Global Betulinic Acid Market Size, Share Analysis Report By Purity (Up to 95% and Above 95%), By Source (Natural and Synthetic), By Application (Pharmaceutical, Cosmetics And Personal Care, Nutraceuticals, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172676

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

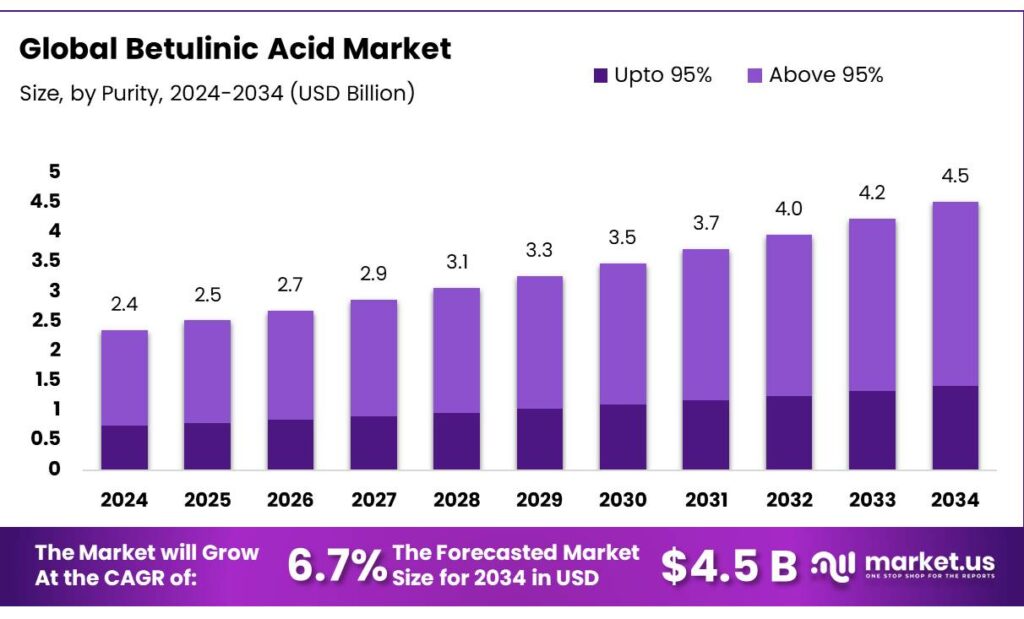

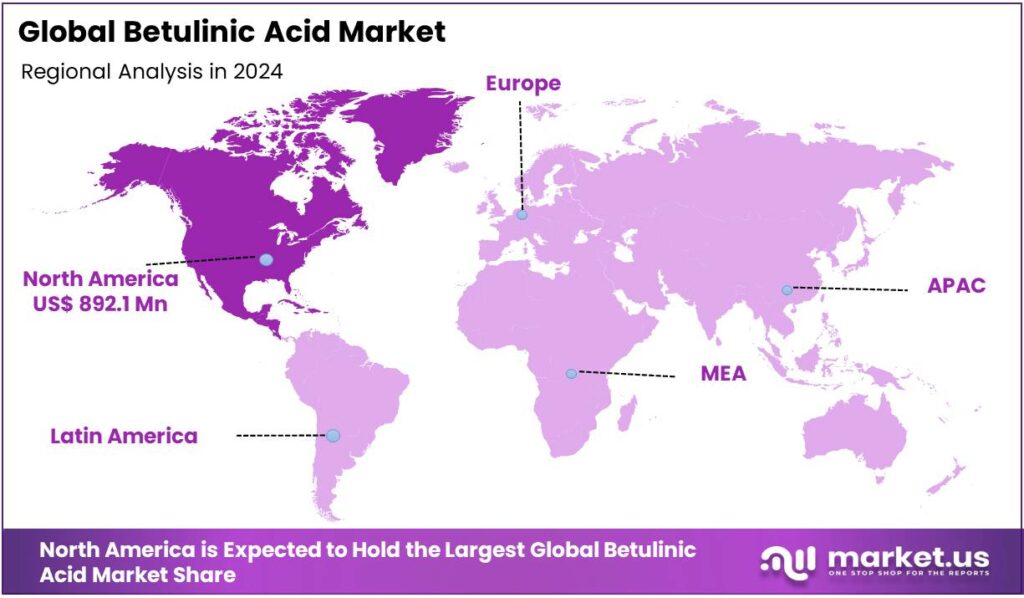

The Global Betulinic Acid Market size is expected to be worth around USD 4.5 Billion by 2034, from USD 2.4 Billion in 2024, growing at a CAGR of 6.7% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 37.8% share, holding USD 0.8 Billion in revenue.

Betulinic acid (BA) is a naturally occurring pentacyclic triterpenoid found in the bark of certain trees, most notably birch trees. The betulinic acid market is driven by its significant potential in pharmaceutical applications, where its anticancer, anti-inflammatory, and antiviral properties make it a highly sought-after compound for drug development.

Additionally, the betulinic acid is used in cosmetics, personal care, and nutraceuticals sectors; however, the pharmaceutical sector remains its dominant focus due to the compound’s therapeutic benefits in treating complex diseases such as cancer and neurological disorders. However, scalability