Global Butterfly Valve Market Size, Share, And Enhanced Productivity By Function (Manual, Electric-actuated, Pneumatic-actuated, Hydraulic-actuated), By End Use (Oil and Gas, Water and Wastewater Treatment, Power Generation, Chemical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 168342

- Number of Pages: 275

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

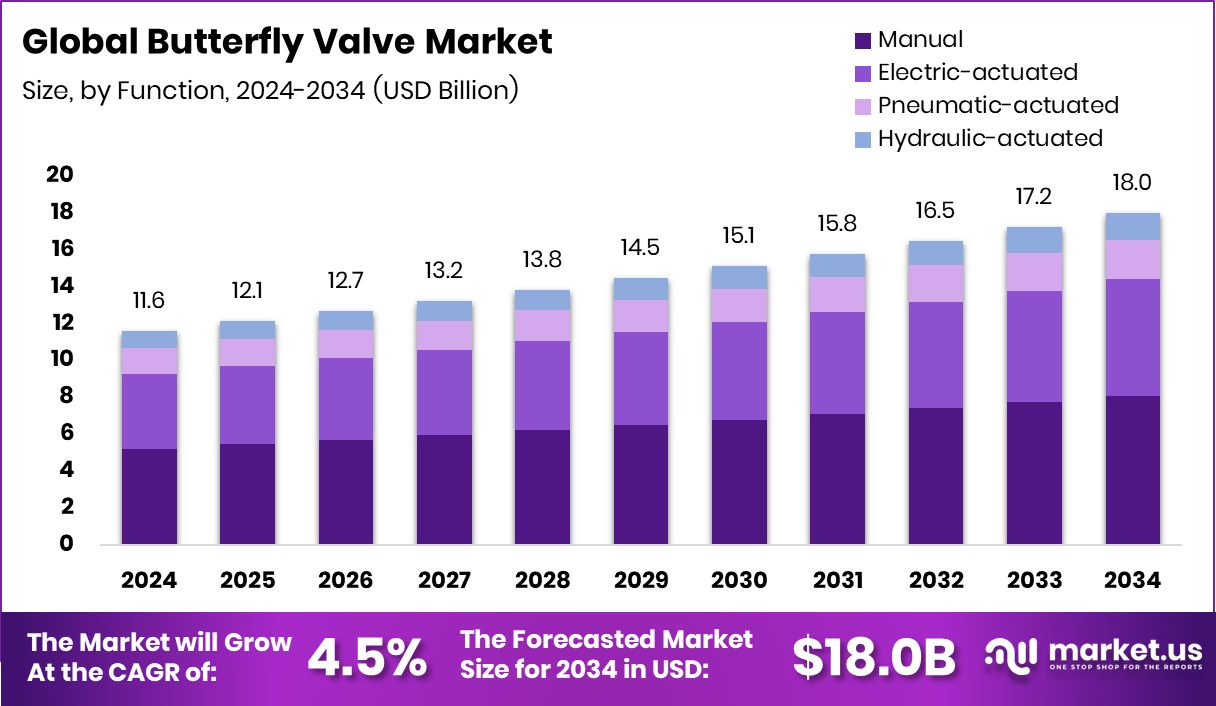

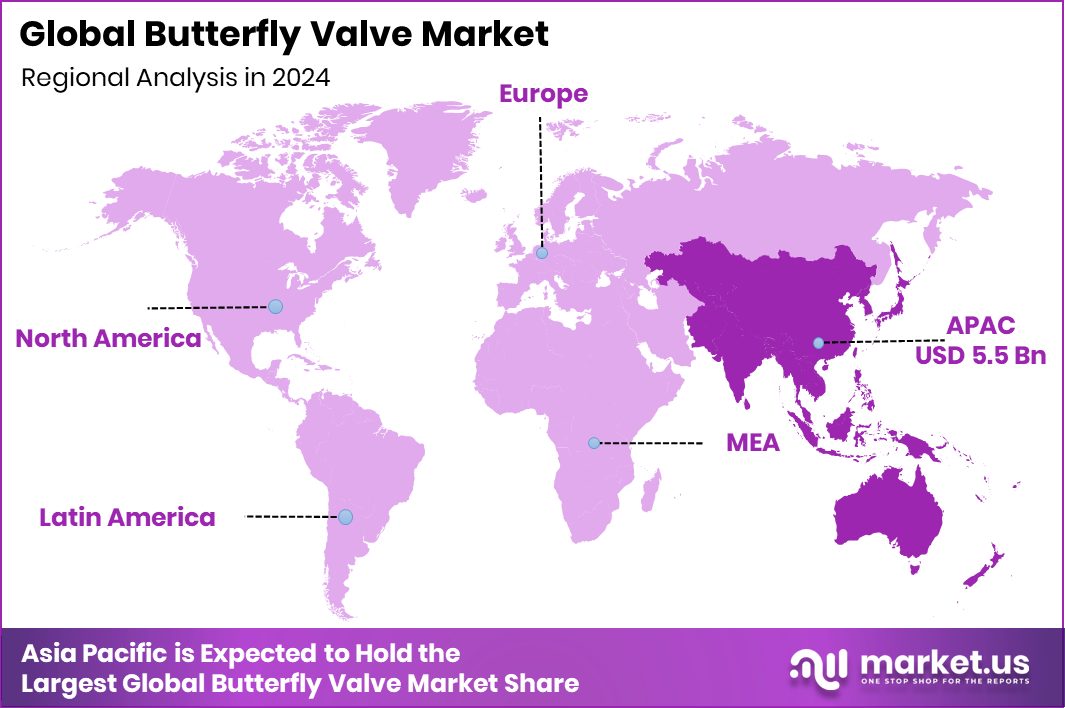

The Global Butterfly Valve Market is expected to be worth around USD 18.0 billion by 2034, up from USD 11.6 billion in 2024, and is projected to grow at a CAGR of 4.5% from 2025 to 2034. Asia Pacific accounts for a 47.90% share as butterfly valves total USD 5.5 Bn.

A butterfly valve is a flow-control device used to regulate or isolate liquids and gases in pipelines. It works through a rotating disc mounted on a central shaft, allowing quick opening and closing. Because of its compact size, low weight, and fast operation, it is widely used in water supply, oil & gas, power plants, HVAC systems, and industrial processing lines.

The butterfly valve market represents the global demand for these valves across energy, utilities, construction, and industrial sectors. Growth is closely linked to infrastructure spending and large-scale energy projects. For example, Nuveen raising $1.3B for energy and power infrastructure supports pipeline and utility upgrades, while Texas creating a $7.2B fund for gas plants signals long-term demand for flow-control equipment, even as build-outs evolve slowly.

Demand is also rising from power generation and energy transition projects. NLC India’s plan to invest ₹50,000 crore to reach 10 GW capacity and Core Energy Systems raising ₹200 crore for nuclear-focused solutions highlight expanding thermal and nuclear assets that rely heavily on durable valve systems. Similarly, X-energy raising $700M strengthens advanced reactor development, increasing the need for high-performance valves.

Opportunities are emerging in Africa and MENA due to decentralised energy and cooling infrastructure. The $500M DRE Nigeria Fund and Strataphy’s $6 million funding for next-generation cooling systems point to new installations where butterfly valves are preferred for efficiency, cost control, and easy maintenance in modern energy and utility networks.

Key Takeaways

- The Global Butterfly Valve Market is expected to be worth around USD 18.0 billion by 2034, up from USD 11.6 billion in 2024, and is projected to grow at a CAGR of 4.5% from 2025 to 2034.

- In the Butterfly Valve Market, manual valves hold a 44.9% share due to low cost, reliability, and easy operation.

