Global Automotive Direct Methanol Fuel Cell Market Size, Share, Growth Analysis By Component (Fuel Cell Stack, Balance of System, Fuel Cartridge), By Power Output (Less Than 1 kW, 1 kW to 5 kW, Greater Than 5 kW), By Vehicle Type (Passenger Vehicles, Commercial Vehicles), By Application (Range Extender, Auxiliary Power Unit, Portable Power, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 168356

- Number of Pages: 334

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

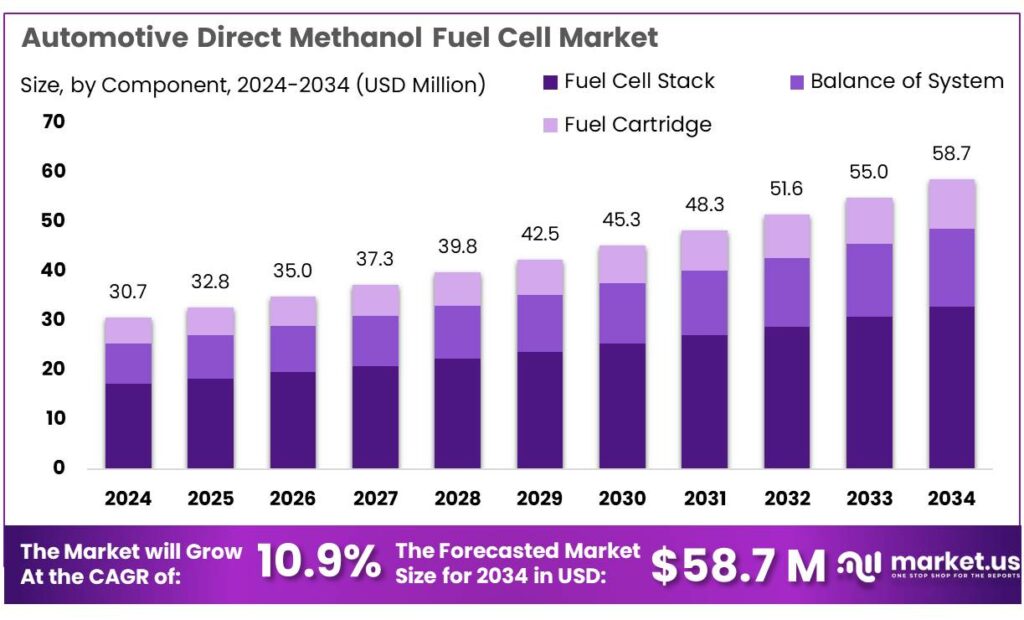

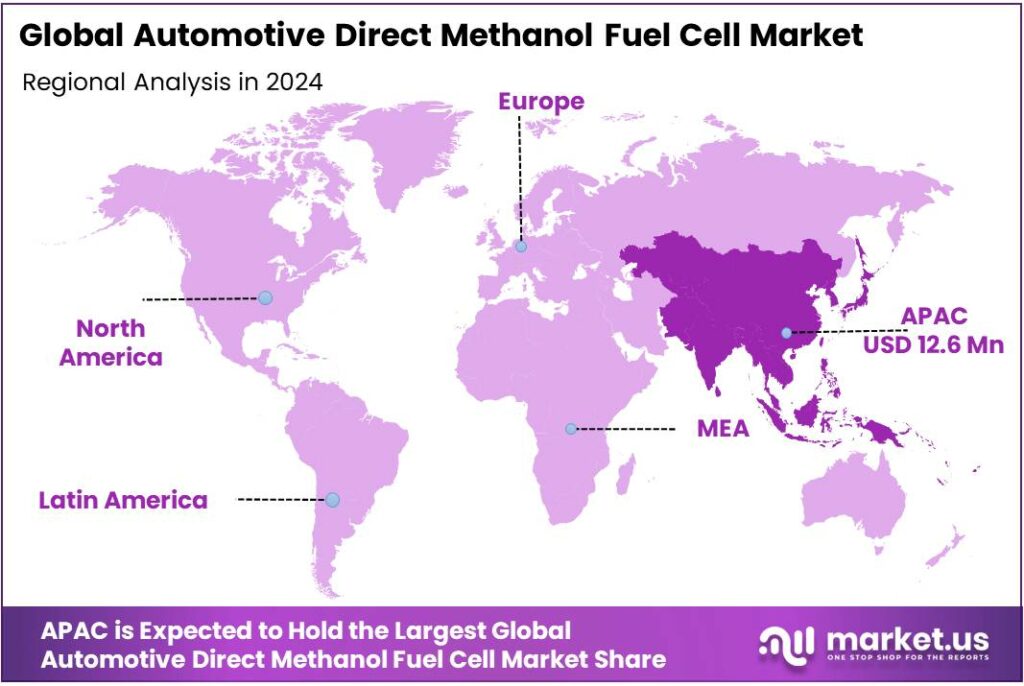

The Global Automotive Direct Methanol Fuel Cell Market size is expected to be worth around USD 58.7 Million by 2034, from USD 30.7 Million in 2024, growing at a CAGR of 10.9% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominan market position, capturing more than a 41.20% share, holding USD 12.6 Million revenue.

Automotive direct methanol fuel cells (DMFCs) sit at the intersection of fuel-cell mobility and liquid-fuel logistics. Unlike conventional proton-exchange membrane fuel cells that require compressed hydrogen, DMFCs electrochemically convert liquid methanol directly into electricity at the anode, simplifying onboard storage and refuelling. This makes them attractive for vehicles and range-extender systems where hydrogen infrastructure is limited and where a compact liquid tank is easier to integrate than high-pressure cylinders.

- According to the IEA, Korea now hosts over half of all fuel cell cars globally, while the United States has more than 15,000 fuel cell electric vehicles, mostly passenger cars, with the stock growing over 20% in 2022. These numbers show that fuel-cell drivetrains are no longer purely experimental, creating know-how and supply chains that DMFC developers can leverage for stacks, balance-of-plant and power-electronics.

