Global Blowout Preventer Market Size, Share, Growth Analysis By Type (Ram Blowout Preventers, Annular Blowout Preventers, Hybrid Blowout Preventers), By Mechanism (Hydraulic Control, Manual Control, Electronic Control), By Application (Offshore Drilling, Onshore Drilling, Well Testing), By End Use (Oil & Gas, Geothermal, Mining, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167567

- Number of Pages: 318

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

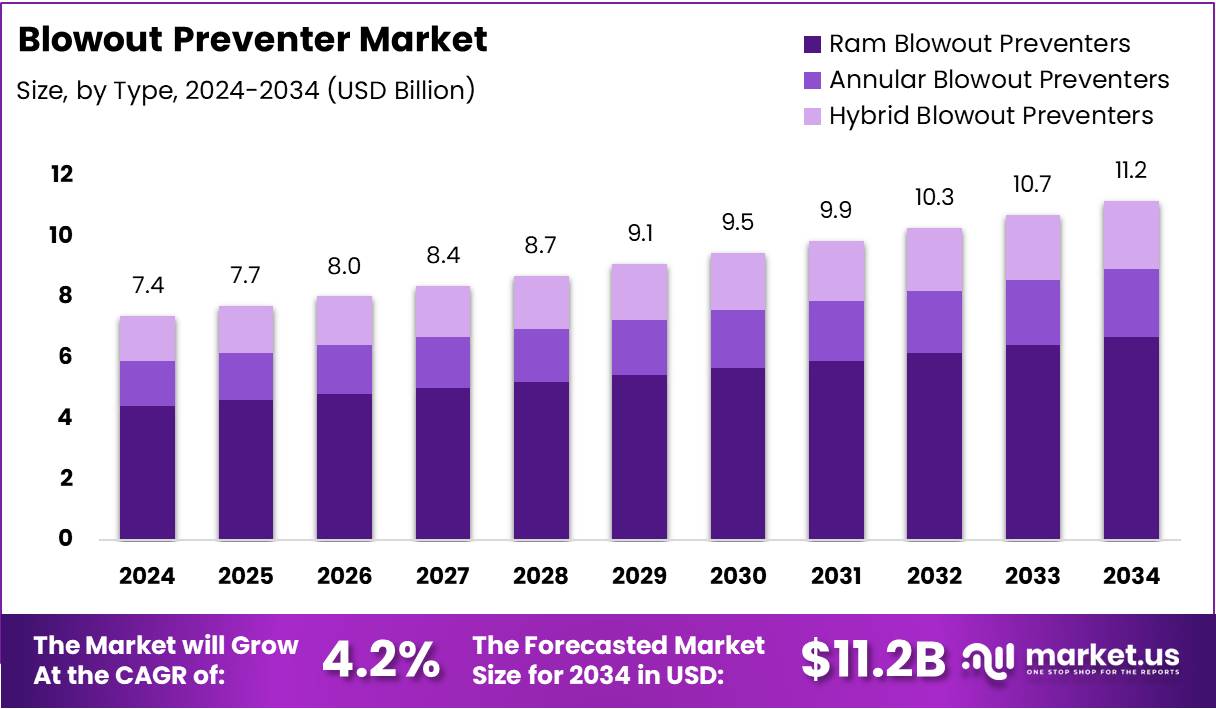

The Global Blowout Preventer Market size is expected to be worth around USD 11.2 Billion by 2034, from USD 7.4 Billion in 2024, growing at a CAGR of 4.2% during the forecast period from 2025 to 2034.

The Blowout Preventer Market forms a crucial part of global drilling safety, as these systems control sudden pressure surges in oil, gas, and mining operations. The market expands steadily as operators prioritize safety, operational continuity, and compliance with strict well-control standards across onshore and offshore environments.

Moreover, a Blowout Preventer functions as a high-pressure safety valve that seals, controls, and monitors wellbore pressure. Its reliability supports safer drilling, reduces downtime, and strengthens well-integrity programs, making it essential for companies adopting digital monitoring, predictive maintenance, and automated control technologies.

