Global Business Process as a Service (BPaaS) Market Size, Share, Industry Analysis Report By Business Process (Human Resource Management (HRM), Accounting and Finance, Sales & Marketing, Customer Service and Support, Procurement & Supply Chain Management, Operations, Others (Legal and R&D)), By Deployment (Public Cloud, Private Cloud, Hybrid Cloud), By Organization Size (Small and Medium Enterprises, Large Enterprises), By Application (BFSI, Telecom & IT, Manufacturing, E-commerce & Retail, Healthcare, Government & Public Sector, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 162368

- Number of Pages: 374

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role of Generative AI

- US Market Size

- Emerging Trends

- Growth Factors

- By Business Process

- By Deployment

- By Organization Size

- By Application

- Key Market Segment

- Key Regions and Countries

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Top 5 Use Cases

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

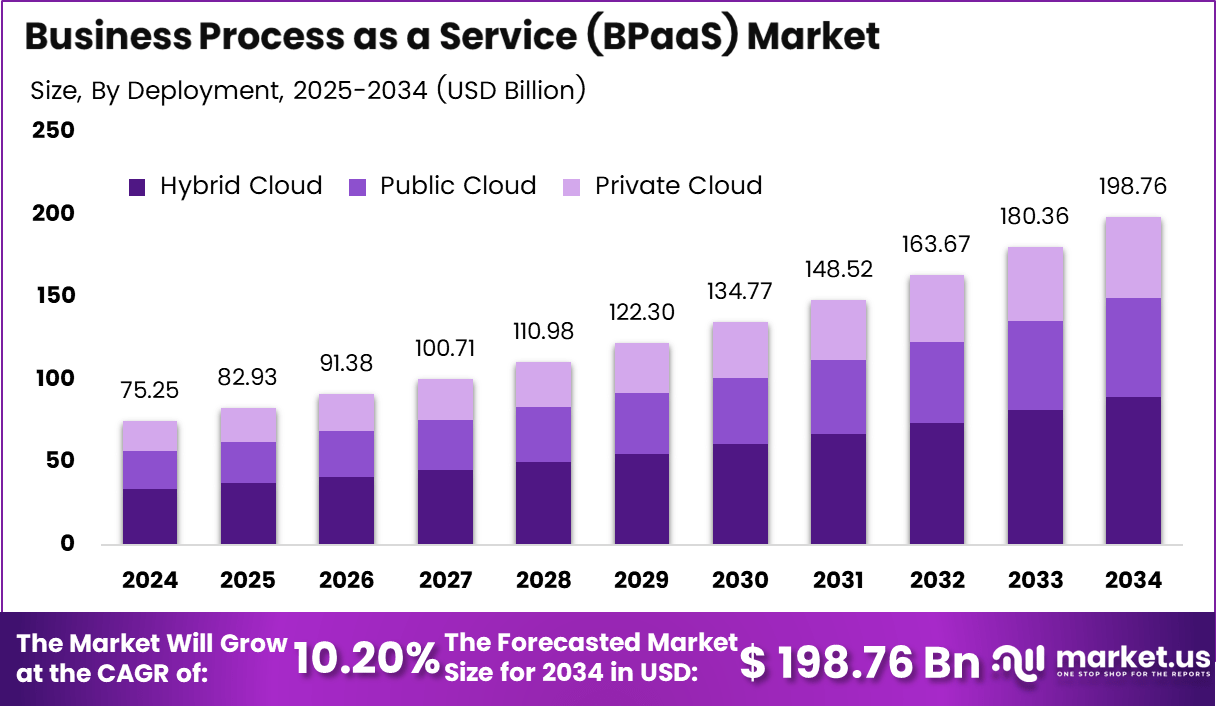

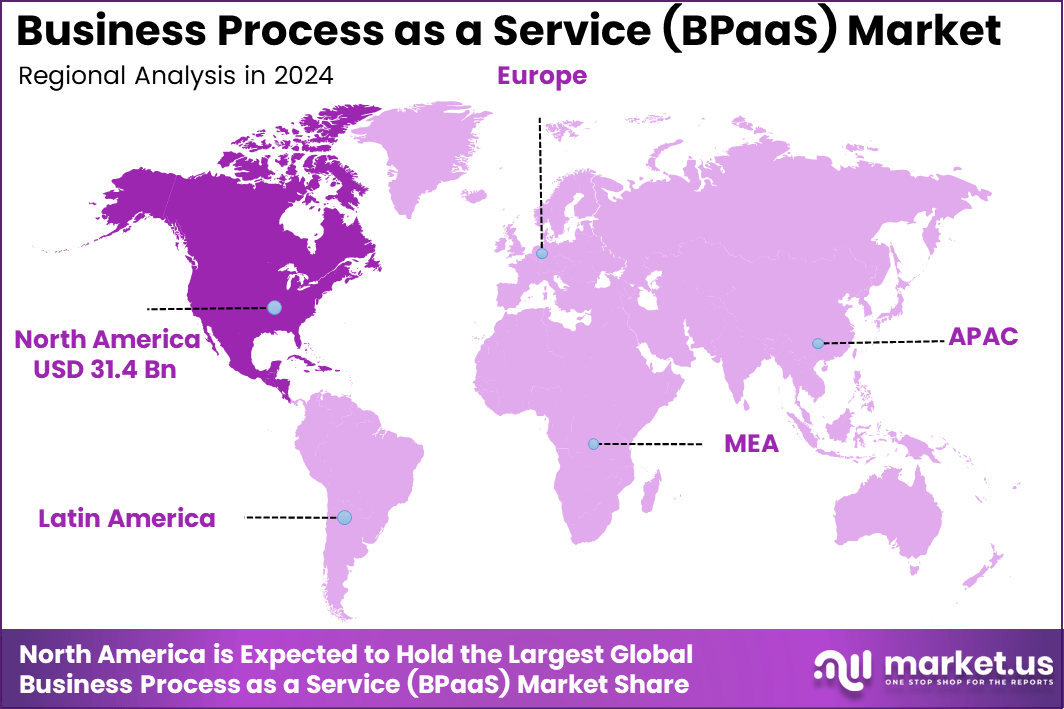

The Global Business Process as a Service (BPaaS) market was valued at Valued at USD 75.25 billion in 2024, the market is projected to reach USD 198.76 billion by 2034, expanding at a CAGR of 10.2%. The rising integration of automation, artificial intelligence, and analytics into business processes is reshaping service delivery models across industries. North America dominates the global landscape, accounting for USD 31.4 billion in 2024, supported by early adoption of cloud technologies and strong presence of major BPaaS providers.

The BPaaS market refers to the outsourcing of end-to-end business processes delivered via the cloud or a service model. These services cover processes such as accounting and finance, human resources, supply chain management, customer service, analytics and more. Organisations engage BPaaS providers so that they can focus on core tasks while service providers manage the underlying process, technology and infrastructure.

