Global Automotive Intercooler Market Size, Share, Growth Analysis Type (Air to Air Intercooler, Air to Water Intercooler), Vehicle Type (Passenger Car, Two-Wheeler, Light Commercial Vehicle, Medium & Heavy Commercial Vehicle, OTR), Design Type (Front Mounted, Top Mounted, Side Mounted), Engine Type (Turbocharged Engine, Supercharged Engine), Sales Channel (OEM, Replacement), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 177868

- Number of Pages: 386

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

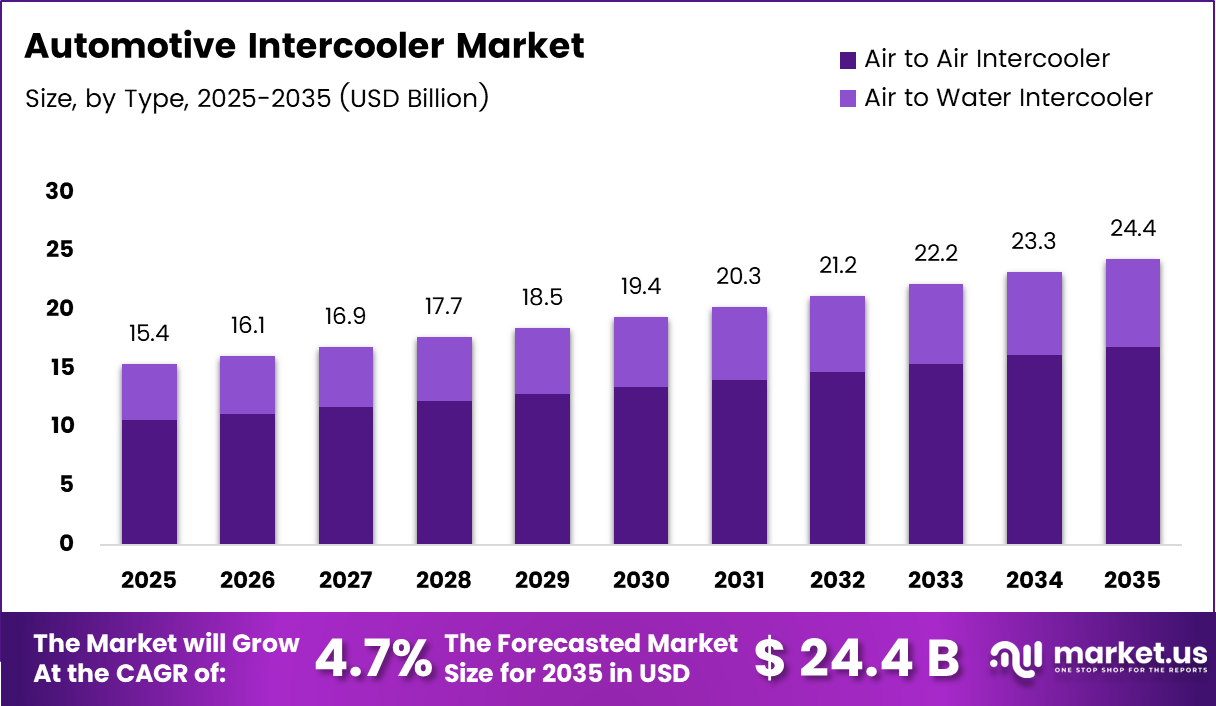

Global Automotive Intercooler Market size is expected to be worth around USD 24.4 Billion by 2035 from USD 15.4 Billion in 2025, growing at a CAGR of 4.7% during the forecast period 2026 to 2035.

The automotive intercooler market represents a critical segment within the global automotive thermal management industry. Intercoolers function as heat exchangers designed to cool compressed air from turbochargers or superchargers before it enters the engine combustion chamber. This cooling process increases air density, thereby improving engine performance and fuel efficiency significantly.

Moreover, intercoolers play a vital role in preventing engine knock and reducing thermal stress on engine components. They enable automakers to achieve higher power output from smaller displacement engines through forced induction technology. Consequently, the adoption of intercoolers has become integral to modern engine design strategies focused on downsizing.

The market is experiencing robust growth driven by stringent emission regulations and rising consumer demand for fuel-efficient vehicles. Additionally, the automotive industry’s shift toward turbocharged engines to meet environmental standards has accelerated intercooler adoption. Therefore, both passenger and commercial vehicle segments are witnessing increased integration of advanced intercooler systems.

