Global Automotive Towbar Market Size, Share, Growth Analysis By Type (Flange Towbar, Swan Neck Towbar, Fixed Towbar, Detachable Towbar), By Operating Mechanism (Manual/Non-electric, Semi-automatic, Fully-electric Retractable), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Sales Channel (Aftermarket, OEM), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 174505

- Number of Pages: 326

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

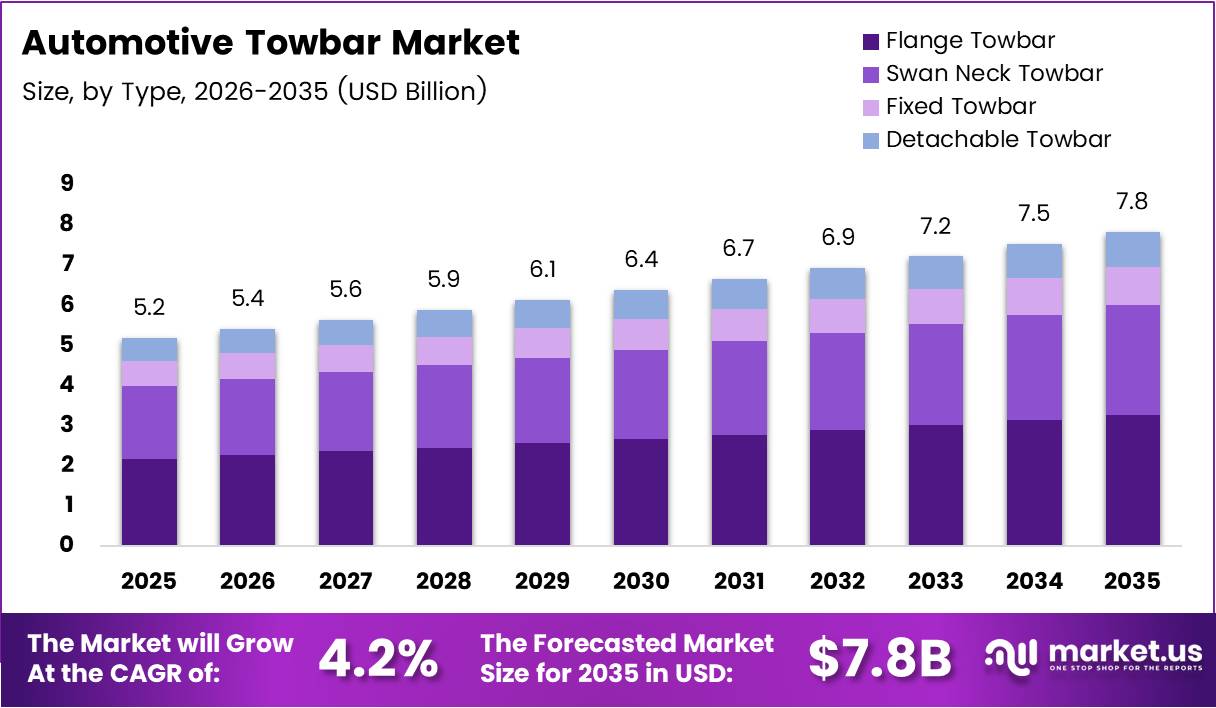

Global Automotive Towbar Market size is expected to be worth around USD 7.8 Billion by 2035 from USD 5.2 Billion in 2025, growing at a CAGR of 4.2% during the forecast period 2026 to 2035.

The automotive towbar market encompasses mechanical coupling devices designed to connect trailers, caravans, and cargo carriers to vehicles. These components enable safe load transfer and facilitate recreational towing activities. Moreover, towbars serve commercial transport applications across passenger cars and utility vehicles globally.

Market expansion reflects rising consumer preference for outdoor recreation and adventure tourism activities. Additionally, increasing ownership of SUVs and pickup trucks drives demand for factory-integrated towing solutions. Consequently, manufacturers focus on lightweight materials and modular designs to enhance vehicle efficiency and user convenience.

