Global Auto Labeler Market Size, Share, Growth Analysis By Type (Below 30 Labels/Min, 30-50 Labels/Min, Above 50 Labels/Min), By Application (Food & Beverages, Electronics, Pharmaceutical, Others), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 178248

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

-

Report Overview

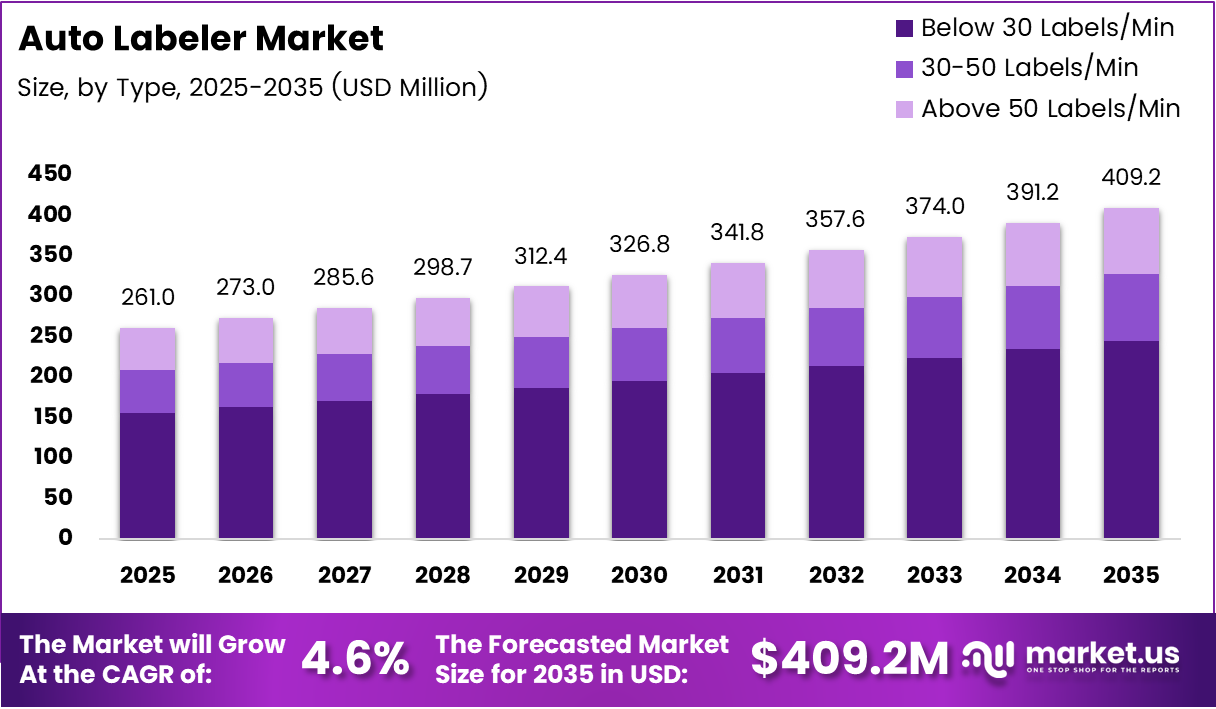

Global Auto Labeler Market size is expected to be worth around USD 409.2 Million by 2035 from USD 261.0 Million in 2025, growing at a CAGR of 4.6% during the forecast period 2026 to 2035.

The auto labeler market covers machines and systems that apply labels to products, containers, and packages automatically. Industries such as food and beverages, pharmaceuticals, and electronics rely on these systems to ensure fast and accurate product identification across high-volume production lines.

Automated labeling systems replace manual application with precision-driven machinery. These solutions support printed barcodes, QR codes, RFID tags, and regulatory compliance labels. Consequently, they reduce human error and improve throughput across manufacturing and logistics operations.

Government agencies worldwide enforce strict labeling mandates for food safety, drug traceability, and hazardous material handling. These regulations push manufacturers to upgrade packaging infrastructure. Moreover, rising consumer awareness around product authenticity further strengthens demand for reliable labeling solutions across global supply chains.

