Global Agrigenomics Market Size, Share, Analysis Report By Technology (Next-Generation Sequencing (NGS), Real-Time PCR (qPCR), Microarrays, Capillary Electrophoresis, Others), By Service (Dna/Rna Sequencing, Dna Extraction And Purification, Genotyping, Gene Expression Profiling, Marker-Assisted Selection, Gmo/Trait Purity Testing, Others), By Application (Crop, Livestock) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155887

- Number of Pages: 338

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

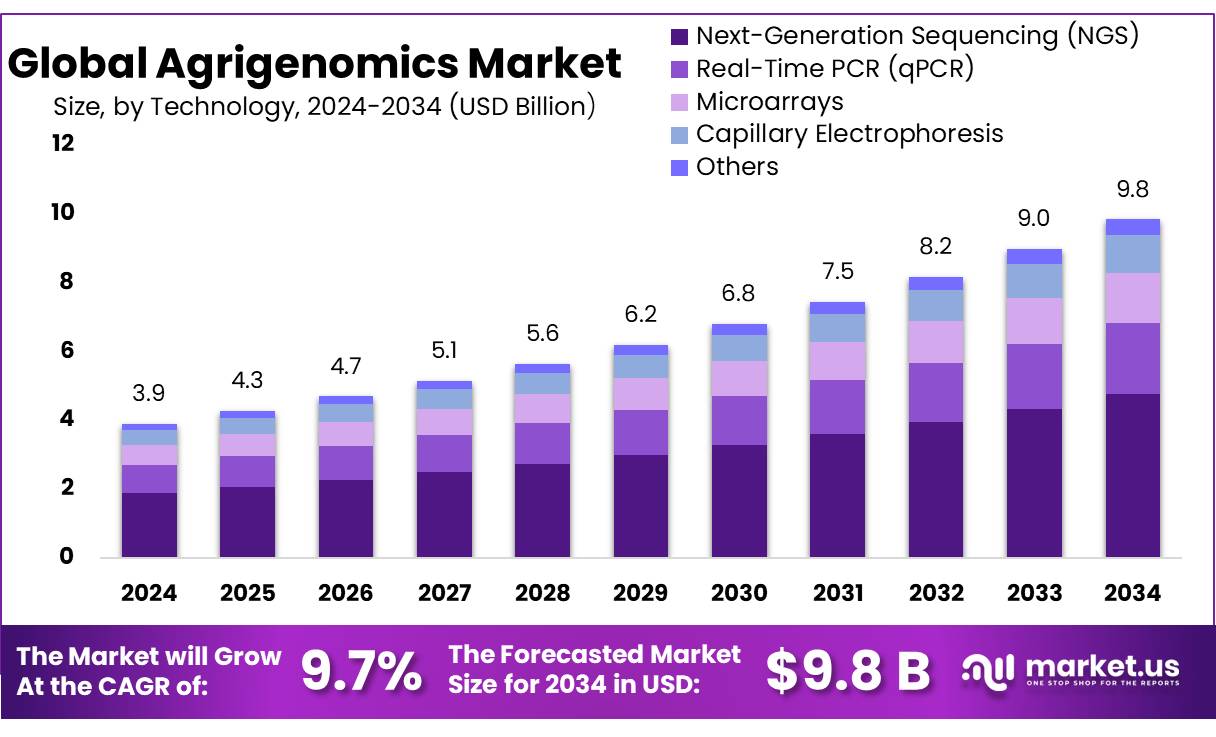

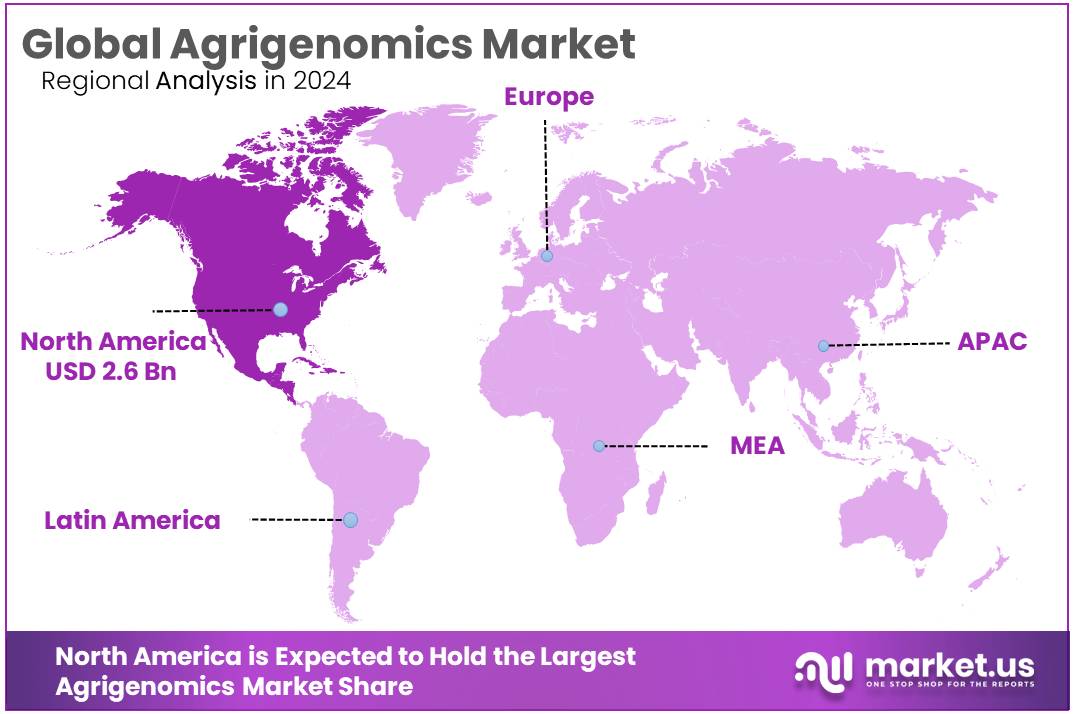

The Global Agrigenomics Market size is expected to be worth around USD 9.8 Billion by 2034, from USD 3.9 Billion in 2024, growing at a CAGR of 9.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 67.9% share, holding USD 2.6 Billion revenue.

Agrigenomics—also known as agricultural genomics—is the application of advanced genomic technologies, such as next‑generation sequencing (NGS) and marker‑assisted selection, to study and enhance the genetic traits of crops, livestock, and agricultural microorganisms. This discipline enables breeders and scientists to identify genetic markers linked to yield, disease resistance, and stress tolerance, streamlining and accelerating traditional breeding processes. For instance, genomic selection techniques have been shown to enhance crop breeding efficiency by up to 30 % over conventional methods.

