Global Bakery Processing Equipment Market Size, Share, Growth Analysis By Equipment (Oven & Proofers, Mixer & Blenders, Dividers & Rounders, Molders & Sheeters, Others), By Application (Bread, Cookies & Biscuits, Pizza Crusts, Cakes & Pastries, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172568

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

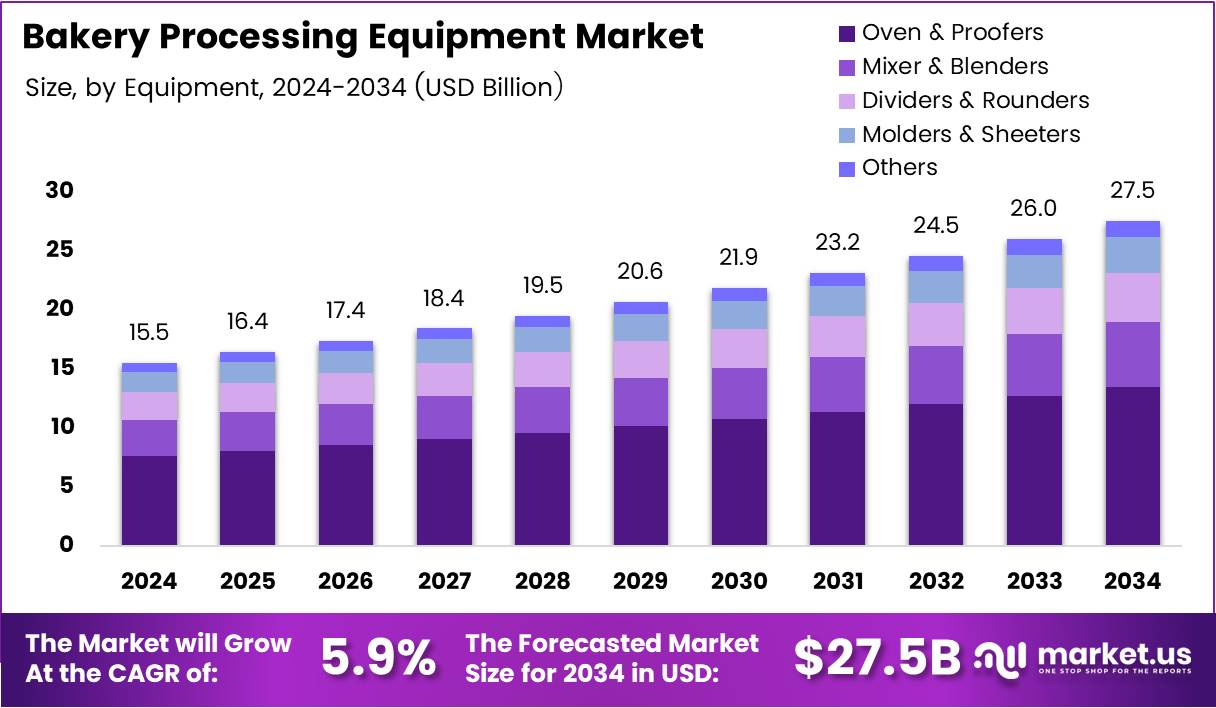

The Global Bakery Processing Equipment Market is projected to reach USD 27.5 Billion by 2034, up from USD 15.5 Billion in 2024, expanding at a CAGR of 5.9% during the forecast period from 2025 to 2034. This robust growth trajectory reflects the evolving dynamics of commercial baking operations worldwide.

Bakery processing equipment encompasses specialized machinery designed for large-scale production of bread, pastries, cakes, and other baked goods. These systems include ovens, mixers, dough dividers, molders, and proofers that streamline manufacturing processes. Modern equipment integrates automation to enhance efficiency, consistency, and hygiene standards across production lines.

The market is experiencing substantial momentum driven by urbanization and changing consumer lifestyles. Rising demand for packaged and ready-to-eat bakery products continues accelerating equipment adoption. Commercial bakeries increasingly prioritize automated solutions to address labor shortages while maintaining product quality and operational efficiency.

