Global Batteries for Smart Wearables Market Size, Share Analysis Report By Product (Li-ion Battery, Li-Po Battery, Others), By Application (Smartwatches, Wireless Headphones, Head Mounted Display (HMDs), Others), By End-user (Consumer Electronics, Healthcare, Industrial, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165243

- Number of Pages: 311

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

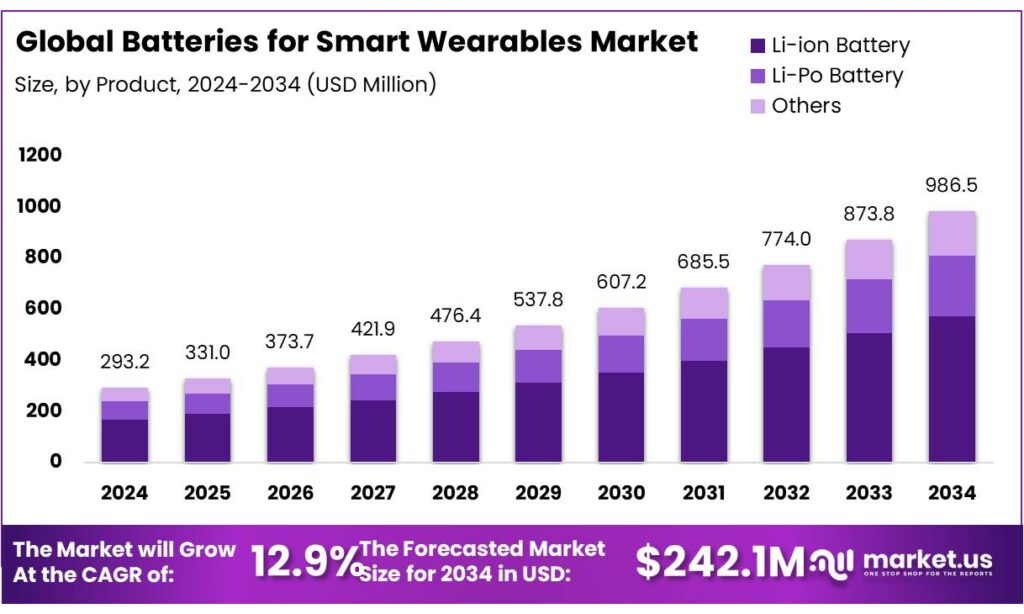

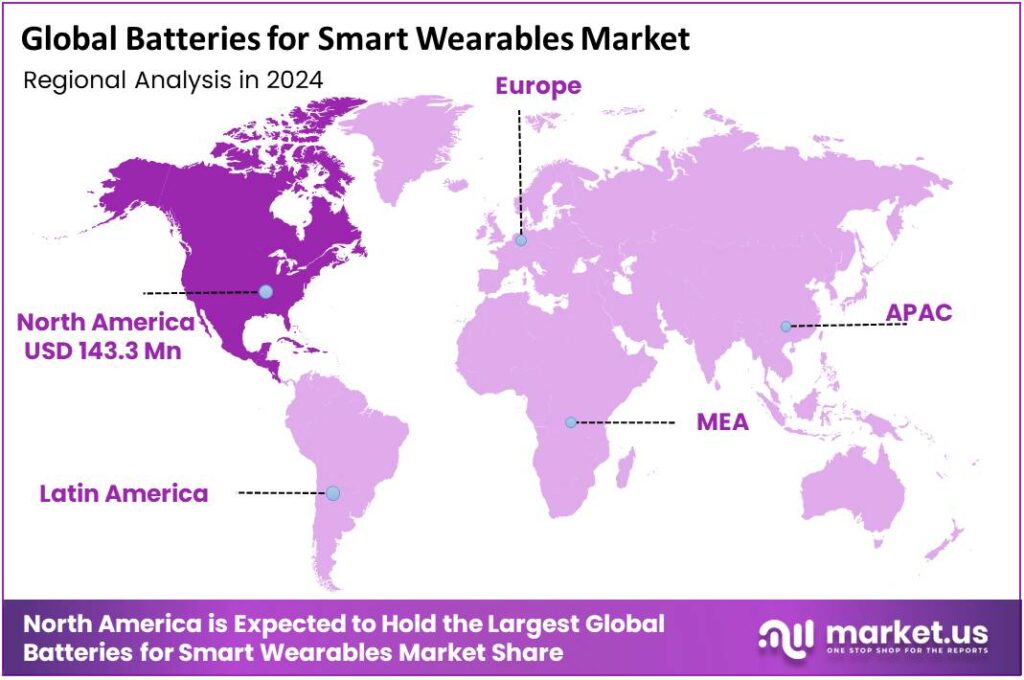

The Global Batteries for Smart Wearables Market size is expected to be worth around USD 986.5 Million by 2034, from USD 293.2 Million in 2024, growing at a CAGR of 12.9% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 48.9% share, holding USD 143.3 Million in revenue.

Batteries for smart wearables sit at the intersection of miniaturized electronics, health monitoring, and low-power connectivity. The segment is dominated by small-format lithium-ion and lithium-polymer cells, with growing interest in solid-state variants for higher energy density and safety. Broader battery-market dynamics matter: in 2024, global battery demand surpassed 1 TWh as EVs scaled, accelerating cost and energy-density learning curves that also benefit small cells for wearables. Average battery pack prices fell below ~USD 100/kWh in 2024, after a >90% drop since 2010—trends that cascade into lower bill-of-materials for consumer devices.

The industrial landscape is shaped by cross-sector supply chains. Lithium-ion’s rise has reallocated critical minerals: by 2022, clean-energy uses accounted for 56% of lithium, 40% of cobalt, and 16% of nickel demand, underscoring supply-security considerations that wearable OEMs must monitor when qualifying chemistries and suppliers. Meanwhile, battery storage in the power sector added over 40 GW in 2023 (2× 2022), strengthening renewable grids that ultimately charge personal electronics—an indirect but material systems link.

