Global Air Transportation Market Size, Share, Growth Analysis By Product (Airplane Air Transportation, Helicopter Air Transportation), By Application (Passenger Air Transportation, Cargo Air Transportation, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174111

- Number of Pages: 376

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

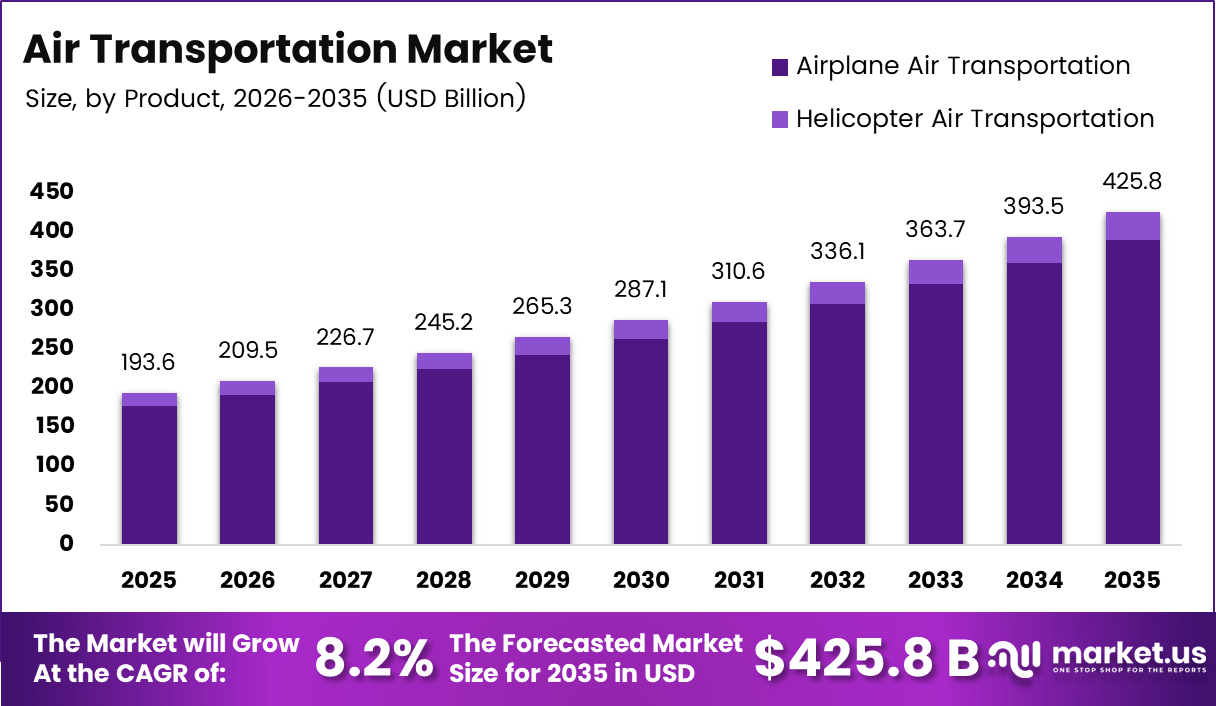

The Global Air Transportation Market size is expected to be worth around USD 425.8 billion by 2035, from USD 193.6 billion in 2025, growing at a CAGR of 8.2% during the forecast period from 2026 to 2035.

The Air Transportation Market represents the integrated ecosystem enabling passenger mobility and cargo movement through commercial aviation, regional aviation, and supporting infrastructure. It includes airlines, airports, air traffic systems, and ground services. Consequently, the market supports global trade, tourism expansion, and time sensitive logistics across domestic and international routes.

From an analyst viewpoint, air transportation functions as a strategic economic enabler rather than a discretionary mobility service. Rising urbanization, expanding middle class populations, and globalization continue to stimulate consistent demand. Moreover, digital booking platforms and route optimization technologies improve accessibility, efficiency, and load factor management across airline operations.

