Global Bacteriological Testing Market Size, Share, And Enhanced Productivity By Bacteria (Coliform, Pathogenic E. coli), By Technology (Traditional Technology, Rapid Technology, PCR, ELISA, Others), By Mode of Use (Portable / Field-use Devices, Laboratory-based Systems), By End-use (Food and Beverage, Fish and Seafood, Dairy, Processed Foods, Fruits and Vegetables, Pharmaceuticals, Cosmetics and Personal Care, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171480

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

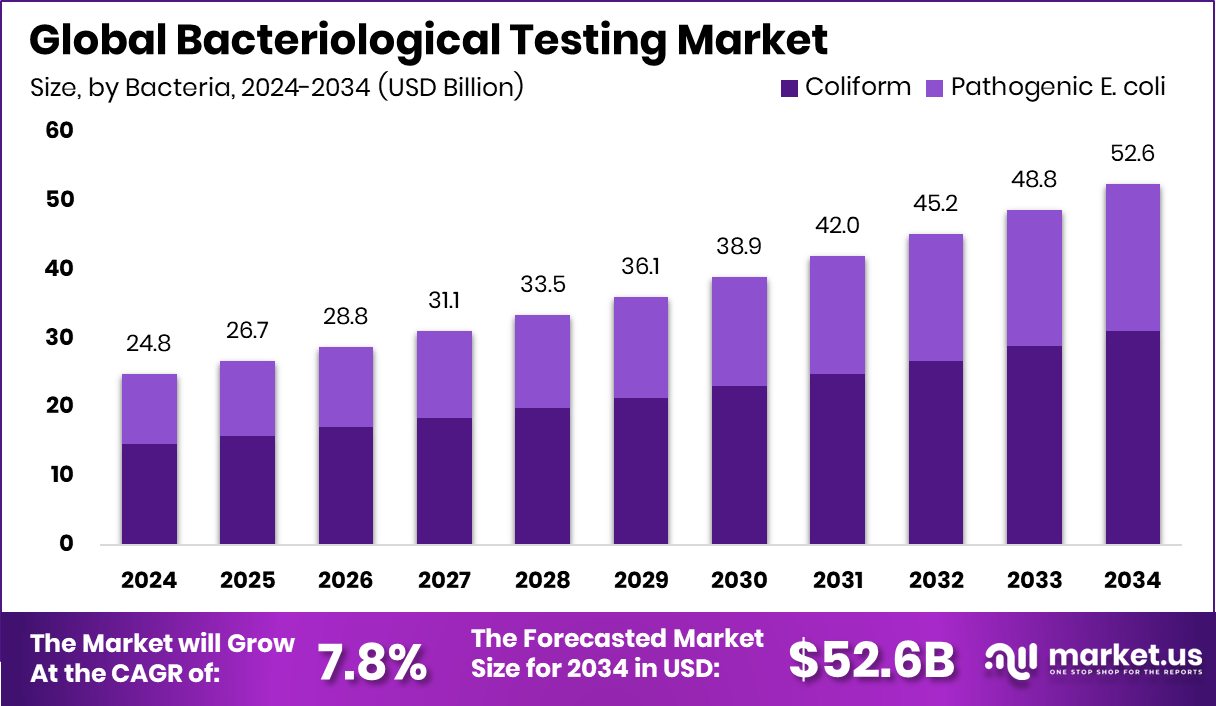

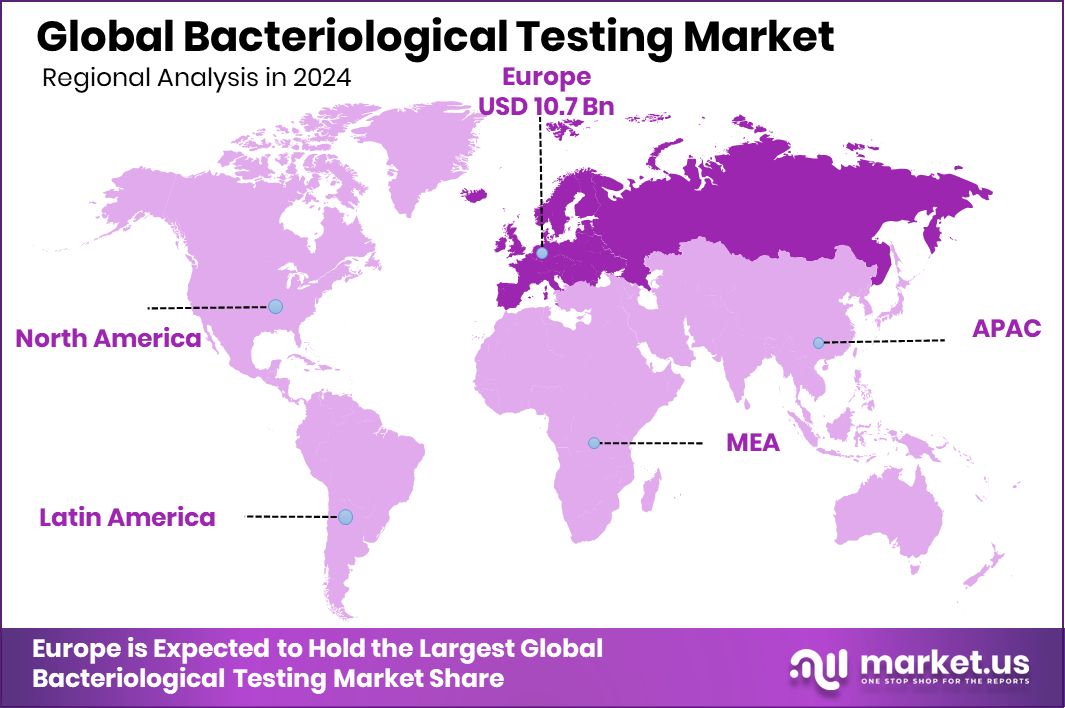

The Global Bacteriological Testing Market is expected to be worth around USD 52.6 billion by 2034, up from USD 24.8 billion in 2024, and is projected to grow at a CAGR of 7.8% from 2025 to 2034. At USD 10.7 Bn and 43.50%, Europe leads regional revenues in the bacteriological testing market.

Bacteriological testing is the process of detecting and identifying bacteria in samples such as food, water, surfaces, and biological materials. It helps determine whether harmful or spoilage-causing bacteria are present and whether hygiene and safety standards are being followed. This testing is essential for preventing contamination, protecting public health, and ensuring product quality across food systems, healthcare, and environmental monitoring.

The bacteriological testing market includes tools, methods, and laboratory services used to analyze bacterial presence and load. It supports routine safety checks, regulatory compliance, and quality control activities. The market serves sectors where microbial risks must be controlled, especially where products are consumed or exposed to humans and ecosystems.

Market growth is supported by rising safety expectations in food systems and marine supply chains. Public investments in fisheries and coastal ecosystems increase the need for routine bacterial monitoring. For example, the Massachusetts government awarded USD 1.2 million in commercial fishing grants, while the UK announced a £360 million Fishing and Coastal Growth Fund, both reinforcing testing needs across seafood handling and processing.