Demand drivers for wearable batteries stem from health and productivity use cases and sustained improvements in power electronics. WHO reports that 31% of adults—about 1.8 billion people—are physically inactive; policy pushes to reduce inactivity and the growth of digital health programs support adoption of trackers and smartwatches that require safe, rechargeable cells designed for frequent micro-cycles and long calendar life. On the technology side, lithium-ion cost declines to <USD 140/kWh in 2023 and rising energy densities enable thinner form factors without sacrificing runtime.

Policy and standards are tightening product requirements. The EU Battery Regulation (2023/1542) mandates that portable batteries be “readily removable and replaceable” by end-users and sets labelling milestones, including capacity labels from 18 Aug 2026 and a mandatory QR code from 18 Feb 2027—changes that will influence enclosure design, sealing, and service strategies for wearables.

Safety certification remains central: IEC 62133-2 specifies tests for portable secondary lithium cells and batteries to mitigate thermal and abuse risks common to body-worn devices. In the United States, the Department of Energy has announced multibillion-dollar grant and loan programs to onshore battery materials and manufacturing—e.g., up to USD 3 billion in 2024 funding rounds and an additional USD 725 million announced in January 2025—supporting domestic availability of small cells and components

Key Takeaways

- Batteries for Smart Wearables Market size is expected to be worth around USD 986.5 Million by 2034, from USD 293.2 Million in 2024, growing at a CAGR of 12.9%.

- Li-ion Battery held a dominant market position, capturing more than a 58.3% share of the global batteries for smart wearables market.

- Smartwatches held a dominant market position, capturing more than a 49.6% share of the global batteries for smart wearables market.