Market growth remains closely linked to infrastructure investments and regional connectivity programs. Governments increasingly prioritize airport modernization, air traffic management upgrades, and multimodal integration. As a result, air transportation benefits from long term public funding, policy backed expansion, and stronger integration with national economic development strategies.

In parallel, regulatory frameworks strongly influence operational planning and capital allocation. Safety standards, emissions compliance, and airspace governance shape fleet decisions and network expansion. Therefore, regulatory alignment encourages airlines and airports to invest in fuel efficiency, digital monitoring, and compliance driven operational excellence.

Opportunities within the Air Transportation Market increasingly concentrate around sustainability and operational resilience. Airlines invest in fuel efficient aircraft, advanced ground handling systems, and optimized turnaround processes. In addition, cargo aviation and express logistics generate incremental revenue streams, particularly supporting e commerce and pharmaceutical distribution.

According to study, the Spanish airport authority, 40% of national passenger traffic concentrates within Madrid and Barcelona airports, highlighting traffic centralization and hub dominance. This concentration drives capacity expansion needs, slot optimization initiatives, and infrastructure monetization strategies across major aviation hubs.

Environmental accountability has become a defining market consideration. According to Airline study, commercial aviation contributes approximately 2% of global greenhouse gas emissions, increasing to 3% when additional pollutants are included. Consequently, airlines increasingly prioritize emission reduction strategies to align with regulatory and investor expectations.

Sustainability driven projects demonstrate measurable impact. According to aviation efficiency disclosures, fleet renewal programs incorporating next generation long haul aircraft achieve approximately 15% kerosene savings per aircraft. Additionally, modernized ground equipment and passenger assistance vehicles further reduce airport level emissions and operational costs.

Operational efficiency initiatives also show tangible outcomes. According to airline sustainability reporting, carbon intensity reduction targets reached 77 grams per passenger kilometer, reflecting more than 33% improvement over two decades. Notably, emissions dropped below 80 grams through technology upgrades and process optimization, reinforcing sustainable growth credibility.

Overall, the Air Transportation Market remains positioned for structured growth, policy backed investment, and sustainability led transformation. Strategic infrastructure spending, regulatory clarity, and efficiency focused innovation collectively strengthen long term market attractiveness for institutional stakeholders and public sector planners.

Key Takeaways

- Global Air Transportation Market size is projected to reach USD 425.8 billion by 2035, growing from USD 193.6 billion in 2025 at a CAGR of 8.2%.

