Global Automotive DC-DC Converter Market Size, Share, Growth Analysis By Product Type (Isolated DC-DC Converters (58.2%), Non-isolated DC-DC Converters), By Propulsion Type (Battery Electric Vehicles (BEVs) (66.5%), Fuel Cell Electric Vehicles (FCEVs), Plug-in Hybrid Vehicles (PHEVs)), By Input Voltage (70V), By Output Voltage (3.3V, 5V, 12V (41.9%), 15V, 24V, Above), By Output Power (20kW), By Vehicle Type (Commercial Vehicle (67.3%), Passenger Vehicle), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168851

- Number of Pages: 365

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Product Type Analysis

- By Propulsion Type Analysis

- By Input Voltage Analysis

- By Output Voltage Analysis

- By Output Power Analysis

- By Vehicle Type Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Automotive DC-DC Converter Company Insights

- Recent Developments

- Report Scope

Report Overview

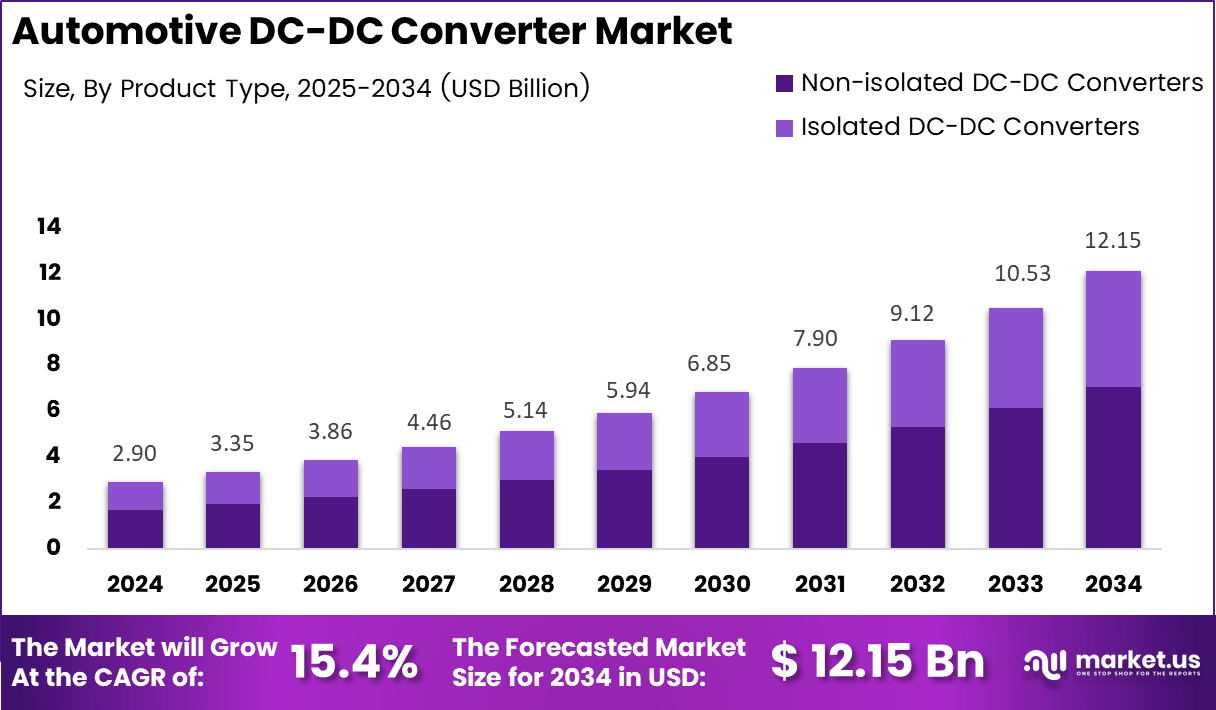

The Global Automotive DC-DC Converter Market size is expected to be worth around USD 12.15 billion by 2034, from USD 2.9 billion in 2024, growing at a CAGR of 15.4% during the forecast period from 2025 to 2034.