Top driving factors include the need for cost reduction, increased operational agility, and the rising demand for digital transformation across industries. As companies seek to focus on core activities, outsourcing back-end processes to BPaaS providers helps streamline workflows and improve service quality. Additionally, the proliferation of cloud technology makes BPaaS solutions more accessible, enabling organizations of all sizes to adopt this model.

BPaaS solutions are increasingly incorporating cloud platforms, multi-tenant architectures, analytics, robotic process automation (RPA) and artificial intelligence for enhanced decision-making, fewer errors and faster turnaround. Some offerings permit hybrid deployment models (public/private cloud) to suit enterprise preferences for security or regulatory compliance. These technology enablers are improving service delivery and widening the addressable market.

Key reasons for adopting BPaaS include cost savings, improved compliance, enhanced flexibility, and the ability to leverage advanced technologies like artificial intelligence and machine learning. BPaaS providers often incorporate these innovations to optimize process workflows, reduce errors, and deliver insights that help improve decision-making. This enables businesses to stay competitive and respond swiftly to market changes.

Investment opportunities are huge in the BPaaS market, especially for firms providing specialized cloud infrastructure, automation tools, and process management platforms. Growing demand in emerging regions offers prospects for market expansion, while innovations in AI and analytics create opportunities for new service offerings. Strategic partnerships and mergers also play a role in shaping market growth as providers look to broaden their service portfolio.