Furthermore, technological advancements in intercooler design have enhanced thermal efficiency and reduced packaging constraints. Manufacturers are developing lightweight aluminum intercoolers with optimized bar-and-plate configurations to maximize heat dissipation. However, design complexity and material costs remain considerations for widespread adoption across all vehicle segments.

According to Natrad, compressed air from turbochargers can reach temperatures over 205°C in extreme conditions, necessitating effective cooling solutions. FMIC reports that air heated to nearly 200°C by turbos requires intercooling, where every 10°C reduction in air temperature increases air density by approximately 3-5%, translating to similar performance gains.

The market benefits from increasing production of performance-oriented passenger vehicles and commercial vehicles with turbocharged diesel engines. Additionally, the growing aftermarket performance upgrade culture in emerging economies presents substantial growth opportunities. Therefore, manufacturers are focusing on innovative thermal system integration and computational fluid dynamics optimization to meet evolving industry demands.

Key Takeaways

- Global Automotive Intercooler Market is projected to reach USD 24.4 Billion by 2035, growing at a CAGR of 4.7%

- Air to Air Intercooler segment dominates with 69.3% market share in 2025

- Passenger Car segment leads vehicle type category with 45.7% share

- Front Mounted design type holds dominant position with 59.9% market share

- Turbocharged Engine segment accounts for 81.5% of the market

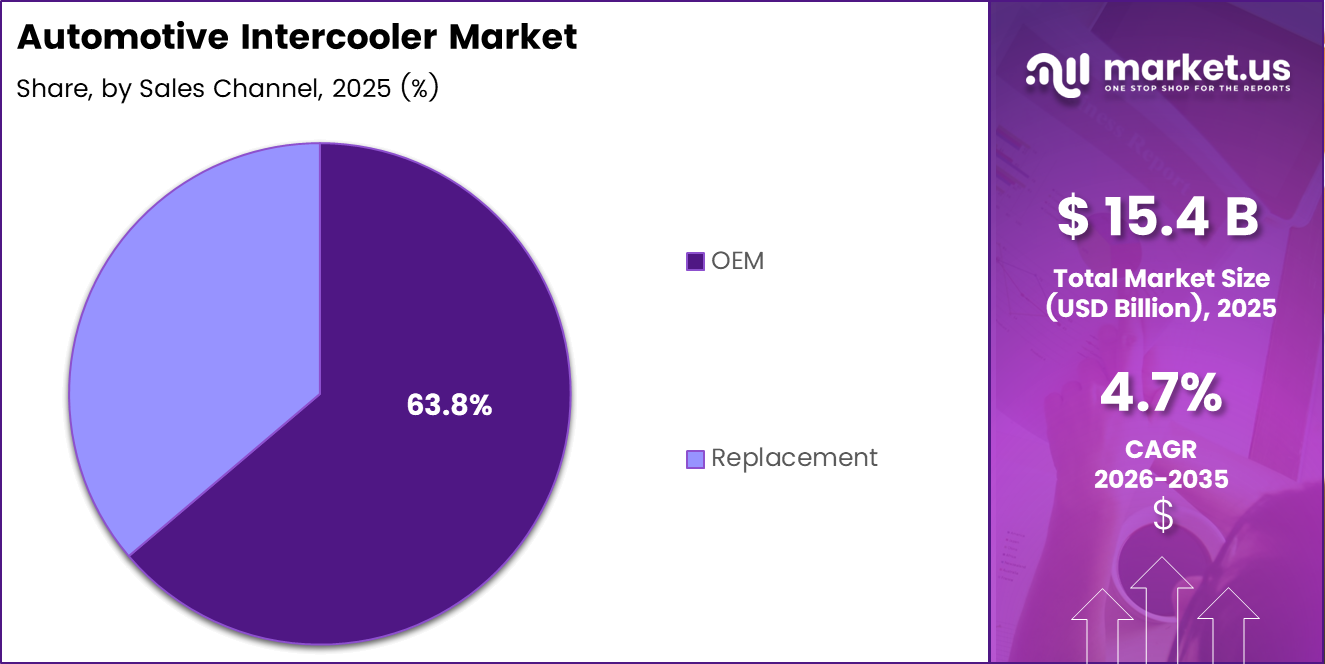

- OEM sales channel represents 63.8% of total market revenue

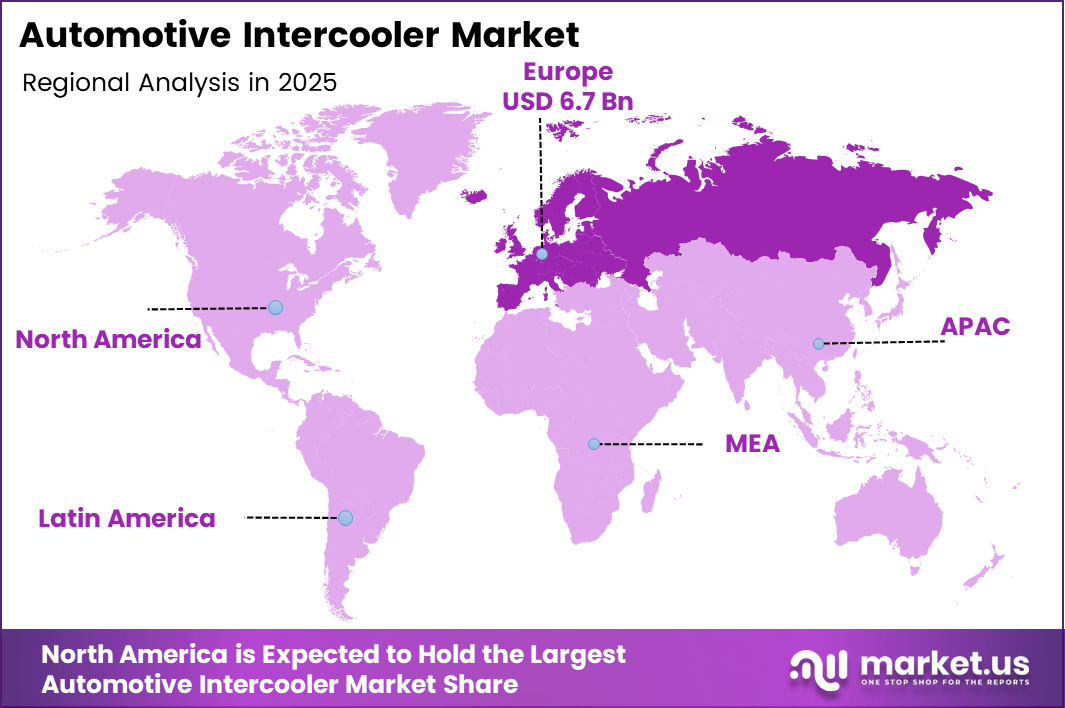

- Europe dominates regional market with 43.80% share, valued at USD 6.7 Billion

Type Analysis

Air to Air Intercooler dominates with 69.3% due to superior cost-effectiveness and widespread OEM adoption.