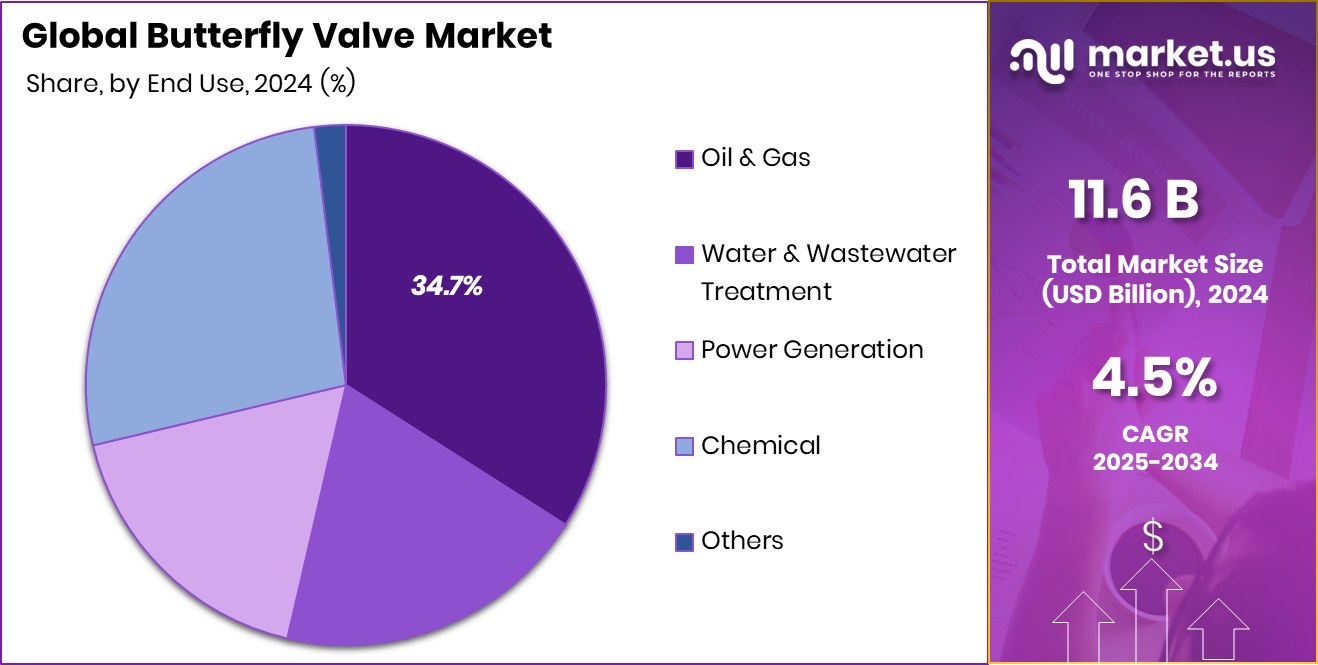

- The Butterfly Valve Market sees oil and gas dominating 34.7%, driven by pipelines, refineries, and midstream expansion.

- In the Asia Pacific, butterfly valve demand reaches 47.90%, generating USD 5.5 Bn value.

By Function Analysis

Manual butterfly valves held a 44.9% share in the butterfly valve market due to simplicity.

In 2024, Manual held a dominant market position in the By Function segment of the Butterfly Valve market, with a 44.9% share. This strong position reflects the continued preference for manual operation in applications where simplicity, reliability, and cost efficiency are critical.

Manual butterfly valves are widely used in water distribution networks, irrigation systems, basic industrial pipelines, and building services, where controlled but infrequent valve adjustments are required.

Their dominance is supported by easy installation, minimal maintenance needs, and independence from external power sources, making them practical for both developed and emerging infrastructure projects. Many end users favor manual valves for their durability in harsh operating conditions and straightforward performance over long service cycles.

As infrastructure operators focus on reducing operational complexity and lifecycle costs, manual butterfly valves continue to remain the most trusted and widely adopted choice within the function-based segmentation of the market.

By End Use Analysis

Oil and gas accounted for 34.7% of the butterfly valve market demand globally.

In 2024, Oil and Gas held a dominant market position in the By End Use segment of the Butterfly Valve market, with a 34.7% share. This dominance is driven by extensive use of butterfly valves across upstream, midstream, and downstream operations where efficient flow control is essential. Oil and gas facilities rely on these valves for crude transport lines, refining processes, gas handling systems, and isolation applications under varying pressure and temperature conditions.

