Global Alkyl Polyglucoside Surfactants Market Size, Share, And Enhanced Productivity By Source (Plant-based, Synthetic), By Formulation Type (Liquid, Powder, Granules), By Application (Household Cleaning, Industrial Cleaning, Personal Care, Agricultural Solutions, Other), By End-use (Food and Beverage, Cosmetics and Personal Care, Pharmaceuticals, Agriculture, Household Products, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 177284

- Number of Pages: 241

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

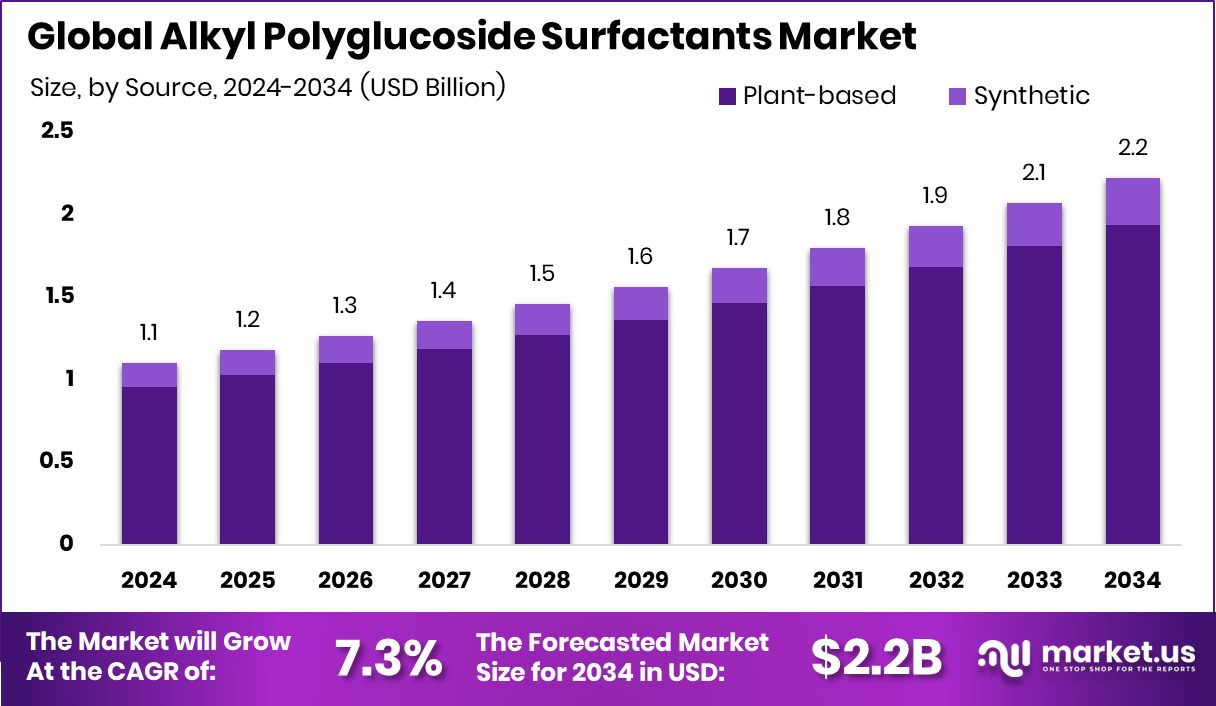

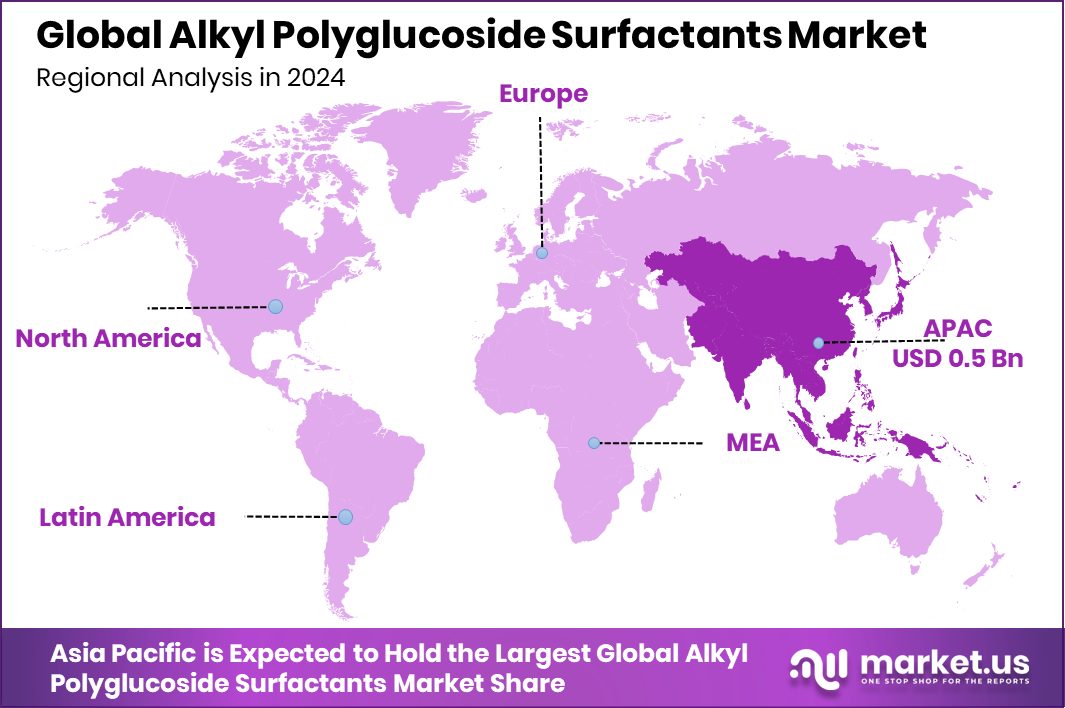

The Global Alkyl Polyglucoside Surfactants Market is expected to be worth around USD 2.2 billion by 2034, up from USD 1.1 billion in 2024, and is projected to grow at a CAGR of 7.3% from 2025 to 2034. Alkyl Polyglucoside Surfactants reached USD 0.5 Bn as the Asia Pacific captured 48.4%.

The global Alkyl Polyglucoside (APG) Surfactants Market covers a wide set of product categories, including plant-based and synthetic sources, as well as liquid, powder, and granular formulations. These surfactants are widely used across household cleaning, industrial cleaning, personal care, agricultural solutions, and several other applications. End-use industries such as food and beverage, cosmetics and personal care, pharmaceuticals, agriculture, and household products rely heavily on APGs because of their mildness, biodegradability, and compatibility with natural formulations.