Demand is rising as seafood innovation and automation expand. Robotics and alternative seafood production require strict microbial validation. Shinkei Systems secured USD 22 million in Series A funding, while FaSS reopened with £6 million investment, highlighting a stronger infrastructure that depends on bacteriological testing.

New food technologies create long-term opportunities for testing services. Startups using microalgae and fermentation raised capital, including NewFish (USD 1.3 million), Seafood Reboot (€3.2 million), and Bluu Seafood (USD 17.5 million). Investment funds such as Bluefront’s USD 100 million and USD 50 million rounds further support expansion.

Key Takeaways

- The Global Bacteriological Testing Market is expected to be worth around USD 52.6 billion by 2034, up from USD 24.8 billion in 2024, and is projected to grow at a CAGR of 7.8% from 2025 to 2034.

- In the bacteriological testing market, coliform detection dominates with a 59.2% share due to routine contamination monitoring.

- Traditional technology holds 33.7% in the bacteriological testing market, supported by low cost and standardized methods.

- Laboratory-based systems lead the bacteriological testing market with 69.3%, driven by accuracy, validation, and regulatory acceptance.

- Food and beverage end-use accounts for 31.1% of the bacteriological testing market demand globally across industries.

- Europe’s 43.50% market share equals USD 10.7 Bn, driven by extensive bacteriological testing adoption.

By Bacteria Analysis

In the Bacteriological Testing Market, coliform bacteria dominate detection demand with a 59.2% share.

In 2024, Coliform held a dominant market position in the Bacteria segment ofthe Bacteriological Testing Market, with a 59.2% share. This dominance reflects the continued importance of coliform testing as a basic indicator of microbial contamination. Coliform bacteria are widely monitored because their presence signals potential hygiene failures and possible exposure to harmful pathogens, making them central to routine bacteriological testing programs.