Moving ahead, the market grows due to rising offshore exploration, deeper well development, and the increasing need for heavy-duty drilling systems. These factors push manufacturers to focus on durability, automation, and remote-operating capabilities, enabling safer and more efficient pressure-control operations across complex drilling projects.

Additionally, government investments in energy infrastructure and tighter operational regulations continue to strengthen demand. Regulatory updates encourage operators to replace or upgrade older BOP units, accelerating adoption of modern, compliance-ready systems designed to reduce operational risks and enhance drilling stability.

Furthermore, sustainability objectives motivate the integration of smart sensors, predictive diagnostics, and continuous monitoring. These enhancements help operators reduce non-productive time and prevent environmental incidents. As a result, the Blowout Preventer Market benefits from digital-oilfield initiatives and improved well-control management frameworks.

As demand increases, mining applications introduce niche opportunities for compact BOP systems. Although still limited, this segment gradually expands and supports diversified product adoption. Meanwhile, offshore megaprojects create stronger procurement cycles as governments allocate budgets for deepwater development and modern well-control infrastructure.

In the statistical context, pressure ratings play a major role in selection and performance. Common industry ratings include 5,000 psi, 10,000 psi, and 15,000 psi, reflecting the high-pressure demands of modern wells. Additionally, mining applications represent around 2–3% of total BOP usage, indicating modest yet steady adoption within specialized operations.

Key Takeaways

- Global Blowout Preventer Market valued at USD 7.4 Billion in 2024 and projected to reach USD 11.2 Billion by 2034.

- Market expected to grow at a CAGR of 4.2% from 2025 to 2034.

- Ram Blowout Preventers lead the type segment with 47.3% share.

- Hydraulic Control dominates mechanism segment with 42.8% share.

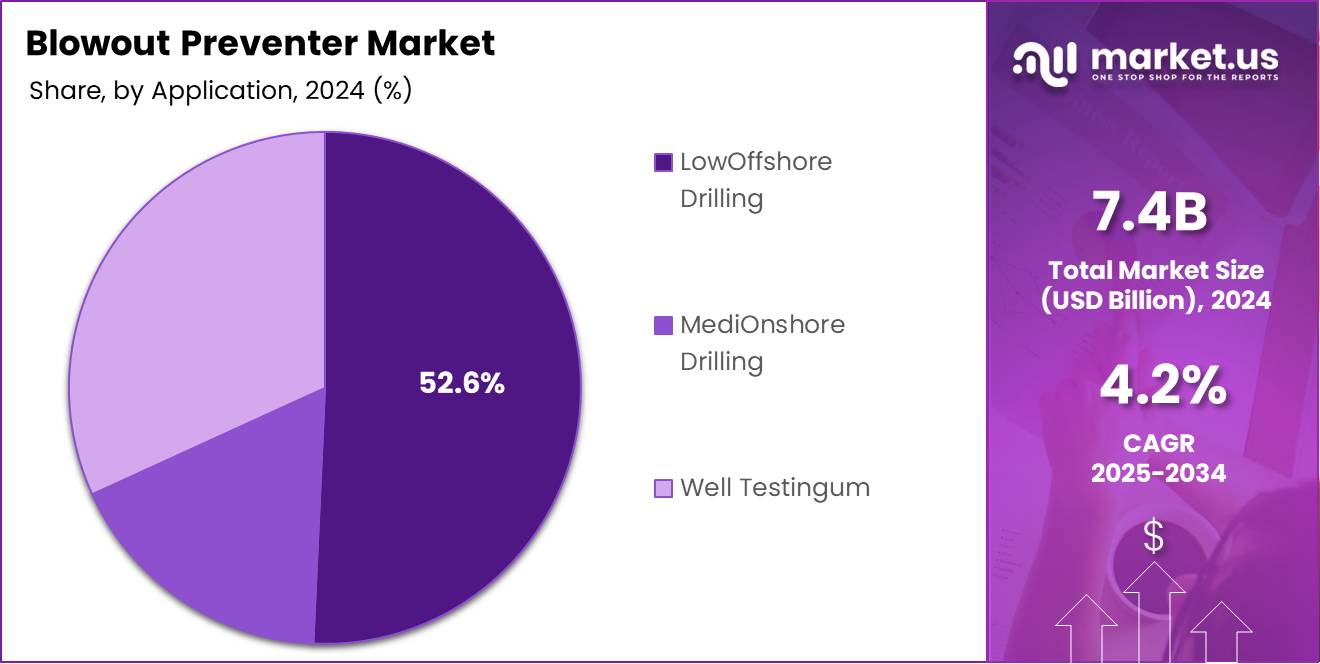

- Offshore Drilling holds the largest application share at 52.6%.

