Global All-flash Array Market Size, Share, Industry Analysis Report By Media (Solid-State Drives (SSDs), Custom Flash Modules (CFMs)), By Storage Architecture (Block Storage, File Storage, Object Storage), By Storage System (Software-Defined Storage (SDS), Cloud Storage, Network-Attached Storage (NAS), Direct-Attached Storage (DAS), Storage Area Network (SAN), Unified Storage), By End Use (BFSI, IT & Telecom, Healthcare, Retail, Government & Public Sector, Media & Entertainment, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 157436

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Analysts’ Viewpoint

- Investment and Business Benefits

- Role of Generative AI

- Latest Trends

- By Media – SSDs: 71%

- Storage Architecture – Block Storage: 46.9%

- Storage System – SAN: 38.9%

- End Use – BFSI: 34.7%

- Regional Market – North America: 38.7%

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

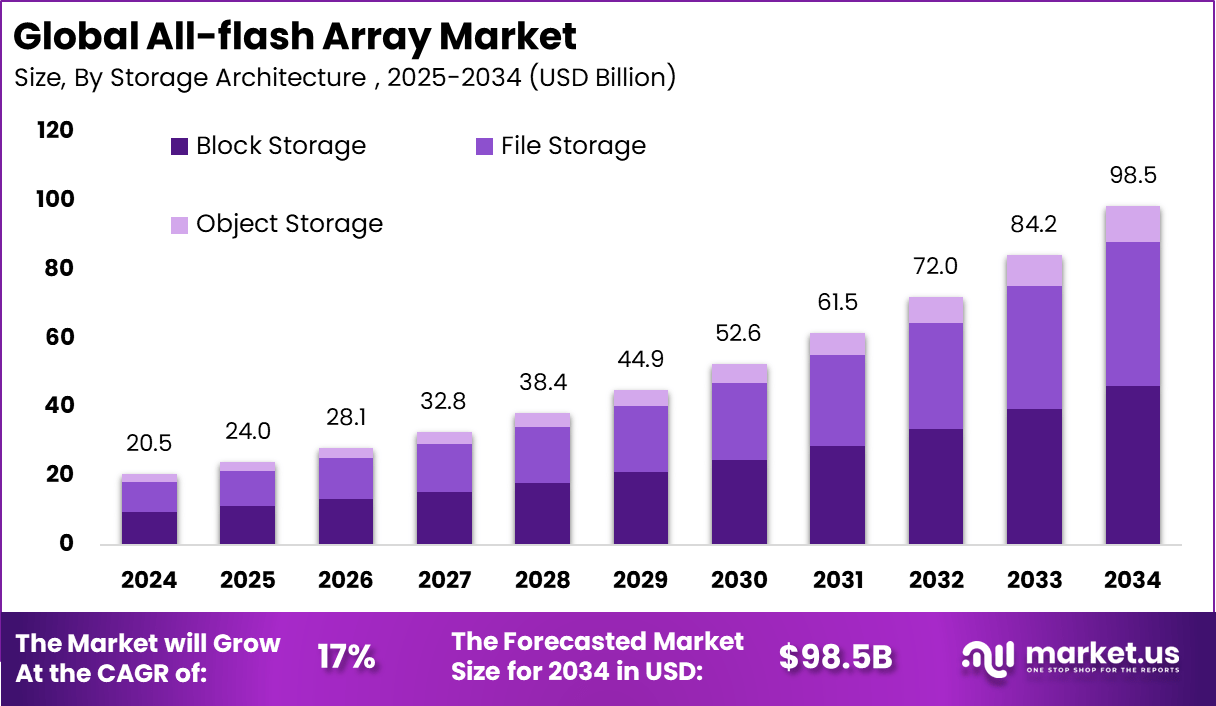

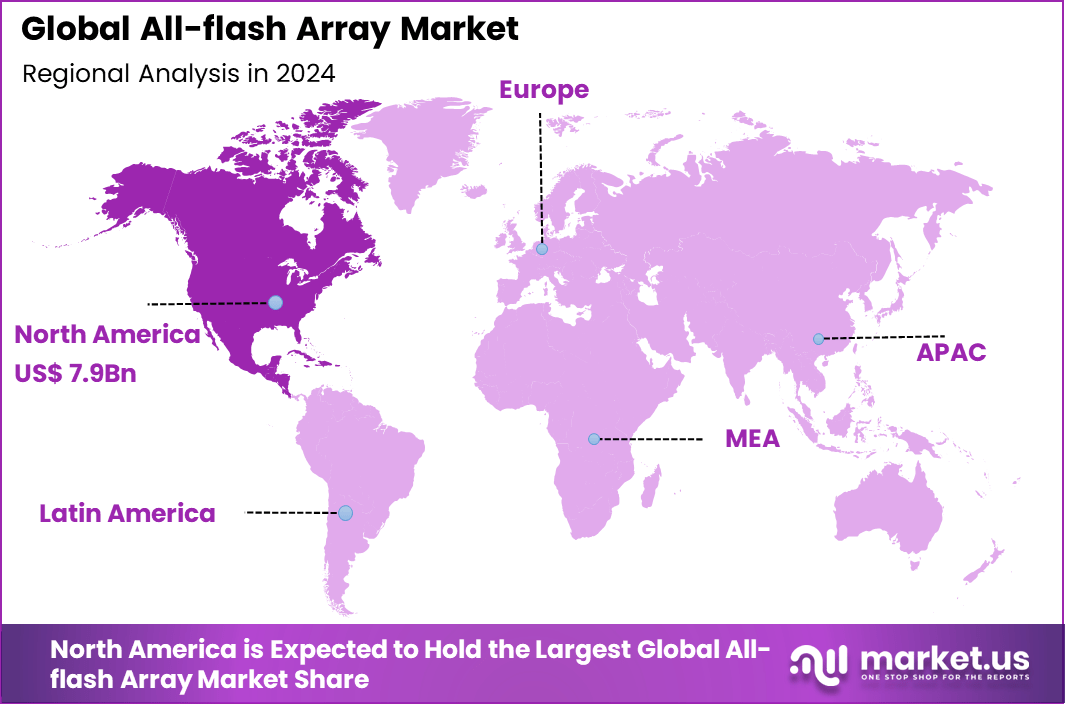

The Global All-flash Array Market size is expected to be worth around USD 98.5 Billion By 2034, from USD 20.5 billion in 2024, growing at a CAGR of 17% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 38.7% share, holding USD 7.9 Billion revenue.

The All‑Flash Array (AFA) Market refers to storage systems composed solely of flash memory drives, without spinning disks. These arrays are engineered for high speed, low latency, and reliable performance, making them suitable for demanding data workloads such as real‑time analytics, transactional databases, and virtualized environments. Their architecture supports rapid access and streamlined data handling.

Top driving factors behind the growth of the all-flash array market include the rising demand for faster, low-latency storage solutions powered by expanding cloud adoption, big data analytics, and artificial intelligence applications. Enterprises increasingly need high-performance infrastructure to support digital transformations and handle larger data volumes efficiently.

In May 2025, Nutanix partnered with Pure Storage to launch an integrated solution combining the Nutanix Cloud Platform with Pure Storage FlashArray. The collaboration focuses on delivering scalable, secure, and high-performance infrastructure, while simplifying virtualization and improving cyber resilience. This joint effort also provides enterprises with greater flexibility in managing mission-critical workloads across hybrid and multi-cloud environments.

Demand analysis reveals that sectors like BFSI (Banking, Financial Services, and Insurance), healthcare, telecommunications, and government are primary adopters due to their critical requirements for secure, rapid data processing and compliance with regulatory standards. The growth of data centers worldwide, driven by IoT integration and cloud solutions, also significantly contributes to increasing demand.

Key Insight Summary

- By media, Solid-State Drives (SSDs) dominated with a 71% share.

- By storage architecture, Block Storage led the market, accounting for 46.9% share.

- By storage system, Storage Area Network (SAN) was the leading segment, holding 38.9% share.