Key growth drivers stem from the urgent need for food security, climate resilience, and meeting growing population demands. Government backing, such as from AG2PI in the U.S., and public-sector genomic infrastructure in India, provide both funding and research platforms. On the institutional front, CGIAR’s genomic breeding efforts have generated widespread impact—for instance, improved rice yields of 0.6 to 1.8 tons per hectare translate to increased income for millions of smallholder farmers. Advancements in gene editing and sequencing technologies also reduce costs and accelerate innovation, facilitating broader adoption.

While many figures come from industry reports, government-verified data like the above give a solid baseline. The U.S. and India signal strong integration of agrigenomics in strategic farming. In India, schemes such as the Prime Minister Dhan‑Dhaanya Krishi Yojana, with a six-year annual outlay of ₹24,000 crore, target increased crop yields and farmer income through integrated approaches—including potential support for genomics and related infrastructure.

Complementary initiatives, such as eNAM (National Agriculture Market), promote efficiency and data-driven transparency across over 50 lakh farmer members and commodities worth over ₹1,22,000 crore traded on the platform, indirectly supporting digital-agricultural technologies. Moreover, Rashtriya Krishi Vikas Yojana (RKVY‑RAFTAAR) under the Department of Agriculture and Farmers Welfare has actively funded agri‑startups, including those focused on innovation and biotechnology

Key Takeaways

- Agrigenomics Market size is expected to be worth around USD 9.8 Billion by 2034, from USD 3.9 Billion in 2024, growing at a CAGR of 9.7%.