- Oil & Gas leads end-use segment with a strong 78.4% share.

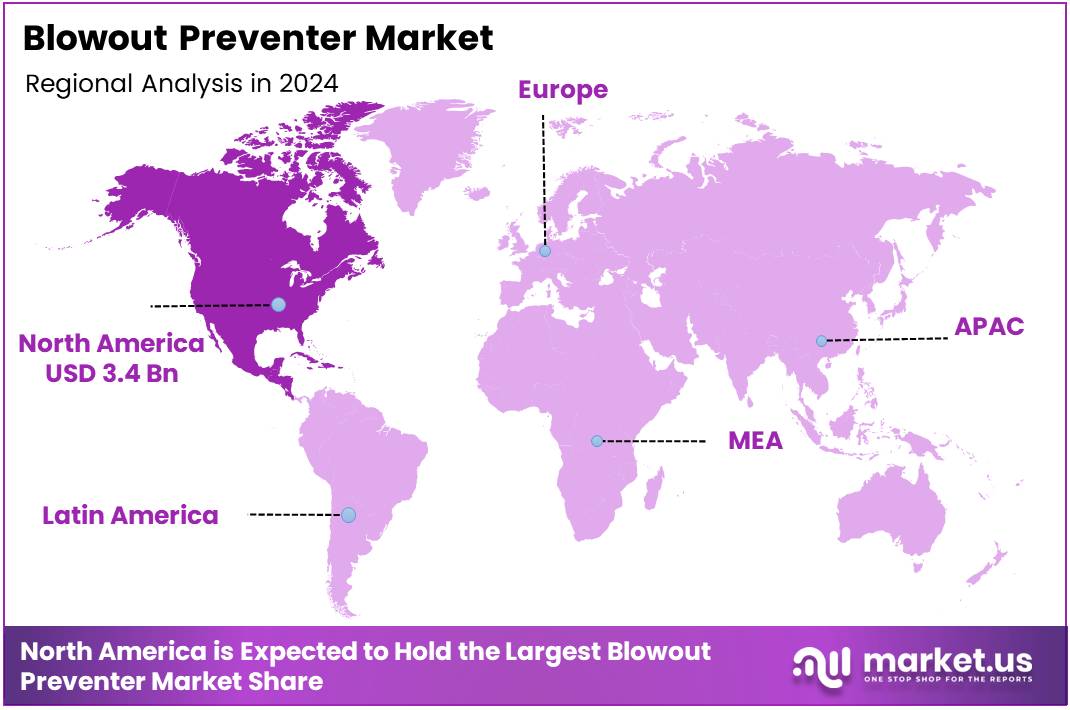

- North America remains the leading region with 46.9% market share worth USD 3.4 Billion.

By Type Analysis

Ram Blowout Preventers dominate with 47.3% due to their reliability in high-pressure drilling operations.

In 2024, Ram Blowout Preventers held a dominant market position in the By Type Analysis segment of the Blowout Preventer Market, with a 47.3% share. This segment benefits from strong adoption in critical drilling environments. Moreover, increasing deepwater exploration further accelerates demand as operators prioritize robust safety mechanisms.

Annular Blowout Preventers demonstrated steady market growth due to their flexible sealing capabilities. Additionally, rising multi-well drilling projects encouraged a higher preference for adaptable BOP solutions. As a result, this sub-segment supported broader operational efficiency while complementing ram-type preventers in complex drilling programs.

Hybrid Blowout Preventers showed gradual adoption as operators sought integrated solutions offering both sealing flexibility and mechanical reliability. Furthermore, advancements in combined-pressure control systems enhanced hybrid BOP functionality. Consequently, interest in hybrid designs increased among companies looking for versatile solutions suitable for diverse drilling conditions.