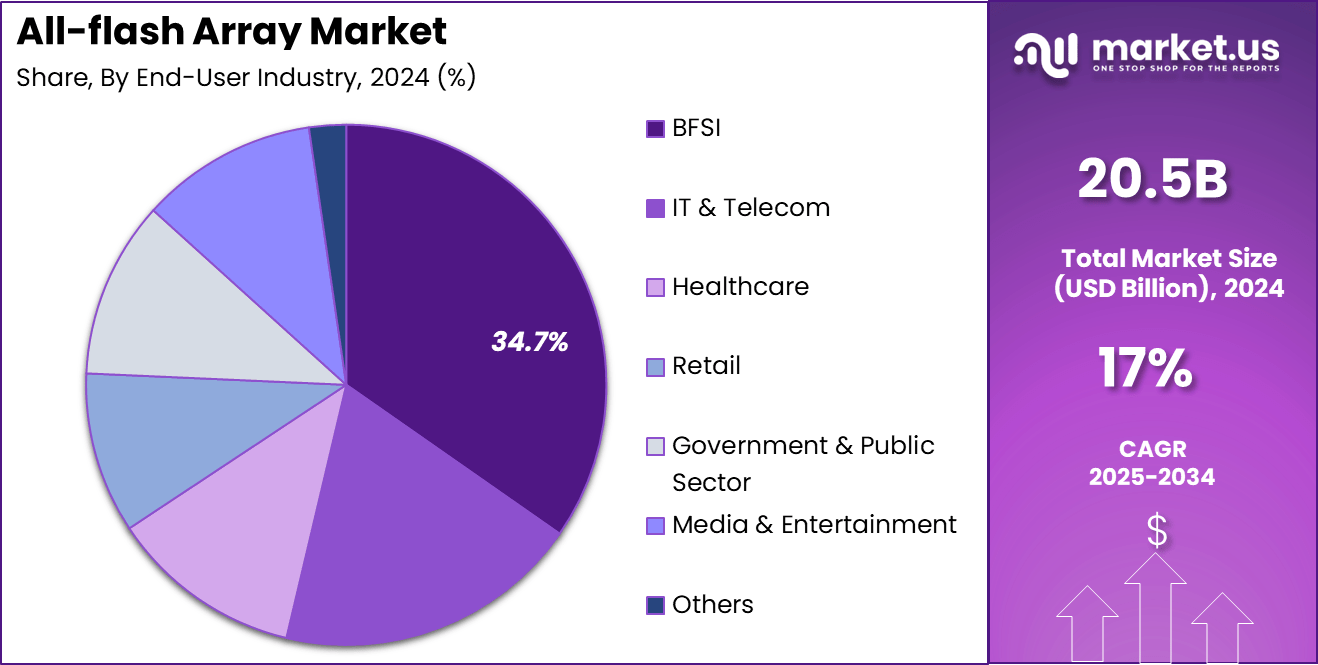

- By end use, the BFSI sector emerged as the top adopter, contributing 34.7% share.

- Regionally, North America was the leading market, securing 38.7% share.

Analysts’ Viewpoint

Technologies increasing adoption include NVMe (Non-Volatile Memory Express) which boosts data transfer speeds and lowers latency even further. Advancements in software-defined storage, AI and machine learning integration for intelligent data management, and hybrid cloud storage models combining on-premise and cloud benefits are prominent drivers.

Key reasons for adopting all-flash arrays include their ability to deliver superior speed and performance, significant power and space savings, enhanced reliability due to lack of moving parts, and better data protection features.

Organizations prioritize these systems for mission-critical workloads where downtime is unacceptable and fast data access directly impacts business outcomes. Scalability without performance loss also ensures readiness for future growth and evolving computing needs.

Investment and Business Benefits

Investment opportunities in the all-flash array market remain attractive, especially as companies and governments invest heavily in cloud infrastructure, digital transformation initiatives, and smart city projects. The rising focus on edge computing and AI applications opens new avenues for vendors offering innovative storage performance solutions.

From a business perspective, the adoption of all-flash arrays results in important benefits such as faster transaction processing, improved real-time decision-making, lower total cost of ownership due to operational savings, and reduced physical footprint in data centers. Enhanced uptime and data availability give enterprises confidence in managing critical workloads seamlessly.

