Global Bare Metal Cloud Market Size, Share and Analysis Report By Type (Hardware (Bare Metal Compute, Bare Metal Network, Bare Metal Storage, Others), Services (Integration & Migration, Consulting & Assessment, Maintained Services)), By Enterprise Size (Large Enterprises, Small and Medium-Sized Enterprises (SMEs)), By End Use (Advertising, BFSI, Government, Healthcare, Manufacturing, Telecom & IT, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 173999

- Number of Pages: 309

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Usage and Performance Comparison Statistics

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- By Type

- By Enterprise Size

- By End Use

- By Region

- Investment Opportunities

- Business Benefits

- Regulatory Environment

- Emerging Trends

- Growth Factors

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Key Market Segments

- Report Scope

Report Overview

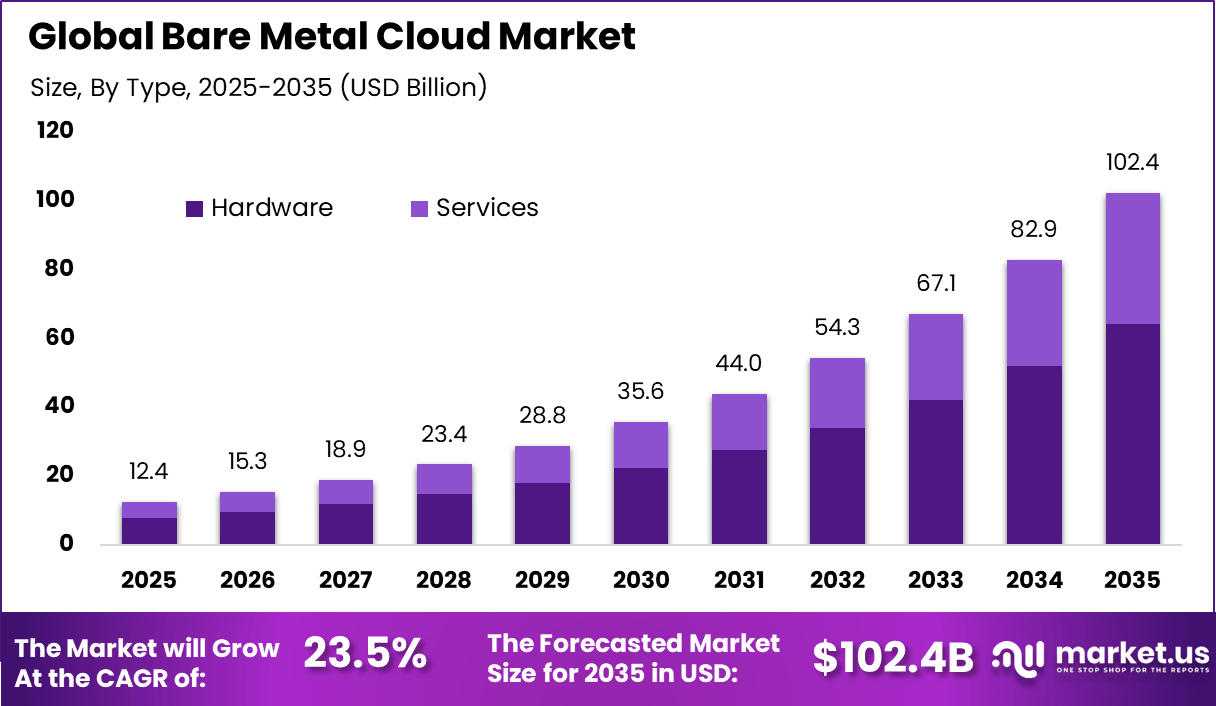

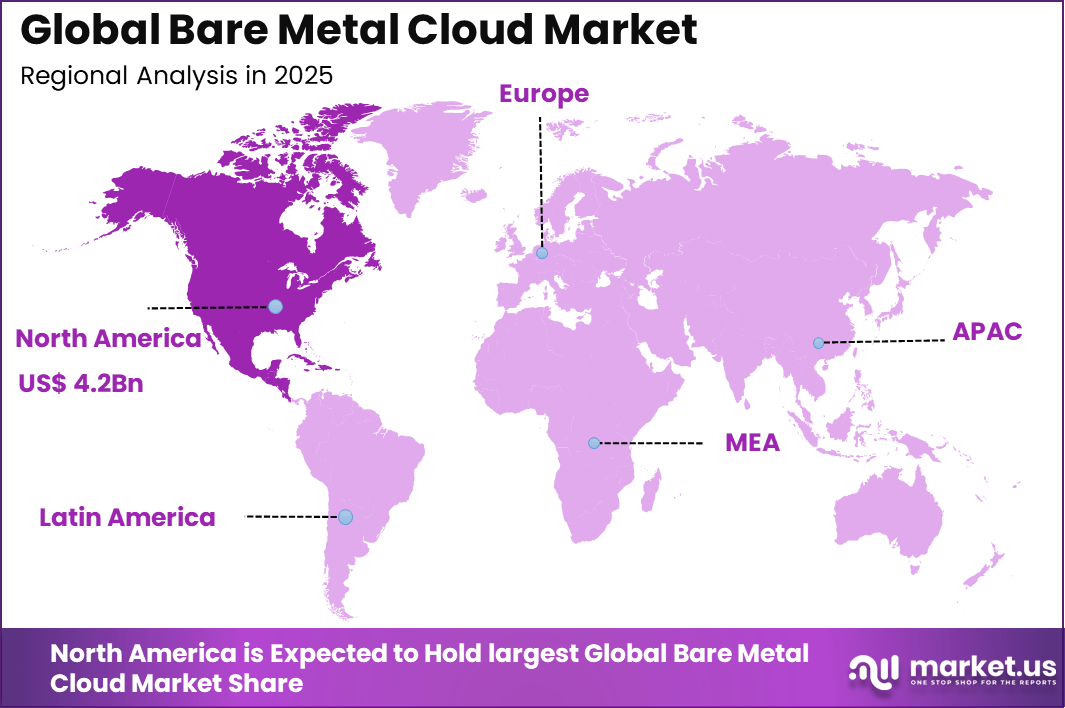

The Global Bare Metal Cloud Market size is expected to be worth around USD 102.4 Billion By 2035, from USD 12.4 billion in 2025, growing at a CAGR of 23.5% during the forecast period from 2026 to 2035. North America held a dominan Market position, capturing more than a 34.2% share, holding USD 4.2 Billion revenue.

The bare metal cloud market refers to infrastructure-as-a-service (IaaS) offerings that provide dedicated physical servers for enterprise workloads without the overhead of virtualisation layers. These services deliver raw compute resources on demand, combining the performance and customisation of traditional physical servers with the flexibility and scalability of cloud provisioning.

Bare metal cloud solutions are used for high-performance computing (HPC), large-scale databases, AI/ML training, gaming servers, financial modelling, and any workloads that require predictable performance and direct hardware access. Adoption spans enterprises, service providers, and developers seeking high throughput, low latency, and enhanced control.

One primary driver of the bare metal cloud market is the need for predictable, high-performance compute environments. Workloads such as real-time analytics, scientific simulation, and in-memory databases benefit from dedicated hardware without virtualization overhead. Bare metal servers deliver consistent performance and reduced latency compared with shared multi-tenant platforms. This performance assurance is critical for latency-sensitive and resource-intensive applications.

Demand for bare metal cloud solutions is influenced by hybrid cloud strategies that blend on-premises infrastructure with cloud resources. Enterprises maintain mission-critical applications on dedicated cloud instances while leveraging virtualised public cloud for general workloads. Bare metal builds support seamless workload portability and consistent performance across environments. This hybrid demand pattern reinforces market traction.

Top Market Takeaways

- Hardware based offerings dominated the market with a 62.7% share, reflecting strong demand for dedicated physical servers that deliver high performance, predictable latency, and enhanced security without virtualization overhead.

