formulations and push formulators to compare CAS with non-aluminium options when targeting global rollouts with harmonised recipes.

Regulators have also examined real-world exposure from specific aluminium-containing additives. EFSA’s follow-on work estimating dietary exposure to aluminium additives found ranges (by scenario) that exceeded the 1 mg/kg bw/week TWI, reinforcing a “use only as needed” posture among many compliance teams. Combined with periodic Codex and JECFA reviews, these assessments keep aluminium on corporate watch-lists, prompting internal thresholds that can disqualify CAS even when formally permitted.

Opportunity

Fortified staples at scale need reliable anti-caking for humid, high-throughput logistics

A powerful growth opening for calcium aluminosilicate (CAS) lies in fortified staples and large-scale food assistance—where powders and micronutrient premixes must stay free-flowing from mill to meal, even in tropical humidity. The operational base is expanding: FAO projects world cereal utilization at about 2.87 billion tonnes in 2024/25, up versus the prior year, which translates into vast volumes of milled flours, blended foods, salts, and premixes moving through long, often warm and moist supply chains. Anti-caking agents such as CAS help prevent clumping, bridging, and dosing errors that compromise nutrition programs at scale.

Humanitarian and social-protection channels amplify this need. The World Food Programme reports reaching ~107 million people in 2023 and distributing ~3.1 million metric tonnes of food, much of it in forms where flow and uniformity matter for safety and nutrition claims. As caseloads fluctuate with conflict and climate shocks, agencies rely on standardized additives and specifications to keep product quality consistent across dozens of countries—an environment where robust, well-characterized anti-caking aids can earn preferred-supplier status.

Government procurement is adding long-term, predictable demand for fortified staples. In India—one of the world’s largest public food systems—the Cabinet has approved continuation of 100% fortified rice across all central schemes through December 2028, backed by ₹17,082 crore in funding; authorities also confirmed that by March 2024, 100% of rice supplied under central schemes had already been fortified. Such multi-year mandates lock in high-volume blending and storage operations that depend on stable powder flow, presenting an attractive runway for CAS where permitted and technically suitable.

Regional Insights

North America dominates with 45.8% share, valued at USD 1.6 billion in 2024 due to industrial and construction demand

In 2024, North America emerged as the leading region in the Calcium Aluminosilicate market, capturing a significant 45.8% share and accounting for an estimated USD 1.6 billion in market value. The dominance of this region is attributed to its well-established industrial base, high adoption of advanced materials in construction, and growing demand from agriculture and environmental sectors.

The United States and Canada remain the largest contributors, driven by ongoing infrastructure expansion, stringent environmental regulations, and increased usage of CAS in water treatment, air purification, and refractory applications. Industrial manufacturers in North America prefer CAS for its thermal stability, chemical inertness, and cost-effective performance, particularly in high-temperature processes and soil enhancement solutions.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Clariant brings specialty chemical competence, particularly in functional additives, catalysis, and surface treatments. It is included among the key firms in aluminosilicate/zeolite market reports. Its niche is adapting functional aluminosilicates into formulations requiring tailored particle size, surface properties, and performance in demanding applications.

W. R. Grace is a major specialty materials and catalysts firm with a long history in molecular sieves and specialty aluminosilicate products. It appears in many competitive market lists for zeolites / aluminosilicates. The company’s edge lies in specialized grades, process innovation, and serving industrial / refining / adsorption markets.

Honeywell’s involvement is more indirect: while not a primary calcium aluminosilicate manufacturer, it participates in adjacent areas like catalysts, molecular sieves, and advanced materials. It is listed among key players in synthetic zeolite / aluminosilicate analyses. Honeywell leverages process technology, integration with gas & refining segments, and global reach to support its material businesses.

Top Key Players Outlook

- Arkema Group

- BASF SE

- Clariant AG

- Tosoh Corporation

- W.R. Grace & Co.

- Honeywell International Inc.

- Zeotech Corporation

- Others

Recent Industry Developments

In 2024, Arkema reported net sales of €9.5 billion, with a net income of €616 million. The company’s EBITDA margin stood at 16.1%, reflecting its operational efficiency and effective cost management.

In 2024, BASF SE, a global leader in the chemical industry, continued to strengthen its position in the Calcium Aluminosilicate (CAS) market. The company reported net sales of €87.3 billion, with a net income of €4.3 billion, reflecting a 3.1% increase from the previous year.

Report Scope

Report Features Description Market Value (2024) USD 3.6 Bn Forecast Revenue (2034) USD 5.8 Bn CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Natural, Synthetic), By Function (Adsorption, Ion Exchange, Anti-Caking, Stabilization, Catalysis, Others), By End-use (Agriculture, Food and Beverages, Water Treatment, Chemical Industry, Construction, Environmental Remediation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Arkema Group, BASF SE, Clariant AG, Tosoh Corporation, W.R. Grace & Co., Honeywell International Inc., Zeotech Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Calcium Aluminosilicate MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Calcium Aluminosilicate MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Arkema Group

- BASF SE

- Clariant AG

- Tosoh Corporation

- W.R. Grace & Co.

- Honeywell International Inc.

- Zeotech Corporation

- Others