The broader zero-emission vehicle transition is another key backdrop. In 2022, over 10 million electric vehicles were sold worldwide, up 54% from 2021, pushing EVs to 13% of global new light-duty sales and bringing cumulative EV sales to 29 million. The IEA reports around 26 million electric cars on the road in 2022, with about 70% of the stock being battery-electric. As OEMs diversify their zero-emission portfolios, DMFCs offer an alternative where fast liquid refuelling and long range are valued, especially for fleet and commercial applications.

Methanol availability and decarbonisation potential are central industrial drivers. IRENA estimates that global methanol production is about 98 million tonnes per year, almost entirely from fossil fuels, with life-cycle emissions around 0.3 gigatonnes of CO₂ annually—roughly 10% of total chemical-sector emissions. Methanol demand almost doubled over the past decade, and separate IEA-AMF analysis notes that global demand climbed from 61 to 125 million tonnes between 2012 and 2016, while sustainable renewable-methanol capacity remains below 1 million tonnes per year.

Renewable methanol economics are gradually becoming more favorable, which underpins future DMFC deployment. IRENA calculates that current e-methanol production costs are roughly USD 800–1,600 per tonne, but could fall to USD 250–630 per tonne by 2050 with cheaper renewables and electrolysers. At the same time, less than 0.2 million tonnes of renewable methanol are produced annually today, highlighting how early the value chain still is. Industrial projects are beginning to scale: for example, the world’s first commercial-scale e-methanol plant in Denmark will produce about 42,000 tonnes per year at an investment of €150 million.

Key Takeaways

- Automotive Direct Methanol Fuel Cell Market size is expected to be worth around USD 58.7 Million by 2034, from USD 30.7 Million in 2024, growing at a CAGR of 10.9%.

- Fuel Cell Stack held a dominant market position, capturing more than a 56.3% share.

- Less Than 1 kW held a dominant market position, capturing more than a 49.9% share.

- Passenger Vehicles held a dominant market position, capturing more than a 68.5% share.