- Next-Generation Sequencing (NGS) held a dominant market position, capturing more than a 48.3% share.

- DNA/RNA Sequencing held a dominant market position, capturing more than a 33.7% share in the agrigenomics service landscape.

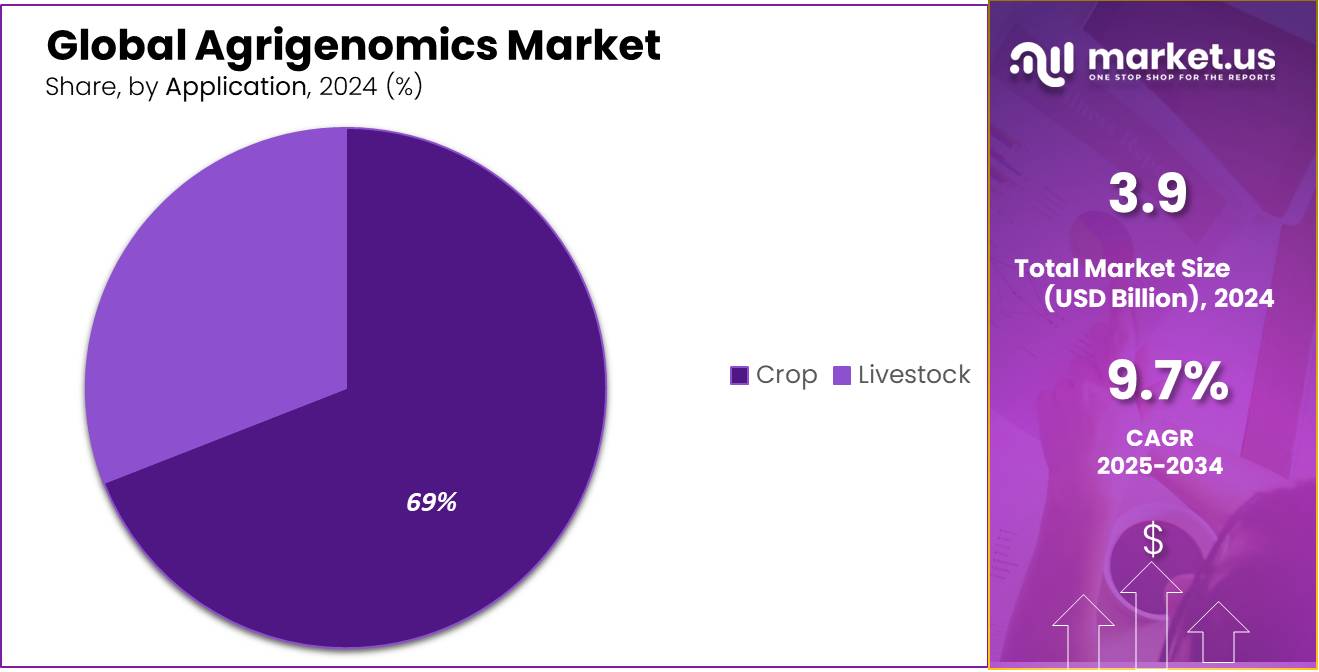

- Crop held a dominant market position, capturing more than a 69.2% share in the agrigenomics market

- North America clearly stands out as the dominant region in agrigenomics, commanding a substantial 67.9% share, which translates to roughly USD 2.6 billion.

By Technology Analysis

NGS leads the pack with 48.3% as breeders chase speed, scale, and clear trait signals.

In 2024, Next-Generation Sequencing (NGS) held a dominant market position, capturing more than a 48.3% share. Its edge comes from doing many things at once—discovering markers, confirming trait introgression, checking seed purity, and tracking pathogens—without forcing labs to switch platforms. Breeders like that NGS fits straight into genomic selection workflows: multiplexed libraries move from field tissue to variant calls and decision-ready reports with fewer steps, which shortens cycle time and keeps programs on schedule.