In 2025, Air to Air Intercooler held a dominant market position in the Type segment of Automotive Intercooler Market, with a 69.3% share. This segment’s leadership stems from its simpler design architecture, lower manufacturing costs, and easier integration into existing vehicle platforms. Moreover, air-to-air systems deliver consistent performance across diverse operating conditions without requiring additional coolant circulation systems.

Air to Water Intercooler represents a specialized segment gaining traction in high-performance and luxury vehicle applications. These systems offer superior cooling efficiency in compact packaging configurations, making them ideal for space-constrained engine bays. However, their complexity and higher initial costs limit mainstream adoption compared to air-to-air alternatives.

Vehicle Type Analysis

Passenger Car dominates with 45.7% due to mass-market turbocharged engine adoption and emission compliance requirements.

In 2025, Passenger Car held a dominant market position in the Vehicle Type segment of Automotive Intercooler Market, with a 45.7% share. This dominance reflects the widespread adoption of turbocharged gasoline engines in sedans, hatchbacks, and SUVs to meet fuel economy standards. Additionally, consumer preference for performance-oriented driving dynamics has accelerated intercooler integration in mainstream passenger vehicles.

Two-Wheeler segment encompasses motorcycles and scooters equipped with forced induction systems for performance enhancement. This niche category is expanding particularly in premium motorcycle segments where manufacturers seek competitive differentiation through power delivery. Consequently, specialized compact intercooler designs are being developed for two-wheeler applications.

Light Commercial Vehicle segment utilizes intercoolers primarily in turbocharged diesel engines for improved payload capacity and operational efficiency. Fleet operators increasingly demand vehicles with enhanced fuel economy, driving intercooler adoption in delivery vans and small trucks. Therefore, this segment shows steady growth aligned with commercial vehicle production trends.

