Global Algae-Based Bioplastics Market Size, Share, And Enhanced Productivity By Product Type (Polyethylene (PE), Polypropylene (PP), Polylactic Acid (PLA), Polyhydroxyalkanoates (PHA), Others), By Application (Packaging, Textiles and Fibers, Automotive, Agriculture, Cosmetics and Personal Care, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 173197

- Number of Pages: 230

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

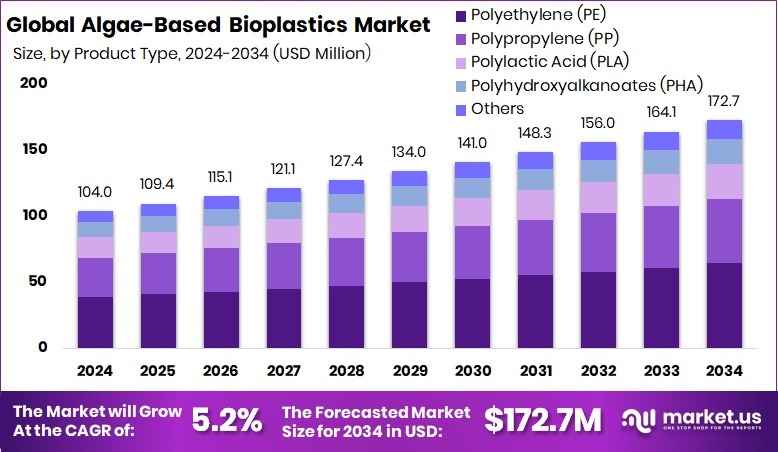

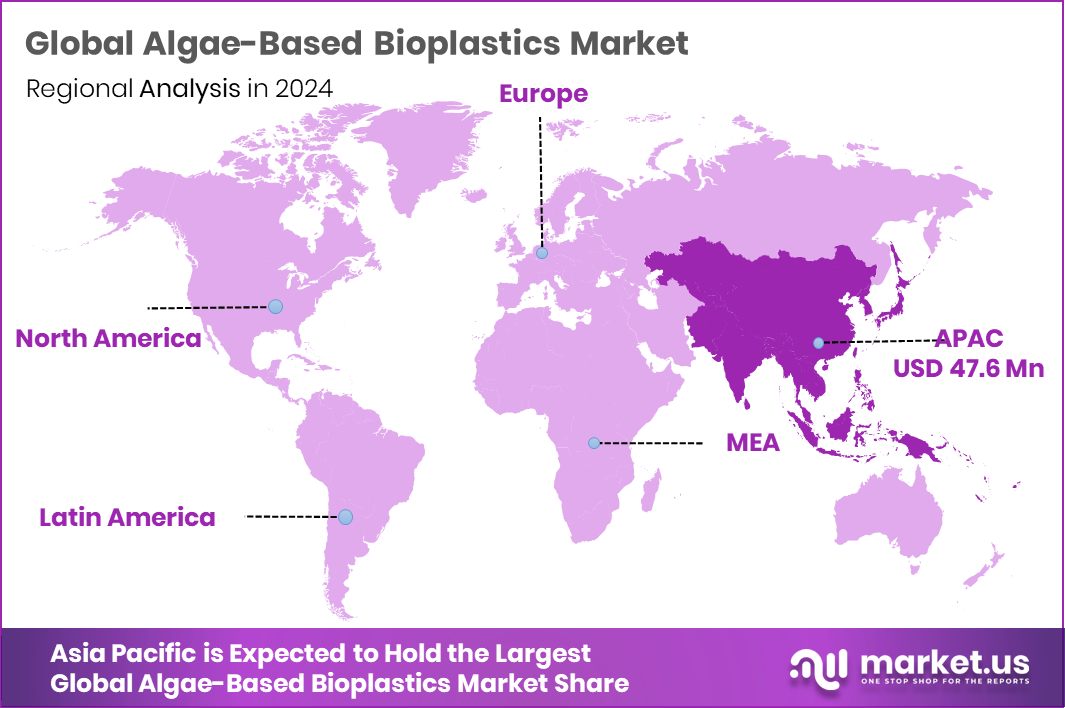

The Global Algae-Based Bioplastics Market is expected to be worth around USD 172.7 million by 2034, up from USD 104.0 million in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034. Rapid packaging demand drives the Asia Pacific bioplastics market to USD 47.6 Mn, 45.80%.

Algae-Based Bioplastics are sustainable plastic materials made from algae biomass instead of fossil fuels. Algae grow quickly, require less land, and do not compete with food crops. These bioplastics can be biodegradable, compostable, or recyclable, making them suitable for packaging, films, coatings, and molded products. Their natural origin and lower environmental impact make them an attractive alternative to conventional plastics.