The Automotive DC-DC Converter Market represents a critical segment of modern vehicle electrification, supporting voltage transformation needs across EVs, hybrids, and conventional platforms. It enables stable low-voltage power delivery for infotainment, ADAS, and battery systems, strengthening overall vehicle efficiency. Rising EV penetration and increasing electronic content consistently stimulate strong market momentum across global automotive supply chains.

Growing demand for compact, energy-efficient converters steadily accelerates technology upgrades as OEMs transition toward 48V architectures and high-density power modules. Additionally, expanding government investment in clean mobility ecosystems encourages Tier-1 suppliers to enhance converter performance, safety, and reliability. These trends collectively reinforce long-term opportunities for high-efficiency DC-DC solutions across passenger and commercial vehicles.

Furthermore, regulatory frameworks promoting reduced emissions propel automakers to adopt advanced power conversion units supporting thermal stability and higher conversion ratios. Parallelly, surging adoption of smart electronics in interiors drives the need for precise low-voltage management. As global policymakers strengthen EV subsidies and charging infrastructure spending, the demand for scalable DC-DC platforms continues to rise.

Analysts observe increasing growth opportunities as innovations in wide-bandgap semiconductors improve thermal behavior and operational efficiency. Market players focus on design flexibility, enabling buck, boost, isolated, and non-isolated topologies optimized for diverse vehicle classes. Additionally, IP-rated converter housings improve durability, enabling deployment in harsh automotive environments exposed to dust, vibration, and moisture.

According to industry information, a typical passenger car uses a 12 V battery composed of six lead-acid cells generating about 2.1 V each, while trucks deploy 24 V systems built from two 12 V batteries. These variations increase the demand for DC-DC converters to stabilize output across vehicle categories.

Moreover, converters operate effectively between –40°C to +80°C, demonstrating robust thermal capability, and exceed 90% efficiency according to technical specifications. Their aluminium die-cast or extruded housings ensure IP67 protection, while customization options further expand adoption in EV, HEV, and off-road vehicle power architectures.

Key Takeaways

- The global Automotive DC-DC Converter Market reached USD 2.9 billion in 2024 and is projected to hit USD 12.15 billion by 2034.

- The market is expected to grow at a strong 15.4% CAGR during 2025–2034.

- Isolated DC-DC Converters dominated the product segment with a share of 58.2% in 2024.

- Battery Electric Vehicles led the propulsion segment with a 66.5% market share in 2024.

- The 40–70V category was the top input-voltage segment with a 51.4% share in 2024.

- The 12V output voltage segment accounted for the largest share at 41.9% in 2024.

- The 1–10kW output power segment dominated the market with a 49.1% contribution in 2024.