By Mechanism Analysis

Hydraulic Control dominates with 42.8% due to its precision and operational reliability.

In 2024, Hydraulic Control held a dominant market position in the By Mechanism Analysis segment of the Blowout Preventer Market, with a 42.8% share. This segment expanded rapidly as drilling operators favored dependable control systems. Additionally, rising automation in drilling boosted hydraulic BOP installations across offshore and high-risk wells.

Manual Control systems maintained relevance within small-scale and low-pressure drilling projects. Moreover, these systems continued to be preferred in regions with limited automation infrastructure. As a result, manual control solutions preserved a consistent presence, especially in cost-sensitive and training-focused operational environments.

Electronic Control systems gained notable traction with the increasing integration of digital monitoring tools. Furthermore, enhanced remote operations improved decision-making and response times. Therefore, electronic control BOPs experienced rising adoption among operators investing in technologically advanced and data-driven well-control systems.

By Application Analysis

Offshore Drilling dominates with 52.6% due to rising deepwater exploration activities.

In 2024, Offshore Drilling held a dominant market position in the By Application Analysis segment of the Blowout Preventer Market, with a 52.6% share. This segment expanded as offshore fields required advanced safety equipment. Additionally, high-pressure and high-temperature operations amplified demand for reliable BOP systems.

Onshore Drilling displayed stable growth driven by increased shale development and conventional field reinvestments. Moreover, expanding drilling activities across North America and the Middle East supported consistent BOP procurement. Thus, onshore operators continued to leverage BOPs to maintain safety standards and operational continuity.

Well Testing applications saw rising adoption of BOPs to ensure safe pressure management during assessment procedures. Furthermore, growing appraisal of new reservoirs encouraged broader use of well-control tools. Consequently, this sub-segment benefited from increasing exploration and production assessments worldwide.

By End Use Analysis

Oil & Gas dominates with 78.4% driven by extensive drilling and production activities.

In 2024, Oil & Gas held a dominant market position in the By End Use Analysis segment of the Blowout Preventer Market, with a 78.4% share. This segment continued to lead due to high global drilling intensity. Additionally, expanding offshore and unconventional projects strengthened reliance on advanced BOP systems.

Geothermal applications adopted BOPs to support high-temperature well development. Moreover, growing renewable energy initiatives increased geothermal drilling activity. As a result, the need for robust well-control equipment enhanced BOP utilization within this specialized segment.

Mining operations integrated BOP solutions to manage subsurface pressure challenges during exploratory drilling. Additionally, expanding mineral extraction projects contributed to rising BOP demand. Therefore, this segment benefited from heightened safety requirements in complex geological environments.

Others category included industrial and research-based drilling environments that required dependable well-control tools. Moreover, increasing small-scale drilling studies fueled steady demand. Consequently, BOP solutions remained essential in supporting safe and controlled subsurface operations across diverse applications.

Key Market Segments

By Type

- Ram Blowout Preventers

- Annular Blowout Preventers

- Hybrid Blowout Preventers

By Mechanism

- Hydraulic Control

- Manual Control

- Electronic Control

By Application

- Offshore Drilling

- Onshore Drilling

- Well Testing

By End Use

- Oil & Gas

- Geothermal

- Mining

- Others

Drivers

Rising Global Energy Demand Pushing Operators Toward Complex Offshore Reserves

The Blowout Preventer (BOP) market is primarily driven by the rising global need for energy, which pushes operators toward deeper and more complex offshore reserves. As onshore fields mature, companies increasingly rely on offshore drilling to maintain production levels. This shift creates higher demand for advanced BOP systems that ensure safety in high-pressure environments.

Moreover, regulatory bodies are enforcing stricter safety rules across drilling operations. These regulations require redundant safety mechanisms to prevent blowouts and protect workers and assets. As a result, operators must invest in reliable and certified BOP equipment, strengthening the market’s growth. These compliance standards also encourage continuous upgrades of existing systems.