The Algae-Based Bioplastics Market refers to the commercial ecosystem involved in producing, processing, and applying algae-derived plastic materials across industries. This market connects algae cultivation, bioprocessing technologies, polymer formulation, and end-use manufacturing. It is gaining attention as governments and industries search for scalable solutions to plastic pollution and carbon reduction.

One key growth factor is strong public and institutional investment supporting algae innovation. Umaro and Sway received a $1.5 million U.S. Department of Energy grant to convert seaweed waste into sustainable bioplastics. Similarly, the UK’s CAER secured $1.2 million to advance algae-based carbon utilization, strengthening research-to-market pathways.

Rising demand comes from the packaging and materials sectors seeking low-carbon alternatives. A €9 million EU initiative supporting interregional collaboration in the seaweed sector is accelerating material development and supply-chain readiness. These programs help move algae-based plastics closer to commercial-scale adoption.

The opportunity lies in advanced biomanufacturing platforms. Provectus Algae raised $11.4 million in Pre-Series A funding, along with $3.25 million seed funding, to scale programmable algae technologies. This funding supports multi-industry applications, opening long-term growth potential for algae-based bioplastics.

Key Takeaways

- The Global Algae-Based Bioplastics Market is expected to be worth around USD 172.7 million by 2034, up from USD 104.0 million in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034.

- In the Algae-Based Bioplastics Market, polyethylene-based products lead with a strong 37.2% share globally today.

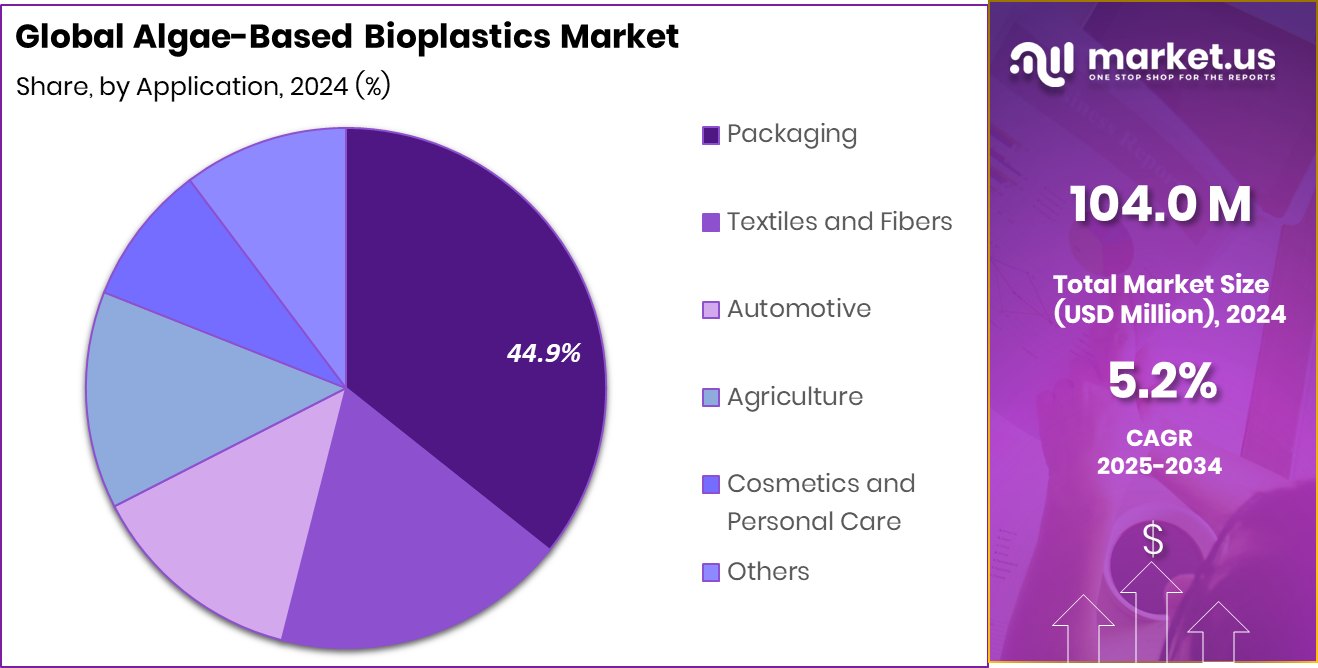

- Packaging dominates the Algae-Based Bioplastics Market application landscape, accounting for a significant 44.9% demand worldwide.