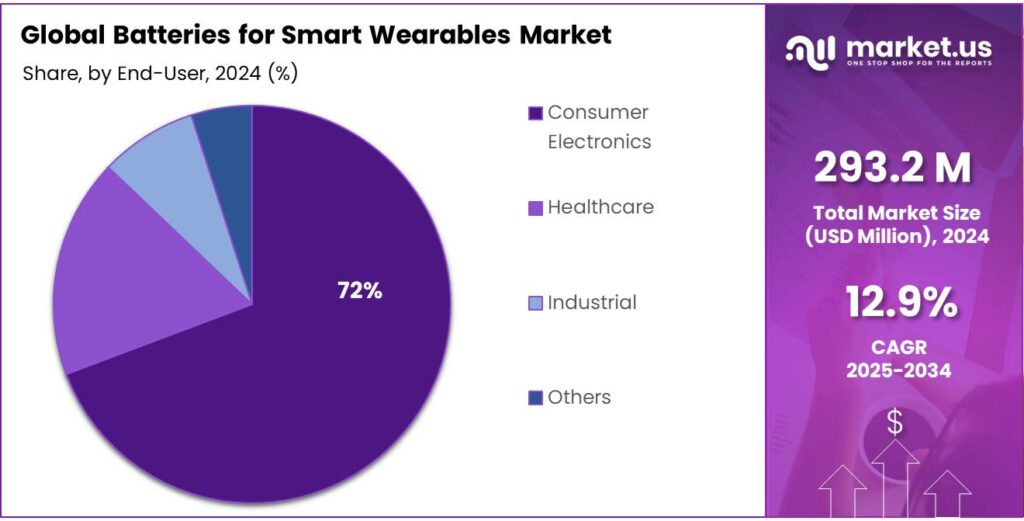

- Consumer Electronics held a dominant market position, capturing more than a 69.9% share of the global batteries for smart wearables market.

- North America dominated the global batteries for smart wearables market, capturing a 48.9% share and reaching a valuation of approximately USD 143.3 million.

By Product Analysis

Li-ion Battery dominates the Batteries for Smart Wearables Market with 58.3% share in 2024 owing to its high energy density and long cycle life

In 2024, Li-ion Battery held a dominant market position, capturing more than a 58.3% share of the global batteries for smart wearables market. The segment’s leadership is mainly driven by the widespread adoption of lithium-ion technology across smartwatches, fitness trackers, medical wearables, and wireless earbuds. Li-ion batteries offer superior energy density, compact size, and longer operational life, which are crucial features for lightweight and continuously operating wearable devices. Their ability to support fast charging, stable power output, and enhanced safety performance has made them the preferred choice among manufacturers.

In 2025, the demand for Li-ion batteries continues to rise, supported by ongoing innovations in solid-state and flexible lithium-ion cells, which enable thinner and safer wearable designs. The growing trend toward health monitoring and connected fitness devices is further boosting battery consumption across North America, Europe, and Asia-Pacific markets. Moreover, improvements in recyclability and energy efficiency are aligning with sustainability goals, increasing adoption among major consumer electronics brands.

By Application Analysis

Smartwatches dominate the Batteries for Smart Wearables Market with 49.6% share in 2024 driven by rising consumer adoption and continuous product innovation

In 2024, Smartwatches held a dominant market position, capturing more than a 49.6% share of the global batteries for smart wearables market. The strong demand is primarily driven by the rapid expansion of the smartwatch industry, supported by increasing health awareness, fitness tracking trends, and growing integration of advanced features such as ECG monitoring, GPS, and AI-based health analytics. These functionalities require reliable, high-capacity batteries capable of supporting extended operation and faster charging cycles, which has significantly boosted the adoption of advanced battery technologies in this segment.

In 2025, the dominance of smartwatches is expected to strengthen further as manufacturers focus on thinner designs, longer battery life, and sustainability. The rising use of smartwatches among professionals, athletes, and healthcare users continues to expand the application base. Additionally, technological advancements in lithium-ion and solid-state batteries are enabling higher energy efficiency and reduced charging times, directly enhancing user experience.