Alkyl Polyglucoside Surfactants are naturally derived cleaning and foaming agents produced from sugars and fatty alcohols. They are known for being gentle, non-toxic, and environmentally friendly, making them suitable for sensitive consumer products. The APG Surfactants Market represents the commercial ecosystem surrounding their production, supply, and use across industries that require safe and performance-driven cleaning ingredients.

Growth in the market is supported by rising awareness of green chemistry and global pushes for cleaner technologies. Large public-sector commitments—such as Germany’s €500 billion special fund for infrastructure and climate neutrality and the EU’s €4 billion clean-energy funding program—encourage industries to adopt sustainable raw materials, indirectly boosting APG demand.

Demand is also rising as cities and governments invest in eco-friendly solutions. Programs like over £1 million to clean chewing-gum stains and the £43 million boost for green aviation highlight the global shift toward safer, biodegradable cleaning systems that benefit from APG-based formulations.

Despite occasional policy reversals—such as the White House cancelling nearly $8 billion in clean-energy projects—the long-term opportunity remains strong. APGs continue gaining traction as industries search for dependable, renewable surfactants that can meet stricter environmental expectations without compromising performance.

Key Takeaways

- The Global Alkyl Polyglucoside Surfactants Market is expected to be worth around USD 2.2 billion by 2034, up from USD 1.1 billion in 2024, and is projected to grow at a CAGR of 7.3% from 2025 to 2034.

- Plant-based APG surfactants dominate the Alkyl Polyglucoside Surfactants Market, contributing 87.2% of total demand.