Butterfly valves are preferred in this end-use segment due to their compact design, quick shut-off capability, and ability to handle large pipe diameters with minimal space requirements. Their suitability for automated and manual operations further supports widespread adoption. As pipeline networks and processing infrastructure continue operating at high utilization levels, oil and gas remain the leading contributors within this end-use segmentation.

Key Market Segments

By Function

- Manual

- Electric-actuated

- Pneumatic-actuated

- Hydraulic-actuated

By End Use

- Oil and Gas

- Water and Wastewater Treatment

- Power Generation

- Chemical

- Others

Driving Factors

Expanding Water Infrastructure Drives Butterfly Valve Demand

One of the strongest driving factors for the butterfly valve market is the steady expansion of water and wastewater infrastructure. Urban growth, rising water consumption, and aging pipeline networks are pushing utilities to upgrade treatment plants and distribution systems.

Butterfly valves are widely used in these networks because they control large water flows efficiently, occupy less space, and are easy to operate. Their low maintenance needs make them suitable for continuous use in water treatment facilities.

Investment activity further strengthens this trend. The water treatment firm Membrane Group, securing $50 million from GEF Capital Partners, highlights growing confidence in advanced water management solutions.

As more treatment plants adopt modern filtration, recycling, and distribution technologies, supporting equipment such as butterfly valves becomes essential for reliable flow regulation. This ongoing focus on water security and infrastructure renewal continues to drive long-term demand for butterfly valves across municipalities and industrial water systems.

Restraining Factors

High Maintenance Risks Limit Butterfly Valve Adoption

One major restraining factor for the butterfly valve market is performance limitation under demanding operating conditions, which can raise maintenance concerns. In applications involving high pressure, extreme temperatures, or abrasive fluids, butterfly valves may face faster wear on seals and discs. This can lead to leakage risks and more frequent servicing compared with heavier valve designs.

Some operators hesitate to deploy butterfly valves in critical systems where shutdowns are costly. Even in water infrastructure, strict reliability expectations can slow adoption decisions. The fact that water treatment projects were among the winners of a £42 million funding round from the regulator shows that authorities are cautious and selective, prioritizing long-term durability and compliance.

Where projects demand longer service life with minimal intervention, buyers may delay or limit butterfly valve use, restraining faster market expansion despite overall infrastructure investment.

Growth Opportunity

Public Water Financing Creates New Valve Opportunities

A major growth opportunity for the butterfly valve market lies in the rapid expansion of publicly funded water infrastructure projects. Governments are increasing spending on drinking water systems, wastewater treatment, and pipeline rehabilitation to meet safety and environmental standards.

Butterfly valves are widely selected in such projects because they are cost-effective, easy to install, and suitable for large-diameter pipelines used in municipal networks. Large-scale financing strengthens this opportunity. The EPA announcement $7 billion in WIFIA funds with five new loan approvals signals a strong pipeline of water infrastructure projects moving into construction and upgrade phases.

As utilities modernize intake systems, treatment plants, and distribution lines, demand rises for reliable flow-control equipment. Butterfly valves benefit directly from these programs, as they offer efficient flow regulation while keeping overall project costs manageable, creating sustained market growth potential.

Latest Trends

Municipal Water Upgrades Accelerate Modern Valve Adoption

A clear latest trend in the butterfly valve market is the rising use of modern valves in municipal water and wastewater upgrade projects. Cities are replacing old pipelines and control systems to improve efficiency, reduce leakage, and meet stricter quality standards. Butterfly valves are increasingly chosen because they handle large water volumes, need less space, and allow quick flow control.

Public funding is accelerating this trend. Solvang securing a $1 million federal grant to upgrade its wastewater treatment plant highlights small-city modernization efforts, while Southern Manitoba communities receiving $77 million for water and waste treatment upgrades reflect large regional investments.

These projects often involve new treatment units and pipeline replacements, pushing demand for reliable and easy-to-maintain valves. As municipalities focus on long-term infrastructure resilience, butterfly valves continue gaining preference in public water systems.

Regional Analysis

Asia Pacific leads the valve market with a 47.90% share, valued at USD 5.5 Bn.