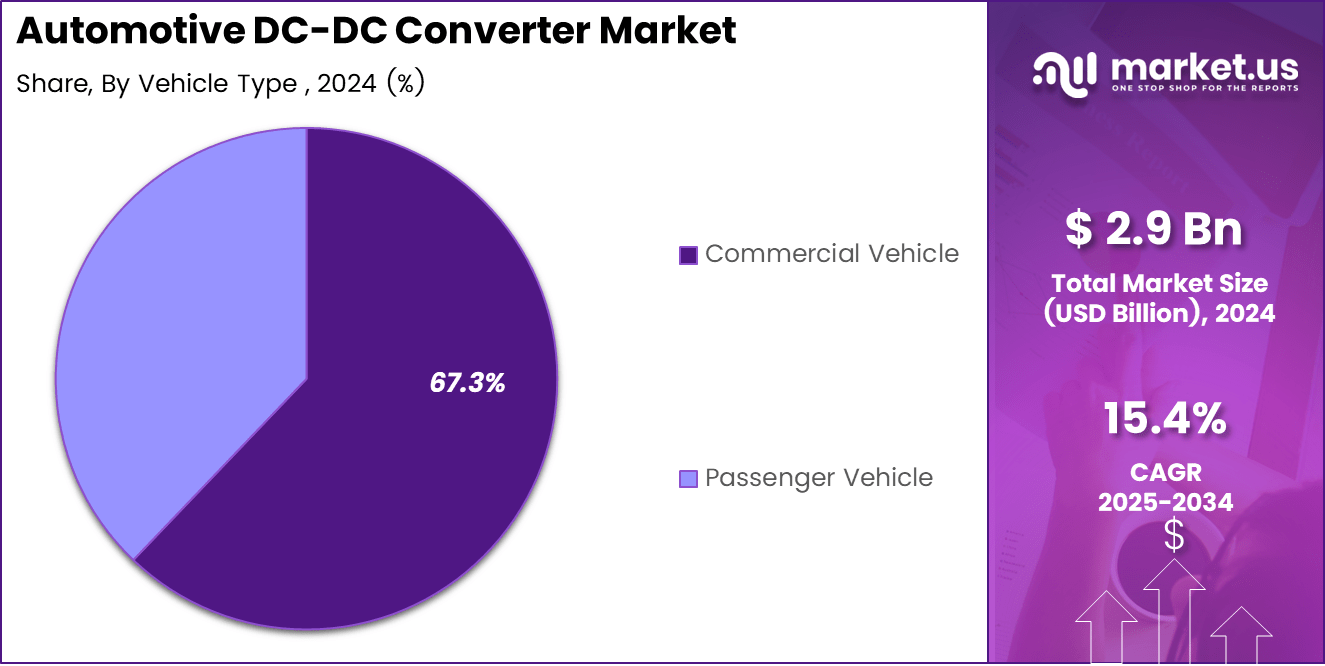

- Commercial Vehicles represented the leading vehicle type segment with a share of 67.3% in 2024.

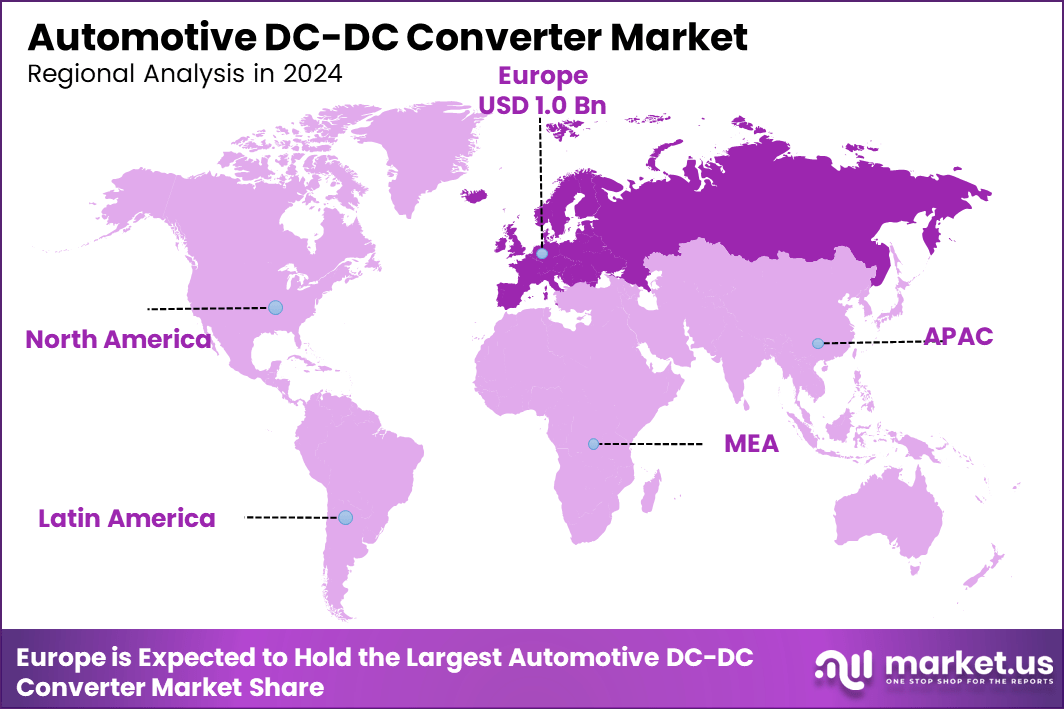

- Europe emerged as the leading regional market, capturing 37.2% share valued at USD 1 billion.

By Product Type Analysis

Isolated DC-DC Converters dominate with 58.2% due to their safety, reliability, and suitability for high-voltage EV architectures.