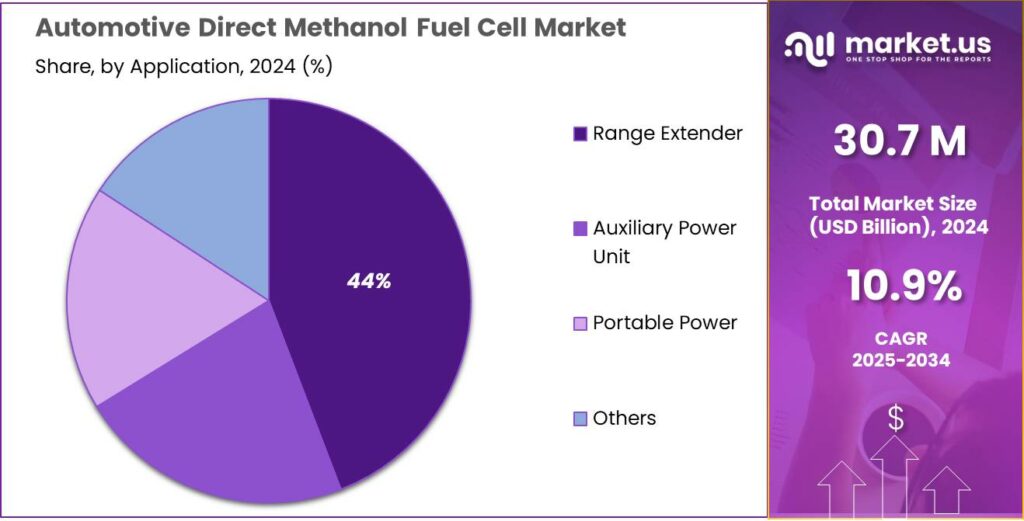

- Range Extender held a dominant market position, capturing more than a 44.2% share.

- Asia Pacific holds the leading position in the Automotive Direct Methanol Fuel Cell (DMFC) market, accounting for around 41.20% of global demand and an estimated value of about 12.6 Mn.

By Component Analysis

Fuel Cell Stack dominates with 56.3% in 2024 owing to its central role in power generation and ease of integration.

In 2024, Fuel Cell Stack held a dominant market position, capturing more than a 56.3% share. The stack’s predominance can be attributed to its role as the core power-generating module, where improvements in membrane electrode assemblies and catalyst utilization have delivered measurable gains in power density and operational reliability. Deployment patterns indicate that the stack is preferentially specified for range-extender and auxiliary-power applications because liquid methanol feed simplifies refuelling logistics and reduces packaging complexity compared with alternative systems; consequently, system architects have been able to streamline balance-of-plant components and contain overall unit costs while preserving energy density.

By Power Output Analysis

Less Than 1 kW dominates with 49.9% owing to its suitability for compact range extenders and auxiliary power needs.

In 2024, Less Than 1 kW held a dominant market position, capturing more than a 49.9% share. This segment was favoured because compact power units offered simpler integration into light vehicles and auxiliary systems, enabling designers to keep weight and packaging requirements low while using methanol’s liquid-fuel advantage for easy refuelling. Adoption was driven by proven reliability in low-power duty cycles and by reductions in balance-of-plant complexity that lowered upfront installation effort and maintenance overhead. System integrators preferred these lower-power modules for range-extender roles and on-board auxiliary power where peak power demands were limited and continuous, stable output was required.

By Vehicle Type Analysis

Passenger Vehicles dominate with 68.5% owing to their wide application as range-extenders and primary on-road use.

In 2024, Passenger Vehicles held a dominant market position, capturing more than a 68.5% share. The dominance was driven by suitability of direct methanol fuel cell systems for compact range-extender architectures and by compatibility with existing liquid-fuel logistics, which simplified vehicle integration and refuelling compared with gaseous alternatives.

Adoption in this segment was supported by ongoing engineering efforts to reduce stack footprint and to harmonize powertrain control with hybrid battery systems, so that packaging and weight penalties were minimized. Fleet and OEM pilots for light-duty passenger models were prioritised because duty cycles and refuelling patterns aligned closely with methanol’s strengths, and integration pathways were standardized to shorten development timelines.

By Application Analysis

Range Extender dominates with 44.2% owing to its ability to extend vehicle range without heavy battery penalties.

In 2024, Range Extender held a dominant market position, capturing more than a 44.2% share. The segment’s leadership can be attributed to the practical fit of direct methanol fuel cells as compact, liquid-fueled range extenders that reduce reliance on large battery packs while preserving usable cabin and cargo space. System designers have favoured range-extender architectures because methanol refuelling is simpler than gaseous alternatives and because the continuous, low-to-moderate power output of DMFCs matches the steady load profile of range-extending duties; as a result, balance-of-plant complexity has been minimised and integration into existing hybrid powertrains has been expedited.