challenges, including difficulties in chemical derivatization, high production costs, and environmental concerns, have hindered its widespread industrial use. Despite the obstacles, ongoing research into novel catalytic systems and biotechnological advancements creates opportunities by unlocking the full potential of betulinic acid for clinical use.

- According to the US Department of Agriculture, over 60 types of birch trees exist globally with varied sizes (12″ to 80′) and ecological roles.

- China and the United States are the largest exporters of betulinic acid, accounting for around 79% of the total imports of betulinic acid.

Key Takeaways

- The global betulinic acid market was valued at USD 2.4 billion in 2024.

- The global betulinic acid market is projected to grow at a CAGR of 6.7% and is estimated to reach USD 4.5 billion by 2034.

- Based on the purity of betulinic acid, above 95% pure acid dominated the market, with a substantial market share of around 68.5%.

- On the basis of source, the synthetic betulinic acid was at the forefront, comprising around 65.6% of the total market share.

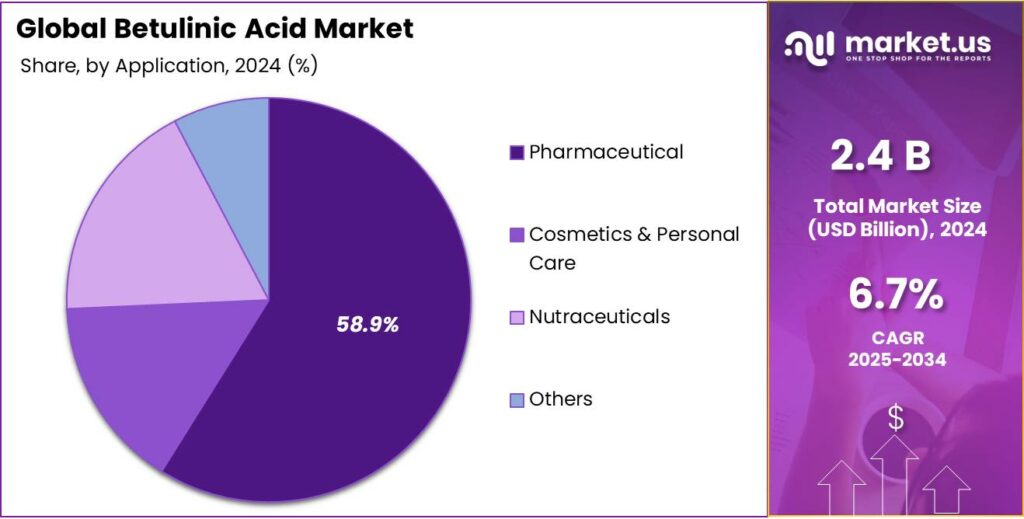

- Among the applications of betulinic acid, pharmaceutical applications held a major share in the market, 58.9% of the market share.