Smart factories and Industry 4.0 adoption accelerate integration of auto labelers with ERP and warehouse management systems. Businesses invest in connected labeling platforms to achieve real-time production visibility and reduce compliance risk. Additionally, the shift toward mass customization requires flexible labeling tools that handle multiple SKUs on a single line.

According to GS1, global retail and supply chains scan approximately 10 billion barcodes daily, reflecting massive dependence on automated identification and labeling infrastructure. This scale demonstrates how critical auto labeling systems have become across FMCG, logistics, and retail ecosystems globally.

According to a U.S. Food and Drug Administration dataset analysis via food safety publication, 71.1% of major food allergen recalls were caused by labeling errors. This finding highlights how precision labeling directly protects public health and reduces costly product recall events for food manufacturers.

Market participants continue to expand product portfolios to address speed, accuracy, and sustainability requirements. Demand for eco-friendly label materials and cloud-connected monitoring tools creates new revenue streams. Therefore, the auto labeler market presents strong growth potential for both established players and emerging solution providers through 2035.

Key Takeaways

- The Auto Labeler Market is valued at USD 261.0 Million in 2025 and is projected to reach USD 409.2 Million by 2035.

- The market grows at a CAGR of 4.6% during the forecast period 2026 to 2035.

- By Type, the Below 30 Labels/Min segment holds the largest share at 44.8% in 2025.

- By Application, Food and Beverages dominates the market with a 51.7% share in 2025.

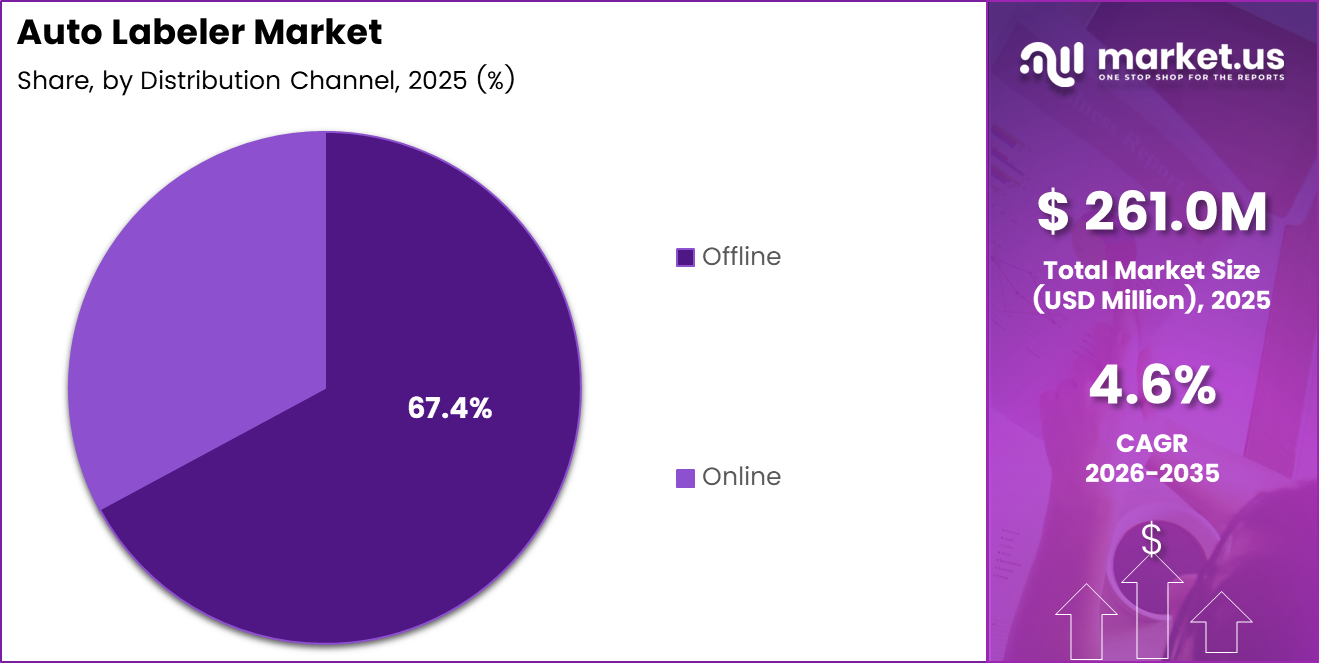

- By Distribution Channel, Offline channels lead with a 67.4% market share in 2025.