- Strong sustainability policies position Asia Pacific at 45.80% share, reaching USD 47.6 Mn.

By Product Type Analysis

In algae-based bioplastics market, polyethylene dominates product types with 37.2% share globally.

In 2024, Polyethylene (PE) held a dominant position in the Algae-Based Bioplastics Market, accounting for 37.2% of the total share. This leadership is mainly due to PE’s strong balance of flexibility, durability, and process compatibility with existing plastic manufacturing systems. Algae-based PE is increasingly preferred because it can closely replicate the performance of conventional fossil-based polyethylene while offering a lower carbon footprint.

Manufacturers favor this material as it allows easier adoption without major equipment upgrades, reducing transition costs. In addition, algae-derived feedstocks support consistent polymer quality and help address concerns around land use associated with crop-based bioplastics. Demand is further supported by growing regulatory pressure to reduce single-use plastics, encouraging brands to switch to bio-based PE for sustainable product lines.

By Application Analysis

Packaging leads the algae-based bioplastics market applications, accounting for 44.9% demand worldwide today.

In 2024, Packaging emerged as the leading application segment in the Algae-Based Bioplastics Market, capturing a significant 44.9% share. Packaging dominates because it represents the largest volume use of plastics globally and faces the strongest sustainability scrutiny from regulators and consumers. Algae-based bioplastics are increasingly used in food packaging, flexible films, pouches, and containers due to their improved barrier properties and compostable or recyclable potential.

Brand owners are adopting these materials to meet environmental targets and enhance eco-friendly branding. Additionally, algae-based packaging helps reduce dependence on fossil fuels while supporting circular economy goals. As e-commerce and ready-to-eat food consumption continue to rise, the demand for sustainable packaging materials is expected to further strengthen this segment.

Key Market Segments

By Product Type

- Polyethylene (PE)

- Polypropylene (PP)

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Others

By Application

- Packaging

- Textiles and Fibers

- Automotive

- Agriculture

- Cosmetics and Personal Care

- Others

Driving Factors

Circular Economy Investments Accelerate Algae-Based Plastic Adoption

Strong investment in circular plastics innovation is a major driving factor for the Algae-Based Bioplastics Market. In recent years, funding has increasingly targeted solutions that reduce plastic waste while improving material recovery and reuse. Novoloop secured $21 million in Series B funding to advance circular plastic technologies, highlighting growing confidence in alternatives that lower environmental impact.

At the same time, Impact Recycling raised €3.8 million to scale advanced separation technologies, which support cleaner recycling streams and better integration of bio-based plastics. Public support is also rising, with the U.S. Department of Energy investing $14.5 million in plastics recycling R&D to improve sustainable material systems.

Together, these investments create a supportive ecosystem where algae-based bioplastics can scale faster, align with recycling infrastructure, and meet sustainability targets, making them more attractive for long-term industrial and packaging use.

Restraining Factors

High Processing Costs And Recycling Compatibility Challenges

High costs and recycling limitations remain a key restraining factor for the Algae-Based Bioplastics Market. Producing algae-based materials still requires specialized processing, which increases overall manufacturing expenses compared to conventional plastics. Even compostable solutions face challenges in real-world waste systems. Although Tipa’s compostable packaging plans received a $70 million boost, large investments are still needed to align bio-based plastics with existing disposal infrastructure.

In parallel, Impact Recycling raised €3.8 million to scale water-based density separation technology, highlighting ongoing efforts to improve recycling efficiency. However, these technologies are not yet widely deployed, slowing large-scale adoption. Limited industrial composting access and inconsistent recycling standards create uncertainty for manufacturers and end users, making it harder for algae-based bioplastics to compete on cost, convenience, and system readiness in the short term.

Growth Opportunity

Strategic Industrial Investments Expand Sustainable Plastic Opportunities

Large industrial investments are opening a strong growth opportunity for the Algae-Based Bioplastics Market. When major energy and chemical players support circular and advanced materials, it improves confidence across the value chain. Hanwha Solutions joined a $21 million investment in a U.S. plastic upcycling startup, signaling rising interest in next-generation materials that complement bio-based plastics.

At the same time, Petronet LNG secured a ₹12,000 crore term loan to fund the Gujarat PDH-PP petrochemicals project, strengthening polymer infrastructure and downstream processing capacity. While this project focuses on petrochemicals, it indirectly supports blending, processing, and scaling capabilities that algae-based bioplastics can later leverage. Together, these investments create room for hybrid material models, smoother commercialization, and wider adoption of algae-based bioplastics in packaging and industrial applications.