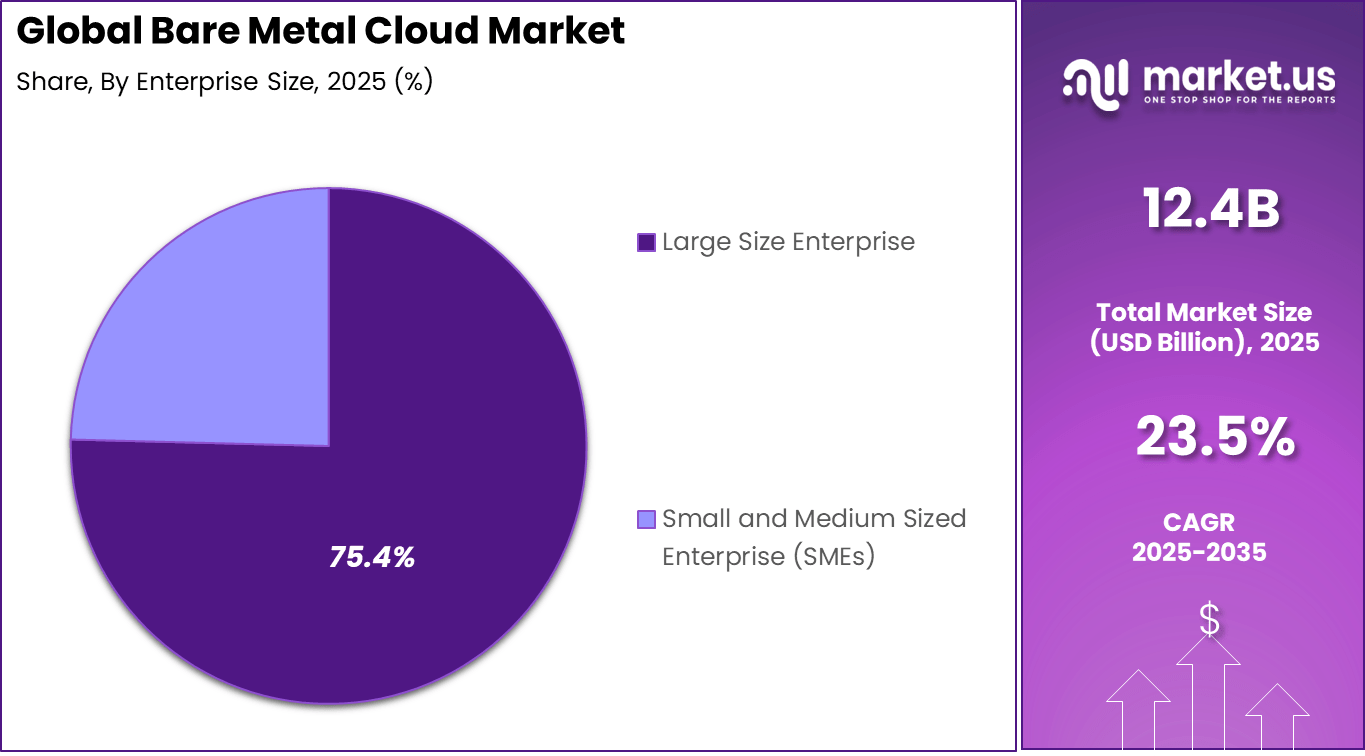

- Large enterprises accounted for a leading 75.4% share, driven by mission critical workloads, compliance requirements, and need for customized infrastructure in data intensive environments.

- The BFSI sector emerged as the top end use industry with a 38.9% share, supported by high performance computing needs, strict data sovereignty standards, and low latency transaction processing.

- North America held a dominant 34.2% share, backed by advanced cloud infrastructure, strong enterprise IT spending, and early adoption of hybrid and bare metal cloud architectures.