- In 2024, North America was the most dominant region in the betulinic acid market, accounting for around 37.8% of the total global consumption.

Purity Analysis

Betulinic Acid, which is More Than 95% Pure, held a Major Share in the Market.

The betulinic acid market is segmented based on purity into up to 95% and above 95%. The betulinic acid that is more than 95% pure dominated the market, comprising around 68.5% of the market share. The betulinic acid that is more than 95% pure is preferred over the lower-purity variants primarily due to its higher potency, consistency, and reliability in therapeutic and cosmetic applications. The more purity ensures that the compound delivers more predictable and effective biological activity, such as enhanced anticancer, anti-inflammatory, and antiviral effects, which are essential in drug development and consumer products.

Lower-purity betulinic acid, with up to 95% purity, may contain impurities or by-products that could reduce its efficacy, affect its safety profile, or interfere with formulation stability. In pharmaceutical applications, where precision is critical, high-purity betulinic acid is necessary to meet stringent regulatory standards and ensure the desired therapeutic outcomes. Similarly, in cosmetics, higher purity translates into better skin compatibility and reduced risk of irritation or adverse reactions, making it the preferred choice for premium formulations.

Source Analysis

Synthetic Betulinic Acid is a Prominent Segment in the Market.

The betulinic acid market is segmented based on the source into natural and synthetic. The synthetic betulinic acid dominated the market, comprising around 65.6% of the market share, due to its higher scalability, cost-effectiveness, and consistent quality. Natural betulinic acid faces limitations such as low yield, high extraction costs, and issues related to biomass availability. In contrast, synthetic production methods can generate relatively large quantities of high-purity betulinic acid in a controlled environment, ensuring uniformity across batches.

Additionally, synthetic processes allow for easier modification of the molecule to enhance its properties, such as improving its solubility or bioavailability, which is crucial for its use in pharmaceuticals and cosmetics. The ability to produce synthetic betulinic acid on a larger scale, compared to natural sources, makes it a more viable option for commercial applications, particularly when large batches are required.

Application Analysis

The Betulinic Acid Was Mostly Utilized for Pharmaceutical Applications.

Based on the applications of betulinic acid, the market is divided into pharmaceutical, cosmetics & personal care, nutraceuticals, and others. The pharmaceutical applications dominated the market, with a market share of 58.9%, due to its potent biological activities, particularly its anticancer, anti-inflammatory, and antiviral properties, which make it a valuable compound in drug development. The high therapeutic potential of betulinic acid in treating chronic and complex diseases such as cancer and neurodegenerative disorders has led to significant focus on its clinical applications.

The rigorous scientific research supporting its effectiveness in targeting tumor cells and modulating immune responses has driven its adoption in pharmaceutical formulations. While betulinic acid is used in cosmetics, personal care, and nutraceuticals, its primary value lies in its capacity to address serious health conditions, which aligns with the greater demand for novel treatments in the healthcare sector. The development of specialized formulations, alongside regulatory approval, has prioritized its use in the pharmaceutical industry over other sectors.

Key Market Segments

By Purity

- Up to 95%

- Above 95%

By Source

- Natural

- Synthetic

By Application

- Pharmaceutical

- Cosmetics & Personal Care

- Nutraceuticals

- Others

Drivers

Rising Prevalence of Certain Chronic Diseases Drives the Betulinic Acid Market.

The rising prevalence of chronic diseases, including cancer, neurological disorders, and inflammatory conditions, is significantly driving the demand for betulinic acid, a natural compound derived from the bark of birch trees. Cancer remains one of the leading causes of death globally.