Labor challenges represent a critical factor reshaping the industry landscape. Skilled workforce scarcity compels manufacturers to invest in automated processing lines that reduce manual intervention. Consequently, equipment suppliers are developing sophisticated machinery with user-friendly interfaces and minimal training requirements to support seamless operations.

Food safety regulations are becoming increasingly stringent across major markets. Bakeries must comply with hygiene standards and traceability requirements, driving demand for equipment with advanced sanitation features. Standardized baking processes enabled by modern machinery help producers meet regulatory compliance while ensuring consistent product quality.

The frozen and par-baked segments present significant expansion opportunities. Retailers and foodservice operators favor these products for their convenience and extended shelf life. Specialized processing equipment tailored for these applications is witnessing heightened adoption as manufacturers diversify their product portfolios.

Emerging markets are experiencing notable infrastructure investments in bakery manufacturing facilities. Growing middle-class populations in Asia Pacific and Latin America fuel consumption of baked goods. According to Eurostat, bread and cereals account for approximately 17% of total food expenditure across EU households, underscoring the category’s fundamental importance.

Equipment costs vary considerably based on scale and automation levels. According to Toast, standard bakery equipment investments average around USD 20,000, while commercial operations require nearly double that amount. Despite higher upfront expenses, long-term operational efficiencies justify these capital outlays for growing enterprises.

Key Takeaways

- Global Bakery Processing Equipment market projected to reach USD 27.5 Billion by 2034 from USD 15.5 Billion in 2024 at a CAGR of 5.9% during 2025-2034