The strong share is also supported by the widespread use of coliform analysis in regulatory compliance and quality control practices. Laboratories rely on coliform detection to ensure safety standards are consistently met, especially where frequent and standardized testing is required. As a result, coliform testing remains a core focus within bacteriological testing workflows, reinforcing its leading position in the segment.

By Technology Analysis

Traditional technology leads the bacteriological testing market methods, holding a 33.7% adoption rate globally.

In 2024, Traditional Technology held a dominant market position in By Technology segment of the Bacteriological Testing Market, with a 33.7% share. This leadership highlights the continued reliance on well-established testing methods that offer proven accuracy, reproducibility, and regulatory acceptance. Traditional techniques remain deeply embedded in laboratory operations due to long-standing validation and technician familiarity.

The segment’s strength is further supported by its consistent performance across routine testing applications. Many laboratories continue to trust traditional technology for its clear protocols and dependable outcomes, especially in standardized testing environments. This sustained adoption underscores the role of conventional methods as a stable foundation for bacteriological testing, maintaining their relevance despite ongoing technological evolution.

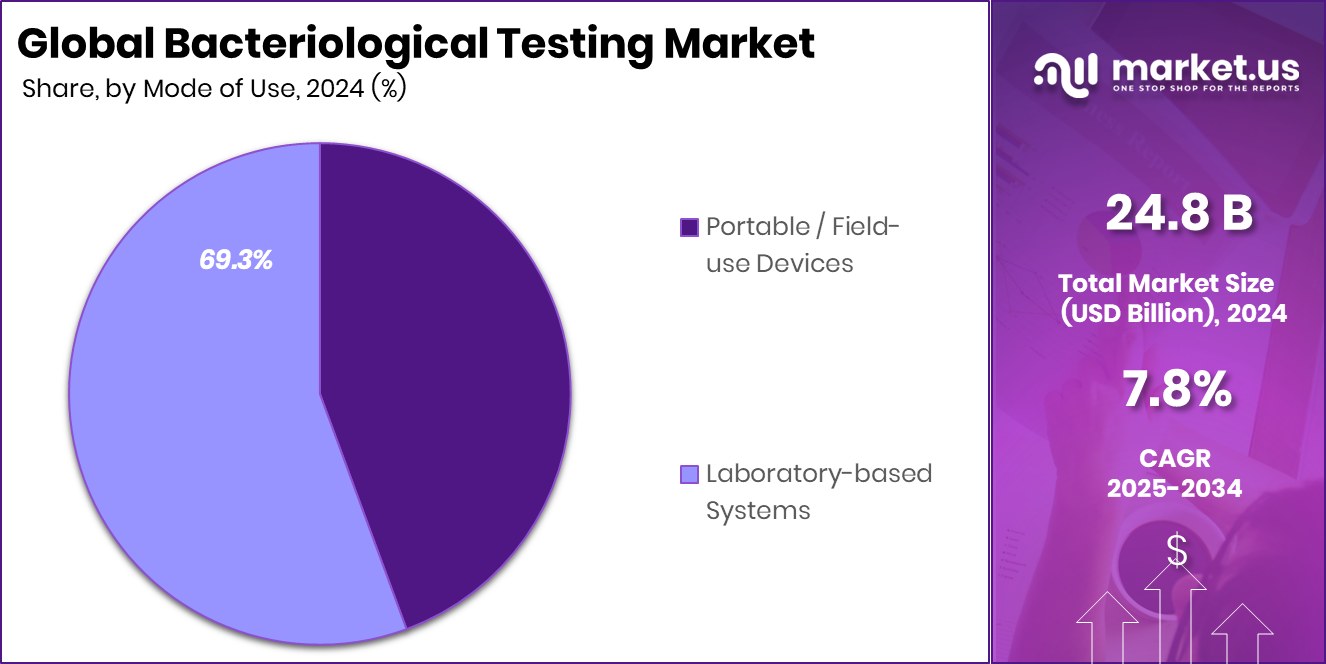

By Mode of Use Analysis

Laboratory-based systems dominate the bacteriological testing market usage, accounting for 69.3% of applications globally.

In 2024, Laboratory-based Systems held a dominant market position in By Mode of Use segment of the Bacteriological Testing Market, with a 69.3% share. This significant share reflects the preference for controlled laboratory environments where testing accuracy, reliability, and documentation are critical. Laboratory-based systems support detailed analysis and consistent quality assurance practices.