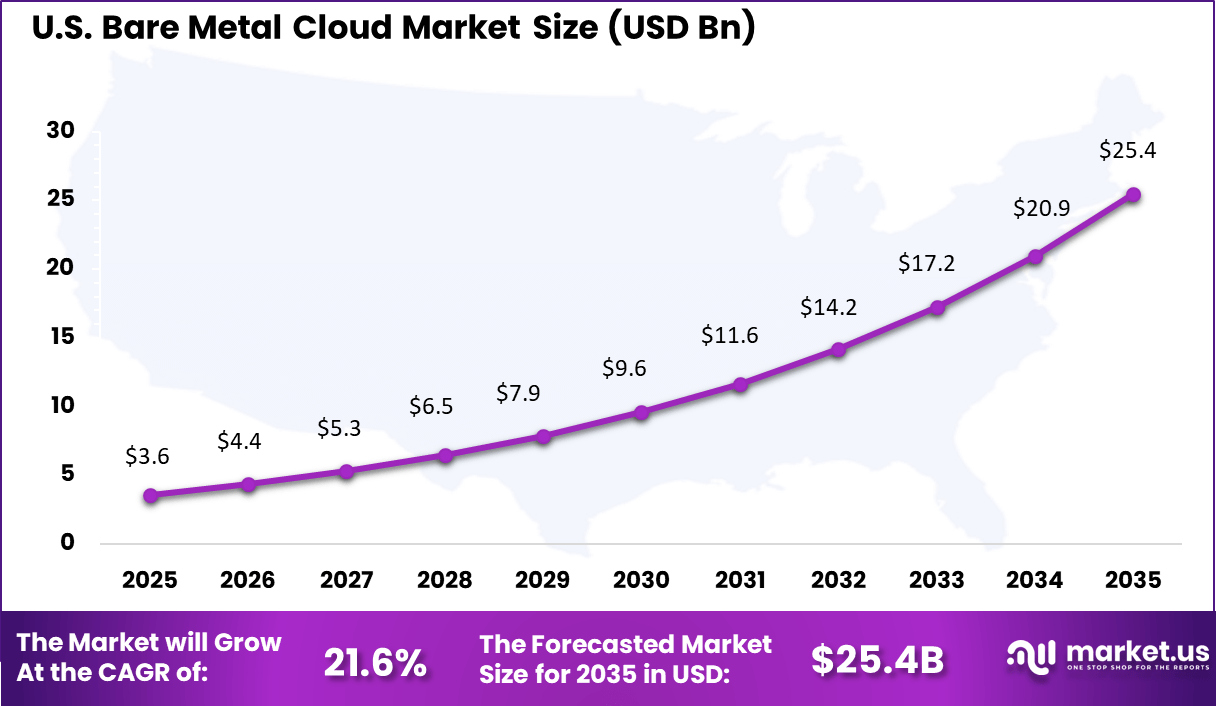

- The United States remained a key contributor with market activity valued at USD 3.62 billion, expanding at a strong 21.6% growth pace due to rising adoption in financial services, SaaS platforms, and performance sensitive applications.

Usage and Performance Comparison Statistics

- Performance advantage remained a key differentiator, as bare metal environments delivered 100% access to physical hardware resources. By removing the hypervisor layer, organizations avoided the performance loss of up to 15% typically observed in virtualized setups.

- Operational efficiency differed by workload type. Virtualization improved average server utilization from around 15% to nearly 80% for general purpose tasks, while bare metal was preferred for stable and predictable workloads where consistent CPU and memory performance were critical.

- Workload concentration was strongest in performance sensitive use cases. Real time analytics accounted for a 32.61% revenue share in 2025, followed by AI and machine learning workloads, high performance gaming platforms, and large scale database hosting.