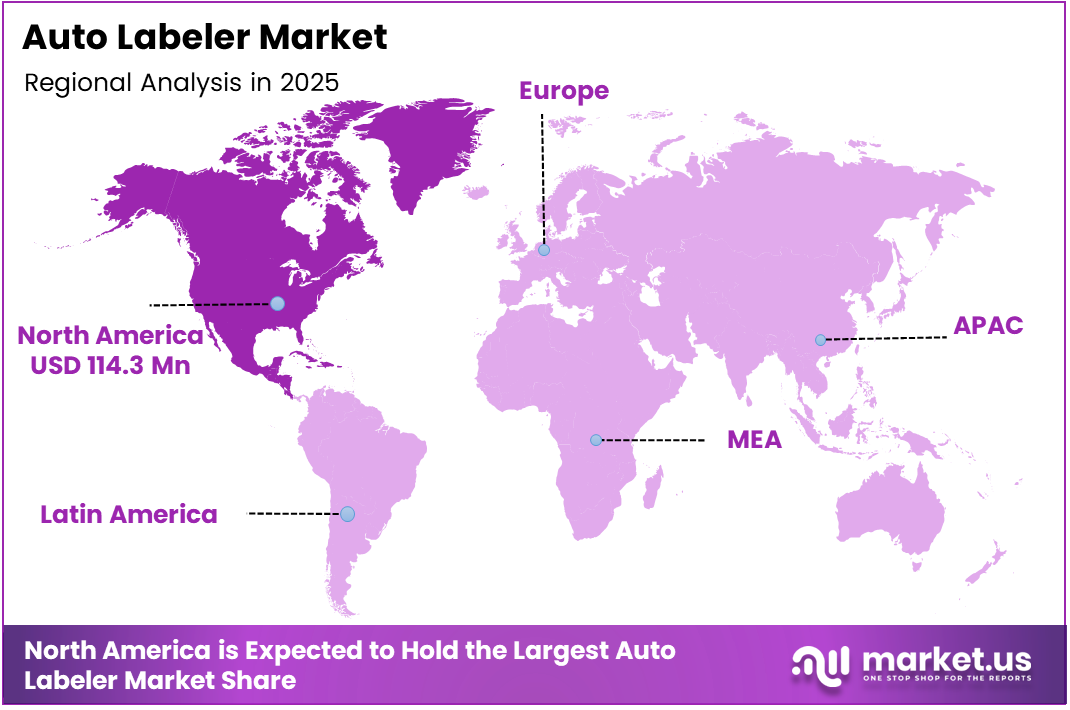

- North America holds the dominant regional position with a 43.80% share, valued at USD 114.3 Million in 2025.

Type Analysis

Below 30 Labels/Min dominates with 44.8% due to widespread use in small and mid-scale packaging operations.

In 2025, Below 30 Labels/Min held a dominant market position in the By Type segment of the Auto Labeler Market, with a 44.8% share. These entry-level systems serve small manufacturers, craft producers, and regional distributors that operate lower-volume lines. Moreover, their lower cost and simpler integration make them accessible to a wide range of businesses.

The 30-50 Labels/Min segment represents mid-range labeling systems used by growing manufacturers seeking speed without full industrial investment. These machines balance throughput and cost efficiency. Additionally, their compatibility with multiple label formats makes them a preferred choice for businesses transitioning from manual to automated packaging workflows.