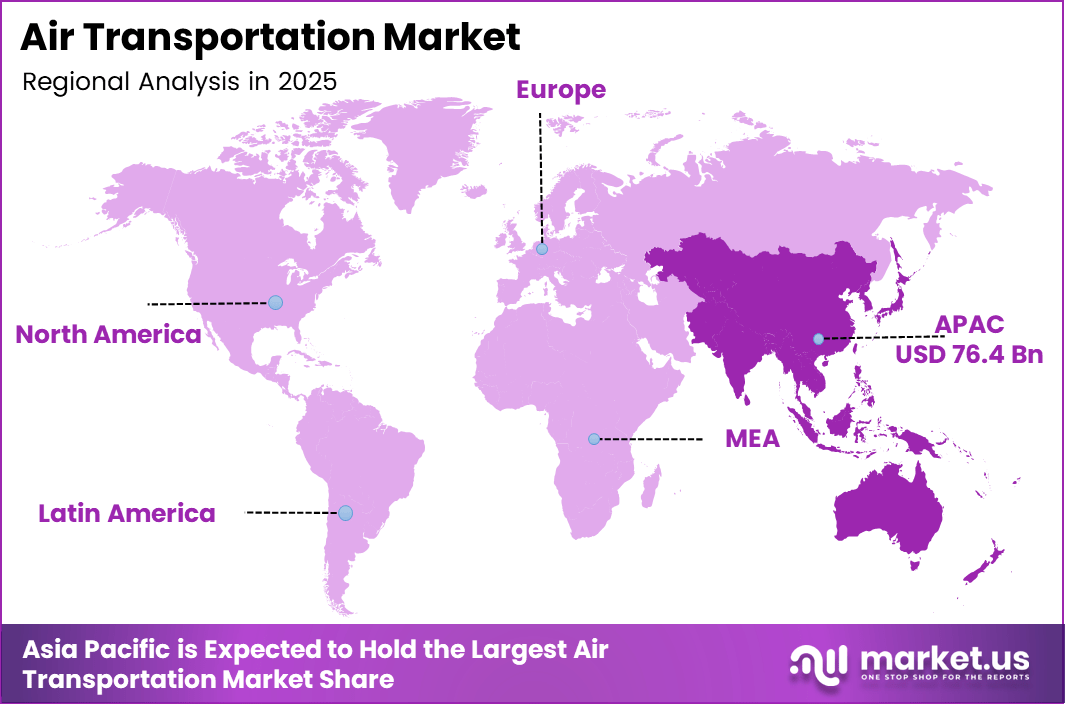

- Asia Pacific dominates the regional market with a share of 39.5%, valued at USD 76.4 billion.

- Airplane Air Transportation leads the product segment, accounting for a dominant share of 91.6%.

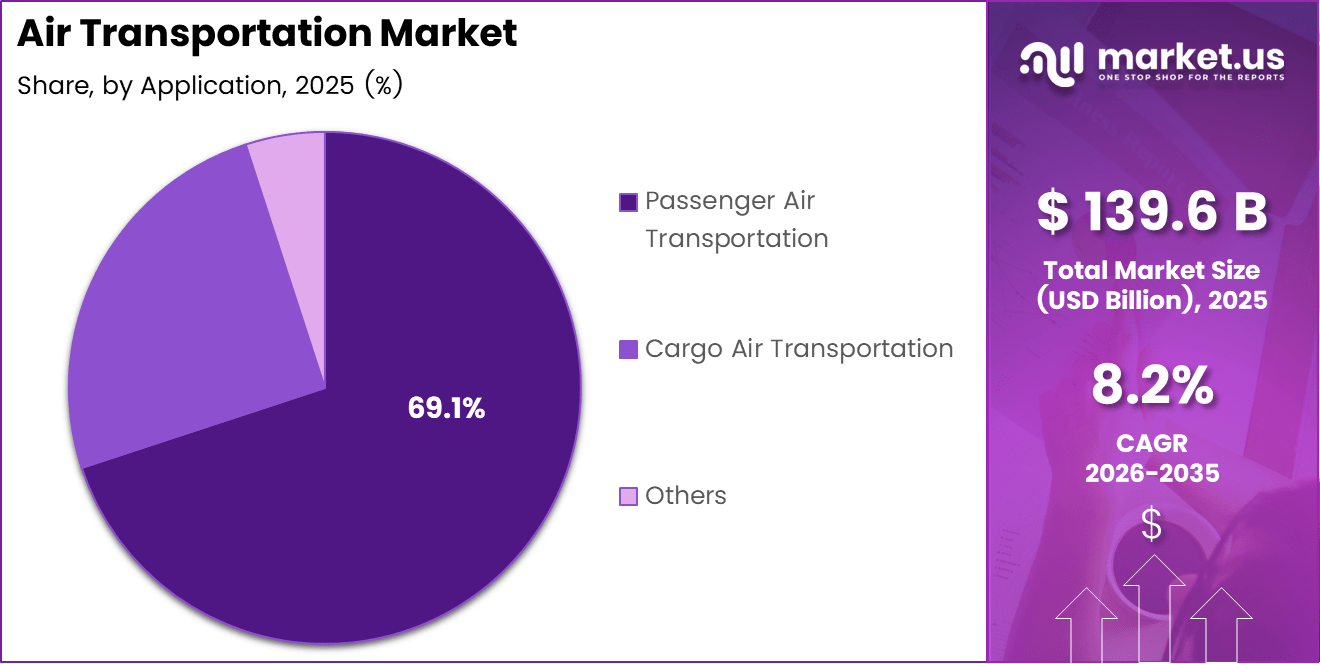

- Passenger Air Transportation is the largest application segment, representing 69.8% of total market demand.