Key Takeaways

- The Human Resource Management (HRM) segment led with 25.6%, driven by the growing demand for automated payroll, recruitment, and employee management solutions.

- Hybrid Cloud deployment accounted for 45.2%, reflecting its advantage in offering flexibility, scalability, and enhanced data security.

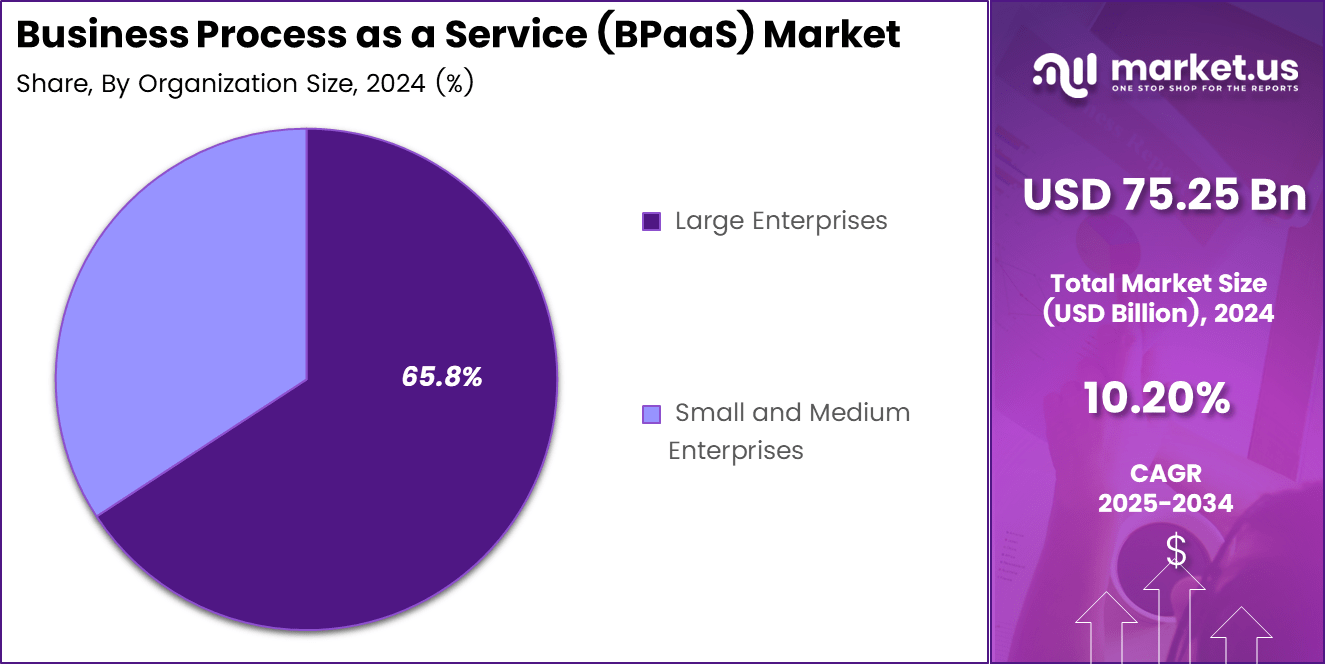

- Large Enterprises dominated with 65.8%, supported by strong adoption of BPaaS for cost optimization and digital transformation initiatives.

- The BFSI sector held 28.3%, highlighting the reliance on BPaaS solutions for regulatory compliance, process automation, and improved customer service.

- North America captured 41.8% of the global market, underpinned by mature cloud infrastructure and high enterprise outsourcing adoption.