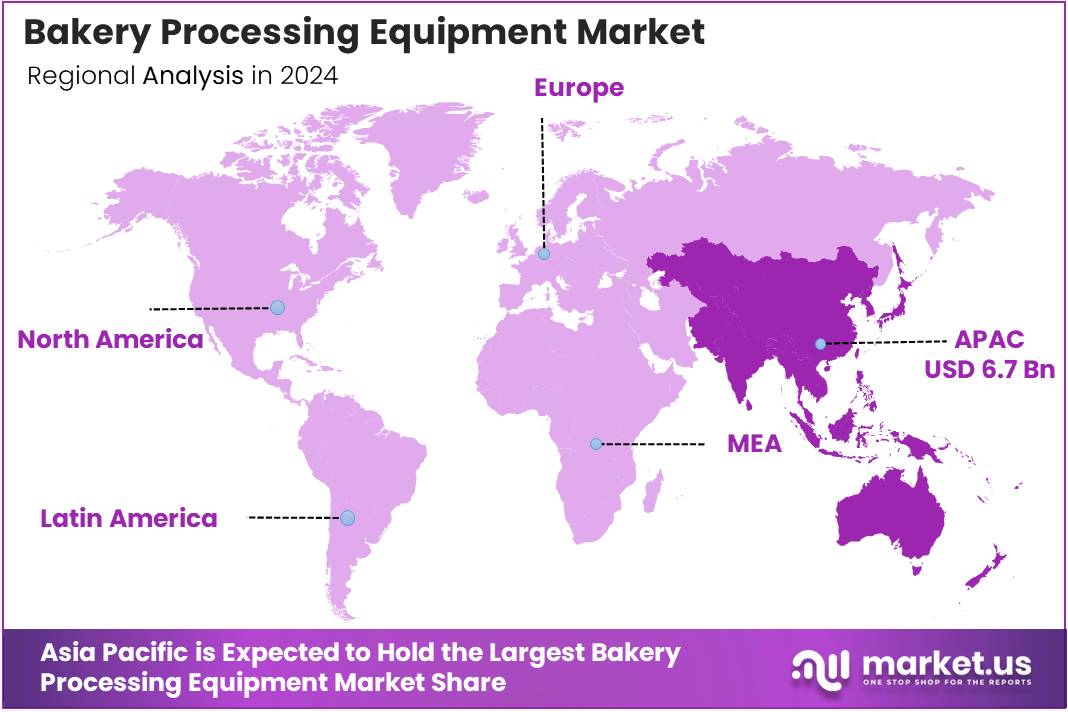

- Asia Pacific dominates with 43.80% market share, valued at USD 6.7 Billion

- Ovens & Proofers segment leads with 41.5% share in equipment category

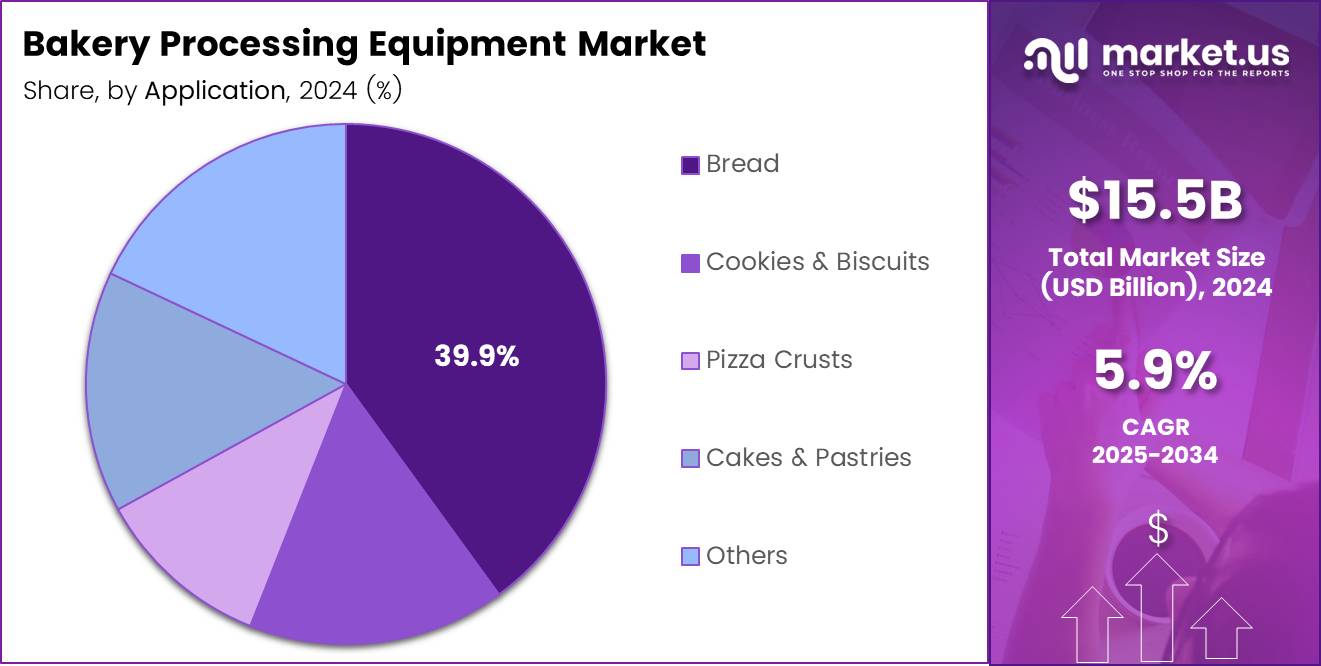

- Bread application accounts for 39.9% of total market demand

Equipment Analysis

Ovens & Proofers dominate with 41.5% due to their critical role in baking operations and temperature control.

In 2024, Ovens & Proofers held a dominant market position in the By Equipment segment of Bakery Processing Equipment Market, with a 41.5% share. These systems represent the core of bakery operations, delivering precise temperature management and consistent baking results. Commercial bakeries prioritize advanced ovens featuring programmable controls, energy efficiency, and uniform heat distribution to optimize product quality.

Mixers & Blenders constitute essential equipment for dough preparation and ingredient homogenization. These machines handle diverse formulations ranging from light cake batters to dense bread doughs. Modern mixers incorporate variable speed controls and planetary mixing actions to accommodate different recipes while reducing processing time significantly.

Dividers & Rounders streamline dough portioning and shaping processes in high-volume production environments. Automated dividers ensure consistent weight accuracy across batches, minimizing waste and maintaining standardized product dimensions. Rounders shape divided dough pieces into uniform balls, preparing them for subsequent molding or proofing stages efficiently.

