Global Barium Carbonate Market Size, Share, And Business Benefit By Product Form (Granular, Powder, Ultra-Fine), By Application (Bricks and Tiles, Specialty Glass, Glazes, Enamel, Electro Ceramic, Others), By End-Use (Construction, Ceramics, Oil and Gas, Electronics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 166419

- Number of Pages: 364

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

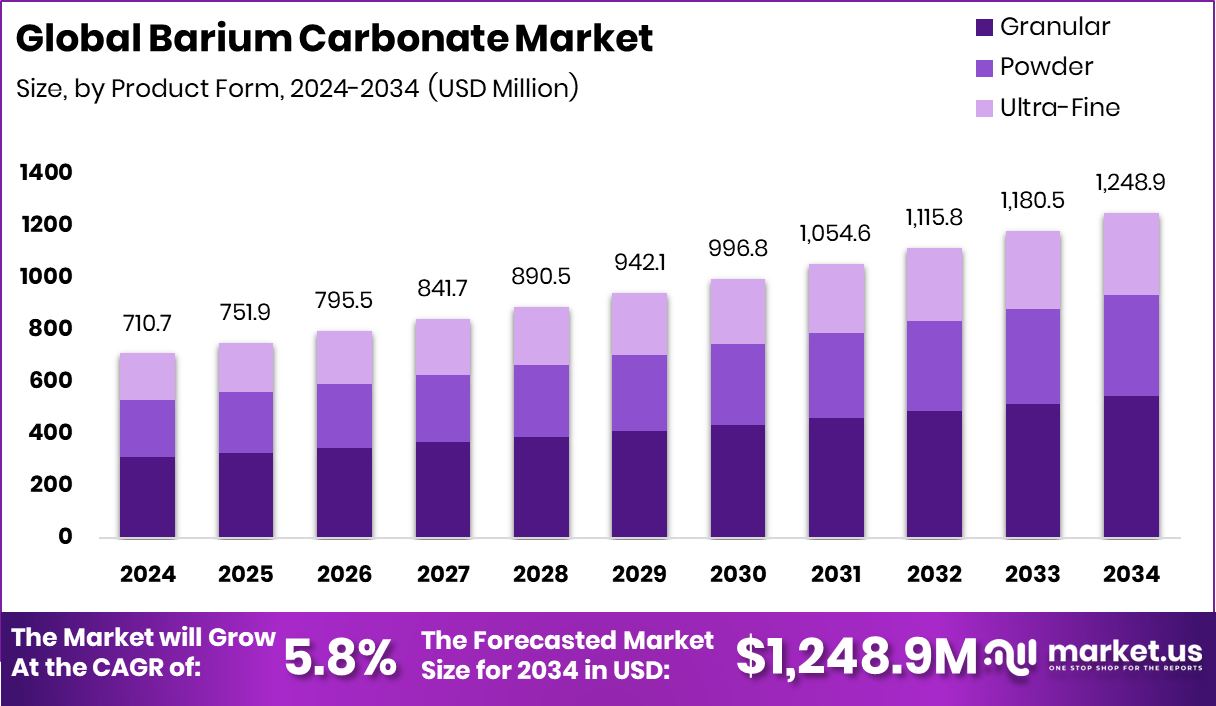

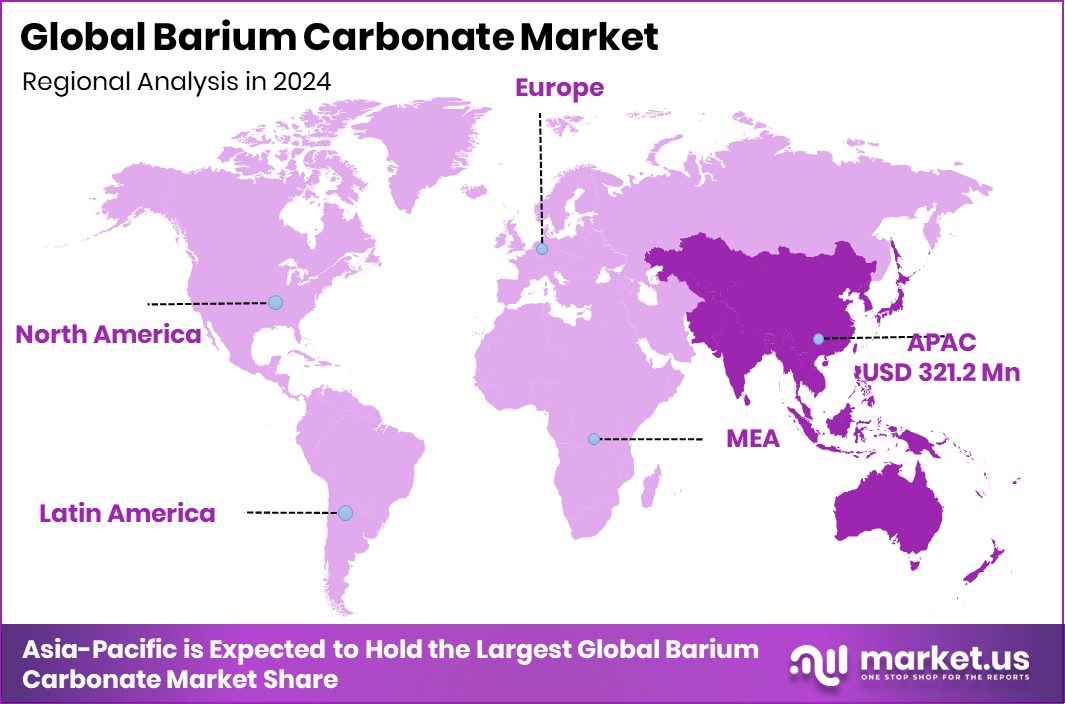

The Global Barium Carbonate Market is expected to be worth around USD 1,248.9 million by 2034, up from USD 710.7 million in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034. Expanding ceramic applications supported Asia Pacific’s 45.20% share, totaling USD 321.2 Mn.

Barium Carbonate is an inorganic compound commonly produced from barium sulfide and naturally occurring witherite. It appears as a white, odorless powder and is valued for its ability to react with impurities like sulfates. Because of its stability and high density, it is widely used in ceramics, glass, bricks, ferrites, and several industrial chemical processes. Its role in removing unwanted ions and improving the strength, color, and durability of finished materials makes it an essential chemical across multiple manufacturing sectors.

The Barium Carbonate Market revolves around its use in ceramics, specialty glass, brick glazing, and electronic components. Demand is shaped by construction growth, electronics manufacturing, and the steady expansion of ceramic technologies. Industries that require consistent material performance rely on barium carbonate to maintain product quality, especially in tiles, ferrites, and specialty coatings. The market continues to evolve as advanced ceramics and high-purity applications gain more importance globally.