Key Market Segments

By Component

- Fuel Cell Stack

- Balance of System

- Fuel Cartridge

By Power Output

- Less Than 1 kW

- 1 kW to 5 kW

- Greater Than 5 kW

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

By Application

- Range Extender

- Auxiliary Power Unit

- Portable Power

- Others

Emerging Trends

Green Methanol Corridors Are Pulling DMFC Vehicles Into the Mainstream Conversation

One clear emerging trend for automotive direct methanol fuel cells (DMFCs) is that they are no longer being developed in isolation. Instead, they are increasingly tied to new “green methanol corridors” being built first for shipping and heavy industry, then opened up to road transport. As these corridors appear around ports and industrial hubs, DMFC cars, vans and buses suddenly have access to the same low-carbon fuel and storage systems, without needing a separate infrastructure of their own.

Today’s methanol system is still mostly fossil, but it is large and visible, which makes it attractive to policymakers. IRENA estimates that about 98 million tonnes of methanol are produced every year, almost all from natural gas or coal, with life-cycle emissions of roughly 0.3 gigatonnes of CO₂ annually—around 10% of the entire chemical sector’s emissions. This big, fossil-heavy base is why governments are pushing hard for renewable methanol, and why any fuel-cell drivetrain that can use methanol—including DMFCs—now gets more attention.

Real bricks-and-mortar projects make this trend feel concrete. In May 2025, the world’s first commercial-scale e-methanol plant at Kassø in southern Denmark was officially inaugurated. The facility cost about €150 million and is designed to produce 42,000 tonnes of e-methanol per year, using renewable electricity and captured CO₂, with shipping giant Maersk as a key offtaker. When a port city has tens of thousands of tonnes of green methanol flowing through each year, the idea of fuelling local delivery vans or shuttle buses with DMFC systems stops being theoretical and starts sounding like a logical extension.

At the same time, electric mobility is booming, which creates both competition and opportunity. The IEA’s Global EV Outlook 2024 notes that electric car sales almost reached 14 million in 2023, making up nearly one in five new cars sold worldwide, with 95% of sales in China, Europe and the United States. Updated IEA data show electric car sales exceeded 17 million in 2024, taking their share to more than 20% of global new car sales. This rapid shift pushes automakers to diversify electric powertrains: batteries for most uses, hydrogen fuel cells where range and refuelling speed matter, and DMFCs where liquid fuels and compact tanks are preferred.

Drivers

Decarbonising Road Transport with Renewable Methanol Fuels DMFC Growth

One powerful driving factor for automotive direct methanol fuel cells (DMFCs) is the urgent need to decarbonise road transport while keeping the convenience of liquid fuels. The IPCC notes that transport accounts for about 15% of total global greenhouse gas emissions and roughly 23% of energy-related CO₂ emissions. The IEA adds that in 2022 transport CO₂ emissions rose by over 250 million tonnes, reaching nearly 8 gigatonnes of CO₂, around 3% higher than 2021. More broadly, total energy-related CO₂ climbed to a record 37.8 gigatonnes in 2024.

Electric vehicles are scaling fast, but not every use case fits battery-only solutions. The IEA reports that almost 14 million electric cars were sold in 2023, and nearly one in five new cars worldwide was electric, with 95% of these sales concentrated in China, Europe and the United States. A private-sector update shows that 17 million electric cars were sold in 2024, taking EVs past 20% of new car sales and lifting the global fleet to about 58 million cars.

Today, methanol is a big emitter but also a big opportunity. IRENA’s Innovation Outlook: Renewable Methanol estimates life-cycle emissions from current methanol production at about 0.3 gigatonnes of CO₂ per year, roughly 10% of total chemical-sector emissions, with global production around 98 million tonnes per year. More than 99% of this methanol still comes from fossil feedstocks such as natural gas and coal.

At the same time, renewable methanol is starting from a tiny base but growing fast. Recent academic work citing IRENA notes that global renewable methanol output is still below 0.2 million tonnes per year, mainly as biomethanol. Yet the Methanol Institute’s latest project database counts 230 renewable methanol projects worldwide, with an announced capacity of 41.3 million tonnes per year by 2030—including 23.3 million tonnes of e-methanol and 18 million tonnes of biomethanol.