The Asia Pacific region holds a dominant position in the butterfly valve market, accounting for 47.90% of total demand and valued at USD 5.5 Bn. This leadership is supported by rapid industrialization, large-scale urban development, and continuous investments in water supply, wastewater treatment, power generation, and oil and gas infrastructure. Expanding municipal networks and ongoing upgrades of aging pipelines further strengthen regional demand, making the Asia Pacific the core growth center for butterfly valves.

North America represents a stable and mature regional market, driven by replacement demand and the modernization of existing industrial and municipal systems. The region benefits from strict operational standards and a strong focus on efficiency, prompting steady use of butterfly valves in water utilities, energy infrastructure, and process industries.

In Europe, the market is shaped by infrastructure renewal and environmental compliance needs. Utilities across the region focus on improving flow control reliability, leakage reduction, and system efficiency, supporting consistent adoption of butterfly valves in water and industrial applications.

The Middle East & Africa region shows demand linked to new infrastructure development and water management needs. Butterfly valves are widely applied in large-diameter pipelines serving desalination, water distribution, and energy facilities.

Latin America demonstrates gradual growth, supported by infrastructure expansion and utility upgrades across key urban and industrial hubs, contributing steadily to overall regional demand.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Alfa Laval Corporate AB plays a strong role in the global butterfly valve market through its focus on fluid handling efficiency, reliability, and process optimization. In 2024, its activity is closely aligned with industries such as energy, water, food processing, and marine applications, where flow control reliability is critical. The company’s emphasis on hygienic design, corrosion resistance, and long service life positions it well for demanding environments. Its integrated approach, combining valves with heat transfer and separation solutions, strengthens its value proposition for customers seeking system-level efficiency rather than standalone components.

Curtiss-Wright Corporation brings an engineering-driven perspective to the butterfly valve market, with strengths rooted in high-performance and safety-critical applications. In 2024, its butterfly valve portfolio is closely linked to power generation, nuclear facilities, and industrial process operations where precision and durability matter. The company’s focus on robust materials, tight shutoff performance, and compliance with strict operational standards supports its relevance in regulated environments. Its long-standing experience in engineered solutions reinforces trust among operators managing complex and high-risk systems.

Flowserve Corporation maintains a broad global footprint in the butterfly valve market by serving utilities, energy, and industrial processing sectors. In 2024, its strategic focus on reliability, lifecycle support, and operational efficiency enhances customer loyalty. Strong aftermarket services, maintenance support, and system integration capabilities allow Flowserve to address long-term operational needs, reinforcing its competitive standing without relying on aggressive expansion narratives.

Top Key Players in the Market

- Alfa Laval Corporate AB

- Curtiss-Wright Corporation

- Flowserve Corporation

- Emerson Electric Co.

- Pentair PLC

- Weir Group PLC

- AVK Group A/S

- Crane Company

- Schlumberger Limited

- Velan, Inc.

Recent Developments

- In January 2025, Curtiss-Wright completed the acquisition of Ultra Energy for USD 200 million, a specialist in safety-critical measurement and control systems for commercial nuclear and aerospace/defense sectors.

- In October 2024, Flowserve completed the acquisition of MOGAS Industries, a Houston-based maker of severe-service valves and aftermarket services. This deal expands Flowserve’s portfolio in valves built for demanding applications (e.g., mining, process industries), strengthening its “severe service” valve offering and aftermarket support.

Report Scope

Report Features Description Market Value (2024) USD 11.6 Billion Forecast Revenue (2034) USD 18.0 Billion CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Function (Manual, Electric-actuated, Pneumatic-actuated, Hydraulic-actuated), By End Use (Oil and Gas, Water and Wastewater Treatment, Power Generation, Chemical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Alfa Laval Corporate AB, Curtiss-Wright Corporation, Flowserve Corporation, Emerson Electric Co., Pentair PLC, Weir Group PLC, AVK Group A/S, Crane Company, Schlumberger Limited, Velan, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Butterfly Valve MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Butterfly Valve MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Alfa Laval Corporate AB

- Curtiss-Wright Corporation

- Flowserve Corporation

- Emerson Electric Co.

- Pentair PLC

- Weir Group PLC

- AVK Group A/S

- Crane Company

- Schlumberger Limited

- Velan, Inc.