By End-user Analysis

Consumer Electronics dominate the Batteries for Smart Wearables Market with 69.9% share in 2024 driven by mass adoption of connected devices and lifestyle wearables

In 2024, Consumer Electronics held a dominant market position, capturing more than a 69.9% share of the global batteries for smart wearables market. This dominance is largely due to the rapid expansion of wearable technologies such as smartwatches, fitness trackers, wireless earbuds, and augmented reality (AR) devices. The growing consumer preference for portable, connected, and health-oriented gadgets has significantly increased the demand for compact, high-performance batteries capable of supporting longer usage and quick charging.

In 2025, the consumer electronics segment is expected to maintain its strong position as wearable adoption grows across global markets, supported by urban lifestyles and rising disposable incomes. The growing popularity of multipurpose devices that combine health monitoring, communication, and entertainment functions is expanding the scope for battery innovation. Continuous advancements in flexible and ultra-thin batteries are also enabling sleeker and more durable wearable designs. As sustainability and energy efficiency gain prominence, manufacturers are focusing on recyclable materials and eco-friendly battery chemistries.

Key Market Segments

By Product

- Li-ion Battery

- Li-Po Battery

- Others

By Application

- Smartwatches

- Wireless Headphones

- Head Mounted Display (HMDs)

- Others

By End-user

- Consumer Electronics

- Healthcare

- Industrial

- Others

Emerging Trends

Designing “week-long” wearables—ultra-low-power plus repairable, regulation-ready batteries

A defining trend in smart-wearable batteries is the push to “week-long” devices: shrinking power draw across radios and sensors while redesigning packs so they can be replaced or recovered at end-of-life. Two forces make this real. First, public-health needs keep people wearing devices all day. The World Health Organization (WHO) reports 31% of adults—about 1.8 billion people—were physically inactive in 2022, increasing cardiometabolic risk and strengthening demand for continuous tracking. Longer battery life is what keeps those devices on-body.

Safety standards remain the guardrails: IEC 62133 testing governs rechargeable cells in portable electronics, so miniature prismatic and coin cells must meet rigorous abuse, thermal, and electrical criteria before they go inside consumer or medical wearables. That pushes suppliers toward stable chemistries, robust protection circuits, and predictable aging—keys to longer life between charges and after hundreds of cycles.

Policy is accelerating a second leg of the trend: serviceability and circularity. The EU’s new battery law—Regulation (EU) 2023/1542—sets sustainability, performance, and end-of-life rules across all battery categories. Guidance around removability and replaceability of portable batteries means wearables must be designed so users can safely swap packs rather than discard whole devices. For battery makers, this opens a design lane: slim, connectorized modules that are easy to remove, log their state of health, and re-enter material recovery streams. It also rewards cells that keep impedance stable and swelling low across life, because replaceable does not mean frequently replaced.

Drivers

Preventive Health And Always-On Monitoring

A powerful demand driver for batteries in smart wearables is preventive health. Governments and public-health agencies are pushing people to move more and manage chronic disease earlier. Yet inactivity and metabolic risk remain high, which keeps consumers wearing sensors all day—and those sensors need safe, energy-dense batteries. The World Health Organization now estimates 31% of adults (1.8 billion people) were physically inactive in 2022, up five percentage points since 2010; WHO’s goal is a 15% relative reduction by 2030. Continuous step, heart-rate, and VO₂ tracking on the wrist is a practical nudge toward that target, so battery performance that supports multi-day wear directly serves a global policy mandate.

Lifestyle disease data reinforce this pull. WHO reports about 16% of the world’s adults were obese in 2022, and a Lancet-linked update notes more than 1 billion people are now living with obesity—conditions where wearables help with weight-management programs and remote coaching, again raising expectations for long runtime between charges. In the U.S., 47.7% of adults had hypertension during Aug 2021–Aug 2023, underscoring why cuff-less blood-pressure trends, arrhythmia alerts, and sleep-apnea screening are crossing into mainstream use; each feature adds power draw, so cell chemistry and pack design become strategic.