- According to the International Agency for Research on Cancer, a branch of the World Health Organization, in 2022, there were almost 20 million new cases and 9.7 million cancer-related deaths worldwide.

Similarly, according to Alzheimer’s Disease International, neurological diseases such as Alzheimer’s and Parkinson’s affect millions worldwide, with over 55 million individuals living with dementia, mostly Alzheimer’s. The betulinic acid has shown potential in preclinical studies for its anticancer, neuroprotective, and anti-inflammatory properties, contributing to its growing interest in therapeutic applications.

Additionally, in inflammatory diseases, such as rheumatoid arthritis, where approximately 1% of the global population is affected, betulinic acid’s ability to modulate immune responses positions it as a viable treatment option. As these chronic diseases continue to rise, the interest in compounds such as betulinic acid is expected to expand accordingly.

Restraints

Scalability Challenges Might Hinder the Growth of the Betulinic Acid Market.

Scalability challenges are a significant barrier to the widespread adoption and commercial access of betulinic acid, particularly due to the difficulties in chemical derivatization and large-scale production. BA’s complex structure, which includes rigid lupane-type pentacyclic triterpenoids, limits its synthetic versatility, making it difficult to generate diverse analogues for industrial applications. Despite its potential as a therapeutic agent, the synthesis of betulinic acid requires harsh reaction conditions or protection/deprotection steps, which increases production costs in addition to reducing overall yield.

Moreover, the use of toxic solvents, expensive reagents, and non-sustainable catalysts in chemical processes further exacerbates environmental concerns. Furthermore, on the biotechnological front, enzymatic or microbial methods, which could offer more sustainable and regioselective alternatives, are still underdeveloped, with challenges related to low expression levels and enzyme stability hindering their industrial application. Moreover, sourcing BA from natural sources such as birch bark is constrained by biomass scarcity and low extraction efficiency. These scalability limitations hinder the market’s growth potential, despite BA’s promising therapeutic benefits.

Opportunity

Demand from Cosmetics and Personal Care Industries Creates Opportunities in the Betulinic Acid Market.

The growing demand for natural and effective ingredients in the cosmetics and personal care industries is creating substantial opportunities for betulinic acid. The global cosmetics market is increasingly shifting towards products with bioactive compounds that offer skin-rejuvenating, anti-aging, and anti-inflammatory benefits. Betulinic acid, with its potent antioxidant and anti-inflammatory properties, is becoming a sought-after ingredient in formulations targeting skin health. For instance, it has been observed to promote collagen synthesis and reduce the appearance of fine lines and wrinkles, making it valuable in anti-aging products.

Furthermore, its anti-inflammatory effects make it beneficial in soothing irritated or sensitive skin, often found in products designed for conditions such as acne and eczema. The global trend towards clean beauty is likely to further accelerate its use in formulations across the cosmetics and personal care sectors. According to a case study in the United States, 74% of consumers consider organic ingredients important in personal care products. Meanwhile, 65% of consumers want a clear ingredient list to identify potentially harmful ingredients. As consumer preference moves towards plant-based skincare solutions, the demand for betulinic acid continues to rise.

Trends

Increased Utilization of Betulinic Acid as a Food Supplement.

The increasing use of betulinic acid as a food supplement is an emerging trend, driven by growing consumer awareness of health and wellness. Betulinic acid, known for its antioxidant, anti-inflammatory, and immune-boosting properties, is being incorporated into dietary supplements aimed at improving general health and managing chronic conditions. With rising concerns over lifestyle-related diseases, such as obesity, heart disease, and diabetes, there is a notable shift towards natural and plant-based supplements.

Betulinic acid’s ability to support the immune system and combat oxidative stress has made it a popular choice for supplements targeting overall well-being. In particular, its potential role in metabolic health is gaining traction as it is observed to improve insulin sensitivity, help manage blood sugar, reduce fat accumulation, and support liver health in obesity-related disorders. As consumers seek more holistic and preventive healthcare solutions, the utilization of betulinic acid in food supplements is expected to expand.