Latest Trends

Bio-Based Polymer Expansion Gains Strong Industry Momentum

A major latest trend in the Algae-Based Bioplastics Market is the growing alignment between large petrochemical infrastructure and bio-based polymer development. Traditional refiners are strengthening downstream capabilities, creating pathways for sustainable materials. BPCL tied up Rs 31,802 crore to support the Bina refinery expansion and petrochemical project, which enhances polymer processing capacity and material integration potential.

Alongside this, Citroniq raised $12 million to advance a bio-based polypropylene plant in the United States, showing rising confidence in renewable polymer production. While these investments are not algae-specific, they signal a broader shift toward blending bio-based inputs with existing plastic value chains. This trend supports scale, cost reduction, and faster commercialization opportunities for algae-based bioplastics across packaging and industrial applications.

Regional Analysis

Asia Pacific dominates the Algae-Based Bioplastics Market with 45.80% share valued at USD 47.6 Mn.

Asia Pacific dominates the Algae-Based Bioplastics Market, holding a leading 45.80% share with a market value of USD 47.6 Mn, driven by strong manufacturing capacity, rising environmental awareness, and growing adoption of sustainable materials across packaging and consumer goods. The region benefits from large-scale production ecosystems and increasing policy focus on reducing conventional plastic usage, which supports faster commercialization of algae-based alternatives.

North America represents a steadily developing regional market, supported by innovation-led adoption and rising demand for bio-based materials in packaging and specialty applications, although adoption remains selective and application-driven. Europe follows closely, supported by strict environmental regulations and circular economy objectives that encourage the use of biodegradable and renewable plastics, including algae-derived materials.

The Middle East & Africa region shows emerging potential, primarily at an early adoption stage, with growing interest in sustainable materials aligned with long-term environmental diversification strategies.

Latin America remains a developing market, where awareness of algae-based bioplastics is increasing gradually, supported by regional sustainability initiatives and expanding packaging needs. Overall, regional dynamics highlight Asia Pacific as the clear growth center, while other regions progress steadily at different maturity levels.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Notpla Limited continues to stand out in 2024 for its strong focus on seaweed-based materials designed to replace single-use plastics. The company’s approach centers on natural, biodegradable solutions that safely decompose without harming ecosystems. Its emphasis on functional packaging alternatives positions Notpla as a key innovation-driven player shaping consumer-facing applications.

Algix LLC plays a strategic role by integrating algae biomass into durable bioplastic compounds suitable for industrial and commercial use. The company’s model focuses on performance parity with conventional plastics while reducing reliance on petroleum-based feedstocks. Algix’s material engineering capabilities support scalable adoption across multiple plastic applications.

Lifeasible contributes to the market through its biotechnology-oriented portfolio, supporting algae-based material development and application research. The company’s strength lies in enabling product customization and technical support for algae-derived bioplastic solutions. This positions Lifeasible as an important facilitator in advancing innovation and material optimization.

Top Key Players in the Market

- Notpla Limited

- Algix LLC

- Lifeasible

- Evoware

- BZEOS

- BLOM

- Eranova

- Sway Innovation Co.

- ALGBIO

Recent Developments

- In February 2025, Evoware introduced edible seaweed-based sachets designed for sandwiches, burgers, sweets, spices, coffee, tea and other dry foods. These sachets are made from seaweed algae, can be stored for up to two years, and are biodegradable or compostable after use. This product expands Evoware’s offering beyond conventional wrappers to more versatile food packaging formats.

- In November 2024, B’ZEOS successfully closed a seed funding round led by Faber with participation from ICIG Ventures. This development provides capital to scale its seaweed-based, home-compostable packaging solutions, accelerate product development, and begin commercial production with corporate partners. The funding builds on earlier support and enables B’ZEOS to expand pilot projects and move closer to wider market readiness.

Report Scope

Report Features Description Market Value (2024) USD 104.0 Million Forecast Revenue (2034) USD 172.7 Million CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Polyethylene (PE), Polypropylene (PP), Polylactic Acid (PLA), Polyhydroxyalkanoates (PHA), Others), By Application (Packaging, Textiles and Fibers, Automotive, Agriculture, Cosmetics and Personal Care, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Notpla Limited, Algix LLC, Lifeasible, Evoware, BZEOS, BLOM, Eranova, Sway Innovation Co., ALGBIO Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Algae-Based Bioplastics MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Algae-Based Bioplastics MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Notpla Limited

- Algix LLC

- Lifeasible

- Evoware

- BZEOS

- BLOM

- Eranova

- Sway Innovation Co.

- ALGBIO