In 2024, Isolated DC-DC Converters held a dominant market position in the By Product Type Analysis segment of the Automotive DC-DC Converter Market, with a 58.2% share. These converters advanced adoption by ensuring galvanic isolation, secure power transfer, and higher protection levels for sensitive EV electronics across rapidly expanding battery-electric platforms.

In 2024, Non-isolated DC-DC Converters continued to gain relevance within the By-product type Analysis segment. These converters strengthened demand through compact designs, low-cost integration, and suitability for auxiliary loads. Additionally, rising adoption in hybrid vehicle electrical systems supported their market presence as manufacturers emphasized efficient low-voltage power distribution solutions for modern vehicle platforms.

By Propulsion Type Analysis

Battery Electric Vehicles dominate with 66.5% as full-electric architectures require stable multi-voltage DC conversion.

Battery Electric Vehicles (BEVs) held a dominant market position in the By Propulsion Type Analysis segment of the Automotive DC-DC Converter Market, with a 66.5% share. Their dominance grew as BEV platforms relied on DC-DC converters to manage auxiliary loads, optimize voltage levels, and improve overall power efficiency across high-capacity battery systems.

Fuel Cell Electric Vehicles (FCEVs) showed steady interest within the By Propulsion Type Analysis segment. These vehicles advanced converter demand through their requirement for stable power regulation between fuel-cell stacks and on-board systems. Moreover, rising government support for hydrogen mobility improved converter integration opportunities across emerging heavy-duty and long-range transportation applications.

Plug-in Hybrid Electric Vehicles (PHEVs) continued to contribute actively within the By Propulsion Type Analysis segment. They benefited from DC-DC converters to balance power between internal combustion systems and electric drivetrains. Furthermore, their growing presence in urban mobility maintained steady adoption as converters supported voltage management across dual-energy architectural setups.

By Input Voltage Analysis

40–70V segment dominates with 51.4% due to its compatibility with mainstream EV and hybrid electrical systems.

The 40–70V segment held a dominant market position in the By Input Voltage Analysis segment of the Automotive DC-DC Converter Market, with a 51.4% share. This range strengthened adoption as most EV and hybrid platforms utilized mid-voltage inputs, ensuring efficient conversion, improved safety margins, and stable auxiliary power support.

The <40V segment maintained a stable presence within the By Input Voltage Analysis segment. This category gained relevance across low-voltage accessory systems, compact vehicles, and micro-mobility applications. Additionally, increasing deployment in lightweight architectures improved demand as manufacturers sought cost-efficient and compact conversion solutions for basic electrical components.

The >70V segment expanded gradually within the By Input Voltage Analysis segment. This category supported high-voltage EV platforms requiring robust converters for advanced electronic loads. Moreover, performance-oriented vehicles strengthened interest as higher voltage inputs demanded reliable conversion efficiency for optimized drivetrain and onboard system operations.

By Output Voltage Analysis

12V segment dominates with 41.9% due to its essential role in powering traditional vehicle electronics and auxiliary loads.

The 12V segment held a dominant market position in the By Output Voltage Analysis segment of the Automotive DC-DC Converter Market, with a 41.9% share. This output remained critical because EVs and hybrids continued using 12V systems for lighting, infotainment, sensors, and safety controls, sustaining strong converter demand.

The 3.3V segment contributed steadily within the By Output Voltage Analysis segment. This voltage level supported microcontrollers, logic circuits, and semiconductor-driven components. Additionally, the rising complexity of electronics in modern vehicles has improved demand for stable low-voltage outputs, particularly across connected and autonomous vehicle subsystems.

The 5V segment gained traction within the By Output Voltage Analysis segment. This category benefited from expanding infotainment interfaces, onboard sensors, and connectivity modules. Furthermore, increasing semiconductor integration encouraged wider DC-DC converter usage as manufacturers emphasized precise voltage regulation for delicate digital components.

The 15V segment continued to develop within the By Output Voltage Analysis segment. Many EV subsystems relied on this output for mid-range electronics requiring moderate voltage levels. Moreover, demand rose across engineered control modules that required stable, noise-free power for consistent performance.