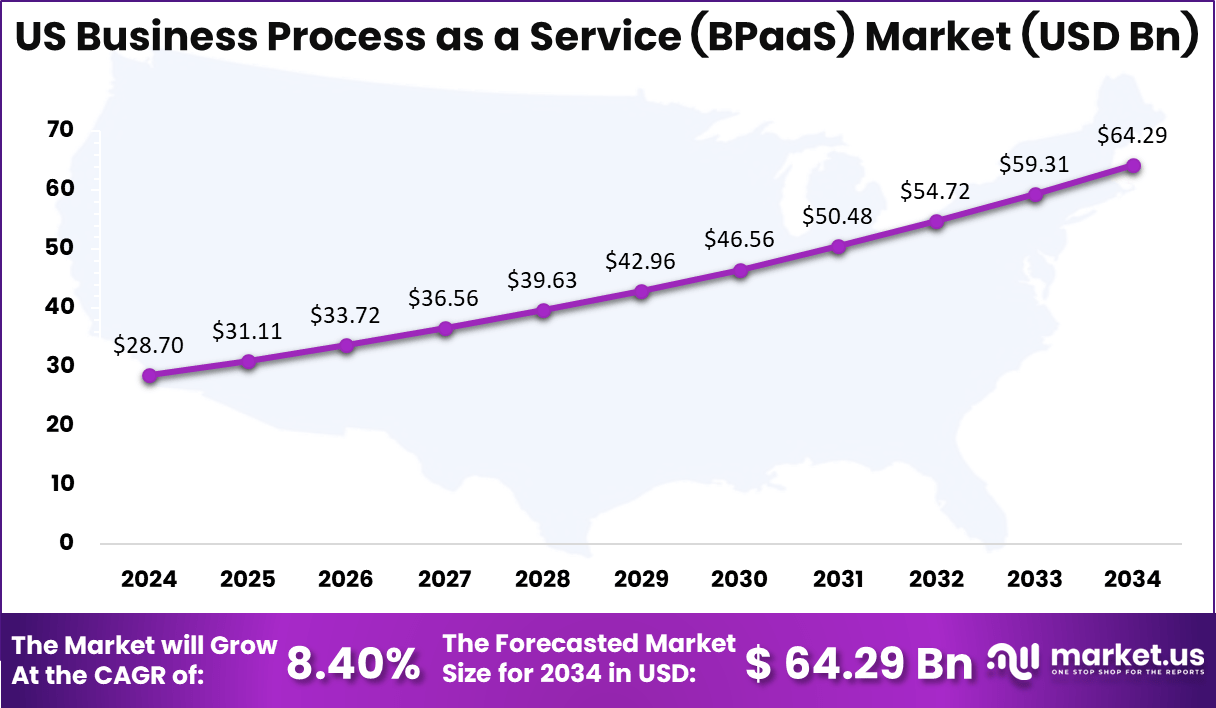

- The US market reached USD 28.7 Billion in 2024, recording a steady 8.4% CAGR, driven by increasing integration of AI and analytics in business process outsourcing models.

Role of Generative AI

Generative AI has become a critical tool within BPaaS, improving workflow automation and decision-making by processing vast amounts of data in real time. It enables businesses to generate relevant content, automate customer support interactions, and accelerate product development cycles.

For example, companies using generative AI report up to a 52% reduction in case handling times, freeing human resources for higher-value tasks. Moreover, 89% of enterprises have advanced their generative AI initiatives in 2025, focusing on improving customer satisfaction (56%) and reducing costs (46%) through AI-enhanced processes.

This AI-driven shift helps businesses anticipate market trends, optimize resource allocation, and minimize errors, fostering a culture of continuous improvement. Generative AI’s integration into BPaaS allows companies to stay competitive by reimagining performance and customer engagement, making it an indispensable element of modern business operations.

US Market Size

The US Business Process as a Service (BPaaS) market, valued at USD 28.7 billion in 2024, is projected to reach USD 64.29 billion by 2034, growing at a CAGR of 8.4%. Growth is driven by increasing adoption of AI-enabled automation, analytics, and cloud-based business platforms.

North America leads the global BPaaS market with a 41.8% share. The region’s mature IT infrastructure, extensive enterprise cloud adoption, and presence of major technology integrators underpin this dominance. Demand is rising across industries as businesses pursue automation, flexibility, and compliance efficiency through cloud-based process solutions. North American companies are also integrating generative AI models into BPaaS offerings to enhance decision-making and reduce administrative workloads.

Emerging Trends

One prominent trend in BPaaS is the rise of intelligent automation which blends AI, robotic process automation (RPA), and business process management (BPM). This combination is transforming how enterprises manage repetitive tasks, enabling more efficient, scalable workflows.