Service providers have also pushed adoption by bundling wet-lab, bioinformatics, and cloud reporting into simple packages, so even smaller teams can run whole-genome resequencing, targeted panels, or RNA-seq without building everything in-house. Just as important, data quality is consistent across crops and livestock, making cross-season comparisons more reliable and helping teams retire older methods that create bottlenecks.

By Service Analysis

DNA/RNA Sequencing dominates with 33.7% as labs seek deeper insights into plant and animal traits.

In 2024, DNA/RNA Sequencing held a dominant market position, capturing more than a 33.7% share in the agrigenomics service landscape. Its strong uptake is tied to the increasing demand for precise trait mapping, gene expression profiling, and variant detection in crops and livestock. Researchers and breeders across both sectors are relying on sequencing to understand genetic diversity, identify favorable alleles, and make informed breeding decisions.

The ability of DNA sequencing to uncover SNPs and other genetic markers, along with RNA sequencing’s power to capture gene activity in real time, makes this service the go-to option for both discovery and applied genomics. Service providers have responded by offering customized solutions for specific crops or species, reducing turnaround times and making sequencing more accessible even to mid-sized breeding programs.

By Application Analysis

Crop applications lead the way with 69.2% as farmers and breeders double down on yield, quality, and resilience.

In 2024, Crop held a dominant market position, capturing more than a 69.2% share in the agrigenomics market by application. This strong lead is driven by rising global pressure to improve crop productivity, nutritional value, and resistance to pests, diseases, and climate stress. From maize and wheat to soybeans, rice, and even specialty vegetables, genomics tools are being used to screen elite germplasm, accelerate trait selection, and reduce breeding cycles.

Researchers are increasingly using high-throughput genotyping and sequencing methods to pinpoint markers for drought tolerance, disease resistance, and grain quality—traits that are now essential rather than optional in today’s competitive agriculture landscape. Government-backed research programs, especially in Asia and Latin America, have also played a role in making agrigenomics more accessible to public breeding centers, thereby expanding adoption beyond just large agribusinesses.

Key Market Segments

By Technology

- Next-Generation Sequencing (NGS)

- Real-Time PCR (qPCR)

- Microarrays

- Capillary Electrophoresis

- Others

By Service

- Dna/Rna Sequencing

- Dna Extraction & Purification

- Genotyping

- Gene Expression Profiling

- Marker-Assisted Selection

- Gmo/Trait Purity Testing

- Others

By Application

- Crop

- Livestock

Emerging Trends

Accelerated Adoption of Genome Editing in Agrigenomics

Agrigenomics is undergoing a transformative shift, with genome editing technologies like CRISPR/Cas9 at the forefront. These tools enable precise modifications in the DNA of crops and livestock, offering solutions to pressing agricultural challenges such as climate change, disease resistance, and food security.

In Sub-Saharan Africa, where agriculture is heavily impacted by climate variability, genome editing is seen as a game-changer. A study highlighted in the FAO’s AGRIS database notes that genome editing can enhance crop resilience to biotic and abiotic stresses, leading to sustained yield increases and improved food security in the region.

Globally, the Food and Agriculture Organization (FAO) is actively promoting the integration of genome editing into agrifood systems. The FAO Global Agrifood Biotechnologies Conference, scheduled for June 2025, aims to explore how biotechnologies, including genome editing, can drive agrifood systems transformation. The conference will focus on empowering small-scale producers to enhance food security, improve nutrition, and build resilience to climate challenges.

In the United States, the USDA’s Agricultural Genome to Phenome Initiative (AG2PI) has allocated $220 million toward crop and livestock genomics. This investment underscores the commitment to advancing genome editing research and its applications in agriculture.

Drivers

Advancements in Agricultural Biotechnology Fuel Growth in Agrigenomics

Agrigenomics is experiencing significant growth, primarily driven by advancements in agricultural biotechnology. The rise of genetic research and its application in agriculture has proven crucial in addressing challenges like food security, pest resistance, and climate change. As technology advances, agrigenomics is positioned to improve crop yields, enhance disease resistance, and reduce environmental impact.