Medium & Heavy Commercial Vehicle and OTR segments represent critical applications where intercoolers support high-boost turbocharged diesel engines. These vehicles require robust thermal management to maintain performance during extended operational cycles and heavy-duty applications. Moreover, stringent emission norms for commercial vehicles mandate advanced charge air cooling solutions across these categories.

Design Type Analysis

Front Mounted dominates with 59.9% due to optimal airflow exposure and thermal efficiency advantages.

In 2025, Front Mounted held a dominant market position in the Design Type segment of Automotive Intercooler Market, with a 59.9% share. This configuration benefits from direct exposure to ambient airflow during vehicle motion, maximizing heat dissipation without requiring additional cooling fans. Consequently, front-mounted intercoolers deliver superior thermal performance across varied driving conditions.

Top Mounted intercoolers are predominantly found in performance vehicles with hood scoop designs that channel ram air directly onto the heat exchanger. This configuration offers shorter intake piping routes, reducing turbo lag and improving throttle response. However, packaging constraints and styling considerations limit widespread application beyond specialized performance segments.

Side Mounted intercoolers represent alternative configurations used when front or top mounting is not feasible due to vehicle architecture limitations. These systems require careful airflow management and ducting to maintain cooling efficiency comparable to front-mounted alternatives. Additionally, side-mounted designs offer packaging flexibility for vehicles with unique engine bay layouts.

Engine Type Analysis

Turbocharged Engine dominates with 81.5% due to global shift toward forced induction for efficiency and performance.

In 2025, Turbocharged Engine held a dominant market position in the Engine Type segment of Automotive Intercooler Market, with an 81.5% share. This overwhelming dominance reflects the automotive industry’s widespread adoption of turbocharging technology to achieve emission compliance while maintaining performance. Moreover, turbocharged engines have become the primary powertrain solution across passenger and commercial vehicle segments globally.

Supercharged Engine segment represents a smaller but specialized market focusing on immediate throttle response and linear power delivery characteristics. Superchargers provide consistent boost across engine speed ranges without turbo lag, making them attractive for performance applications. However, their parasitic power consumption and lower efficiency compared to turbochargers limit mainstream adoption in modern fuel-conscious automotive markets.

Sales Channel Analysis

OEM dominates with 63.8% due to factory-fitted intercooler integration in new vehicle production.

In 2025, OEM held a dominant market position in the Sales Channel segment of Automotive Intercooler Market, with a 63.8% share. This segment’s leadership reflects the growing adoption of turbocharged engines in new vehicle production, where intercoolers are integrated as standard equipment. Additionally, OEM specifications drive technological advancement and quality standards across the intercooler manufacturing industry.

Replacement channel serves the aftermarket segment where vehicle owners upgrade or replace worn intercoolers for performance enhancement or maintenance. This segment shows particular strength in regions with aging vehicle fleets and strong automotive tuning cultures. Consequently, aftermarket suppliers offer diverse product ranges catering to both performance enthusiasts and standard replacement requirements.

Drivers

Rising Adoption of Turbocharged Engines for Fuel Efficiency and Power Density

The automotive industry’s transition toward turbocharged powertrains represents the primary growth driver for intercooler market expansion. Automakers globally are implementing forced induction technology to achieve stringent fuel economy targets while maintaining consumer-expected performance levels. Moreover, engine downsizing strategies rely fundamentally on turbocharging combined with effective charge air cooling to prevent performance degradation.

Turbocharged engines deliver significantly higher power output per displacement unit compared to naturally aspirated alternatives, enabling manufacturers to reduce engine sizes without sacrificing capability. This approach directly supports corporate average fuel economy compliance and carbon emission reduction initiatives. Consequently, the penetration of turbocharged engines across vehicle segments from compact cars to heavy-duty trucks continues accelerating.

Furthermore, consumer awareness regarding fuel efficiency benefits has increased acceptance of turbocharged powertrains across global markets. The integration of intercoolers ensures these engines operate within optimal temperature ranges, maximizing efficiency gains and longevity. Therefore, the symbiotic relationship between turbocharging adoption and intercooler demand establishes a robust foundation for sustained market growth.

Restraints

High Material and Manufacturing Costs of Advanced Aluminum Intercoolers Limit Market Adoption

The production of high-performance intercoolers requires precision-engineered aluminum components with complex internal fin structures to maximize heat transfer efficiency. These manufacturing processes involve significant material costs and specialized fabrication techniques that increase unit prices substantially. Moreover, the need for rigorous quality control and pressure testing adds further cost burden to manufacturers.