By 2025, 79% of companies deployed three or more AI solutions to streamline processes, reflecting the broad acceptance of such technologies for driving operational excellence. Additionally, AI agents and assistants are rapidly replacing traditional automation bots, taking on more complex, interactive tasks such as fraud detection, invoice processing, and customer personalization.

This trend is significantly altering service delivery, with industries like healthcare automating patient data entry and diagnosis, while banking automates compliance and loan processing, showcasing how BPaaS is evolving with AI-driven innovation.

Growth Factors

Key growth drivers for BPaaS include the increasing complexity of business operations and the need for scalable cloud-based solutions that provide cost savings and operational flexibility. The market growth is further supported by advancements in automation technologies like RPA and AI, helping companies improve efficiency by reducing manual interventions and error rates.

The growing emphasis on digital transformation initiatives across sectors is fueling BPaaS adoption, with firms prioritizing operational agility to keep up with changing market demands. The drive to enhance customer experiences and optimize resource utilization has businesses investing heavily in BPaaS offerings integrated with AI analytics and real-time data insights.

By Business Process

Human Resource Management (HRM) accounts for around 25.6% of the Business Process as a Service (BPaaS) market. Organizations are increasingly adopting BPaaS models to automate payroll, benefits, and recruitment functions while improving compliance accuracy.

Cloud-based HR platforms are helping firms handle employee data securely while maintaining flexibility in workforce planning. This shift is particularly strong among global corporations aiming to unify HR practices across multiple countries under a single digital infrastructure. The use of analytics-driven HR tools is expanding, allowing leaders to predict workforce needs and measure productivity more efficiently.

Many enterprises are also integrating AI into HR BPaaS solutions to enhance talent matching, training, and retention. These innovations are improving cost control and enabling faster decision-making, aligning with companies’ broader digital transformation goals. With remote and hybrid work now commonplace, HRM BPaaS services are proving essential in managing distributed teams effectively.

By Deployment

Hybrid cloud deployment leads the BPaaS market with a 45.2% share. It provides companies with both the scalability of public cloud and the control of private infrastructure, helping them manage sensitive business processes safely. Many enterprises prefer hybrid models for regulatory compliance and data protection, especially in sectors like finance and healthcare.

The combination of cloud agility with in-house oversight has made hybrid BPaaS a dependable choice for large-scale business operations. As companies modernize their IT ecosystems, hybrid deployment also allows gradual migration from legacy systems to cloud-based services. This flexible transition protects existing data integrity while opening access to new tools powered by AI and process automation.

Service providers are continuously improving interoperability to ensure seamless communication between public and private environments. The popularity of hybrid BPaaS reflects the corporate need for dependable performance and adaptable scalability in an evolving digital landscape.

By Organization Size

Large enterprises dominate the BPaaS market with a 65.8% share. Their global operations demand streamlined, cost-effective service delivery models that maintain consistent performance across multiple regions. BPaaS helps these organizations standardize complex processes – such as supply chain coordination, finance management, and HR functions – without heavy infrastructure investment.

This model also enables quicker deployment of new services through preconfigured business frameworks. The increasing focus on operational agility has encouraged large enterprises to expand automation through BPaaS platforms. By outsourcing non-core activities to managed service partners, organizations gain flexibility and focus on strategic functions.

Many corporations also leverage data integration capabilities within BPaaS to support predictive planning and risk reduction. This approach continues to enhance productivity across enterprise systems while lowering maintenance overhead.

By Application

The BFSI sector holds about 28.3% of the total BPaaS market, reflecting its strong digital adoption rate. Financial institutions rely on BPaaS for streamlining compliance reporting, claims processing, and customer onboarding. These services help reduce manual workflow time while maintaining strict adherence to industry regulations.

Cloud-driven automation also improves transaction transparency and strengthens fraud detection capabilities. The move toward digital banking and insurance operations has reinforced BFSI’s dependence on BPaaS. By combining advanced analytics and robotic process automation, service providers are delivering faster and more secure process execution.