- Organizational cloud strategies continued to evolve, as by 2025 nearly 75% of organizations shifted focus from traditional virtualization toward containerization and bare metal deployments. This transition reflected growing demand for performance transparency, efficiency, and workload control.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Demand for high performance computing Low latency and dedicated resources ~6.3% North America, Europe Short Term Data security and compliance needs Isolation without virtualization overhead ~5.1% North America, Europe Short Term Growth of data intensive workloads AI, analytics, and big data processing ~4.6% Global Mid Term Hybrid cloud adoption Integration with private infrastructure ~3.9% Global Mid Term Expansion of financial digital services Mission critical workloads in BFSI ~3.6% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline High infrastructure costs Dedicated hardware capital intensity ~5.4% Emerging Markets Short Term Provisioning complexity Longer deployment cycles ~4.1% Global Short to Mid Term Limited elasticity Less flexible scaling than virtual cloud ~3.6% Global Mid Term Vendor lock in Proprietary hardware ecosystems ~2.9% Global Long Term Skills dependency Need for specialized infrastructure teams ~2.4% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact High deployment cost Premium pricing versus shared cloud ~5.8% Emerging Markets Short to Mid Term Limited SME adoption Scale and budget constraints ~4.2% Global Mid Term Infrastructure rigidity Reduced on demand flexibility ~3.5% Global Mid Term Integration challenges Compatibility with cloud native tools ~2.8% Global Long Term Energy consumption Higher power usage ~2.1% Global Long Term By Type

In 2025, Hardware accounts for 62.7%, highlighting its importance in bare metal cloud environments. Bare metal cloud relies on dedicated physical servers to deliver high performance. Hardware resources provide direct access without virtualization layers. This improves processing speed and workload stability. Reliability remains a key requirement for users.

The dominance of hardware is driven by performance-sensitive applications. Organizations prefer dedicated servers for predictable performance. Hardware-based infrastructure supports customization of configurations. It also reduces overhead caused by shared environments. This sustains strong demand for hardware-driven bare metal solutions.

By Enterprise Size

In 2025, Large enterprises represent 75.4%, making them the primary adopters of bare metal cloud services. These organizations handle complex and resource-intensive workloads. Bare metal cloud supports large-scale data processing and analytics. Enterprises require consistent performance and security. Dedicated infrastructure meets these needs effectively.

Adoption among large enterprises is driven by digital transformation initiatives. These organizations migrate critical workloads to cloud environments. Bare metal cloud provides flexibility without sacrificing control. Integration with enterprise systems improves efficiency. This sustains strong enterprise-level adoption.

By End Use

In 2025, the banking, financial services, and insurance sector accounts for 38.9%, making it the leading end-use segment. This sector manages sensitive financial data and transactions. Bare metal cloud supports high security and compliance requirements. Dedicated servers reduce exposure to shared risks. Performance consistency is essential for financial operations.

Growth in this segment is driven by regulatory and operational demands. Financial institutions require low-latency systems. Bare metal cloud supports secure data processing. It also enables customization of security controls. This keeps BFSI as a major end user.

By Region

In 2025, North America accounts for 34.2%, supported by advanced cloud infrastructure adoption. Enterprises in the region invest in high-performance computing solutions. Demand for dedicated cloud resources continues to rise. Technology maturity supports deployment. The region remains a key contributor.

The United States reached USD 3.62 Billion with a CAGR of 21.6%, reflecting rapid market expansion. Growth is driven by enterprise cloud migration. Organizations seek performance and security balance. Bare metal cloud supports modern workloads. Market momentum remains strong.

Regional Driver Comparison

Region Primary Growth Driver Regional Share (%) Regional Value (USD Bn) Adoption Maturity North America Compliance driven enterprise workloads 34.2% USD 4.26 Bn Advanced Europe Data sovereignty requirements 27.6% USD 3.44 Bn Advanced Asia Pacific Expansion of digital enterprises 25.3% USD 3.15 Bn Developing to Advanced Latin America Banking infrastructure modernization 7.1% USD 0.88 Bn Developing Middle East and Africa Early cloud infrastructure investments 5.8% USD 0.72 Bn Early Investment Opportunities

Investment opportunities in the bare metal cloud market exist in specialised hardware platforms that support AI/ML and HPC workloads. Providers investing in GPU/TPU arrays, high-bandwidth memory, and low-latency networking can capture demand from performance-centric segments.

Solutions tailored for intensive analytics, simulation, and training workloads attract adoption from research and enterprise communities. These capabilities address unmet performance requirements. Another opportunity lies in hybrid and multi-cloud integration tools that enable seamless orchestration across virtualised, bare metal, and on-premises environments.