Design complexity creates additional challenges particularly for compact vehicle platforms where packaging constraints demand custom-engineered solutions for each application. This customization requirement prevents economies of scale and maintains higher per-unit development costs compared to standardized components. Consequently, cost-sensitive vehicle segments may delay or limit intercooler adoption despite performance benefits.

Furthermore, the price differential between basic and advanced intercooler systems influences purchasing decisions in emerging markets where vehicle affordability remains paramount. OEMs must balance performance enhancement against cost competitiveness, sometimes compromising on intercooler specifications to meet target price points. Therefore, material and manufacturing cost pressures continue constraining market expansion across budget-oriented vehicle categories.

Growth Factors

Integration of Intercoolers with Hybrid and Mild-Hybrid Powertrain Architectures Accelerates Market Expansion

The automotive industry’s electrification trajectory includes numerous hybrid configurations that retain turbocharged internal combustion engines requiring effective thermal management solutions. Mild-hybrid systems combining turbochargers with electric motor assistance present new opportunities for advanced intercooler integration. Moreover, these powertrain architectures demand precise temperature control to optimize combined efficiency of electrical and combustion components.

Expanding demand for air-to-liquid intercoolers in high-boost applications reflects the performance segment’s pursuit of maximum power density and thermal efficiency. These sophisticated systems offer superior cooling capacity in compact packages, enabling extreme boost pressures exceeding traditional air-to-air limitations. Consequently, manufacturers are investing in advanced materials and design methodologies to support this growing segment.

Rising aftermarket performance upgrade culture in emerging economies creates substantial replacement and enhancement opportunities beyond original equipment applications. Enthusiast communities in Asia Pacific and Latin America increasingly modify vehicles with upgraded intercooler systems to extract additional performance. Therefore, specialized aftermarket suppliers are expanding product offerings tailored to regional preferences and popular vehicle platforms.

Emerging Trends

Shift Toward Lightweight, High-Efficiency Bar-and-Plate Intercooler Designs Reshapes Market Landscape

Advanced manufacturing techniques enable production of optimized bar-and-plate intercooler cores offering superior thermal performance with reduced weight compared to traditional tube-and-fin constructions. These designs maximize heat transfer surface area while minimizing flow resistance and pressure drop across the heat exchanger. Moreover, computational modeling allows engineers to optimize internal geometry for specific application requirements.

Increasing use of computational fluid dynamics during intercooler development accelerates design optimization and reduces physical prototyping requirements significantly. CFD simulation enables manufacturers to predict thermal performance, pressure characteristics, and airflow patterns with high accuracy before production tooling investment. Consequently, development cycles shorten while product performance and reliability improve through virtual validation processes.

Modular thermal system integration combining intercoolers with radiators and other heat exchangers into unified assemblies represents an emerging approach to packaging optimization. This strategy reduces component count, simplifies installation procedures, and improves overall thermal management system efficiency. Therefore, OEMs increasingly specify integrated thermal modules that streamline manufacturing processes and enhance vehicle-level thermal performance coordination.

Regional Analysis

Europe Dominates the Automotive Intercooler Market with a Market Share of 43.80%, Valued at USD 6.7 Billion

In 2025, Europe held a dominant market position with a 43.80% share, valued at USD 6.7 Billion, driven by stringent emission regulations and high turbocharged diesel penetration. The region’s established automotive manufacturing base and consumer preference for performance-oriented vehicles support robust intercooler demand. Moreover, European OEMs lead global innovation in downsized turbocharged powertrains requiring advanced thermal management solutions.

North America Automotive Intercooler Market Trends

North America demonstrates strong intercooler market growth supported by increasing turbocharged gasoline engine adoption across light-duty vehicles and pickup trucks. Additionally, the region’s performance vehicle segment and aftermarket tuning culture contribute substantially to replacement channel revenues. Therefore, manufacturers focus on developing products tailored to American consumer preferences for power and towing capability.

Asia Pacific Automotive Intercooler Market Trends

Asia Pacific represents the fastest-growing regional market driven by expanding automotive production in China, India, and Southeast Asian nations. Rising middle-class income levels and increasing vehicle ownership rates accelerate demand for fuel-efficient turbocharged vehicles. Consequently, both passenger car and commercial vehicle segments show strong intercooler adoption trajectories across the region.