Growth is driven by stronger adoption of advanced ceramics in sectors such as electronics, energy components, and specialty coatings. Recent funding activity reflects how ceramic innovation is accelerating. Ceramic storage player Cerabyte received part of a €411M European funding package, signifying high interest in next-generation ceramic technologies. Such momentum indirectly boosts demand for materials like barium carbonate, which support improved thermal stability and purity.

Demand continues to rise as industries seek better-performing ceramic and glass products. Apple’s awarding $45 million to Corning through its Advanced Manufacturing Fund highlights how premium glass technologies are moving forward. As manufacturers push for tougher, more efficient, and more refined surfaces, the supporting chemical inputs benefit, especially those used in refining and enhancing glass and ceramic formulations.

The shift toward high-performance, 3D-printed ceramics opens new opportunities for barium carbonate producers. A €5M and an additional €4.5M grant supporting 3D-printed ceramic projects showcase strong European backing for advanced materials. Alongside this, Cerafiltec securing €30 million for international expansion signals rapid scaling in ceramic filtration and specialty applications. These developments create room for barium carbonate to find new roles in high-purity, high-strength, and engineered ceramic solutions.

Key Takeaways

- The Global Barium Carbonate Market is expected to be worth around USD 1,248.9 million by 2034, up from USD 710.7 million in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034.

- In the barium carbonate market, the granular form dominated with a strong 43.8% share in 2024.

- In the barium carbonate market, the bricks and tiles application dominated with a 37.2% share.