The 24V segment retained importance within the By Output Voltage Analysis segment. This output catered primarily to commercial vehicles, heavy-duty electronics, and industrial-grade components. Additionally, high-load systems encouraged converter integration to ensure efficient voltage management across demanding operational environments.

The above 24V segment experienced gradual adoption within the By Output Voltage Analysis segment. High-power systems in advanced EV architectures benefited from these outputs, especially for performance-driven functions. As vehicle electrification advanced, higher voltage tiers provided improved power density and efficiency.

By Output Power Analysis

1–10kW segment dominates with 49.1% as EVs increasingly rely on mid-range converters for balanced load distribution.

In 2024, the 1–10kW segment held a dominant market position in the By Output Power Analysis segment of the Automotive DC-DC Converter Market, with a 49.1% share. This range performed well because EVs used mid-power converters for traction support, auxiliary systems, and thermal management, ensuring balanced and reliable electrical efficiency.

In 2024, the <1kW segment maintained adoption within the By Output Power Analysis segment. These converters served low-power electronics, sensors, and small controllers. Additionally, micro-mobility solutions and compact hybrid systems benefited from low-power outputs supporting efficient accessory operations.

In 2024, the 10–20kW segment expanded within the By Output Power Analysis segment due to rising demand from high-performance EV platforms. These converters delivered stable high-power outputs for advanced vehicle functions, supporting torque delivery and performance subsystems that required strong electrical capacity.

In 2024, the >20kW segment observed gradual acceptance within the By Output Power Analysis segment. Heavy-duty vehicles adopted these converters for demanding power loads. Furthermore, increasing electrification of commercial fleets strengthened the need for high-power converters capable of managing intensive operational requirements.

By Vehicle Type Analysis

Commercial Vehicles dominate with 67.3% due to higher power demand and broader electrification across logistics and fleet operations.

In 2024, Commercial Vehicles held a dominant market position in the By Vehicle Type Analysis segment of the Automotive DC-DC Converter Market, with a 67.3% share. Their strong adoption resulted from increased electrification in buses, trucks, and fleet vehicles, requiring high-capacity converters to stabilize auxiliary loads and support heavy electrical systems.

In 2024, Passenger Vehicles continued contributing actively within the By Vehicle Type Analysis segment. Growing EV adoption across global consumers increased converter demand for powering infotainment, connectivity, and safety electronics. Furthermore, the rising penetration of hybrid and BEV platforms increased the need for stable voltage regulation across diverse passenger vehicle architectures.

Key Market Segments

By Product Type

- Isolated DC-DC Converters

- Non-isolated DC-DC Converters

By Propulsion Type

- Battery Electric Vehicles (BEVs)

- Fuel Cell Electric Vehicles (FCEVs)

- Plug-in Hybrid Vehicles (PHEVs)

By Input Voltage

- <40V

- 40–70V

- >70V

By Output Voltage

- 3.3V

- 5V

- 12V

- 15V

- 24V

- Above

By Output Power

- <1kW

- 1–10kW

- 10–20kW

- >20kW

By Vehicle Type

- Commercial Vehicle

- Passenger Vehicle

Drivers

Rising Demand for High-Efficiency Power Conversion Supports Market Expansion

The rising demand for high-efficiency power conversion is strengthening the Automotive DC-DC Converter Market. Modern EVs depend on these converters to power advanced subsystems such as sensors, controllers, and infotainment units. As vehicle electronics increase, automakers prefer converters that deliver stable output while reducing energy losses during daily operation.

The growing integration of 48V architectures in hybrid and premium vehicles is also accelerating market growth. These systems provide better fuel efficiency and improved performance, increasing the need for reliable DC-DC converters. As manufacturers adopt mild-hybrid technologies, the requirement for efficient voltage conversion becomes essential for supporting advanced electronic loads.

The expansion of onboard electronics in new-generation vehicles is driving additional converter adoption. Cars now include ADAS, digital clusters, connected modules, and battery management systems. Each subsystem depends on a stable low-voltage power supply, increasing the installation of compact and efficient DC-DC converters across electric and hybrid models.