Platforms that unify management, automation, and governance across heterogeneous infrastructures appeal to enterprises seeking operational consistency. Investors may focus on orchestration layers, API frameworks, and management consoles that streamline cross-environment workflows. These integrative solutions strengthen competitive positioning.

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior Large enterprises Very High ~75.4% Performance and security Long term infrastructure contracts BFSI institutions High ~38.9% Regulatory compliance Mission critical deployments Cloud service providers High ~18% Infrastructure differentiation Capital intensive Government agencies Moderate ~11% Secure data hosting Program based adoption SMEs Low ~6% Cost sensitive workloads Selective usage Business Benefits

Adoption of bare metal cloud solutions improves resource predictability and operational performance. Organisations can allocate dedicated hardware resources that match workload demands without contention from virtualised neighbours. This predictability enhances service reliability and supports consistent application performance.

Businesses benefit from reduced variability and improved user experience. Bare metal cloud also simplifies performance optimisation and cost planning. Dedicated resources eliminate the need for over-provisioning to cushion performance variability.

Enterprises can tailor configurations to workload needs and optimise cost efficiency. Predictable billing and resource utilisation support more accurate budgeting and IT planning. These outcomes strengthen financial control and operational transparency.

Regulatory Environment

The regulatory environment for the bare metal cloud market includes data protection, security compliance, and industry specific governance frameworks. Providers and users must adhere to privacy laws, such as GDPR and sectoral mandates, when handling personally identifiable information (PII) and sensitive datasets.

Bare metal environments often support compliance by offering isolated hardware that aligns with data residency and segregation requirements. Security standards and certification requirements also influence adoption in sectors such as finance, healthcare, and government.

Organisations must demonstrate adherence to security frameworks and audit protocols. Bare metal solutions are often configured to meet these standards with tailored control planes, encryption practices, and access governance. Regulatory alignment is essential to support lawful operations and market credibility.

Emerging Trends

In the bare metal cloud market, one trend is the increased deployment of dedicated hardware resources that support high performance workloads. Organisations are choosing bare metal options when consistent compute performance and direct control over physical servers matter most. This approach removes shared resource contention and helps deliver predictable performance for demanding applications.

Another trend is the integration of bare metal infrastructure with flexible orchestration tools. Bare metal systems are being connected to automation layers and provisioning frameworks that allow rapid deployment, scaling, and lifecycle management. This helps organisations combine the performance of dedicated hardware with more agile resource control.

Growth Factors

A key growth factor in the bare metal cloud market is the growing need for performance and isolation in critical workloads. Industries such as data analytics, scientific computing, financial modelling, and high throughput databases require systems that support intense processing without the variability of shared virtualised environments. Bare metal solutions provide direct access to hardware that can meet these performance expectations.

Another factor supporting growth is the expansion of hybrid and multi-cloud strategies. Organisations are distributing workloads across different environments to balance cost, latency, regulatory requirements, and resilience. Bare metal infrastructure is often included in these strategies when specific workloads demand dedicated compute and hardware level access.

Opportunity

An opportunity exists in the development of server configurations optimised for specialised use cases. Customised bare metal offerings for artificial intelligence training, large scale databases, or high performance computing can attract organisations with niche performance needs. Tailored hardware options can improve efficiency and strengthen value propositions.

Another opportunity lies in simplifying user experiences through automation and integrated tools. Providers that offer more intuitive provisioning, monitoring, and lifecycle workflows can reduce operational friction. This approach can expand appeal beyond traditional infrastructure teams to a broader set of users.

Challenge

One challenge for the bare metal cloud market is ensuring effective performance monitoring and diagnostics. Dedicated hardware offers high performance but requires tools that can observe, report, and analyse system behaviour. Organisations must invest in monitoring systems that provide visibility without overwhelming users with complexity.

Another challenge involves balancing scalability with physical resource limits. Unlike purely virtualised environments, bare metal infrastructure has finite hardware capacity. Planning for peak demand without excessive idle capacity requires careful forecasting and may involve hybrid approaches that blend dedicated and virtualised resources.