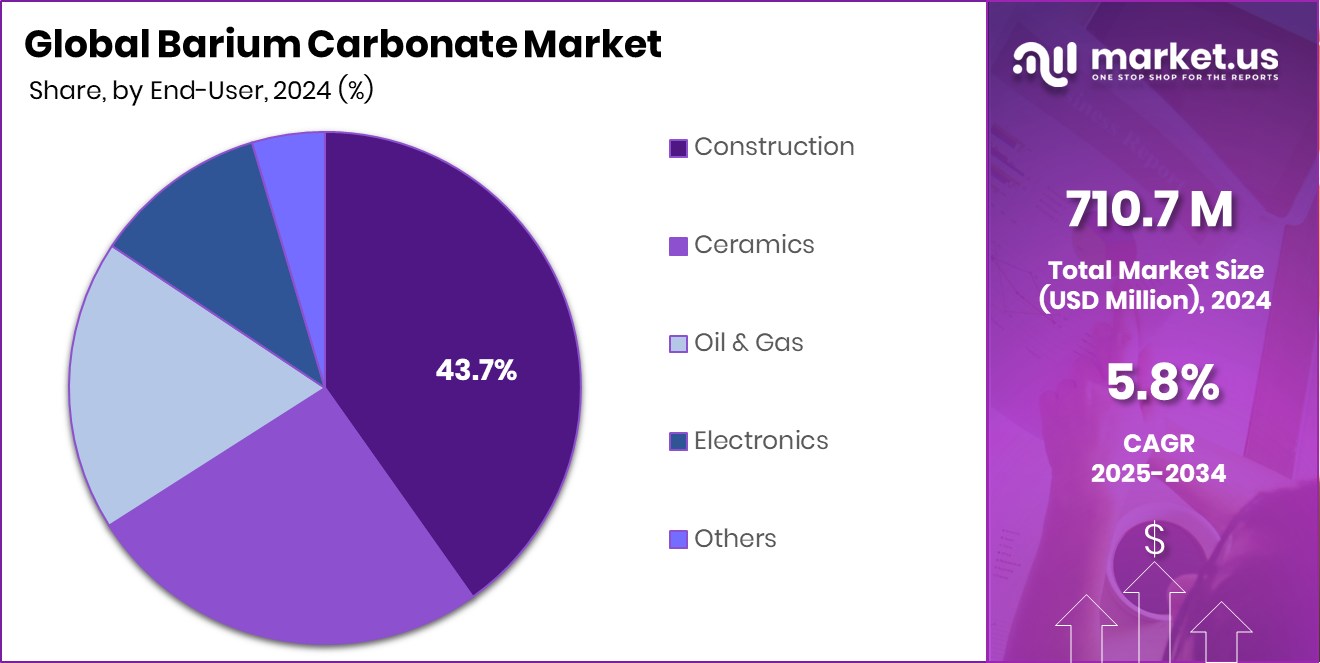

- In the barium carbonate market, construction end-use dominated significantly with a leading 43.7% share overall.

- Strong construction demand helped the Asia Pacific maintain 45.20% and achieve USD 321.2 Mn.

By Product Form Analysis

The barium carbonate market is dominated by the granular form, with 43.8% due to wider usability.

In 2024, Granular held a dominant market position in the By-Product Form segment of the Barium Carbonate Market, with a 43.8% share. This form remained the preferred choice because industries that rely on consistent flowability and uniform mixing, such as ceramics, tiles, and specialty glass makers, benefit from its stable handling properties. Granular material also supports cleaner dosing during large-scale production, helping manufacturers reduce impurities and improve final product strength.

Its performance in maintaining batch uniformity made it especially valuable for high-temperature ceramic applications. With steady use across structural ceramics, glazing, and refining processes, granular barium carbonate continued to set the benchmark for reliability in production lines where consistency and purity are critical.

By Application Analysis

The barium carbonate market’s bricks & tiles segment dominated with a 37.2% share globally.

In 2024, Bricks & Tiles held a dominant market position in the By Application segment of the Barium Carbonate Market, with a 37.2% share. This segment maintained its lead because barium carbonate plays a key role in improving the quality and durability of ceramic bricks and tiles by preventing efflorescence and enhancing color consistency. Manufacturers prefer it for its ability to remove sulfate impurities, which helps avoid surface defects during firing.