The Above 50 Labels/Min segment serves high-volume industrial operations including large FMCG companies and pharmaceutical manufacturers. These systems deliver maximum throughput with advanced sensors and precision application. Consequently, demand for this segment grows alongside expansion of automated production facilities and stricter regulatory traceability requirements across global supply chains.

Application Analysis

Food and Beverages dominates with 51.7% due to strict safety regulations and high-volume production requirements.

In 2025, Food and Beverages held a dominant market position in the By Application segment of the Auto Labeler Market, with a 51.7% share. Regulatory bodies require detailed ingredient, allergen, and expiry date labeling on food products. Therefore, food producers invest heavily in automated labeling to maintain compliance and reduce costly recall events across retail supply chains.

The Electronics segment relies on auto labelers for asset tracking, serial number application, and compliance marking across compact and fragile components. Manufacturers use precision labeling systems to meet global traceability standards. Moreover, the growth of consumer electronics and contract manufacturing further drives demand for high-accuracy labeling in this segment.

The Pharmaceutical segment demands the highest labeling accuracy to meet regulatory serialization and patient safety requirements. Drug manufacturers use automated systems to apply tamper-evident labels and verify print quality. Additionally, anti-counterfeiting regulations in key markets accelerate adoption of advanced labeling solutions within pharmaceutical packaging lines.

The Others segment includes logistics, chemicals, and cosmetics industries that adopt auto labelers for compliance and branding purposes. These sectors apply labels for hazardous material identification, product origin, and barcode scanning. Consequently, demand from diverse end-use industries continues to support steady market growth beyond core food and pharma applications.

Distribution Channel Analysis

Offline dominates with 67.4% due to the technical complexity and customization needs of industrial labeling equipment.

In 2025, Offline held a dominant market position in the By Distribution Channel segment of the Auto Labeler Market, with a 67.4% share. Buyers prefer offline channels for in-person machine demonstrations, technical consultations, and installation support. Moreover, large capital equipment purchases typically require direct sales team engagement and post-sale service agreements.

The Online distribution channel gains traction among smaller businesses and repeat buyers who prioritize convenience and price comparison. Digital platforms allow manufacturers to offer modular labeling solutions with transparent specifications. Additionally, the growth of e-commerce-driven procurement accelerates online sales of standard and compact auto labeling systems.

Key Market Segments

By Type

- Below 30 Labels/Min

- 30-50 Labels/Min

- Above 50 Labels/Min

By Application

- Food and Beverages

- Electronics

- Pharmaceutical

- Others

By Distribution Channel

- Offline

- Online

Drivers

Rising Automation Demand Across FMCG, Pharma, and E-commerce Operations Drives Auto Labeler Market Growth

FMCG companies, pharmaceutical manufacturers, and e-commerce fulfillment centers accelerate adoption of automated packaging lines to manage growing order volumes. Auto labelers support traceability, compliance, and speed requirements across these sectors. According to FDA Enforcement Report analysis, labeling errors caused 45.5% of U.S. food recalls in 2024, costing approximately USD 1.92 billion, making error-free automation a business-critical investment.

Manufacturers demand high-speed, error-free product identification systems to support mass customization and SKU proliferation. Modern auto labelers handle multiple product formats on a single line without downtime. Moreover, integration with smart sensors, vision systems, and AI-based print verification allows businesses to detect and correct labeling defects in real time during production.

Regulatory labeling requirements for food safety, drug serialization, and hazardous material logistics expand globally. Governments enforce stricter compliance frameworks that require precise, machine-readable label application. Therefore, businesses across regulated industries prioritize auto labeling investments to meet legal mandates, avoid financial penalties, and maintain product integrity throughout complex distribution networks.

Restraints

High Capital Investment and Integration Complexity Limit Adoption of Advanced Auto Labeling Systems

Auto labeling systems require substantial upfront capital for machinery, installation, and integration with existing packaging lines. Businesses running legacy ERP and packaging infrastructure face significant compatibility challenges. Consequently, many small and mid-sized manufacturers delay automation upgrades due to the high total cost of ownership and prolonged return on investment timelines.