Government-backed projects are reinforcing this trend. In India, a green hydrogen pilot at V.O. Chidambaranar Port includes a planned green methanol bunkering facility of 750 m³ to support a coastal green shipping corridor between Kandla and Tuticorin.

Restraints

High Cost and Scarce Green Methanol Supply Limit DMFC Adoption

A major restraint for automotive direct methanol fuel cells is simple but stubborn: there is not enough low-carbon methanol at a reasonable price. DMFC vehicles only make climate sense when they run on green or renewable methanol. Today, the fuel system is still built almost entirely around cheap fossil methanol, so carmakers hesitate to bet on a technology whose clean fuel is both scarce and expensive.

The global methanol industry shows this clearly. In 2022, around 106 million tonnes of methanol were produced worldwide, with about 65% made from natural gas, 35% from coal and only 0.2% from renewable sources, according to IRENA and the Methanol Institute.Another joint IRENA–WTO analysis notes that today roughly 98 million tonnes of methanol each year generate about 0.3 gigatonnes of CO₂-equivalent, around 10% of emissions from the chemical sector.This fossil weight makes it hard to market DMFC cars as truly low-carbon.

On the renewable side, volumes are still tiny. Recent academic work, drawing on IRENA data, estimates that global renewable methanol production is less than 0.2 million tonnes per year, mainly biomethanol. Put against the 106 million tonnes total output, that means well under 1% of the methanol pool is currently green. At the same time, demand for methanol is expected to soar, with some studies projecting a rise from about 98 million tonnes in 2021 to as much as 500 million tonnes by 2050 if current trends continue. In that world, early supplies of renewable methanol are likely to be pulled first into shipping and chemicals, not cars.

Price makes the restraint even sharper. IRENA explains that producing methanol from fossil feedstocks typically costs around USD 100–250 per tonne, while early e-methanol plants can face costs between USD 800 and 1,600 per tonne. For a fleet operator or taxi company considering DMFC vehicles, this kind of fuel-cost uncertainty is a serious red flag. Until policy closes that gap with subsidies, carbon pricing or mandates, most will stick with batteries, conventional engines or hydrogen where price signals are clearer.

Early flagship plants underline both progress and constraint. Reuters reports that the world’s first commercial-scale e-methanol plant in Denmark cost about €150 million to build and will produce roughly 42,000 tonnes per year. That is a milestone, but in fuel terms it is just enough for one large container ship each year. Automotive DMFC developers know such volumes are a drop in the ocean, so they cannot plan mass-market models around them yet.

Opportunity

Scaling Renewable Methanol Unlocks New Niches for DMFC Vehicles

One major growth opportunity for automotive direct methanol fuel cells (DMFCs) lies in the rapid build-out of renewable methanol supply, driven by climate policy in heavy industry and shipping. DMFC cars, vans and buses can ride on the same green fuel backbone that steel mills, chemical plants and ocean-going vessels will increasingly depend on, without needing a separate refuelling ecosystem.

Renewable methanol is still small but highly strategic. IRENA estimates that global methanol production is close to 100 million tonnes per year, with life-cycle emissions of about 0.3 gigatonnes of CO₂ annually, roughly 10% of total chemical-sector emissions. Yet only around 0.2 million tonnes of this is currently renewable methanol, meaning green product is well below 1% of the pool. For DMFC vehicles, this gap is not just a constraint; it is a clear growth window as new plants come online and fuel buyers look beyond shipping to road transport.

The project pipeline shows how quickly that situation could change. The Methanol Institute, together with GENA Solutions, reports 220 renewable methanol projects worldwide with a combined announced capacity of 37.1 million tonnes per year by 2030—including 20.6 million tonnes of e-methanol and 16.5 million tonnes of biomethanol. A broader database including low-carbon “blue” methanol points to a total renewable and low-carbon methanol pipeline of 47.2 million tonnes by 2030, although IRENA and the Methanol Institute caution that realistically 7–14 million tonnes may actually be operating by that date.

Most of this fuel will first be pulled into global shipping and heavy industry, which is precisely why the opportunity for DMFCs is so strong. IEA Bioenergy notes that global shipping already consumes over 300 million tonnes of oil equivalent per year and emits around 1 billion tonnes of CO₂, prompting the International Maritime Organization to adopt a net-zero greenhouse-gas strategy for 2050.