Public digital-health rails are expanding, which strengthens the case for medical-grade wearables—and robust batteries that pass safety standards. India’s Ayushman Bharat Digital Mission reports 73.98 crore (739.8 million) ABHA health IDs and 4.90 crore (490.6 million) linked health records as of 6 Feb 2025; integrating wearable vitals into such records is a logical next step and will depend on reliable, certified power sources to support 24/7 logging.

This health momentum is mirrored by consumer behavior. Even before the current wave, about 21% of U.S. adults reported using a smartwatch or fitness tracker, and country regulators now treat wearables as part of the health ecosystem, not just gadgets. As features like continuous SpO₂, skin temperature, and ECG become standard, energy budgets tighten; manufacturers must pursue higher-capacity lithium-ion coin/prismatic cells, silicon-graphite anodes, and better power-management ICs to sustain multi-day battery life without bulk.

Restraints

Escalating E-Waste and Lifecycle Challenges for Wearable Batteries

One major restraining factor for batteries in smart wearables is the mounting challenge of electronic waste (e-waste) tied closely to short device lifecycles, frequent replacement, and embedded batteries that are difficult to recycle or service. According to United Nations Institute for Training and Research (UNITAR) and the International Telecommunication Union (ITU), global e-waste generation reached an estimated 62 million tonnes in 2022.

Governments and international institutions have also noted the regulatory and lifecycle burden. The Global E-Waste Monitor 2024 highlights that if countries were to raise formal recycling to 60% by 2030, the benefits—both in health and materials recovery—would exceed costs by more than US $38 billion. For wearable battery suppliers, this creates additional compliance risk: standards may tighten, reporting burdens may expand, and product designs may need to include greater ease of end–of–life disassembly or circular design. For companies that prioritise only upfront cost and form-factor, this presents a strategic pitfall.

On the cost front, miniaturised rechargeable batteries with safe chemistry (e.g., poly-mer lithium-ion, lithium-sulphur) at high energy density are costlier to design, manufacture and certify. These costs get passed, at least in part, to accessory makers and ultimately consumers, which may slow adoption of high-quality wearable devices. The greater the cost and the shorter the effective lifespan (including the battery), the less the return on investment for both OEMs and consumers. This paradox—smaller size, higher performance, shorter refresh cycles—amplifies the e-waste burden and weakens the sustainability case for battery-rich wearables.

Opportunity

Clinical-grade remote monitoring built on national digital-health rails

A big growth opening for batteries in smart wearables sits where consumer fitness meets formal healthcare—continuous, clinical-grade remote monitoring plugged into national digital-health systems. Health agencies want earlier detection of risk, and hospitals need lower-cost, at-home care. When watches, patches, and rings become part of care pathways, runtime, safety, and cycle life shift from “nice to have” to mandatory—creating room for advanced wearable cells. The public-health numbers are blunt: 31% of adults—about 1.8 billion people—were physically inactive in 2022, directly raising cardiovascular and metabolic risk and making continuous tracking more valuable.

- Governments are now laying digital pipes that make wearable data usable in care. India’s Ayushman Bharat Digital Mission reports 73.98 crore (739.8 million) ABHA health IDs and ~49.06 crore (490.6 million) linked health records as of 6 Feb 2025—exactly the type of infrastructure where continuous vitals could flow with consent into longitudinal records. In Europe, the European Health Data Space (EHDS) entered into force in March 2025, creating common rules for electronic health data access and secondary use across the EU—another nudge for clinically reliable wearables, and by extension, higher-grade batteries that pass strict safety and reliability thresholds.