Banks are also adopting BPaaS to support open banking frameworks and real-time data sharing. These advantages make BPaaS a key component in enabling financial firms to scale digital operations while sustaining customer trust.

Key Market Segment

By Business Process

- Human Resource Management (HRM)

- Accounting and Finance

- Sales & Marketing

- Customer Service and Support

- Procurement & Supply Chain Management

- Operations

- Others (Legal and R&D)

By Deployment

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size

- Small and Medium Enterprises

- Large Enterprises

By Application

- BFSI

- Telecom & IT

- Manufacturing

- E-commerce & Retail

- Healthcare

- Government & Public Sector

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Automation and AI Enhance Operational Efficiency

The Business Process as a Service (BPaaS) market is driven significantly by advancements in automation and artificial intelligence technologies. These innovations allow businesses to streamline repetitive tasks, reduce human error, and improve decision-making processes. By automating routine activities, companies can save time and resources, enabling employees to focus on higher-value tasks which ultimately boosts overall operational efficiency.

Moreover, AI integration in BPaaS platforms facilitates real-time analytics and predictive insights, helping organizations optimize their workflows dynamically. This technological evolution makes BPaaS an attractive solution for companies aiming to improve performance while maintaining flexibility in response to changing market conditions.

Restraint Analysis

Data Security and Privacy Concerns

Despite the benefits, data security and privacy issues remain a significant restraint for BPaaS adoption. Since BPaaS involves cloud-based delivery of critical business processes, organizations worry about potential data breaches and compliance with strict regulations. This concern is heightened in industries dealing with sensitive information, such as healthcare and finance, where regulatory requirements are stringent.

The fear of unauthorized data access and risks related to storing business-critical information in the cloud results in slower decision-making processes. Providers must invest heavily in robust security measures such as encryption, identity control, and continuous monitoring to build customer trust, yet concerns linger as a barrier for some prospects.

Opportunity Analysis

Expanding Adoption Across Industries

A prominent opportunity lies in the widening adoption of BPaaS across various industries, including healthcare, finance, retail, and telecommunications. Businesses in these sectors are increasingly embracing BPaaS to improve agility, reduce costs, and support digital transformation initiatives. With flexible, scalable cloud platforms, companies can rapidly deploy and adjust services to meet evolving needs without heavy upfront investments.

Additionally, specialized solutions tailored to industry-specific requirements create growth avenues by addressing unique operational challenges. Sectors incorporating AI-driven analytics and robotic process automation stand to gain from enhanced efficiency and better customer experiences.

Challenge Analysis

Integration Complexity with Legacy Systems

One of the critical challenges BPaaS faces is the complexity involved in integrating with existing legacy core systems. Many enterprises operate with outdated or proprietary technologies that do not easily mesh with modern cloud-based platforms. This leads to costly and time-consuming customization efforts that deter or delay BPaaS adoption.

Furthermore, the need for specialized technical expertise to manage these integrations adds to operational burdens, especially for smaller firms lacking deep IT resources. Overcoming these technical barriers is essential for seamless deployment and realizing the full benefits of BPaaS solutions.

Top 5 Use Cases

- HR Process Automation 25.6% of Business Process as a Service (BPaaS) Market are applied to HR processes (recruitment, payroll, talent) under the business-process segmentation.

- Finance & Accounting Optimization Organizations implementing automation report cost reductions between 10-50%.

- Customer Experience Enhancement AI-driven chatbots and CRM automation help reduce service-cycle times, with some firms reporting 30% improvement.

- Procurement & Supply Chain Efficiency Organizations adopting BPaaS and automation report 40% efficiency improvement in back-office/operational tasks.

- Regulatory Compliance & Risk-Management Among firms using cloud-based BPaaS, 77% are investigating or using AI to automate non-core processes.

Key Player Analysis

The Business Process as a Service (BPaaS) Market is led by global technology and consulting firms such as Accenture plc, IBM Corporation, Tata Consultancy Services (TCS), Cognizant Technology Solutions, and Capgemini SE. These companies deliver cloud-based business process outsourcing integrated with automation, analytics, and artificial intelligence. Their platforms enable enterprises to optimize workflows, improve cost efficiency, and accelerate digital transformation across finance, HR, procurement, and supply chain operations.