At the same time, road transport itself is under pressure to move beyond fossil fuels, but not all duty cycles fit pure batteries. The IEA’s Net Zero by 2050 roadmap envisions 100% of new passenger car sales being plug-in hybrids, battery-electric or fuel-cell vehicles globally by 2035, phasing out conventional internal-combustion-only models. Electric cars are already surging: electric car sales reached nearly 14 million in 2023, about one in every five new cars sold worldwide.

Regional Insights

Asia Pacific Dominates the Automotive Direct Methanol Fuel Cell Market with 41.20% Share, Valued at 12.6 Mn

Asia Pacific holds the leading position in the Automotive Direct Methanol Fuel Cell (DMFC) market, accounting for around 41.20% of global demand and an estimated value of about 12.6 Mn in 2024. This dominance reflects the region’s rapid shift toward cleaner mobility, anchored by China, India, Japan, South Korea and emerging Southeast Asian markets.

China alone has become the epicentre of electric mobility; electric cars represented close to 50% of all new car sales in 2024, and the country captured almost two-thirds of global electric car sales, underlining a deep industrial base for advanced electric powertrains, including fuel cells. In Southeast Asia, electric car sales grew nearly 50% in 2024 to reach a 9% share of regional car sales, showing how quickly new technologies can scale once infrastructure and policy align.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Ballard Power Systems — Ballard is a leading developer of PEM fuel-cell engines for heavy-duty transport and stationary power. Its portfolio focuses on high-power density, durability and system integration for buses, trucks, rail and maritime applications, supported by recent product launches and long-term supply agreements that scale production capacity. Ballard’s technology roadmap prioritizes cost reduction through catalyst and stack improvements, while manufacturing scale-up and strategic partnerships are being used to accelerate commercialization across global transport segments.

BMW — BMW has pursued fuel-cell technology as a complementary zero-emission route, developing small-series vehicles and in-house fuel-cell system production for niche models. Efforts have targeted system integration, hydrogen storage and hybridisation with battery systems to meet real-world driving profiles. BMW’s strategy has emphasised modular production and collaboration with industrial partners to shorten development timelines, while pilot series programmes are used to validate durability and cost metrics prior to wider deployment.

PowerCell — PowerCell develops compact, high-power fuel-cell stacks and systems for on-road, marine and stationary uses, with an emphasis on high power density and modular integration. Its product suite is being adapted for both hydrogen and methanol-based applications via methanol-to-power solutions, enabling use where liquid fuels are preferred. The company’s recent annual reporting highlights expanded production capability and orders across transport and maritime segments as it seeks to commercialise scalable stack technologies.

Top Key Players Outlook

- Ballard

- BMW

- Powercell

- SFC Energy

- LG Chem

- Viaspace

- Johnson Matthey

- Others

Recent Industry Developments

In 2024 Ballard remained a leading fuel-cell supplier for heavy-duty transport, though its core focus was on PEM hydrogen engines rather than direct methanol systems; the company’s 2024 financial results recorded Revenue: $69.7M (2024) and Q4 revenue: $24.5M (Q4 2024), reflecting a challenging year for the sector.

In 2024, SFC Energy’s clean-energy business delivered a clear step up in commercial performance: Sales: €144,754,000 (2024), representing a 22.5% year-on-year increase, and Gross profit: €59,324,000 (2024) with a gross margin of 41.0%. EBITDA: €20,190,000 (2024) (EBITDA margin 13.9%) and Adjusted EBITDA: €22,008,000 (2024) signalled improved operating profitability, while the order book stood at €104,583,00.

Report Scope

Report Features Description Market Value (2024) USD 30.7 Mn Forecast Revenue (2034) USD 58.7 Mn CAGR (2025-2034) 10.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Fuel Cell Stack, Balance of System, Fuel Cartridge), By Power Output (Less Than 1 kW, 1 kW to 5 kW, Greater Than 5 kW), By Vehicle Type (Passenger Vehicles, Commercial Vehicles), By Application (Range Extender, Auxiliary Power Unit, Portable Power, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ballard, BMW, Powercell, SFC Energy, LG Chem, Viaspace, Johnson Matthey, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Direct Methanol Fuel Cell MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Direct Methanol Fuel Cell MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ballard

- BMW

- Powercell

- SFC Energy

- LG Chem

- Viaspace

- Johnson Matthey

- Others