The aftermarket segment dominates sales channels due to flexible installation options and cost advantages. Furthermore, detachable towbar designs gain popularity among urban consumers seeking aesthetic vehicle appearance. However, regulatory compliance and safety certification requirements shape product development strategies across developed markets.

European manufacturers maintain technological leadership through advanced engineering and quality standards. Meanwhile, Asia Pacific regions exhibit strong growth potential driven by expanding middle-class populations. Therefore, companies invest in regional production facilities and distribution networks to capture emerging market opportunities.

Integration of sensor technology and trailer stability systems represents significant innovation direction. Subsequently, electric vehicle compatibility requirements influence material selection and design optimization efforts. The market demonstrates steady growth trajectory supported by lifestyle trends and infrastructure development investments.

According to the Tourism Research Australia, as of January 2024, Australia reached an all-time record of 901,000 registered caravans and campervans, a 27% increase compared to 2019 levels. Additionally, Australian recreational vehicle manufacturing data shows towable units accounted for 94% of all production in 2024, with traditional caravans representing 73% of output.

According to UK government statistics, light commercial vehicles accounted for 17% of all motor vehicle traffic in Great Britain in 2024. Van traffic reached 58.5 billion vehicle miles, representing a 9.5% increase over pre-pandemic levels, indicating strong demand for utility towing applications.

Key Takeaways

- Global Automotive Towbar Market valued at USD 5.2 Billion in 2025, projected to reach USD 7.8 Billion by 2035 at 4.2% CAGR