Molders & Sheeters transform dough into specific shapes and thicknesses required for various bakery products. Sheet dough processing supports production of laminated pastries, pizza bases, and flatbreads. Molding equipment creates consistent loaf shapes and specialty forms, enabling bakeries to diversify their product offerings without compromising production speed or quality standards.

Application Analysis

Bread dominates with 39.9% due to its status as a daily staple across global markets.

In 2024, Bread held a dominant market position in the By Application segment of Bakery Processing Equipment Market, with a 39.9% share. Bread production remains the largest application segment given its fundamental role in diets worldwide. Equipment tailored for bread manufacturing includes specialized mixers, proofers, and tunnel ovens designed to handle various bread types from artisanal loaves to industrial sandwich breads.

Cookies & Biscuits represent a significant equipment application driven by snacking trends and packaged confectionery demand. Production lines for these items require rotary molders, wire-cut depositors, and precision baking ovens. Manufacturers invest in versatile equipment capable of producing multiple cookie varieties to respond quickly to changing consumer preferences and seasonal demands.

Pizza Crusts have emerged as a growing application segment fueled by expanding pizzeria chains and frozen pizza consumption. Specialized sheeting and pressing equipment produces consistent crust thickness and diameter. Par-baking systems allow manufacturers to supply partially cooked crusts to restaurants and retailers, creating opportunities for dedicated processing equipment.

Cakes & Pastries require specialized equipment for delicate batter handling and decorative applications. Automated depositors, enrobing machines, and convection ovens enable high-volume production while maintaining product aesthetics. This segment benefits from growing demand for premium and customized bakery items across retail and foodservice channels globally.

Key Market Segments

By Equipment

- Oven & Proofers

- Mixer & Blenders

- Dividers & Rounders

- Molders & Sheeters

- Others

By Application

- Bread

- Cookies & Biscuits

- Pizza Crusts

- Cakes & Pastries

- Others

Drivers

Rising Demand for Automated Bakery Production Drives Market Expansion

Large-scale commercial bakeries increasingly adopt automated processing equipment to ensure consistent quality and maximize production output. Manual operations cannot match the speed and precision offered by modern machinery, particularly when handling high-volume orders. Automation enables bakeries to standardize recipes, reduce human error, and maintain uniform product specifications across production runs.

Growing consumption of packaged and ready-to-eat bakery products across urban populations significantly boosts equipment demand. Busy lifestyles drive preference for convenient food options that require minimal preparation. Manufacturers respond by expanding production capacities and investing in efficient processing lines capable of meeting escalating consumer requirements.

Labor shortages in commercial bakeries accelerate the transition toward automated processing solutions. Skilled bakers are increasingly difficult to recruit and retain in many markets. Consequently, equipment featuring intuitive controls and reduced manual intervention becomes essential for maintaining operational continuity while managing workforce constraints effectively.

Increasing focus on food safety, hygiene, and standardized baking processes compels investments in advanced equipment. Regulatory bodies enforce strict sanitation standards that legacy machinery often cannot satisfy. Modern processing equipment incorporates stainless steel construction, easy-clean designs, and automated cleaning systems to support compliance with evolving food safety regulations comprehensively.

Restraints

High Capital Investment Requirements Limit Market Accessibility

High initial capital investment and maintenance costs of advanced bakery processing equipment present significant barriers to market entry. Comprehensive production lines incorporating ovens, mixers, dividers, and auxiliary equipment require substantial financial commitments. Ongoing maintenance expenses, spare parts procurement, and technical support further increase total ownership costs over equipment lifecycles.

Limited adoption among small and artisanal bakeries stems from budget constraints and space limitations. These establishments often operate on tight margins that cannot accommodate expensive automation investments. Additionally, compact urban bakeries lack sufficient floor space to install large-scale processing equipment, restricting their ability to modernize operations effectively.

The complexity of advanced machinery necessitates specialized technical knowledge for operation and troubleshooting. Many smaller bakeries struggle to justify hiring dedicated equipment technicians or investing in comprehensive staff training programs. This skills gap creates reluctance to adopt sophisticated processing systems despite their potential efficiency benefits.