Additionally, growing capital investments in offshore rig modernization programs are supporting market expansion. Many operators are refurbishing older rigs with next-generation BOP units to meet new safety norms and improve operational efficiency. This modernization trend enhances system reliability and reduces downtime, making BOPs essential for sustainable drilling operations. Collectively, these factors continue to generate steady demand for advanced BOP technologies.

Restraints

Escalating Compliance Burden Due to Tightening Offshore Safety Mandates

Stricter offshore safety rules are becoming a major restraint for the Blowout Preventer (BOP) market. Regulators are continuously updating standards, pushing operators to invest more time and money to remain compliant. As requirements expand, companies face rising operational complexity and higher documentation loads, slowing project execution and increasing overall drilling costs.

Additionally, the industry is experiencing growing pressure to adopt advanced safety mechanisms and redundant systems. While these measures improve risk control, they also raise procurement and installation expenses for BOP units. This compliance-driven cost escalation often delays new drilling activities, especially for smaller operators with limited budgets.

High downtime linked to frequent recertification and pressure testing is another strong market challenge. BOP systems must undergo periodic inspections to ensure reliability, but these processes temporarily halt drilling operations. Each testing cycle adds substantial non-productive time, causing financial losses and reducing asset utilization rates.

Moreover, the need for specialized technicians and testing equipment increases operational disruption. As BOP designs become more complex, testing intervals occur more frequently, further slowing offshore workflows. This continuous downtime pressure makes operators cautious about expanding drilling programs, ultimately restraining the overall market growth.

Growth Factors

Rising Adoption of Predictive Maintenance Platforms Drives Market Growth

The Blowout Preventer (BOP) market is witnessing strong growth opportunities as operators increasingly shift toward predictive maintenance systems. These platforms use real-time sensor data to detect equipment stress early, helping reduce downtime and extend component life. This approach also supports safer drilling, which encourages wider industry adoption.

At the same time, aging offshore rigs are creating higher demand for retrofit upgrades. Many rig operators prefer modernizing existing BOP units instead of purchasing new systems, making retrofit solutions a cost-effective choice. This trend opens steady revenue prospects for service providers offering advanced components and digitalized control systems.

Additionally, rising interest in ultra-deepwater drilling is unlocking new growth avenues. Exploration companies are moving into frontier basins with challenging conditions, which require high-performance BOP systems. This shift increases demand for equipment designed to handle extreme pressures and deeper formations.

Moreover, the integration of autonomous control systems is becoming a key opportunity in the market. Automated functions help reduce human intervention, improve precision, and enhance emergency response capabilities. As offshore projects focus on operational safety, autonomous technologies are expected to accelerate future BOP innovation and adoption.

Emerging Trends

Increasing Use of Digital Technologies Enhances Blowout Preventer Market Growth

The blowout preventer market is experiencing strong momentum as operators increasingly adopt digital twins for real-time performance simulation. This trend helps companies predict failures early, improve operational safety, and extend equipment life. As offshore drilling becomes more complex, digital twins offer a reliable way to test scenarios without interrupting operations, making them a valuable investment.

Moreover, the market is shifting toward modular BOP stacks, driven by the need for faster deployment and reduced operating costs. Modular designs allow operators to assemble, transport, and maintain units more efficiently. This flexibility supports offshore projects where time-saving and cost optimization are major priorities, especially in deepwater and ultra-deepwater environments.

In addition, the adoption of smart BOPs equipped with high-density data logging technology is rising steadily. These systems capture real-time operational data, helping teams monitor pressure changes, system health, and equipment performance with higher accuracy. This capability increases safety and supports more informed decision-making, which is essential for modern drilling programs.

Regional Analysis

North America Dominates the Blowout Preventer Market with a Market Share of 46.9%, Valued at USD 3.4 Billion

North America leads the global Blowout Preventer market, supported by extensive offshore drilling activities and strict safety standards. The region’s strong investment in modern rig fleets and advanced well-control technologies continues to drive higher adoption of BOP systems. With a dominant share of 46.9% valued at USD 3.4 Billion, the market benefits from ongoing upgrades and regulatory compliance requirements that ensure consistent demand.