Key IT service providers including Wipro Limited, HCL Technologies, Infosys Limited, Genpact Ltd., Fujitsu Ltd., Oracle Corporation, SAP SE, DXC Technology, and Tech Mahindra focus on scalable BPaaS platforms that combine robotic process automation (RPA), data analytics, and AI-based decision support. Their offerings cater to sectors such as banking, healthcare, and retail, helping organizations modernize legacy processes and achieve operational resilience.

Additional contributors such as Deloitte Touche Tohmatsu Limited, NTT DATA, CGI Inc., EXL Service Holdings, ADP Inc., Alight Solutions, Paychex Inc., UKG (Ultimate Kronos Group), TriNet Group, Ceridian HCM, WNS Global Services, and Sutherland Global Services, along with other market participants, specialize in HR outsourcing, payroll management, and industry-specific business process automation.

Top Key Players

- Accenture plc

- IBM Corporation

- Tata Consultancy Services (TCS)

- Cognizant Technology Solutions

- Wipro Limited

- HCL Technologies

- Capgemini SE

- Infosys Limited

- Genpact Ltd.

- Fujitsu Ltd.

- Oracle Corporation

- SAP SE

- Deloitte Touche Tohmatsu Limited

- NTT DATA

- CGI Inc.

- DXC Technology

- Tech Mahindra

- EXL Service Holdings

- ADP Inc.

- Alight Solutions

- Paychex Inc.

- UKG (Ultimate Kronos Group)

- TriNet Group

- Ceridian HCM

- WNS Global Services

- Sutherland Global Services

- Others

Recent Developments

- March 2025, Tata Consultancy Services (TCS) launched a sustainability-focused BPaaS solution to help organizations monitor and report ESG metrics, reinforcing TCS’s commitment to sustainable digital transformation.

- February 2025, HCL Technologies enhanced its HR management BPaaS offering by integrating generative AI for talent acquisition and employee engagement, reflecting the adoption of advanced AI in HR processes.

Report Scope

Report Features Description Market Value (2024) USD 75.25 Bn Forecast Revenue (2034) USD 198.76 Bn CAGR(2025-2034) 10.20% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, nd Emerging Trends Segments Covered By Business Process (Human Resource Management (HRM), Accounting and Finance, Sales & Marketing, Customer Service and Support, Procurement & Supply Chain Management, Operations, Others (Legal and R&D)), By Deployment (Public Cloud, Private Cloud, Hybrid Cloud), By Organization Size (Small and Medium Enterprises, Large Enterprises), By Application (BFSI, Telecom & IT, Manufacturing, E-commerce & Retail, Healthcare, Government & Public Sector, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Accenture plc, IBM Corporation, Tata Consultancy Services (TCS), Cognizant Technology Solutions, Wipro Limited, HCL Technologies, Capgemini SE, Infosys Limited, Genpact Ltd., Fujitsu Ltd., Oracle Corporation, SAP SE, Deloitte Touche Tohmatsu Limited, NTT DATA, CGI Inc., DXC Technology, Tech Mahindra, EXL Service Holdings, ADP Inc., Alight Solutions, Paychex Inc., UKG (Ultimate Kronos Group), TriNet Group, Ceridian HCM, WNS Global Services, Sutherland Global Services, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to choose from: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users, Printable PDF)  Business Process as a Service (BPaaS) MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Business Process as a Service (BPaaS) MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Accenture plc

- IBM Corporation

- Tata Consultancy Services (TCS)

- Cognizant Technology Solutions

- Wipro Limited

- HCL Technologies

- Capgemini SE

- Infosys Limited

- Genpact Ltd.

- Fujitsu Ltd.

- Oracle Corporation

- SAP SE

- Deloitte Touche Tohmatsu Limited

- NTT DATA

- CGI Inc.

- DXC Technology

- Tech Mahindra

- EXL Service Holdings

- ADP Inc.

- Alight Solutions

- Paychex Inc.

- UKG (Ultimate Kronos Group)

- TriNet Group

- Ceridian HCM

- WNS Global Services

- Sutherland Global Services

- Others