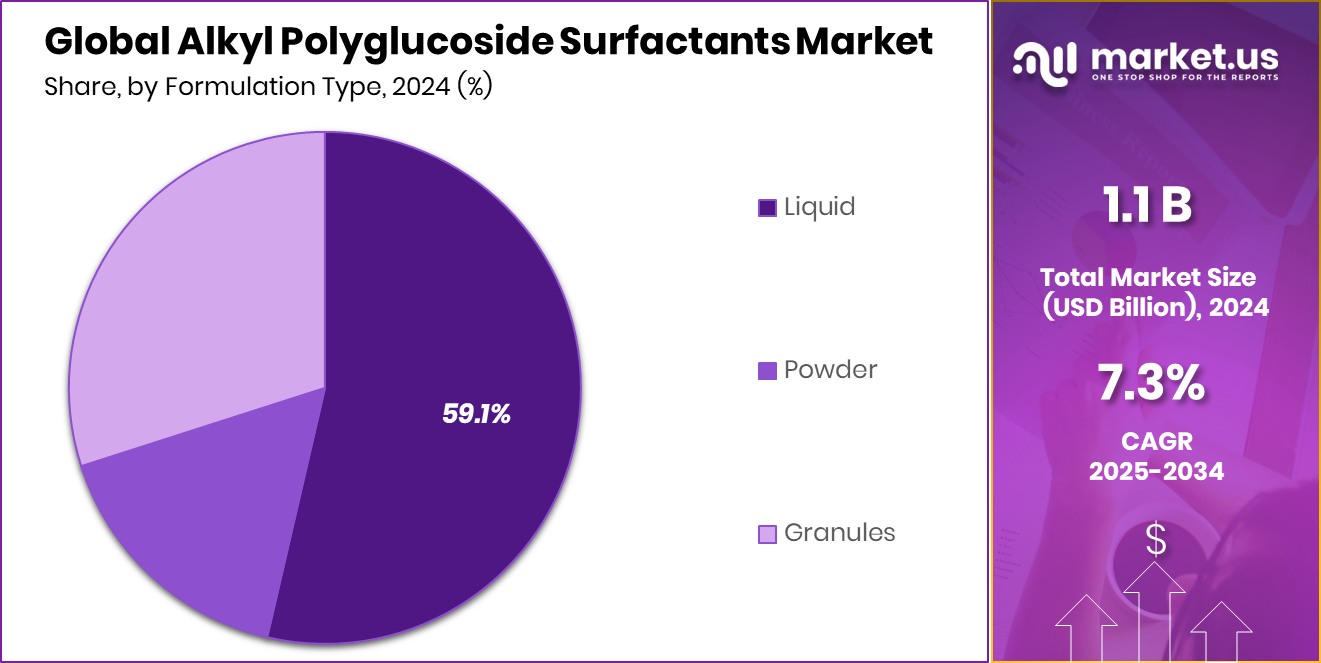

- Liquid formulations hold strong influence in the Alkyl Polyglucoside Surfactants Market, representing 59.1% overall share.

- Household cleaning applications significantly drive the Alkyl Polyglucoside Surfactants Market, accounting for 39.8% usage.

- Household products remain key end-use within the Alkyl Polyglucoside Surfactants Market, capturing 36.9% global share.

- The region Asia Pacific contributed 48.4% value, supporting USD 0.5 Bn market growth.

By Source Analysis

Alkyl Polyglucoside Surfactants Market sees strong growth as plant-based sources reach 87.2%.

In 2024, the Alkyl Polyglucoside (APG) Surfactants Market continued shifting strongly toward plant-based sources, which accounted for around 87.2% of total usage. This dominant share reflects how brands and consumers now prefer ingredients derived from renewable crops like corn, sugarcane, and coconut. Companies increasingly highlight plant-origin surfactants to reduce environmental stress, lower carbon footprints, and meet tightening global sustainability guidelines.

Manufacturers also benefit from stable agricultural supply chains, enabling cleaner formulations without compromising performance. As environmental labels grow more influential in purchasing decisions, plant-based APGs are becoming the standard for many product lines. This steady transition shows how plant-derived chemistry is shaping everyday consumer and industrial cleaning innovations.

By Formulation Type Analysis

Liquid formulations dominate the Alkyl Polyglucoside Surfactants Market, accounting for nearly 59.1% usage.

In 2024, liquid formulations represented roughly 59.1% of the overall Alkyl Polyglucoside Surfactants Market, driven by their ease of processing and compatibility with modern manufacturing setups. Liquid APGs blend smoothly with other ingredients, reducing production time and improving batch consistency for detergent and personal-care companies. Their stable viscosity and excellent solubility make them a preferred choice for concentrated cleaning solutions and ready-to-use products.

Many brands also lean toward liquids to simplify transport, reduce energy used for heating or melting solid materials, and achieve cleaner label claims. As manufacturers push for flexible, cost-efficient formulations, liquid APGs continue to anchor development pipelines across household, institutional, and industrial applications.

By Application Analysis

Household cleaning applications lead the Alkyl Polyglucoside Surfactants Market, contributing around 39.8% demand.

In 2024, household cleaning applications accounted for nearly 39.8% of APG surfactant demand, reflecting growing consumer preference for mild, skin-safe, and biodegradable cleaning products. APGs perform well in dishwashing liquids, surface cleaners, and multipurpose sprays because they offer strong detergency without harsh side effects.