Return on investment timelines for premium equipment can extend several years, deterring businesses with immediate cash flow concerns. Economic uncertainties and fluctuating raw material costs make long-term capital planning challenging. Consequently, many operators postpone equipment upgrades, opting instead for incremental improvements to existing production infrastructure when possible.

Growth Factors

Expansion of Frozen and Par-Baked Segments Creates Equipment Opportunities

Expansion of frozen and par-baked bakery segments requires specialized processing equipment tailored to these applications. Pre-baked products demand precise temperature control and rapid cooling systems to lock in freshness. Equipment manufacturers develop customized solutions incorporating blast freezing capabilities and modified atmosphere packaging integration to support this growing market segment effectively.

Increasing investments in bakery manufacturing facilities across emerging economies drive substantial equipment demand. Governments in Asia Pacific, Latin America, and Africa prioritize food processing infrastructure to enhance domestic production capabilities. These investments create opportunities for equipment suppliers to establish regional partnerships and expand their market presence strategically.

Growing demand for energy-efficient and low-emission bakery processing machines reflects heightened environmental consciousness. Bakeries seek equipment that minimizes utility consumption while maintaining production standards. Manufacturers respond by developing heat recovery systems, improved insulation, and variable frequency drives that reduce operational costs and environmental impact simultaneously.

Rising popularity of gluten-free, organic, and specialty baked goods necessitates equipment customization and flexibility. These products require modified processing parameters and contamination prevention measures. Equipment suppliers offer modular systems and easy changeover capabilities, enabling bakeries to diversify product lines without investing in entirely separate production infrastructure or compromising efficiency.

Emerging Trends

Integration of IoT and Smart Controls Transforms Bakery Operations

Integration of IoT and smart controls enables real-time monitoring of bakery operations, revolutionizing production management. Connected equipment transmits performance data, temperature profiles, and maintenance alerts to centralized dashboards. Operators gain unprecedented visibility into production efficiency, enabling proactive interventions that minimize downtime and optimize resource utilization across facilities.

Adoption of modular and flexible equipment supports product diversification in competitive markets. Manufacturers design systems with interchangeable components that accommodate various recipes and batch sizes. This flexibility allows bakeries to respond quickly to market trends and seasonal demands without significant capital investments in dedicated equipment lines.

Increasing use of automated dough handling, proofing, and baking systems reduces labor dependency while improving consistency. Robotic arms transfer products between processing stages, eliminating manual handling that can affect dough quality. Automated proofing chambers maintain precise humidity and temperature conditions, ensuring optimal fermentation regardless of external environmental factors influencing production.

Focus on sustainable equipment designs with reduced energy and water consumption addresses both cost and environmental concerns. Manufacturers incorporate heat recovery systems that capture waste energy for reuse in other processes. Water-efficient cleaning systems and eco-friendly refrigerants minimize environmental footprint while helping bakeries meet corporate sustainability commitments and regulatory requirements effectively.

Regional Analysis

Asia Pacific Dominates the Bakery Processing Equipment Market with a Market Share of 43.80%, Valued at USD 6.7 Billion

Asia Pacific commands the largest regional market share at 43.80%, representing approximately USD 6.7 Billion in market value. Rapid urbanization, expanding middle-class populations, and westernization of dietary habits drive robust bakery consumption across China, India, and Southeast Asian nations. Governments actively promote food processing infrastructure development, creating favorable conditions for equipment market expansion.

North America Bakery Processing Equipment Market Trends

North America maintains a mature market characterized by equipment modernization and automation upgrades. Established bakery chains focus on replacing legacy systems with energy-efficient, IoT-enabled equipment to reduce operational costs. Health-conscious consumers drive demand for specialty and artisanal products, prompting investments in flexible processing lines. Labor cost pressures accelerate adoption of fully automated production systems across commercial bakeries.

Europe Bakery Processing Equipment Market Trends

Europe demonstrates strong demand driven by bread’s central role in traditional diets and premiumization trends. Stringent food safety regulations necessitate continuous equipment upgrades to maintain compliance standards. Sustainability initiatives encourage investments in energy-efficient machinery with reduced environmental impact. Artisanal bakery resurgence coexists with industrial production, creating diverse equipment requirements across market segments.