Geopolitical Impact Analysis

Geopolitical Tensions Are Impacting the Betulinic Acid market by Disrupting the Essential Supply Chains in the Market.

The geopolitical tensions have the potential to significantly impact the betulinic acid market, particularly through disruptions in global supply chains, raw material sourcing, and manufacturing processes. As geopolitical instability affects trade relations, regions that supply key raw materials for BA production, such as birch bark, face logistical challenges. For instance, countries in Eastern Europe and Russia, which are primary sources of birch bark, have experienced supply chain disruptions due to ongoing conflicts, potentially limiting the availability of high-quality raw materials. This scarcity has increased production costs for both pharmaceutical and cosmetic applications.

Additionally, the imposition of trade tariffs, such as potential US tariffs on Chinese pharmaceutical ingredients, has increased the cost for manufacturers to make end-use products, which may then be passed on to consumers. Furthermore, political instability leads to a shift in investment priorities, as companies become more cautious about pursuing new ventures in volatile regions.

Regional Analysis

North America Held the Largest Share of the Global Betulinic Acid Market.

In 2024, North America dominated the global betulinic acid market, holding about 37.8% of the total global consumption. The region has maintained the largest share of the global betulinic acid market, driven by advanced research and development in biotechnology and pharmaceutical sectors, as well as a strong preference for natural and plant-based products. The well-established healthcare infrastructure in the region and substantial investments in pharmaceutical innovation play a key role in the demand for bioactive compounds such as betulinic acid.

Additionally, a robust regulatory framework in the region supports the development of novel natural formulations, while stringent quality standards ensure the safety and efficacy of products. The increasing consumer preference for clean beauty and plant-derived skincare products contributes to the demand for betulinic acid in the cosmetics and personal care industries in the region.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Companies in the betulinic acid market employ several strategic activities to strengthen their market position and expand their reach. The companies invest in research and development to enhance the bioavailability, stability, and effectiveness of betulinic acid in various applications, particularly pharmaceuticals. Additionally, companies focus on expanding their production capabilities, often adopting synthetic routes over natural extraction to ensure scalability and cost-effectiveness.

Some companies emphasize sustainability by exploring green chemistry and biotechnological methods for more eco-friendly production. Furthermore, major companies focus on strategic partnerships with pharmaceutical and cosmetics firms to boost market visibility, and collaborations with academic institutions and research organizations to drive innovation in creating novel derivatives and improving synthesis processes.

The Major Players in The Industry

- Symrise BioActives GmbH

- Manus Aktteva Biopharma LLP

- Aktin Chemicals

- Capot Chemicals

- Cayman Chemical

- Jigs Chemical Limited

- Xi’an Eco Biotech

- Norse Biotech A/S

- Other Key Players

Key Development

In March 2023, Norwegian startup Norse Biotech AS launched betulin as an active ingredient for cosmetic use. The company had developed a proprietary extraction process that ensures the purity, sustainability, and effectiveness of betulin in cosmetic products.

Report Scope

Report Features Description Market Value (2024) USD 2.4 Bn Forecast Revenue (2034) USD 4.5 Bn CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (Up to 95% and Above 95%), By Source (Natural and Synthetic), By Application (Pharmaceutical, Cosmetics & Personal Care, Nutraceuticals, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Symrise BioActives GmbH, Manus Aktteva Biopharma LLP, Aktin Chemicals, Capot Chemicals, Cayman Chemical, Jigs Chemical Limited, Xi’an Eco Biotech, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Symrise BioActives GmbH

- Manus Aktteva Biopharma LLP

- Aktin Chemicals

- Capot Chemicals

- Cayman Chemical

- Jigs Chemical Limited

- Xi’an Eco Biotech

- Norse Biotech A/S

- Other Key Players