By Product Analysis

Airplane Air Transportation dominates with 91.6% due to its extensive route coverage, high passenger capacity, and cost efficiency.

In 2025, Airplane Air Transportation held a dominant market position in the By Main Segment Analysis segment of the Air Transportation Market, with a 91.6% share. This dominance reflects its critical role in long haul and short haul connectivity. Moreover, airplanes support mass passenger movement, international trade, and scheduled cargo operations, strengthening overall market stability.

Airplane Air Transportation continues to benefit from fleet modernization, fuel efficiency improvements, and strong airport infrastructure alignment. Consequently, airlines increasingly rely on airplanes to optimize operational scale and network economics. Additionally, regulatory frameworks and government backed airport expansions further reinforce the central role of airplanes in global and regional air mobility.

Helicopter Air Transportation represents a specialized yet essential sub-segment within the market. It supports emergency medical services, offshore operations, defense logistics, and short distance mobility. Although smaller in scale, helicopters address niche transportation needs where fixed wing aircraft remain impractical.

Furthermore, helicopter services gain relevance in remote access, urban air mobility trials, and disaster response scenarios. As a result, this sub-segment complements airplane transportation by enhancing accessibility and operational flexibility, thereby contributing to a balanced and diversified air transportation ecosystem.

By Application Analysis

Passenger Air Transportation dominates with 69.8% driven by rising travel demand and expanding global connectivity.

In 2025, Passenger Air Transportation held a dominant market position in the By Main Segment Analysis segment of the Air Transportation Market, with a 69.8% share. This leadership stems from growing tourism, business travel, and urban population mobility. Moreover, digital booking platforms and route expansion strategies continue to improve passenger access.

Passenger Air Transportation benefits from government investments in airport modernization and regional connectivity programs. Consequently, airlines enhance frequency, capacity, and service quality. In addition, evolving consumer preferences for faster travel reinforce the sustained demand for passenger focused air transportation services.

Cargo Air Transportation plays a vital role in supporting time sensitive logistics, global trade, and high value goods movement. It enables rapid delivery of pharmaceuticals, electronics, and perishable products. Therefore, cargo aviation strengthens supply chain resilience and complements passenger network operations.

Others within the application segment include charter services, emergency transport, and specialized aviation activities. Although smaller in scale, these applications address critical operational needs. As a result, they enhance market adaptability and ensure comprehensive air transportation coverage across diverse use cases.

Key Market Segments

By Product

- Airplane Air Transportation

- Helicopter Air Transportation

By Application

- Passenger Air Transportation

- Cargo Air Transportation

- Others

Drivers

Sustained Growth in Global Passenger Travel Drives Air Transportation Market Expansion

The Air Transportation Market continues to grow due to rising passenger travel across urban and semi urban regions. Increasing urbanization encourages people to travel more often for work, education, and leisure. At the same time, higher disposable incomes allow consumers to choose air travel instead of slower transportation modes.

The expansion of low cost carrier networks further supports market growth. These airlines make air travel affordable for middle income travelers. As a result, route connectivity improves between cities and regions. Consequently, passenger volumes rise steadily, strengthening airline operations and airport utilization.

Continuous investments in airport infrastructure also act as a major driver. Governments and airport authorities focus on terminal expansion, runway upgrades, and digital systems. Therefore, capacity increases and congestion reduces. These improvements enhance passenger experience and operational efficiency across the air transportation ecosystem.

In addition, growing reliance on air cargo boosts overall market demand. Industries increasingly transport high value and time critical goods by air. This trend supports faster delivery cycles, strengthens global trade, and improves supply chain reliability, reinforcing the importance of air transportation services.