Middle East and Africa Bakery Processing Equipment Market Trends

Middle East and Africa exhibit growing market potential supported by population growth and increasing urbanization rates. Traditional bread varieties maintain cultural significance while western-style bakery products gain popularity among younger demographics. Government initiatives promoting food security stimulate domestic bakery production capacity expansion. International equipment suppliers increasingly target this region through local partnerships and distribution networks.

Latin America Bakery Processing Equipment Market Trends

Latin America experiences steady growth fueled by rising disposable incomes and expanding retail infrastructure. Brazil and Mexico lead regional equipment adoption, driven by large populations and established bakery industries. Small and medium-sized bakeries gradually modernize operations to compete with industrial producers. Growing tourism sector creates additional demand for bakery products, encouraging equipment investments in hospitality and foodservice segments.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Bakery Processing Equipment Company Insights

Ali Group maintains a prominent position in the global bakery processing equipment landscape through its diverse brand portfolio and comprehensive product offerings. The company provides integrated solutions spanning mixing, forming, baking, and cooling equipment across multiple price points. Their global service network and application expertise enable them to support both artisanal bakeries and large-scale industrial operations effectively across diverse geographical markets.

Baker Perkins specializes in sophisticated processing systems for biscuits, crackers, and confectionery applications, establishing strong market recognition. Their engineering capabilities focus on high-capacity production lines that emphasize efficiency and product consistency. The company’s commitment to innovation and customization allows clients to develop unique products while maintaining operational excellence and meeting stringent quality standards reliably.

Bühler leverages its extensive experience in food processing technology to deliver advanced bakery equipment solutions emphasizing automation and digitalization. The company’s integrated systems optimize entire production workflows from ingredient handling through packaging. Their focus on sustainability and energy efficiency resonates with environmentally conscious manufacturers seeking to reduce operational costs while minimizing environmental impact throughout production processes.

GEA Group offers comprehensive bakery processing technology supported by strong engineering capabilities and global technical support infrastructure. The company provides customized solutions for dough preparation, shaping, baking, and cooling applications across various bakery segments. Their modular equipment designs enable flexible production configurations that accommodate changing market demands and facilitate efficient capacity expansions as businesses grow and evolve.

Key Companies

- Ali Group

- Baker Perkins

- Bühler

- GEA Group

- Middleby Corporation

- Markel

- John Bean Technologies Corporation

- Rheon Automatic Machinery

- Anko Food Machine

- Gemini Bakery Equipment

Recent Developments

- In April 2025, Rademaker Group successfully acquired Form & Frys Maskinteknik, expanding its portfolio of specialized bakery processing solutions. This strategic acquisition strengthens Rademaker’s capabilities in dough handling and forming technologies, enabling enhanced service offerings to customers across European markets.

- In August 2025, Middleby completed the acquisition of Oka-Spezialmaschinenfabrik GmbH & Co. KG, bolstering its bakery equipment division. This transaction provides Middleby access to advanced German engineering expertise and specialized equipment for artisanal and industrial bakery applications, supporting its growth strategy in premium market segments.

- In September 2025, Lantmännen Unibake expanded into the savoury segment through acquisition of Boboli Benelux B.V. This strategic move diversifies their product portfolio beyond traditional sweet bakery items, creating demand for additional processing equipment tailored to pizza crust and flatbread production requirements.

Report Scope

Report Features Description Market Value (2024) USD 15.5 Billion Forecast Revenue (2034) USD 27.5 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Equipment (Oven & Proofers, Mixer & Blenders, Dividers & Rounders, Molders & Sheeters, Others), By Application (Bread, Cookies & Biscuits, Pizza Crusts, Cakes & Pastries, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Ali Group, Baker Perkins, Bühler, GEA Group, Middleby Corporation, Markel, John Bean Technologies Corporation, Rheon Automatic Machinery, Anko Food Machine, Gemini Bakery Equipment Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Bakery Processing Equipment MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Bakery Processing Equipment MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ali Group

- Baker Perkins

- Bühler

- GEA Group

- Middleby Corporation

- Markel

- John Bean Technologies Corporation

- Rheon Automatic Machinery

- Anko Food Machine

- Gemini Bakery Equipment