Its steady use aligns with ongoing construction needs, where reliable building materials remain essential. The strong share reflects how brick and tile producers continue to depend on barium carbonate to achieve stable production output, a better visual finish, and improved long-term structural performance.

By End-Use Analysis

The barium carbonate market construction end-use dominated with 43.7% overall market share.

In 2024, Construction held a dominant market position in the By End-Use segment of the Barium Carbonate Market, with a 43.7% share. Its strong presence comes from the steady demand for durable bricks, tiles, and ceramic components used across residential and commercial projects. Barium carbonate supports construction materials by improving firing stability, reducing defects, and enhancing long-term strength, making it a reliable additive for large-scale building applications.

Its role in maintaining color consistency and preventing surface issues further strengthens its adoption. With continuous infrastructure activity and the need for high-quality ceramic products, the construction sector remained the key consumer, reinforcing its leadership within the overall end-use landscape.

Key Market Segments

By Product Form

- Granular

- Powder

- Ultra-Fine

By Application

- Bricks and Tiles

- Specialty Glass

- Glazes

- Enamel

- Electro Ceramic

- Others

By End-Use

- Construction

- Ceramics

- Oil and Gas

- Electronics

- Others

Driving Factors

Stronger Construction Demand Boosts Market Growth

One major driving factor for the Barium Carbonate Market is the rising need for better-quality construction materials. Barium carbonate is widely used in bricks and tiles to prevent white salt marks and improve overall strength, making it important for builders who want clean and durable finishes.

The push from the red brick industry adds more momentum, especially as the sector seeks a 5% GST reduction, which shows how builders are trying to lower costs while improving product quality.

When brick makers look to upgrade their processes, they rely more on materials that enhance firing performance and reduce defects. This steady construction activity keeps the demand for barium carbonate moving upward across both small and large projects.

Restraining Factors

High Environmental Concerns Slow Market Expansion

One major restraining factor for the Barium Carbonate Market is the growing pressure on industries to reduce environmental impact. Many manufacturers, especially in ceramics and brick production, are being pushed to cut emissions and adopt cleaner processes. These rules can make production costlier and slow down the use of chemicals like barium carbonate.

Even though the sector receives support in certain areas, such as the £93,000 grant secured by Bulmer Brick and Tile Company for its preservation project, the focus of such funding is often on heritage, sustainability, and low-impact production rather than chemical-intensive methods.

Growth Opportunity

Advanced Ceramic Innovation Creates New Opportunities

A major growth opportunity for the Barium Carbonate Market comes from the fast-growing interest in advanced ceramic materials. As industries look for stronger, cleaner, and more precise ceramic products, the need for high-quality additives increases. Barium carbonate plays an important role in improving stability, removing impurities, and helping manufacturers achieve better finishing results.

The momentum in the ceramics space is getting stronger, especially with new investments such as Ceramic raising $12 million in seed funding, which reflects rising confidence in next-generation ceramic technologies. As more companies explore innovative ceramic designs for electronics, construction, and specialty materials, demand for reliable raw materials like barium carbonate is expected to grow steadily, opening fresh opportunities for producers.

Latest Trends

Growing Shift Toward High-Performance Ceramic Materials

One of the latest trends in the Barium Carbonate Market is the rapid shift toward high-performance ceramic materials used in advanced engineering and industrial applications. As industries look for lighter, stronger, and more heat-resistant components, ceramic matrix composites are gaining serious attention. This trend is supported by new investments, such as a firm raising £1.3 million to bring ceramic matrix composites into mass-market production.

Such developments show how the ceramics industry is moving toward more technical and specialized products. In these advanced materials, purity and consistency are crucial, which increases the use of barium carbonate as a refining and stabilizing ingredient. As high-performance ceramics expand into aerospace, electronics, and energy sectors, demand for barium carbonate grows alongside.

Regional Analysis

Asia Pacific led the Barium Carbonate Market with 45.20%, reaching USD 321.2 Mn.

Asia Pacific remained the dominant region in the Barium Carbonate Market, holding a strong 45.20% share valued at USD 321.2 Mn in 2024. This leadership reflects the region’s large-scale use of barium carbonate in bricks, tiles, and ceramic-related industries, which continue to expand with ongoing construction and infrastructure activity.