Government-led electrification mandates are further boosting demand. Policies promoting reduced emissions and higher EV adoption encourage automakers to integrate more power electronics. As a result, DC-DC converters play a larger role in meeting efficiency regulations and supporting safe and reliable vehicle electrical architectures.

Restraints

High Thermal Management Challenges Restrict Market Progress

High thermal management challenges are limiting performance reliability in the Automotive DC-DC Converter Market. As EV power demands rise, converters must operate efficiently under heavy load. Excess heat can damage semiconductor components, reducing lifespan. This issue pushes manufacturers to develop advanced cooling systems, raising design complexity and overall system cost.

Limited standardization in automotive power electronics architectures also acts as a restraint. Automakers use different voltage levels, layouts, and integration processes, creating challenges for unified converter designs. This increases engineering time and slows mass adoption. Without common standards, suppliers must customize products, affecting production scalability and market penetration.

Growth Factors

Development of Next-Generation High-Density Converters Creates Strong Opportunities

The development of GaN- and SiC-based high-density converters is creating major opportunities in the Automotive DC-DC Converter Market. These materials offer higher efficiency, faster switching, and improved thermal performance. Automakers increasingly explore these technologies to reduce size and weight while boosting power density for electric and hybrid vehicles.

The growing adoption of solid-state battery systems is opening new avenues for optimized power modules. These batteries require specialized DC-DC converters to manage precise voltage levels. As research progresses, demand for advanced power conversion units capable of supporting these high-energy storage solutions continues to rise across global EV programs.

The expansion of EV charging ecosystems, particularly bidirectional charging, is boosting converter opportunities. Vehicle-to-home and vehicle-to-grid applications require converters capable of managing energy flow in both directions. As charging infrastructure evolves, DC-DC converters will become essential in enabling intelligent energy management across multiple charging environments.

Emerging Trends

Shift Toward Modular Power Platforms Shapes Market Trends

The shift toward modular and software-defined power conversion platforms is becoming a major trend in the Automotive DC-DC Converter Market. Automakers are moving away from fixed-function hardware and adopting flexible, modular architectures. These platforms allow faster upgrades, easier integration, and improved optimization for EV and hybrid electrical systems.

The increased use of digital control algorithms is another strong trend. These algorithms enhance efficiency, thermal stability, and load management within converters. As vehicles add more electronic functions, digital control enables real-time monitoring and smarter decision-making, supporting stable and reliable power delivery across all EV subsystems.

Regional Analysis

Europe Dominates the Automotive DC-DC Converter Market with a Market Share of 37.2%, Valued at USD 1 Billion

Europe recorded a strong leadership position in the automotive DC-DC converter market, contributing 37.2% share and generating around USD 1 billion in revenue. The region benefits from rapid EV adoption, stringent carbon reduction mandates, and expanding 48V mild hybrid deployment. Strong government-backed electrification programs further support the rising need for efficient on-board power conversion systems across passenger and commercial fleets.

North America Automotive DC-DC Converter Market Trends

North America observes steady demand growth driven by large-scale EV manufacturing expansion and increasing integration of advanced electronic architectures. Supportive federal incentives and rising production of hybrid vehicles strengthen converter adoption. The region also benefits from enhanced consumer interest in cleaner mobility solutions and wider charging infrastructure deployment.

Asia Pacific Automotive DC-DC Converter Market Trends

Asia Pacific remains one of the fastest-growing regions due to rising automobile production, strong EV penetration in China, Japan, and South Korea, and extensive investment in battery technologies. Governments across the region continue to promote electric mobility adoption, accelerating the use of high-efficiency DC-DC converters. Increasing demand for compact, cost-effective power electronics further boosts market expansion.

Middle East & Africa Automotive DC-DC Converter Market Trends

Middle East & Africa experience gradual growth as countries introduce early-phase electrification initiatives and emission-control targets. Investments in premium vehicles and commercial fleet upgrades support the integration of advanced power conversion components. The market is steadily shifting toward modern vehicle architectures as automotive OEM presence expands.