SMEs lack the technical expertise required to operate and maintain advanced automated labeling ecosystems. Skilled technicians capable of programming and servicing modern labeling equipment remain scarce in several regional markets. Moreover, reliance on vendor support for troubleshooting increases operational costs and creates dependency risks that discourage smaller businesses from committing to full automation transitions.

The complexity of integrating auto labelers with multi-vendor production environments adds project risk. Customization requirements for specific label formats, substrates, or application speeds extend implementation timelines. Additionally, downtime during installation and staff retraining periods disrupts production schedules, creating further hesitation among manufacturers evaluating automated labeling investment decisions.

Growth Factors

Cloud Connectivity, Sustainable Materials, and Smart Warehousing Create Significant Growth Opportunities in Auto Labeler Market

Cloud-connected auto labeling systems enable real-time production monitoring, remote diagnostics, and predictive maintenance across distributed manufacturing facilities. Businesses adopt these platforms to reduce downtime and optimize line efficiency. In December 2025, The Label Makers acquired First Choice Labels, strengthening its position in self-adhesive label production and expanding cloud-integrated labeling capabilities for industrial clients.

Demand for sustainable and eco-friendly labeling materials compatible with automated labeling machines grows rapidly. Brands respond to consumer and regulatory pressure by adopting recyclable substrates and water-based adhesives. According to FDA recall data research, 76.8% of allergen recall cases with known root cause linked to poor label control processes, making precision-compatible sustainable labeling a dual priority for compliance and sustainability goals.

Smart warehousing and robotics-driven logistics operations create strong demand for dynamic real-time label printing and application systems. Rising adoption of serialization and anti-counterfeiting labeling in global supply chains further expands the addressable market. Additionally, labeling system vendors develop modular architectures that integrate directly with warehouse management systems and robotic picking platforms.

Emerging Trends

AI-Powered Systems, Smart Labels, and Digital Twin Technology Reshape the Auto Labeler Market Landscape

AI-powered predictive maintenance and self-calibrating label application systems reduce unplanned downtime and improve machine accuracy. These intelligent systems analyze sensor data to anticipate mechanical failures before they disrupt production. According to research indexed in the National Institutes of Health database, 78.8% of allergen recalls involved a single allergen, highlighting the precision demands that drive adoption of AI-based verification in automated labeling workflows.

RFID, NFC, and QR smart labels gain widespread adoption for omnichannel retail and inventory visibility applications. Brands embed digital information into packaging for real-time tracking and consumer engagement. Moreover, regulatory mandates in pharmaceuticals and electronics increasingly require machine-readable smart labels, pushing labeling equipment manufacturers to support these formats natively on standard auto labeling platforms.

Modular and compact auto labelers support flexible, multi-product production lines that switch formats quickly. Manufacturers adopt digital twin-based simulation to model labeling line performance and reduce changeover time. Consequently, labeling equipment vendors invest in software tools that replicate physical line behavior in virtual environments, allowing engineers to optimize workflows and minimize costly physical trials.

Regional Analysis

North America Dominates the Auto Labeler Market with a Market Share of 43.80%, Valued at USD 114.3 Million

North America leads the global auto labeler market, accounting for 43.80% of total revenue and valued at USD 114.3 Million in 2025. The United States drives this dominance through strict FDA and USDA labeling regulations across food and pharmaceutical sectors. Moreover, high automation penetration in U.S. manufacturing facilities and strong investment in FMCG packaging infrastructure support sustained regional leadership.

Europe Auto Labeler Market Trends

Europe maintains a strong market position driven by rigorous EU food safety regulations, pharmaceutical serialization mandates, and sustainability labeling requirements. Germany, France, and the UK lead regional demand. Additionally, European manufacturers invest in eco-friendly label solutions and smart packaging systems to meet evolving regulatory frameworks and consumer expectations for transparent product labeling.