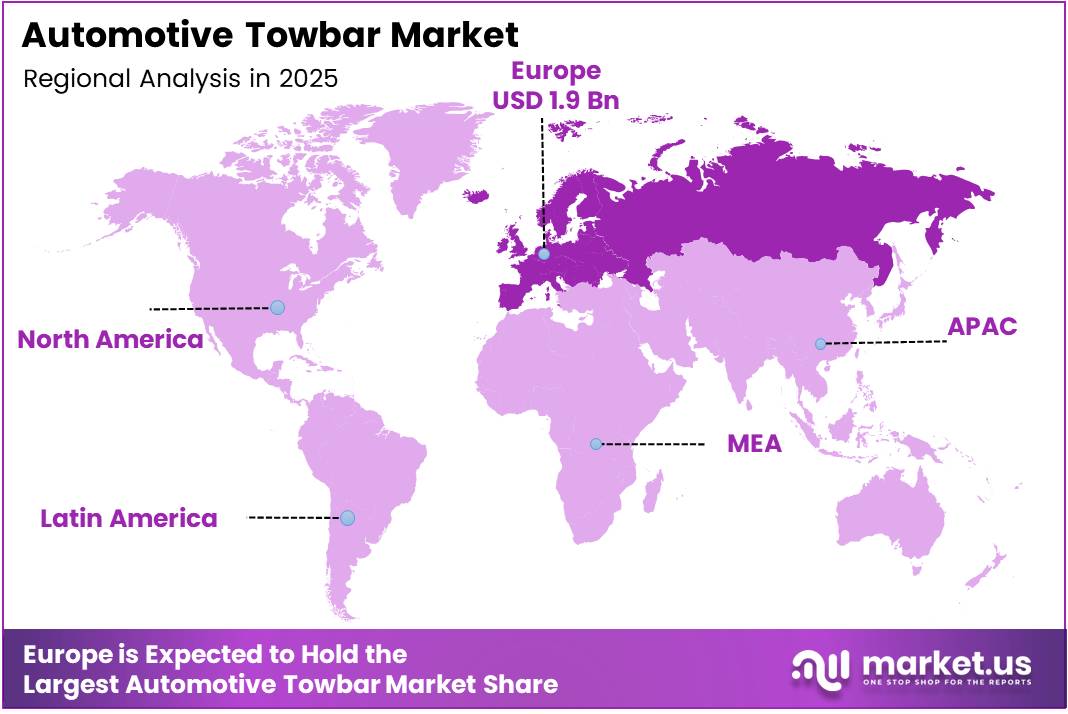

- Europe dominates with 37.7% market share, valued at USD 1.9 Billion in 2025

- Flange Towbar holds 38.6% share in Type segment

- Manual/Non-electric Operating Mechanism commands 64.8% market share

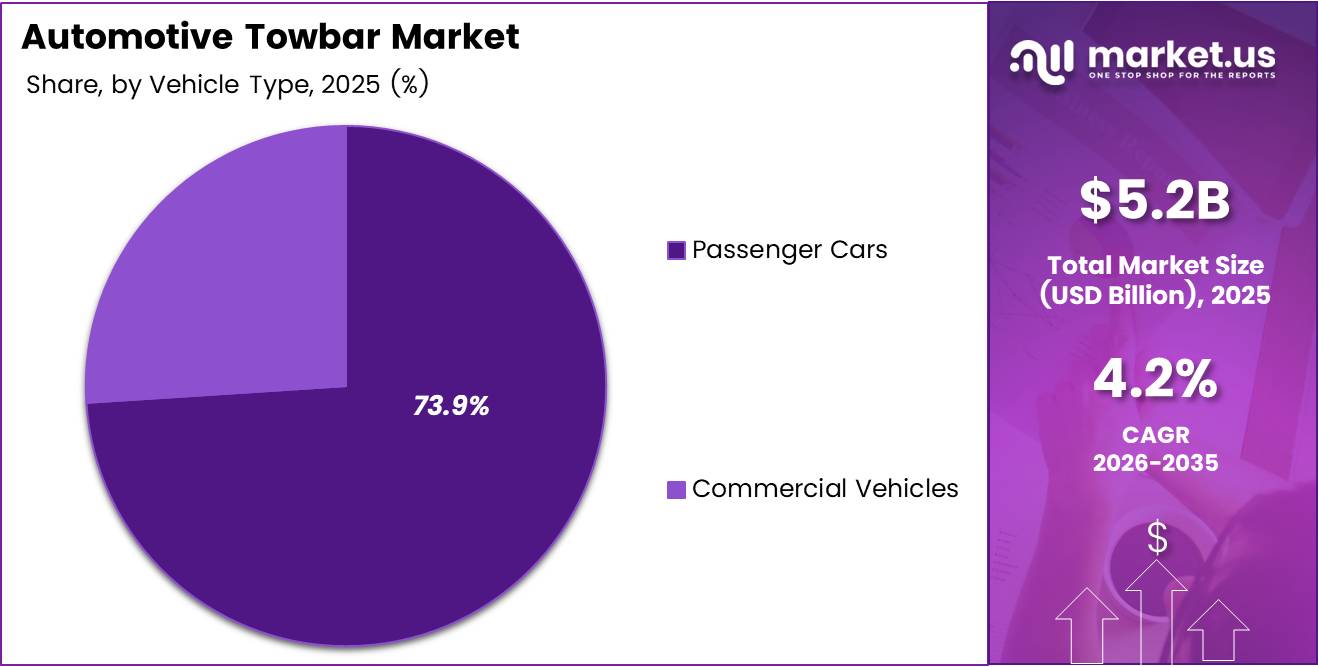

- Passenger Cars segment leads Vehicle Type category with 73.9% share

- Aftermarket Sales Channel dominates with 69.3% market share

Type Analysis

Flange Towbar dominates with 38.6% due to robust construction and universal vehicle compatibility.

In 2025, Flange Towbar held a dominant market position in the By Type segment of Automotive Towbar Market, with a 38.6% share. This towbar type features bolt-mounted flange plates that provide superior strength and load distribution capabilities. Consequently, commercial fleet operators and heavy-duty applications prefer flange designs for reliability and longevity.

Swan Neck Towbar offers streamlined aesthetics with concealed mounting hardware beneath vehicle bumpers. This design appeals to passenger car owners prioritizing visual appearance alongside functional towing capability. Moreover, swan neck configurations reduce aerodynamic drag and minimize dirt accumulation around coupling points.

Fixed Towbar provides permanent installation solutions with cost-effective manufacturing and simplified maintenance requirements. Fleet vehicles and utility applications favor fixed designs for consistent daily towing operations. Additionally, fixed towbars eliminate mechanical complexity associated with detachable systems.