Public-health weight trends also keep remote monitoring in focus. In 2022, 2.5 billion adults were overweight, including 890 million with obesity, and one in eight people worldwide lived with obesity; sustained lifestyle support works best when the device stays on-body because its battery is dependable, comfortable, and safe. For battery makers, this means designing small prismatic or coin cells—and emerging flexible micro-batteries—that deliver higher energy per cubic millimetre, fast but gentle charging, and long cycle life without swelling. That performance is what unlocks medical-grade features like continuous ECG, SpO₂, nocturnal respiration, and temperature trends, all of which draw more power than step counting.

Regional Insights

North America leads the Batteries for Smart Wearables Market with 48.9% share valued at USD 143.3 million in 2024, driven by high wearable adoption and technological advancement

In 2024, North America dominated the global batteries for smart wearables market, capturing a 48.9% share and reaching a valuation of approximately USD 143.3 million. The region’s leadership is primarily supported by strong consumer demand for advanced wearable devices such as smartwatches, fitness trackers, and wireless earbuds.

The United States, in particular, remains a global hub for wearable innovation, driven by leading consumer electronics brands, robust R&D investments, and early adoption of cutting-edge technologies. The rapid integration of health-monitoring features and AI-enabled analytics in wearable devices has further increased the need for high-density, fast-charging, and long-lasting batteries, strengthening the regional market position.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Apple Inc.: Apple is a global technology leader whose devices—from iPhone and Apple Watch to AirPods and MacBook—incorporate advanced lithium-ion batteries designed for high energy density and fast charging. The company has committed to using 100% recycled cobalt in all Apple-designed batteries by 2025, underscoring its focus on sustainability and supply-chain innovation.

Artek Energy Pvt. Ltd.: Artek Energy, headquartered in India, specialises in lithium-ion, LiFePO₄ and polymer battery technologies and offers customised battery packs for applications including wearables, IoT and consumer electronics. Their facilities span more than 14,000 m² and include an in-house engineering team focused on high-density cells suitable for compact device applications.

Enfucell Flexible Electronics Ltd.: Enfucell specialises in ultra-thin, printable “paper battery” technologies (SoftBattery®) designed for wearables, smart packaging and IoT. The firm’s technology supports roll-to-roll production of flexible power sources and has been licensed globally to support wearable and medical-patch applications.

Top Key Players Outlook

- Apple Inc.

- Artek Energy Pvt. Ltd.

- Energizer Holdings Inc.

- Enfucell

- GMB CORP.

- Ilika

- ITEN

- Jenax Inc.

- LiPol Battery Co. Ltd.

- Molex LLC

- Panasonic Holdings Corp.

Recent Industry Developments

In 2024, Apple Inc. generated USD 37,005 million in net sales from its Wearables, Home and Accessories segment, which includes key smart-wearable devices.

In 2024, Artek Energy Pvt. Ltd. operates a facility covering over 14,000 m² and employs over 150 staff, including around 40 engineers and technicians dedicated to custom battery solutions.

Report Scope

Report Features Description Market Value (2024) USD 293.2 Mn Forecast Revenue (2034) USD 986.5 Mn CAGR (2025-2034) 12.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Li-ion Battery, Li-Po Battery, Others), By Application (Smartwatches, Wireless Headphones, Head Mounted Display (HMDs), Others), By End-user (Consumer Electronics, Healthcare, Industrial, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Apple Inc., Artek Energy Pvt. Ltd., Energizer Holdings Inc., Enfucell, GMB CORP., Ilika, ITEN, Jenax Inc., LiPol Battery Co. Ltd., Molex LLC, Panasonic Holdings Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Batteries for Smart Wearables MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Batteries for Smart Wearables MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Apple Inc.

- Artek Energy Pvt. Ltd.

- Energizer Holdings Inc.

- Enfucell

- GMB CORP.

- Ilika

- ITEN

- Jenax Inc.

- LiPol Battery Co. Ltd.

- Molex LLC

- Panasonic Holdings Corp.