Latin America Automotive DC-DC Converter Market Trends

Latin America shows emerging demand driven by hybrid vehicle imports, policy-driven energy transition goals, and rising urban mobility programs. While the region remains in the early electrification stage, growing awareness of EV benefits and government incentives is improving adoption rates. The increasing modernization of vehicle fleets contributes to the gradual market development.

U.S. Automotive DC-DC Converter Market Trends

The U.S. market demonstrates significant momentum supported by federal clean energy policies, rising EV sales, and major OEM investments in next-generation electric platforms. Growing reliance on advanced electronics and safety systems reinforces the need for stable low-voltage power conversion. The country sees expanding demand across both consumer and commercial vehicle categories

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive DC-DC Converter Company Insights

The global Automotive DC-DC Converter Market in 2024 demonstrates steady technological consolidation, with leading manufacturers strengthening efficiency, thermal performance, and integration capabilities to support fast-growing EV and hybrid platforms. Key players continue to refine power electronics designs to meet rising OEM expectations for compact size, higher conversion efficiency, and stable low-voltage regulation across advanced vehicle architectures.

Delphi Plc maintains a strong position by improving high-efficiency converter modules designed for modern EV subsystems, focusing on durability and compact packaging. The company increasingly emphasizes system-level optimization to support next-generation vehicle electrical architectures.

Valeo expands its influence through energy-efficient power conversion solutions tailored for hybrid and electric vehicles. Its strong focus on thermal management and scalable converter platforms enhances compatibility with diverse OEM models and supports higher power densities.

Toyota Industries reinforces its market role by integrating robust DC-DC converters into its electrified vehicle ecosystem. Its solutions emphasize reliability, long service life, and seamless integration with battery management systems, which strengthens its competitive advantage across global automotive markets.

LG Innotek accelerates innovation in compact, high-efficiency converters designed for increasing EV demand. Its advancements in electronic component miniaturization and enhanced power stability position the company as a key enabler of advanced vehicle electronics and emerging 48V architectures.

Top Key Players in the Market

- Delphi Plc

- Valeo

- Toyota Industries

- LG Innotek

- AUMOVIO ENGINEERING SOLUTIONS

- Denso Corporation

- HELLA GmbH & Co. KGaA

- Hyundai Mobis

- BorgWarner Inc.

- TDK-Lambda Corporation

Recent Developments

- In June 2024, Renesas Electronics completed the acquisition of Transphorm, Inc., enabling Renesas to offer GaN-based power products and related reference designs — a move expected to support rising demand for wide-bandgap semiconductor-based DC-DC converters across automotive and other high-efficiency power applications.

- In March 2025, Vicor released a new DCM™ family of regulated 48 V-to-12 V DC-DC converters, reflecting ongoing demand for efficient power conversion for automotive low-voltage subsystems as EV architectures evolve.

Report Scope

Report Features Description Market Value (2024) USD 2.9 billion Forecast Revenue (2034) USD 12.15 billion CAGR (2025-2034) 15.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Isolated DC-DC Converters (58.2%), Non-isolated DC-DC Converters), By Propulsion Type (Battery Electric Vehicles (BEVs) (66.5%), Fuel Cell Electric Vehicles (FCEVs), Plug-in Hybrid Vehicles (PHEVs)), By Input Voltage (<40V, 40–70V (51.4%), >70V), By Output Voltage (3.3V, 5V, 12V (41.9%), 15V, 24V, Above), By Output Power (<1kW, 1–10kW (49.1%), 10–20kW, >20kW), By Vehicle Type (Commercial Vehicle (67.3%), Passenger Vehicle) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Delphi Plc, Valeo, Toyota Industries, LG Innotek, AUMOVIO ENGINEERING SOLUTIONS, Denso Corporation, HELLA GmbH & Co. KGaA, Hyundai Mobis, BorgWarner Inc., TDK-Lambda Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive DC-DC Converter MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive DC-DC Converter MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Delphi Plc

- Valeo

- Toyota Industries

- LG Innotek

- AUMOVIO ENGINEERING SOLUTIONS

- Denso Corporation

- HELLA GmbH & Co. KGaA

- Hyundai Mobis

- BorgWarner Inc.

- TDK-Lambda Corporation