The regulatory environment influences the all-flash array market by mandating compliance with data privacy and security standards such as GDPR and CCPA. These regulations create a push for secure storage solutions with strong encryption, data replication, and recovery capabilities. Enterprises must meet strict data sovereignty and governance needs, so they increasingly adopt all-flash arrays with built-in security for regulated sectors like BFSI and healthcare.

Role of Generative AI

Key Points Description Supports High-Performance Storage Facilitates rapid read/write speeds necessary for generative AI workloads handling large data volumes. Reduces Data Bottlenecks Ensures high-throughput storage to prevent delays when processing millions of images or data points concurrently. Enables Real-Time Analytics Provides the speed and low latency needed for real-time AI model training and inference. Enhances AI Model Training Accelerates training by supporting fast synchronous data access and processing for generative AI networks. Integrates with NVMe Technology Uses advanced NVMe and NVMe-over-Fabrics for scalable, low-latency storage in generative AI applications. Latest Trends

Key Trends Description Adoption of NVMe-Based Storage NVMe technology is increasingly integrated to enhance speed and efficiency of all-flash arrays. Declining Flash Storage Costs Cost reductions are broadening the adoption of AFAs beyond large enterprises to mid-market segments. Growth in Cloud and Big Data AFAs are critical for cloud providers and big data analytics requiring rapid access to large datasets. Shift to Software-Defined Storage Software-defined storage solutions paired with AFAs offer greater flexibility and scalability. By Media – SSDs: 71%

Solid-State Drives (SSDs) dominated the all-flash array market in 2024 with a significant market share of 71%. The preference for SSDs stems from their superior speed, reliability, and energy efficiency compared to traditional hard disk drives.

Enterprises and data centers favor SSDs for their ability to rapidly process large volumes of data, reduce latency, and sustain high input/output operations per second (IOPS), which is essential for handling complex workloads such as AI, analytics, and real-time transaction processing.

These advantages support critical applications across industries including BFSI, healthcare, and retail, where performance and uptime are paramount. Moreover, the continuous advancement in NAND flash technology and the associated decrease in production costs have made SSDs more accessible to a broader range of organizations.

This has accelerated the migration from spinning disk-based storage to all-flash systems. The cost-effectiveness combined with scalability and reduced physical storage footprint reinforces SSDs as the preferred choice in modern storage architectures, facilitating faster data access and streamlined operational workflows for enterprises undergoing digital transformation.

Storage Architecture – Block Storage: 46.9%

Block storage held the dominant position in the all-flash array market in 2024 with a market share of 46.9%. This storage architecture is highly favored for enterprise applications requiring structured data handling with optimized performance and minimal latency.

Block storage is ideal for critical workloads such as databases, virtualization, and enterprise resource planning (ERP) systems, as it allows data to be managed in discrete blocks, enabling faster retrieval and robust performance under high-demand scenarios. Its efficiency, reliability, and integration with existing IT infrastructures make it foundational in many data centers.

The adoption of block storage in all-flash arrays is further driven by its inherent flexibility and scalable design. Enterprises leverage block storage to streamline workflows by supporting mission-critical applications that require consistent low latency and high-speed data access. Furthermore, block storage’s compatibility with diverse enterprise applications and its capacity to deliver high availability and disaster recovery capabilities contribute to its market dominance.

Storage System – SAN: 38.9%

The Storage Area Network (SAN) segment accounted for 38.9% of the all-flash array market in 2024, making it the leading storage system choice for enterprises. SAN provides a high-speed network that connects storage devices to servers, enabling centralized storage management and improved data accessibility.

This architecture supports complex, data-intensive environments by delivering high throughput, low latency, and reliable data transfers essential for enterprise applications. SAN systems facilitate scalability, enabling IT departments to expand storage capacity without disrupting operations.

SAN’s strength lies in its ability to support virtualized environments and highly transactional workloads common in industries such as BFSI, healthcare, and telecommunications. By integrating with all-flash arrays, SAN solutions provide enhanced performance benefits including faster data delivery and improved disaster recovery capabilities. This combination ensures uninterrupted business continuity and operational efficiency, further solidifying SAN’s leadership in the storage systems market.