As families increasingly look for products suitable for children, pets, and sensitive skin, APG-based cleaners gain more visibility on retail shelves. Their ability to generate stable foam and maintain cleaning power even in hard water makes them a go-to ingredient for home-care brands. With hygiene awareness remaining high and eco-friendly cleaning solutions expanding rapidly, APGs continue shaping the new generation of safer household formulations.

By End-use Analysis

Household products remain essential in the Alkyl Polyglucoside Surfactants Market, holding 36.9% share.

In 2024, household products made up around 36.9% of total Alkyl Polyglucoside surfactant consumption, highlighting the material’s deep integration into everyday consumer goods. From detergents and floor cleaners to fabric sprays and dishwashing liquids, APGs help manufacturers build reliable, gentle, and environmentally responsible formulations. Consumers increasingly scrutinize product labels, pushing companies to replace harsher chemicals with naturally derived alternatives.

APGs provide an effective balance of mildness and strong cleaning capability, which supports a wide spectrum of home-care innovations. As global households continue prioritizing safe indoor environments and sustainable product choices, APG usage remains on a strong upward path, reinforcing its value across mainstream and premium product lines.

Key Market Segments

By Source

- Plant-based

- Synthetic

By Formulation Type

- Liquid

- Powder

- Granules

By Application

- Household Cleaning

- Industrial Cleaning

- Personal Care

- Agricultural Solutions

- Others

By End-use

- Food and Beverage

- Cosmetics and Personal Care

- Pharmaceuticals

- Agriculture

- Household Products

- Others

Driving Factors

Rising demand for biodegradable cleaning ingredients

The Alkyl Polyglucoside Surfactants Market is strongly influenced by the rising demand for biodegradable cleaning ingredients, as households and industries move away from harsh petrochemical surfactants. APGs are plant-derived, skin-friendly, and align well with the growing interest in naturally sourced cleaning formulations. This shift is further supported by innovations in bio-based ingredient development, highlighted when Sironix, which turns soybeans into cleaning ingredients, raised $3.5 million to fund manufacturing.

Such investments show how the cleaning sector is preparing for a new generation of sustainable products. As global consumers place more value on safety and environmental responsibility, APGs gain even more relevance, creating long-term momentum across home-care, personal-care, and institutional-cleaning applications.

Restraining Factors

Higher production costs reduce broader adoption

While demand continues to rise, the Alkyl Polyglucoside Surfactants Market faces challenges linked to higher production costs, especially compared with conventional synthetic surfactants. The use of plant-based raw materials, along with specialized processing steps, keeps APG manufacturing more expensive, slowing broader adoption in price-sensitive sectors.

The pressures of scaling sustainable technologies are also reflected in larger industry movements, such as Remora Robotics securing €13.9 million to scale AI-enabled net-cleaning capacity, showing how capital is often required to expand eco-focused solutions. For APGs, this cost barrier forces many manufacturers to balance sustainability goals with affordability, making it harder for widespread use in low-margin cleaning and industrial applications.

Growth Opportunity

Expanding green-formulation demand increases adoption

The market offers strong growth opportunities as green formulations gain traction across household cleaning, personal care, and agricultural solutions. APGs fit perfectly into this trend, offering biodegradable and non-toxic performance that supports cleaner-label product launches. Growing interest in automation and advanced cleaning technologies also complements APG demand, as sustainable surfactants pair well with next-generation cleaning systems.

A signal of this momentum was seen when Avidbots, maker of autonomous industrial cleaning robots, secured $70 million, showing how the cleaning ecosystem is evolving toward smarter and greener operations. As industries continue modernizing and consumers prioritize safe, plant-derived cleaning ingredients, APGs stand well-positioned to benefit from this expanding wave of sustainable product development.

Latest Trends

Rapid shift toward ultra-mild formulations

A leading trend in the Alkyl Polyglucoside Surfactants Market is the rapid move toward ultra-mild formulations designed for sensitive-skin products, baby care, natural personal care, and low-toxicity household cleaners. Consumers increasingly prefer products that provide effective cleaning without irritation or environmental harm, and APGs deliver on these expectations with their gentle, sugar-derived chemistry.

The broader cleaning industry is also witnessing investment in modernization, as Avidbots raised $24 million for its commercial floor-cleaning robots, signaling a shift toward advanced, efficient, and environmentally aligned cleaning systems. These developments highlight how manufacturers are combining high-performance mild surfactants with new cleaning technologies to meet evolving expectations for safety, sustainability, and product transparency.