Detachable Towbar enables removal when not in use, preserving vehicle appearance and reducing parking sensor interference. Urban consumers increasingly adopt detachable systems for occasional recreational towing needs. Furthermore, this design maintains vehicle resale value through flexible configuration options.

Operating Mechanism Analysis

Manual/Non-electric dominates with 64.8% due to affordability and mechanical simplicity.

In 2025, Manual/Non-electric held a dominant market position in the By Operating Mechanism segment of Automotive Towbar Market, with a 64.8% share. Manual systems require physical engagement and release through lever mechanisms or pin assemblies. Therefore, cost-conscious consumers and emerging markets prefer manual options for budget-friendly towing solutions.

Semi-automatic mechanisms incorporate spring-assisted coupling that reduces physical effort during trailer attachment procedures. This intermediate technology bridges manual and fully automated systems through enhanced user convenience. Moreover, semi-automatic designs maintain affordability while improving operational efficiency for frequent users.

Fully-electric Retractable systems deploy and retract towbars through electronic actuators controlled via vehicle interface panels. Premium vehicle segments increasingly integrate fully-electric mechanisms for luxury user experience. Additionally, retractable designs optimize aerodynamics and fuel efficiency when towing capability remains unused.

Vehicle Type Analysis

Passenger Cars dominate with 73.9% due to widespread SUV adoption and recreational towing demand.

In 2025, Passenger Cars held a dominant market position in the By Vehicle Type segment of Automotive Towbar Market, with a 73.9% share. Sport utility vehicles and crossovers increasingly feature factory tow ratings that accommodate caravan and trailer applications. Consequently, lifestyle consumers drive passenger car towbar installations for leisure activities.

Commercial Vehicles utilize towbars for work-related cargo transport and utility trailer operations across construction and logistics sectors. Light commercial vans require robust towing solutions for daily business applications. Furthermore, commercial segment demands higher load capacities and durability standards compared to passenger applications.

Sales Channel Analysis

Aftermarket dominates with 69.3% due to installation flexibility and competitive pricing.

In 2025, Aftermarket held a dominant market position in the By Sales Channel segment of Automotive Towbar Market, with a 69.3% share. Independent installers and automotive accessory retailers provide customized towbar solutions for existing vehicle fleets. Moreover, aftermarket channels offer diverse product ranges accommodating specific towing requirements.

OEM channels integrate towbars during vehicle manufacturing processes with factory warranties and certification compliance. Premium automakers increasingly offer factory-installed towing packages as optional equipment. Additionally, OEM installations ensure complete vehicle system integration including electrical harnesses and stability control calibration.

Key Market Segments

By Type

- Flange Towbar

- Swan Neck Towbar

- Fixed Towbar

- Detachable Towbar

By Operating Mechanism

- Manual/Non-electric

- Semi-automatic

- Fully-electric Retractable

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Sales Channel

- Aftermarket

- OEM

Drivers

Rising Adoption of Passenger SUVs and Crossovers with Factory Tow Ratings Drives Market Growth

Modern SUV platforms increasingly incorporate towing capability as standard or optional equipment configurations. Automakers respond to consumer demand for versatile vehicles supporting both daily commuting and weekend recreation. Consequently, factory tow ratings enhance vehicle utility without compromising passenger comfort or safety features.

Crossover segments expand market reach beyond traditional truck-based towing platforms through unibody construction advancements. Moreover, improved suspension systems and transmission technologies enable smaller vehicles to safely tow recreational equipment. Therefore, towbar installations extend across broader vehicle categories.

Growth in recreational towing for caravans, boat trailers, and utility trailers reflects lifestyle changes toward outdoor activities. Additionally, expansion of pickup truck ownership in urban markets creates new customer segments. Furthermore, multi-purpose vehicle demand strengthens as consumers seek flexible transportation solutions for diverse applications.