Their dominance is reinforced by the ability to handle complex testing procedures and high sample volumes efficiently. These systems enable standardized workflows, skilled oversight, and precise result interpretation, which are essential for dependable bacteriological assessment. As a result, laboratory-based systems continue to form the backbone of bacteriological testing operations, sustaining their leading role in this segment.

By End-use Analysis

Food and beverage end-use drives the bacteriological testing market demand, contributing a 31.1% share.

In 2024, Food and Beverage held a dominant market position in By End-use segment of the Bacteriological Testing Market, with a 31.1% share. This leadership is driven by the critical need to ensure product safety, quality, and compliance across food and beverage production. Bacteriological testing plays a vital role in preventing contamination and protecting consumer health.

The segment’s strong position also reflects ongoing monitoring requirements throughout processing, storage, and distribution stages. Regular testing helps identify microbial risks early and supports consistent quality standards. Consequently, bacteriological testing remains an integral part of food and beverage operations, securing its dominant share within the overall market end-use landscape.

Key Market Segments

By Bacteria

- Coliform

- Pathogenic E. coli

By Technology

- Traditional Technology

- Rapid Technology

- PCR

- ELISA

- Others

By Mode of Use

- Portable / Field-use Devices

- Laboratory-based Systems

By End-use

- Food and Beverage

- Fish and Seafood

- Dairy

- Processed Foods

- Fruits and Vegetables

- Pharmaceuticals

- Cosmetics and Personal Care

- Others

Driving Factors

Rising Food Innovation Demands Strong Bacterial Safety Checks

One major driving factor for the Bacteriological Testing Market is the fast growth of new food technologies, especially in seafood and plant-based alternatives. As more companies develop novel food formats, ensuring bacterial safety becomes critical before products reach consumers. Advanced bacteriological testing helps verify hygiene, shelf life, and compliance with food safety rules, reducing health risks and recalls.

Recent investments clearly show this shift. Google Ventures invested in a seafood trading platform through a USD 23 million funding round, highlighting the scale at which digital and physical food supply chains are expanding. Seafood Reboot raised USD 3.3 million to launch plant-based fish products, while food-tech startup Lasso entered the market backed by USD 6.5 million in funding. Each of these developments increases the need for reliable bacteriological testing across sourcing, processing, and final product validation.

Restraining Factors

High Compliance Costs Slow Widespread Testing Adoption

One key restraining factor for the Bacteriological Testing Market is the high cost of compliance and testing integration, especially for emerging seafood and alternative protein producers. New cultivated and sidestream-based food companies must invest heavily in production scale, leaving limited budgets for frequent and advanced bacteriological testing.

For instance, Wanda Fish secured USD 7 million in seed funding to boost cultivated bluefin tuna production, where capital is primarily directed toward bioprocessing rather than extensive testing and expansion. Similarly, SuperGround closed a €2.5 million funding round to develop products from fish and chicken sidestreams, facing similar cost allocation pressures.

Even public support, such as the CAD 830,000 awarded by the Canadian government for Quebec fisheries projects, is often focused on infrastructure and sustainability, limiting immediate spending on advanced bacteriological testing. These financial trade-offs slow testing adoption despite clear safety needs.

Growth Opportunity

Rising Personal Care Brands Increase Microbial Safety Needs

A major growth opportunity for the Bacteriological Testing Market comes from the fast expansion of personal care and beauty brands that must meet strict microbial safety standards. As skincare and grooming products come into direct contact with skin, brands increasingly rely on bacteriological testing to ensure products remain safe, stable, and contamination-free throughout their shelf life.

In 2024, Yse Beauty secured USD 15 million in Series A funding, supporting product scaling where bacterial testing becomes essential. Similarly, luxury beauty brand Kimirica raised USD 15 million from Carnelian Ventures to expand premium offerings requiring high hygiene validation.

Large acquisitions, such as Unilever paying USD 1.5 billion for Dr. Squatch, further increase production volumes, creating sustained demand for bacteriological testing across manufacturing and quality control stages.

Latest Trends

Fresh Produce Supply Chains Demand Stronger Bacterial Testing

A key latest trend in the Bacteriological Testing Market is the rapid investment in fresh fruits and vegetables supply chains, which increases the need for routine bacterial safety checks. As companies shorten farm-to-consumer timelines, bacteriological testing becomes essential to detect contamination early and maintain freshness.

Handpickd raised USD 15 million to optimise fruits and vegetables distribution, where bacterial testing supports quality control during handling and transport. Similarly, KisanKonnect secured INR 72 crore to expand fresh produce sales, driving demand for microbial testing at aggregation and storage points.