Manufacturers in the Asia Pacific rely heavily on consistent material quality, supporting steady consumption across major producing countries in the region. The combination of strong industrial output and growing ceramic applications keeps the Asia Pacific firmly ahead of other markets.

North America follows with stable demand supported by its use of barium carbonate in specialty ceramics and refined glass applications. Growth here is guided by steady production requirements across construction and industrial processing. Europe maintains balanced usage, driven by established ceramic traditions and ongoing investment in material improvement practices.

In the Middle East & Africa, demand stays linked to construction development and the need for durable building materials, creating a gradual but steady market presence. Latin America shows consistent consumption from its expanding ceramic and construction industries, which continue to adopt additives that improve product stability and performance. Across all regions, usage patterns vary, but Asia Pacific remains the clear leader due to its strong ceramic manufacturing base and higher production volumes.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Sakai Chemical Industry Co., Ltd. maintains its position by focusing on stable production quality and supplying materials that meet the needs of ceramic, glass, and brick manufacturers. Its approach toward controlled processing and reliable purity levels supports client industries that require uniform performance in high-temperature applications.

Shaanxi Ankang Jianghua Group Co., Ltd plays a key role through its strong regional manufacturing base and ability to deliver bulk volumes to construction-dependent sectors. Its operations continue to align with rising brick and tile demand, especially in areas prioritizing structural development and consistent ceramic output.

Chemical Products Corporation adds to market stability through its experience in handling specialized chemical formulations. The company’s emphasis on dependable supply and controlled production helps industries that rely on barium carbonate for refining and impurity removal.

Top Key Players in the Market

- Sakai Chemical Industry Co., Ltd.

- Shaanxi Ankang Jianghua Group Co., Ltd

- Chemical Products Corporation

- Honeywell International Inc.

- Nippon Chemical Industrial Co., Ltd

- Ag Chemi Group

- Kandelium

- Hubei Jingshan Chutian Barium Salt Corporation Ltd.

- Hebei Xinji Chemical Group Co. Ltd.

- Zaozhuang Yongli Chemicals Co., Ltd

Recent Developments

- In December 2024, the European Commission opened an anti-dumping investigation into imports of barium carbonate from China and India, following a complaint lodged by Kandelium Group GmbH on 5 November 2024. This step shows Kandelium working to protect the EU barium carbonate industry from unfairly low-priced imports and to keep a level playing field for its products.

- In March 2024, trade records show multiple export shipments of barium carbonate (HS 283660) from Hubei Jingshan Chutian Barium Salt Corporation Ltd. to Russian customers. The product is described as chemically produced barium carbonate used as an additive in brick production to prevent surface salt marks and improve performance and appearance, underlining the company’s role as an important supplier to construction-linked ceramics.

Report Scope

Report Features Description Market Value (2024) USD 710.7 Million Forecast Revenue (2034) USD 1,248.9 Million CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Form (Granular, Powder, Ultra-Fine), By Application (Bricks and Tiles, Specialty Glass, Glazes, Enamel, Electro Ceramic, Others), By End-Use (Construction, Ceramics, Oil and Gas, Electronics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Sakai Chemical Industry Co., Ltd., Shaanxi Ankang Jianghua Group Co., Ltd, Chemical Products Corporation, Honeywell International Inc., Nippon Chemical Industrial Co., Ltd, Ag Chemi Group, Kandelium, Hubei Jingshan Chutian Barium Salt Corporation Ltd., Hebei Xinji Chemical Group Co. Ltd., Zaozhuang Yongli Chemicals Co., Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Barium Carbonate MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Barium Carbonate MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sakai Chemical Industry Co., Ltd.

- Shaanxi Ankang Jianghua Group Co., Ltd

- Chemical Products Corporation

- Honeywell International Inc.

- Nippon Chemical Industrial Co., Ltd

- Ag Chemi Group

- Kandelium

- Hubei Jingshan Chutian Barium Salt Corporation Ltd.

- Hebei Xinji Chemical Group Co. Ltd.

- Zaozhuang Yongli Chemicals Co., Ltd