Asia Pacific Auto Labeler Market Trends

Asia Pacific records the fastest growth trajectory, supported by rapid manufacturing expansion in China, India, and Southeast Asia. Rising FMCG production volumes and growing pharmaceutical exports push regional adoption of automated labeling systems. Consequently, global equipment vendors target Asia Pacific with cost-competitive product lines designed for high-volume, multi-SKU production environments in emerging industrial hubs.

Middle East and Africa Auto Labeler Market Trends

The Middle East and Africa region shows steady demand growth as food processing and logistics sectors modernize their packaging infrastructure. GCC countries invest in smart warehousing and compliant labeling to support expanding retail and export markets. Moreover, South Africa's growing pharmaceutical manufacturing base contributes to increasing regional adoption of automated label application systems.

Latin America Auto Labeler Market Trends

Latin America expands its auto labeler market driven by Brazil and Mexico's growing food and beverage manufacturing sectors. Regulatory alignment with global labeling standards creates demand for compliant automated solutions. Additionally, rising e-commerce penetration in the region increases demand for precise labeling in fulfillment and logistics operations, encouraging manufacturers to invest in scalable automated labeling platforms.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Weber Packaging Solutions holds a strong position in the global auto labeler market through its broad portfolio of pressure-sensitive labeling systems and print-and-apply technologies. The company serves food, beverage, pharmaceutical, and industrial clients with customized labeling platforms. Moreover, Weber's focus on integration-ready systems and global service networks strengthens its competitive standing in automated packaging environments.

Markem-Imaje delivers advanced coding, marking, and labeling solutions that support traceability and compliance across regulated industries. Its systems integrate seamlessly with production line software for real-time verification. Additionally, Markem-Imaje invests in cloud-connected platforms and AI-powered inspection tools, positioning itself as a technology leader in high-accuracy industrial label application and serialization workflows.

Videojet specializes in continuous inkjet, laser, and thermal transfer printing systems used alongside auto labeling infrastructure across FMCG, pharmaceutical, and chemical industries. Its solutions support high-speed production lines demanding reliable, smear-resistant coding and labeling. Consequently, Videojet maintains strong demand by offering robust after-sales service programs and application-specific labeling technology configurations globally.

Domino provides labeling and coding systems engineered for precision and uptime across fast-moving consumer goods and pharmaceutical packaging operations. In September 2025, Portrait Capital launched a label printing platform through acquisitions including AAi Labels and Decals and Sticker Ranch, intensifying competition in industrial labeling production and digital ordering. Domino counters this with continuous product innovation and expanded application coverage across its global installed base.

Key Players

- Weber Packaging Solutions

- Markem-Imaje

- Videojet

- Domino

- Pro Mach

- Label-Aire

- Matthews

- Diagraph

- Quadrel Labeling Systems

- ALTech

- Panther Industries

Recent Developments

- March 2025 - ProMach acquired Cincinnati-based KelCode Solutions, expanding its auto labeling and coding capabilities. This acquisition strengthens ProMach's product portfolio across automated packaging and label application for FMCG and industrial markets.

- May 2025 - Advantage Capital invested USD 11.5 million in Specialty Printing to expand label, packaging, and tag manufacturing operations. This investment supports workforce capacity expansion and accelerates production capabilities for industrial and commercial labeling applications.

Report Scope

Report Features Description Market Value (2025) USD 261.0 Million Forecast Revenue (2035) USD 409.2 Million CAGR (2026-2035) 4.6% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Below 30 Labels/Min, 30-50 Labels/Min, Above 50 Labels/Min), By Application (Food & Beverages, Electronics, Pharmaceutical, Others), By Distribution Channel (Offline, Online) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Weber Packaging Solutions, Markem-Imaje, Videojet, Domino, Pro Mach, Label-Aire, Matthews, Diagraph, Quadrel Labeling Systems, ALTech, Panther Industries Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- Weber Packaging Solutions

- Markem-Imaje

- Videojet

- Domino

- Pro Mach

- Label-Aire

- Matthews

- Diagraph

- Quadrel Labeling Systems

- ALTech

- Panther Industries