A major driving factor for this growth is the increasing global demand for food. With the world’s population expected to reach nearly 9.7 billion by 2050, food production must rise by 70% to meet this demand, according to the Food and Agriculture Organization (FAO). This pressure on food systems is pushing the agricultural sector toward innovation, particularly in genomics. Genetic research is key to developing more resilient and productive crops that can withstand extreme weather conditions and grow in nutrient-poor soils, addressing the challenges of climate change and land degradation.

Additionally, the economic potential of agrigenomics is another significant driver. The global market for genetically modified crops alone is expected to surpass $40 billion by 2025. With the advent of CRISPR technology and gene editing tools, scientists can now directly modify the DNA of crops, leading to faster, more cost-effective solutions for improving crop quality. In particular, gene editing in crops like rice, wheat, and maize is seen as an effective way to combat pests, diseases, and adverse environmental conditions, which translates into higher crop yields.

Governments worldwide are also supporting agrigenomics through various initiatives. The U.S. Department of Agriculture (USDA) has committed millions of dollars to promote genetic research and innovation in agriculture.

- For instance, in 2021, the USDA allocated $26 million for the development of new breeding technologies, which includes agrigenomics, to address climate-related challenges in farming. In India, the government’s push to introduce genetically modified (GM) crops has led to the launch of several initiatives aimed at improving food production using genomics. The Indian Council of Agricultural Research (ICAR) has made significant strides in genomic research, focusing on crop varieties that are drought-resistant, pest-resistant, and more nutritious.

Restraints

Regulatory Hurdles and Public Perception: Challenges in Agrigenomics Adoption

Despite the promising potential of agrigenomics to revolutionize agriculture, several challenges hinder its widespread adoption. One significant barrier is the complex and often stringent regulatory landscape governing genetically modified organisms (GMOs).

In the United States, for instance, the U.S. Department of Agriculture (USDA), Environmental Protection Agency (EPA), and Food and Drug Administration (FDA) each have distinct roles in regulating GMOs, leading to a multifaceted approval process that can be time-consuming and costly for developers.

This regulatory complexity can delay the introduction of beneficial agrigenomic innovations. For example, the development and approval of genetically modified crops can take over a decade, with costs reaching up to $136 million, according to a study by the National Academy of Sciences.

Public perception also plays a crucial role in the adoption of agrigenomics. Consumer concerns about the safety and environmental impact of GMOs can lead to resistance against their use. In Europe, for instance, there is widespread skepticism regarding GMOs, resulting in stringent regulations and limited market acceptance. This public apprehension can influence policy decisions and affect market dynamics, making it challenging for agrigenomic products to gain traction.

Opportunity

Harnessing Agrigenomics for Climate-Resilient Agriculture

Agrigenomics, the application of genomic technologies in agriculture, presents a significant opportunity to address the challenges posed by climate change to global food security. As the world faces increasing environmental stresses, agrigenomics offers innovative solutions to develop crops and livestock that are more resilient, nutritious, and sustainable.

The Food and Agriculture Organization (FAO) emphasizes the need to transform agrifood systems to achieve the Sustainable Development Goals (SDGs), particularly SDG 2, which aims to end hunger, achieve food security, improve nutrition, and promote sustainable agriculture. FAO’s roadmap outlines actions to reform agrifood systems for climate goals, food security, and nutrition, aligning with SDGs, and is a master plan to overcome inaction. Agrifood systems contribute 30% of anthropogenic greenhouse gas emissions, impeding climate goals.

However, the growing urgency demands action and a change in narratives. Providing healthy food for all, today and tomorrow, is crucial; as is aligning agrifood systems transformation with climate actions. Agrifood systems should address food security and nutrition needs, but they host a large number of actions aligned with mitigation, adaptation, and resilience objectives. Simultaneously, the climate agenda could mobilize climate finance to unlock the potential of these systems and drive their transformation.

This comprehensive transformation requires an efficient, integrated strategy that unites stakeholders, fostering a multi-sphere collaboration according to FAO’s principles. These systems aim to achieve more than just climate goals; they also prioritize improving food security and combating malnutrition. FAO acts as a catalyst, breaking down barriers between sectors, institutions, and different SDGs, showcasing its legitimacy in uniting a wide range of stakeholders.