Competitive Analysis

The Bare Metal Cloud Market is led by global infrastructure providers such as IBM Corporation, Equinix, Inc., Oracle, and Lumen Technologies. These players focus on high performance computing, low latency infrastructure, and enterprise grade security. Their bare metal offerings support mission critical workloads. Strong global data center presence improves scalability.

Mid sized and regional providers strengthen the market through flexible deployment models and cost efficient services. Companies such as DataBank Holdings, Ltd., Hivelocity, Inc, Hetzner Online GmbH, OVH SAS, and phoenixNAP emphasize rapid provisioning and transparent pricing. Their solutions appeal to startups and mid size enterprises.

Emerging infrastructure specialists and edge focused players add differentiation to the competitive landscape. Firms including BIGSTEP, HorizonlQ, Linode, LLC, Scaleway SAS, Vapor IO, Inc., and Zenlayer focus on edge computing and global reach. Their platforms support latency sensitive applications. The presence of other providers increases innovation and customization across use cases.

Top Key Players in the Market

- DataBank Holdings, Ltd.

- IBM Corporation

- BIGSTEP

- Equinix, Inc.

- Hivelocity, Inc

- Hetzner Online GmbH

- HorizonlQ

- Linode, LLC

- Lumen Technologies

- OVH SAS

- Oracle

- phoenixNAP

- Scaleway SAS

- Vapor IO, Inc.

- Zenlayer

- Others

Recent Developments

- April, 2025 – Oracle teamed up with Google Cloud to roll out OCI Exadata X11M bare metal infrastructure across more regions, adding cross-region disaster recovery and customer-managed keys for demanding workloads.

- May, 2025 – Lumen Technologies partnered with IBM to push real-time AI at the edge, blending Lumen’s bare metal edge cloud with IBM’s watsonx tools on OCI bare metal.

- In May 2025, Nutanix expanded its hybrid cloud platform with new innovations, including deeper integration with NVIDIA for Agentic AI, a partnership with Pure Storage, and the launch of Cloud Native AOS for Kubernetes storage. The company also previewed Nutanix Cloud Clusters on Google Cloud, offering greater flexibility, efficiency, and security across distributed cloud environments.

- In May 2025, Atlantic.Net introduced a high performance GPU cloud hosting service designed for AI and machine learning workloads. The platform allows users to deploy GPU powered cloud servers in under 60 seconds, enabling rapid scalability. The service targets businesses, developers, and researchers seeking cost effective and high performance computing solutions.

Key Market Segments

By Type

- Hardware

- Bare Metal Compute

- Bare Metal Network

- Bare Metal Storage

- Others

- Services

- Integration & Migration

- Consulting & Assessment

- Maintained Services

By Enterprise Size

- Large Size Enterprise

- Small and Medium Sized Enterprise (SMEs)

By End Use

- Advertising

- BFSI

- Government

- Healthcare

- Manufacturing

- Telecom & IT

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Report Scope

Report Features Description Market Value (2025) USD 12.4 Bn Forecast Revenue (2035) USD 102.4 Bn CAGR(2026-2035) 23.5% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Hardware (Bare Metal Compute, Bare Metal Network, Bare Metal Storage, Others), Services (Integration & Migration, Consulting & Assessment, Maintained Services)), By Enterprise Size (Large Enterprises, Small and Medium-Sized Enterprises (SMEs)), By End Use (Advertising, BFSI, Government, Healthcare, Manufacturing, Telecom & IT, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape DataBank Holdings, Ltd., IBM Corporation, BIGSTEP, Equinix, Inc., Hivelocity, Inc., Hetzner Online GmbH, HorizonlQ, Linode, LLC, Lumen Technologies, OVH SAS, Oracle, phoenixNAP, Scaleway SAS, Vapor IO, Inc., Zenlayer, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- DataBank Holdings, Ltd.

- IBM Corporation

- BIGSTEP

- Equinix, Inc.

- Hivelocity, Inc

- Hetzner Online GmbH

- HorizonlQ

- Linode, LLC

- Lumen Technologies

- OVH SAS

- Oracle

- phoenixNAP

- Scaleway SAS

- Vapor IO, Inc.

- Zenlayer

- Others