Restraints

High Installation and Vehicle Re-Certification Costs Limit Market Penetration

Professional towbar installation requires specialized equipment and technical expertise, increasing total ownership costs significantly. Vehicle modifications may void manufacturer warranties unless performed through authorized service networks. Consequently, price-sensitive consumers delay or avoid towbar installations despite towing needs.

Re-certification procedures in developed markets ensure compliance with safety and emission standards after modifications. Regulatory testing imposes administrative burdens and additional expenses on vehicle owners. Moreover, stringent trailer stability regulations mandate electronic system integration, elevating technical complexity.

Safety compliance requirements vary across jurisdictions, creating barriers for standardized product development strategies. Furthermore, liability concerns influence consumer decisions regarding aftermarket modifications versus factory-installed solutions. Therefore, regulatory frameworks shape market dynamics and adoption patterns globally.

Growth Factors

Integration of Smart Towbars with Trailer Stability Assist Technology Creates Opportunities

Advanced sensor systems monitor trailer sway and automatically apply corrective braking interventions during unstable conditions. Smart towbar technology enhances safety margins for inexperienced towers through electronic assistance features. Consequently, manufacturers differentiate product offerings through intelligent connectivity and driver assistance integration.

Increasing electric SUV sales require lightweight aluminum towbar designs that minimize impact on driving range. Material innovation supports sustainability objectives while maintaining structural strength and load capacity requirements. Moreover, aftermarket custom towbar kits for compact cars expand addressable market segments.

Rising caravan tourism and road-trip culture in emerging economies stimulate demand for affordable towing solutions. Growing middle-class populations pursue leisure travel experiences requiring vehicle-trailer combinations. Additionally, infrastructure development facilitates long-distance recreational travel across previously inaccessible regions. Therefore, demographic shifts create sustained growth opportunities.

Emerging Trends

Surge in Detachable and Foldable Towbar Installations Reflects Urban Consumer Preferences

Removable towbar designs address aesthetic concerns among passenger car owners who tow infrequently throughout the year. Urban parking constraints favor compact vehicle profiles when trailers remain disconnected. Consequently, detachable mechanisms gain market share through enhanced versatility and appearance preservation.

Growing preference for corrosion-resistant powder-coated towbars extends product lifespan in harsh environmental conditions. Advanced coating technologies protect steel components from salt exposure and weathering effects. Moreover, colored finishes enable customization matching vehicle exterior themes.

Increased demand for plug-and-play electrical towbar harness systems simplifies installation procedures for aftermarket applications. Standardized connector interfaces reduce installation time and eliminate custom wiring requirements. Additionally, aerodynamic towbar designs minimize fuel consumption penalties through optimized airflow management. Therefore, innovation focuses on user convenience and operational efficiency.

Regional Analysis

Europe Dominates the Automotive Towbar Market with a Market Share of 37.7%, Valued at USD 1.9 Billion

Europe maintains market leadership through established caravan tourism culture and comprehensive towing infrastructure networks. The region’s 37.7% market share reflects strong consumer preference for recreational vehicles and trailer-based leisure activities, valued at USD 1.9 Billion in 2025. Moreover, stringent safety regulations drive adoption of certified towbar systems. Consequently, European manufacturers set global quality benchmarks through advanced engineering capabilities and compliance standards.

Asia Pacific Automotive Towbar Market Trends

Asia Pacific demonstrates rapid growth potential driven by expanding middle-class populations and increasing vehicle ownership rates. Rising disposable incomes enable recreational spending on caravans and outdoor equipment across emerging economies. Additionally, infrastructure development facilitates long-distance travel and adventure tourism activities. Therefore, manufacturers establish regional production facilities targeting cost-sensitive consumer segments.

North America Automotive Towbar Market Trends

North America exhibits strong demand through widespread pickup truck culture and utility vehicle preferences among consumers. The region’s extensive highway networks support trailer-based commerce and recreational activities across vast geographic areas. Moreover, camping traditions and boat ownership drive consistent aftermarket towbar sales. Furthermore, light-duty truck platforms dominate new vehicle sales with integrated towing capabilities.