Regional Analysis

Asia Pacific held 48.4% share, driving Alkyl Polyglucoside Surfactants to USD 0.5 Bn.

The Alkyl Polyglucoside Surfactants Market shows varied regional performance across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, with Asia Pacific clearly emerging as the dominant region. In 2024, Asia Pacific accounted for 48.4% of the total market, reaching approximately USD 0.5 billion, driven by strong demand for sustainable cleaning solutions and rapid expansion of home and personal care manufacturing.

North America continues to show steady adoption as consumers shift toward plant-derived surfactants in household and institutional cleaning products. Europe maintains a mature but stable market supported by regulatory emphasis on biodegradable ingredients and cleaner formulations.

The Middle East & Africa demonstrate gradual growth as awareness of eco-friendly cleaning agents rises, while Latin America benefits from evolving consumer habits and expanding detergent production. Together, these regions highlight a cohesive global shift toward mild, renewable surfactant technologies, with the Asia Pacific setting the pace through higher consumption, large-scale production, and growing adoption across household and industrial applications.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, BASF SE continued to strengthen its position in the Alkyl Polyglucoside Surfactants space by focusing on consistent product quality, large-scale production capability, and strong integration across its chemical value chain. The company’s broad technical expertise and ability to streamline renewable feedstock usage supported a stable supply for global home-care and personal-care brands. BASF’s portfolio breadth allowed it to adapt APG grades to different performance needs, making it a preferred partner for manufacturers seeking reliable, plant-derived surfactants.

In 2024, Croda International Plc remained highly influential in the APG landscape due to its focus on specialty formulations and its reputation for developing mild, skin-friendly surfactant technologies. The company leveraged its long experience in personal-care ingredients to align APG offerings with premium cosmetic and skincare applications. Croda’s strategic emphasis on sustainability and traceable raw materials continued resonating with brands shifting toward natural, biodegradable formulations, reinforcing its relevance across emerging clean-label product lines.

In 2024, SEPPIC advanced its role in the global APG segment through innovation-driven product development and a focus on high-performance surfactants tailored for demanding applications. The company emphasized technical refinement, targeting formulations needing both mildness and strong stability. SEPPIC’s expertise in specialty ingredients positioned it well with customers aiming to differentiate their products through gentle and naturally aligned surfactant systems. Its continued commitment to quality and functional improvements strengthened its competitiveness in the evolving APG market.

Top Key Players in the Market

- BASF SE

- Croda International Plc

- SEPPIC

- Evonik Industries

- Kao Corporation

- Galaxy Surfactants Ltd.

- Shanghai Fine Chemical Co., Ltd.

- Fenchem Biotek

- Stepan Company

- Sasol Limited

- Pilot Chemical Company

- Dow

Recent Developments

- In November 2025, BASF announced the expansion of its Alkyl Polyglucosides (APGs) production with a new plant at the Bangpakong site in Chonburi, Thailand. This facility was added to strengthen the company’s manufacturing foothold in Asia and support growing demand for sustainable surfactants used in personal care, home care, and industrial cleaning formulations.

- In January 2024, Evonik completed and started producing its first product from the world’s first industrial-scale biosurfactant plant at its facility in Slovakia. This plant makes sustainable biosurfactants, including types such as rhamnolipids and related green surfactants that serve as alternatives to traditional chemical surfactants, such as alkyl polyglucosides. The products are biodegradable and used in cleaning and personal care formulations. This milestone strengthens Evonik’s ability to supply advanced, eco-friendly surfactants to global customers.

Report Scope

Report Features Description Market Value (2024) USD 1.1 Billion Forecast Revenue (2034) USD 2.2 Billion CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Plant-based, Synthetic), By Formulation Type (Liquid, Powder, Granules), By Application (Household Cleaning, Industrial Cleaning, Personal Care, Agricultural Solutions, Other), By End-use (Food and Beverage, Cosmetics and Personal Care, Pharmaceuticals, Agriculture, Household Products, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Croda International Plc, SEPPIC , Evonik Industries, Kao Corporation, Galaxy Surfactants Ltd., Shanghai Fine Chemical Co., Ltd., Fenchem Biotek, Stepan Company, Sasol Limited, Pilot Chemical Company, Dow Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Alkyl Polyglucoside Surfactants MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Alkyl Polyglucoside Surfactants MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Croda International Plc

- SEPPIC

- Evonik Industries

- Kao Corporation

- Galaxy Surfactants Ltd.

- Shanghai Fine Chemical Co., Ltd.

- Fenchem Biotek

- Stepan Company

- Sasol Limited

- Pilot Chemical Company

- Dow