End Use – BFSI: 34.7%

The BFSI (Banking, Financial Services, and Insurance) sector represented 34.7% of the all-flash array market in 2024, driven by the critical need for secure, high-performance storage solutions. Financial institutions require fast, reliable data access to manage real-time transaction processing, fraud detection, compliance reporting, and risk management.

The low latency and high throughput capabilities of all-flash arrays enhance these operations, supporting seamless digital banking, mobile payments, and AI-driven analytics. Additionally, BFSI organizations prioritize data security, regulatory compliance, and disaster recovery – all critical factors that all-flash arrays address effectively.

The reliability of flash storage helps ensure minimal downtime and rapid recovery from failures, essential for financial firms that operate 24/7. As digital banking adoption grows and data volumes expand exponentially, BFSI continues to be a major driver of all-flash array market growth.

Regional Market – North America: 38.7%

North America led the global all-flash array market in 2024 with a 38.7% share, supported by its advanced IT infrastructure and widespread digital transformation initiatives. The region’s significant concentration of data centers, cloud service providers, and technology companies drives strong demand for high-performance storage solutions like all-flash arrays.

Enterprises in various sectors, including BFSI, healthcare, IT, and retail, actively adopt these technologies to support AI, big data analytics, and cloud workloads. The robust presence of major technology vendors and continuous investments in data center modernization further fuel market growth in North America.

Government policies and cyber resilience initiatives also promote the adoption of secure and innovative storage architectures. As a result, North America remains the most mature and revenue-generating market for all-flash arrays, setting the pace for global industry trends.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Market Segments

By Media

- Solid-State Drives (SSDs)

- Custom Flash Modules (CFMs)

By Storage Architecture

- Block Storage

- File Storage

- Object Storage

By Storage System

- Software-Defined Storage (SDS)

- Cloud Storage

- Network-Attached Storage (NAS)

- Direct-Attached Storage (DAS)

- Storage Area Network (SAN)

- Unified Storage

By End Use

- BFSI

- IT & Telecom

- Healthcare

- Retail

- Government & Public Sector

- Media & Entertainment

- Others

Driver Analysis

Increasing Demand for High-Speed Data Storage

The all-flash array market is driven significantly by the growing need for high-speed data storage solutions across industries. Enterprises are generating massive volumes of data daily and require storage systems that deliver low latency and high performance. All-flash arrays provide the speed and reliability necessary for real-time analytics, transaction processing, and data-intensive applications such as artificial intelligence and big data analytics.

This demand is supported by the advantages all-flash arrays offer over traditional storage, including faster data access, enhanced energy efficiency, and reduced maintenance needs. The rise of cloud computing and digital transformation initiatives have further accelerated the adoption of all-flash arrays as organizations aim to improve their IT infrastructure performance and scalability.

Industries such as banking, financial services, insurance (BFSI), healthcare, and telecommunications are investing heavily in all-flash arrays to handle large and complex data workloads. The superior input/output operations per second (IOPS) and reduced latency improve overall system responsiveness and user experience.

Restraint Analysis

High Initial Deployment Costs

One of the main restraints for the all-flash array market is the high initial investment required to deploy these systems. Although all-flash arrays deliver superior performance and operational savings in the long run, the upfront capital expenditure remains a significant barrier, especially for small and medium-sized enterprises.

The cost of flash memory and related infrastructure components is higher compared to traditional hard disk drives. This can delay adoption or force organizations to opt for hybrid or traditional storage solutions rather than fully transitioning to all-flash arrays.

Additionally, integrating all-flash arrays into existing IT infrastructures can involve extra expenses for upgrades or compatibility adjustments, further adding to the initial deployment costs. These financial constraints are particularly challenging for businesses with limited IT budgets or those uncertain about the immediate return on investment.

Opportunity Analysis

Growing Adoption in AI and Big Data Workloads

The surge in artificial intelligence, machine learning, and big data analytics presents a significant growth opportunity for the all-flash array market. These advanced workloads require lightning-fast data access, high throughput, and low latency to operate efficiently.