Latin America Automotive Towbar Market Trends

Latin America shows emerging growth as economic development expands commercial vehicle fleets and recreational vehicle ownership. Agricultural and construction sectors require utility towing solutions for work-related transport applications. Additionally, coastal regions demonstrate boat trailer demand supporting fishing and tourism industries. Therefore, aftermarket channels dominate distribution through flexible installation options.

Middle East & Africa Automotive Towbar Market Trends

Middle East & Africa markets develop gradually through increasing SUV adoption and adventure tourism infrastructure investments. Desert regions favor robust towbar systems capable of handling off-road and utility trailer applications. Moreover, commercial sectors utilize light trucks with towing capability for business operations. Furthermore, expatriate communities introduce caravan culture driving specialized product demand.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Towbar Company Insights

Brink Group B.V maintains strong European market presence through comprehensive product portfolios covering detachable and fixed towbar systems. The company emphasizes vehicle-specific engineering solutions ensuring perfect fit and regulatory compliance across diverse automotive platforms. Moreover, Brink leverages extensive distribution networks reaching independent installers and authorized dealerships throughout the region.

Bosal International N.V operates as a leading global manufacturer with integrated production facilities serving OEM and aftermarket channels simultaneously. The company invests in lightweight aluminum towbar development supporting electric vehicle applications and fuel efficiency objectives. Additionally, Bosal’s quality management systems meet stringent automotive industry standards, ensuring consistent product reliability.

Westfalia-Automotive GmbH pioneered detachable towbar technology and continues innovation leadership through electrically retractable systems and smart connectivity features. The manufacturer supplies premium vehicle brands with factory-installed towing solutions featuring integrated electrical harnesses and stability control calibration. Furthermore, Westfalia’s aftermarket divisions provide retrofit kits for existing vehicle fleets.

PCT Automotive Ltd. specializes in aftermarket towbar solutions with competitive pricing strategies targeting cost-conscious consumer segments across Europe and Asia Pacific. The company maintains extensive product catalogs covering passenger cars and commercial vehicles through modular design approaches. Consequently, PCT expands market reach through partnerships with automotive accessory retailers and installation service providers.

Key Players

- Brink Group B.V

- Bosal International N.V

- Westfalia-Automotive GmbH

- PCT Automotive Ltd.

- GDW N.V

- Tow-Trust Towbars

- Pulliam Enterprises Inc

- Horizon Global

- Curt Manufacturing LLC

Recent Developments

- In March 2025, Lippert, parent company of the CURT brand, acquired the assets of RVibrake, a supplemental braking system provider. This acquisition strengthens Lippert’s position in the recreational vehicle safety equipment market and expands its product portfolio.

- In July 2025, VBG Group AB through its Ringfeder Power Transmission division acquired the German firm M.A.T. Malmedie Antriebstechnik GmbH. The transaction enhances VBG’s engineering capabilities and European manufacturing footprint in precision automotive components.

- In December 2024, DexKo Global Inc., parent of AL-KO Vehicle Technology, completed the acquisition of Cerma Srl, an Italian manufacturer of high-precision hydraulic components. This strategic move diversifies DexKo’s technology offerings in the towbar and trailer systems segment.

Report Scope

Report Features Description Market Value (2025) USD 5.2 Billion Forecast Revenue (2035) USD 7.8 Billion CAGR (2026-2035) 4.2% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Flange Towbar, Swan Neck Towbar, Fixed Towbar, Detachable Towbar), By Operating Mechanism (Manual/Non-electric, Semi-automatic, Fully-electric Retractable), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Sales Channel (Aftermarket, OEM) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Brink Group B.V, Bosal International N.V, Westfalia-Automotive GmbH, PCT Automotive Ltd., GDW N.V, Tow-Trust Towbars, Pulliam Enterprises Inc, Horizon Global, Curt Manufacturing LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Brink Group B.V

- Bosal International N.V

- Westfalia-Automotive GmbH

- PCT Automotive Ltd.

- GDW N.V

- Tow-Trust Towbars

- Pulliam Enterprises Inc

- Horizon Global

- Curt Manufacturing LLC