Restraints

Volatility in Aviation Fuel Prices Restrains Market Performance

Fuel price volatility remains a key restraint for the Air Transportation Market. Aviation fuel represents a major operating cost for airlines. Sudden price increases directly reduce profit margins. As a result, airlines face challenges in pricing tickets while maintaining financial stability.

Fuel cost uncertainty also complicates long term planning. Airlines struggle to forecast expenses accurately. Therefore, fleet utilization and route expansion decisions become more cautious. This uncertainty slows capacity growth and limits aggressive network development strategies.

Stringent safety and security regulations further restrain market growth. Aviation authorities enforce strict operational standards to ensure passenger safety. While necessary, compliance increases operational complexity and costs for airlines and airports.

Environmental regulations add additional pressure on the industry. Emission limits and sustainability requirements require continuous investment. Consequently, smaller operators face financial strain, which can limit market entry and slow overall industry expansion.

Growth Factors

Development of Regional Connectivity Programs Creates Strong Growth Opportunities

Regional and short haul air connectivity programs offer significant growth opportunities. Emerging economies invest in linking smaller cities through air routes. As a result, air travel becomes accessible to new passenger groups, supporting long term demand expansion.

Rising demand for dedicated air freight services also creates new opportunities. E commerce growth increases the need for fast and reliable delivery. Therefore, air cargo operators expand capacity and improve logistics efficiency.

Fleet renewal programs focused on fuel efficient aircraft further support market growth. Airlines replace older planes with next generation models. Consequently, operating costs decline and environmental performance improves, strengthening long term competitiveness.

Growth in airport ancillary services adds additional revenue potential. Airports expand retail, parking, and digital services. These non aeronautical revenues improve financial sustainability and reduce dependence on passenger fees alone.

Emerging Trends

Adoption of Digital Passenger Processing Accelerates Industry Transformation

Digital passenger processing systems increasingly shape the Air Transportation Market. Airports adopt biometric identification and automated check in solutions. As a result, passenger flow improves and waiting times reduce, enhancing overall travel experience.

Data analytics usage continues to expand across airline operations. Airlines analyze travel patterns to optimize routes and pricing strategies. Therefore, yield management improves and capacity utilization becomes more efficient.

Sustainable aviation fuel integration represents a key market trend. Airlines gradually introduce cleaner fuel options into operations. Consequently, emissions reduce and regulatory compliance improves, supporting long term environmental goals.

Contactless and automated ground handling technologies also gain traction. Airports invest in automation to improve safety and efficiency. This trend reduces manual dependency, lowers operational risk, and supports faster aircraft turnaround times.

Regional Analysis

Asia Pacific Dominates the Air Transportation Market with a Market Share of 39.5%, Valued at USD 76.4 Billion

Asia Pacific accounted for 39.5% of the global Air Transportation Market, with a valuation of USD 76.4 billion, driven by rapid urbanization, expanding middle class populations, and rising domestic and international air travel demand. Large scale investments in airport infrastructure, regional connectivity schemes, and fleet expansion continue to strengthen capacity across key aviation hubs. The region also benefits from strong growth in air cargo volumes, supported by e-commerce expansion and cross-border trade activity.

North America Air Transportation Market Trends

North America represents a mature yet stable air transportation market, supported by high passenger traffic, established airline networks, and advanced airport infrastructure. Demand remains steady due to strong business travel, tourism flows, and consistent air cargo movement for high-value goods. Ongoing investments in airport modernization, air traffic management upgrades, and sustainability initiatives continue to enhance operational efficiency across the region.

Europe Air Transportation Market Trends

Europe’s air transportation market is shaped by dense regional connectivity, strong international travel demand, and integrated aviation policies across countries. Growth is supported by short-haul travel, low-cost carrier penetration, and airport capacity expansion in major metropolitan areas. Additionally, regulatory emphasis on emissions reduction and digital air traffic management influences long-term infrastructure and fleet planning.