All-flash arrays are uniquely positioned to meet these demands, making them the preferred storage solution for enterprises implementing AI-driven processes and data analytics platforms. As organizations increasingly rely on AI to drive decision-making and automate operations, the need for storage solutions that can handle large volumes of structured and unstructured data quickly and reliably grows.

Further, cloud providers and data centers are incorporating all-flash arrays to support scalable, high-performance computing environments, enhancing the appeal of these storage systems. This expanding demand across industries such as technology, finance, healthcare, and retail creates substantial market potential for vendors offering innovative and tailored flash storage solutions.

Challenge Analysis

Data Security and Integration Complexities

A key challenge for the all-flash array market lies in ensuring robust data security and managing the integration with legacy IT systems. Transitioning to all-flash storage often raises concerns about cyber threats, ransomware, and data breaches, especially for sectors like BFSI and healthcare that handle sensitive information.

Protecting this data demands advanced encryption, disaster recovery, and real-time replication capabilities, which can increase the complexity and cost of deployment. Moreover, integrating all-flash arrays with existing, sometimes outdated, IT infrastructure can be difficult, requiring significant technical expertise and time.

Compatibility issues and the need for system upgrades may slow adoption rates or increase operational disruption during migration. These hurdles necessitate skilled resources and careful planning to ensure smooth integration and compliance with security regulations, presenting a barrier for organizations without sufficient IT capacity or experience in flash storage technologies.

Competitive Analysis

Hewlett Packard Enterprise, Huawei, and Dell have maintained strong positions in the all-flash array market through wide product portfolios and global reach. Their strategies focus on enterprise adoption by delivering high performance, scalability, and integration with hybrid cloud environments. These companies benefit from established customer bases and strong R&D investments, allowing them to capture demand from large organizations transitioning from legacy storage systems .

Fujitsu, Hitachi Vantara, and IBM have focused on innovation in enterprise storage infrastructure. Their offerings emphasize reliability, data protection, and advanced analytics integration, which align with growing demand for secure and intelligent storage. These companies also capitalize on partnerships with enterprises across industries that require high-speed data access and strong compliance features. .

Inspur, Micron Technology, NetApp, and Pure Storage have shaped the market by addressing diverse enterprise needs. Inspur and Micron strengthen the ecosystem with hardware and semiconductor expertise, while NetApp and Pure Storage focus on cloud-ready and AI-driven storage solutions. Their strategies target both mid-sized businesses and large enterprises seeking flexible, cost-efficient storage. .

Top Key Players in the Market

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- Dell Inc.

- Fujitsu

- Hitachi Vantara LLC

- IBM Corporation

- INSPUR Co., Ltd.

- Micron Technology, Inc.

- NetApp

- Pure Storage, Inc.

Recent Developments

- In March 2025, Huawei introduced its new-generation all-flash data center portfolio, featuring OceanStor Dorado, OceanStor A800, OceanStor Pacific 9928, and OceanProtect E8000. Alongside these products, the company launched tailored solutions for industries such as finance and education. The portfolio is designed to deliver future-proof storage power, with a focus on AI enablement, scalability, resilience, and advanced data protection, supporting the needs of enterprises in the AI-driven era.

Report Scope

Report Features Description Market Value (2024) USD 20.5 Bn Forecast Revenue (2034) USD 98.5 Bn CAGR(2025-2034) 17% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Media (Solid-State Drives (SSDs), Custom Flash Modules (CFMs)), By Storage Architecture (Block Storage, File Storage, Object Storage), By Storage System (Software-Defined Storage (SDS), Cloud Storage, Network-Attached Storage (NAS), Direct-Attached Storage (DAS), Storage Area Network (SAN), Unified Storage), By End Use (BFSI, IT & Telecom, Healthcare, Retail, Government & Public Sector, Media & Entertainment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Dell Inc., Fujitsu, Hitachi Vantara LLC, Hewlett Packard Enterprise Development LP, Huawei Technologies Co. Ltd., IBM Corporation, INSPUR Co. Ltd., Micron Technology Inc., NetApp, Pure Storage Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- Dell Inc.

- Fujitsu

- Hitachi Vantara LLC

- IBM Corporation

- INSPUR Co., Ltd.

- Micron Technology, Inc.

- NetApp

- Pure Storage, Inc.