Middle East & Africa Automotive Intercooler Market Trends

Middle East and Africa markets exhibit growing intercooler demand primarily through commercial vehicle segments operating in extreme temperature conditions requiring robust thermal management. Additionally, premium passenger vehicle imports with turbocharged engines contribute to regional market development. However, price sensitivity and infrastructure limitations moderate overall market growth compared to other regions.

Latin America Automotive Intercooler Market Trends

Latin America shows steady intercooler market expansion supported by recovering automotive production and increasing turbocharged vehicle availability in mainstream segments. Brazil and Mexico lead regional demand through both manufacturing activity and growing replacement market opportunities. Therefore, manufacturers are establishing localized supply chains to serve this developing market efficiently.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Bell Intercoolers specializes in high-performance intercooler manufacturing for motorsport and premium automotive applications, offering custom-engineered solutions with advanced core designs. The company has established a strong reputation in the aftermarket performance segment through technical innovation and quality manufacturing. Moreover, Bell’s expertise in air-to-air and air-to-water configurations serves diverse customer requirements across racing and street performance applications.

Valeo represents a global tier-one automotive supplier with comprehensive thermal management capabilities including intercooler design and production for major OEM customers worldwide. The company leverages advanced manufacturing technologies and extensive research facilities to develop next-generation thermal solutions. Additionally, Valeo’s integrated approach combines intercoolers within broader powertrain thermal management systems, delivering optimized vehicle-level performance and efficiency.

Garrett Motion Inc. brings deep turbocharging expertise to intercooler development, offering integrated boosting and charge air cooling solutions that maximize system efficiency. The company’s engineering capabilities span from turbocharger matching to complete thermal management optimization for turbocharged powertrains. Consequently, Garrett provides OEM customers with comprehensive forced induction packages that simplify integration and enhance overall performance delivery.

MANN+HUMMEL Group maintains a strong position in automotive filtration and thermal management, including advanced intercooler manufacturing for passenger and commercial vehicle applications. The company’s global production network and engineering resources support major automotive manufacturers with high-volume production capabilities. Furthermore, MANN+HUMMEL’s focus on lightweight materials and optimized designs aligns with industry trends toward efficiency and sustainability.

Key players

- Bell Intercoolers

- Valeo

- Garrett Motion Inc.

- MANN+HUMMEL Group

- Nissens Automotive A/S.

- KALE Oto Radyatör A.Ş

- NRF Global

- Mishimoto Automotive

- Modine Manufacturing Company

- Pro Alloy Motorsport Ltd

Recent Developments

- July 2024 – Imperial Auto Industries Ltd., a leading global manufacturer of fluid transmission products, acquired the assets of Metallwerk Biebighäuser GmbH, a German manufacturer of metal tubular assemblies for the automotive industry. The acquisition also includes Biebighäuser’s Slovakian subsidiary and was executed through IAIL’s German arm, Imperial Auto Germany GmbH, strengthening the company’s European manufacturing capabilities.

- November 2024 – SMP completed the acquisition of European aftermarket supplier Nissens Automotive, expanding its thermal management product portfolio and strengthening its position in the European replacement parts market. This strategic acquisition enhances SMP’s ability to serve customers across diverse automotive thermal management applications including intercoolers and heat exchangers.

Report Scope

Report Features Description Market Value (2025) USD 15.4 Billion Forecast Revenue (2035) USD 24.4 Billion CAGR (2026-2035) 4.7% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Type (Air to Air Intercooler, Air to Water Intercooler), Vehicle Type (Passenger Car, Two-Wheeler, Light Commercial Vehicle, Medium & Heavy Commercial Vehicle, OTR), Design Type (Front Mounted, Top Mounted, Side Mounted), Engine Type (Turbocharged Engine, Supercharged Engine), Sales Channel (OEM, Replacement) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Bell Intercoolers, Valeo, Garrett Motion Inc., MANN+HUMMEL Group, Nissens Automotive A/S., KALE Oto Radyatör A.Ş, NRF Global, Mishimoto Automotive, Modine Manufacturing Company, Pro Alloy Motorsport Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Intercooler MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Automotive Intercooler MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Bell Intercoolers

- Valeo

- Garrett Motion Inc.

- MANN+HUMMEL Group

- Nissens Automotive A/S.

- KALE Oto Radyatör A.Ş

- NRF Global

- Mishimoto Automotive

- Modine Manufacturing Company

- Pro Alloy Motorsport Ltd