Regional Insights

North America Commands the Agrigenomics Arena with 67.9% Market Share, Around USD 2.6 Billion

North America clearly stands out as the dominant region in agrigenomics, commanding a substantial 67.9% share, which translates to roughly USD 2.6 billion in market value. This commanding position reflects a strong synergy of robust research infrastructure, supportive public funding, and a well-developed private sector that embraces innovation in crop and livestock genomics.

The United States, in particular, plays a central role. Federal agencies like the USDA and National Science Foundation consistently allocate generous budgets to agrigenomic programs—spanning from genome-to-phenome platforms to diagnostics for disease resistance. This sustained investment fuels both foundational research and the development of field-ready tools. On the private side, well-capitalized seed and ag‑tech companies are rapidly adopting technologies such as high-throughput sequencing, marker-assisted selection, and genomic prediction models, accelerating their breeding pipelines.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Agilent Technologies is a major player in the agrigenomics sector, providing advanced instruments, software, and consumables for gene expression, DNA methylation, and genotyping analysis. Its SureSelect and TapeStation systems are widely used for high-throughput plant and animal genome sequencing. Agilent collaborates with academic and ag-biotech institutions to support trait mapping, genome editing, and diagnostics. The company’s presence in North America and Europe strengthens its role in precision agriculture and genomic-based research programs.

BGI Genomics, a global leader based in China, offers comprehensive sequencing services for crop and livestock genomics. Its extensive sequencing platforms, such as DNBSEQ™, power large-scale genotyping, gene expression profiling, and genome-wide association studies. BGI actively supports agricultural projects focused on yield improvement, disease resistance, and genome selection. The company collaborates with global universities and government institutes, making it a key enabler of precision breeding and large-scale agrigenomic research across Asia and beyond.

Eurofins Scientific SE is a major player in genomic testing services for agriculture, offering a wide range of DNA-based services for crops and livestock. Through its Eurofins Genomics division, it provides SNP genotyping, DNA barcoding, microbiome profiling, and molecular marker development. The company supports plant variety registration, food traceability, and breeding program optimization. With labs across Europe, North America, and Asia, Eurofins helps integrate genomics into practical agricultural decisions and regulatory compliance worldwide.

Top Key Players Outlook

- Agilent Technologies Inc.

- Arbor Biosciences

- Azenta Life Sciences (Genewiz)

- BGI Genomics Co. Ltd.

- Eurofins Scientific SE

- Illumina Inc.

- KeyGene N.V.

- LGC Limited

- QIAGEN N.V.

- Tecan Genomics Inc.

Recent Industry Developments

Eurofins Scientific SE 2024 with roughly €6.95 billion in annual revenue—a solid 6.7% growth from 2023—highlighting its steady expansion in core testing services like food, feed, and agrigenomics‑related diagnostics.

In 2024, BGI Genomics Co. Ltd. recorded annual revenues of CNY 3,866.92 million, marking a decline of 11.10% year‑over‑year from 2023.

Report Scope

Report Features Description Market Value (2024) USD 3.9 Bn Forecast Revenue (2034) USD 9.8 Bn CAGR (2025-2034) 9.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Next-Generation Sequencing (NGS), Real-Time PCR (qPCR), Microarrays, Capillary Electrophoresis, Others), By Service (Dna/Rna Sequencing, Dna Extraction And Purification, Genotyping, Gene Expression Profiling, Marker-Assisted Selection, Gmo/Trait Purity Testing, Others), By Application (Crop, Livestock) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Agilent Technologies Inc., Arbor Biosciences, Azenta Life Sciences, BGI Genomics Co. Ltd., Eurofins Scientific SE, Illumina Inc., KeyGene N.V., LGC Limited, QIAGEN N.V., Tecan Genomics Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Agilent Technologies Inc.

- Arbor Biosciences

- Azenta Life Sciences (Genewiz)

- BGI Genomics Co. Ltd.

- Eurofins Scientific SE

- Illumina Inc.

- KeyGene N.V.

- LGC Limited

- QIAGEN N.V.

- Tecan Genomics Inc.