In the UK, renewed focus on agricultural funding, including calls to continue a £40 million fruit and vegetable fund, further highlights the growing importance of bacteriological testing in fresh produce ecosystems to ensure safety, reduce waste, and protect consumer trust.

Regional Analysis

Europe dominated the Bacteriological Testing Market with 43.50% share, valued at USD 10.7 Bn.

Europe dominates the Bacteriological Testing Market, holding a 43.50% share and valued at USD 10.7 Bn, reflecting its strong regulatory framework, well-established laboratory infrastructure, and consistent focus on public health and food safety monitoring. The region’s leadership is supported by routine bacteriological testing across healthcare, food quality control, and environmental monitoring, where standardized testing practices are deeply integrated into operations.

North America represents a mature regional market characterized by widespread adoption of bacteriological testing in clinical diagnostics and industrial quality assurance, supported by structured testing protocols and advanced laboratory capabilities.

Asia Pacific shows steady market participation driven by expanding testing needs across population-dense economies and growing awareness of microbial safety in food, water, and healthcare settings.

The Middle East & Africa region reflects developing adoption patterns, where bacteriological testing is increasingly recognized as essential for public health surveillance and regulatory compliance. Latin America contributes to the overall market through routine testing activities linked to food safety, healthcare diagnostics, and environmental assessment.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Eurofins Scientific continues to play a central role in the bacteriological testing landscape through its broad laboratory network and deep technical expertise. In 2024, the company’s strength lies in its ability to deliver consistent, high-quality bacteriological analysis across food, environmental, and healthcare applications. Its focus on standardized testing procedures and laboratory scalability positions it as a trusted partner for routine and complex microbiological testing needs worldwide.

SGS Société Générale de Surveillance SA remains a key contributor to bacteriological testing by leveraging its long-standing inspection and testing capabilities. The company emphasizes reliability, regulatory alignment, and method validation, which supports widespread adoption of its bacteriological testing services. Its strong global presence allows SGS to support multinational clients requiring harmonized testing approaches across different regions and regulatory environments.

ALS holds a solid position in bacteriological testing through its focus on laboratory accuracy and operational efficiency. In 2024, ALS benefits from its experience in microbiological analysis and its commitment to quality-driven testing services. The company’s laboratory-driven model supports dependable bacteriological assessments, reinforcing its role in ensuring safety, compliance, and consistent testing outcomes across multiple end-use sectors.

Top Key Players in the Market

- Eurofins Scientific

- SGS Société Générale de Surveillance SA

- ALS

- Intertek Group plc

- Mérieux NutriSciences Corporation

- Certified Group

- TÜV SÜD

- Symbio Labs

- Alfa Chemistry

- AGQ Labs

Recent Developments

- In September 2025, the Australian Export Grains Innovation Centre (AEGIC) moved its laboratory operations to Symbio Laboratories. This change means that Symbio will now host AEGIC’s lab work, including testing and analysis support, at its facilities. The relocation expands Symbio’s role in providing laboratory testing services, strengthening its ability to handle samples and scientific work for agricultural and grain quality testing.

- In April 2025, Eurofins Scientific, a global bioanalytical testing company, completed the acquisition of SYNLAB’s clinical diagnostics testing operations in Spain. This deal expanded Eurofins’ clinical testing network, enabling its laboratories to serve over 10 million patients and process more than 100 million tests annually across the country.

Report Scope

Report Features Description Market Value (2024) USD 24.8 Billion Forecast Revenue (2034) USD 52.6 Billion CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Bacteria (Coliform, Pathogenic E. coli), By Technology (Traditional Technology, Rapid Technology, PCR, ELISA, Others), By Mode of Use (Portable / Field-use Devices, Laboratory-based Systems), By End-use (Food and Beverage, Fish and Seafood, Dairy, Processed Foods, Fruits and Vegetables, Pharmaceuticals, Cosmetics and Personal Care, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Eurofins Scientific, SGS Société Générale de Surveillance SA, ALS, Intertek Group plc, Mérieux NutriSciences Corporation, Certified Group, TÜV SÜD, Symbio Labs, Alfa Chemistry, AGQ Labs Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Bacteriological Testing MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Bacteriological Testing MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Eurofins Scientific

- SGS Société Générale de Surveillance SA

- ALS

- Intertek Group plc

- Mérieux NutriSciences Corporation

- Certified Group

- TÜV SÜD

- Symbio Labs

- Alfa Chemistry

- AGQ Labs