Europe Blowout Preventer Market Trends

Europe shows steady growth in the Blowout Preventer market due to its increasing focus on North Sea redevelopment and enhanced subsea safety measures. Countries across the region are integrating modern control systems to support deepwater operations and meet evolving environmental mandates. Rising offshore reinvestment and modernization of drilling platforms continue to support demand for reliable BOP systems.

Asia Pacific Blowout Preventer Market Trends

Asia Pacific is emerging as one of the fastest-growing regional markets, driven by expanding exploration initiatives in China, India, and Southeast Asia. The region benefits from rising energy demand and continuous development of offshore basins, which accelerates the need for advanced BOP equipment. Government-backed investments and new deepwater projects further strengthen long-term market prospects.

Middle East & Africa Blowout Preventer Market Trends

The Middle East & Africa market is supported by large-scale drilling programs and expanding offshore exploration activities. National oil companies in the region are investing in advanced pressure control systems to ensure operational safety and reduce downtime. Increased focus on deepwater potential in Africa and sustained production expansion in the Middle East contribute to stable market demand.

Latin America Blowout Preventer Market Trends

Latin America demonstrates solid potential, driven by growing ultra-deepwater projects and renewed exploration interest in key offshore zones. The region is prioritizing modern well-control infrastructure to improve operational reliability and safety standards. Continuous investments in deepwater fields and upgraded drilling technologies support market expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Blowout Preventer Company Insights

In 2024, the global Blowout Preventer (BOP) market continued to reflect steady innovation and enhanced safety expectations, with leading companies influencing technology advancement and operational reliability. Each major player contributed uniquely to the competitive landscape, shaping performance benchmarks for offshore and onshore drilling environments.

Schlumberger maintained a strong market footprint by expanding its high-spec BOP systems integrated with digital monitoring capabilities. The company’s emphasis on real-time data intelligence and lifecycle maintenance strengthened operator confidence, particularly in deepwater and high-pressure wells.

Halliburton focused on performance-driven BOP solutions aligned with rising demand for automated well-control systems. Its investments in remote operations and improved sealing mechanisms supported better uptime, reducing downtime costs for drilling contractors across complex drilling programs.

Parker Tube Fitting played a vital role by offering precision-engineered pressure-control components that enhanced the functional reliability of BOP stacks. Its product durability and compatibility with high-pressure configurations helped operators meet stringent safety requirements without compromising operational efficiency.

FMC Technologies continued prioritizing subsea BOP development, particularly for ultra-deepwater applications where stability and high-pressure sealing are critical. The company’s engineering advances supported improved control performance, helping offshore operators manage challenging well conditions more effectively.

Top Key Players in the Market

- Schlumberger

- Halliburton

- Parker Tube Fitting

- FMC Technologies

- Baker Hughes

- Tenaris

- Valve Solutions

- National Oilwell Varco

- GE

Recent Developments

- In October 2024, Mako Industries announced the acquisition of Global Tech Subsea, strengthening its service portfolio. The move enhances its deepwater drilling capabilities and supports expansion into high-spec offshore projects.

- In Mar 2025, Cameron entered into an agreement to acquire KB Industries to broaden its engineering expertise. This acquisition aims to accelerate development of advanced pressure-control systems for global drilling operations.

- In Jan 2025, Sino Mechanical expanded its global presence by supplying high-quality BOP stacks to new international clients. The company is leveraging this momentum to boost its standing in the global blowout preventer market.

Report Scope

Report Features Description Market Value (2024) USD 7.4 Billion Forecast Revenue (2034) USD 11.2 Billion CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Ram Blowout Preventers, Annular Blowout Preventers, Hybrid Blowout Preventers), By Mechanism (Hydraulic Control, Manual Control, Electronic Control), By Application (Offshore Drilling, Onshore Drilling, Well Testing), By End Use (Oil & Gas, Geothermal, Mining, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Schlumberger, Halliburton, Parker Tube Fitting, FMC Technologies, Baker Hughes, Tenaris, Valve Solutions, National Oilwell Varco, GE Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Schlumberger

- Halliburton

- Parker Tube Fitting

- FMC Technologies

- Baker Hughes

- Tenaris

- Valve Solutions

- National Oilwell Varco

- GE