Middle East and Africa Air Transportation Market Trends

The Middle East and Africa region benefits from its strategic geographic position as a global transit hub between Asia, Europe, and Africa. Investment in new airports, hub expansion, and long-haul connectivity continues to support passenger and cargo growth. In Africa, gradual improvements in regional connectivity and airport infrastructure are strengthening domestic and intra-regional air travel networks.

Latin America Air Transportation Market Trends

Latin America’s air transportation market is supported by rising tourism activity, improving airline connectivity, and gradual airport capacity upgrades. Domestic travel demand plays a significant role due to geographic distances and limited alternative transport options. Economic recovery trends and public-private investments in airport infrastructure are expected to support steady market development across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Air Transportation Company Insights

Delta Air Lines continues to position itself as a resilience driven operator within the global Air Transportation Market in 2025. The company emphasizes network optimization, premium passenger experience, and operational reliability to protect margins in a highly competitive environment. Its focus on fleet modernization, digital passenger services, and hub efficiency supports stable demand across both domestic and international routes, reinforcing its role as a benchmark carrier in mature aviation markets.

Singapore Airlines Cargo reflects the strategic importance of air freight within the broader air transportation ecosystem. In 2025, its strength lies in handling high value, time sensitive goods, supported by strong connectivity across Asia Pacific and global trade lanes. The operator benefits from disciplined capacity management, specialized cargo handling capabilities, and integration with global logistics flows, positioning it as a critical enabler of cross border commerce and supply chain reliability.

Lufthansa Group represents a diversified aviation model combining passenger, cargo, and aviation services under one integrated structure. The group’s analyst appeal stems from its focus on network rationalization, sustainability investments, and operational efficiency across Europe and intercontinental markets. In 2025, its strategic emphasis on digitalization, fuel efficiency, and alliance driven connectivity supports long term competitiveness despite regulatory and cost pressures.

United Continental Holdings demonstrates a growth oriented strategy centered on international network expansion and capacity deployment across key long haul corridors. The company prioritizes fleet renewal, data driven route planning, and enhanced customer experience to strengthen yield management. From a market perspective, its scale, geographic reach, and focus on operational recovery position it as a significant contributor to global air transportation demand in 2025.

Top Key Players in the Market

- Delta Air Lines

- Singapore Airlines Cargo

- Lufthansa Group

- United Continental Holdings

- Emirates

- British Airways

- Cathay Pacific Airlines

- China Airlines

- American Airlines Group

- DHL Aviation

Recent Developments

- April 2025, Air Transport Services Group, Inc. completed its acquisition by Stonepeak in an all-cash transaction, strengthening its long-term capital base and infrastructure focus. The deal, valued at approximately USD 3.1 billion, is expected to support fleet expansion, leasing stability, and scalable air cargo operations aligned with global logistics demand.

- November 2025, Archer reported its third quarter results, highlighting an additional USD 650 million raised through fundraising activities alongside record flight test milestones. The update also included the closing of the Lilium patent portfolio acquisition, reinforcing Archer’s intellectual property position and supporting sustained global demand momentum.

Report Scope

Report Features Description Market Value (2025) USD 193.6 billion Forecast Revenue (2035) USD 425.8 billion CAGR (2026-2035) 8.2% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Airplane Air Transportation, Helicopter Air Transportation), By Application (Passenger Air Transportation, Cargo Air Transportation, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Delta Air Lines, Singapore Airlines Cargo, Lufthansa Group, United Continental Holdings, Emirates, British Airways, Cathay Pacific Airlines, China Airlines, American Airlines Group, DHL Aviation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Delta Air Lines

- Singapore Airlines Cargo

- Lufthansa Group

- United Continental Holdings

- Emirates

- British Airways

- Cathay Pacific Airlines

- China Airlines

- American Airlines Group

- DHL Aviation